HI Market View Commentary 04-22-2019

What I want to talk about today?

ABT – $11,975 or $74.83 per share

Bought $75 Long Puts for $1.83

Risk per share on ABT = $74.83

So we add $1.83 for the right to sell the stock @ 75

New Cost Basis = 74.83 + 1.83 = $76.66

New Risk in the trade?=$76.66 – right to sell at $75= $1.66 or $265.60 or 2.2% of you total invested capital at risk

What if it goes all the way down to $37.50 lost 50%

We have the right to sell at $75 = 12,000 we buy back in @ 37.50 = 320 shares of stock. Initial investment of $12,240.60

What if the stock gets back to only $50 a share? But you

320 * 50 = $16,000 or a 25% return on a stock that is still $28 below your original purchase price

Some of you are using MARGIN ?!?!?!?!!!!!!

A little bit of margin (10%) is ok

Too Much margin is expensive

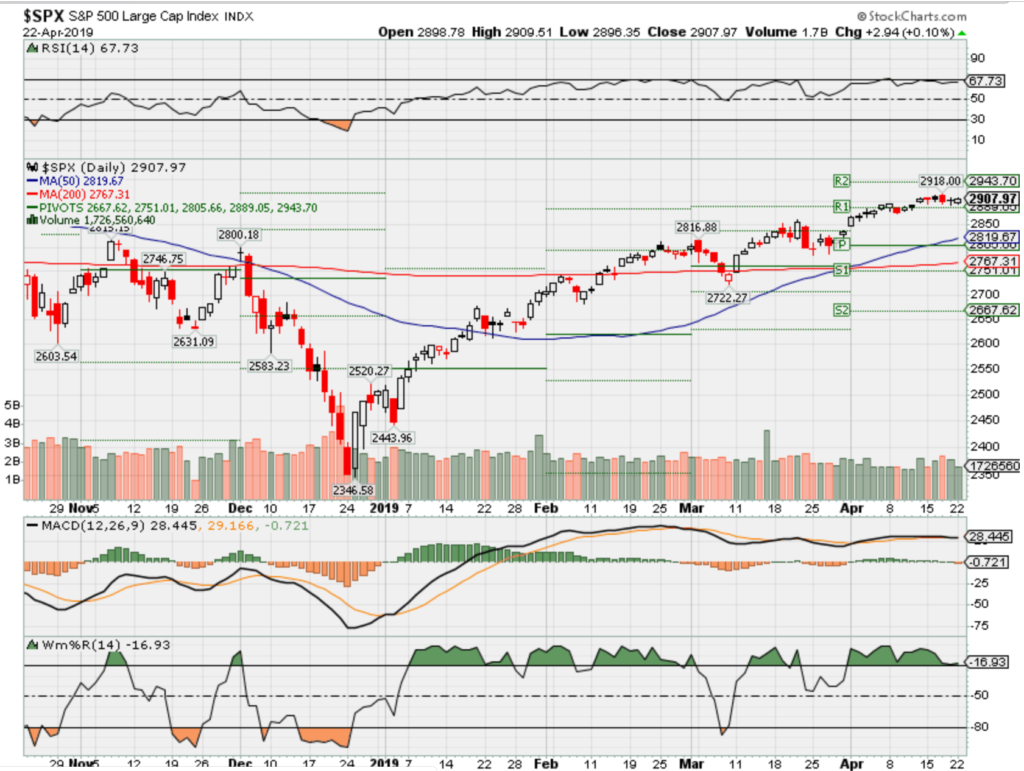

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end April 2019?

