HI Financial Services Commentary 04-24-2018

You Tube Link: https://youtu.be/uwFsQTljun4

What I want to talk about today?

What a wild market we are in right now!!!!

What reason do we have for the market to go down?-

End of a historic bull run…

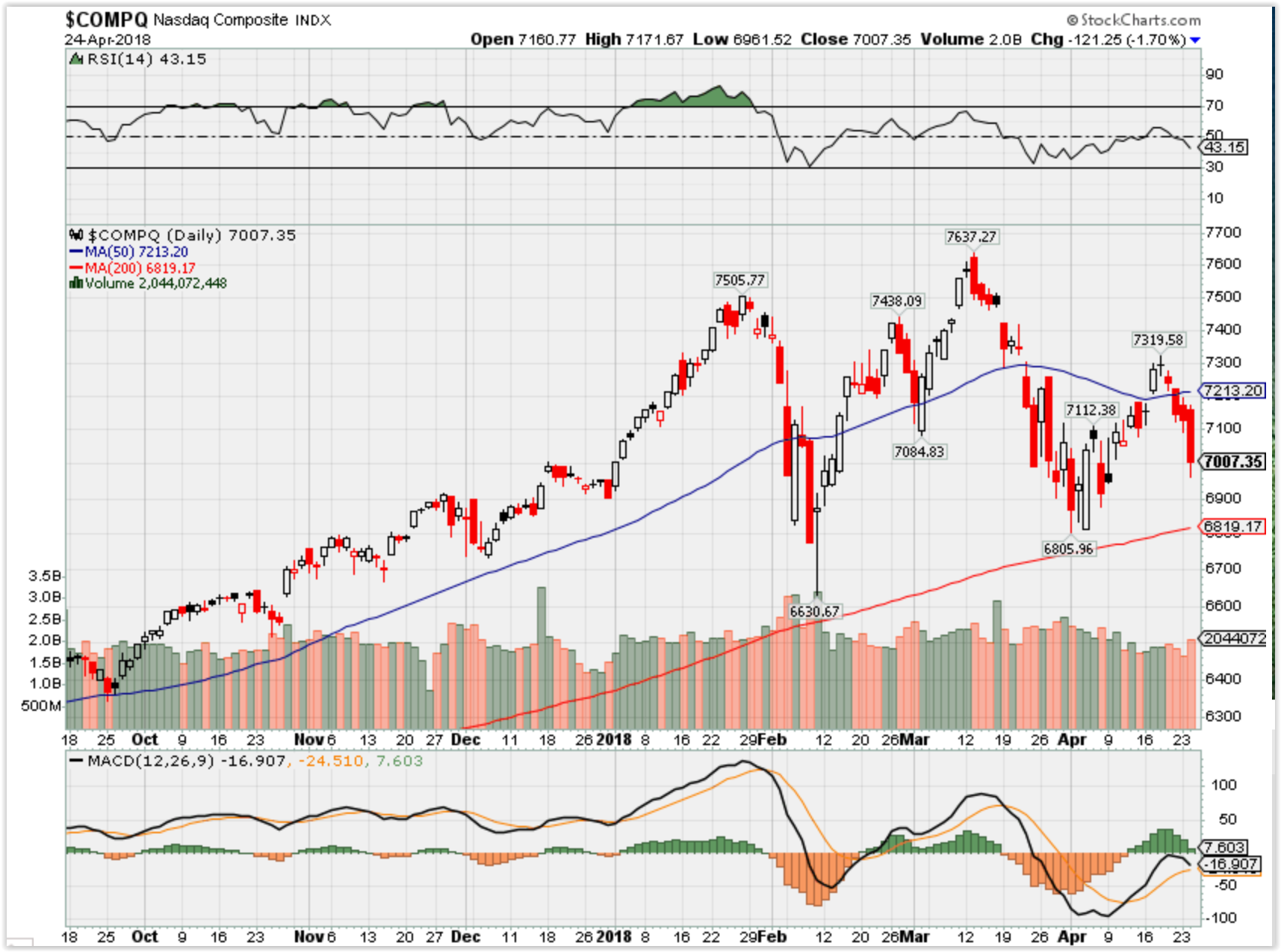

Technical bounce off 50 SMA

Higher interest rates which right lead to an inverted yield curve

Earnings trifecta !!!

