HI Market View Commentary 02-10-2020

| Market Recap |

| WEEK OF FEB. 3 THROUGH FEB. 7, 2020 |

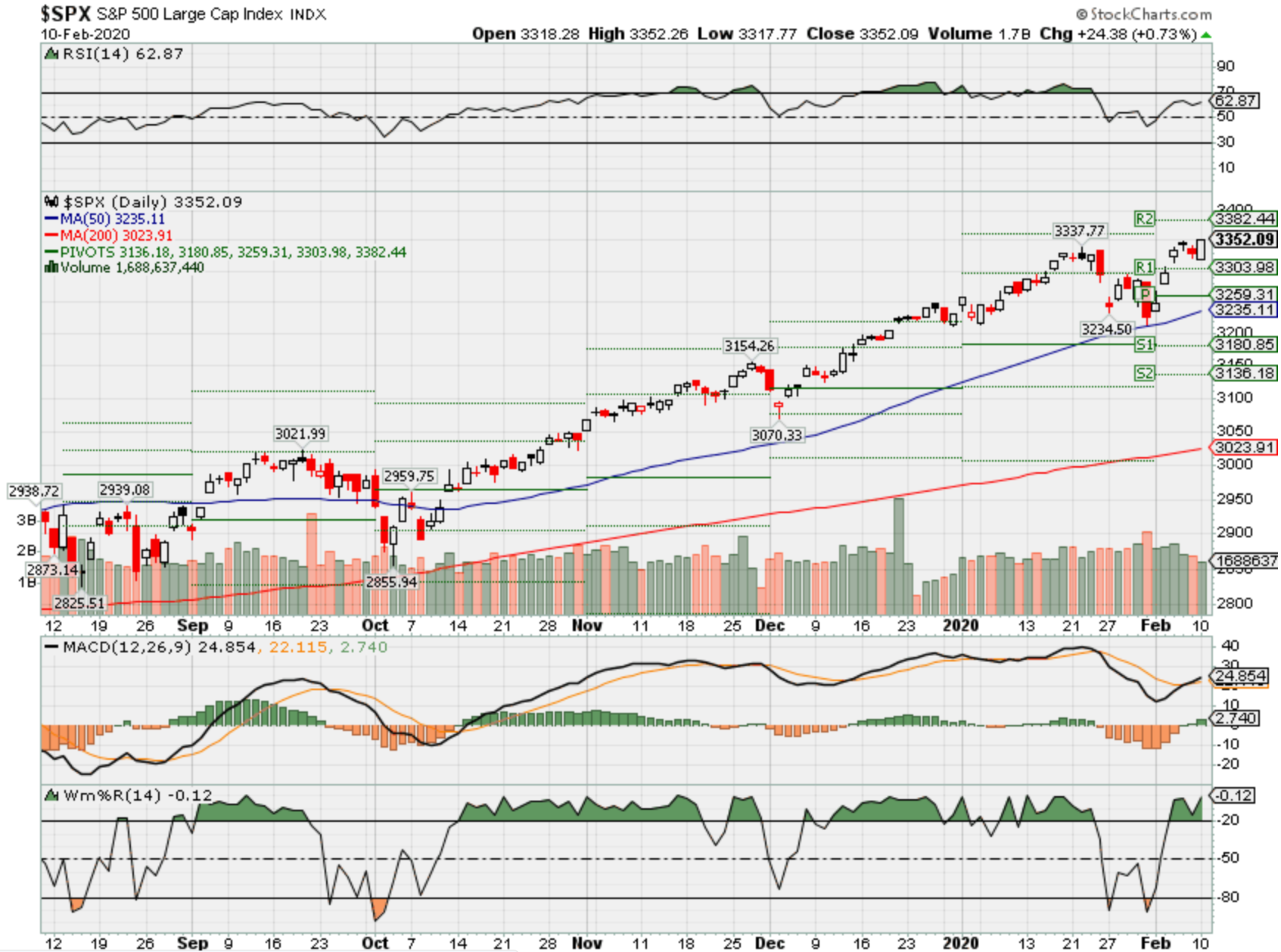

| The Standard & Poor’s 500 index rose 3.2% last week, rebounding from two consecutive down weeks as an encouraging round of earnings reports along with plans by China to halve tariffs on some US goods helped investors shrug off some of their fears about the novel coronavirus.

The market benchmark ended the week at 3,327.71, up from last week’s closing level of 3,225.52. New records were set Thursday as the S&P 500 traded as high as 3,347.96 intraday and closed at 3,345.78 following four consecutive days of gains, but the index traded lower Friday as investors took on a more cautious stance heading into the weekend. Still, Friday’s drop erased just a small part of the weekly advance. Thursday’s record highs were reached amid an announcement by China that it would cut tariffs on some $75 billion of US goods to 5% from 10% while levies on some other items would also be halved to 2.5% from 5%, effective Feb. 14. The announcement was seen as a sign of improving trade relations between China and the US, which reached an initial trade deal last month following a nearly two-year trade conflict but left other details unresolved. Market sentiment was also boosted this week by more Q4 corporate earnings reports coming in above analysts’ expectations. And while US stocks didn’t rise on the data Friday, the latest monthly employment report showed the US added more jobs than expected in January. The data also showed the unemployment rate edged up to 3.6% in January from 3.5% in December, but the Labor Department said the increase reflected more Americans looking for work. The week’s climb was broad, with all but one sector — utilities — in the black this week. The technology sector had the largest percentage increase of the week, up 4.6%, followed by a 4.3% rise in materials and a 3.9% increase in health care. Utilities, which is often considered a safety sector and was one of the few sectors that rose in the previous two weeks, edged down 0.6% this week. The technology sector’s gainers included Cognizant Technology Solutions (CTSH), whose shares climbed 13% this week as the provider of information-technology services reported Q4 adjusted earnings per share and revenue above analysts’ expectations. In materials, FMC (FMC) shares gained 10% as the company also posted Q4 earnings per share and revenue above analysts’ expectations. In health care, Biogen (BIIB) shares jumped 26% on the week amid reports the company won a legal battle against Mylan (MYL) over a patent on Tecfidera, its multiple sclerosis drug. Many analysts raised their price targets on Biogen’s shares. Provided by MT Newswires. |

What I want to talk about today? PROTECTION and Adjusting PROTECTION

What do we use for protection when we use options? LONG PUTS

NO a short call is NEVER truly protection

IF you short a call for maybe 3% credit Risk = 97% total invested capital

Long Put protection on AAPL 317.50 and we spent $9.56

Risk in the trade 9.56/317.50 = 3% of our total invested capital at risk

I could sell a put @$300 strike for a credit of $2.89

9.56 – 2.89 = 6.67

How much protection do I have IF I short a put against the long?

