Trade Findings and Adjustments 09-19-2019

IF you are going to place a trade there are three VERY important things to consider:

- FOMC Rate meeting reaction – Up, down and volatile

- Triple witching Friday

- Middle East Powder Keg ready to blow

Sentimental issues moving our markets

IF you are going to place a trade what type of trade would you be looking for

IE… Non-Directional, high to low volatility, longer term, extremely short term

PLACING a trade – Credit spreads or a bleed off trade, Pre announcement with an adjust ready to be placed. Debit spread maybe after the announcement,

Biggest problems in trading/investing – NOT patient enough and forcing a trade at the worst possible time because you’ve justified the potential (not probable) profit

There SHOULD be a big difference in a trading account vs and investment account

Trading accounts description = shorter term trades, spread trading, smaller account 10-25K, money you truly can afford to lose, high risk high reward, small individual but I would like to see a IRA, ROTH with 20 years until the money has to be pulled

Investing Account description = Money set aside for retirement, longer term, maybe safer (collar trade) an account with time to add shares, sell them off later and collect dividends

IF I was PLACING a trade tomorrow I would go back to UAA

IF UAA opens at 20.80 and I sell a Oct-11-19 $21 short call for $0.70-$0.80 I like the trade

It gives me credit to protect down to $20

$20.00 to $20.10 I could make $0.90 – $1 = 4.4-5% or close to it

IF it breaks the $20 market and looks to close below I would add a $20 Long put to play these guys through earning

