HI Market View Commentary 12-09-2019

| Market Recap |

| WEEK OF DEC. 2 THROUGH DEC. 6, 2019 |

| The Standard & Poor’s 500 index edged up 0.2% this week as advances led by energy, consumer staples and health care managed to slightly outweigh declines led by industrials and consumer-discretionary stocks.

The market benchmark ended the week at 3,145.91, up from last week’s closing level of 3,140.98. The slight move reflected mixed sentiment across the market as investors began the final month of the calendar year still grappling with concerns about the trade dispute between the US and China but also saw strong signs for the US economy from the latest monthly jobs figures. The trade concerns are intensifying again as a Dec. 15 deadline for new tariffs on consumer goods nears. Investors are questioning whether a deal can be signed before the deadline. Meanwhile, November nonfarm payrolls released Friday showed some 266,000 jobs were added in the US in November while the unemployment rate was at a 50-year low of 3.5%, with both figures coming in better than economists expected. The energy sector had the largest percentage increase of the week, up 1.5%, followed by gains of 1.1% in consumer staples and 0.9% for health care. Four sectors were in the red, led by industrials, which fell 1.2%, and consumer discretionary, down 0.6%. The energy sector’s climb came as crude-oil futures climbed amid hopes for the Organization of the Petroleum Exporting Countries to extend production cuts. Among the gainers, shares of Exxon Mobil (XOM) rose 2.0% while Chevron (CVX) shares added 0.7% this week. The consumer-staples sector’s gainers included Mondelez (MDLZ), which was named Morgan Stanley’s top pick in US food. The firm said it views the company’s “recent top-line acceleration as sustainable, aided by successful strategic changes implemented by management, increased reinvestment, as well as a favorable geographic/category footprint.” Shares of Mondelez rose 2.5% this week. In health care, shares of Bristol-Myers Squibb (BMY) climbed 5.5% as the company said the US Food & Drug Administration has granted breakthrough therapy designation to its Orencia in the prevention of moderate to severe acute graft-versus-host disease in patients undergoing stem cell transplants from unrelated donors. Also boosting the shares, Bristol-Myers Squibb’s board an increase of 9.8% in the company’s quarterly dividend, beginning in the first quarter of 2020. Shares of Varian Medical Systems (VAR) rose 3.6% this week as UBS lifted its price target on the stock to $160 from $155 while reiterating a buy investment rating on the shares. On the downside, shares of Boeing (BA) fell 3.3% this week, weighing on the industrial sector amid reports the company said in an October letter to the Securities & Exchange Commission that new regulatory requirements or delays in returning its 737 MAX jetliner to service could cause a halt to production. Provided by MT Newswires. |

The smart thing to do here is what?

Buy more time with long puts

Trump extends the deadline

Where will our markets end this week?

