HI Financial Services Commentary 09-25-2018

YouTube Link: https://youtu.be/P3WV2r6v4-8

What I want to talk about today?

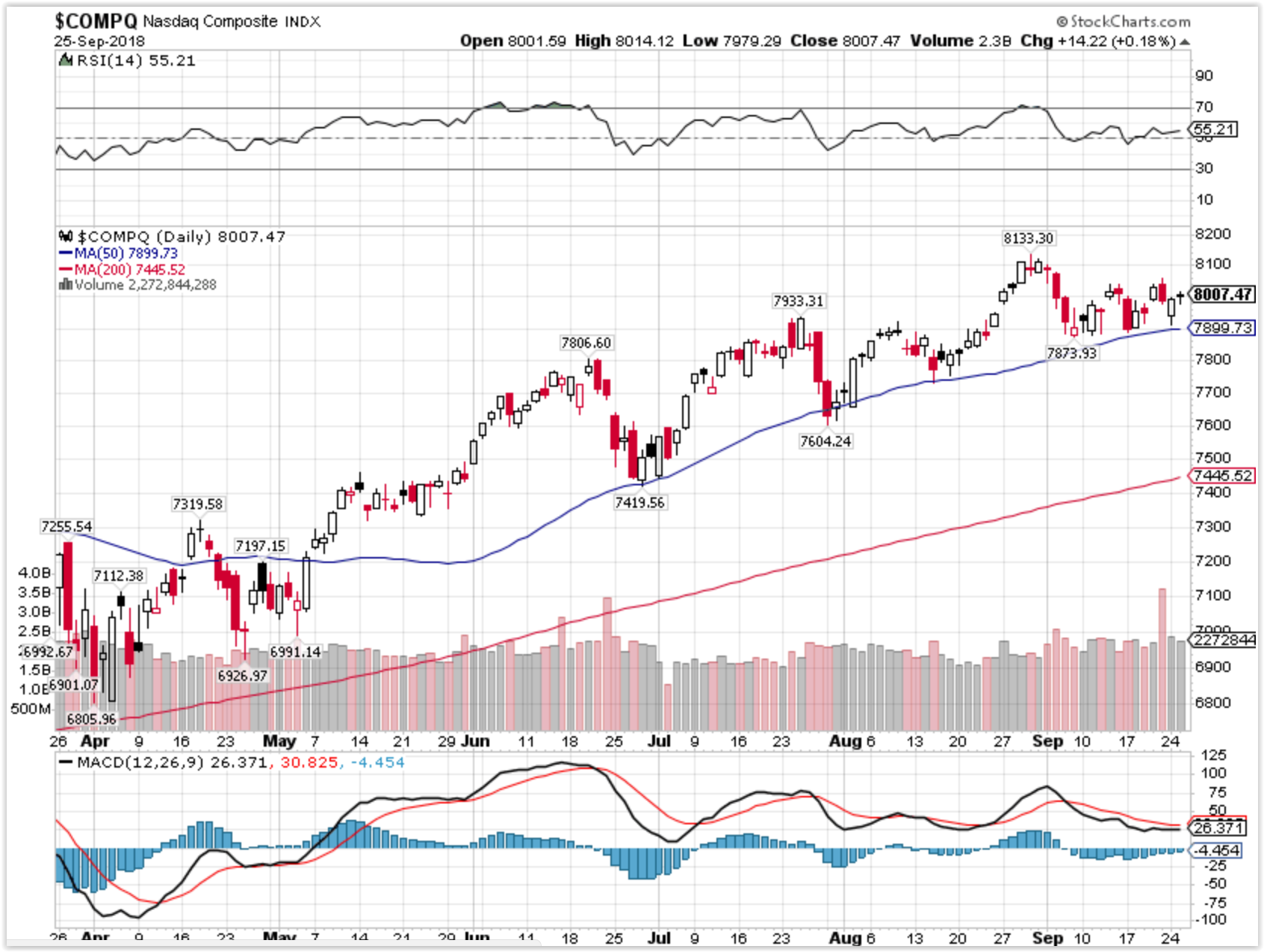

Two up days in arrow for total HI Monies under management when the S&P was negative

Well you are up on a down S&P 500 Day but the Nasdaq was flat or positive

Well what the HELL are you comparing me too?

