HI Market View Commentary 06-01-2020

So I blew into town – San Clemente CA to the Surf-Break Hotel late last night

Are you some Old Utah, gun tote’n, hippie, cowboy?

So why am I sharing this?…..

Well it is going to come back!!!!

What the hell are you doing hiring the expert to tell you what you already know, and that does NOTHING to help you when big draw-downs occur to your portfolio?

You should expect more out of people !!! ie Policemen, Brokers, Freaking busy bodies who bug you at 9:45 PM after you’ve just drove 11 ½ hours

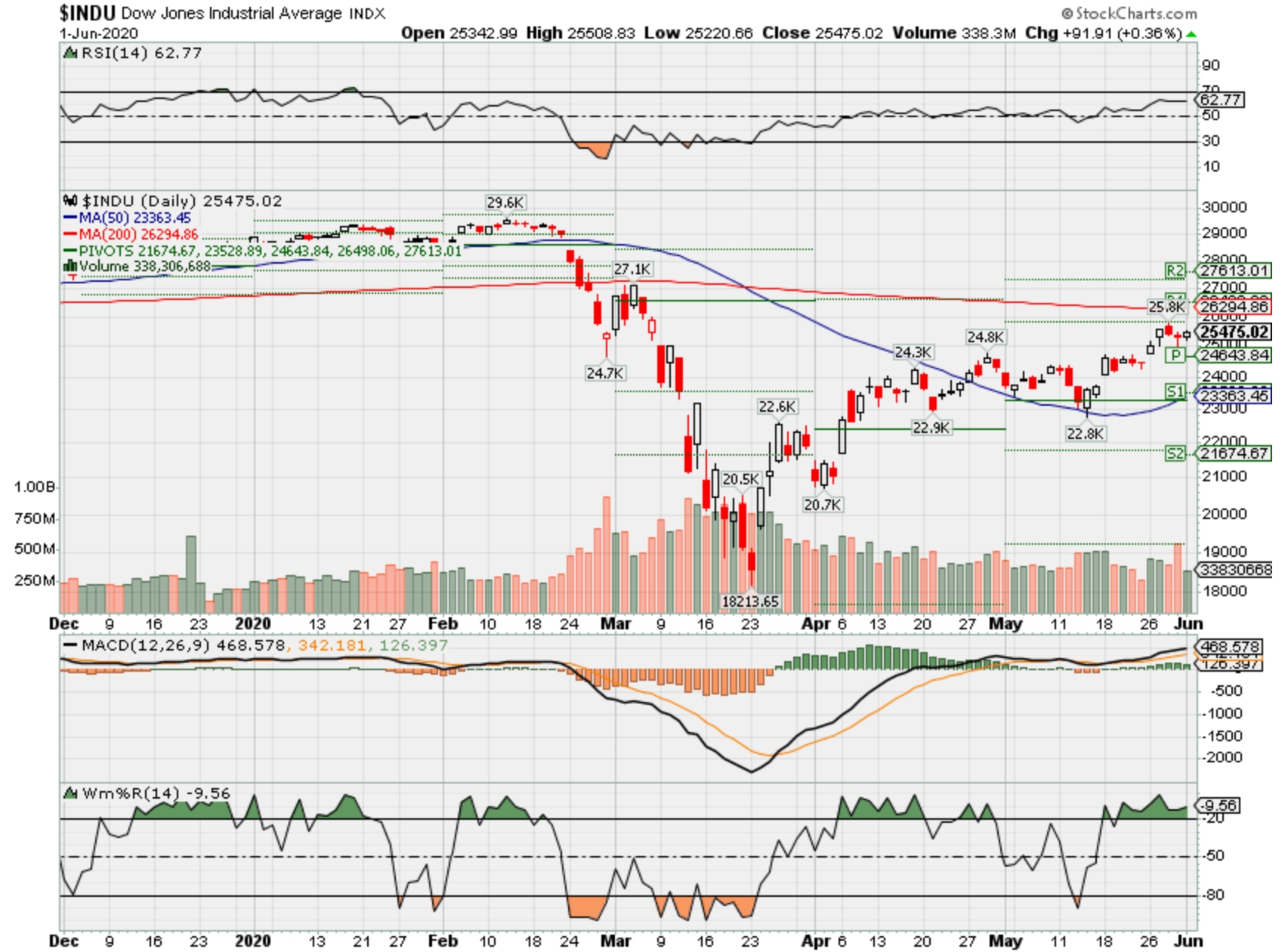

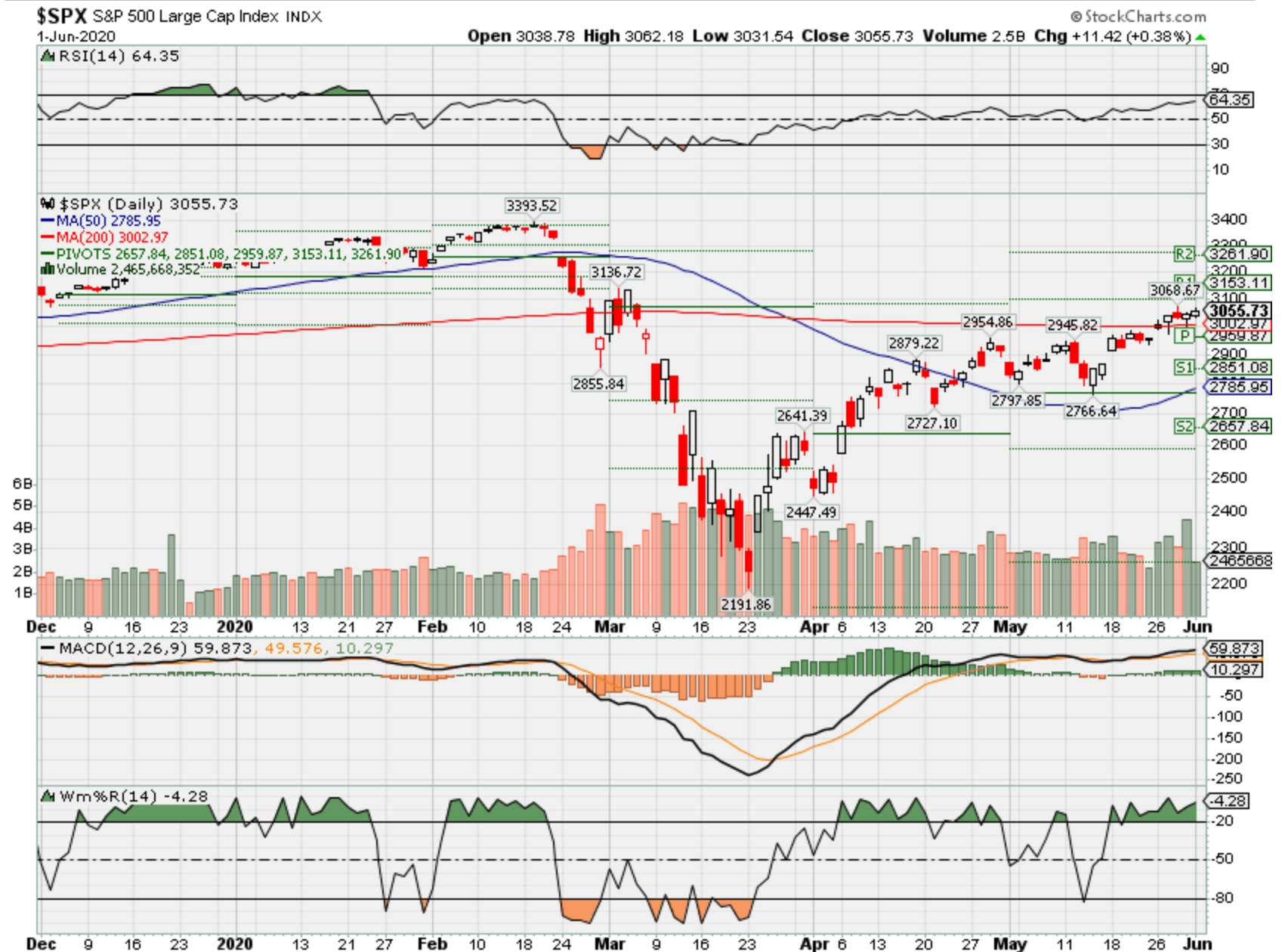

| Market Recap |

| Week of May. 25 through May. 29, 2020 |

| The S&P 500 was higher for a second straight time last week, rising 3.3% on optimism that global economies will rebound as retailers and service providers reopen after being shut for months due to the COVID-19 pandemic.

