HI Financial Services Commentary 04-10-2018

You Tube Link: https://youtu.be/XT5IgxDqd5g

What I want to talk about today?

Why do I collar trade?

So when I am wrong I can make up some of the downward movement

Protect profits, and protect “MY” money that I have in the stock

I Like picking up more shares of stock without having to find extra money because I can do it with long put, short call profits.

IS because you are supposed to trade/invest with money you can afford to lose and I can’t afford to lose ANY money

Chinese President Xi de-escalated the trade war rumors and allowed no tariffs on Autos

The trade imbalance is 360 billion but the USA buys 510 B and China reciprocates by buying 150 B

The problem with the Chinese is that they would rather Die than be dishonored

ALL Information was researched and complied by Michael Virden CIO of Hurley Investments

S&P 500 trading ranges

Here’s a current chart of the S&P 500 futures divided into various zones that I’ll use to adjust trades from a macro standpoint. Currently we are in a bearish trend. Shorter term, if we may break out to the upside my upside target is around 2720 which I would expect to fail. You can see this more clearly on a 4-hour chart. If we break through the 2720 level then I’ll be looking for a retest of the 2875 area for a break to new highs for the year. This could happen if we see a quick resolution to some of the trade fears that have dominated the headlines recently.

Looking at the daily chart you can see that if we break support around the 2580 level (where below you enter the red danger zone), we would expect to challenge the recent lows of approximately 2530. If this level doesn’t hold a drawdown to the longer term support around 2200 could come into play. This is clearly shown on the longer term weekly chart from the 2009 lows.

All of these potential outcomes will be driven by the fundamental story of the day. I am a fundamental investor but use technical triggers to adjust positions as the market will generally tell you what to do. To that end, I do believe the market has changed as the central banks appear to be entering a tightening cycle which would portend a reversal of the multiple expansion we have witnessed for years now. To me the real question is will earnings growth be greater than the multiple contraction the market will experience. We’ll wait to see the market response.

What happening this week and why?

PPI and Core PPI came in at .3 vs .2 so I little hooter than expected

Wholesale Inv 1.0 vs est 1.1

Good News from China, FB Zuckerburg did well

Financials and Tech have been hit hard and have great bounce back potentials

Where will our markets end this week?