It’s not fair that a money manager always has to be perfect –

All I tell my clientele is = We insure stock positions, we can make money in a 2008 scenario and we are looking/doing the best to protect your investments EVERY single day

Today: AAPL +1.40, AMZN +40.19 (Spread trade), AOBC +0.26, BAC -0.07, BIDU -0.03, IBB +0.27

DIS +0.86, F -0.20, FB -0.50, FCX +0.25, MRVL -0.29, UAA -0.25, V +0.47, ZION -0.09

For me any day I can beat the S&P 500 or lessen the downside movement I consider the day a success whether or not clientele do!!!! It’s really hard to be invested in a headline risk market where every headline moves the market.

What happening this week and why?

NEWS – Rate Hike, GDP on Thursday, Personal Spending/Income, Possible Canada NAFT agreement, Mutual fund rebalancing this week

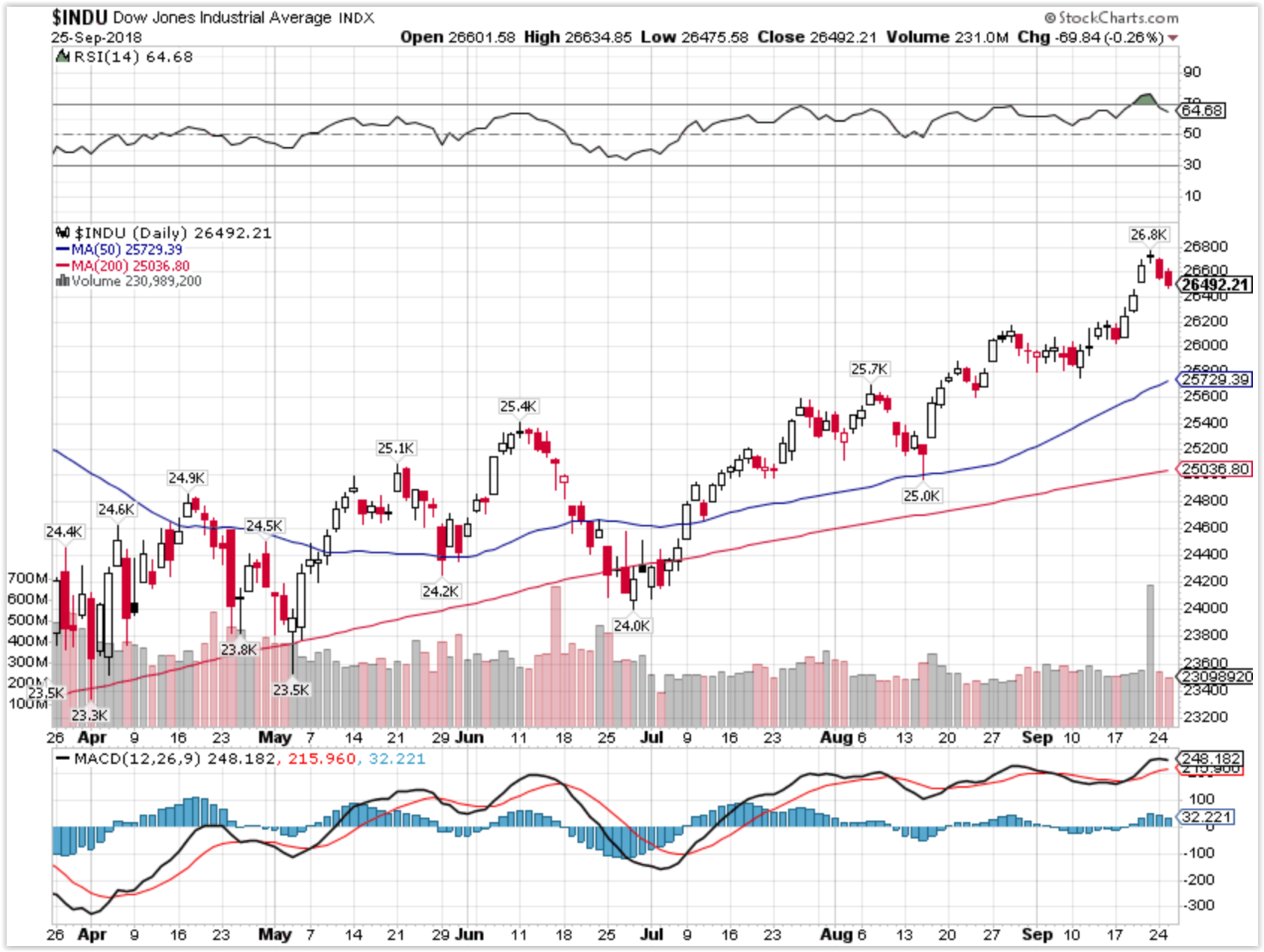

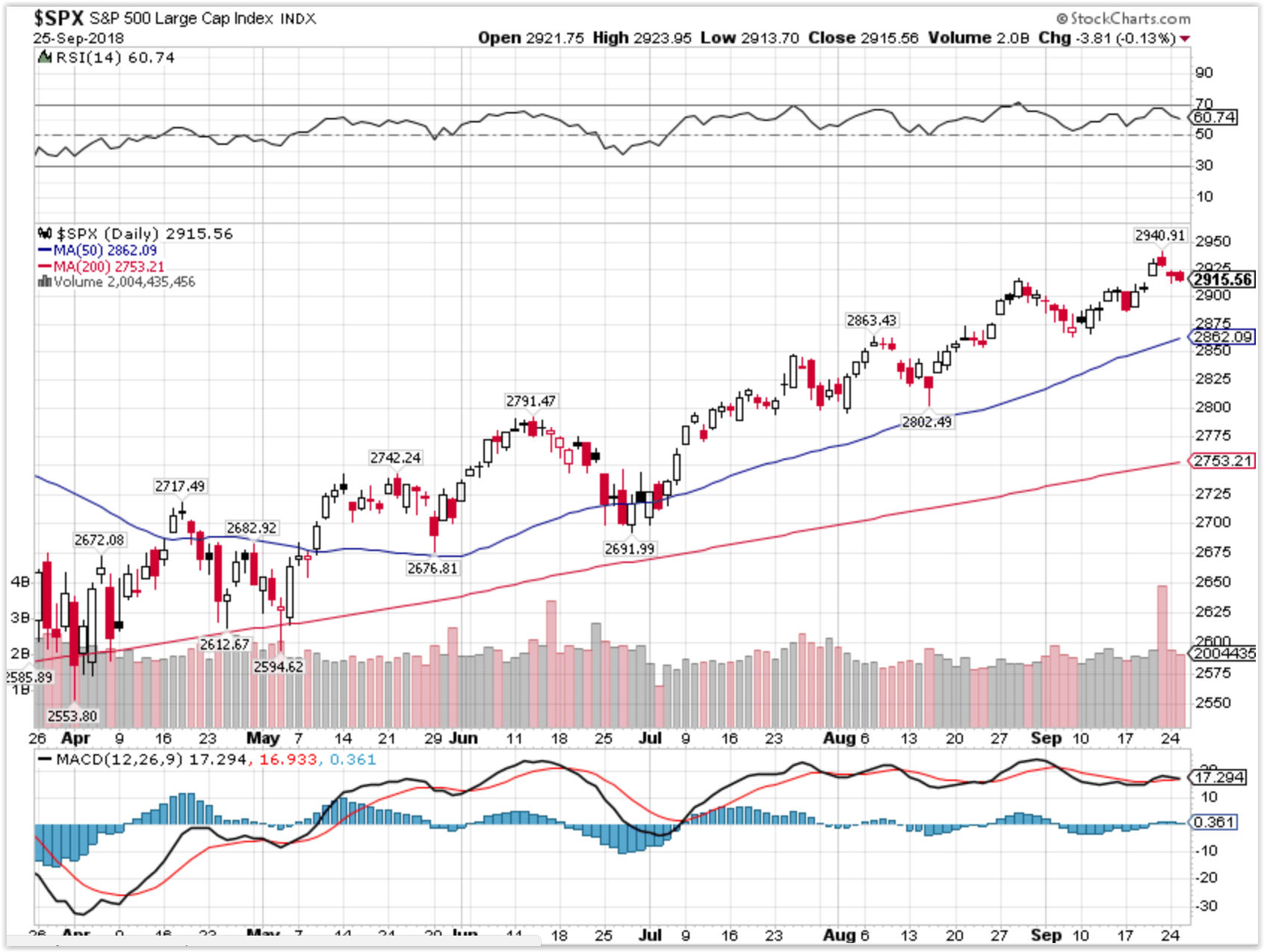

Where will our markets end this week?

