HI Market View Commentary 09-30-2019

| Market Recap |

| WEEK OF SEP. 23 THROUGH SEP. 27, 2019 |

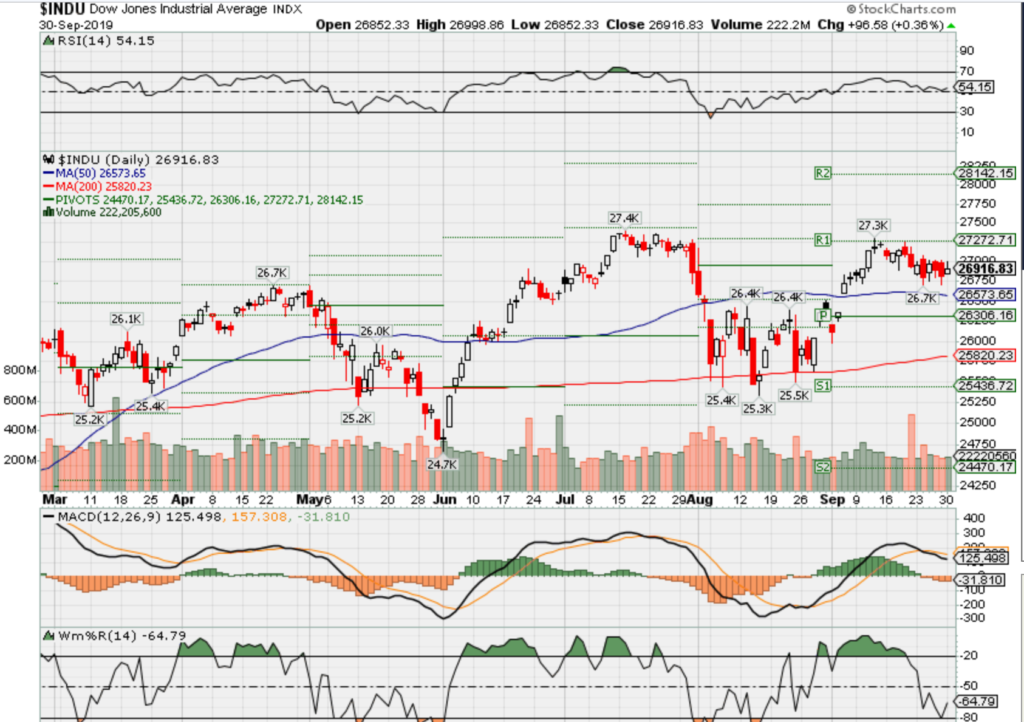

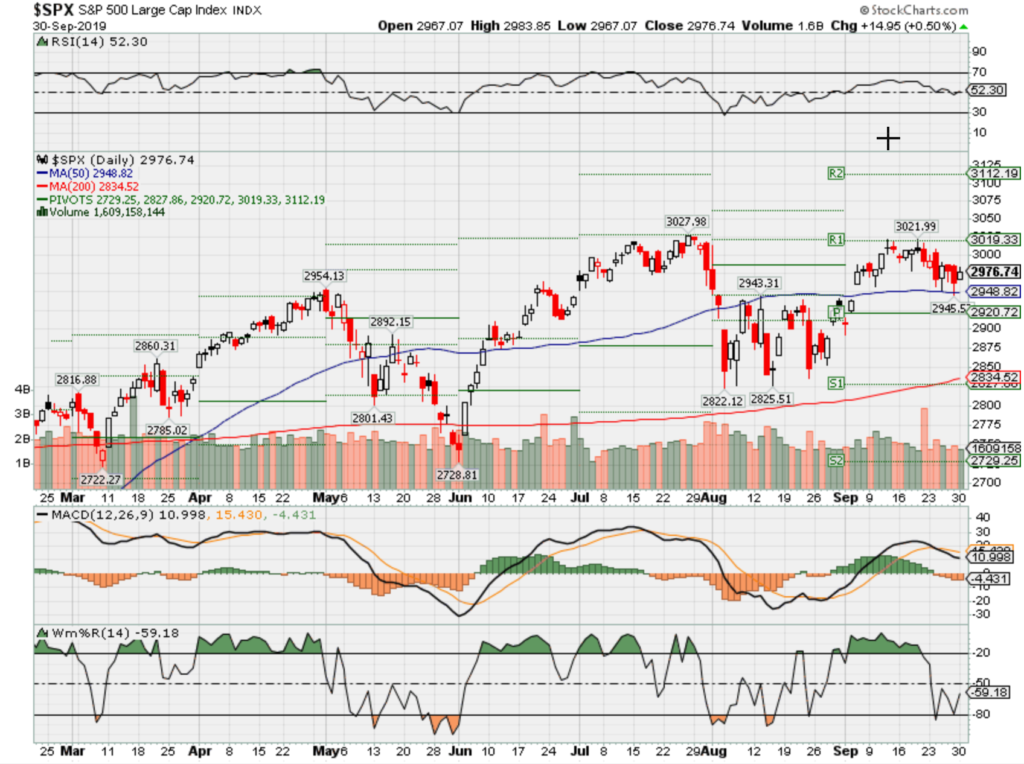

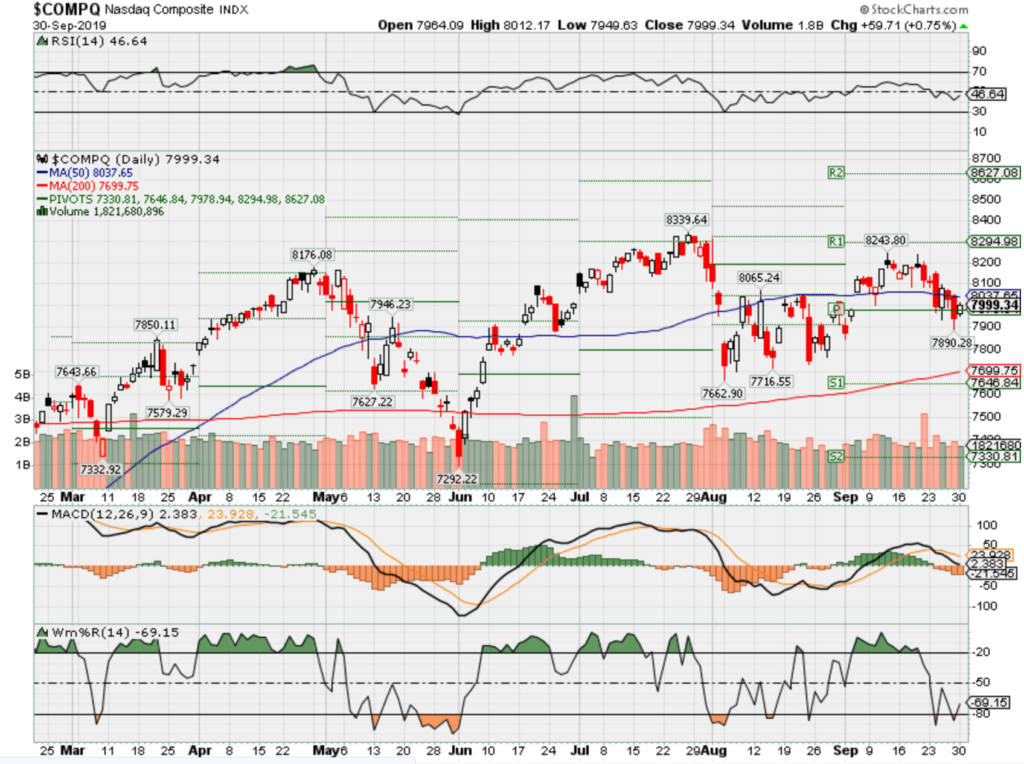

| The stock market went straight down last week with the Dow Jones losing 0.43%, the S&P 500 lost 1.01%, and the Nasdaq down 2.19%. Only 3 of 11 sectors — Utilities +1.30%, Consumer Staples +1.33%, and Real Estate +0.43% — managed to add value on the week, and Health Care sank 2.90%. Internationally, Developed Markets sold off 0.90% while Emerging Markets were down 1.28%. Small Caps also struggled, with the Russell 2000 going down 2.42% |

So let’s talk about our markets

Today on CNBC hear how small caps and mid caps were the safe haven for the month of September YET both were down for the month. I looked at the averages and was confused.