Bullish

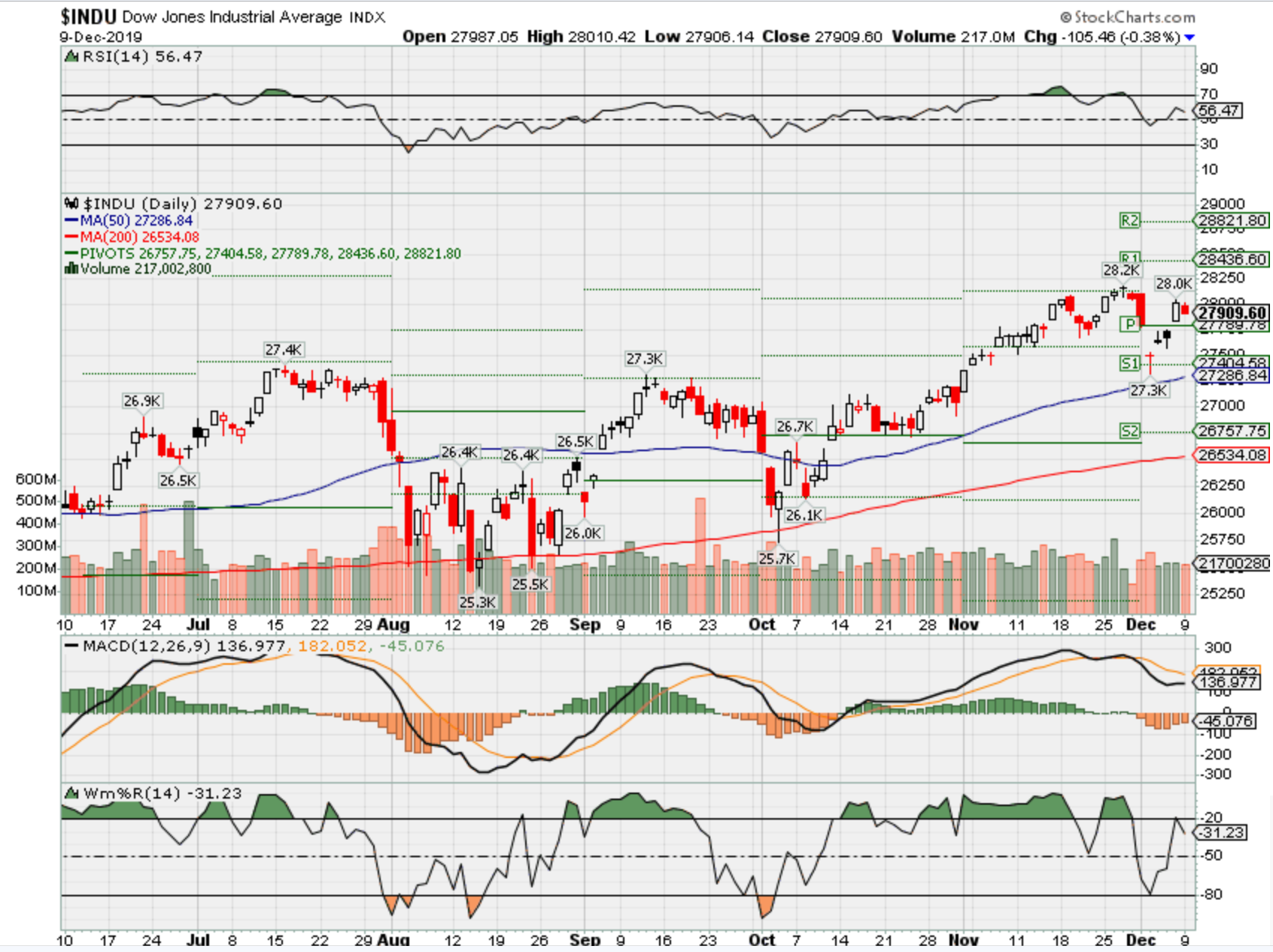

DJIA – Bullish

SPX – Bullish

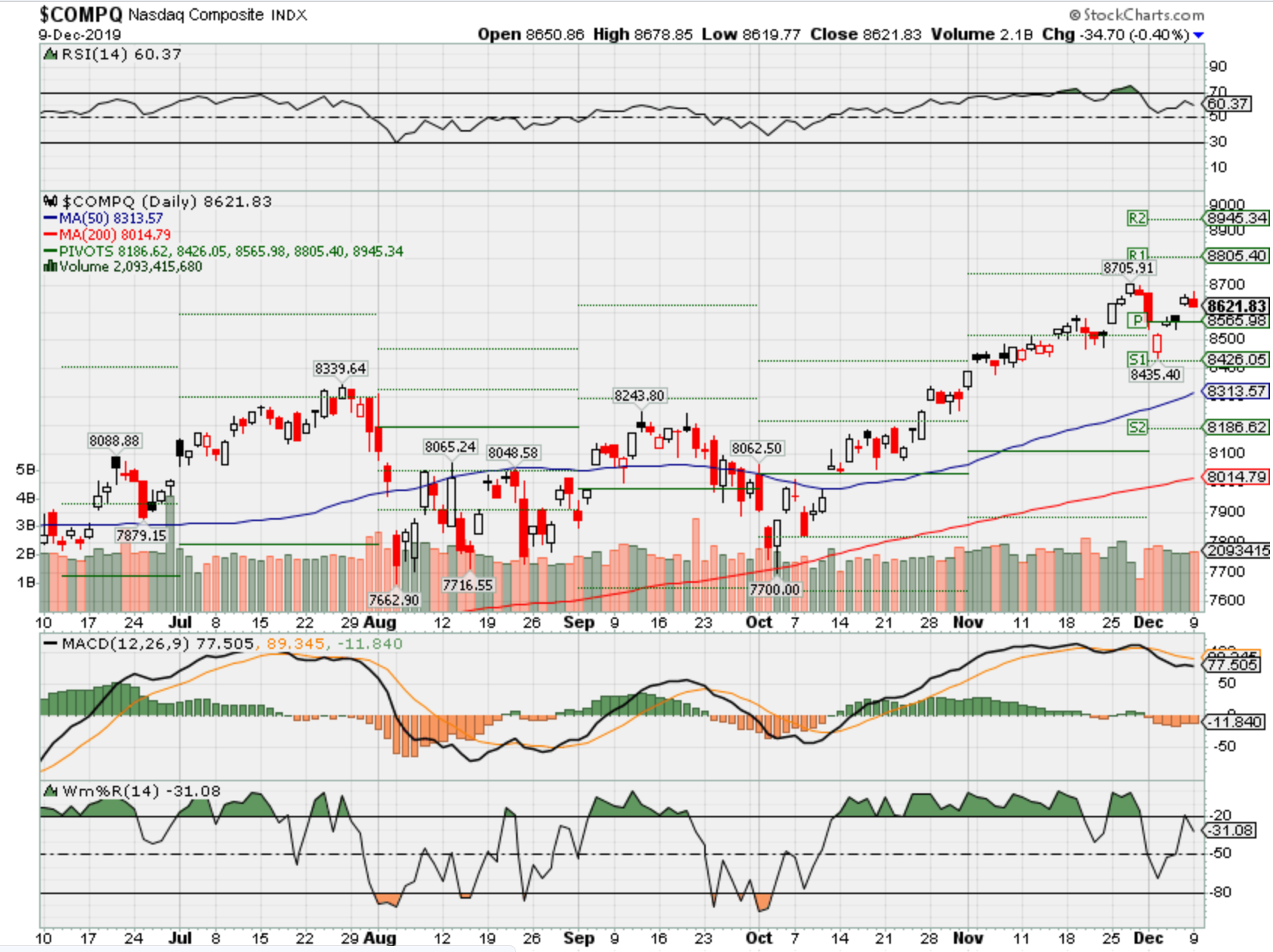

COMP – Bullish

Where Will the SPX end Dec 2019?