Lower

Where Will the SPX end September 2018?

09-23-2018 -2.0%

09-18-2018 -2.0%

09-11-2018 -2.0%

09-04-2018 -2.0%

Earnings:

Tues: JBL, NKE, KBH

Wed: FUL, BBBY

Thur: CCL, RAD

Fri: BB, MTN

Econ Reports:

Tues: FHFA Housing Price Index, Case Shiller, Consumer Confidence

Wed: New Home Sales, FOMC Rate

Thur: Initial, Continuing, Durable Goods, Durable ex-trans, GDP , GDP Deflator Pending Homes Sales

Fri: PCE Prices, PCE Core, Michigan Sentiment, Personal Spending, Personal Income

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Added Long puts or bear puts out to OCT monthly for BIDU

Added a small number of FB long call contracts at Jun 2020 $200 Strike

Added Long puts to DIS, AAPL, V shares, BAC,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

OCT – China Gold back oil trading currency to avoid US $, Rate hike if it doesn’t come in Sept, Start of the UGLY name calling midterm election

Nov 6th we find out if the government hits gridlock

The stock market has just undergone a major transformation

Published 12:50 PM ET Fri, 21 Sept 2018 Updated 4:02 PM ET Fri, 21 Sept 2018CNBC.com

After the bell Friday, around $2.8 trillion in equities reshuffled into the newly created communications services sector.

Those changes leave the tech sector looking a little different to investors.

“What’s going to be left of the technology sector is going to be largely driven by the hardware and the software and services space,” explained Lindsey Bell, investment strategist at CFRA Research, on CNBC’s “Trading Nation” on Thursday.

Among the biggest changes, Facebook and Google parent Alphabet moved out of tech into the new sector. Apple‘s leadership expanded to a 21 percent weighting, up from 17 percent, while Microsoftplaces second with a 17 percent weighting from 13 percent.

Apple and Microsoft as the two biggest drivers should continue to lead gains in the tech sector, says Bell.

“As those two companies switch to face higher growth and higher margin businesses — services within Apple and cloud within Microsoft — you will continue to see strong growth out of the tech sector,” she said.

The tech sector also became more weighted to volatile chip stocks such as Advanced Micro Devices and Micron, but Bell believes that could be a positive.

“Semiconductors — they were 14% of the market cap, they’re going to be about 17 percent — they should continue to weigh, but earnings estimates have come down so significantly right there that we think that you’ll still be able to have solid growth out of this sector overall,” said Bell.

Earnings growth for semiconductor stocks has been reduced to 6 percent in 2019, down from 26.5 percent, according to CFRA Research. Lowered estimates make for easier analyst beats come reporting season.

It’s not just tech seeing a big change. The new communications sector absorbed the telecom space, ending its reputation as a defensive play.

“Even though the media stocks have high dividends, they’re just going to be such a small component of the new sector,” said Bell. “A lot of people like the sector because of the 5.4 percent dividend yield. It was a bond proxy, but now it’s going to be closer to about 1.5 percent.”

Alphabet has a 29 percent weighting in the new sector, while Facebook accounts for nearly 16 percent. Neither offers a dividend.

https://www.cnbc.com/2018/09/21/3-billion-money-manager-sees-troubling-trend-in-record-rally.html

Mayflower Advisors’ Larry Glazer: Don’t expect FANG stocks to keep carrying the rally

Stephanie Landsman | @stephlandsman

Published 5:00 PM ET Sun, 23 Sept 2018 Updated 9:06 PM ET Sun, 23 Sept 2018

Veteran fund manager Larry Glazer is worried too many investors are in the wrong trade.

His concerns stem from the crucial role big technology stocks are playing in the record rally. If investors don’t diversify away from some of the year’s biggest winners now, Glazer believes they’re going to feel a world of pain.

“Ten names driving half of the return of the S&P 500 in the first seven months of the year. They want to hear that can continue because it’s a neat and convenient story,” the Mayflower Advisors managing partner told CNBC’s “Futures Now” last week. “That divergence can’t continue.”

Glazer, who has almost $3 billion in assets under management, referred to Amazon, Microsoft, Apple, Netflix, Facebook, Alphabet, Mastercard, Visa, Adobe and Nvidia as some of the biggest names behind this year’s index imbalances.

