HI Market View Commentary 05-27-2019

Please remember those who have made our freedoms possible

Why are you in the market?= Retirement, to buy things I probably wouldn’t if the returns weren’t there, to make some quick money to get the home I currently live in

It allows me freedoms I otherwise would not have and the ability to help more when needed

So if you made such good money in the past why don’t you continue to spread trade instead of collar trading

I can’t afford to see the draw downs that occur with spread trading!!!!

Collar trading, dollar figure wise, makes tons more money

You have to enjoy the market, the research and the work it take to be successful

Where will our markets end this week?

????

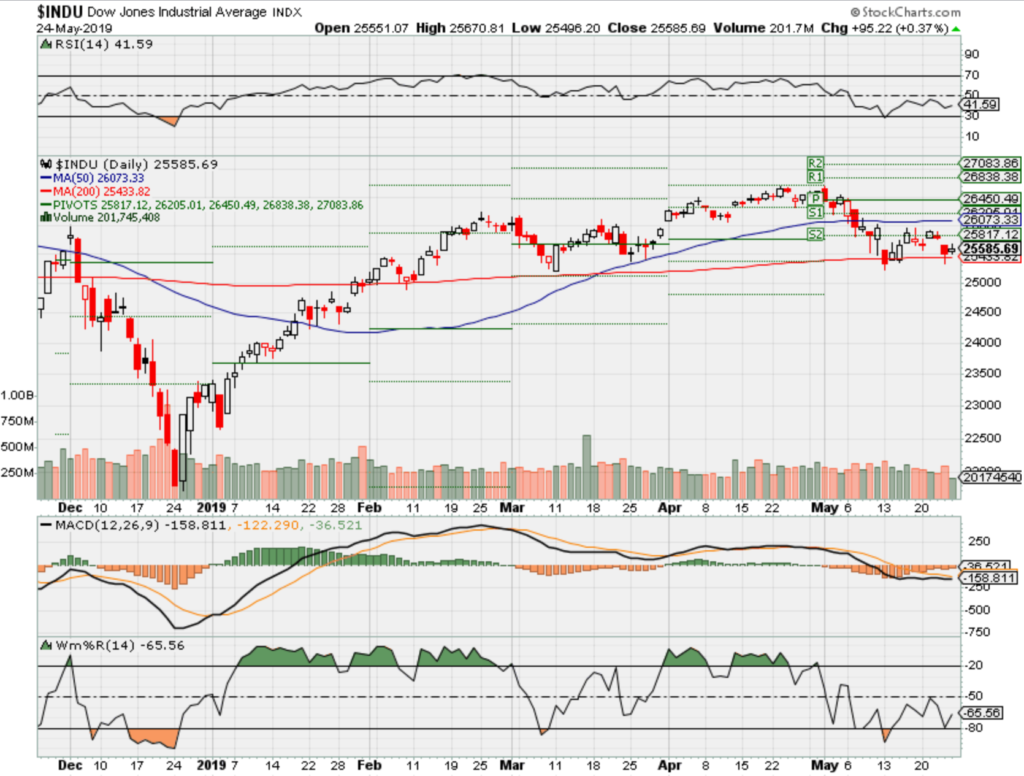

DJIA – Bearish

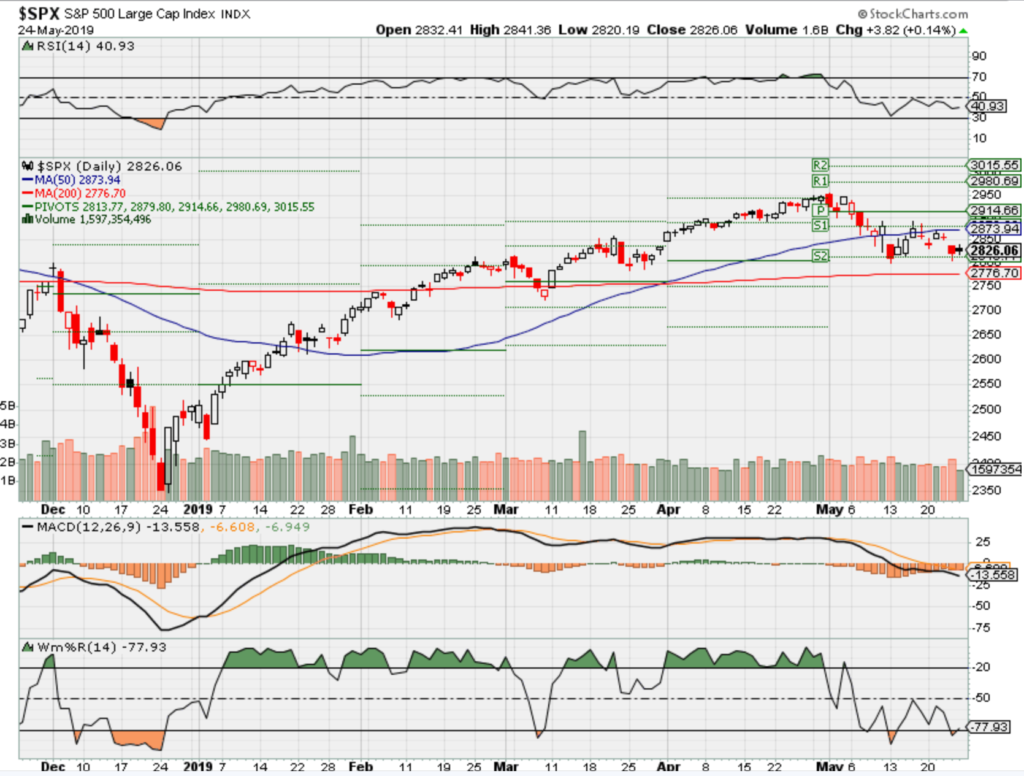

SPX – Bearish

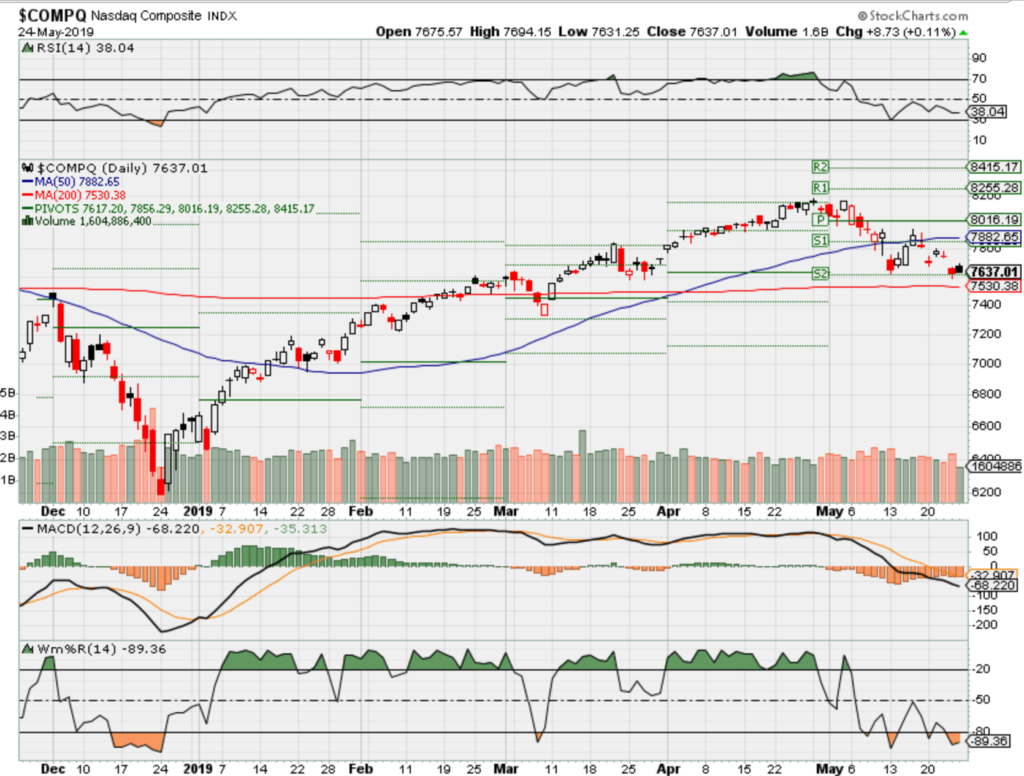

COMP – Bearish

Where Will the SPX end June 2019?

05-27-2019 -1.0%

Earnings:

Mon:

Tues:

Wed: ANF, DKS, GES, PANW, PVH, TYLS

Thur: BURL, DG, DLTR, EXPR, SPWN, DELL, GPS, MRVL, UBER, VMW, COST

Fri: BIG

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, Case-Shiller

Wed: MBA,

Thur: Initial, Continuing, GDP, GDP Deflator, Pending Home Sales,

Fri: Personal Income, Personal Spending, PCE Index, Core PCE Index, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday- CN: Non- Manufacturing PMI, NBS Manufacturing PMI

Sunday –

How am I looking to trade?

Extending protection out from Earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://seekingalpha.com/article/4266553-baidu-tech-giant-trading-dwarf-sized-valuations

Baidu: Tech Giant Trading At Dwarf-Sized Valuations

May 26, 2019 7:13 PM ET

Max Loh

Summary

Baidu is trading 25% lower since its Q1’19 results in mid-May, and is trading a whopping 60% below its all-time highs.