Then FOX news talked about safe havens – Consumer Discretionary

What’s going on and where is the September drop? Will it come in October pre-Christmas Rally ?

Could it be the Media trying to make it sound like it has been in the past?

In fact right now I am planning for the end of the year run

AAPL for Iphone sales. BA for a possible 737 approval, China Deal – BIDU, Disney Plus bundle, Visa end of the year Christmas shopping, Target TGT for retail sales

We do have Christmas Rally, China deal or small deal and maybe/most likely one more rate cut in Nov/Dec

What is the expectation next year? Always Bullish because it is an election year

Where will our markets end this week?

Up

DJIA – Bullish

SPX – Bullish

COMP – Bearish

Where Will the SPX end Oct 2019?

09-30-2019 +1.25%

Earnings:

Mon: CALM

Tues: SFIX, MKC

Wed: LEN, BBBY

Thur: PEP, COST

Fri:

Econ Reports:

Mon: Chicago PMI

Tues: ISM Manufacturing, Construction Spending, Auto, truck

Wed: MBA, ADP Employment

Thur: Initial, Continuing, Factory Orders, ISM Services,

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Trade Balance

Int’l:

Mon –

Tues – China National Day Starts

Wed –

Thursday –

Friday- Powell Speech

Saturday/Sunday –

How am I looking to trade?

I’m preparing for earnings = Adding long puts

AA – 10/16 AMC

AAPL – 10/31 est

AOBC – 12/05 est

BA – 10/23 BMO

BIDU – 10/29 est

BAC – 10/16 BMO

CVS – 11/06 BMO

CVX – 11/01 est

DIS – 11/07 AMC

F – 11/23 AMC

FB – 10/30 est

FCX – 10/23 est

MRO – 11/06 est

MRVL 11/26 est

SLB – 10/18 BMO

TGT –

V – 10/23 est

XOM – 11/01 est

ZION – 10/21 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Trump says US reaches trade deals with Japan, no vote needed

PUBLISHED MON, SEP 16 2019 8:08 PM EDT

KEY POINTS

- U.S. President Donald Trump said on Monday that the United States has reached initial trade agreements with Japan on tariff barriers and digital trade that will not require congressional approval.

- Neither agreement would require a vote in Congress under the so-called “fast track” approval process. The Trump administration last year notified Congress that it would pursue negotiations with Japan under this method.

U.S. President Donald Trump said on Monday that the United States has reached initial trade agreements with Japan on tariff barriers and digital trade that will not require congressional approval.

In a letter to Congress released by the White House, Trump said that he intends to enter into the agreements “in the coming weeks” and was notifying lawmakers that the tariff deal would be made under a trade law provision allowing the U.S. president to make reciprocal tariff reductions by proclamation.

“In addition, I also will be entering into an Executive Agreement with Japan regarding digital trade,” Trump said in the letter.

Neither agreement would require a vote in Congress under the so-called “fast track” approval process. The Trump administration last year notified Congress that it would pursue negotiations with Japan under this method.

But over much of the past year, the scope of talks have narrowed to exclude the automotive sector, which is the source of most of the $67 billion U.S. trade deficit with Japan.

Instead, Trump and Japanese Prime Minister Shinzo in August announced an agreement in principle of a deal that covered reductions in tariffs on agricultural and industrial goods, but not autos.

The two leaders said at the G-7 summit in France that they hoped to sign the agreement at next week’s United Nations General Assembly in New York.

Trump’s letter did not disclose any contents of the agreements, but Japan had previously said it was willing to consider a deal that would reduce agriculture tariffs to levels previously contemplated under the Trans-Pacific Partnership, a trade deal that Trump quit on his third day in office in 2017.

Trump’s letter said that the United States would pursue further trade negotiations with Japan.

“My Administration looks forward to continued collaboration with the Congress on further negotiations with Japan to achieve a comprehensive trade agreement that results in more fair and reciprocal trade between the United States and Japan,” Trump said.

https://seekingalpha.com/article/4293197-riverpark-large-growth-fund-walt-disney-company

RiverPark Large Growth Fund – The Walt Disney Company

Sep. 24, 2019 6:51 AM ET

Summary

DIS shares returned an impressive 26% for the quarter as the company unveiled its plans to launch Disney+, its Netflix-style streaming service, and to grow Hulu and ESPN+.