These so-called FANG [Facebook, Amazon, Netflix, Google] stocks are “not the U.S. economy,” he added. “Investors need to make that distinction. They don’t want to hear it.”

The ‘Honest Abe conversation’

He also suggested sentiment in the market was getting out of hand.

“Investors are starting to feel a little bit confident here. Maybe overconfident. Maybe almost little bit invincible. And, we’re starting to see some laziness creep into investment strategies,” said Glazer. “That laziness is precisely why at this moment we need the Honest Abe conversation.”

It sounds like a pretty bearish argument. However, Glazer isn’t classifying himself as a bear.

“It’s not so much that we can’t be bullish on the broad U.S. economy because when you look at jobless data, it’s really strong. You look at GDP, it’s strong. Consumer confidence [is at a] multi-decade high. All of those things are really bullish,” he said. “It’s really more a matter of the leadership of the market changing.”

According to Glazer, investors should shift their exposure to value names, particularly groups that typically do well as inflation rises and the dollar weakens. He likes financials, energy and gold. Plus, he suggested hard hit emerging markets are showing signs of a bottom.

“You are starting to see emerging markets coming back. So, that global story is intact. The divergence is dissipating. That’s what you really want to see to see the market go higher,” he added.

His thoughts came as stocks rallied to all-time highs, with the Dow reaching its highest level since January 26.

“It’s so convenient at a cocktail party to say ‘I want to stick with the Nasdaq. I’ll stick with the S&P. I don’t want to know about anything else. Asset prices will go up. There will be no inflation,'” Glazer said. “It doesn’t work that way. You got to get into the global picture.”

China reveals its new party line: We’re trying to save the world from the US

- China accused the U.S. of “trade bullyism practices” that have become “the greatest source of uncertainty and risk for the recoveryof the global economy.”

- Those comments were laid out in a 71-page white paper that carried the Chinese government’s response to criticisms it received from the U.S.

- “China does not want a trade war, but it is not afraid of one and will fight one if necessary,” Beijing said in the paper.

China hit out against the U.S. in a 71-page paper, accusing President Donald Trump’s administration of “trade bullyism practices” that have become “the greatest source of uncertainty and risk for the recovery of the global economy.”

The document, published on Monday, outlined the Chinese government’s response to criticisms leveled against it by the U.S. Issues addressed in the report include the trade imbalance between the two countries, Beijing’s subsidy policy and alleged intellectual property theft by China’s companies.

Meanwhile, Beijing called out Washington for practices that it said inhibit fair competition in the U.S. — such as subsidies — and allegedly abusing national security laws to obstruct the “normal investment activities” of Chinese companies on American shores.

Of note, those claims from China’s leadership mirror exactly what many experts say Beijing has, in fact, done. Yet despite the longstanding evidence of Chinese protectionism, the Monday white paper sought to position Asia’s largest economy as the global standard-bearer for fair trade.

“China does not want a trade war, but it is not afraid of one and will fight one if necessary,” Beijing said in the document. “We have a highly resilient economy, an enormous market, and the hard-working, talented and united Chinese people. We also have the support of all countries in the world that reject protectionism, unilateralism and hegemony.”

“The US government has taken extreme trade protectionist measures, which have undermined the international economic order, caused damage to China-US trade and trade relations around the world, disrupted the global value chain and the international division of labor, upset market expectations, and led to violent swings in the international financial and commodity markets. It has become the greatest source of uncertainty and risk for the recovery of the global economy,” the paper said.

The document was released on the same day as an escalation in the trade dispute between the world’s two largest economies. The Trump administration levied tariffs on an additional $200 billion of Chinese goods on Monday, while the government of Chinese President Xi Jinping retaliated by targeting roughly $60 billion worth of U.S. imports.

China stopped short of issuing new threats against the U.S. in the paper, which was published in full by state media outlets such as the People’s Daily and Xinhua, establishing a definitive party line on the trade war issue. To some experts, the paper’s content showed that China wants to retain the appearance of the victim in its trade fight with the U.S.

“The white paper that the Chinese government put out responding to the many allegations by the U.S. is very interesting. It shows again that China really wants to retain the moral high ground on this issue,” Eswar Prasad, a professor at Cornell University, told CNBC’s “The Rundown.”

“They’ve been very careful to make the point that they’re only striking back when they’re struck,” he added.

Importantly, American officials have claimed that China is, in fact, the aggressor in the dispute because it took advantage of the U.S. for many years.