Baidu’s aggressive investment in its video-streaming arm, iQIYI (Netflix of China), may have concerned investors. However, I believe this is necessary, and will pay dividends in the future.

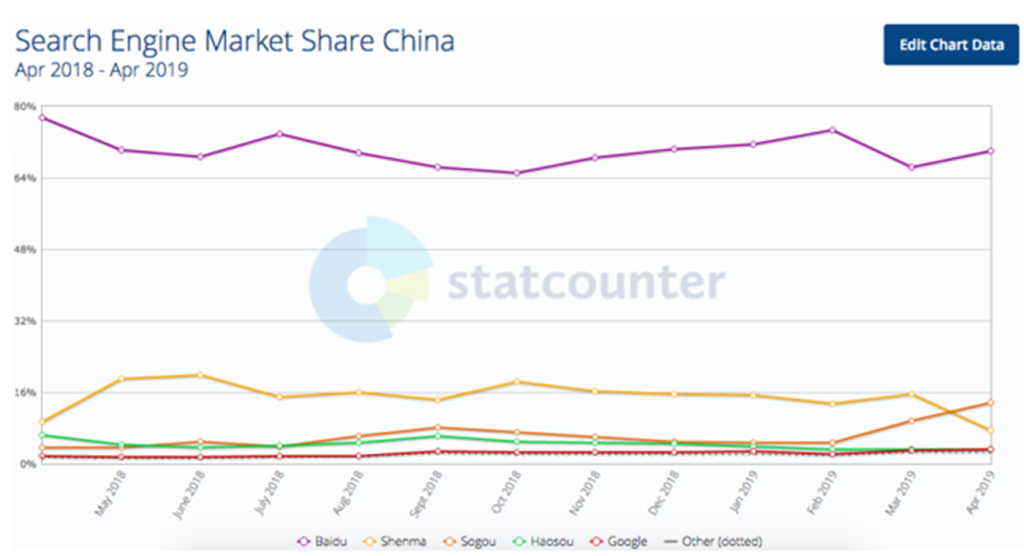

Baidu continues to enjoy about 70% market share of China’s search market, and the US-China trade war is curtailing Google’s efforts to re-enter the market. Talk about silver linings.

Technically, short interest in BIDU has risen to levels only seen once in the last 5 years. This makes the stock vulnerable to a short squeeze.

Baidu stock is trading about 25% lower since it released its Q1’19 results on 16 May (and a whopping 60% below its all-time high!), largely due to the company surprisingly posting its first loss in over 13 years. Investors have punished the Tech giant, with the company now trading at a very inexpensive, dwarf-sized 20x 12-month forward P/E (Source: Bloomberg).

In this article, I detail Baidu’s dominance in China’s search market, as well as give some perspective on the reasons why investor concerns may be inflated. From a technical perspective, Baidu stock is flashing strong over-sold signals, and I believe this is a very rare opportunity to pick up the stock for potential out-sized gains.

Baidu’s Leadership in China’s Search Market

Baidu (BIDU) is known as the “Google of China”, with an estimated 70% market share in China’s search engine space, according to Statcounter. Their “competition” is largely scattered across 3-4 other small players, all controlling less than 15% market share each.

Source: StatcounterThis competition includes Google (GOOGL), which is caught between a rock and a hard place. After pulling out of China’s search market in 2010 after co-founder Sergey Brin protested against the Chinese government’s “totalitarian policies”, Google has attempted to re-enter the lucrative market via Dragonfly, a censored search product for China. This has not gone down well with human rights advocates and lawmakers.