04-22-2019 3.0%

04-15-2019 2.5%

04-08-2019 2.5%

04-01-2019 2.5%

03-25-2019 0.0%

Earnings:

Mon: HAL, WHR, RMBS, ZION

Tues: ARCH, KO, HAS, JBLU, LMT, NUE, PG, VZ, EBAY, VMI

Wed: TBSX, CAT, GD, SIRI, TMO, CMG, MSFT, PYPYL, TSLA, WYNN, V, FB, BA

Thur: BMY, IP, RTN, LUV, UPS, WM, ALK, AMZN, FLSR, JNPR, SBUX, INTC, F, FCX, MO

Fri: ALL, CL, XOM, CVX

Econ Reports:

Mon: Existing Home Sales,

Tues: FHFA Housing Price Index, New Home Sales

Wed: MBA,

Thur: Initial, Continuing, Durable Goods, Durable ex-trans,

Fri: Michigan Sentiment, GDP, GDP Deflator

Int’l:

Mon –

Tues –

Wed –

Thursday – JP: BOJ Interest Rate Decision

Friday-

Sunday –

How am I looking to trade?

Going long for a China Deal and next Earnings which I expect to be better than expected Earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Apple had four terrible options to get the iPhone to 5G, so it went with the least of all evils

PUBLISHED WED, APR 17 2019 • 8:22 AM EDT UPDATED WED, APR 17 2019 • 9:09 PM EDT

KEY POINTS

- Apple and Qualcomm surprisingly settled their legal dispute over chip patent payments Tuesday.

- Meanwhile, Intel, which has been providing modems for iPhones instead of Qualcomm, announced it would abandon its plans to make 5G modems.

- The moves on Tuesday show Apple had limited options to get to a 5G iPhone, and none of them were ideal.

Here’s the good news for Apple.

Its surprise settlement with Qualcomm on Tuesday over a yearslong patent spat means it’s now in a position to keep pace with its competitors to bring a 5G-ready iPhone to market as soon as this year.

But even though Apple may win by getting a 5G iPhone to customers sooner than most people anticipated, it lost by settling with a company it loathes. Getting the iPhone to 5G means Apple was put in a sticky situation where it had to weigh four less-than-ideal options to make it all a reality.

In the end, Apple had to choose the lesser of all evils:

Option one: Settle with Qualcomm, the leader in 5G chips. Qualcomm’s 5G chips are already shipping in some devices today, with more expected as the year rolls on.

But Apple has seen Qualcomm’s business model as detrimental to the entire industry since it uses its dominant position to squeeze large fees out of each company that uses its chips and patents. Hence that nasty lawsuit. Apple CEO Tim Cook made his disdain for Qualcomm’s practices known in a January interview with CNBC’s Jim Cramer, and even blasted Qualcomm’s decision to hire a PR firm to write fake news stories about Apple, which Business Insider reported.

Option two: Wait for Intel to catch up in 5G. Even before Intel announced Tuesday night that it would abandon its plans to make 5G modems, there was speculation that the company was running behind to deliver the chips on time. Apple has been exclusively using Intel’s 4G modems in its latest iPhones as its dispute with Qualcomm raged on. If that dispute continued, a 5G iPhone might not have been possible until 2020 or even 2021.

Option three: Choose Huawei. In an interview that ran on CNBC this week, Huawei’s CEO said the company was “open” to talks with Apple about bringing its 5G chips to the iPhone. But a partnership with Huawei would’ve looked bad for Apple, given the stink of political and security concerns around the company. (Huawei’s CEO has denied spying allegations.)

Option four: Apple could make its own 5G chips. Apple is thought to be working on its own modems after opening an office in San Diego, Qualcomm’s hometown, and posting job listings for modem chip designers. But it would likely take Apple several years to develop its own 5G chip, putting it several years behind its rivals.

None of those options were ideal for Apple. It could’ve waited an extra year or two for Intel to get its 5G chips up to snuff. It could’ve waited several more years to develop a 5G chip of its own as competitors like Google and Samsung push out their 5G devices and market themselves as more innovative than Apple. It could’ve worked with Huawei, a company that still can’t sell products in the U.S. over security concerns.

Or it could’ve ended its dispute with Qualcomm, even if Cook is allergic to its business practices. Unfortunately for Apple, Qualcomm was the best bet.

Tuesday’s settlement could result in a 5G iPhone as soon as this fall, when Apple is expected to release its next iPhone. (For what it’s worth, timing on a 5G iPhone is still unclear. Qualcomm CEO Steve Mollenkopf said in an interview Wednesday on CNBC’s “Squawk Box ” that he couldn’t comment on Apple’s product plans that include Qualcomm chips.)

