HI Financial Services Commentary 11-14-2017

https://www.youtube.com/watch?v=6wFYGOTj8bs

What do you want to talk about today?

Let’s talk about what, when and why protection is needed and what is protection??

Long puts are protection and let me give you an example

On the IBB which is trading at $305.05 you can sell a ATM 305 Jan 18 short call for $10.70

How much is at risk in this trade? 305.05 – 10.70=$294.35 or

294.35 / 305.05 = 96.5% of you total invested capital at RISK

NO a covered call is NOT protection on stock

What if the covered call is DITM like a 95 CC Jan 18 on Visa

111.98 and the short call is $16 ITM

95.98 is the breakeven which means right now 16/111. You have 85.7% of you total invested capital at risk

Long Puts as protection = Right to sell

335 LP Nov 17 we spent 5.11 to protect the IBB 341

341 + 5.11= 346.11 total invested capital

Right to sell at 335 lowers risk 341 – 335= 6.11 total risk or 1.7% of your total invested capital at risk

The question remains do you really want to get paid to play OR

Is 96.5% TIC worth not spending $5.11 for 1.7% TIC at risk

When – Definitely before earnings IF you believe in probabilities= Most probable cause for downward movement

You buy the long put how far out in time 45 – 90 days

45 to 60 days if placed two weeks before earnings gives you 6 weeks to capture profits, adjust or take them off

Why – protect for a sudden downturn ie, earnings. Index bearish crossovers, tech crossovers due to news on a stock

What happening this week and why?

Core PPI 0.4 vs est 0.2

PPI 0.4 vs est 0.1

What IF’s are on the horizon

Rate Hike ? Maybe or maybe Yellen will not want to rock the boat for the new FOMC Chair

Christmas Rally? Maybe but not by retail sales or retail store numbers

In fact read an article that 51% of interviewed pollsters will spend less than $501 for Christmas this year

Pay off credit cards

What about a tax reform rally this year? OR Why would people sell this year when it most likely be cheaper to sell next year?

Where will our markets end this week?

Lower as big money sells off for the next holiday week

DJIA – Bullish

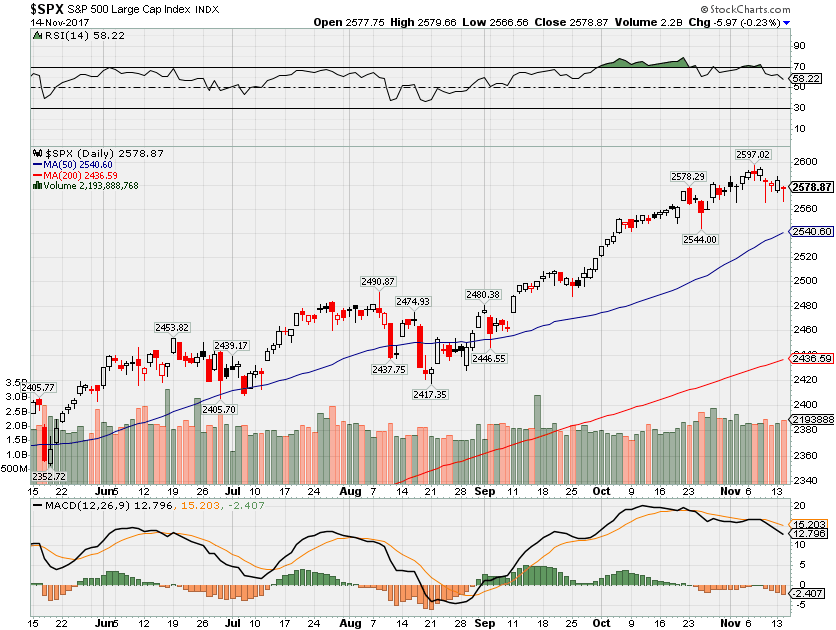

SPX – Bullish

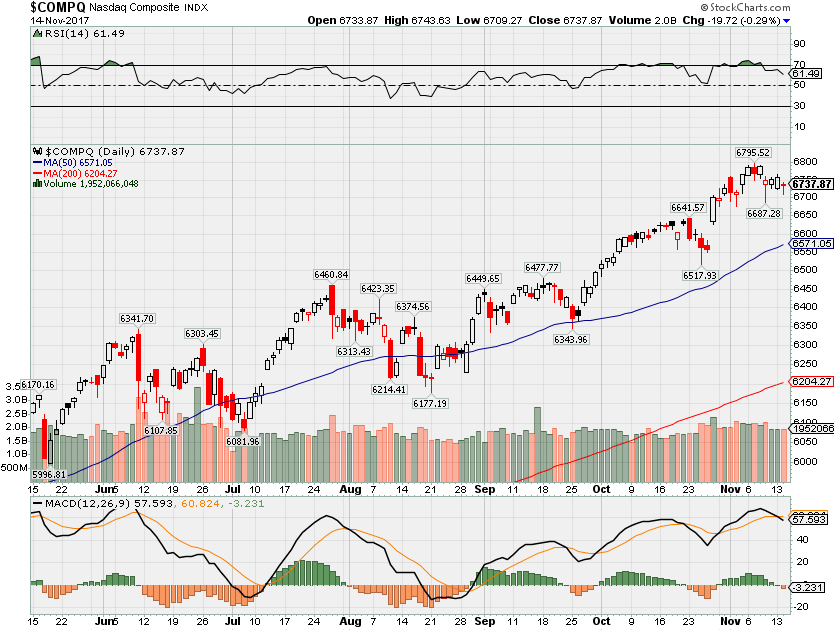

COMP – Bullish

Where Will the SPX end November 2017?

