HI Market View Commentary 07-08-2019

Trading – Limit orders

IF you are trying to scalp a nickel STOP IT !!!

NOW if you are trying to avoid reversals, setting exits, giving the limit a little leeway than I would suggest you keep using limit orders

Might I suggest that you NEVER use a good to cancelled limit order

A July 12 expiration 197.50/200 bull call for a limit debit of $1.75

Max return $0.75

Collar trading is the BEST way to increase shares in a portfolio without having to dollar cost average (bring in more money to the portfolio) and it is also the best long term investment strategy to weather the market storms = Simple to be profitable 8-18% in a 2008 year

It is the best trade coming after a historic market bull run

Where will our markets end this week?

?????

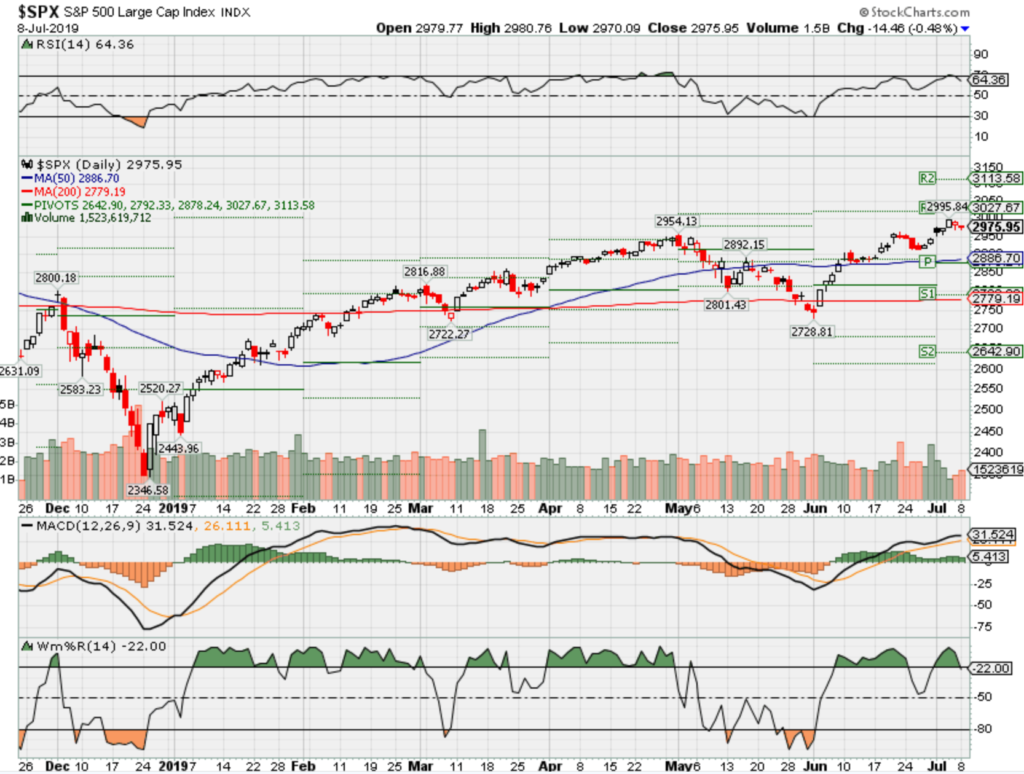

DJIA – Bullish Market

SPX – Bullish

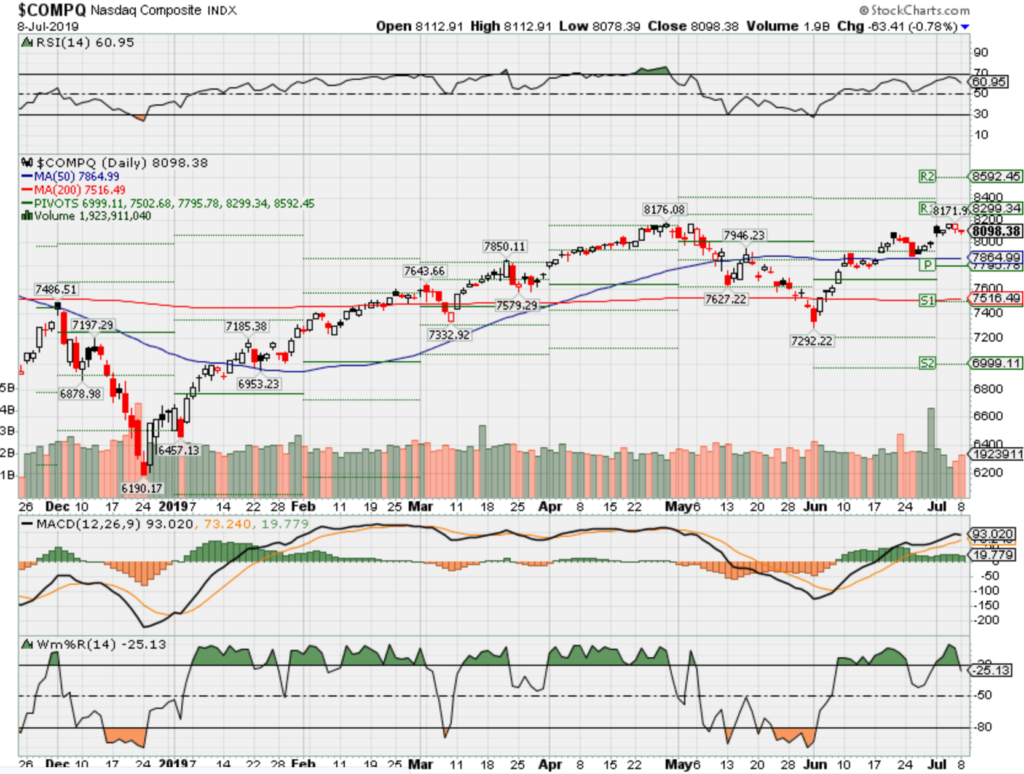

COMP – Bullish

Where Will the SPX end July 2019?

07-08-2019 +2.5%

07-01-2019 +2.5%

Earnings:

Mon:

Tues: PEP, WDFC

Wed: KHC, BBBY

Thur: DAL, FAST

Fri:

Econ Reports:

Mon: Consumer Credit

Tues:

Wed: MBA, Wholesale Inventories, FOMC Minutes, POWELL Testifies in Congress

Thur: Initial, Continuing, CPI, Core CPI, POWELL Testifies in Congress

Fri: PPI, Core PPI

Int’l:

Mon –

Tues –

Wed – CN: CPI, PPI

Thursday –

Friday- CN: Trade Balance

Sunday –

How am I looking to trade?