Indexes also rose after US President Donald Trump didn’t mention the Phase 1 trade deal during a speech Friday denouncing China’s national security resolution that critics say strips Hong Kong of its autonomy. Prices rebounded from intraday lows Friday after he didn’t mention ending or altering the trade agreement. Instead, Trump said the US would end protections for Hong Kong because it’s no longer autonomous. Washington also will cut ties and funding to the World Health Organization and instead redirect about $400 million to other organizations. Some analysts believe China will retaliate, though it’s unclear if or what type of action Beijing will take. Despite the increased tensions between the world’s two largest economies, the benchmark index closed on Friday at 3,044.31 versus the prior week’s close of 2,955.45. For the month, the S&P 500 jumped 4.5%. All 11 sectors in the S&P 500 gained this week, led by real estate, which were up 8.3%. Financials gained 6.4%, industrials rose 5.9%, and utilities were up 6.9%. Materials gained 4.6%, consumer staples added 3.4%, health care rose 3.6%, consumer discretionary stocks added 2.3%, technology was up 1.9%, energy rose 0.1% and communications services gained 1.2%. Financial stocks jumped this week on optimism about global economies, while housing data this week also was positive, giving the real estate sector a boost. Wells Fargo (WFC) shares jumped 8.2% for the week, JPMorgan Chase (JPM) stock surged 7.9% and Bank of America (BAC) gained 5.3%. In the energy sector, oil production and services companies rode a wave of higher crude prices as West Texas Intermediate futures, the US benchmark, gained more than 5% on the week. Oil prices jumped almost 89% in May, marking the best month on record. Services company Baker Hughes (BKR) shares jumped about 7.1% for the week, Kinder Morgan (KMI) added 2.9% while Chevron (CVX) was slightly down 0.4%. The retail sector, crushed by the COVID-19 pandemic, saw signs of a rebound as L Brands (LB), the owner of Victoria’s Secret and Bath & Body Works stores, gained 12%. The economic calendar for the first week of June includes the Markit and ISM manufacturing reports and construction spending on Monday, ADP’s employment report on Wednesday and the Labor Department’s nonfarm payrolls report for May. |

Where will our markets end this week?

Flat

Where Will the SPX end June 2020?

05-26-2020 +0.0%

Earnings:

Mon:

Tues: ZM

Wed: AEO, CPB, CNK

Thur: ACGO, DOCU, GPS, MTN,

Fri: TIF

Econ Reports:

Mon: Construction Spending, ISM Manufacturing

Tues: Auto, Truck

Wed: MBA, ADP Employment, Factory Orders, ISM Services

Thur: Initial Claims, Productivity, Trade Balance, Unit Labor Costs

Fri: Average Workweek, Hourly Earnings, Non-Farm Payroll, Private Payroll, Unemployment Rate, Consumer Credit

Int’l:

Mon – CN: Caixin Manufacturing

Tues –

Wed –

Thursday – EUR: ECB Interest Rate Decision

Friday-

Sunday –

How am I looking to trade?

Letting some things run, Taking Profits on FB, short term covered calls on stock positions for June

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Stocks claw back early losses, rise slightly as traders bet on the economy reopening

Published Sun, May 31 20206:02 PM EDTUpdated an hour ago

U.S. stocks rose slightly on Monday to start June trading as investors hoped to extend gains seen across both May and April.