12-09-2019 +2.0%

12-02-2019 +1.6%

Earnings:

Mon: CHWY, TOL, MTN

Tues: AZO, GME

Wed: AEO, LULU

Thur: ADBE, AVGO, COST, ORCL

Fri:

Econ Reports:

Mon:

Tues: Productivity, Unit Labor Costs, NIFB Small Business Optimism

Wed: MBA, CPI, Core CPI, Treasury Budget, FOMC Rate Decision

Thur: Initial, Continuing, PPI, Core PPI

Fri: Retail Sales, Retail ex-auto, Business Inventories, Import, Export

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Saturday/Sunday –

How am I looking to trade?

Going long into the end of the year

www.myhurleyinvestment.com = Blogsite

support@hurleyinvestments.com = Email

Questions???

Investors fear another December sell-off if Trump lets tariffs take effect Dec. 15

PUBLISHED TUE, DEC 3 201911:29 AM ESTUPDATED TUE, DEC 3 20194:04 PM EST

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

- President Trump’s comment that he could wait until after the 2020 election for a trade deal with China sent stocks reeling.

- Markets had been expecting a trade deal by Dec. 15 — the date for another round of tariffs on Chinese goods are scheduled to take effect.

- “I think investors are using Dec. 15 as a barometer. It’s probably the purest, simplest barometer, to see if progress is being made. If it isn’t, we’ll probably limp in the rest of the year,” one strategist says of the market.

Investors have been awaiting Dec. 15 as a pivot point for the stock market, with expectations the U.S. and China would agree to a first phase trade deal and stocks would then glide higher, capping a strong year with some late December gains.

But comments Tuesday from President Donald Trump that he could wait until after next year’s election for a deal added to a growing unease as trade talks showed no new signs of progress. Stocks were hit hard Tuesday, with the Dow down 278 points, or 1% to 27,503, on top of a 268-point drop Monday.

Dec. 15 is the date when tariffs on another $156 billion in Chinese goods would go into effect, and economists have viewed these tariffs as potentially the most damaging, since they directly target consumer goods.

“I think investors are using Dec. 15 as a barometer. It’s probably the purest, simplest barometer, to see if progress is being made. If it isn’t, we’ll probably limp in the rest of the year,” said Jack Ablin, chief investment officer at Cresset Wealth Advisors.

Some traders viewed Trump’s comments as a bargaining ploy. However, the president’s actions over the past few days have sent a harsh reminder that he intends to play hardball on trade, not just with China but with other trading partners, after his threat of new tariffs on Brazil, Argentina and France.

“I think the jury is still out on that, and that’s why the market is beginning to reset expectations,” said Daniel Deming, managing director at KKM Financial. “Is this just another one of those ploys or is this something they’re going to stand fast on?”