317.50 down to 300 so we have ONLY $17.50 of protection

Let’s talk markets – What is going on in our markets?

President NOT impeached

Wuhan Virus because that’s the epicenter Risks are death, shut down of companies in China, Cruise quarantined

How is really going to affect company earnings?

Yes a company might take a slight hit in earnings

Right now and through this year I believe the market will be quick to take profits off the table on the gains received over the last decade. We will have a volatile 2020

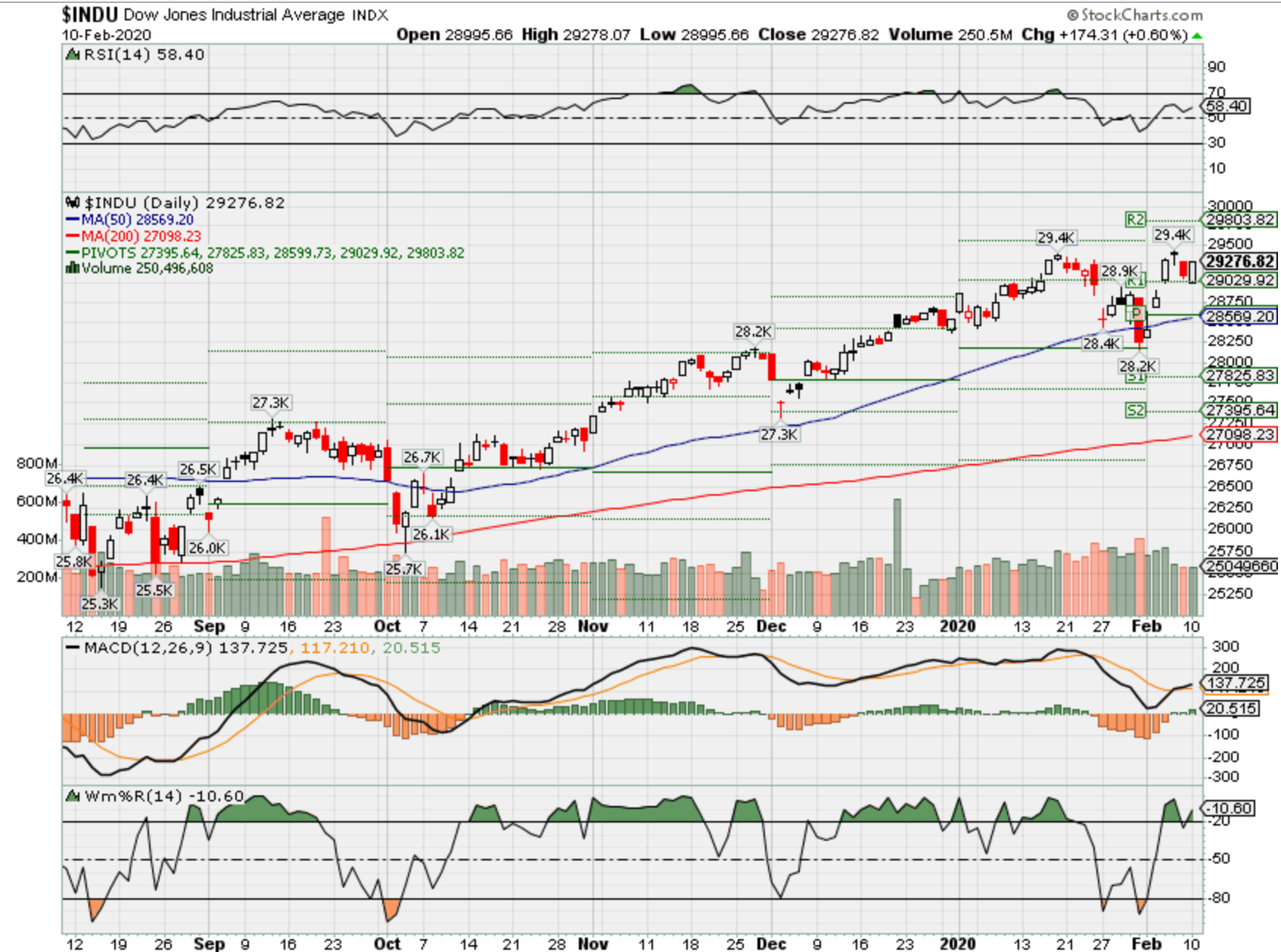

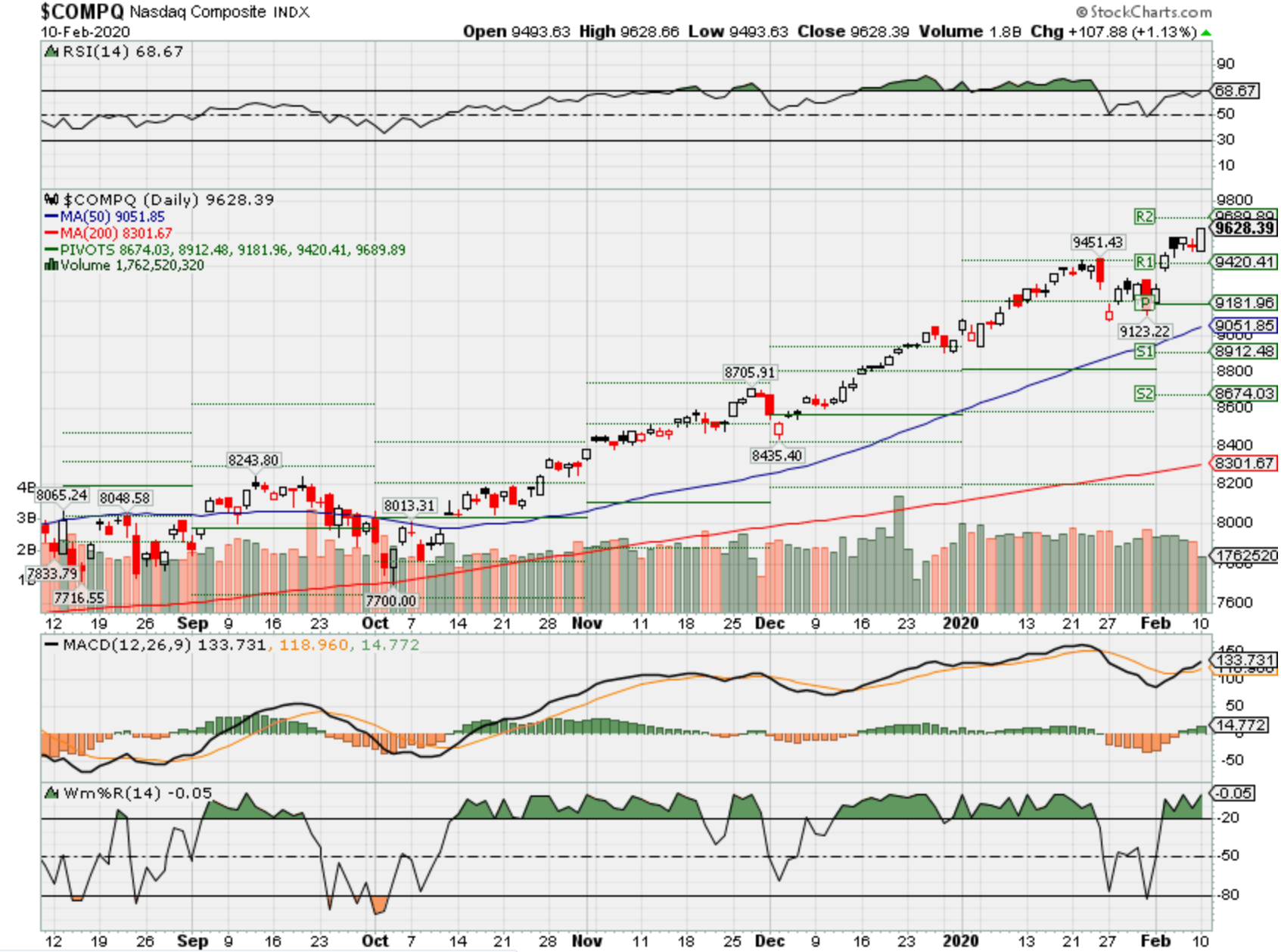

Where will our markets end this week?

Higher

SPX – Bullish

COMP – Bullish

Where Will the SPX end February 2020?

02-10-2020 -2.0%

02-03-2020 -2.0%

Earnings:

Mon: AGN, L,

Tues: HAS, HLT, AKAM, WU, UAA

Wed: GOLD, TAP, NBL, CTL, FOSL, NTAP, NUS, TRIP, CVS, MRO

Thur: DUK, GNC, HUN, KHC, PEP, WM, GDDY, MAT, NVDA, ROKU, YELP

Fri:

Econ Reports:

Mon:

Tues: NFIB Small Business Optimism Index, JOLTS

Wed: MBA,

Thur: Initial, Continuing, CPI, Core CPI

Fri: Retail Sales, Retail ex-auto, Import, Export, Capacity Utilization, Industrial Production, Business Inventories, Michigan Sentiment

Int’l:

Mon – CN:CPI, PPI

Tues – CN: Money Supply, Direct Foreign Investment

Wed –

Thursday – FED Chair Powell Testifies

Friday- CN: Retail Sales, Industrial Production

Sunday –

How am I looking to trade?

Earnings are coming up and protecting through earnings with protective puts and NO short Calls

AOBC – 3/05 est

BIDU – 2/27 est

MRO – 2/12 AMC

MU – 3/19 est

NEM – 2/20 BMO

TGT – 3/03 est

UAA – 2/13 est

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Disney: Compelling Investment, These Are Details You Should Consider

Feb. 5, 2020 1:05 PM ET

Summary

Disney+ paid subscribers reach close to 29 million.

Discussing Disney’s main competitive advantage – parks & merchandise.

Many moving parts and assumptions, but there are more than enough reasons to consider this stock undervalued.

Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Get started today »

Investment Thesis

Disney’s (DIS) Q1 2020 results superficially were reasonable, indeed investors’ after-hours reaction was muted.

However, upon deeper analysis, we can see this juggernaut taking up arms and repositioning itself for the challenge ahead: streaming wars. This is a highly compelling opportunity for savvy investors. Here’s why:

Front and center: Disney+ most recently reported figures 28.6 million paid subscribers – if that doesn’t give investors pause for thought, nothing will.

Netflix’s (NFLX) global figures are guided for 174 million in Q1 2020. However, if you follow this space closely, you know that global subscribers are not so profitable to Netflix – and a similar economic profile can be assumed for Disney (for now).

However, what is pertinent to Disney is that Netflix’s domestic subscribers hit 61 million after years of growing its content library. And in little over a single quarter, Disney+’s paid subscribers are already at approximately 50% of Netflix’s.

On the other hand, one could argue that Netflix’s package is priced at close to double that of Disney+. Further, through Verizon (VZ), customers are able to get a free year of Disney+ at no additional cost.