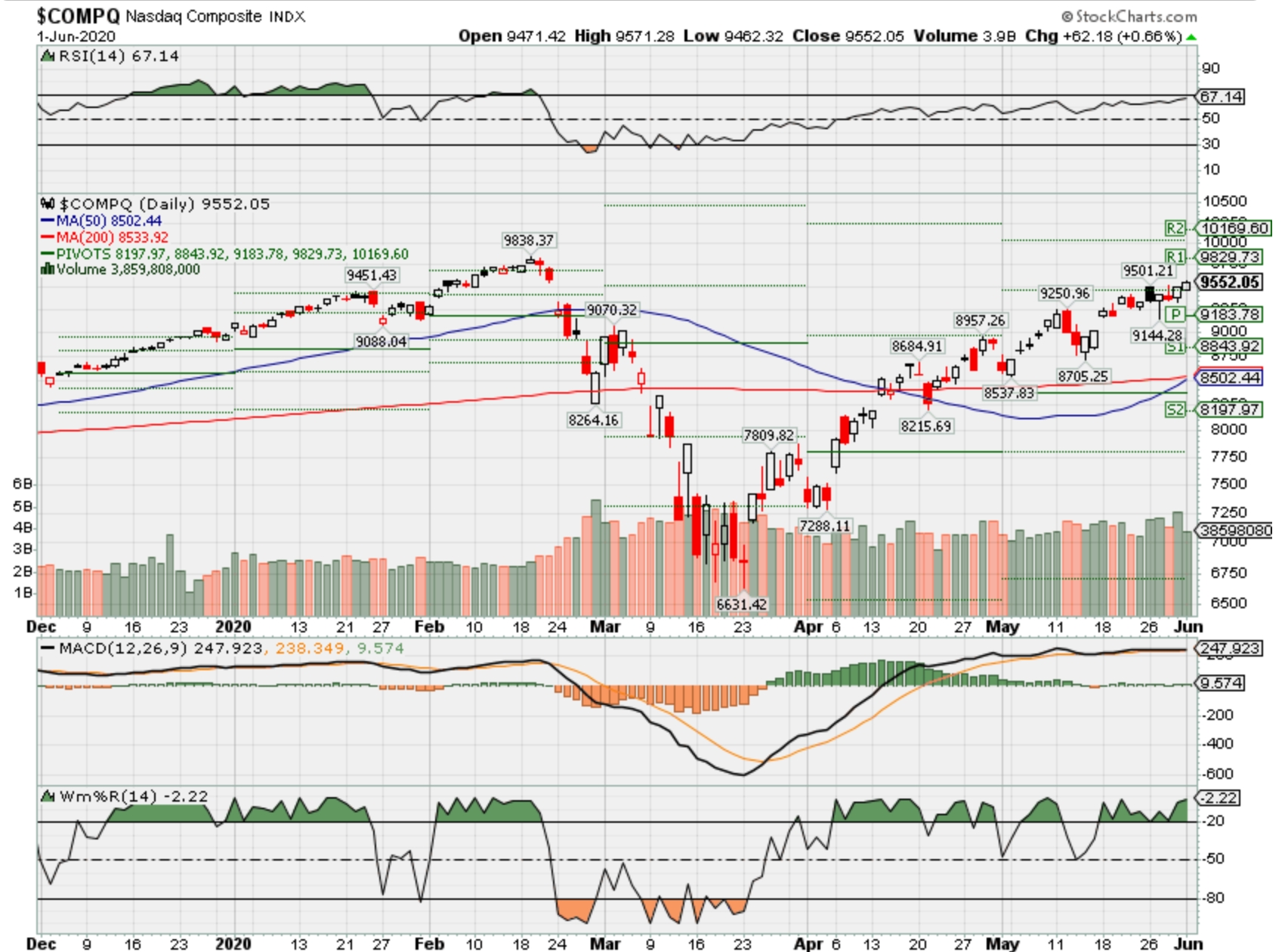

The Dow Jones Industrial Average gained 63 points, or 0.3%. The S&P 500 climbed 0.2% while the Nasdaq Composite added 0.5%. The major averages fell slightly earlier in the session.

Stocks closely linked to the economy reopening led the slight gains. Carnival, Norwegian Cruise Line and Royal Caribbean were all up at least 4%. Hilton Worldwide climbed 2.6% and Marriott International advanced 4.8%. American Airlines and Delta advanced 6.3% and 4.3%, respectively, while United advanced 6.2%.

Those gains were capped, however, by a 7.6% drop in Pfizer shares.

Monday’s moves came after the S&P 500 and Dow each gained at least 3% last week while the Nasdaq Composite advanced 1.8% to close out May. Those gains were propelled by increasing bets by traders that the global economy will successfully reopen after the coronavirus forces a shutdown of most economic activity.

Last week’s gains led the major averages to their first back-to-back monthly advances since late 2019. The Dow and S&P 500 gained 4.3% and 4.5%, respectively, for May while the Nasdaq Composite advanced 6.8%.

Here’s what traders were monitoring to start the new month:

- States continue to reopen their economies after the coronavirus pandemic forced the country to shutter nonessential businesses. The reopening is now taking place amid widespread protests across the U.S. over police brutality.

- Traders are also grappling with rising tensions between China and the U.S. President Donald Trump said Friday the U.S. would end its special treatment towards Hong Kong.

- The announcement came after China had approved a national security bill that would increase the mainland’s power over the city. However, Wall Street breathed a sigh of relief as Trump did not say he would pull the U.S. out of the phase one trade deal reached earlier this year.

- Data showed China’s manufacturing activity expanded in May. Investors have been monitoring China’s economic data for signs of recovery in the country, where the coronavirus was first reported.

- Pfizer reported disappointing trial results for a breast cancer drug, keeping sentiment in check.

“Nothing that has happened since the market closed on Friday has been market positive,” said Art Hogan, chief market strategist at National Securities. “When you think about clearly we’re beginning to take U.S.-China tensions seriously and you add on to that the massive amount of disruption going on in almost every major city in the country right now, none of that could be seen as market positive.”

“At the levels we’re at, I wouldn’t be surprised to see the market take a pause and pull back,” Hogan added.