In addition to its deep library of media assets, Disney has a consistent and highly profitable parks business, its best-in-class studio segment, and its consumer products division, each of which are thriving.

Disney is a well-positioned company that, prior to its investor day, traded at a significant discount to the broader market. We maintained our position during the quarter and DIS is a core holding in the Fund.

The following segment was excerpted from this fund letter.

Disney: DIS shares returned an impressive 26% for the quarter as the company unveiled its plans to launch Disney+, its Netflix (NASDAQ:NFLX)-style streaming service, and to grow Hulu and ESPN+. DIS is blessed with distinctive content that includes both live sports (providing large, non-time shifted audiences) and incomparable brands including Disney, Marvel, Pixar and Lucasfilm (the Star Wars franchises), as well as the ABC network (providing deep inventories of stories and characters). We believe that, as the owner of such an expansive library of proprietary content, Disney is among the best positioned media companies in the new landscape combining multi-channel and direct-to-consumer distribution. Based on an expected price of $7 a month for Disney+ and the company’s projection for a subscriber base of 60-90 million people by 2024 (about half of each of Netflix’s 150 million subscribers and the 150 million people that visit Disney parks annually), Disney should add $5-$7.5 billion in incremental annual revenue (an 8%-13% boost to 2018 revenue). On top of that, management expects ESPN+ and Hulu to add an additional 50-70 million subscribers.

In addition to its deep library of media assets, Disney has a consistent and highly profitable parks business, its best-in-class studio segment, and its consumer products division, each of which are thriving. We also note that DIS has an extremely strong balance sheet (just over 1x debt to EBITDA ratio) and a growing pool of excess free cash flow ($10 billion for 2018) to be used both to return to shareholders and to invest in future opportunities. Disney is a well-positioned company that, prior to its investor day, traded at a significant discount to the broader market. We maintained our position during the quarter and DIS is a core holding in the Fund.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

White House deliberates block on all US investments in China

PUBLISHED FRI, SEP 27 2019 12:18 PM EDTUPDATED FRI, SEP 27 2019 6:03 PM EDT

KEY POINTS

- The discussion is in its preliminary stages and nothing has been decided, CNBC’s source says.

- There’s also no time frame for their implementation, the source adds.

- Restricting investments in Chinese entities would be meant to protect U.S. investors from excessive risk due to lack of regulatory supervision, the source says.

The White House is weighing some curbs on U.S. investments in China, a source familiar with the matter told CNBC. This discussion includes possibly blocking all U.S. financial investments in Chinese companies, the source said.

It’s in the preliminary stages and nothing has been decided, the source said. There’s also no time frame for their implementation, the source added.

Restricting financial investments in Chinese entities would be meant to protect U.S. investors from excessive risk due to lack of regulatory supervision, the source said.

The deliberations come as the U.S. looks for additional levers of influence in trade talks, which resume on Oct. 10 in Washington. Both countries slapped tariffs on billions of dollars worth of each other’s goods. The discussions also come as the Chinese government is taking steps to increase foreign access to its markets.

Bloomberg News first reported earlier on Friday that Trump administration officials are considering ways to limit U.S. investors’ portfolio flows into China, including delisting Chinese companies from American stock exchanges and preventing U.S. government pension funds from investing in the Chinese market.

Shares of Alibaba, Baidu and other Chinese companies plunged following the news. China’s yuan weakened to 7.15 against the dollar on the report.

The White House declined to comment.

https://seekingalpha.com/article/4293462-apple-buybacks-ending

Apple Buybacks Are Not Ending

Sep. 25, 2019 11:26 AM ET

Summary

Company still has over $100 billion in net cash.

Tremendous free cash flow allows for status quo to remain.

Share count reduction getting more important.

Earlier this week, I read an interesting article from fellow Seeking Alpha Bluesea Research suggesting that technology giant Apple (AAPL) will see its buyback program ending soon. While I agree that the company’s recent history has changed the short-term math a bit, I think the article made some critical errors that make the situation look a bit too negative.