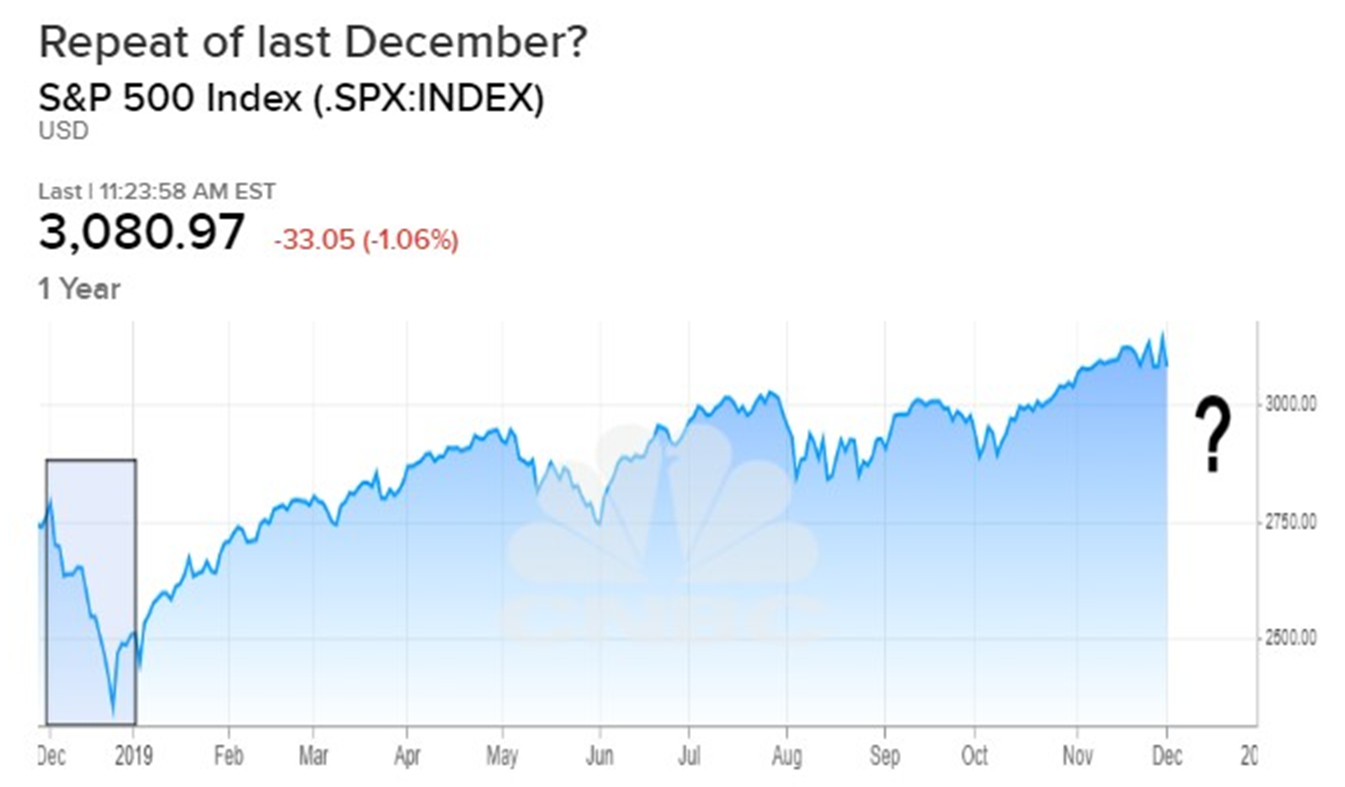

Expectations in the final days of November had been high that the deal would get done, and the market would add to the year-to-date gain of 25%. December is often positive for stocks, but last year the market lost about 9 percent in the month.

“It seemed phase one might get done. In the last couple of days, that mindset has been challenged in the market, and that’s what you’re seeing. …Then you get the psychological impact of last year coming into people’s minds.,” Deming said. “You’re seeing some repositioning of exposure, and they’ve had a great year. Why not take some chips off the table?”

Commerce Secretary Wilbur Ross told CNBC on Tuesday that Trump would be willing to leave tariffs in effect if he doesn’t get the deal he wants. He also said no high-level talks are scheduled, and the situation in Hong Kong has been a factor. Trump signed legislation last week supporting Hong Kong protesters.

“The new variable is the Hong Kong situation. That’s complicated life for President Xi [Jinping]. They got somewhat upset when the president signed that bill,” said Ross, adding the bill would have been veto proof because of its wide support in the Senate.

A tough choice

Ablin said investors are faced with a tough choice. “One is to say, ‘I booked 30% this year. I don’t need to be any greedier than I already am. The other thing is, If I wait two or three weeks, I can push my capital gain into 2020,’” he said. “We’ll see how investors will fall out on that.”

Tariffs already in place and the prospect of more have slowed business spending and crimped the ability of companies to plan. They have also resulted in a scramble to change supply lines and relocations of some businesses from China. The next wave of tariffs would hit consumers for the first time.

“This [sell-off] is foreshadowing the imposition of the December tariffs. It’s hard to tell how this would affect the economy,” said Ablin.

He said the market could see a bigger sell-off if the tariffs are imposed, but he noted that last year when stocks skidded in December, the Fed was raising rates. Now, the central bank has reversed some of its hikes, with three rate cuts from July to October.

“I think the trade deal is important, but whether it’s the Dec. 15 deadline or not, don’t believe it will have the same magnitude of impact that raising short term interest rates did,” Ablin said.

Big hedging around deadline

Deming said investors were expecting some turbulence into January. He said there were heavy purchases of calls in the VIX, the Cboe’s Volatility Index. A popular trade was to sell one call and buy two high-side calls, signaling investors were expected a surge in market volatility.

Ablin said the trade deal could still happen, and that would be a positive. “It may be an 11th-hour negotiation tactic. China is under a fair amount of pressure, too. Pork prices are skyrocketing. Soybean prices are very high, and they’re staring down some relatively serious inflation,” Ablin said

Ablin said a first phase deal makes sense, and that’s what the market was hoping for. “In light of the Hong Kong situation and everything else, I think it would be difficult for President Xi to shake hands on a sweeping deal,” he said.

Trump has to show he made a tough deal politically, since a weak one would be attacked by Democrats.

“My expectation is they probably will get some mini deal done and that should assuage the market,” Ablin said.

Some strategists see Trump as more willing to take a harsh stand when the stock market is performing well. All three major indexes hit new highs last week.

“In order for the market to break through to new highs, we need resolution on trade, especially U.S.-China trade,” said Michael Arone, chief investment strategist at State Street Global Advisors. “I think you can see that each time the market makes new all-time highs, trade tensions escalate and markets become more volatile and sell off. That happened in May, and August, and now in the last couple of days. It’s become a vicious cycle.”

Trump, speaking in London on Tuesday, said he doesn’t watch the stock market, though he has tweeted to followers to “enjoy” its performance when it is at record highs. “I watch jobs,” he said, adding he wants to make the “proper deal.”