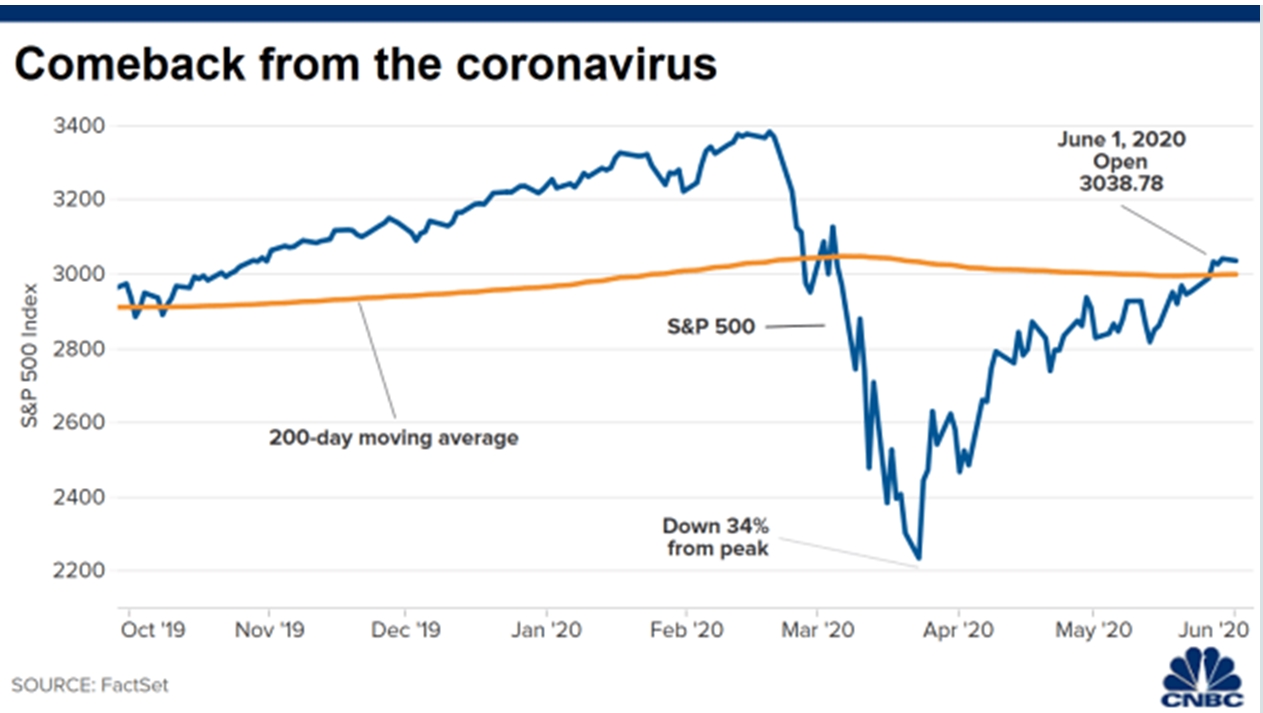

The S&P 500 is up 38% from its intraday low set on March 23. Before May’s gains, the S&P 500 surged 12.7% in April. The Dow gained 11% in April.

“The main downside risk facing stocks is a second wave of the disease,” said Peter Berezin, chief global strategist at BCA Research, in a note to clients. “If fears of a new outbreak were to escalate, risk assets would suffer.”

Berezin added, however, he recommends a “modest overweight” portfolio allocation to stocks, noting: “Even if a vaccine does not become available later this year, increased testing should allow for a more economically palatable approach to containment strategies.”

More than 6 million coronavirus cases have been confirmed globally, including over 1.7 million in the U.S., according to Johns Hopkins University. However, Novavax said last week is started Phase 1 clinical trials for its coronavirus vaccine candidate while Moderna said May 18 its early stage vaccine trial had yielded positive results.

—CNBC’s Patti Domm and Eustance Huang contributed to this report.

U.S. savings rate hits record 33% as coronavirus causes Americans to stockpile cash, curb spending