A ‘knife to China’s neck’

The two largest economies in the world have tried to find common ground on trade and business policy disputes, but several rounds of negotiations in recent months have not produced any breakthroughs. Over the weekend, Beijing reportedly cancelled mid-level trade talks with Washington and called off a proposed visit to the U.S. by Chinese Vice Premier Liu He.

It’s not clear when both sides will meet again, but a senior White House official said last week the U.S. is optimistic about finding “a positive way forward.” But it’s difficult to hold negotiations with the U.S. putting a “knife to China’s neck,” China’s Vice Commerce Minister Wang Shouwen said at a Tuesday news conference.

A solution can only be reached if both sides are on equal footing and show sincerity, Wang added, reiterating the white paper’s content that called for “mutual respect” and “win-win cooperation” between China and the U.S.

“Win-win” is a frequent refrain from Chinese officials on any geopolitical issue, but many outside experts have expressed concern that the term may be meaningless rhetoric in some cases.

And while China proclaimed through its state-run media on Monday that “no one can take us down,” it demanded that the U.S. treat it with respect.

“China has kept the door to negotiations open, but negotiations can only happen when there is mutual respect, equality good faith and credibility. Negotiations cannot be conducted under the threat of tariffs, or at the cost of China’s right to development,” the white paper said.

But experts are not optimistic that a common ground can actually be reached between the two economic giants.

“I think there is a fundamental miscalculation on the two sides that is going to lead to a prolonged trade war,” Prasad said.

He explained that China seemed to take the view that Trump would be under political pressure to strike a deal before the November mid-term elections. But with a strong domestic economy and surging stock markets, the U.S. president has no impetus to compromise, according to the Cornell expert.

William Zarit, chairman of the American Chamber of Commerce in China, also said the conflict will likely get worse.

“How is this going to end? It has to end with the two leaders coming up with some kind of accommodation. Unfortunately … tactics that the U.S. side has been using, it doesn’t give the Chinese any room to step back,” Zarit told CNBC’s “Squawk Box” on Tuesday.

“I’m not so sure that the U.S. side is well aware of what is actually going on and how to best deal with the Chinese,” he added.

https://www.cnbc.com/2018/09/25/cnbc-fed-survey-fed-to-hike-rates-two-more-times-this-year.html

Fed expected to hike rates twice more this year and then risk a ‘policy mistake’: CNBC survey

- Nearly all respondents to the CNBC Fed Survey see the Fed hiking ratesa quarter point this week to a new range of 2 to 2¼ percent.

- In addition, 96 percent believe another quarter-point hike is coming in December.

- About 60 percent see the Fed eventually raising rates above neutral to slow the economy.

Published 12 Hours Ago Updated 5 Hours Ago

Look out for two more rate hikes this year from the Federal Reserveto go along with economic growth nearing 3 percent and a central bank that eventually raises rates explicitly to slow growth, according to respondents to the latest CNBC Fed Survey.

A full 98 percent of the 46 respondents, who include economists, fund managers and strategists, see the Fed hiking rates a quarter point this week to a new range of 2 to 2¼ percent. And 96 percent believe another quarter-point hike is coming in December.

“Fed funds increases in September and December are as certain as certain can be,” John Donaldson, director of fixed income at Haverford Trust, wrote in his response to the survey. “Their real challenge starts after the first increase in 2019, which will bring the rate to 2.75 percent, or finally back to even to inflation.”

Respondents see the funds rate rising by two more quarter points (50 basis points) in 2019, which would bring it to a range of 2.75 to 3 percent. After that, divisions set in, with about half the group seeing a third hike in 2019.

About 60 percent of the group see the Fed raising rates above neutral to slow the economy. The average that respondents see the funds rate eventually ending this hiking cycle is 3.3 percent.

“This means that the U.S. bond market will reach a decision point sometime in the next year, when market participants will have to decide whether the Fed will go beyond current market pricing,” said Tony Crescenzi, executive vice president at Pimco. “If and when it does, U.S. Treasuries will move higher.”

A fifth of the group say a “fed policy mistake” is one of the biggest threats facing the expansion, second only to trade protectionism.

“We are in jeopardy of watching trade and monetary policy plunge into a head-on collision, with no one wearing seat-belts, and the airbags have been disabled,” wrote Art Hogan, chief market strategist at B. Riley FBR. “The biggest risk in the market is a policy mistake, and we are working on a two-for-one special.”