Bond yields back to 3% oooohhhhhh

Higher than average volatility 18

Herd mentality and ETF balancing

Maybe tax and deregulation already baked in

Financials expectations are to have to be 20% year over year growth

Political uncertainty from Democrats, Republican, twitter,

The market is confused everyone! So let me try to do a little explaining from what we know that may or may not explain our markets today. I am not going to pretend that I have the exact reason our market is acting the way it is, but I do have some facts to share with you. If you would have asked me I would have told you for the first time the predicted earnings of the S&P 500 might actually be $124 for the year. Most of the time we get these predictions and by May we have a revision and they are in the $97 to $103 range. Where were the earnings coming from you may ask? De-regulation and the tax savings over last year. Yes, mathematically the markets could go higher on tax savings and earnings even if the tax savings were baked in. The valuations are stretched but they have been stretched for years so why not one more? With the big sectors of the S&P 500 receiving the tax breaks we should get a mathematical push higher. Unfortunately, after some “token” Christmas bonuses, we haven’t seen companies re-invest into their businesses. The earnings per share gains are coming from share buy backs where companies are spending this money to take shares out of the market. I think Wall Street was looking for business growth instead of business manipulation. In all honesty, I am in the Wall Street camp and have been disappointed in corporate America so far.

Now, if you corner Michael Virden and I, we are in agreement with each other’s comments but don’t see it the same way. Not to put words into Michael’s mouth or to just give you my viewpoint let me give you an overview of money flows, interest rates and bonds. With how much the government owes in debt we really can’t spike interest rates. It will not only crush the dollar (as it already has been), it could bankrupt the US and/or spike inflation as the Fed tries to inflate the debt away. It would cause serious damage to the housing market which just 8 years ago we entered the Bernanke Experiment to save both the banks and the housing markets. Interest rates have moved the 10 year treasuries to 2.94% and the 30 year sits above at 3.04 percent. This means “smart” money has to churn people out of lower paying bonds into the average, perfect 3% guaranteed return. I guess smart money hasn’t realized with all the US debt and weaker dollar, that we might not be the safe guaranteed return that we have been in the past. So what if the broker gets 6 to 7% commissions on the sale of the bonds and sells previous bonds for a 5 to 7% loss. Five years from now the bonds will break even and fulfill the status quo 60/40 portfolio mix that killed people through the mid 90’s and the 2000’s. But more importantly, let me discuss money flows with an inverted yield curve.

Money flows, in my opinion, are dependent on the “health” of the US economy. So what if the Fed inverts the yield curve? An inverted yield curve is an interest rate environment in which the long term debt instruments have a lower yield than the short term debt instruments of the same quality. If you look at the last paragraph we are darn close. This type of “yield” curve is considered to be a predictor of economic recessions. If my memory serves me correctly, the yield curve indicator is 100% accurate at predicting recessions. What if we hit deflation or we have to lower rates as inflation takes off? Oil back to $70 a barrel and we now have other countries, like China, which are going to start to create their own trade agreements and trade commodities with their own gold backed currency. I mean, why should the US be the only one with a reserve currency status and an economic advantage when it comes to purchasing and selling commodities. By having the big brother status in the world other countries are sick of the US imposing tariffs, economic sanctions and trade agreements that benefit the west significantly. Yes, it is a matter of opinion but we are not the most ideal or favorite person to do business with internationally. We are just the biggest which causes some resentment in today’s world economy and markets. Watch money flow out of the US during recessions to find better, high growth opportunities.

In conclusion, companies are having stellar earnings and maybe it was baked in last year. Maybe in January the markets realized that they got ahead of themselves by a ridiculous amount. We have the next two weeks where portfolios are protected and the majority of companies we invest in report. I would tell you that the market should go higher but it seems like so far earnings aren’t good enough being up 18% year over year. If a company’s misses earnings or guides to the low side of expectations look out below. With an over inflated and stimulated markets, the drops could be significantly lower than expected. That is why we watch the markets constantly so you don’t have too. Advisors at Hurley Investments work daily on economic models to be ready for drops so we don’t ever have to tell you to just hang in there and wait it out. Last time the market “waited it out” it took over a decade to break even on the S&P 500 and that doesn’t count all the hidden fund fees that existed. We are willing to talk with you personally on your individual portfolio but know we are doing our best to prevent huge downswings in your market and we are constantly crunching the numbers for clues on when a bear market may occur. We survived the 10% correction and we are ready for worse if it were to occur!