Published Fri, May 29 20208:39 AM EDTUpdated Fri, May 29 202010:41 AM EDT

Maggie Fitzgerald@mkmfitzgerald

Key Points

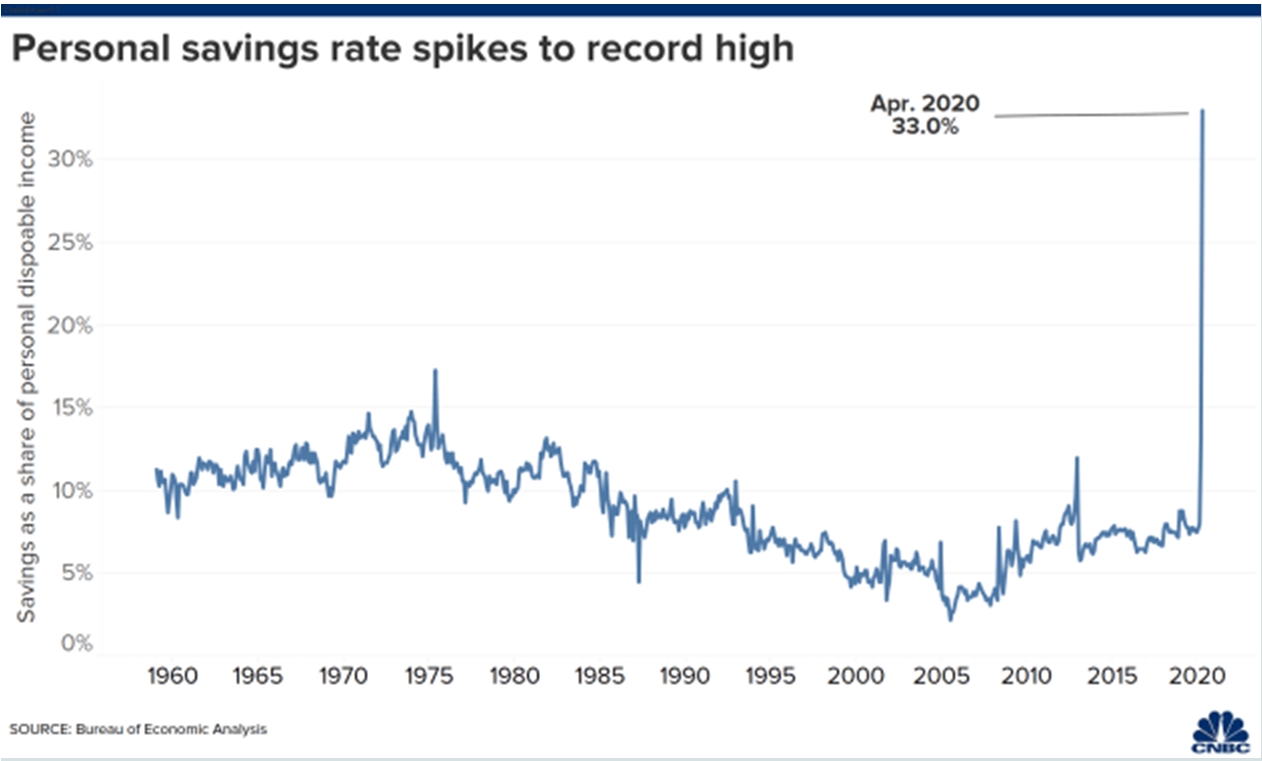

- The personal savings rate hit a historic 33% in April, the U.S. Bureau of Economic Analysis said Friday.

- “There is a tremendous uncertainty and virus fear that is lingering and that is restraining people’s desire to go out and spend as they normally would,” said Gregory Daco, chief U.S. economist at Oxford Economics.

- With the U.S. consumer accounting for more two-thirds of the economy, the economic recovery depends on whether the increase in savings is a result of shutdowns or structural changes in consumer habits, analysts said.

- The increase in savings came as spending declined by a record 13.6% for the month.expected

The coronavirus crisis has Americans hoarding more money than ever as widespread fear paralyzes consumer spending habits.

The personal savings rate hit a historic 33% in April, the U.S. Bureau of Economic Analysis said Friday. This rate — how much people save as a percentage of their disposable income — is by far the highest since the department started tracking in the 1960s. April’s mark is up from 12.7% in March.

The swiftness and severity of a U.S. economic recovery hinges on whether consumers continue to stockpile cash or start to spend again.

“There is a tremendous uncertainty and virus fear that is lingering, and that is restraining people’s desire to go out and spend as they normally would,” said Gregory Daco, chief U.S. economist at Oxford Economics.

Sign me up

The previous record savings rate was 17.3% in May 1975, according to FactSet. The savings rate was elevated above 13% throughout most of the early 1970s. The increase in savings came as spending declined by a record 13.6% in April.

U.S. consumers have amassed savings as the deadly coronavirus causes unprecedented economic and societal disruption. The deadly virus — which forced a government mandated shutdown of the economy — has caused more than 40 million Americans to file for unemployment since the virus was declared a pandemic.

“The saving rate is the residual of an extraordinary event,” Diane Swonk, chief economist at Grant Thornton, told CNBC.

With the U.S. consumer accounting for more two-thirds of the economy, the speed and robustness of economic recovery depends on whether the increase in savings is a result of the shutdown or reflects a more structural change in consumer habits, analysts told CNBC.

‘Forced savings’

Saving during the Covid-19 pandemic is especially unique due to the shutdowns. Hundreds of thousands of small and large businesses shuttered their doors in an effort to curb the fast-spreading virus.

There is an aspect of “forced savings,” said Swonk.

“There’s not much opportunity for many people to go out and spend money,” said Megan Greene, a senior fellow at Harvard Kennedy School. “With shops all closed and everybody locked up, the ‘shopportunities’ have dried up. That speaks to a kind of demand shock.”

On the other hand, a more structural change in saving and spending habits with “scarring” in consumers can have intense repercussions for the economy. This occurred during the Great Recession and can exacerbate secular stagnation, which “keeps interest rates and growth and inflation all low for a long time,” said Greene.

“As long as the money is put in savings instead of being invested, then typically that tends to weigh on interest rates, it tends to curb growth and to weaken the potential of the economy,” Daco said.

During a crisis or a recession it is entirely rational for an individual to be more conservative with their spending and savings, said Marc Odo, portfolio manager at Swan Global Investments.

“The paradox is that if everyone across the broad economy is hunkering down, that only makes the recession worse,” Odo said. “The paradox of thrift is a negative feedback loop. The more people save, the less they spend; the less they spend, the worse the recession gets; the worse the recession gets the more they save.”