I’m preparing for earnings = Adding long puts

AAPL – 7/30 AMC

AOBC – 8/29 est

BA – 7/24 BMO

BIDU – 7/30 est

BAC – 7/17 BMO

CVS – 8/08 est

CVX – 8/02 BMO

DIS – 8/06 est

F – 7/24 BMO

FB – 7/24 AMC

FCX – 7/24 BMO

MRO – 7/31 est

MU – 9/19 est

MRVL 9/05 est

SLB – 7/19 BMO

V – 7/23 AMC

ZION – 7/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

AAPL, BA, BIDU and FCX all should tank

I like BAC, ZION, JPM, CVS, WBA, DIS, V, MA, DFS, CVX, MRO, SLB

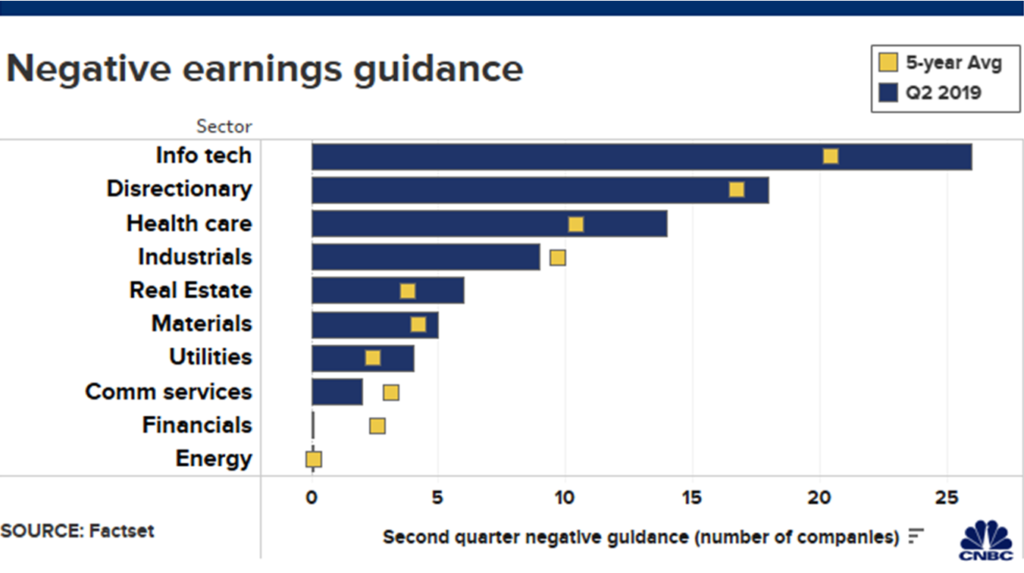

Companies are warning that earnings results are going to be brutal

PUBLISHED MON, JUL 1 2019 1:55 PM EDTUPDATED MON, JUL 1 2019 3:09 PM EDT

KEY POINTS

- With earnings season looming, 77% of companies issuing pre-announcements say their profit picture will be worse than Wall Street is expecting.

- That’s the second-worst quarter on record going back to 2006, according to FactSet.

- Two tariff-sensitive sectors, tech and health care, have seen the highest amounts of negative announcements.

Stocks may have brushed up against record highs Monday. However, a looming threat is just a couple weeks away once profit reports from the second quarter hit.

Analysts have been taking a dimmer view of what is ahead for earnings. They’ve already forecast a decline for the first three quarters of 2019. Now companies are echoing those concerns with a level of pessimism not often seen from corporate America.

Ahead of a season that starts in earnest the week of July 15, 77% of the 113 companies that have issued earnings per share guidance have warned that their numbers will be worse than what Wall Street analysts are estimating, according to FactSet.

That total of 87 companies is well above the typical level of 70% negative pre-announcements and the second-worst level since FactSet started keeping track in 2006. The worst was in the first quarter of 2016, which saw 92 negative such warnings.

At a time when the Dow Jones Industrial Average of blue chip stocks is coming off its best June since 1938, a wobbly profit picture doesn’t do much to instill confidence that such an aggressive rally can continue. Earnings for the S&P 500, which had its best June since 1955, are projected to decline 2.6% from the same period a year ago.

“The harsh reality is data is going to impact sentiment,” said Michael Yoshikami, founder of Destination Wealth Management. “I don’t think it’s something that can be ignored. Even though markets are at all-time highs, the economy is definitely slowing.”

The issues with earnings now are multi-pronged but tied mostly to tariffs and waning global growth.

In terms of sectors, the two with the biggest negative pre-announcements — information technology and health care — are at the center of the tariff battle between the U.S. and its global trading partners, particularly China.

At the industry level, semiconductors and equipment along with health-care equipment and supplies and life sciences tools and services have seen the highest number of negative pre-announcements.

Technology has been at the core of President Donald Trump’s tariffs against $250 billion worth of Chinese goods. At the same time, his steel and aluminum duties are making a direct hit on the health-care industry, impacting about $1.8 billion worth of medical imports, according to Tara O’Neill Hayes, the deputy director of health-care policy for the American Action Forum.

The total tariff impact will cost the industry about $400 million, Hayes wrote in a recent report. In addition to tariffs, health care also faces a serious regulatory risk ahead, with leaders in both parties expressing interest in curbing the amount pharmaceutical companies can charge for their drugs.

Multinationals, in general, also are seeing a big tariff impact. FactSet estimates that companies doing more than half their sales outside the U.S. are looking at a more than 9% earnings decline on a year-over-year basis.

Determining the market impact is difficult, but the downbeat sentiment from companies will give investors plenty to think about as Wall Street tries to build on a Dow gain this year of 14.4%.

“Stocks are priced for perfection. You haven’t seen too much suffering yet, but it’s kind of incipient. It’s creeping into the numbers little by little,” said Mitchell Goldberg, president of ClientFirst Strategy. “When stocks are priced for perfection, even little things become insurmountable.”

One major attribute the market has going for it is that even at a slower pace, the U.S. is still outgrowing the rest of the world. However, mounting headwinds could send investors further into safe haven assets like bonds and gold, which have benefited during the intensifying U.S-China trade dispute.