What happening this week and why?

New Home Sales 694 vs est 631

Consumer confidence 128.7 vs est 126.1

FHFA Mortgage Purchase iNdex .6 vs est .5

Case Shiller 6.8 vs est 6.4

Higher steel and metals commodity pricing is occurring

Where will our markets end this week?

Higher

DJIA – 50 SMA resistance bounce down

SPX – %) SMA Resistance

COMP – Technical 50 SMA resistance bounce

Where Will the SPX end May 2018?

04-17-2018 0.0%

04-10-2018 -2.0%

04-02-2018 -2.0%

03-28-2018 -2.0%

Earnings:

Tues: CAT, GLW, HOG, JBLU, LMT, MDR, VZ, AMGN, CREE, WYNN, FCX

Wed: BA, DPS, HES, DC, SOHU, TWTR, AMD, T, CMG, EBAY, KBR, PYPL, F, V, FB

Thur: AAL, MO, BMY, CME, COP, DHI, IP, MGM, NEM, PEP, RTN, TWX, LUV, VLO, AMZN, FSLR, INTC, MSFT, SBUX, X, WDC, BIDU

Fri: CL, D, CVX, XOM, PSX, VFC

Econ Reports:

Tues: New Home Sales, Consumer Confidence, FHFA Mortgage Purchase Index, Case Shiller

Wed: MBA,

Thur: Initial, Continuing Claims, Durable Goods, Durable ex-trans

Fri: GDP-Adv, Chain Deflator, Export, Import, Michigan Sentiment, Chicago PMI

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday – CN: CFLP Manufacturing PMI

How am I looking to trade?

Build my earnings list a couple of weeks before AA Reports

AAPL – 05/01 AMC

AOBC 06/28

BAC – 04/16 BMO

BIDU – 04/26 AMC

DIS – 05/08 AMC

F – 04/25 AMC

FB – 04/25 AMC

FCX – 04/24 BMO

KMX – 04/04 BMO

MO – 04/26 BMO

V – 04/26 AMC

ZION – 04/23 AMC

UAA – 05/01 BMO

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Earnings Candidates – The earnings list above !!!!

A trade hangover has kept markets from pricing in explosive earnings, market watcher says

Published 7:46 AM ET Thu, 19 April 2018CNBC.com

Earnings expectations are sky high, but markets haven’t fully caught up to the forecasts, according to one market watcher.

“We might have a little bit more to go,” said Doug Gordon, senior portfolio manager at Russell Investments.

Gordon, speaking to CNBC’s “Trading Nation” on Wednesday, said the hangover from trade war threats and the possibility one could still arise have kept stocks from realizing the full potential of an earnings boon.

The tug-of-war between earnings optimism and trade war fears was best seen in the banking sector, Gordon said.

“To a certain extent the banks kind of ran up a little bit and you maybe got a little bit of selling on the news because it was so expected,” he said. Investors had been fully able to price in earnings expectations because “tariffs don’t as materially impact the banking sector.”

The financials sector has seen 28 percent blended earnings growth this quarter, second highest among S&P 500 sectors. Since the sector kicked off earnings last Thursday, the Financials XLF ETF has dropped 1.5 percent.

“Some of the others [outside financials] are maybe where some of the headwinds have been tied to exogenous risk, policy risks, that sort of thing,” Gordon said.

Those stocks that were impacted by trade uncertainty could play catch-up as profit forecasts become reality, he said. Earnings estimates surged earlier this year.

“We saw this big ramp-up with respect to U.S. earnings expectations driven by, of course, tax reform. Also, think about the weak dollar that we had in the early part of the year. That also elevated earnings expectations,” Gordon said. There is “modest upside still to go in terms of actualization of that.”