Higher

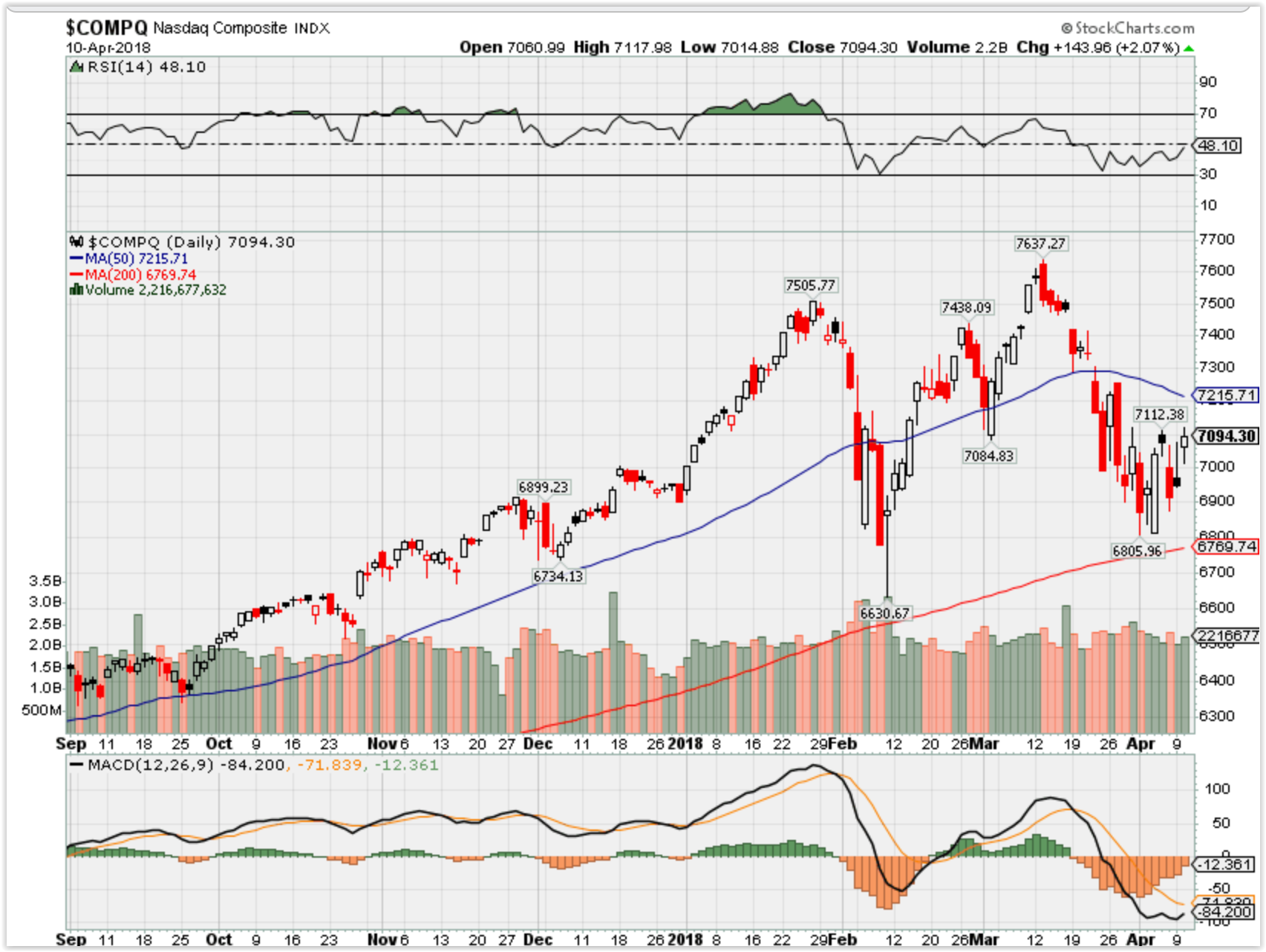

COMP – Bearish

Where Will the SPX end April 2018?

04-10-2018 -2.0%

04-02-2018 -2.0%

03-28-2018 -2.0%

Earnings:

Tues:

Wed: FAST, BBBY

Thur: BLK, DAL, RAD

Fri: FHN, JPM, PNC, WFC

Econ Reports:

Tues: PPI, Core PPI, Wholesale Inventory

Wed: MBA, CPI, Core CPI, Jolts, FOMC Minutes

Thur: Initial, Continuing Claims, Import, Export

Fri: Michigan

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Rolled down protection on BIDU and FB

BIDU I rolled down 250 down to 230 long puts

FB went from 175 down to 160 long puts and took off Jun 195 short calls for $3.00 profit and paid $0.64 to buy them back

BAC, C, MS, ZION include V as a financial

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Guggenheim investment chief sees a recession and a 40% plunge in stocks ahead

- Guggenheim chief investment officer Scott Minerd is warning clients that the market is on a “collision course with disaster.”

- He sees a recession, a 40 percent plunge in the stock market and a wave of corporate debt defaults.

- He expects the Fed to intervene to stem the crisis but says that will only make matters worse.

Published 5:44 AM ET Fri, 6 April 2018

Updated 10:25 AM ET Fri, 6 April 2018

Guggenheim’s head of investing sees a tough road ahead for the market and economy, with a sharp recession and a 40 percent decline in stocks looming.

Scott Minerd, who warned clients in a recent note that the market is on a “collision course with disaster,” expects the worst of the damage to start in late 2019 and into 2020.

Along with the decline in equities, a rise in corporate bond defaults is likely as the Federal Reserve raises interest rates and companies struggle to pay off record debt levels.

“For the next year … equities will probably continue to go up as we have all these stock buybacks and free cash flow,” Minerd told CNBC’s Brian Sullivan in a “Worldwide Exchange” interview. “Ultimately, when the chickens come home to roost and we have a recession, we’re going to see a lot of pressure on equities especially as defaults rise, and I think once we reach a peak that we’ll probably see a 40 percent retracement in equities.”

(Editor’s note: Video above is an extended interview with Minerd, including parts exclusive for the web and not aired on “Worldwide Exchange”.)

One of the main problems is that Congress and President Donald Trumphave pushed through aggressive fiscal policies at a time when the Fed is looking to control growth with higher interest rates and less accommodative monetary policy.

Corporate debt currently stands at a record $8.83 trillion, according to Securities Industry and Financial Markets Association data. Higher rates will make it harder for companies to refinance and will put pressure on them once the stimulative effects of tax cuts wear off, Minerd said.

Once short-term rates hit 3 percent, that will be enough to drive up defaults and cause a recession, he added.

“As interest rates keep ratcheting higher, with record levels of corporate debt it’s going to be harder and harder to service,” Minerd said. “At some point, as the economy starts to mature and as cash flows start to stabilize and decline, it’s going to be difficult for everybody to pay this interest.”

“Defaults are going to be concentrated in corporate America, where in the past downturn they were basically focused in areas of consumer activity,” he added.

From there, Minerd figures the Fed will get involved, going back to the quantitative easing policies that helped pull the economy out of the last recession and pushed a surge in stock market prices but also coincided with lackluster economic growth.

“All that will do is defer the problem into the future and allow excesses to continue to build and the collision course that we’re on will just come later and probably be worse,” he said.