Hence, there are some exclusions, but the ballpark figure is enough for investors to grasp the potential of Disney+.

Parks & Merchandise – Competitive Advantage

The biggest problem for Netflix is that content creation is incredibly expensive, reaching $15 billion in 2019, forcing its already frail balance sheet to be further restricted to accommodate Netflix’s ambitions as the ”must-have” platform.

Lucky for Disney’s shareholders, Disney does not lack funds. Indeed, its Parks, Experiences, and Products segment’s operating income approximates 58% of consolidated operating income and continues to benefit from positive pricing and some attendance growth.

Meanwhile, its balance sheet carries a net debt position of $38 billion. Hence, given that it historically was generating approximately $8 billion of free cash flow, this balance sheet speaks of maneuverability while Disney goes about pivoting its direct to consumer business.

Valuation – Medium Margin of Safety

If you have followed my work before, you will notice the absence of my valuation table.

This is because Disney finds itself in a transition period making financial metrics misleading – in this instance.

However, assuming that Disney continues to make positive headway domestically, while minimally succeeding in Europe and Internationally, investors should expect the company to at least be growing its revenues in the ballpark of 10-15% over its coming couple of years.

But this figure is a huge assumption based on its paid subscribers reaching close to 30 million as quickly as they have – highlighting the tremendous demand of its Disney+ platform.

Investment Risks

Amongst the excitement of Disney’s potential uprise against Netflix, let’s not forget the main critical aspect: This is not a two-player streaming war. This is an increasingly fragmented market, where consumers demand high quality and volume.

Indeed, Apple (AAPL) and Amazon (AMZN) are no push-overs to be taken lightly. But going further, there are even more competitors, both free, such as YouTube (GOOGL) or at various pricing points such as Roku (ROKU).

While Netflix and Disney are equally determined to push the narrative that consumers are likely to adopt more than one platform, I remain skeptical.

Yes, some households will, particularly wealthier ones, but the world is not made up of just wealthy households. However, for now, Wall Street remains happy to unquestionably adopt this narrative.

For Disney, personally, I would keep a focus on the numbers of paid subscribers Disney+ discloses.

The Bottom Line

Disney has everything it needs to take market share in the streaming war. Focused management, and in no way overpriced – yet. Giving its strong revenue diversification, it offers Disney huge maneuverability to reposition itself for the decade ahead.

Why You Should Join My Marketplace?

Even though Disney is terrific, evidence shows it’s difficult to beat the S&P500 by investing in widely followed richly-priced popular names.

Meanwhile, by being investing in smaller contrarian stocks, your chances of outperforming improve.

