HI Financial Services Commentary 04-25-2017

Insane = Via LA France Vote didn’t matter and real vote is on May7th

Earnings inline but better than expected TOP Line revenue

Tariff on Wood against Canada and he is still going to build the wall very soon

Tax Plan / Repatriation / possible Dodd Frank Repeal = 10% in the stock market

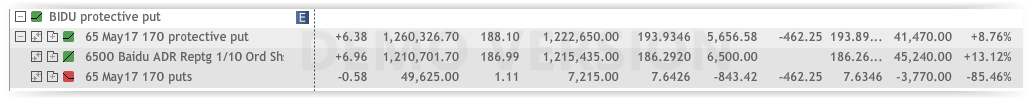

Must Roll Long Puts @ 170 to $185 Strike and add another month in time

What would you do?

Could turn around and I am looking May 11 LP

What’s happening this week and why?

Headline News and great earnings

Where will our market end this week?

Higher

DJIA – Technically Bullish and 50 SMA bounce

SPX – Technically Bullish and 50 SMA bounce

COMP – All-time highs , bullish and over-bought

Where Will the SPX end April 2017?

04-28-2017 +2.0%

04-18-2017 -2.0%

04-11–2017 -2.0%

04-04-2017 -2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: MMM, T, CHRW, CAT, LLY, DFS, CREE, GLUW, KO, CMG, FCX, FSLR, MCD, LMT, JNPR, JBLU, X, TXN, WYNN

Wed: ALK, BA, DPS, GD, HSY, HESS, PEP, PG, SIX, TWTR, UTX, WM, AMGN, BWLD, FFIV, NTRI, PYPL

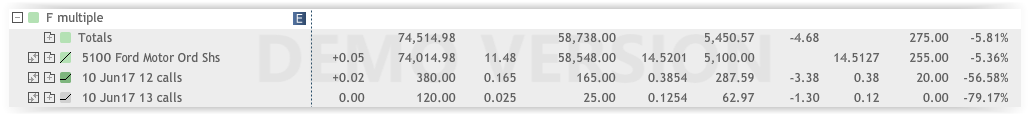

Thur: CME, DPZ, GRUB, IP, MGM, NOK, RTN, LUV, UPS, GOOG, AMZN, INTC, SBUX, F, BIDU, JCI

Fri: UBS, CVX, CL, GM, GT, PSX

Econ Reports:

Tues: Case Shiller, FHFA Housing Price Index, New Home Sales, Consumer Confidence

Wed: MBA, Crude,

Thur: Initial, Continuing Claims, Durable Goods, Durable ex-trns, Pending Home Sales

Fri: GDP-adv, GDP Delflator, Employment Cost Index, Chicago PMI, Michigan Sentiment

Int’l:

Tues –

Wed –

Thursday –

Friday –

Sunday –

How I am looking to trade?

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

https://powerprofittrades.com/2017/04/heres-when-apple-could-give-you-the-biggest-profits#deeplink

Here’s When Apple Could Give You the Biggest Profits

TOM GENTILE Email Tom@PowerProfTrades

April 21, 2017 0

When we spoke on Wednesday, I mentioned that I’d show you the best way to play Apple in light of its upcoming earnings announcement on May 2.

What I didn’t tell you, though, is that your best profit opportunity’s actually got nothing to do with earnings at all.

In fact, you could make the most on Apple by waiting until this date…

Four Reasons Why it’s More Lucrative to Take a Longer-Term Approach to Apple Stock

I’ve said before that I’m an Apple guy. I have the smartphone and laptop, among other products, and have been pleased with them for some time.

But aside from my personal fondness for Apple, there are both fundamental and technical reasons why it’s far more lucrative to take profits by December 31 than to get in and out ahead of or shortly after earnings come out.

And these are the top four:

- The iPhone 8

For the first time in three years, Apple will be releasing a new iPhone design sometime in early September. The new design will also possibly include a fingerprint reader embedded into the display. Now this isn’t confirmed, but images of the schematics were leaked a couple days ago seem to agree with this speculation:

Source: www.neowin.net

Source: www.bgr.com

There is also the likelihood that it’ll include a dual lens 3D selfie camera (under the screen and invisible to the user).

And I believe that, as long as it comes to fruition, the iPhone 8 could be unlike any other smartphone in the market – which is good news for the stock (I’ll get to that in a minute).

- Project Titan

Guess who’s listed on the California Department of Motor Vehicles website as an approved autonomous vehicle tester? That’s right – this iPhone company.

No matter how strange it may look seeing Apple listed on the website alongside companies like Tesla, Nissan, and Subaru, it’s there. In fact, they’ve already started hiring Tesla employees to work on this project, called “Project Titan.”