“If you’re worried about earnings, you should be taking some chips off the table,” Goldberg said. “We’ve had a real nice rally this year. I wouldn’t be surprised if we had a pullback.”

Deutsche Bank will exit global equities business and slash 18,000 jobs in

sweeping overhaul

PUBLISHED SUN, JUL 7 2019 10:46 AM EDTUPDATED MON, JUL 8 2019 6:27 AM EDT

KEY POINTS

- Deutsche Bank announced Sunday that it will pull out of its global equities sales and trading business as part of a sweeping restructuring plan to improve profitability.

- The bank will also slash 18,000 jobs for a global headcount of around 74,000 employees by 2022. The bank aims to reduce costs by 6 billion euros.

- Deutsche expects its restructuring plan to cost 7.4 billion euros by the end of 2022.

- The German bank also expects to report a net loss of 2.8 billion euros in the second quarter of 2019. It will release its second quarter results on July 25.

- Deutsche Bank announced Sunday that it will pull out of global equities sales and trading, scale back investment banking and slash thousands of jobs as part of a sweeping restructuring plan to improve profitability.

Deutsche will cut 18,000 jobs for a global headcount of around 74,000 employees by 2022. The bank aims to reduce adjusted costs by a quarter to 17 billion euros ($19 billion) over the next several years.

The German bank’s decision to scale back investment

banking comes just two days after investment banking chief Garth Ritchie stepped down by

“mutual agreement.”

Deutsche expects its restructuring plan to cost 7.4 billion euros by the end of

2022. The German bank may report a net loss of 2.8 billion euros in the second

quarter of 2019. It will release second quarter results on July 25.

Deutsche Bank’s supervisory board met on Sunday to hash out the restructuring

plan. The bank’s CEO, Christian Sewing, had broadcast “tough cutbacks” during

a shareholders’ meeting in May.

“Today we have announced the most fundamental

transformation of Deutsche Bank in decades,” Sewing said Sunday in a corporate

press release.

Deutsche had previously considered merging with rival Commerzbank to shore up

its position, but merger talks collapsed in April.

An industry source told CNBC that there wasn’t enough support for a merger

within Deutsche.

The German lender once sought to compete with America’s big banks on Wall

Street, but has been pummeled by scandals, investigations and massive fines

stemming from the financial crisis and other issues in recent years.

Deutsche reached a $7.2 billion settlement with

the U.S. Justice Department in January 2017 for allegedly misleading investors

in the sale of mortgage-backed securities in the lead-up to the 2008 financial

crisis. Weeks later, the bank was slapped with a $630 million fine over

allegations of Russian money laundering.

Those penalties came two years after the bank paid a $2.5 billion fine to

U.S. and U.K. regulators for allegedly participating in a scheme to rig

interest rates.

Deutsche has come under renewed scrutiny in the U.S. over its business

relationship with President Donald Trump. The

House Intelligence and Financial Services Committees subpoenaed Deutsche in April for

records on Trump’s finances.

Trump and his family sought to have that subpoena squashed in court, but a

federal judge ruled the bank can turn over

financial documents to House Democrats.

Chinese stocks are a buy even without a trade deal, says top emerging market fund manager