To add fuel to fire, the Trump administration has banned US companies from doing business with Huawei. Google has joined a host of companies such as Broadcom (AVGO), Qualcomm (QCOM), Intel (INTC) and Microsoft (MSFT) to cut ties with Huawei, by announcing it would cease providing support to Huawei phones, and will take away their access to the Google Play Store app marketplace, as well as applications such as Gmail and YouTube.

This makes it extremely difficult for Google to re-enter China’s lucrative search market. In essence, a protracted trade war between US and China will help Baidu fend off competition from the world’s number one Search company in its domestic market. Talk about silver linings.

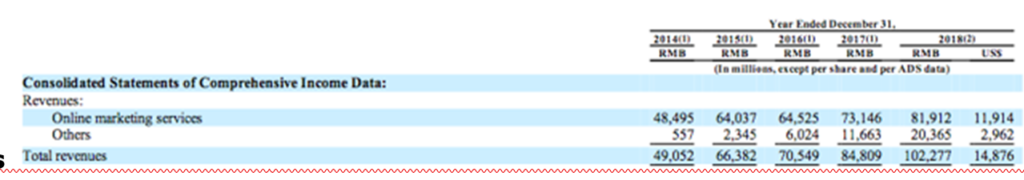

Breakdown of Baidu’s FY18 RevenuesSource: Company Annual Report FY2018Baidu’s dominance in China’s search market is expected to continue, and this has thus far given rise to a CAGR of about 12% in the company’s “Online Marketing Services” revenue segment from FY14 to FY18.

Baidu’s Expansion into Video Streaming – Think Netflix of China

Aside from its core search business, Baidu owns a c. 58% stake in iQIYI (IQ), known as the “Netflix of China”. In the recently released Q1’19 results, iQIYI announced it has 96.8 million subscribers. This compares with c. 148 million subscribers Netflix (NFLX) has currently.

Baidu announced its first loss in more than 13 years in its Q1’19 results. The main culprit was the company’s cost of revenues surging 50%, largely due to aggressive investment in new content for iQIYI.

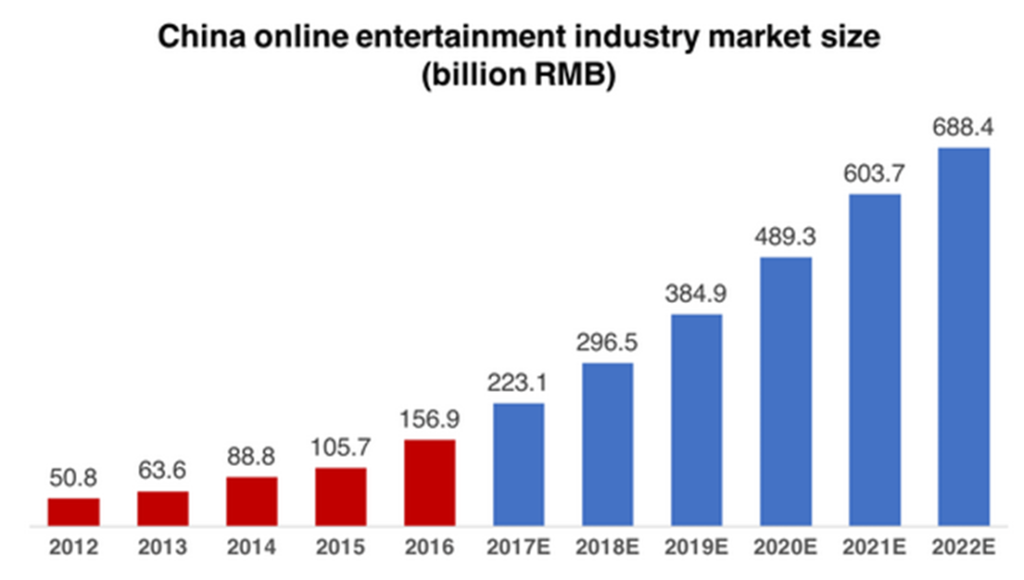

While investors have punished the stock, I remain of the view that such investment into iIQYI is necessary for iQIYI to cement its leadership position in the very lucrative online entertainment market in China. iQIYI continues to enjoy a lead over its closest contender, Tencent Video, which has c. 82 million users as of February 2019. The online entertainment market in China is huge, and is expected to grow at a CAGR of c. 30% from 2012 to 2022. In 2022, the market is expected to be worth c. USD 100 billion (USDCNY = 6.90).

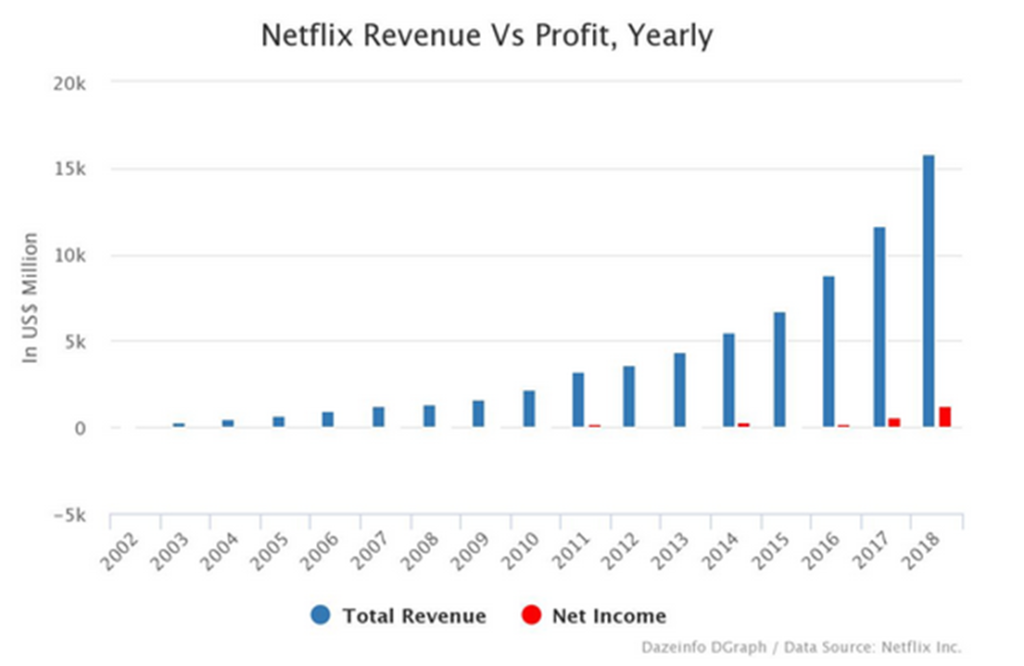

Looking at Netflix’s case, the company only managed to turn a profit for 5 of the years between 2002 to 2018. In 2018 (the company’s most profitable year), Netflix’s net income margin was a measly c. 7.5%. As such, I would advocate investors to remain patient over iQIYI (and Baidu). Investment into the online entertainment market is necessary to win over subscribers, and iQIYI has found joy in growing its subscriber base so far. The profit will come later (the company expects to turn a profit only in 2020-2021), and the online entertainment market size in China definitely justifies Baidu / iQIYI’s investments.