Consumer spending habits will play a large roll in whether the economy recovers in a V shape, a W shape or a swoosh. ow to save more and spend less

‘Pent up demand’

Bank of America — which touches half of American households — said checking accounts have 30% to 40% more money in them compared with 12 weeks ago, CEO Brian Moynihan told CNBC Thursday. But Moynihan is seeing a recovery in spending habits.

“That means that the stimulus is still in their accounts and it’s going to be spent. Part of it’s been spent but there’s more to come,” he said.

Ark Invest founder Cathie Wood, who manages $15 billion in assets for clients, said consumers will lead the economy out of this downturn, making up for the months they weren’t able to spend. This theory is consistent with V-shape recovery, where activity returns as fast as it evaporated.

“Sure there’s a lot of despair out there and really difficult stories, but if you look at the consumer as a whole, the consumer has this huge saving right now, and that, once the paralysis is done, that’s pent up demand waiting to be deployed,” Wood said.

Wood likens the current savings to the post-9/11 era, when consumers went through a brief period of “paralysis” after the attack, followed by a robust recovery in spending. During the SARS pandemic there was a big drop in retail sales but a year later, the data had completely recovered.

“So we actually think the market is beginning to understand this. That’s why we haven’t had the retest that most investors expected. What usually happens is a retest, but it doesn’t look like we’re going back to the old lows,” Wood said. “I think the market is seeing through to the other side of this cycle, and trends in motion before the crisis will remain in motion. That means businesses will have to chase to keep up with consumers as they satisfy pent-up demand.”

Stocks have come way off their March lows on investor optimism about the economic reopening and a potential coronavirus vaccine. All 50 states have begun to reopen to some extent, two months after the pandemic thrust the country into lockdown.

Savings were increasing pre-Covid-19

The savings rate was increasing, although less drastically, before the global pandemic.

This was largely driven by the elderly population, according to Swonk. Pre-Covid-19, baby boomers were pulling back on spending amid a surge in mortgage restructuring, meaning the older population was saving money each month and not spending.

“Baby boomers are near or in retirement, which makes them more skittish than they once would have been,” Swonk added.

Swonk expects this trend to continue in the post-Covid era, as boomers are among the highest-risk groups for contracting the virus.

“There’s no reason to think that baby boomers who are most at risk, in a world where the well is still Covid-tainted, that they’ll drink from the well freely as consumers,” said Swonk. “There’s a reason to save more and they will.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

— with reporting from CNBC’s John Schoen.

Navy SEAL Gives the Top 5 Reasons You Get Kicked Out of Spec Ops Training (or Don’t Reach Any Goals You Have)

Your chances of making it through a top level Special Ops training course are pretty low—Less than 20% survive to graduate. Thousands try out, but the failure rate is very high…over 80% fail. You have a better chance of getting accepted and graduating Harvard Law school.

In my BUD/S Class 132, we had 140 trainees line up at the start and only 16 men finished.

This is not counting the many thousands who try to take the initial test just to get accepted and stand in that training compound.

In that initial testing at the on base pool we had over 25 tryout and only 2 sailors made it. That is just to get a PST to go to BUDS. That is not counting the medical screening and having a top score on the ASVAB.

So if you’re gearing up for Navy SEAL training (BUD/S), Ranger school (RASP), Green Beret Special Forces (Selection Course), USAF PJs—or any other Spec Ops training course—make sure you avoid these mistakes.

And while I’m writing these from the point of SOF training, they also work for why you fail at reaching any goal you have.

As you read them, think of how you can adapt them to anything you want to achieve in life.

REASON #1: LACK OF MOTIVATION AND NOT HAVING A “WHY”

More Spec Ops candidates fail out of training due to lack of mental toughness than they do the physical. Your “why” is what keeps you motivated. Without one, your level of achievement drops. Your “why” is your motivation anchor.

SOF athletes face enormous physical challenges. But the mind quits before the body. So for many of those that get kicked out it is their inability to push through the grind and tap into their “why”. That’s what allows you to keep going despite negative thinking

At some point, even the guys who graduate thought about quitting. I did. And what kept me going was my “why”

Wanting to become a SEAL or a Ranger because it’s “cool” is not a valid why. You need one that has a deep, personal meaning you can almost feel gripping you. It’s the beacon you can visualize when you’re feeling worn out and like you can barely get one foot in front of thr other

REASON #2: THINKING IT’S MAINLY ABOUT BEING PHYSICAL AND MINDSET HAS NO BENEFIT/EFFECT

A lot of the guys who failed out of BUD/S (and why they fail out of any SOF training—and why people fail reaching pretty much any goal)—banked their success totally on how fit they were. You need strength, yeah—but this is connected to Reason #1.

I remember asking some of those guys why they were going through BUD/S and all they did was shrug and say, “I don’t know. Because it’s cool, I guess.”

If you’re trying to be a Ranger or a SEAL or a Force Recon Marine for that same reason, I guarantee you’ll fail out. They say success in BUD/S (or in life) is 80% mental and 20% physical. Some might even say it’s 90/10.