PUBLISHED SAT, JUL 6 2019 8:50 AM EDTUPDATED MON, JUL 8 2019 1:42 AM EDT

KEY POINTS

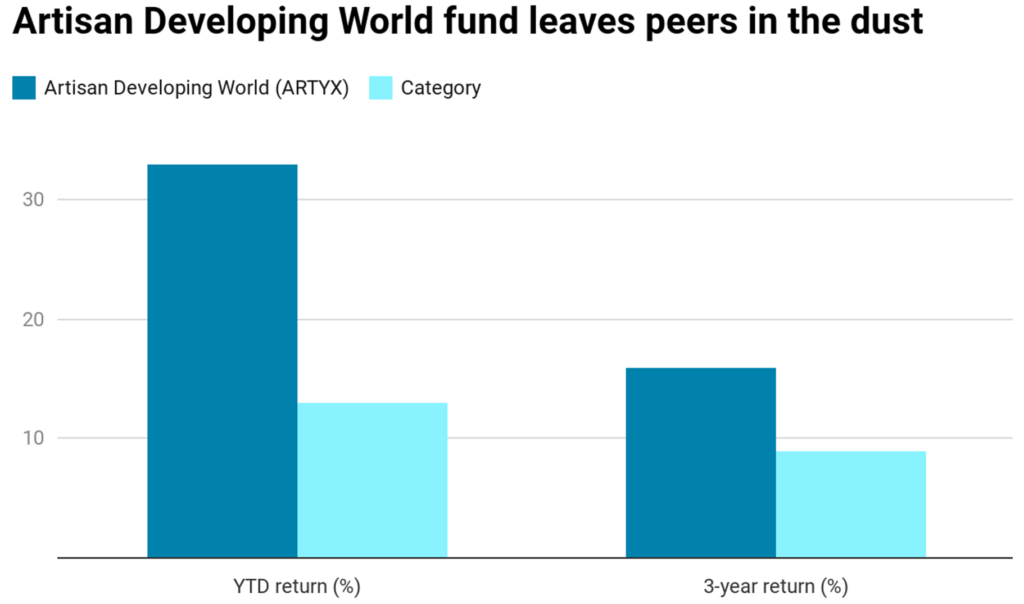

- “Regardless of what ultimately happens with the China trade tensions, there is a robustness to China that doesn’t exist anywhere else in the emerging markets,” says Lewis Kaufman, manager of the Artisan Developing World fund.

- The fund has benefited from Kaufman’s bullishness on China. The five-star rated fund has outperformed 98% of its peers over the past three years, returning more than 15% to investors, Morningstar data shows.

- The fund is on fire this year, returning a whopping 33%.

The outlook for Chinese stocks may be risky given the uncertain state of U.S.-China trade relations. But Lewis Kaufman, a portfolio manager at Artisan Partners, thinks investors should buy them anyway.

“Regardless of what ultimately happens with the China trade tensions, there is a robustness to China that doesn’t exist anywhere else in the emerging markets,” Kaufman told CNBC in a phone interview. “We want to be leveraged to that.”

“There’s an ecosystem for capital formation. It’s very difficult to access domestic demand through the vehicles we would wish to use in so many emerging-market countries,” Kaufman said. “But in China, if I want to buy into a health-care company, I have 10 choices. If I want to buy into an internet company, there are lots of choices.”

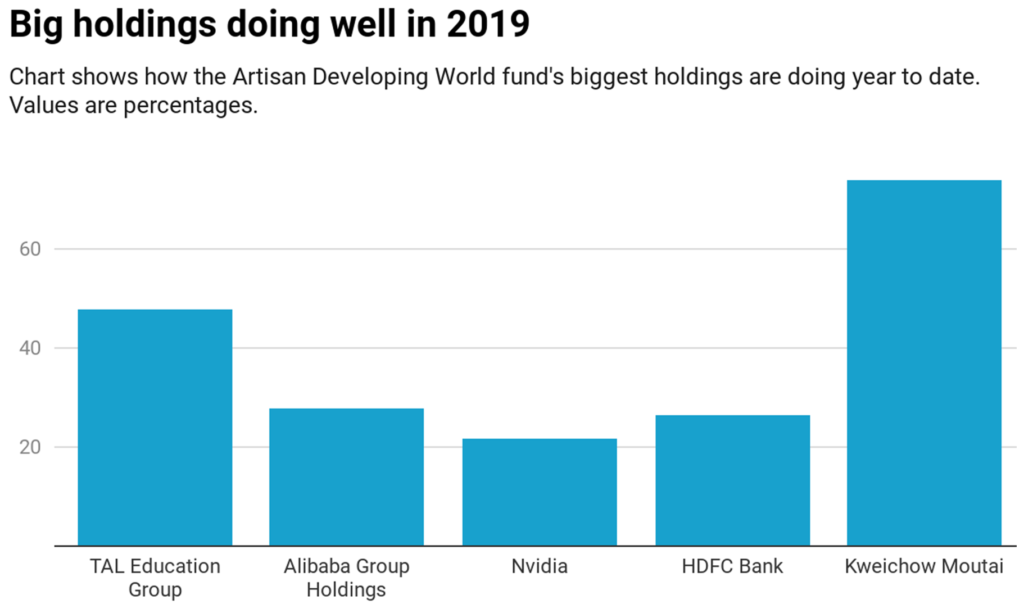

Kaufman’s fund, the Artisan Developing World (ARTYX), has benefited greatly from his bullishness on China. The five-star rated fund has outperformed 98% of its peers over the past three years, returning more than 15% annually to investors, Morningstar data shows. The fund has been on fire this year, returning a whopping 33%. It also ranks in the Global Emerging Markets Equity category’s top percentile in 2019 and has more than $2 billion in assets under management.