11-14-2017 +1.5%

11-07-2017 +2.0%

10-31-2017 +2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: DKS, HD, TJX, BZH

Wed: JASO, TGT, CSCO, LB, NTAP, NTES, SMRT

Thur: WMT, GPS, ROST, AMAT

Fri: ANF, BKZ, FL

Econ Reports:

Tues: Core PPI, PPI

Wed: MBA, Core CPI, CPI, Empire Manufacturing, Retail Sales, Retail ex-auto, Business Inventories

Thur: Initial, Continuing Claims, Import, Export, Phil Fed, Capacity Utilization, Industrial Production,

Fri: Building Permits, Housing Starts

Int’l:

Tues – JP: GDP

Wed – GB: Labour Market Report

Thursday –

Friday- CN: Housing Price index

Sunday – JP: Merchandise Trade, All Industry Index

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Silicon Valley is freaking out about this provision in the Senate tax bill regarding stock options

- The Senate’s tax reform proposal released last week would tax stock options when employees receive the right to them.

- Venture capitalists and start-up founders say the proposal would severely limit the ability for U.S. companies, especially in tech, to compete.

- “Generally it’ll put a deep freeze on recruitment of the best talent into high-growth, innovative industries,” said Leigh Drogen, founder and CEO of Estimize, which collects and publishes financial estimates for data such as earnings.

Published 11:39 AM ET Mon, 13 Nov 2017 Updated 2:46 PM ET Mon, 13 Nov 2017CNBC.com

Start-ups are worried about one part of the Senate’s tax reform proposal that would hurt their ability to compete: taxing stock options when they vest, instead of when they are exercised, as is currently done.

Companies, often Silicon Valley start-ups such as Twitter, typically compensate employees with the promise of being able to cash out on the company’s stock in the future. Usually, the right to those shares is distributed over time, a process known as vesting. Stock options are currently taxed when they’re exercised, or sold at a set price.

The Senate bill if it became law “would be the end of equity compensation in startups as we know it,” Fred Wilson, managing partner at venture capital firm Union Square Ventures, said in a blog post Monday.

“If this provision becomes law, startup and growth tech companies will not be able to offer equity compensation to their employees,” Wilson said. “We will see equity compensation replaced with cash compensation and the ability to share in the wealth creation at your employer will be taken away. This has profound implications for those who work in tech companies and equally profound implications for the competitiveness of the US tech sector.”

The Senate’s bill would tax employees on those shares even before their potential gain is realized. As a result, employees may owe taxes on something they only have the rights to and don’t actually own.

“Generally it’ll put a deep freeze on recruitment of the best talent into high-growth, innovative industries,” said Leigh Drogen, founder and CEO of Estimize, a six-year-old company that collects and publishes financial estimates for data such as earnings. “There’s no way you could hire the best talent to a start-up or high-growth company. It’s just impossible.”

Drogen said Estimize’s roughly 20 employees collectively own about 15 percent of the company through stock options worth about $15 million in the next year or two. “That’s an order of magnitude more than our payroll,” Drogen said. The “risk they took to join us early on is dependent on that stock.”

The Senate is set to begin discussing the proposal as early as Monday. A spokeswoman for the Senate Finance Committee did not immediately return a CNBC request for comment.

“It’s really creating some heartburn in Silicon Valley,” said Dan Clifton, head of policy research at Strategas. “There’s some larger companies, not just venture companies, that are worried about this.”

That said, the Senate’s proposal on taxing stock options may not make it into the final tax law.

The House Republicans’ tax reform bill would only tax stock options when they are liquid, rather when an employee exercises the options.

Qualcomm draws up plans to rebuff Broadcom’s $103 billion offer: Sources

- S. chipmaker Qualcomm is making preparations to reject rival Broadcom’s $103 billion bid as early as this week, four people familiar with the matter said on Sunday.

- The rejection sets the stage for one of the biggest-ever takeover battles.

- Qualcomm Chief Executive Steven Mollenkopf feels that Broadcom’s $70-per-share bid undervalues the company, according to the sources.

Published 5:52 AM ET Mon, 13 Nov 2017Reuters

U.S. chipmaker Qualcomm is making preparations to reject rival Broadcom’s $103 billion bid as early as this week, four people familiar with the matter said on Sunday, setting the stage for one of the biggest-ever takeover battles.