I was not paying attention my first time through BUD/S and this small detail crept on my and almost got my a** flushed out the door.

Like I said, your mind will fail before your body. You can’t physically power your way through negative thinking.

REASON #3: YOU THINK RELYING ON YOUR MENTAL OUTLOOK IS ALL YOU NEED

So maybe you read about that 80/20 or 90/10 ratio of mindset to physical and think you can just breeze through BUD/S with a positive outlook. It’s important, but if you can’t physically hack it, you’re going to fail.

A lot of the guys who failed out of BUD/S did so in the first few days because they couldn’t handle the physical side of the training. They passed the BUD/S PST (Physical Standard Test), but banked their success on that being all they needed.

Here at SGPT, we tell guys the bare minimum numbers are what you need. I’ve heard from SOF candidates their recruiter lied to them about the physical requirements for BUD/S, including that you’ll be taught how to swim when you get there.

Navy SEAL PST Standards

Aim for the competitive levels given, if not better. The harder you train and prepare, the easier it will be from that aspect.

Also, find ways to mimic BUD/S conditions as best as you can. Train in cold, sh*tty weather. Make your training difficult so you can practice your mindset. One of the hardest things we did was continually running in the deep sand and doing calisthenics and then getting back in the cold surf at night. Find a way to replicate this.

REASON #4: YOU DON’T LET YOUR TEAM HELP YOU WHEN YOU NEED IT

Being an SOF soldier means relying on other people to get a mission done. This includes times when you’re exhausted and need help. Not asking for help in some way means you’re not betting in a team-oriented mindset. You’re not working as a unit. You might think it makes you a burden to ask, but it’s the opposite—not asking when you’re struggling makes you the burden because when you slow down, so does everyone else.

Yes, it does come down to you and your mindset and personal approach for whether you graduate or not, but if you can’t reach out and rely on your buddies then you become a weak link in the missions success. Or, at BUD/S the success of the evolution.

If you look at pictures of boat crews at BUD/S it’s a team of individuals. If you’re struggling, then your whole team will struggle. Reach out.

REASON #5: YOU DON’T HELP YOUR TEAM WHEN YOU SEE SOMEONE STRUGGLING

Yes, it’s important to focus on what you’re doing as an individual to get you to graduation. But if you only focus on yourself and let the guy (or guys) next to you who are having a tough time struggle because their failure means a better chance of success for you, then you’re caught up in your ego and are making yourself the weakest link.

Your team is only as strong as the weakest member. Being arrogant with your self-centered attitude (seeing a teammate’s struggles as your benefit) is a quick way for the instructors to focus on you and for you to fail out.

If your “why” is based around making other people’s struggles your strengths, you will get kicked out.

Taking the time to understand and realize this one is key. I watched dozens of guys get kicked out of the initial training for this one thing.

BONUS TIP: YOU DON’T COMBINE ALL OF THESE TIPS INTO A SOLID FRAMEWORK

Only focusing on each of these tips as something to focus on one at a time means you’re not getting through BUD/S in a balanced way. There will be times when one tip is at the forefront of your focus, but it’s important to think of them as a cycle.

Also, it’s important to recognize when you might be focused on the wrong tip. There will be times when you do need to drill down and focus only on yourself in a moment. But that may also be a moment when you need to reach out and ask for help—or give help. The ironic thing is that if you give help when you’re the most exhausted, you start feeling more energized and positive.

BONUS TIP #2: YOU TAKE EVERYTHING PERSONALLY THE INSTRUCTORS SAY TO YOU OR HAVE YOU DO

I’ve had athletes say SOF instructors (or even boot camp instructors) are bullies. These are not teachers who are picking on you because they’re a**holes. They’re doing it to make you dig down deep and find stronger levels of your “why” and strengths in you that you didn’t know you had.

It’s about making you see you’ve got more in you than you realize. If an instructor is always putting his focus on you, there’s a reason for it. Listen. Figure out why he’s doing it. It’s for a good reason and is not about cutting you down out of meanness.

If you take his focus personally and make it about you and start feeling sorry for yourself, you’re going to give him reasons to focus on you even more. You’re in control of the cycle. Find a way to break it.

SOF instructors aren’t there to be your friend. They’re there to push you—hard—so you’ll succeed.

Brad McLeod knows first hand about mental toughness. After passing Hell Week and Dive Pool Comp at BUD/S, he failed a math test and was kicked out of training. A year later, he returned, graduated, and served as an operator on the Navy SEAL Teams. Proceeds from this website go to help raise funds for the Navy SEAL Foundation on CrowdRise. SEALgrinderPT is also a proud sponsor of the Navy SEAL Foundation.

1 comment

Thanks for every other wonderful post. Where

else may anyone get that type of information in such an ideal manner of writing?

I have a presentation next week, and I’m on the look for such

info.