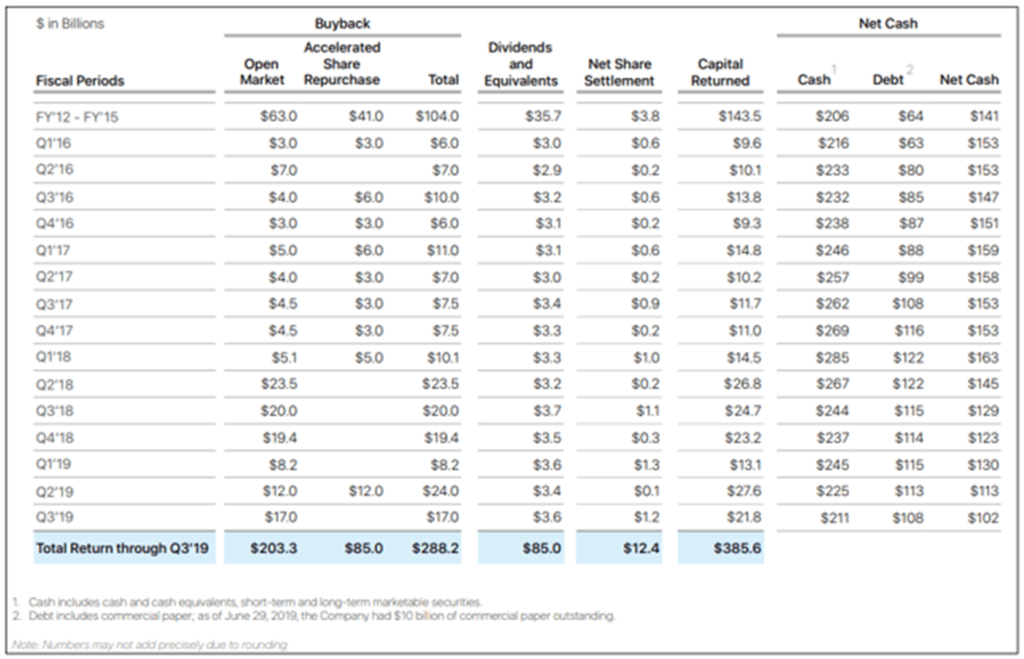

First of all, let’s take a quick review of Apple’s capital return plan, which started back in fiscal 2012. As a reminder, the company’s fiscal year ends in September, not the usual calendar period many other names use. With the company having a huge net cash position, a combination of dividends, net share settlements, and share repurchases has returned almost $400 billion since. The chart below provides the key details.

(Source: Apple capital return plan document, seen here)

In the past six quarters, the company has brought its net cash position down by more than a third, from $163 billion to $102 billion. That’s primarily because management stepped in with some huge quarterly share repurchases. Five quarters saw at least $17 billion spent, much more than the previous couple of years. That gets me to this key point made in the other article:

Apple’s net cash position in the latest quarter was $102 billion. This is down from $113 billion in the previous quarter. Apple’s net cash position was $130 billion at the end of 2018. It has reduced the net cash by $28 billion in the last two quarters. At the current pace, it will reduce another $84 billion in net cash by end of 2020. A back of the envelope calculation shows that Apple would be left with $18 billion in net cash at the end of 2020.

On the face of it, the argument seems logical. If Apple reduces its net cash position by $28 billion every six months until the end of calendar 2020, then the reduction will leave it with just $18 billion in net cash. However, there are a couple of very key items missing from this analysis that really skew the argument, and they must be discussed to get the complete picture.

First, Apple’s net cash position has dropped recently partially because of timing. In the six calendar months of 2019, which are two of Apple’s three slowest quarters of the year, free cash flow has totaled a little more than $18.4 billion. In the first fiscal quarter, last year’s December holiday period, free cash flow was more than $23.3 billion. Over the next six quarters, Apple will have two of those holiday periods, meaning free cash flow will be more than one might expect looking at just the past two periods.