Chinese stocks have lagged the S&P 500 since the U.S.-China trade war began in March 2018. Since then, the Shanghai Composite is down more than 6%. The S&P 500, meanwhile, has risen more than 12% in that time.

For more than a year, China and the U.S. have slapped tariffs on billions of dollars worth of each other’s goods. The exchange of tariffs has shaken investor confidence as it stokes fears of lower corporate earnings and slower economic growth.

The latest trade escalation between the world’s largest economies came in May after the Trump administration hiked tariffs on Chinese goods and threatened to impose additional levies. China then retaliated with higher tariffs on U.S. products of its own. Trade tensions dissipated slightly on June 29 after President Donald Trump and Chinese President Xi Jinping agreed to restart trade negotiations. The two leaders did not set a timetable for when talks would resume or how long the would take, however.

“In China, we’ve got the trade tensions. We’ll see how that evolves. There’s certainly a possibility we’re in a deeper, more drawn out trade tension. There’s also a possibility that gets resolved, although I think that probability is falling,” Kaufman said. “But my point is there is a robustness to the Chinese economy and equity story that really doesn’t exist anywhere else in the emerging markets.”

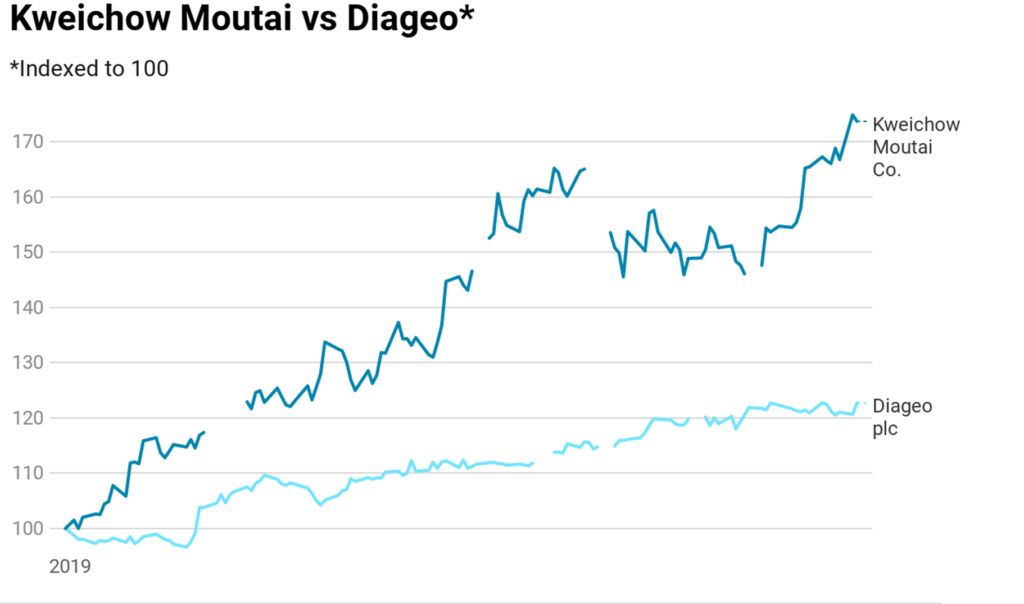

That robustness is seen in Kweichow Moutai, a Chinese spirits company that makes Baijiu, a popular liquor in China. Shanghai-listed Kweichow Moutai have been on fire this year, rallying around 70%. Meanwhile, Diageo — the world’s largest spirits company — is up about 25% year to date. The stock is also among Kaufman’s biggest holdings, comprising more than 4.5% of his fund’s holdings.

“It’s a $170 billion company and that speaks to the size and the scale of the Chinese consumer story,” Kaufman said about Kweichow Moutai. “You have 1.3 billion people there. On a per capita basis, it’s still an emerging country. But if you put that in aggregate against the 1.3 billion people, you have a very large market opportunity.”