Qualcomm gets to take a victory lap this week. Its lead in 5G forced a settlement with Apple and added a massive boost to its stock. Qualcomm shares was up 12% Wednesday, adding to its 23% gain Tuesday. Intel was up about 4%. Apple was up just 1%.

The market agrees. Apple was the loser in this fight.

Chipmakers’ lousy first-quarter earnings could threaten sector’s strong stock market gains

PUBLISHED TUE, APR 9 2019 • 2:21 PM EDT UPDATED WED, APR 10 2019 • 9:24 AM EDT

KEY POINTS

- Semiconductor stocks have been flying high on hopes of a trade deal with China that would end tariffs and boost the global economy.

- But the industry is looking at a double-digit earnings decline for the first quarter and continued declines in the next two, and analysts say negative guidance this earnings season could take some of the wind out of the stocks in coming weeks.

- The first quarter is expected to be the first negative quarter for earnings in nearly three years.

Semiconductor stocks, up sharply this year on hopes for a China trade deal, could face their day of reckoning during earnings season.

On Tuesday, chip stocks were being sold in a broader market decline, that saw some other tech names, like Apple and Facebook hold onto gains.

The S&P technology sector closed at a record high Monday, and is up about 33% since the market’s Christmas Eve sell-off. Within that sector, semiconductors have been outperforming. The SMH VanEck Vectors Semiconductor ETF is about 3% off its all-time high and very close to its 52-week high. It was trading down 1% Tuesday, but still up nearly 28% year to date.

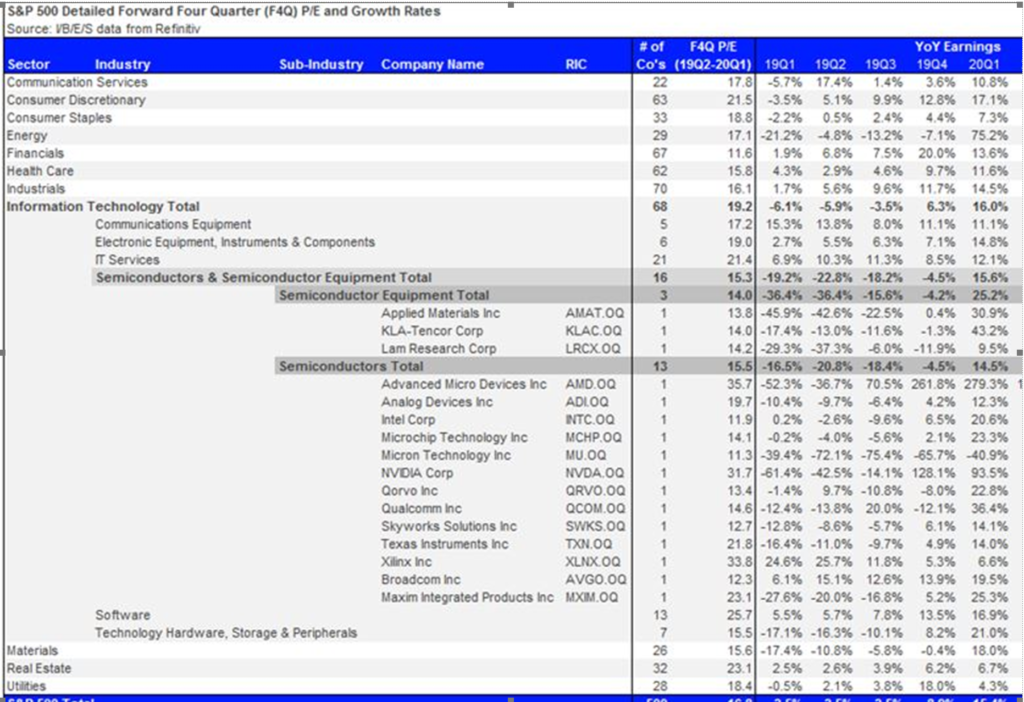

Chip stocks have made sharp gains this year, even though analysts expect the industry’s earnings to be down 20% for the first quarter and continue to decline this year, according to Refinitiv data.