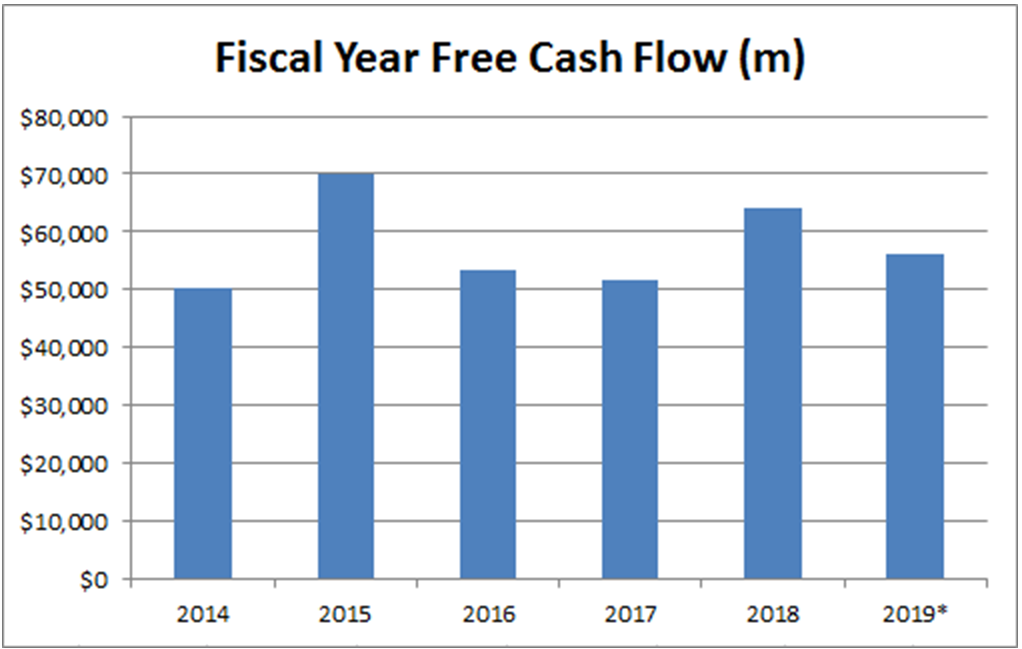

Another thing to consider is what happens once Apple gets to a cash neutral position. Regardless of when that does actually occur, the company still produces tremendous free cash flow each fiscal year, averaging about $58 billion per fiscal year over the last five (not counting the period we are currently in) as seen below. This year was a down year thanks to last year’s holiday disappointment, but earnings should rise moving forward, and that likely will boost free cash flow at least a little.

(Source: Apple quarterly/annual filings, seen here. Fiscal 2019 number has been projected by author based on first 9 months’ results in current fiscal year versus prior one.)

So, if the company generates even $60 billion in free cash flow per fiscal year moving forward, what is that money going to be spent on? Well, the dividend is currently running at about $14 billion a year, and let’s assume another $10 billion per goes to debt repayments and $1 billion goes to acquisitions. That would leave $35 billion a year to go to share repurchases, meaning Apple could still buy back more than $8 billion a quarter and still be at a cash neutral position. Share repurchases could be even more if interest rates remain really low and management chooses to go into a net debt position.

There is also one other important part to remember. As the company reduces its share count further by the quarter, the buyback becomes even more important for the same number of shares repurchased. For example, when the share count after the split was about 6.5 billion, a 100 million share count reduction would improve EPS by 1.54%. Now, we are roughly at 4.5 billion shares, meaning every 100 million lowering now boosts EPS by 2.22%. The benefit only increases exponentially from here.

Now, there are certainly some ways management could limit the buyback’s potential moving forward. Perhaps, there is a major strategy change and a major acquisition is announced, one that spends a lot of cash unlike previous history. I don’t see that, but it must be mentioned. Another is that management decides to slow down the buyback with the stock near all-time highs. This hurts the situation in the short term, but would extend the life of the program. Finally, if we were to see a major spike in interest rates, perhaps management decides to be more of a saver. With even a 10-year Treasury yielding less than 2%, this is unlikely, but if that number was much higher, the argument does change.

In the end, I don’t think Apple investors have to worry about the company’s buyback ending anytime soon. While the net cash position has dropped in the first half of calendar 2019, these are two of the company’s slowest quarters. By the end of next year, we’ll see two more huge free cash flow holiday periods, and even after that, free cash flow of $60 billion or so a year still allows for plenty of share repurchases. With the buyback reducing the share count further and further, the impact on EPS will only grow.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

There are 4 main paths to becoming a millionaire—and this is the easiest one, says money expert

Published Fri, Sep 27 2019 11:47 AM EDTUpdated Mon, Sep 30 2019 5:39 AM EDT

Tom Corley, Contributor@RICHHABITS

Unless you were born into a rich family, building wealth can be very hard — depending on the path you choose.