Baidu’s Future-oriented Research Arms – Think Google

Baidu is not simply a search company. It has invested in various technological fields which are likely to pay dividends in the future. Baidu Research, which has offices in Silicon Valley, Seattle, and Beijing, “brings together top talents from around the world to focus on future-looking fundamental research in artificial intelligence“.

Its research areas are multitudinous – including data science and mining, robotics and autonomous driving, machine learning and deep learning, and quantum computing.

Does this not resemble Google’s research and development arm, Google AI, which has similarly invested in a vast number of technological fields for the future?

Not many technological companies have the scale, capabilities, infrastructure and talent to do what Google does. While Baidu may not be on the same stage as Google, its investments in technological research and development will ensure the company will remain at the forefront of some of the world’s most cutting-edge technologies.

Technical Perspective – Stock is Heavily Oversold

First, Baidu is trading at a whopping 60% discount versus its all-time high. Next, some of my technical indicators are showing that the stock is massively oversold:

- The magnitude of BIDU’s recent sell-off is more than 3 standard deviations (based on price action of previous 20 weeks)

- Short interest levels in BIDU have risen to levels only matched once in the past 5 years (in 2016). A short squeeze may see an outsized rally in BIDU stock

- BIDU’s 10-day volatility has risen to levels only matched once in the past 5 years (in 2018)

- BIDU is trading at levels last seen in 2015. Previously during that week, BIDU staged a rebound to close above $152, indicating there might be strong support around current levels

Source: Tradingview.comPutting together everything, Baidu may have experienced a bad quarter, but this can be explained by the company’s aggressive investment in developing video content for iQIYI. Taking into account the online entertainment market size in China, I believe this investment is warranted, and it is necessary for iQIYI to continue to cement its leadership position in the market.

Going forward, Baidu should continue to reap dividends from its strong leadership position in its core search engine business, with the US-China trade war essentially curtailing Google’s ventures into this market. Competition remains scattered and is unlikely to threaten Baidu in the near future.

Baidu’s dominance in China’s search market, coupled with its future arms of growth (video streaming, machine learning, autonomous driving, etc.) should see the stock trading much higher than its 20x forward P/E currently.

Lastly, Baidu stock looks massively oversold from a technical perspective. The high amount of short interest in the stock in particularly, makes the stock vulnerable to a short squeeze, which could see it enjoy an outsized rally in the near future.

Is this the bottom for BIDU? It is difficult to say. The stock could continue to trade lower, but I strongly believe the risk-reward is heavily tilted to the upside for investors.

Disclosure: I am/we are long BIDU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

China would benefit from a positive response to US trade complaints

PUBLISHED SUN, MAY 26 2019 9:50 PM EDT

- A Beijing decision to rapidly and sharply cut its excessive and unsustainable trade surplus with the U.S. would change for the better the dynamics of bilateral ties.

- If China did that, Washington would have to withdraw its claim to interfere in China’s trade legislation and economic policies.

- China should remember, however, that Washington takes it as a “strategic competitor,” and should not expect liberal access to U.S. markets and technologies.

Was it ruthless greed, ineptitude or hubris that led China to entrap itself into its huge, systematic and unsustainable trade imbalances with the United States?

The answer is: All of the above.

Beijing’s trade problem was also part of unintended consequence of America’s economic policy errors. China, therefore, cannot complain about any sinister scheming. In trade and in most of the rest, America’s policy toward China has been an open book ever since the Shanghai Communique in 1972, when Washington began its “triangulation” game of playing China to fight its cold war with the Soviet Union.

The focus of American policy changed after the collapse of the Soviet Union, as Washington tried to promote a market economy and democracy in China. The Chinese ignored the advice, kept pocketing the benefits of open access to U.S. markets and free technology transfers, accumulating $3.1 trillion of foreign reserves (at the last count) and steadily growing net foreign assets.

Thanks in large part to American investments and technology, China moved from its cheap smokestack manufacturing base of the 1980s to an engineering powerhouse, with cutting-edge industries ranging from infrastructure to transportation, telecommunications, computing, military hardware, space exploration and global retailing.

Free-riding is over

It took a while for Washington to sober up from its missionary zeal, and to realize the importance of China’s bold and seemingly unstoppable economic development — with all of its political and security corollaries.

The problem then became: What do we do now?

Torn between extreme and useless advice of American sinologists — take it easy, cooperate; or hit them hard with everything you got, and the sooner the better — Washington opted early this decade for the containment strategy with a “pivot to Asia,” later morphing into the “rebalancing to Asia” as a semantic adjustment to apparently make it sound less offensive to China.

And while the U.S. was agonizing over its China policy, or, if you wish, kicking the can down the road from one administration to the next, Beijing was stepping up its sales on American markets.

Between the beginning of 2011 and the end of the first quarter of this year, the Chinese took $4 trillion on their goods exports to the U.S., encouraged by some economics-challenged pundits that there was nothing Washington could do to stop that. Some of them are still telling the Chinese that U.S. trade deficits and rising foreign debt are pre-ordained, because even in good years American spendthrifts save barely 6% of their after-tax income, while the penny-pinching Chinese squirrel away half of what they earn.

The Chinese apparently could not bother with that nonsense. They just kept unloading their stuff, earning a net income of $3 trillion on those $4 trillion of American sales.

Showing an incredible chutzpah, the Chinese did not change their trade policy even after U.S. President Donald Trump took office in January 2017 — a man who was throwing harsh trade warnings at China from the campaign trail since 2015. No, Beijing paid no attention to Trump threats: China’s exports to the U.S. in 2017 and 2018 exceeded the half-a-trillion dollar mark, and the Chinese surpluses on American trade kept soaring at average annual rates of 10%.