Analysts surveyed by FactSet expect nearly 19 percent earnings growth on the S&P 500 for the year. That would be its strongest annual growth since 2010. Earnings are forecast to slow to 10 percent growth in 2019 and 2020.

Companies in the crosshairs of trade negotiations could also use the earnings season to shine a spotlight on the potential for economic harm, Gordon said.

“You’ve got really the bully pulpit for management where they can come out and use this as a lobbying opportunity to talk about what might be the outcome or impact of trade restrictions and tariffs,” he said. “I think we’ll hear a little bit of that in guidance.”

Already, Citigroup, BlackRock and real estate investment trust Prologishave voiced alarm over the potential harm of a trade war during their earnings calls.

Gordon shares their reason for concern.

“When I think about the trade war and what its potential impacts are, it’s a case where if it really goes wrong, it’s a catastrophic event, it’s an end-of-cycle event, but low probability,” he added.

It’s still early in the first-quarter reporting season with just 10 percent of S&P 500 companies having released reports. Of those, 79 percent have reported profit above consensus and 12 percent below, according to Thomson Reuters estimates. The energy sector has contributed the largest earnings growth at 71 percent.

https://www.cnbc.com/2018/04/23/bonds-and-fixed-income-data-auctions-on-the-agenda.html

The 10-year Treasury yield is inches away from 3%, a level that could cause shock waves in the financial markets

- The 10-year Treasury yield hits 2.998 percent early Monday morning before retreating, its highest level since January 2014.

- “I think that the move higher in 10-year yields is certainly the result of easing of geopolitical events and possible trade tensions relaxing,” said Craig Bishop of RBC Wealth Management.

Thomas Franck | John Melloy | Alexandra Gibbs

Published 5:17 AM ET Mon, 23 April 2018 Updated 23 Hours Ago

The yield on the benchmark 10-year Treasury note started the week on a tear, jumping to 2.99 percent and toying with the key 3 percent level that could trigger a reaction across global financial markets.

The 10-year yield was at 2.973 percent at 4:00 p.m. ET, after hitting 2.998 percent earlier Monday, its highest level since January 2014. The yield on the 30-year Treasury bond was higher at 3.143 percent. Yields move inversely to bond prices.

The benchmark for mortgage rates and other financial instruments has jumped in April on signs of increasing inflation and as the Federal Reserve signaled more rate increases are to come this year.

“I think that the move higher in 10-year yields is certainly the result of easing of geopolitical events and possible trade tensions relaxing,” said Craig Bishop, vice president of U.S. fixed income at RBC Wealth Management. “Oil’s made a nice run as well … it plays into concerns of higher inflation as well as a more aggressive Fed.”

Bishop, who believes the Fed will only hike rates two more times this year, said that the central bank will likely be closely following the first reading of first-quarter GDP on Friday. First-quarter economic activity increased by 2 percent, according to CNBC’s Rapid Update. Investors are concerned inflation is rising, but without an accompanying increase in the pace of economic growth.

Earlier in April, however, the Fed released the minutes from its March meeting stating that “all participants” expected a strengthening economy and rising inflation in coming months. Also this month, prices for everything from oil to wheat have jumped, sparking concerns inflation may be running hotter than investors would like.

The Fed’s next meeting is May 2.

The Fed funds futures market gave almost a 50 percent probability that the central bank would move one more time in December as of Monday morning. The CME’s FedWatch tool, a reliable gauge for the Federal Open Market Committee’s actions, assigned a 48.2 percent

On Friday, the yield on the 10-year Treasury note hit 2.96 percent, its highest level since January 2014, while the two-year yield hit its highest level since September 2008.

The approach to 3 percent could weigh on global stock markets. When the yield climbed above 2.9 percent in February, concerns about rising borrowing costs helped trigger a correction for the S&P 500.

Still, some investors may welcome the move, coming as the Fed unwinds its giant balance sheet built up during the financial crisis.

| Symbol | Yield | Change | %Change | |

| US 3-MO | 1.867 | — | UNCH | 0% |

| US 1-YR | 2.219 | — | UNCH | 0% |

| US 2-YR | 2.475 | — | UNCH | 0% |

| US 5-YR | 2.828 | — | UNCH | 0% |

| US 10-YR | 3.00 | — | UNCH | 0% |

| US 30-YR | 3.183 | — | UNCH | 0% |

U.S. sales of existing homes increased 1.1 percent on a monthly basis in March, suggesting that buyers aren’t fazed by dwindling numbers of properties available.