Kaufman noted that Moutai’s biggest constraint right now is supply, since Baijiu needs to be aged five years before being brought to market. “Right now, there’s a lot of demand for high-end premium Baijiu, but only a finite supply. Volumes are growing at a steady pace. They can probably sell more if they had more supply.”

Another stock that benefits from China’s robust consumer story is TAL Education Group, an after-school education company. TAL is Kaufman’s biggest holding at nearly 5% of the overall portfolio. The company’s U.S.-listed shares are up more than 47% in 2019.

“The difference between doing well in school and not doing well in school can have a big impact on whether you attend one of the very selective universities and ultimately have a prosperous life in China,” Kaufman said.

The fund also owns shares of Alibaba, Nvidia and HDFC Bank.

Kaufman has managed the fund since its inception in 2015. He said he uses the same approach he used when managing another fund at Thornburg Asset Management, which “embeds the importance of compounding,” or finding companies with the potential to steadily grow their business over time and benefit from strong domestic demand.

“With this approach, Kaufman has led this fund to superior results over both the past year and his full tenure,” said William Samuel Rocco, an analyst at Morningstar, in an April note. “This fund is a good choice for investors who seek a long-term emerging-markets offering and who understand that its atypical geographic orientation and other distinctions can hurt as well as help its returns.”

The week ahead: Powell’s testimony could make or break the stock rally

PUBLISHED FRI, JUL 5 2019 12:53 PM EDTUPDATED SUN, JUL 7 2019 9:09 AM EDT

KEY POINTS

- Fed Chair Jerome Powell testifies for two days before Congress in the week ahead, and he has a chance to reinforce the Fed’s position on interest rate policy.

- There is also inflation data expected Thursday and Friday, and Pepsico is one of the first companies to report second quarter earnings when it reports Tuesday.

- Federal Reserve Chair Jerome Powell has the opportunity to reinforce market expectations for a late July rate cut or rein them in when he speaks to Congress in the week ahead.

Powell testifies before the House Financial Services Committee Wednesday and at the Senate Banking Committee Thursday, and is expected to answer questions on the economy and Fed policy.

His testimony comes after a strong June jobs report raised questions about whether the Fed will actually cut rates this month. The U.S. economy added 224,000 jobs last month, easily topping a Dow Jones estimate of 165,000. The report sent the benchmark 10-year Treasury yield back above the key 2% level. The dollar also rallied against a basket of currencies, pressuring commodities like gold.

The report was “stronger than expected, but with an accompanying -11k in revisions the job gains were nothing to derail the Fed’s anticipated cut in 26 days,” Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, wrote in a note. The Fed next decides on rates on July 31.

In the coming week, the market also has other places to look for clues on Fed policy, including in the Fed’s minutes from its last meeting, after which it suggested it could cut rates if it needs to. Those minutes are released Wednesday afternoon. There is also important consumer price index inflation data Thursday and producer level inflation data on Friday, when PPI is reported.

But Powell’s comments to Congressional committees could clarify whether the Fed is on course to cut interest rates later this month, as widely expected.

“It’s not clear to me the data are going to create a screaming case one way or the other. What it comes down to, is the Fed able to validate the market’s dovishness here?” said Stephen Stanley, chief economist at Amherst Pierpoint. “The one thing that has characterized Fed communications over the last month or six weeks is they’re just not willing to commit to anything ahead of time.”

Hopes for a rate cut have sent bond yields lower and supported stocks this week. The Dow Jones Industrial Average, S&P 500and Nasdaq Composite hit all-time highs. The tech sector rose more than 1% to a record as well, while the communications services sector surged more than 2%.

Economists say the markets would see a violent swing if Powell doesn’t stay on track for a rate cut. The fed funds futures market is pricing in one full quarter point rate cut and a little more for July.

“I personally don’t see the case for an ease right now,” said Stanley. “Do they passively accept the market’s verdict or do they push back, in that they’re not fully on board with an ease right now? It would be easy to realign the market’s expectations. Powell speaks next week and that would be the perfect opportunity if they were so inclined.”

Stanley said such a move would upset the stock market and weaken financial conditions, something the Fed would not want to do. But there is not a unanimous view about interest rate moves on the Fed either. Cleveland Fed President Loretta Mester said this week that rates should be kept where they are for awhile. On the other hand, St. Louis Fed President James Bullard dissented at the June meeting because the Fed did not cut interest rates.