“They certainly have ground to give up, and that’s what gets dangerous. When you come into the earnings season with the kind of momentum we’ve seen in some of these high-flying names … whether it’s Nvidia or Micron … unfortunately you’re on a knife’s edge and there’s a potential for a great deal of volatility, ” said Art Hogan, chief market strategist at National Securities.

Analysts say there is a good chance that some chip companies could offer even weaker forward guidance, with demand expected to decline for everything from PCs to smartphones and cars.

“I think there’s some earnings caution building in here,” said Art Cashin, UBS director of floor operations at the New York Stock Exchange. But he also said there were doubts circulating about a Chinese trade deal Tuesday, after reports that President Donald Trump could put tariffs on Europe.

But despite Tuesday’s sell-off, the chip stocks have been rising on the view that a turnaround could come in the second half of the year.

“Investors have discounted the entire recovery in the back half of they year,” said Dan Niles, founding partner of AlphaOne Capital Partners. “Memory prices continue to go lower and PC demand looks like it will be negative this year. … It’s very hard to see these stocks sitting at all-time record highs and knowing earnings are going to be down 25%, and we’ve got summer sitting between now and the end of the year. If you were sitting in August and September, you could say people are getting jacked up for holiday sales.”

Chip companies are expected to see earnings drop by 16.5%, then another 20.8% in the second quarter and an 18.4% decline in the third quarter, according to Refinitiv. The semiconductor equipment companies are expected to see earnings decline 36.4% for the first quarter, and the same type of drop is expected in the second quarter, according to Refinitiv data. By the fourth quarter, earnings comparisons are expected to fall by just about 4%.

“If companies come out and are cutting their forecast, do the stocks go down? The reaction to earnings will be very telling,” said Niles.

Nvidia fell 1.4% Tuesday. Micron, down just 1% on Monday when Cowen downgraded it, was down 2.4% Tuesday. It has been downgraded by a number of analysts.

Oppenheimer analysts, in a note, said semiconductor shares remain sharply higher despite the “raft of estimate cuts” year to date. “We attribute much of the move to hopes for a U.S./China trade deal and 2H fundamental inflection. Near-term visibility remains poor and 2Q expectations appear low, in our view. We remain stock selective.” The Oppenheimer analysts said their top picks are Broadcom, Nvidia, Marvell Technology and Monolithic Power Systems.

U.S. and Chinese negotiators continue to work on a deal that markets expect would end many of the punitive tariffs put on goods from both countries and despite the selling, there was still a sense a deal could be announced this quarter.

“People are saying it’s China, China, China. … At a certain point, we’ll find out. It could be sell the news. That doesn’t fix the issues. That doesn’t fix the issues with global growth. A China deal is not going to make people run out and buy a 5G cellphone,” said Niles.

Source: Refninitiv

Niles said the decline in smartphone sales is a big issue for chips, since 25% of chip demand is the smartphone market. He said consumers are waiting for new 5G models. “This year smartphones are going to be down more than they were last year,” he said.

Another 10% of chips go into personal computers, which have been in decline since 2012, and 15% go into cloud infrastructure. “Cloud vendors are all absorbing huge spending they had last year. That’s going to grow, but it’s going to slow down from last year,” he said.

Automobiles are about 15% of end demand, and Niles notes China had its first decline in unit sales ever last year and auto sales are expected to drop again this year.

“When you’re saying most companies are going to come out and report and guide lower, the positives are obviously investors are saying the Fed’s done and we’re going to get a trade deal with China and that’s going to fix everything. I would say not really, the economy was slowing down globally already,” said Niles.

Ford Motor (F) Presents At Bank of America Merrill Lynch 2019 Auto Summit – Slideshow

Apr. 17, 2019 2:11 PM ET

The following slide deck was published by Ford Motor Company in conjunction with this event.

DOWNLOAD the attachment in GoTo Webinar