Qualcomm’s board of directors could meet as early as Sunday to review the unsolicited acquisition offer and decide on its strategy, the sources said. The preparations for the board meeting indicate that Qualcomm is poised to rebuff the bid as insufficient as early as Monday, although it may decide to spend a few more days this week to prepare its full response to Broadcom, the sources added.

Qualcomm Chief Executive Steven Mollenkopf has spent the past few days soliciting feedback from Qualcomm shareholders and feels that Broadcom’s $70-per-share bid undervalues the company and does not price in the uncertainty associated with getting the deal approved by regulators, according to the sources.

Broadcom CEO Hock Tan, who said earlier this month he would redomicile his company to the United States from Singapore, has stated he is open to launching a takeover battle. The sources said Broadcom was preparing to submit a slate of directors by Qualcomm’s Dec. 8 nomination deadline. That would allow Qualcomm shareholders to vote to replace the company’s board and force it to engage with Broadcom.

Broadcom has also been deliberating the possibility of raising its bid for Qualcomm, including through more debt financing, some of the sources said, although it was not clear when Broadcom would choose to make such a move.

The sources asked not to be identified because the deliberations are confidential. Qualcomm and Broadcom did not immediately respond to requests for comment.

Qualcomm provides chips to carrier networks to deliver broadband and mobile data. It is engaged in a patent infringement dispute with Apple, and is also trying to close its $38 billion acquisition of automotive chipmaker NXP Semiconductors after signing a deal in October 2016. Broadcom has indicated it is willing to acquire Qualcomm irrespective of whether it closes the NXP deal.

NXP shares have been trading above Qualcomm’s offer price, as many NXP shareholders, including hedge fund Elliott Management, have been holding out for a better price. Qualcomm does not plan to significantly raise its price for NXP as a defensive strategy to make its acquisition by Broadcom more expensive, according to one of the sources.

Qualcomm shares closed at $64.57 on Friday, while Broadcom ended at $264.96.

https://www.cnbc.com/2017/11/10/cramer-shares-an-investing-concept-critical-to-buying-stocks.html

Cramer shares a little-known investing concept critical to buying stocks

- “Mad Money” host Jim Cramer explains a key concept he learned in his early days of investing.

- Risk tolerance matters to individual investors, which is why suitability is so critical, he says.

- Cramer also shares why buying stocks does not have to be a “caveat emptor.”

Elizabeth Gurdus | @lizzygurdus

Published 6:10 PM ET Fri, 10 Nov 2017 Updated 9:03 PM ET Fri, 10 Nov 2017CNBC.com

There used to be a widespread understanding in the stock market that stocks could be here today and gone tomorrow, but CNBC’s Jim Cramer finds that that’s not the case anymore.

“We’ve gone well beyond that,” the “Mad Money” host said. “Those days are long over, and if you recommend a stock for a trade, even if you say, ‘Buy it today for the analyst meeting and sell it tomorrow,’ there will always be a YouTube video kicking around that shows you liked the stock but never gave it the ‘sell’ call.”

That is why Cramer wanted to explain the concept of suitability — an idea that suggests certain stocks are right for some investors, but wrong for others.

Cramer first heard about suitability when he started working at Goldman Sachs as a summer intern for the group helping small businesses and individuals.

He had already been buying individual stocks for himself and others for five years before he started at Goldman, even setting up answering machines messages recommending various stocks to buy.

Not long after Cramer got the Goldman position, an employee from the firm contacted him, got the answering machine message, and told Cramer to call him as soon as possible.

“I did, and he asked me if I knew what suitability was. I had no idea. So he introduced me to the concept,” Cramer said. “He asked me: Did I ever consider that many people who called me and got my answering machine might not be ready for the stock of the hottest semiconductor company in the land, and that I was recommending it to them one-on-one without any sense of it was right for them?”

Cramer replied that he thought it was obvious stocks came with no guarantees, a “caveat emptor” situation. The executive explained the worth of knowing what an individual investor wants based on what he needs out of a stock and the risks he is willing to take while investing.

That opened the “Mad Money” host’s eyes to the importance of risk tolerance. Clothes, cars, devices and houses either come with some level of insurance or can be returned. Stocks cannot.

“You buy a share of Nike and the next day Goldman Sachs downgrades it and the day after Foot Locker says there’s been a slowdown in Jordans. You can’t go back to your broker and say, ‘Hey, chief, you never told me this could happen. I’m down $3 on 2000 shares. I’m out $6,000. I want that six grand. I want it back,” Cramer said.

There is no real insurance when it comes to stocks, except for complicated and expensive put options, which give owners the right to sell their shares of a given stock when it hits a particular price, Cramer explained.

These days, all electronic brokers do in the way of protecting investors from risk is give them a form to sign saying they know what they are getting into and accept responsibility.

“That stops here,” Cramer said. “Caveat emptor? No, just ‘buyer be a-little-more-aware of what you might be committing your hard earned dollars to when you pull the trigger on a buy.”

HI Financial Services Mid-Week 06-24-2014