The National Association of Realtors says that homes sold last month at a seasonally adjusted annual pace of 5.60 million, up from 5.54 million in February.

Geopolitics were front and center. On Saturday, North Korea pledged to halt nuclear and missile tests, adding that it would abandon its nuclear test site, in order to pursue peace and economic growth instead. President Donald Trump tweeted on Sunday, however, that the North Korean nuclear crisis was far from resolved.

French President Emmanuel Macron began his state visit to the U.S. this week and is set to meet with Trump.

US stocks could slide 30 to 40 percent on interest rate volatility, wealth advisor predicts

- Rainer Michael Preiss, executive director at Taurus Wealth Advisors, predicts that Wall Street could potentially see a 30 to 40 percent decline, but did not specify a timeline for such a drop to happen.

Published 18 Hours Ago Updated 15 Hours Ago

Interest-rate volatility could be a real stinger for U.S. stocks, and investors may be ill-prepared to handle potentially steep declines, according to a wealth advisor.

U.S. stocks could see 30 to 40 percent slide over time, according to Rainer Michael Preiss, executive director at Taurus Wealth Advisors. He did not specify a timeline for such a correction to happen.

Preiss argued on CNBC’s “Capital Connection” on Tuesday that his view is not pessimistic.

“I would rather use the word realistic,” he said. “Don’t forget that we are (at a) late stage cycle. Everybody has been conditioned to buy the debt. That was the right strategy; it was a bit like the analogy, the narrative, that equities are cheap because bonds are even more mis-priced.”

US Treasurys on a tear

He explained that there are signs of potential re-adjustment in the fixed income markets that over time would likely lead to a higher cost of capital.

An environment where there is both monetary and fiscal stimulus could be inflationary, he said, adding that a 3 percent yield on the 10-year U.S. Treasury note is considered “the line in the sand” for more re-pricing in the global financial market.

Preiss added that investors are nervous that further increase in bond yields could lead to correction in equities and in corporate debt.

The 10-year Treasury yield started the week on a tear, jumping to 2.99 percent and toying with the key 3 percent level — that points to signs of increasing inflation amid signals from the Federal Reserve that more rate hikes are to come this year.

Still, some analysts said that a 3 percent or higher 10-year Treasury yield isn’t enough to cause a meltdown in the stock market.

Preiss added that investors could be spooked if certain parts of the U.S. economy slow at the same time that interest rates are rising.

“That is basically a more challenging outlook for corporates,” which already carry a great deal of debt, he said.

“That’s why increasingly … it’s important to have a look at portfolio construction and potentially reduce passive ETF exposure,” he said, referring to exchange-traded funds.

— CNBC’s Thomas Franck, John Melloy and Alexandra Gibbs contributed to this report.

Saheli Roy ChoudhuryReporter, CNBC.com

10-year Treasury yield tops 3% for first time since 2014, a key interest rate milestone that should ripple through the financial markets

- The yield on the benchmark 10-year Treasury note hit the key psychological level of 3 percent Tuesday for the first time since January 2014.

- The yield on the two-year Treasury note also set a multiyear record Tuesday, topping 2.5 percent for the first time since September 2008.

- “It’s more of a demand-driven move,” said Jim Bianco, head of the Chicago-based advisory firm Bianco Research. “People are concerned that inflation is going to stay sticky.”

Published 11 Hours Ago Updated 1 Hour Ago

10-year Treasury yield tops 3% for first time since 2014 9 Hours Ago | 01:03

The yield on the benchmark 10-year Treasury note hit the key psychological level of 3 percent Tuesday for the first time since January 2014.

The yield on the two-year Treasury note also set a multiyear record Tuesday, topping 2.5 percent for the first time since September 2008.

The yield inched past 3 percent shortly after the open of stock trading, before gyrating slightly downward throughout the session. The yield was at 3 percent as of 5:49 p.m. ET.

“It’s certainly a psychological level for people,” said Gary Pollack, head of fixed-income trading at Deutsche Bank Private Wealth Management. “We have a lot of supply this week, and that’s certainly putting pressure on the market … the quarterly refundings have been settings records.”