Are You Pressed For Time?

I do the hard work of finding a select group of value stocks that grow your savings.

- Invest by avoiding losers.

- Honest service aimed at novice and professional investors.

- Strategy inspired by Buffett, Pabrai, and Greenblatt.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

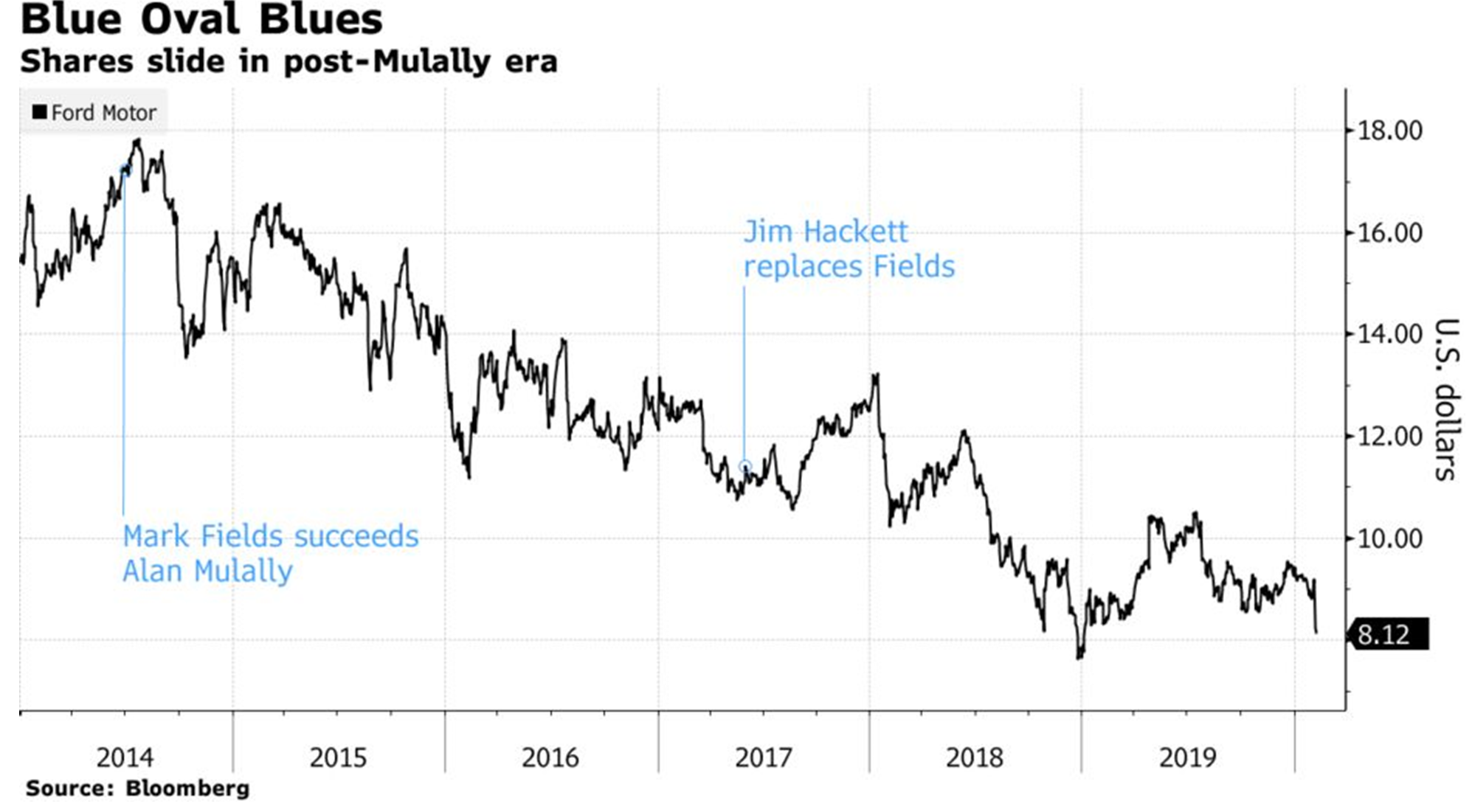

Ford Board Leaves Embattled CEO With Little Room for Error

February 8, 2020, 4:00 AM MST Updated on February 10, 2020, 8:31 AM MST

‘We cannot wait year and years,’ soon-to-be COO Farley says

Hackett ‘can’t miss a beat’ anymore after botched Explorer

A little executive bloodletting can sometimes ease the pressure on an embattled chief executive officer. But Jim Hackett is unlikely to see any letup from Ford Motor Co.’s board following the surprise early retirement of one his two top lieutenants.

Joe Hinrichs, Ford’s 53-year-old automotive president, will leave on March 1 after almost two decades with the company. As a rising star under celebrated former CEO Alan Mulally, he was put on the fast track to be a potential heir to the top job.

With Hinrichs out of the picture, Ford is elevating Jim Farley, the company’s only other president, to become the first chief operating officer since the automaker planned for Mulally’s succession seven years ago. The announcement that the board will revive the role of COO came days after Hackett reported dismal earnings results, dogged by the disastrous rollout of the redesigned Explorer SUV, and forecast more disappointing numbers for the upcoming year.

“This signals to everyone that Farley is Hackett’s successor, unless they plan to go outside the company,” said David Whiston, an analyst with Morningstar in Chicago. “Perhaps it could be nine months from now, or it could be 18 months from now, but they will make an announcement that Hackett is retiring and Farley takes over as CEO.”

Staying Put

Hackett, who was asked by an analyst 18 months ago whether he expected to last in the job, told reporters Friday he’s not going anywhere.

“As far as my tenure, this is the kind of thing I love to do and I’m having a really fulfilling assignment here,” said the former CEO of office-furniture maker Steelcase Inc. “I need to be here.”

Since being pressed into duty almost three years ago by Executive Chairman Bill Ford to stabilize his family’s foundering automaker, Hackett, 64, has promised to accelerate the 116-year-old company’s “clock speed.” But Wall Street analysts have long groused that Hackett’s global restructuring has moved at a plodding pace.

“There is a long way to go,” Michael Ward, a Benchmark Co. analyst who rates Ford a hold, wrote in a report Monday, cutting his projection for earnings this year and warning that cash needs for restructuring are likely to remain a headwind into 2021. Morgan Stanley’s Adam Jonas wrote separately that he made the “wrong call” upgrading Ford to the equivalent of a buy in August and making it his top pick among U.S. auto stocks.

Ford shares slipped as much as 0.5% to $8.07 as of 10:30 a.m. in New York. The stock has fallen 25% under Hackett and by more than half since the departure of Mulally, the only CEO of a Detroit automaker who kept his company out of bankruptcy in 2009.