Diane Swonk, chief economist at Grant Thornton, said a change in tone from Powell would be disruptive and unlikely. “There are other people trying to figure out what is the right thing to do right now, and there’s no easy answer,” said Swonk. “Jay Powell has made up his mind, and he doesn’t want to be on the wrong side of a recession.”

Swonk said she expects the Fed to cut interest rates by a quarter point at the end of the month. “All you need is uncertainty. You’ve got that. You need inflation running low. You got that. You need wages not accelerating rapidly. You’ve got that,” she said. “You’ve got all these things lining up.”

Some economists expect a half point cut, but Swonk said that would be too much since the Fed does not really have a lot of ammunition, given that the fed funds rate range is 2.25 to 2.50%. “They want insurance, but they don’t want to give away the house,” she said.

Besides the Fed, investors will begin to think second quarter earnings season in the week ahead. Pepsico is a big name releasing its report Tuesday, ahead of the flood of reports from banks and others in the following week.

Calendar for the week ahead (times are ET)

Monday

3:00 p.m. Consumer credit

Tuesday

Earnings: Pepsi, Levi Strauss, Helen of Troy

6:00 a.m. NFIB

10:00 a.m. JOLTS

Wednesday

Earnings: Bed, Bath and Beyond, MSC Industrial

10:00 a.m. Fed Chair Jerome Powell at House Financial Services

10:00 a.m. Wholesale trade

2:00 p.m. FOMC minutes

Thursday

Earnings: Fastenal, Delta Air Lines

8:30 a.m. CPI (June)

8:30 a.m. Jobless claims

10:00 a.m. Fed Chair Jerome Powell at Senate Banking commitee

2:00 p.m. Federal budget

Friday

Earnings: Infosys

8:30 a.m. PPI

For most Americans, $1.7 million is the magic retirement number

PUBLISHED SAT, JUL 6 2019 9:15 AM EDTUPDATED SUN, JUL 7 2019 3:24 PM EDT

KEY POINTS

- Americans believe they need $1.7 million, on average, to retire, according to a survey from Charles Schwab.

- However, most savers aren’t putting enough away every year to get there.

When it comes to retirement savings, many Americans miss the mark.

On average, Americans believe they need $1.7 million to retire, according to a recent survey from Charles Schwab, which looked at 1,000 401(k) plan participants nationwide.

In fact, “that’s a pretty good number if you average out age and median salary across the U.S.,” said Nathan Voris, a managing director at Schwab Retirement Plan Services.

However, “the bulk of folks do not get there,” he said.

More than half of those polled are contributing 10% or less of their salary to their 401(k) — their largest source of retirement savings — with an average annual contribution of $8,788, Schwab found.

That’s is a good start but may not suffice for most savers, Voris said, especially if you start saving for retirement later in life.

For example, if you start in your 20s, stashing 10% to 15% of your salary each year could be enough to retire comfortably, according to Schwab. But if you don’t start until age 45 or older, you would need to set aside as much as 35% of your salary annually — a goal few workers achieve.

In addition to those basic guidelines, experts recommend using a retirement calculator to get a more accurate picture of your retirement number.

The discrepancy between retirement confidence and preparation is not new.

Two-thirds of U.S. workers said they are very or somewhat confident they’ll be able to live comfortably throughout retirement, according to a study by the Employee Benefit Research Institute.

Yet only 42% have done any retirement calculations, EBRI found. And fewer than 1 in 3 workers has tried to figure out how much money is needed for medical expenses.

To be sure, savers have come a long way since the Pension Protection Act of 2006, which made it easier for companies to automatically enroll their employees in 401(k) plans.

Now, 401(k) balances are near all-time highs, according to a separate report by Fidelity, the nation’s largest provider of 401(k) plans.

In the last decade, the average 401(k) retirement plan balance rose by 466% to roughly $297,700, Fidelity said.

And Congress could soon pass the first major retirement reform since 2006, which is aimed at further expanding access to retirement savings for workers.

Among other measures, the Secure Act would push back the required minimum distribution age for retirement accounts to 72 (up from 70½), let long-term part-time workers participate in 401(k) plans and make it easier for small businesses to offer plans to employees.

The legislation cleared the House of Representatives in May and awaits action in the Senate. As of now, the bill is in limbo partly due to opposition from Sen. Ted Cruz, R-Texas.