Many people look at multi-millionaires and desperately want to know: What’s their secret? How did they get there? What does it take?

Those are the things I wanted to know back in 2004, when I began my “Rich Habits” study, in which I spent five years interviewing and researching the daily activities, habits and traits of 233 wealthy individuals. All of them had at least $160,000 in annual gross income and $3.2 million in net assets.

During my research, I found there are four predominant paths toward accumulating wealth. The “Savers-Investors” path is the easiest, while the other three involve much more risk.

1. The Saver-Investors path

Just less than 22% of the millionaires in my study chose to take the Saver-Investors path. Not only is it the easiest way to build wealth, but if you start early, it almost always guarantees a lot of money.

The Saver-Investors in my group reached their first $1 million around their mid-to-late 30s, and accumulated an average net worth of $3.3 million by their mid-50s.

They also had four things in common:

- They typically had a middle-class income (many reached a six-figure salary early in their career, and if they didn’t, they lived very frugally.)

- They had a low cost of living and preferred to save, rather than spend lavishly.

- They saved 20% or more of their income.

- They started investing their savings early in life and continued to do so prudently for many years.

No matter what their day job was, this group made saving and investing part of their routine; they were constantly thinking about smart ways to grow their wealth.

The Savers-Investors path isn’t for everyone. It requires enormous financial discipline and long-term commitment.

2. The Dreamers path

This is perhaps the hardest path to building wealth because it requires the pursuit of a dream, such as starting a business, becoming a successful actor, musician or author.

Approximately 28% of the folks in my study were Dreamers, and they accumulated an average net worth of $7.4 million — far more than any of the other groups — over a period of about 12 years.

All of them told me that pursuing their dreams was one of the most rewarding things they had done in their lives. They loved what they did for a living, and their passion showed up in their bank accounts.

Those who want to take this path, however, must be willing to work long hours and able to handle financial stress. The Dreamers in my study worked more than 61 hours per week before finally achieving their dreams. Weekends and vacations were almost non-existent.

Trying to make ends meet was not easy. At first, getting a steady paycheck was “nearly impossible,” one Dreamer said. It was even harder for those who had families to support. To finance their dreams, some decided to put off buying a home, while others dipped into their retirement savings.

If you’re risk-averse, this path may not be for you.

3. The Company Climbers path

Climbers are individuals who work for a big company and devote all of their energy into climbing the corporate ladder until they land a senior executive position.

This is the second-hardest path to becoming a millionaire, and about 31% of the rich people I studied fell into this group. It took them an average of 22 years to accumulate a net worth of $3.4 million or more. In most cases, their wealth came from either stock compensation or a partnership share of profits.

To be a Climber, you must have strong relationship-building skills. Networking and making lasting connections with powerful people in your industry is essential.

Like Dreamers, however, Climbers also have long work hours. The ones I interviewed all arrived at the office early and left late. Many were required to travel frequently and even had to sacrifice a lot of their vacation time.

Profitability is a huge factor in determining a Climber’s success. If their company struggles financially, their time and investment there might not be rewarded to the extent they had expected.

4. The Virtuosos path

Roughly 19% of the participants in my study chose this path. Virtuosos are among the best at what they do in their profession. They are paid a high premium for their knowledge and expertise, which sets them apart from the competition.

It took the Virtuosos in my study about 20 years to reach an average net worth of $4 million. Some worked in the medical field, while others worked in law. A handful either worked for large, publicly-held corporations, or they were small business owners with highly profitable enterprises.

Of course, Virtuosos aren’t necessarily born with natural intelligence. They must spend many years continuously studying and learning. Formal education, such as advanced degrees, is usually a requirement.

This means investing an enormous amount of money and time before seeing any payoff at all. Not everyone has the ability to devote significant hours every day practicing their skill or the financial resources to pursue advanced degrees.

Tom Corley is an accountant, financial planner and author of “Rich Kids: How to Raise Our Children to Be Happy and Successful in Life” and ”Rich Habits: The Daily Success Habits of Wealthy Individuals.”