Respondents support President Donald Trump‘s handling of the economy by a 61 percent to 30 percent margin, unchanged from the July survey. But 59 percent say his trade policies will reduce growth, and 52 percent say they will lower employment in the U.S.

A slight 53 percent majority also say the president’s negotiating tactics will lead to better trade agreements for the U.S., while 20 percent say they will be worse and 22 percent expect them not to change much.

Overall, the tariff effects on the economy are seen as modest. Among those who see negative effects, the average is just a 0.2 percent decline for GDP in 2019 and a 0.2 percent higher inflation.

But some see more substantial effects.

“The president should be remembered for his cuts in regulations that served the economy so poorly for years but instead will be remembered for his illogical, un-economically justifiable support for trade protection and tariffs. How sad is that?” wrote Dennis Gartman, editor and publisher of The Gartman Letter.

Strong economic growth ahead

But forecasts suggest the president has some room for his trade policies to subtract from growth without doing enormous economic damage. Respondents look for GDP year over year to be up 3 percent in 2018, compared to 2.2 percent in 2017, and 2.8 percent in 2019, suggesting only a modest slowdown next year.

Inflation is seen ticking up to around 2.5 percent this year and next, while the unemployment rate is forecast to fall to 3.7 percent by 2019.

“Rarely are so many economic gauges of the U.S. economy so strong — including employment, income, retail sales, business spending, manufacturing and small business,” wrote Jack Kleinhenz, chief economist for the National Retail Federation. “The near-term outlook appears to be steady as she goes.”

Respondents see a low 14 percent probability of a recession in the next 12 months.

Stocks are seen growing, but slowly. The average forecast predicts the S&P 500 will rise to 2,956 this year and end 2019 at 3,038. While it would break the 3,000 level, it would represent just a 4 percent gain over the next 15 months.

Treasury yields are seen ending this year at 3.15 percent and 3.45 percent in 2019, suggesting much of the Fed tightening is priced into the bond.

https://www.cnbc.com/2018/09/25/i-wouldnt-be-surprised-to-see-another-correction-jeremy-siegel.html

‘I wouldn’t be surprised to see another correction,’ long-time bull Jeremy Siegel warns

Stephanie Landsman | @stephlandsman

Published 11 Hours Ago Updated 10 Hours Ago

Wharton finance professor Jeremy Siegel is known for predicting market milestones from Dow 20,000 to Dow 25,000. Now, the long-time bull is turning cautious — suggesting the probability of another leap higher is dwindling.

Siegel makes it clear that he’s not completely abandoning his bull case for stocks. He considers the stock market a short-term buy. However, he believes it’s vital for investors to be aware of growing risks stemming from trade tensions and the Federal Reserve’s policy because they could spark a deep sell-off before year’s end.

“This market has had a great run, and I wouldn’t be surprised to see another correction,” he said Monday on CNBC’s “Trading Nation.”

If another deep sell-off batters U.S. stocks, Siegel expects it’ll look like the one that began on Feb. 2. By early April, the S&P 500 was down 11 percent from its Jan. 26 all-time high. But it staged a powerful comeback, and now the index is up more than 9 percent so far this year.

But this time, a snapback may not be in the cards.

“We have some major challenges. The trade war is not yet resolved,” he said, adding that it puts pressure on the country’s gross domestic product.

His second biggest risk to the stock market comes from the Federal Reserve, which begins a two-day meeting Tuesday.

“We’re going to see how hawkish they are with the labor market as tight as it is. I still believe that they’re going to be on track for four increases this year,” Siegel said. “The question is how will they feel about another raise in December. And, I think between the trade situation and the interest rate situation, and then of course the midterms in November, there are a lot of challenges facing Wall Street.”

And, that could set up next year as a rough year for gains.

“There’s going to be a little bit of disappointment on 2019,” Siegel said. “I’m not going to call it an end to the bull market. I’m going to just call it a potential sideways reaction to economic news.”

https://www.cnbc.com/2018/09/24/how-much-money-people-in-their-50s-have-in-their-401ks.html

Here’s how much money people in their 50s have in their 401(k)s

Kathleen Elkins | @kathleen_elk

11:44 AM ET Mon, 24 Sept 2018

By age 50, retirement-plan provider Fidelity recommends having at least six times your salary in savings in order to retire comfortably at age 67. By age 55, it recommends having seven times your salary. Are you on track?