- Its Services Business

Credit Suisse recently predicted that Apple’s services business (which includes the iTunes Store, the TV App Store, Apple Pay, and Apple Music) will double within the next three years.

And I agree.

As of this February, Apple’s services business accounts for 9% of revenue, at $7.2 billion. Not only is that an 18% increase from the same time last year – it’s also a quarterly record. Apple has also said that they plan on doubling the services side of the business by 2020 and believe this segment could increase its revenue to $50 billion by then.

- The Stock – AAPL

Between Trump’s presidential victory last November and now, AAPL has been in a healthy uptrend. It’s broken new highs and is one of the leading components that’s helped the PowerShares QQQ ETF (QQQ) reach new highs as well. AAPL‘s weighting in QQQ is at around 12% right now – almost double that of Microsoft Corporation (MSFT), the second-highest weighted stock in the fund. That’s why AAPL and QQQ correlate so well.

Now as of the time of writing, AAPL is trading around $142 – a bit off from its all-time highs. I consider the $140 price to be a previous resistance point from which AAPL broke out to its most recent high of $144. Should it hold at this price, then you’re looking at the technical formation of old resistance becoming new support. And the upcoming earnings report, which comes out after the market close on May 2, could account for most of the stock’s movement – at least in the short term.

So long as we don’t get a bad earnings surprise, you can expect to see AAPL climbing higher throughout the rest of the year. In fact, I predict it could reach $180 by the end of the year, which is exactly why you could get even bigger profits by waiting until December 31.

Now you could take the old buy-and-hold approach, of course. But as you know, I’m an options guy. I like options because you can “rent” and control 100 shares of stock instead of paying to own a single share of stock. Options are also a much more profitable way to make money on a stock – without the same risk you face when buying and holding stock.

So one of the better options strategies to consider for AAPL is a Long-Term Equity Anticipation Security (LEAP).

Take a look at the January 19, 2018 $140 Calls…

One contract of these calls at $11.15 would cost you $1,115. Remember, you’d be getting control of 100 shares of the stock at this price. But if you wanted to buy 100 shares of AAPL at $142.39, then you’re looking at a total cost of $14,139.

To profit on these calls, all you need to do is ride AAPL higher and close your position by the January expiration date. You also might’ve heard of selling calls (or shorting calls) to generate monthly income. But remember that this strategy comes with potentially unlimited risk. So talk to your financial professional before doing that.

And keep an eye out next week – I’m going to tell you exactly what you can expect from the markets next month.

Until then…

Good trading,

Tom Gentile

https://moneymorning.com/2017/04/19/investors-will-get-slammed-in-any-grexit/

Investors Will Get Slammed in Any Grexit

By SHAH GILANI, Capital Wave Strategist, Money Morning • @WallStreet_II • April 19, 2017

Poor, beleaguered Greece hopes to get its next €7.1 billion ($7.5 billion) bailout payment in June, just in time to make roughly €6 billion ($6.5 billion) in payments to creditors in July.

Now, tense negotiations in Valetta, Malta, last month appeared to smooth some stumbling blocks to releasing the latest tranche of the €86 billion ($92 billion) “rescue package,” but this deal is not a done deal.

Then again, it’s likely Greece will get its next handout… but there’s a better than even chance it might be its last.

And that should have investors all over the world, even in booming America, concerned.

You need to know what could happen…

We’ve Got to Talk Honestly

The “diplomat-ese” coming out of Valetta, spouted for the benefit of mass media consumption, contains all sorts of pleasant, encouraging words, like “breakthrough” and “agreement.”

Unfortunately, it’s mostly bull. And the public doesn’t know it.

There are some serious questions investors need to have answered – and answered frankly – so they can be properly informed.

Questions such as…

Who’s really propping up Greece, and why are they doing it?

What happens to the markets if Greece defaults, or, much worse, repudiates its debts?

These are just the biggies. Let me show you what’s going on…

How Everyone Got Dragged into This Mess

Since, as always, we’re being honest here: Greece lied and cheated its way into the European Union. They had a lot of help from Goldman Sachs.

Under the Maastricht Treaty, the rules that govern the European Union and created the euro, a country that wanted into the Union and the common currency had to have “sound fiscal policies,” including debt limited to 60% of GDP and annual deficits not greater than 3% of GDP.

Goldman Sachs created a series of massive currency swaps that essentially masked Greece’s true economic condition by burying, temporarily, the extent of Greece’s budget deficit.

Whether it was a game that economically strong EU countries knew was being played has never been openly questioned. However, in all likelihood, it was no secret.

The euro was initially a boon to all countries that adopted it, but lately, it’s tough to escape the fact that it’s serving some countries better than others lately.