Balanced trade and better ties

One might call that a ruthless greed, a self-assured defiance toward Trump’s America or, more generously, a rational response to America’s decades-old apparent indifference to one-third of its economy, where China’s trade surpluses were slashing growth, jobs and incomes.

Instead of following the old law of holes — if you find yourself in a hole, stop digging — China continued to aggravate its U.S. trade case and broadening bilateral tensions with vacuous, lecture-style incantations of “win-win cooperation,” a “harmonious co-existence” and a “shared future for mankind.” That sort of hubris could perhaps sell in China, but it finds no takers in the U.S., Europe and most other places around the world.

Somehow, Beijing officials seem to have chosen to use sloganeering as a substitute for a prompt and decisive action to sharply narrow their excessive trade surpluses with the U.S. — a policy that would have deprived Washington of any legitimate reason to seek relief from damages caused by China’s aggressive mercantilism.

It is hard to believe that Beijing’s leaders did not step in to do the obvious, and the only thing China had to do: Slash the excessive trade surplus with the U.S. quickly and build a more productive relationship with Washington.

Trump apparently still hopes that he can cut the Gordian knot with Chinese President Xi Jinping during the G-20 meeting in Japan next month. That perhaps explains his puzzling one-liners bubbling with optimism regarding trade talks with China.

China should support that by sending stronger signals on bilateral trade flows to make such a deal possible. Maybe that’s what is intended by a 14% annual decline of Chinese exports to the U.S. during the first quarter of this year, resulting in a 12% cut of America’s trade deficit with China. But, if that’s Beijing’s true policy intent, China should restrain its apparent urge to “punish” Washington, as it did with a whopping 19% cut of American goods purchases in the January to March period.

Stepping up imports from the U.S. would be a much better, and correct, thing to do to atone for China’s abusive trade policies toward the U.S.

Washington, for its part, should step back from meddling in China’s legislative process and economic policies, while reserving the right to vigorously respond to cases of intellectual property violations, forced technology transfers, illegal industry subsidies and restricted market access to U.S. businesses operating in China.

Investment thoughts

Beijing’s decision to rapidly and sharply cut its excessive and unsustainable trade surplus with the U.S. would change for the better the dynamics of bilateral ties. That would go some way toward extricating China from damaging and dangerous security tensions with the U.S.

If China did that, Washington would have to withdraw its claim to interfere in China’s trade legislation and its economic policies.

China should remember, however, that Washington takes it as a “strategic competitor,” and Beijing should not expect liberal access to American markets and technologies. Solving the bilateral trade problem would only be the first step toward a more productive and cooperative relationship.

Meanwhile, markets should not exaggerate the importance of U.S.-China trade tensions for a fully employed American economy driven by low credit costs, real disposable household incomes growing at annual rates of 3% and strong corporate earnings.

Commentary by Michael Ivanovitch, an independent analyst focusing on world economy, geopolitics and investment strategy. He served as a senior economist at the OECD in Paris, international economist at the Federal Reserve Bank of New York, and taught economics at Columbia Business School.

Dow rises nearly 100 points, but posts longest weekly losing streak since 2011

PUBLISHED FRI, MAY 24 2019

[U.S. markets were closed May 27, 2019 in observance of Memorial Day.]

Stocks rose on Friday, but notched weekly losses as investors worried the U.S.-China trade war is hurting economic growth.

The Dow Jones Industrial Average ended the day up 95.22 points at 25,585.69 while the S&P 500 climbed 0.1% to 2,826.06. The Nasdaq Composite rose 0.1% at 7,637.01. The indexes rebounded slightly from sharp losses on Thursday after President Donald Trump said Thursday afternoon the ongoing trade war could be over quickly.

“We still think the negotiators are going to reach a deal, but it’s clearly going to take a lot longer and be more difficult than investors thought a few weeks ago,” said Kate Warne, investment strategist at Edward Jones. “But any glimmer of hope that progress is being made will help stocks rebound.”

But Friday’s gains were not enough to offset this week’s losses. The Dow dropped 0.7% this week to post its fifth consecutive weekly decline, its longest streak since 2011. The S&P 500 and Nasdaq fell a third straight week of losses, their longest slide since December 2018. The weekly losses come at a time when investors are growing more convinced that the trade war will take longer than expected to conclude and could hurt the economy.

U.S. durable goods orders dropped 2.1% last month amid a slowdown in exports and a buildup in inventories. This is the latest economic data set showing cracks in the economy while the world’s largest economies engage in a trade war. IHS Markit said Thursday that U.S. manufacturing activity fell to a nine-year low.

Crude prices dropped 6.6% this week as trade worries spilled over to other markets. Investors also loaded up on Treasurys this week. On Thursday, the 10-year Treasury note yield fell to its lowest level since October 2017.

“It seems, for the moment, [trade] is the only thing investors are thinking about,” said Mike Bailey, director of research at FBB Capital Partners. “You’ve got this one narrow issue that’s basically spreading across the entire market.”

“Investors had been hoping for more certainty,” Bailey said. “Instead, they’re getting more uncertainty across the board.”

Energy and tech were the worst-performing sectors for the week. The energy sector fell 3.4% while tech — the largest S&P 500 sector by market weight — lost 2.8%.

Chipmakers led tech down this week as the VanEck Vectors Semiconductor ETF (SMH) dropped 5.6%. Qualcomm and Broadcom were the worst-performers in the ETF this week, dropping 18.8% and 11.7%, respectively.

Chip stocks have been under pressure as the U.S. increases pressure on Chinese telecom giant Huawei. Last week, the Trump administration made it harder for U.S. companies to do business with Huawei, before granting a temporary 90-day reprieve for the company.

Apple shares also contributed to the tech losses as several analysts raised concern over the company’s exposure to China. The stock ended the week down 5.3%.

“The growing worries around a US/China elongated trade battle and its implications on the tech space are heavily weighing on the minds of both investors and the companies themselves caught in the cross hairs,” Dan Ives, analyst at Wedbush Securities, wrote in a note to clients. “The ‘poster child’ for the US/China trade wars continue to be Apple with the stock under heavy pressure as many competitors are yelling fire in a crowded theater around the potential China impact to Cupertino if this situation worsens.”

—CNBC’s Silvia Amaro contributed to this report.