Hackett himself acknowledged Ford has run out of margin for error when he told analysts during last week’s earnings call: “It does boil down to we can’t miss a beat now in the product launches.”

On Friday, he addressed the costly mistakes made with the Explorer sport utility vehicle again, telling reporters there’s “no room for that type of miss” anymore.

Hackett’s Headache

U.S. sales of key models have shrunk since Mullaly left in 2014

Source: Company statements

In an interview Friday, Farley, 57, didn’t want to talk executive succession. But he said he’s eager to pick up the pace as Ford rolls out a redesigned F-150 pickup — its most profitable model — and pours billions into the electric and self-driving cars upending the industry.

“We cannot wait years and years,” Farley said by phone. “In the context of our industry and how it’s changing, we have to accelerate.”

Tough Talk

Farley joined Ford from Toyota Motor Corp. in 2007, just before the bottom fell out of the U.S. auto market. He helped navigate the company through the Great Recession without resorting to the government bailouts and bankruptcies that befell General Motors and Chrysler.

A marketing specialist and cousin of the late actor and comedian Chris Farley, Jim Farley broadened his skills over the years with stints running Ford’s European operations and launching a comeback at Lincoln. Most recently, he’s been head of strategy and technology, cutting deals with Volkswagen AG and Rivian Automotive Inc. on electric and autonomous vehicles.

Along the way, Farley earned a reputation as a tough taskmaster, never afraid to speak his mind and throw a few elbows.

“F— GM, I hate them and their company,” he was quoted as saying in the 2011 book “Once Upon a Car” by then-New York Times Detroit Bureau Chief Bill Vlasic. “I’m going to beat Chevrolet on the head with a bat.”

Blunt Contrast

Farley’s tone may have softened since then, but his drive remains and Ford insiders are bracing for an extremely demanding new boss.

“Farley is very blunt, and I think Wall Street is actually going to like that because it’s such a contrast from Jim Hackett being very indirect,” said Whiston, who has the equivalent of a buy rating on Ford. “Farley has worked on his temperament a bit and tends to give more diplomatic answers now. The f-bombs are probably a thing of the past.”

As for when Hackett might become a thing of the past, Farley isn’t speculating.

“That’s for the board to decide,” Farley said. “My job is to get the most out of this team, just like we did many years ago, and bend that curve of financial performance and make the right bets strategically.”

— With assistance by Melinda Grenier

https://seekingalpha.com/article/4322211-why-fords-ceo-got-to-go

Why Ford’s CEO Has Got To Go

Feb. 6, 2020 6:06 PM ET

Summary

Ford took another massive write-down, hurting shareholder value.

Weak outlook and poor execution just a few headwinds.

Price target still over $9.00.

I do much more than just articles at DIY Value Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

The nearly 10% drop in shares of Ford Motor Company (F) is an indication of just how disappointed investors are with management. The company botched the release of key new vehicle models, wrote down billions in pension costs, and is nowhere near completing its restructuring program.

Ford’s management is hardly accountable for its missteps. Maintaining its dividend at a yield of 6.5% is the only thing it is doing right. Suffering shareholders may offset a single day’s loss with a year and a half of waiting for the dividend payment.

Why should investors continue holding Ford shares and put up with the current management and the CEO? There are three reasons that Ford’s management needs a major change.

1. Botched Product Launches in 2019

Ford management claimed it learned from its volume losses in Chicago during its all-new Explorer launch. Yet, the two fines received in the last two decades suggest that the company did nothing to improve output quality. Requiring fixes before these new models are sold will weigh on the already thin profit margins. It also frustrates loyal Ford fans who cannot get the truck fast enough.

New warranty issues, plus existing ones, raised costs and hurt quarterly results. Again.

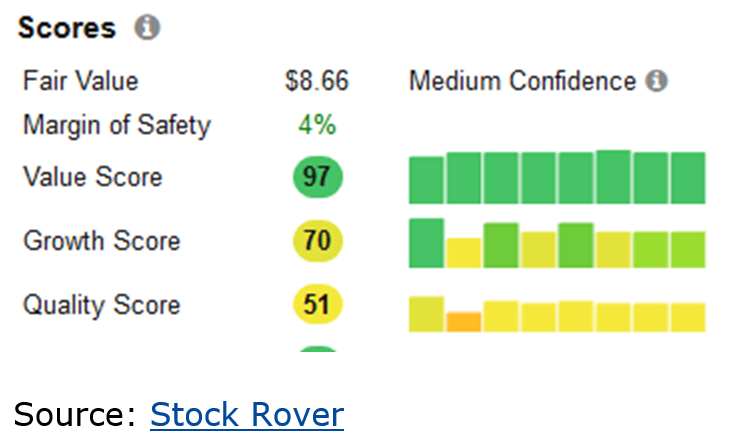

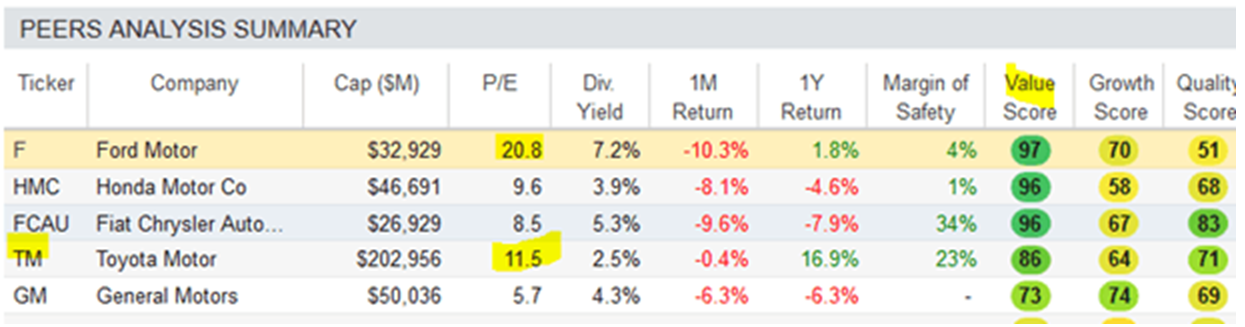

After launching multiple products, such as the Escape, Super Duty, and Puma in Europe, investors cannot have any confidence that the Mach-E launch will go smoothly. And at a P/E of 21 times, Ford shares are not trading at a discount. Unless the company beats its EPS forecast of $0.94-1.20 in 2020, investors are not getting much of a margin of safety. Still, the stock has a value score of 97 but scores poorly on growth and quality:

The 4% margin of safety does not give management much room in disappointing investors yet again in the next quarter.

After the stock’s drop, Ford shares offer the highest value. Disappointed investors may want to buy Honda (HMC) or Toyota Motor (TM) stock instead. Even though Toyota stock is already up 17% in the last year, the stock has a 23% margin of safety.

