Trade Findings and Adjustments 3-26-2020

Let’s Talk Initial Claims, A bottoming, and why/numbers when it comes to dollar cost averaging options or leaps

With today’s initials claim what should our market be doing right now?

Should be tanking because: Beat the previous record in 1982 by more than quadruple

The initial claims report started in 1967 and

Ellen Zentner Morgan Stanley projected through her newly made model, 17 million job losses which should be twice as many as the 8.7 million in the Great Depression

Does anyone here today believe we are going to go through a great depression

YES it can get much worse but most likely this is a one quarter, maybe two quarter, blip

I predict we sell off like we did yesterday and are up less than one percent

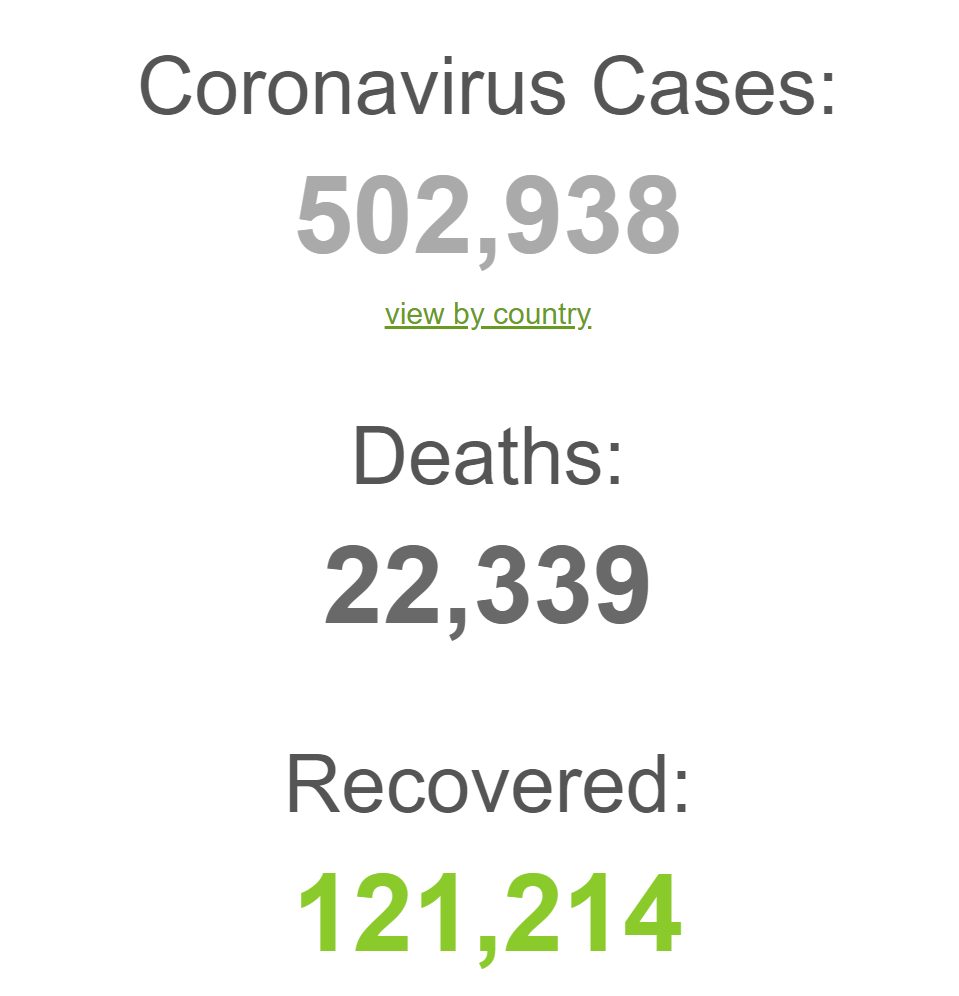

How many new cases will we have from Friday after the markets closes to Monday when it opens up? We will gain somewhere between 30-45K and be at 150K by Monday

Are you ready to take off protection? I’m cashing some in and adding bear puts

It looks like businesses are going to have a 45 day reprieve from having to give earnings and

Guidance. I don’t even know how far out to go to cover a company/stock for earnings

Are we bottoming? YES the bottoming process has started which means we will most likely come back and test the 2200 range on the S&P 500

To warn you, you will hear the term “slingshot” mention more and more in advestisement and the media

How can I best make up some of the downward movement and how do I put it back to work

Obviously to add new positions is ideal if you are sitting on a ton of cash

For those who have had positions and now have some good cash due to protection dollar cost

averaging a benefit

stock purchased at $100 and falls to $50 is down 50%

So we buy a second share at $50 and our new cost basis is?= $75

Which means when the stock gains half of what it was you are breaking even and if it gains all of it back you are up 33.3%

Does this work with options?

HELL YES !!!

IF you bought the right to buy BA at $350 Jan 21 and paid $38 for that right

You can now buy the same call for $4

$4 + $38 = $42 /2 = $21 per contract cast basis

BA might not get to $350 this year

And currently the delta for a 350 Jan 21 is $0.14 cents

Eight strike prices higher it is $.28

If BA moves $40 the options will gain $5.60 at the $200 mark

If they gain another $50 moving to $250 or more than $14

$4 +4 + 14 = $22 per contract on the low side

So the question is why the hell don’t we buy three, four, or five times the amount of contracts ?

Just in case it doesn’t go up YOU need to limit the max contracts so you don’t throw good money at bad !!!!!

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com