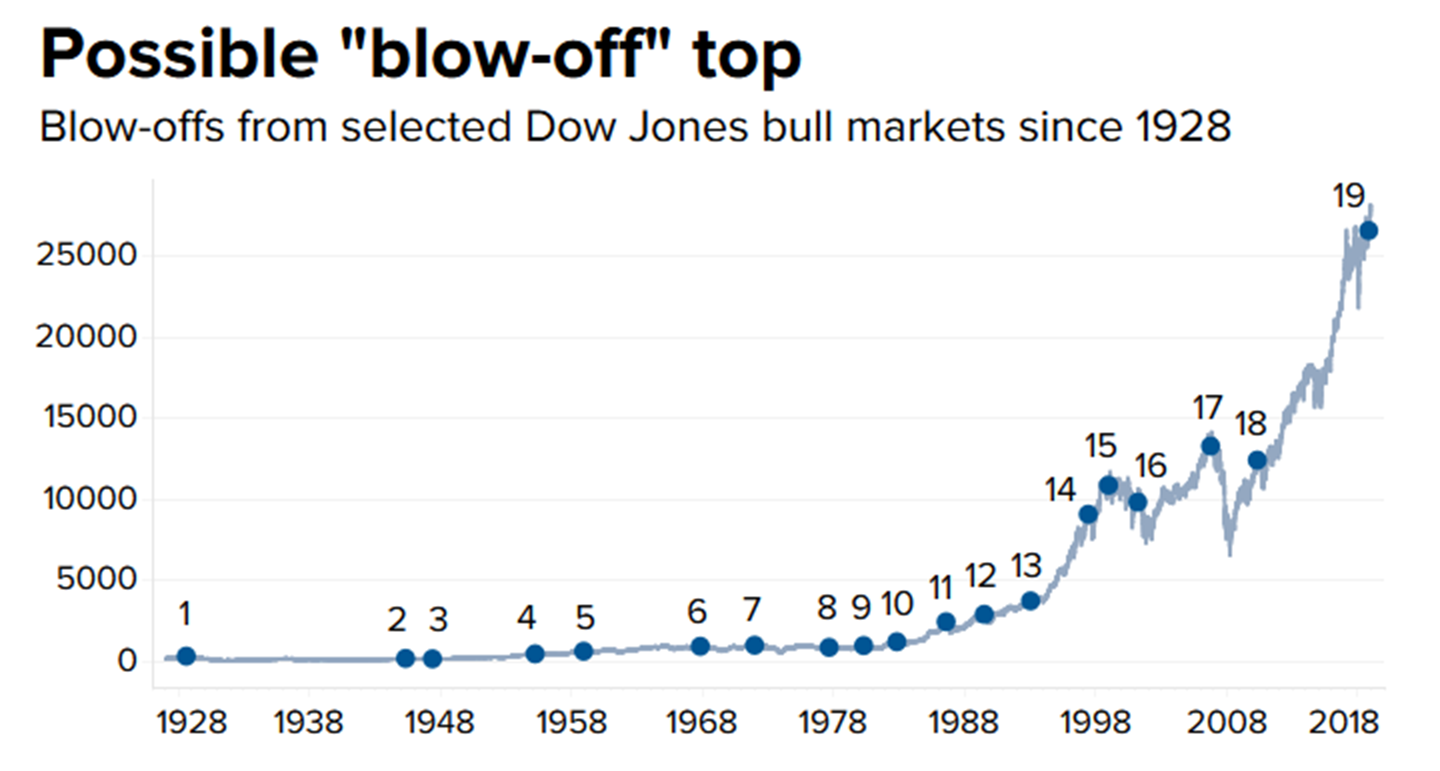

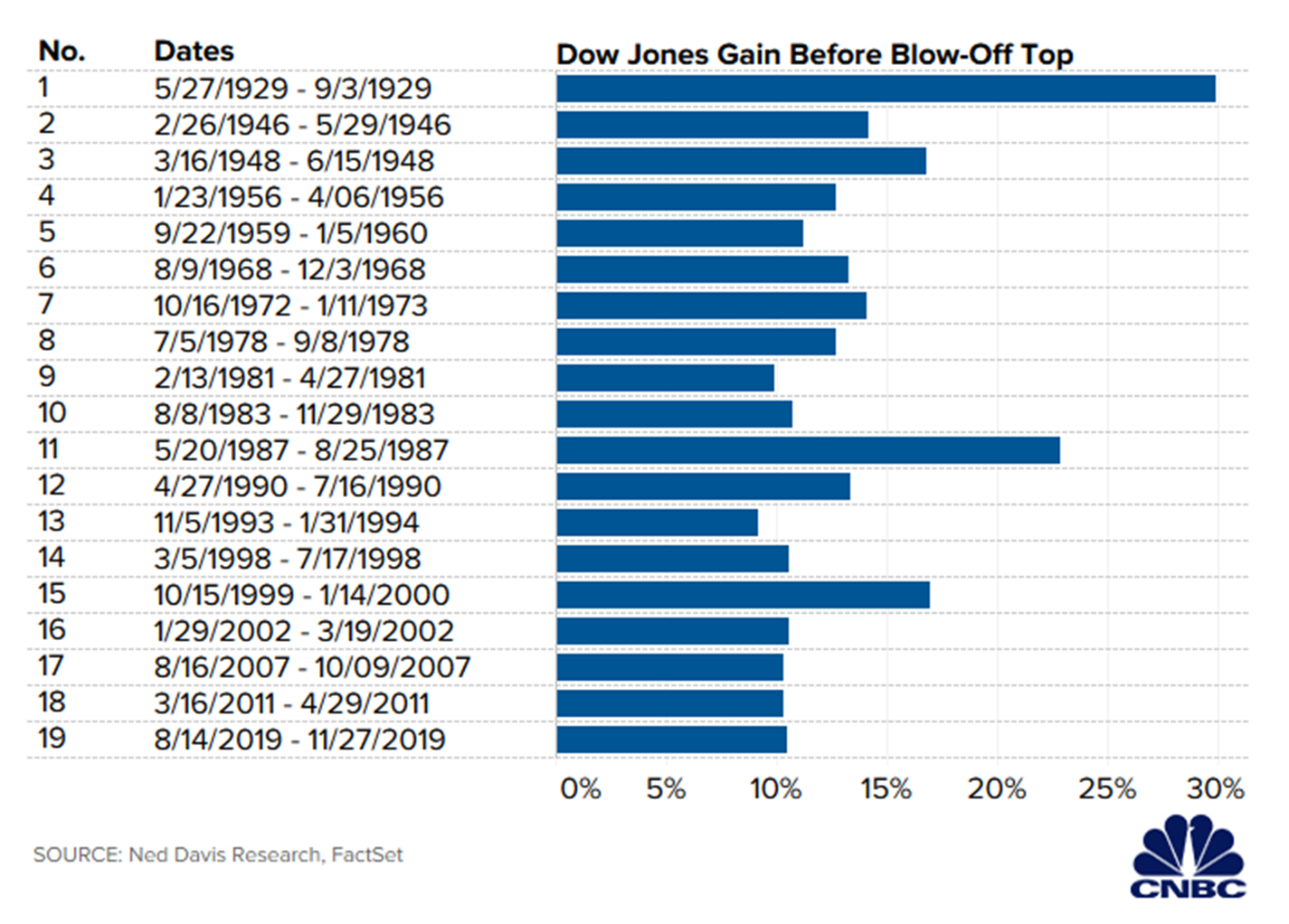

Bull markets often end with a euphoric rally called a ‘blow-off top.’ We may have just had one

PUBLISHED WED, DEC 4 20191:56 PM ESTUPDATED THU, DEC 5 20198:51 AM EST

KEY POINTS

- The Dow was up 10.5% over the course of just 74 trading days from mid-August to late November.

- That kind of rally is similar to the ones that ended previous bull markets, data from Ned Davis Research shows.

- The Dow has posted a median gain of 13.4% over a median time frame of 61 days in blow-off tops dating to 1901, according to the data.

The stock market’s poor start to December halted in its tracks the kind of euphoric rally that has marked the end of past bull markets, a so-called blow-off top.

Between mid-August and late November, the Dow Jones Industrial Average was up 10.5% in a 74-day sprint that seemed to be immune from negative headlines.

According to Ned Davis Research, the Dow has posted a median gain of 13.4% during blow-off tops dating to 1901. The median rally length was 61 days.

“Given the high valuations I see, plus these divergences between many different indices, I am aware that many bull markets have ended with a rally similar to what we have seen since August,” firm founder Ned Davis said in a note.

One rally similar to this one happened between Oct. 15, 1999, and Jan. 14, 2000, just before the dot-com bubble burst. The Dow rallied 17% over 64 trading days back then. Another one took place from Aug. 16, 2007, to Oct. 9, 2007, preceding the financial crisis. In that time, the Dow jumped 10.3% in just 38 trading days.