2. Ford at Inflection Point, Again

Ford posted a 67% drop in adjusted free cash flow. Its cash balance of $22 billion and $35 billion in liquidity allows the company to pay investors a dividend to wait. North America is Ford’s only segment showing higher revenue. If it keeps losing money in China, Europe, and the Middle East and Africa, why not shut down and double its efforts in North America?

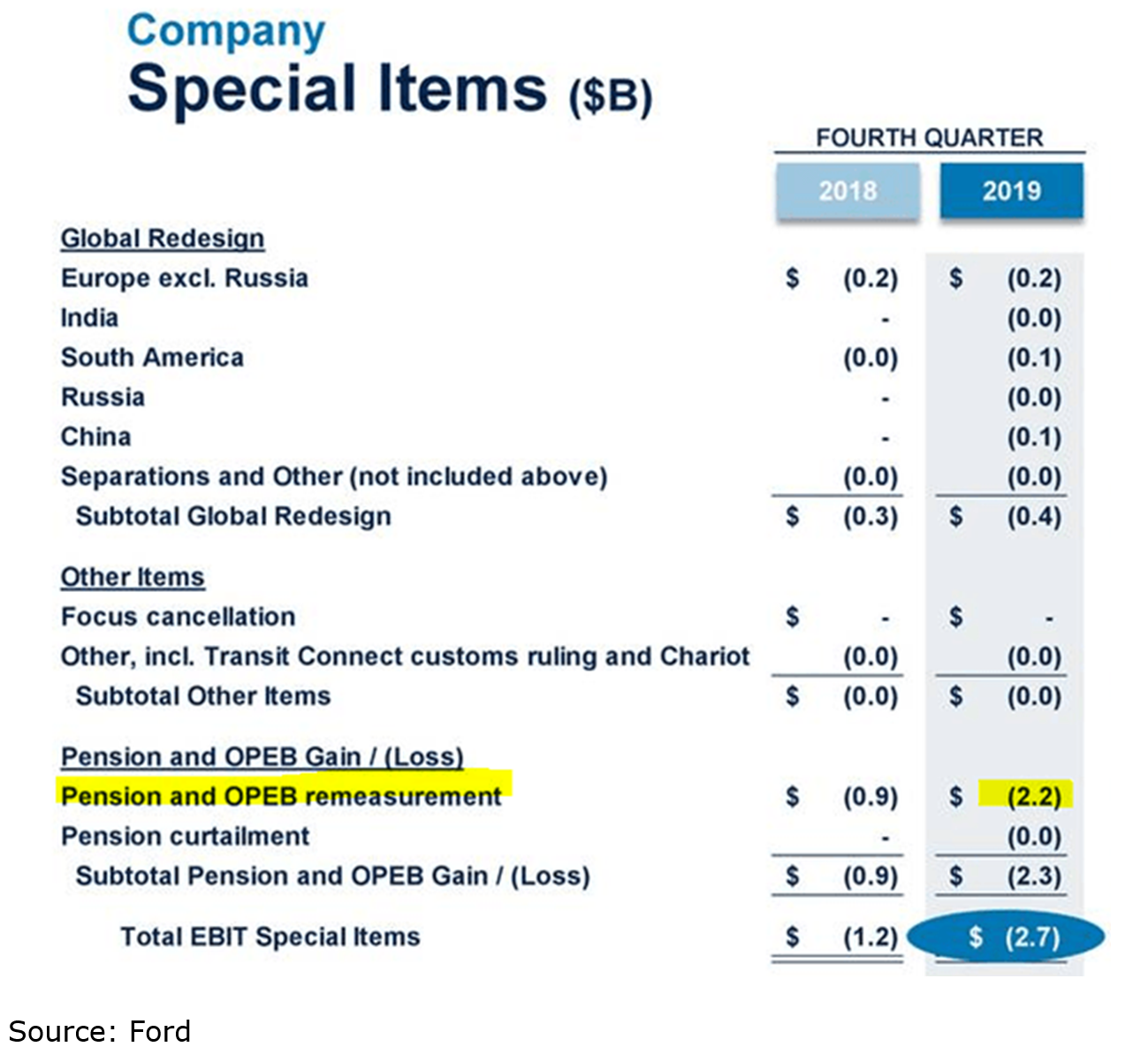

Ford took a $2.2 billion pension write-down:

The amount should cover its obligations and might suggest the company is at an inflection point. With no more major write-offs, the company may turn its attention back to business execution.

Despite its issues, the company may count a full-year of all-new Explorer sales this year. Its product mix is favorable and ramp-up costs for new products are now behind it. Plus, the UAW will not get another bonus. Headwinds for 2020 include additional costs in launching the F-150 and a higher tax rate.