Bipartisan retirement bill clears House, moves closer to becoming law

PUBLISHED THU, MAY 23 2019

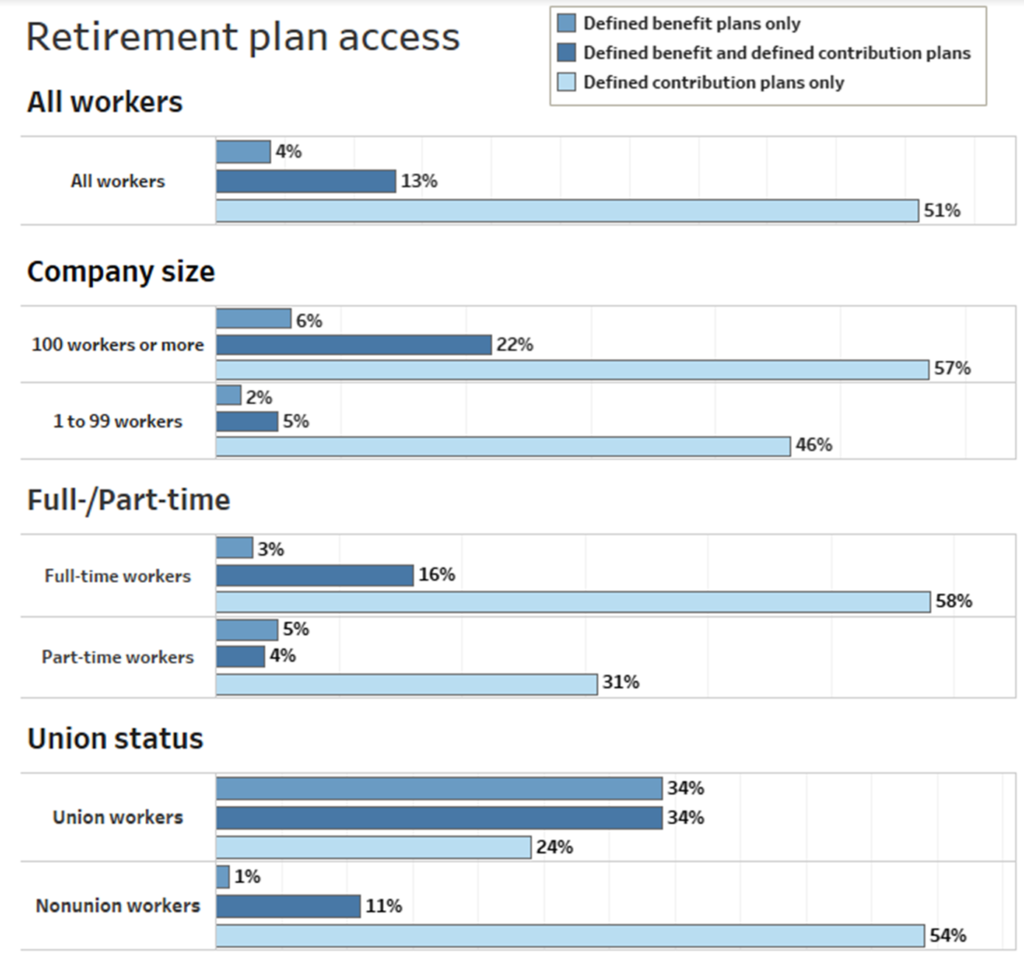

- The Secure Act includes provisions that would make it easier for small businesses to band together to offer 401(k) plans and eliminate the maximum contribution age on traditional individual retirement accounts (it’s currently 70½).

- A provision that would have allowed money from tax-advantaged 529 education savings plans to be used for home-schooling expenses was stripped from the measure earlier this week.

- Some lawmakers and Washington watchers have referred to this legislative effort as a first step in addressing the lack of retirement savings among the nation’s workers.

Lawmakers in the House of Representatives have passed a bill that aims to improve the nation’s retirement savings, moving it a step closer to becoming law.

Called the Secure Act and backed by both Republicans and Democrats, the measure includes a variety of provisions intended to increase the ranks of savers and the amount they put away.

Changes include: making it easier for small businesses to band together to offer 401(k) plans, requiring businesses to let long-term, part-time workers become eligible for retirement benefits and repealing the maximum age for making contributions to traditional individual retirement accounts (right now, that’s 70½).

It also would raise the age when required minimum distributions, or RMDs, from certain retirement accounts must start to age 72, from 70½, along with making changes to allow more annuities to be offered in 401(k) plans.

“We continue to be optimistic that we’ll move this bill over the goal line,” said Paul Richman, chief government and political affairs officer at the Insured Retirement Institute. “It’s likely that before the end of this year, there will be a retirement bill that gets sent to the president’s desk.”

A provision that would have allowed money from tax-advantaged 529 education savings plans to be used for home-schooling expenses was stripped from the Secure Act during a House Rules Committee vote earlier this week.

With the Secure Act’s passage, it will now head to the Senate, where a similar bill has yet to be voted out of committee. In the upper chamber, it’s known as the Retirement Enhancement and Savings Act, or RESA, and its provisions largely mirror those in the House bill.

However, it does not include some of the Secure Act proposals, including an increase in the age for RMDs and the requirement that companies provide 401(k) access to part-time workers.

RESA’s co-sponsor, Chuck Grassley, R-Iowa, said during a recent Finance Committee hearing — which he chairs — that he looks forward to receiving the Secure Act in the Senate and working out the differences between it and RESA.

Both bills also rely on funding their provisions by changing the rules governing inherited retirement accounts. The House measure would require most nonspouse beneficiaries to withdraw the money within 10 years of the original owner’s death, while the Senate bill would require distribution within five years for accounts worth at least $400,000, unless the beneficiary is the spouse.

Meanwhile, some lawmakers and Washington insiders have referred to this legislative effort to address the lack of retirement savings among the nation’s workers as a first step. When the Secure Act was introduced, co-sponsor Richard Neal, D-Mass. — who also is chairman of the House Ways and Means Committee — said he would introduce another round of retirement legislation later this year.

It’s expected by some congressional watchers that he will include a proposal to require companies of a certain size to offer retirement plans to their workers. Neal has pursued this approach in past sessions and is expected to use his powerful position to put the issue front and center at some point.

More from

Personal Finance:

Younger couples say ‘I don’t’ to

high-cost engagement rings

Layaway loans are back, with a new

look

These are the 10 most affordable

vacations in the US

A House Ways and Means Committee spokeswoman told CNBC that Neal hopes to include the provision in a future retirement bill, but that the legislation is in its early stages.

On the Senate side, another retirement bill was also recently added to the mix by Sens. Ben Cardin, D-Md., and Rob Portman, R-Ohio. Called the Retirement Security and Savings Act, its notable provisions include increasing the RMD age to 75 from 70½ over time and allowing companies to make a matching contribution to a worker’s retirement account equal to the amount of their student loan payment.