Stocks were on fire last month in large part because of easier monetary policy and expectations that China and the U.S. will strike a trade deal. The Federal Reserve cut rates twice since August and has signaled it will keep them at current levels for a while. Also, China and the U.S. have said they were closing in on a “phase one” trade agreement to be signed before year-end, although President Donald Trump suggested on Tuesday that an agreement may not come until after next November’s election.

However, the fast rise in stocks gave some experts pause. Ed Yardeni, president of Yardeni Research, told CNBC last month the market was going up in a “melt-up fashion,” noting: “That’s actually the risk.”

Christopher Harvey, head of equity strategy at Wells Fargo Securities, also said in November the key catalysts that were driving the market higher had “played out.”

“What we’re left with is near-term sentiment and near-term sentiment being the driver of prices,” he added. “That could be based on a tweet. It could be based on positioning.”

Stocks started off December on the wrong foot. The Dow dropped 548.6 points in the first two trading days of the month amid renewed worries around U.S.-China trade relations. Trump’s comment on Tuesday, coupled with negative trade rhetoric out of China, sent stocks tumbling.

To be sure, the market’s rocky start to the final month of 2019 could be just a byproduct of investors taking some profits after a big run. Even after the Dow’s declines, the 30-stock average remains up nearly 20% for the year and within striking distance of its all-time high. Most Wall Street strategists expect the bull market to continue next year.

“A pause after a two-month rally shouldn’t be surprising,” said Willie Delwiche, investment strategist at Baird. “And it shouldn’t preclude from strength over the latter half of December, which is when we tend to see seasonal strength for the month.”