According to Fidelity, most 50-something Americans aren’t. As of the second quarter of 2018, those between 50 and 59 years old with a 401(k) had an average balance of $174,200 and were contributing 10 percent of their paychecks. On average, employers were matching 4.9 percent, putting the total savings rate for this group at 14.9 percent.

While this group has a high savings rate, by Fidelity’s rule, their nest egg may not be big enough: If you earn $50,000 a year, you should have $300,000 in savings by age 50. If you earn $75,000 a year, you should have $450,000 in savings by 50.

On the bright side, Fidelity reports that Americans aged 50 to 59 are saving more in their 401(k)s than they were five years ago: In 2013, they had an average balance of $128,900.

Keep in mind that Fidelity’s data only takes into account those Americans with a retirement account and so can’t present the full picture. GOBankingRates found in a 2017 report that 40 percent of older Gen Xers (those aged 45-54) and 33 percent of baby boomers (55-64) have nothing at all saved.

Read on to see how much you should be setting aside for retirement and how to get to that savings rate.

How much should you be saving?

The answer to this is highly personal and depends on your lifestyle and spending habits, but there are a few basic guidelines to follow if you want to retire comfortably.

For starters, Fidelity suggests that everyone set aside 15 percent of their income in a retirement account. “We believe if you save 15 percent throughout your career you will have enough to maintain your lifestyle in retirement,” Katie Taylor, VP of thought leadership at Fidelity Investments, tells CNBC Make It.

That 15 percent can include any matching contributions from your employer, she says.

Other experts, including co-founder of AE Wealth Management David Bach, say that if you set aside at least 10 percent of your income, you’ll set yourself up to be fine. Of course, more is better: Bach adds that if you want to retire “rich,” save 15 to 20 percent.

Another rule of thumb, according to Fidelity, is to have 10 times your final salary in savings if you want to retire by age 67. It suggests a timeline in order to get to that magic number:

- By age 30: Have the equivalent of your starting salarysaved

- By age 35: Have two times your salarysaved

- By age 40: Have three times your salarysaved

- By age 45: Have four times your salarysaved

- By age 50: Have six times your salarysaved

- By age 55: Have seven times your salarysaved

- By age 60: Have eight times your salarysaved

- By age 67: Have 10 times your salarysaved

How do you get on track?

If you’re not setting aside 10 to 15 percent of your income or you don’t have the equivalent of six times your salary saved by age 50, don’t panic.

As Bach tells CNBC Make It: “If you’re looking at these charts and it’s depressing you … here’s what I can tell you: It’s never too late to start investing and the best time to start is now. We’ve seen many people who look at these charts at 50 and have zero in savings — maybe they’ve gone through a divorce or they’ve lost a job or a business or the recession forced them to take a step back. Well, now you’ve just got to get back up and get going again.”

There are strategies you can use that will help you get to, or nearer to, where you need to be.

First things first: “When you are hired with an employer, make sure that you are inquiring about 401(k) benefits,” says Taylor. “Find out what kind of 401(k) they have and make sure you get enrolled as soon as you’re eligible. A lot of employers will automatically enroll you, but you can always proactively enroll.”

Next, find out if your company offers a 401(k) match. If they do, take full advantage of it, says Taylor: “If there is a match that’s 3 percent, make sure that you’re saving at least 3 percent. Otherwise, you’re leaving free money on the table.”

Another useful tool you may have access to is “auto-increase,” which allows you to choose the percentage you want to raise your contributions by and how often. This way, you won’t forget to up your contributions or talk yourself out of setting aside a larger chunk when the time comes.

Most importantly, start setting aside money now. “It’s harder to catch up if you don’t save,” says Taylor. “If you spend the first half of your career not saving, you’ve got to do a lot of catch up later in your career and you don’t have the time in the market to ride out any fluctuations. It’s always a good idea to get started as early as possible.”

What if you don’t have a 401(k)?

If you’re one of the many Americans without access to a 401(k), don’t stress, and don’t use that as an excuse to put off saving for retirement. You have plenty of other options, including a traditional, Roth or SEP IRA, a health savings account (HSA) or a normal investment account.

Read up on all of your options, choose an account to fund and start setting aside money for your future today.