— CNBC’s John Schoen contributed to this report.

https://seekingalpha.com/article/4266623-bank-america-pullback-opportunity-happens

Bank Of America Pullback Opportunity Happens Again

May 27, 2019 12:38 PM ET

Summary

Bank of America’s stock declines again from its previous high peak, due to US-China trade tensions.

The stock price is not reacting to fundamental changes in the business model, only to temporary political news.

The most recent stock decline offers a leveraged risk/reward opportunity for traders (again).

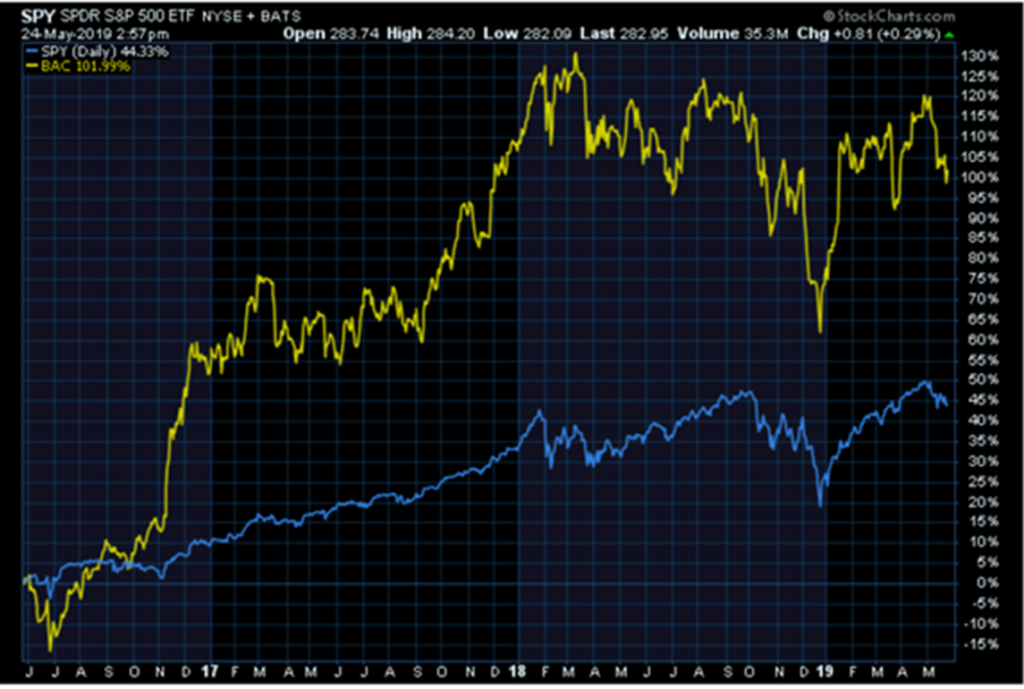

Bank of America (BAC) has risen strongly in the previous years, outperforming the general stock market index (SPY). An investment in BAC would have delivered a ROI of 102%, whereas a passive investment in SPY would have “only” yielded 44% ROI.

Source: stockcharts.com

Other major bank stocks achieved this strong stock performance as well, all outperforming the stock market index (with the exception of WELLS FARGO). The strongest major bank stock was Bank of America, followed by JP MORGAN.

Source: stockcharts.com

Since the beginning of 2019, Bank of America (BAC) has appreciated with 12.6% in line with the general performance of the S&P 500 stocks (SPY) of 12.8%. The stock price rose from $23 in January to the $30 level in February, to bounce between the $27 and $31 level. The stock price moves along with the general stock market trend and tends to strongly react to any new developments regarding the US China trade war.

As we look at the stock price of BAC over the last months we can clearly see the pattern of volatile stock price action, resulting in strong price corrections often followed by rising stock prices.

Source: finviz.com

As BAC has not managed to make new high levels, investors are worrying whether the bull case is still valid. In this article, we will highlight why new high prices are not required to make (elevated) returns on investments. We will present a trading strategy, which benefits from the range bound market BAC has been moving in recently.

Business Model Remains Solid

In my previous article on BAC, I wrote my view on the fundamental model behind BAC and why I belief this model justifies the stock growth price of Bank of America. The main reasons can be summarized as follows:

- Anticipation of higher interest rates, driving the earnings and intrinsic value of BAC to higher levels. As the earnings of BAC remain highly sensitive to the general interest rates, we can expect their earnings to increase solidly in the future.

- Low valuation rates (P/E below 10.5 and P/B ratio of 1.12), which are relatively low taking into consideration the stock market has been rising in the past years and many companies have much higher price ratio’s

- Multiple internal cost cutting initiatives & share buybacks

- A growing US economy, increasing the demand for banking transactions

None of these points here above have changed in a significant way, which would justify a (temporary) stock price correction. The only driver behind the stock price decline are the recent US-China trade war tensions. As time plays out, we expect their impact on the stock prices of strong companies will also fade out. In the meantime, we can use this event to gain an elevated ROI on Bank of America.

Options Trade

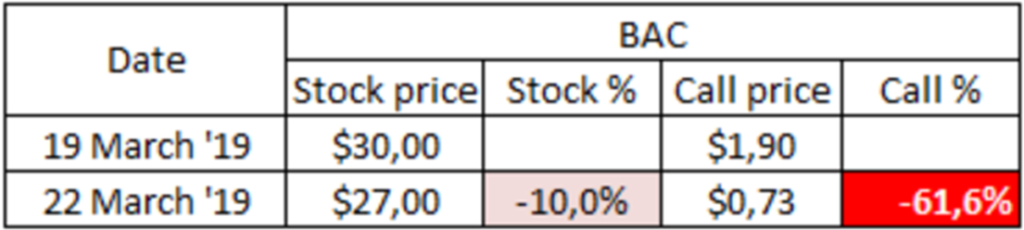

Earlier this year in March, I presented a trading idea which benefits from the price action in BAC’s stock price. In that article, I described how BAC’s stock was going through a price correction very similar to the previous price corrections.

At that time the stock price had declined with 10% in only a week time, while the call options had declined with 61%.