Apple is killing the charging plug on its highest-end phones by 2021, top analyst predicts

PUBLISHED THU, DEC 5 201912:01 PM ESTUPDATED THU, DEC 5 20191:41 PM EST

KEY POINTS

- Apple will launch an iPhone in 2021 that doesn’t include a Lightning connector, according to Ming-Chi Kuo, an analyst at TF Securities.

- The company would only remove the Lightning port from the highest-end iPhone, creating a “completely wireless experience,” Kuo wrote in a note to clients on Thursday.

- Speculation has been building for several years that Apple plans to remove the Lightning connector in favor of other charging technology.

Apple could ditch the Lightning connector on the highest-end versions of the iPhone in 2021, meaning the devices will require wireless charging, according to a report on Thursday from Ming-Chi Kuo, an analyst at TF Securities.

The removal of the Lightning cable, along with other differentiating updates, will boost shipments and the average selling price of the high-end iPhone models, Kuo, a top Apple analyst, wrote. Without the connector, the top-tier iPhone would provide a “completely wireless experience,” Kuo said.

Speculation has been building for several years that Apple plans to remove the Lightning cable. As far back as 2017, Kuo predicted that Apple would discard the Lightning connector in favor of the USB Type-C connector, which is widely used across the industry.

However, Apple has continued to include Lightning ports in the latest iPhone models. Apple’s new iPhone 11, iPhone 11 Pro and iPhone 11 Pro Max models, which were announced in September, all have Lightning ports.

Apple has started to include the USB-C connector in some products. The new iPhones support Apple’s fast charger, which promises to deliver up to a 50% charge in 30 minutes. The charger uses USB-C and requires iPhone users to buy a specific cable that goes from the Lightning connector to USB-C ports.

Disney nears $10 billion global box office record and ‘Rise of Skywalker’ isn’t even out yet

PUBLISHED SUN, DEC 8 20194:08 PM EST

KEY POINTS

- Disney’s has garnered nearly $10 billion at the global box office so far this year.

- The company currently has five films that have hauled in more than $1 billion worldwide.

- “Frozen II” is expected to cross the $1 billion benchmark this week.

With Sunday’s estimates, Disney is now a breath away from hauling in $10 billion globally from its 2019 box office titles.

As “Frozen II” continues to dominate the box office, both domestically and internationally, Disney’s tally for the year hovers around $9.9 billion, according to data from Comscore.

This record smashes the $7.6 billion Disney posted in 2016, which had remained the highest a studio had ever earned in a year until 2019. Of course, Disney’s massive haul does not include the Fox titles it acquired during its acquisition of 20th Century Fox earlier this year.

Including Fox titles such as “X-Men: Dark Phoenix,” “Ad Astra” and “Ford v. Ferrari” would put Disney’s at nearly $12 billion.

And all this is before the release of “Star Wars: The Rise of Skywalker.”

“Disney has had an unbelievable year at the box office in 2019 and the international component of that success clearly demonstrates the power of the brand not just in the U.S. market, but with fans the world over,” Paul Dergarabedian, senior media analyst at Comscore, said.

Already, Disney has five feature films that have surpassed $1 billion at the global box office. Within the week “Frozen II” is expected to join that club as the sixth alongside “Avengers: Endgame,” “The Lion King,” “Aladdin,” “Captain Marvel,” and “Toy Story 4.”

This is the most $1 billion films any studio has ever had in a single year and “Rise of Skywalker” could be the seventh.

However, Disney will be hard pressed to repeat this year’s success in 2020. Many of the company’s titles this year were hotly anticipated origin stories, sequels and finales. Next year, the slate is not quite as strong.

Still, films like “Jungle Cruise,” “Mulan,” “Black Widow,” “The Eternals,” “Onward,” “Soul” and “Raya and the Last Dragon,” will draw crowds to theaters. Not to mention, it has a collection of Fox titles coming out next year, too, like “Free Guy,” “West Side Story” and “The King’s Man.”

Disney packed 2019 with major releases as it prepared the launch of its streaming service Disney+. Starting with “Captain Marvel,” all future box office titles will only ever be available to stream through Disney’s platform. Digital copies are still available to be purchased through third-party vendors.

“Star Wars: The Rise of Skywalker” arrives in theaters Dec. 20.

What Trump does before trade deadline is the ‘wild card’ that will drive markets in the week ahead

PUBLISHED FRI, DEC 6 20193:53 PM ESTUPDATED SUN, DEC 8 20199:51 PM EST

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

- The trade countdown is on, and it’s up to the Trump administration to decide whether to slap new tariffs on China or extend its Dec. 15 deadline if it still has no trade agreement.

- Markets could be rocked by the outcome if it is not what most strategists expect — an extension of the deadline as talks continue.

- But strategists also note President Trump is often unpredictable and he could take an unexpected action.

- The Fed is also important in the week ahead, though it is not expected to take any interest rate actions Wednesday.

The Trump administration’s Dec. 15 deadline for new tariffs on China looms large, and while most strategists expect them to be delayed while talks continue, they don’t rule out the unexpected.

“That’s the biggest thing in the room next week. I don’t think he’s going to raise them. I think they’ll find a reason,” said James Paulsen, chief investment strategist at Leuthold Group. But Paulsen said President Donald Trump’s unpredictable nature makes it really impossible to tell what will happen as the deadline nears.