Adjustment – Fall below $20 and add long put protection Nov monthly at $20

After announcement trade

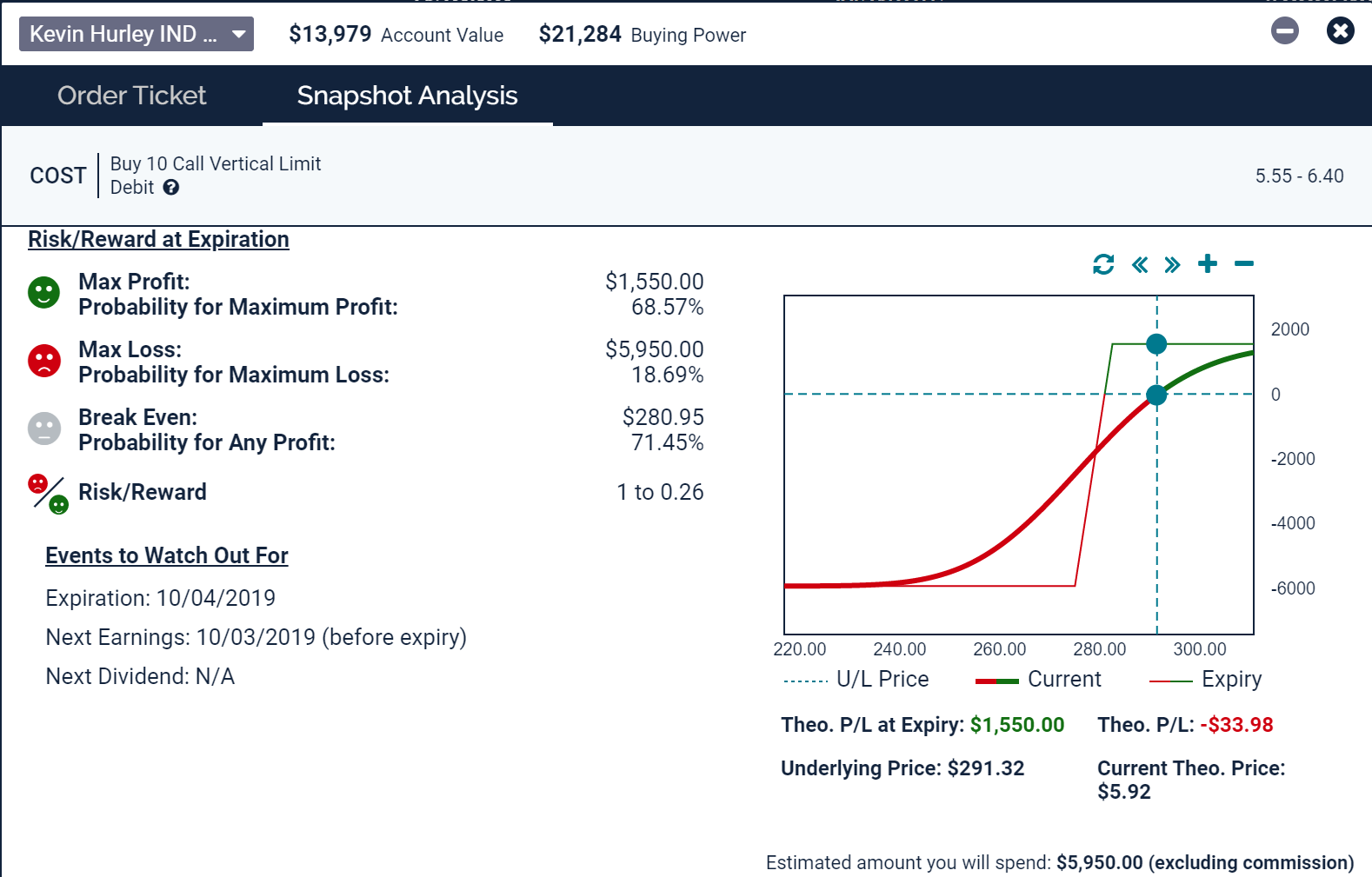

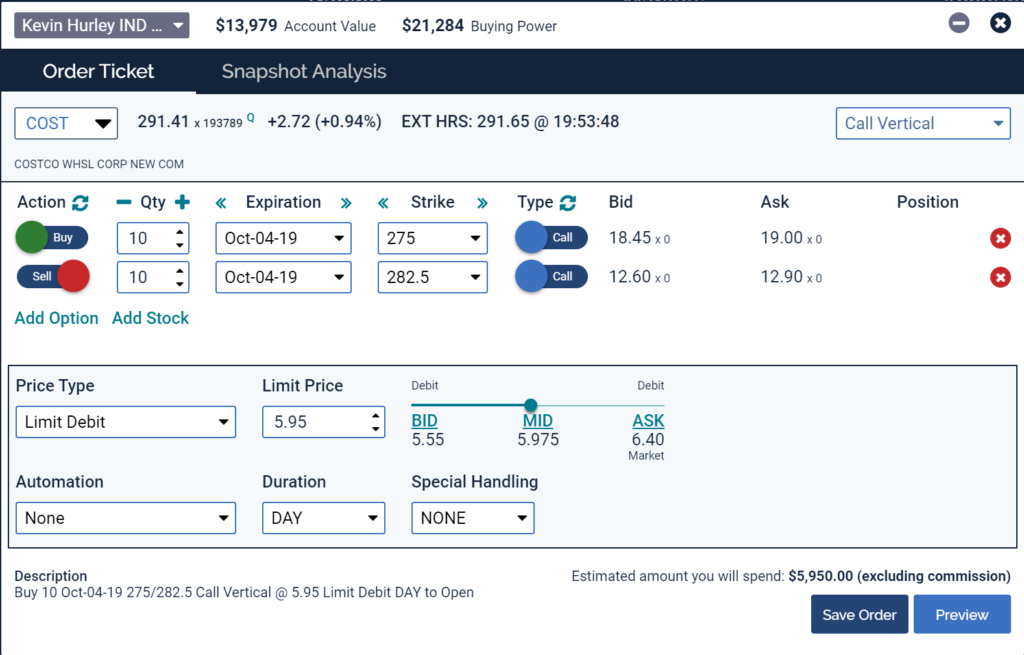

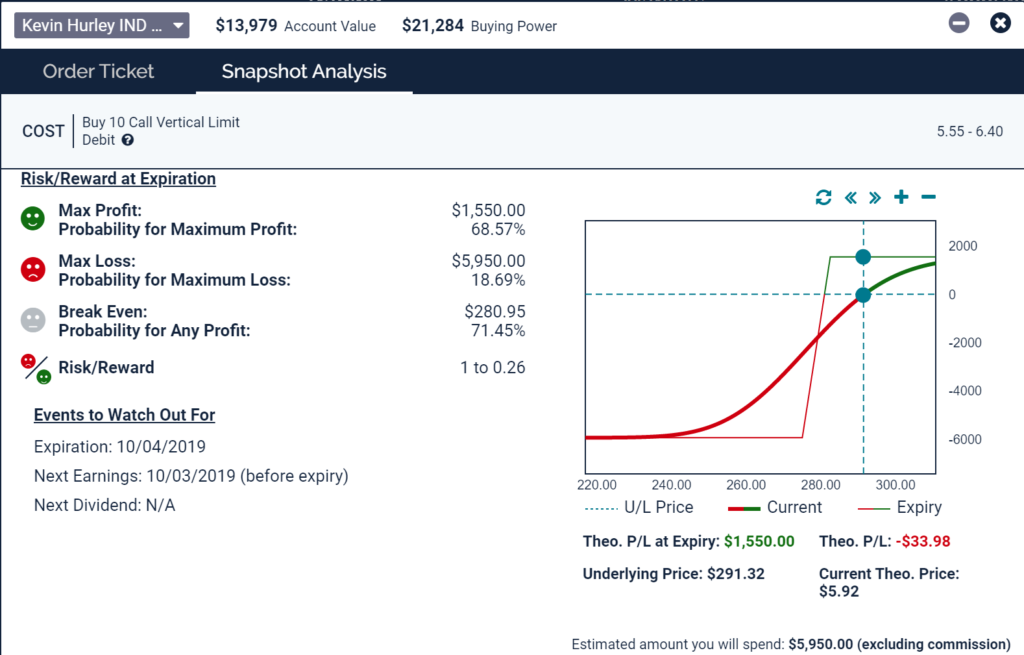

COST Bull call Oct-04-19 275/282.50

09-19-2019 – Bernstein analyst

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com