3. Outlook

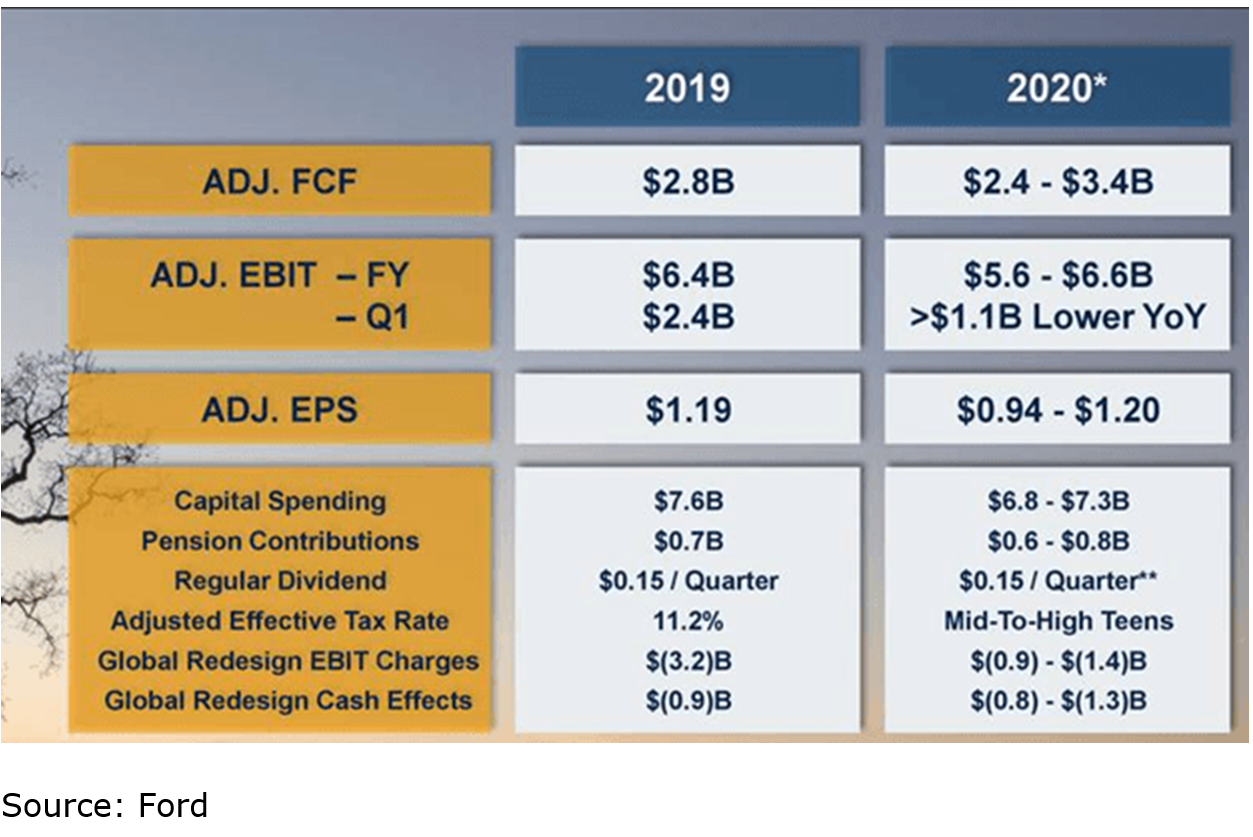

Ford forecast its adjusted free cash flow may or may not improve from last year. Adjusted EBIT will very likely fall:

The disappointing outlook suggests that Ford will trade in a range in the best-case scenario. A positive catalyst would be replacing underperforming management and bringing in leadership that accelerates the turnaround plan. Of around $7-11 billion in planned charges, Ford guided to only $4.6-5.1 billion.

Price Target and Your Takeaway

Assuming a discount rate of 9% and a ~12 times terminal EBITDA multiple, Ford stock is worth $9.28:

My 5-year DCF model (EBITDA exit) assumes revenue growth improves with management changed by FY 2021:

Ford’s post-earnings drop gives income investors another entry point. While capital gains are more likely with Honda or Toyota stock, Ford stock may still reward investors. It will just take at least 1.5 to 2 years to happen.

Disclosure: I am/we are long F. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

White House to unveil Trump’s election-year budget calling for extending individual tax cuts

PUBLISHED SUN, FEB 9 20203:42 PM ESTUPDATED MON, FEB 10 20206:43 AM EST

KEY POINTS

- The fiscal 2021 budget projects the deficit will hit $1 trillion this fiscal year and linger at $200 billion after a decade.

- It includes a plan to extend the disputed tax overhaul that Republicans passed in 2017.

- The White House is proposing to continue tax cuts for individuals through 2035 at a cost of $1.4 trillion — a figure that serves as a rough placeholder for President Trump’s promised “Tax Cuts 2.0.”

- The budget also assumes that interest rates remain at historically low levels despite projections for a strong economy.

WASHINGTON — The White House’s election-year budget will show the economy growing at an average rate of 3% for the next 15 years, a senior administration official said Sunday, spurred on by another round of tax cuts and low interest rates.

The fiscal 2021 budget, to be released Monday, includes a plan to extend the disputed tax overhaul that Republicans passed in 2017. The reductions in the individual rate are set to expire in 2025. The White House is proposing to continue those cuts through 2035 at a cost of $1.4 trillion — a figure that serves as a rough placeholder for President Donald Trump’s promised “Tax Cuts 2.0.”

The budget also assumes that interest rates remain at historically low levels despite projections for a strong economy, with the 10-year Treasury yield rising to only about 3% by the end of the decade. The Federal Reserve cut its benchmark interest rate three times last year, and officials are not forecasting any changes this year. But Trump has repeatedly pressed Fed Chairman Jay Powell to cut rates to zero and has dismissed central bank officials as “boneheads.”

Assuming no changes to current law, the nonpartisan Congressional Budget Office projects much lower economic growth than the White House projection of 3%.

The White House is counting on economic growth to help shrink the deficit. Its forecast projects the deficit will hit $1 trillion this fiscal year and linger at $200 billion after a decade. The senior White House official said it will take the administration five more years to balance the budget.

“First and foremost, we have to restore growth,” Vice President Mike Pence told CNBC on Friday. “That’s how we will deal with the long-term fiscal challenges facing our country.”

But the White House budget will also propose $4.4 trillion in spending reductions over the next decade, about half coming from sweeping changes to popular social safety net programs. Establishing tighter work requirements for food and housing assistance and Medicaid would reduce spending by $300 billion, the official said. Changes to the government’s student loan forgiveness program could lower costs by $170 billion.

The Corporation for Public Broadcasting would be privatized, and the AmeriCorps volunteer program would be eliminated. The official said no cuts are proposed to Social Security or Medicare, though the administration has proposed tougher reviews of the Social Security disability insurance program as well as drug pricing reforms that could affect Medicare costs.

The president’s budget is traditionally viewed as a vision statement, rather than a detailed policy paper. Trump’s budget assumes that all of his proposals are enacted — a long shot at best, given that Democrats control the House.

For example, the White House proposal falls short of the bipartisan budget deal struck with lawmakers last year on the amount of nondefense discretionary spending. The House Budget Committee warned on Friday that it is on “high alert” for attempts by the administration to circumvent Congress.

“If the budget is as destructive and irresponsible as the President’s previous proposals, House Democrats will do everything in our power to stop the cuts and policies from coming to pass,” the committee said.

Even areas where there might have been bipartisan agreement — such as the White House proposal to leverage $200 billion in federal funding for a trillion-dollar infrastructure project — appear unlikely given the bitter personal feud between Trump and House Speaker Nancy Pelosi, D-Calif.

“This is an incredibly important president’s budget to pay attention to,” Zach Moller, deputy director of the economic program at Third Way, a centrist think tank, said ahead of the release if the spending plan. “What Trump proposes is going to be a first look at his 2020 election platform. The policy decisions made by his administration to date have continued to put the country’s long-term health in jeopardy.”

The CBO estimates the economy will expand at a rate of 1.6% to 1.7% over the next 10 years, about half of the administration’s forecast.

It also projects that the deficit will not shrink, but rather balloon to $1.7 trillion by the end of the decade. The widening deficit has drawn criticism from Democrats who accuse conservatives of fiscal hypocrisy and budget hawks who are raising red flags about the looming debt crisis.

“My hope is that this budget finally starts to take the return of trillion-dollar deficits seriously,” Marc Goldwein, senior policy director at the Committee for a Responsible Federal Budget, said before the budget was released.

Goldwein expressed support for some of the cost-saving changes that the administration has proposed for Medicare. But he cautioned that the economy is unlikely to unfold as the White House expects.

“I worry that the budget will instead rely on fantasy economic growth to paper over widening deficits,” he said.