“He’s the one off you’re never sure about. It’s not just tariffs. It could be damn near anything,” Paulsen said. “I think he goes out of his way to be a wild card.”

Just in the past week, Trump said he would put new tariffs on Brazil, Argentina and France. He rattled markets when he said he could wait until after the election for a trade deal with China.

Once dubbing himself “tariff man,” Trump reminded markets that he sees tariffs as a way of getting what he wants from an opponent, and traders were reminded tariffs may be around for a long time.

Trade certainly could be the most important event for markets in the week ahead, which also includes a Fed interest rate decision Wednesday and the U.K.’s election that could set the course for Brexit. If there’s no China deal, that could beat up stocks, send Treasury yields lower and send investors into other safe havens.

When Fed officials meet this week, they are not expected to change interest rates, but they are likely to discuss whether they believe their repo operations to drive liquidity in the short-term funding market are running smoothly, ahead of year end. Economic reports in the coming week include CPI inflation Wednesday, which could be an important input for the Fed.

Punt, but no deal

As of Friday, the White House did not appear any closer to striking a deal with China, though officials say talks are going fine. Back in August, Trump said if there is no deal, Dec. 15 is the date for a new wave of tariffs on $156 billion in Chinese goods, including cell phones, toys and lap top computers.

Dan Clifton, head of policy research at Strategas, said it seems like a low probability there will be a deal in the coming week. “What the market is focused on right now is whether there’s going to be tariffs that to into effect on Dec. 15, or not. It’s being rated pretty binary,” said Clifton. “I think what’s happening here and the actions by China overnight looks like we’re setting up for a kick.”

China removed some tariffs from U.S. agricultural products Friday, and administration officials have been talking about discussions going fine.

Clifton said if tariffs are put on hold, it’s unclear for how long. “Those are going to be larger questions that have to be answered. This is really now about politics. Is it a better idea for the president to cut a deal without major structural reforms, or should he walk away? That’s the larger debate that has to happen after Dec. 15,” Clifton said. “I’m getting worried that some in the administration… they’re leaning toward no deal category.”

Clifton said Trump’s approval rating falls when the trade wars heat up, so that may motivate him to complete the deal with China even if he doesn’t get everything he wants.

Michael Schumacher, director of rates strategy at Wells Fargo, said his base case is for a trade deal to be signed in the next couple of months, but even so, he said he can’t entirely rule out another outcome. It would make sense for tariffs to be put on hold while talks continue.

“The tweeter-in-chief controls that one, ” said Schumacher. “That’s anybody’s guess…I wouldn’t be at all surprised if he suspends it for a few weeks. If he doesn’t, that’s a pretty unpleasant result. That’s risk off. That’s pretty clear.”

Because the next group of tariffs would be on consumer goods, economists fear they could hit the economy through the consumer, the strongest and largest engine behind economic growth.

Fed ahead

The Fed has moved to the sidelines and says it is monitoring economic data before deciding its next move. Friday’s strong November jobs report, with 266,000 jobs added, reinforces the Fed’s decision to move to neutral for now.

So the most important headlines from its meeting this week could be about the repo market, basically the plumbing for the financial system where financial institutions fund themselves. Interest rates in that somewhat obscure market spiked in September. Market pros said the issue was a cash crunch in the short term lending market, made better when the Fed started repo operations.

The Fed now has multiple operations running over year-end, and Schumacher said it has latitude to do more. Strategists expect there to be more pressure on the repo market as banks rein in operations to spruce up their balance sheets at year- end.

“No one is going to come to the Fed and say you did too much in the year-end funding,” said Schumacher. “If repo happens to spike somewhat on one day, the Fed is going to hammer it the next day.”

Paulsen said the markets will be attuned to this week’s inflation numbers. Consumer inflation, the CPI is reported on Wednesday and producer prices are Thursday.

A pickup in inflation of any significance is one thing that could pull the Fed from the sidelines, and prod it to consider a rate hike.

“I think the inflation reports might start to get a little attention. Given the jobs numbers, the employment rate, growth picking up a little bit and a better tone in manufacturing. I do think if you get some hot CPI number, I don’t know if the Fed can ignore it,” he said. “Core CPI is 2.3%.” He said it would get noticed if it jumped to 2.5% or better.

The Fed’s inflation target is 2% but its preferred measure is the PCE inflation, and that remains under 2%.

Stocks were sharply higher Friday but ended the past week flattish. The S&P 500 was slightly higher, up 0.2% at 3,145, and the Dow was down 0.1% at 28,015. The Nasdaq was 0.1% lower, ending the week at 8,656.

Week ahead calendar

Monday

no economic reports

Tuesday

FOMC begins two-day meeting

6:00 a.m. NFIB

8:30 am. Productivity and costs

Wednesday

8:30 a.m. CPI

10:00 a.m. QSS

2:00 p.m. Federal budget

2:00 p.m. FOMC statement

2:30 p.m. Fed Chairman Jerome Powell briefs media

Thursday

8:30 a.m. Initial claims

8:30 a.m. PPI

Friday

8:30 a.m. Retail sales

8:30 a.m. Import prices

10:00 a.m. Business inventories

HI Financial Services Mid-Week 06-24-2014