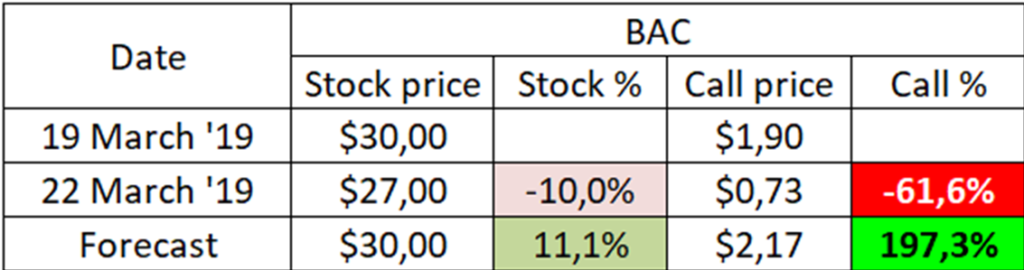

As the reasons behind the price correction were only temporary (and no long-term fundamental threats), I advised to buy out-of-the money call options on BAC. The strike price of the options was 11% above the stock price at that time. If the stock price would achieve the $30 target, the call options would deliver an estimated return of 197% (19x the ROI of a common stock investment).

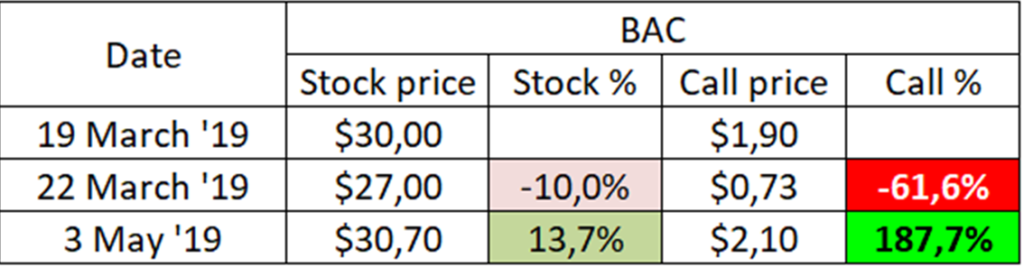

The stock price appreciation we had anticipated materialized in the coming weeks and by 3 May 2019, the common stock price was at $30,7. The premium of the call options had risen to 187%, delivering a strongly leveraged return to investors.

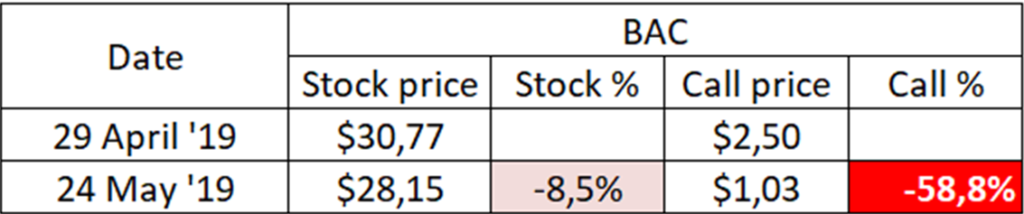

Today we see a similar option trade opportunity presenting itself. Bank of America recently declined from its $30.7 high price on 29 April to $28.15 as of today (24 May 2019). This means a stock price decline of 8.5%. When we look at the impact on the price of the call options we can see the effect was much more severe.

In this case we will look at the $30 call options expiring in November 2019, which have a stock price of $1.03. This price is 58% below the option price of 24 April 2019, which was around the $2.50 level. We can summarize the price action in the below table:

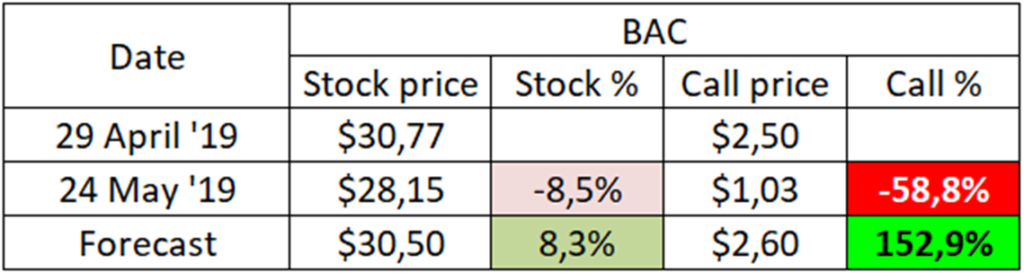

Assuming the stock price will recover again in the coming weeks, we can see what ROI an option investment would deliver compared with an investment in the common stock:

Obeservations from this table:

- BAC common shares have declined with 8.5% while the call options declined with 58%. The leverage factor is around x6.5.

- Assuming the stock price will appreciate to the $30.5 level we can anticipate a price appreciation of 153% in the call options

- An investment in 100 common stocks of BAC would cost $2,815 at this moment, while an investment in the $30 call options only requires a capital outlay of $103. As the required investment of the call options is much lower than the required investment in the common stock, investors can attribute a small part of their equity to this trade and still benefit from the upside potential.

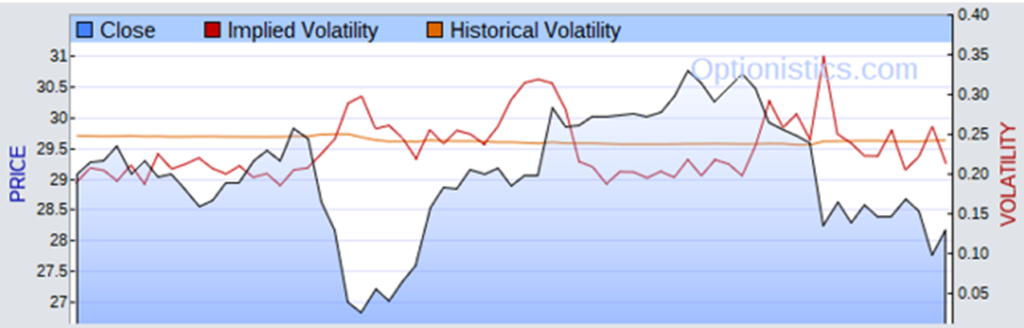

Lastly, we want to ensure the premium of the call options is not overpriced. When can do this by comparing the Implied volatility of the options with the Realized (of Historical) volatility. From the chart below we can see the implied volatiltiy remains below the historical volatility, meaning the options are not overpiced in relation to their volatility level.

Conclusion

BAC’s stock price declines again from its high peak as a consequence of external events which have no major impact on their buiness model. Their earnings flow and earnings potential remains solid. We can benefit from the temporary decline in stock price by buying out-of-the-money call options, which will return a leveraged reward profile in comparison with the common stock.

Disclosure: I am/we are long BAC CALLS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.