Pollack added that this week’s Treasury auctions of two-year, five-year and seven-year notes are likely to set a record in terms of size. Increased supply weighs on bond prices and yields move inversely to those prices.

Global investors have been fixated on the 10-year note yield in recent days as it climbed upward, concerned that the 3 percent level could trigger a reaction from financial markets around the world.

The yield, a barometer for mortgage rates and other financial instruments, has jumped in April on signs of nascent inflation and as the Federal Reserve stood by its plan to gradually tighten monetary policy. A move in the yield above 2.9 percent in February triggered a correction for U.S. stocks.

Billionaire bond investor Jeffrey Gundlach told CNBC on Monday that if the 10-year yield does crack the 3 percent ceiling, traders may then get the confidence to bid rates even higher.

“I’ve been of the opinion that closing above 3 [percent] would lead to an acceleration to higher yields,” said Gundlach.

The rise in rates throughout 2018 has become a divisive issue on Wall Street. Some see higher rates as a vote of confidence on the strength of the economy, with the government set to report on first-quarter GDP this Friday. The economy grew at a pace of around 3 percent annualized the previous two quarters.

However, others consider increased borrowing costs a threat to the bull market that began amid — and was fueled by — historically low rates and extraordinary Fed stimulus.

The central bank has started to unwind its massive balance sheet and gradually hike rates, a move traders have blamed for a sharp rise in short-term rates and a resulting flattening in the yield curve.

The Treasury Department auctioned $32 billion in two-year notes at a high yield of 2.498 percent on Tuesday. The bid-to-cover ratio, an indicator of demand, was 2.61. Indirect bidders, which include major central banks, were awarded 41.6 percent. Direct bidders, which includes domestic money managers, bought 15.3 percent.

Cheap corporate borrowing has allowed companies not only to borrow cash easily, but also buy back their own stock. Many of Wall Street’s largest technology and internet companies — responsible for much of the historic run in equities — have taken advantage of the low rates. Netflix, renowned for its big spending and negative free cashflow, said it plans to raise $1.5 billion in the corporate bond market on Monday.

| Symbol | Yield | Change | %Change | |

| US 3-MO | 1.867 | — | UNCH | 0% |

| US 1-YR | 2.219 | — | UNCH | 0% |

| US 2-YR | 2.475 | — | UNCH | 0% |

| US 5-YR | 2.828 | — | UNCH | 0% |

| US 10-YR | 3.00 | — | UNCH | 0% |

| US 30-YR | 3.183 | — | UNCH | 0% |

Investors have also been selling Treasurys as of late — leading to rising yields— amid expectations of rising inflation, which may encourage the U.S. central bank to tighten monetary policy more quickly.

“I would argue it’s more of a demand-driven move,” said Jim Bianco, head of the Chicago-based advisory firm Bianco Research. “People are concerned that inflation is going to stay sticky, and reiterating the idea that the Federal Reserve will raise rates six times over the next two years.”

Earlier in April, the Fed released the minutes from its March meeting stating that “all participants” expected a strengthening economy and rising inflation in coming months, suggesting that the central bank would stick with its plan to gradually hike rates.

The pivot in Fed policy toward more stringent lending, Bianco said, has also buoyed the two-year yield higher at an even faster pace, shrinking the spread between the two rates to 0.5 percentage point, down from 1.25 percentage points at the end of 2016.

“If Fed members do plan on raising rates six times, the thing that saves us from a recession is inflation,” Bianco added. “If you get more inflation, the back end goes up and the market’s OK. But we’re really worried the Fed will make a mistake.”

Yields likely drew support from strong consumer confidence and home pricing data released on Tuesday. An index of U.S. consumer attitudes increased to 128.7 this month, up from a print of 127 in March, notching its highest read since February’s multiyear record, according to the Conference Board.

Housing prices, meanwhile, jumped 6.3 percent in February compared to a year ago, according to the S&P CoreLogic Case-Shiller Home Price Index. A chronic shortage of homes is blamed for the rising home prices, especially in metropolitan areas.

—CNBC’s Alexandra Gibbs contributed to this report.