Coronavirus is the biggest market threat right now, Wall Street bull Ed Yardeni says

PUBLISHED SUN, FEB 9 20205:01 PM EST

Stephanie Landsman@STEPHLANDSMAN

Wall Street bull Edward Yardeni isn’t sure how much longer investors will shrug off coronavirus fears.

He sees the outbreak as the most critical risk to the record stock market rally.

“That’s all I really see,” the Yardeni Research president told CNBC’s “Trading Nation” on Friday. “The longer that this virus threat continues to weigh on the global economy, the more it poses a risk for at least a correction in the stock market.”

A correction is a decline of at least 10% from recent highs.

Yardeni, who spent decades on Wall Street running investment strategy for firms including Prudential and Deutsche Bank, came into the year on pullback watch. Even though he’s a long-term bull, Yardeni believes stretched market valuations have been increasing correction risks for months.

According to Yardeni, coronavirus fears could emerge as the catalyst that puts the record rally on pause.

“The markets have done remarkably well in the face of headline news that’s still unsettling like cruise ships being quarantined and China basically being completely quarantined because of cancellations of flights,” he said. “That’s got to be disruptive for supply chains.”

The S&P 500 and Dow broke four-day win streaks on Friday, but they’re still up 3% and 2%, respectively, on the year.

“The global economy was actually starting to show signs of improving before the virus became headline,” said Yardeni.

If the coronavirus outbreak contributes to the market’s next serious leg lower, he believes U.S. stocks will rebound quickly.

“Interest rates are so extraordinarily low,” he noted. “The central banks have basically provided no interesting reasons to buy in the fixed-income markets and lots of reasons to buy in the stock market.”

But that doesn’t mean Yardeni is recommending an all-in approach to stocks.

“If I’ve got some spare cash, I’d like to just keep it as dry powder until I get a little bit more clarity on this coronavirus,” Yardeni said.

When investors lose trust, they can put stocks in the ‘penalty box’

PUBLISHED SUN, FEB 9 20209:16 AM EST

KEY POINTS

- When investors lose faith in management teams after debacles or scandals, they may put stocks of these companies in the “penalty box.”

- Boeing, Wells Fargo, Facebook and Equifax are cases in point.

- Investors are increasingly using environmental, social and governance, or ESG, factors to measure corporate sustainability, which can hurt companies that don’t measure up.

A new client recently told us that he didn’t want to own Boeing.

He did not cite the two planes that crashed or Boeing’s enormous consumption of fossil fuels. His primary concern was the integrity of its management. We mentioned that a new management has taken over the company, but he responded that that there is not enough evidence that Boeing’s values had changed across the organization to alter his opinion. We might call this approach “penalty box” investing.

Since our inception, we have complied with both individual and institutional client requests to avoid certain stocks and industries, commonly fossil-fuel related. We chose not to purchase tobacco and gun stocks, because of our personal beliefs and because we heard frequent client objections to them.

A couple of years ago, the tone changed entirely with Facebook. What had previously been an aversion to owning shares of a company selling cigarettes, assault rifles, or even gambling experiences, shifted to a rejection of the way in which a company, about whose products or services you might have no objection, conducts itself.

If Boeing is now in the penalty box for its management behavior surrounding the 737-MAX, how long might that last, and how will they make their way back onto the ice? The answer, of course, is that it depends. Factors include how egregious investors view the infraction, the length of time in which new pieces of negative news emerge, the complexity of the solution, and the way in which the “guilty” management handles the crisis and changes its practices.

In recent years, we have, a range of examples, including Wells Fargo, Facebook and Equifax. All three failed to protect their customers’ privacy or capitalized on their access to client accounts without approval from them.

Wells Fargo engaged in a widespread fraud, opening millions of fee paying accounts without consent from its customers. While The Wall Street Journal and the Los Angeles Times had unearthed the relentless cross-selling strategy years earlier, the scandal broke widely in September of 2016 when the Consumer Financial Protection Bureau announced $100 million of fines on Wells.

Despite management changes, repeated apologies in recent years, and restructuring of all the misguided sales incentives, the stock is still 12% below its level when the story emerged publicly. What good is a bank if you can’t trust it with your money? Wells Fargo stock has attempted to recover, but strong competitors and low interest rates have depressed earnings.

The Facebook scandal, which hit the headlines in March, 2018, exposed how the social network had allowed the UK data mining firm, Cambridge Analytica, to access private information on over 87 million users without their knowledge. The stock fell 14% on the news, more than recovered to hit a high of $209 in July, but tumbled again when investors learned how much it would cost to monitor the website and improve security.

Since the end of 2018, the stock has climbed over 60%, as investors have forgiven Facebook, or, at least, overlooked its transgressions. Unlike Wells Fargo, which violated an original bank commandment — to keep depositors’ money safe — Facebook’s raison d’etre is sharing, not privacy, and its platforms still dominate this market. Also, despite media outcry, the currency of privacy may have a lower value than real money.

Equifax, the credit agency, was involved with a data breach in 2017, when personal information on close to 147 million Americans was hacked. The company paid a $650 million fine, apologized profusely, agreed to spend $1 billion on enhanced cybersecurity, and offered compensation to affected parties. Investors appear to have forgiven them; the stock is now at an all-time high.

Boeing, down almost 30% from its high last March, still has its highest hurdle to overcome — the re-certification of the 737 Max by the Federal Aviation Administration. The investing public probably trusts the FAA, which feels the heat of this decision, and that seal of approval could prompt the company’s release from the penalty box.

Like Facebook, Boeing is the dominant U.S. player in its field. Once investors feel a higher authority has sanctioned the aircraft, they will likely look forward rather than back.

Meanwhile, how should investors address their concerns about corporate behavior? Since most individuals hold equities via index or mutual funds, their allocations are tied to the index constituents without other considerations. Several fund complexes, such as Fidelity, Blackrock and, Schwab, now offer customers funds that are focused on environmental, social, and governance factors, which measure sustainability. Presumably, these ESG funds eliminate equities with poor rankings. Those investors who work with financial advisors should articulate their concerns about corporate behavior.

ESG rating systems offered by S&P, Morningstar, MSCI, and others are expensive for individuals, often costing more than $5,000 for comprehensive data. They can also vary widely between ranking systems for the same name, because each organization creates its own standards. Over time, customer demand will require the major firms offering ESG, socially responsible investing, or SRI, aligned products to provide more user-friendly and comprehensive analysis of company rankings.

Even without standardized metrics of public corporate behavior or easy accessibility to the highest quality ratings systems, the public has numerous news sources on which to make its own judgments. The market concern for accountability and trust of all public companies is growing, and managements need character strength and awareness to avoid the “penalty box.”

HI Financial Services Mid-Week 06-24-2014