In fact, there won’t be a market in the world that won’t crash.

Nowhere is that better illustrated than in Greece – the posterchild example of what went right then so terribly wrong, and Germany, where it all went right.

Germany is essentially the backbone of the Union – and the euro. And of course it was a powerhouse even before the EU formally came into being.

But Germany had a growing problem, precisely because it was an economic and export juggernaut with a strong currency, the old deutschmark.

Countries across Europe, especially the so-called “Southern Tier” of Portugal, Spain, Italy, and Greece, who weren’t doing as well economically as Germany, had currencies that reflected their tougher economic conditions.

Since their individual escudos, pesetas, lire, and drachmas were weak relative to Germany’s deutschemark, Germany’s exports were increasingly expensive to buy with their weaker currencies.

A Union with a common currency would eliminate cross-currency differences and make Germany’s exports to the rest of the Eurozone appear to be cheaper – or at least not an obstacle in terms of currency differentials.

And since it was easier to borrow in a common currency, interest rates came down and euro loans became readily available in quantity across the continent.

Greece borrowed and spent while Germany exported more and more.

Then of course came the financial crisis of 2008 and the global Great Recession that followed. Southern European countries that had converted to the euro and borrowed heavily were leveraged close to insolvency and had to be bailed out.

The backing for all those bailouts came from none other than the European Central Bank (ECB), the Union’s collective central bank.

And we all know how helpful and honest and altruistic central banks are…

In Reality, the ECB Is a Fantasy (and a Scam)

The ECB, like our own central bank, the U.S. Federal Reserve System, doesn’t actually have capital like, you know, a real bank.

Central banks are “fiat” banks; they’re banks because they call themselves banks (or, in our case, a “system”). People believe they have unlimited “capital,” and central bankers do nothing to disabuse them of the idea.

The only capital they really have is (misplaced, unearned) trust, because everyone who trusts the world’s banking system buys in – literally – to the fantasy that these central banks have unlimited capital.

In reality, the ECB has a tiny amount of capital, contributed by some of the countries in the EU. Not that it’s important, because the fantasy is such a given, but several of the countries who pledged capital to the ECB never bothered to actually fork it over.

So in order to pull off Greece’s third bailout, the ECB has had to supply money (which it doesn’t have) to badly damaged, extremely shaky European banks, so that they may buy the debt Greece issues to keep paying off previous bailout loans it’s been racking up.

Without the ECB promising to guarantee Greece’s debt and lend money to the banks that are buying Greece’s bonds, there wouldn’t have been any bailout of Greece, and it would have stopped paying its debts.

You can see how that’s problematic, but we’re only scratching the surface here.

The truly monumental, world-smashing problem comes if Greece can’t pay. Or, much worse, it could repudiate the debt – just boycott it and say it will never pay.

In that nightmare case, all the banks that borrowed from the ECB, and who are backstopped by the same fantasy factory, would have to declare those loans nonperforming or in default and write them off.

If they have to do that, the hit to their capital, their wafer-thin equity, the short-term money they borrow to make loans, and not to mention their depositors’ money, would render them insolvent.

And there would be no one to bail them out.

There’s a Chance This Charade Will Fall Apart

That’s why Germany and the ECB are so hell-bent on this “extend and pretend” scheme writ large.

You see, so long as the EU, in particular the Eurozone, hangs together, the fantasy that the ECB is backstopped by the taxing power of its members can be perpetuated; the game can go on.

But if France leaves, or if the Netherlands leaves, if other countries make to leave or even threaten to leave, the whole fantasy factory evaporates, and the bottom drops out of the markets.

In fact, there won’t be a market in the world that won’t crash.

For now, it looks like Greece will do what it’s being asked to do by the IMF and European backstopping powers (Germany) – including painful pension benefit cuts, labor market reforms, and tax base expansion.

So, Greece is probably going to get the June tranche it’s waiting for to pay its July bills coming due.

But… there are lots of negotiations ongoing to get Greece from there to here. What’s more, there are hotly contested elections in France starting this weekend, and equally momentous balloting in Germany itself in the fall. If those elections overturn the status quo – something that’s been happening a lot lately… look out below.

If that happens, I’ll be issuing recommendations to add plenty of short euro and financial exposure to my Short-Side Fortunes and Capital Wave Forecast portfolios. A way for Money Morning Members to play this would be ETFs, like the Direxion Daily European Financials Bear 1x Shares ETF (NYSE Arca: EUFS) and the ProShares Ultrashort Euro ETF (NYSE Arca: EUO), that pay off when the euro and euro-financials start to slide. And slide they likely will.

You’ve been warned, you’ve got the truth on your side, so now you can prepare.

Follow Shah on Facebook and Twitter.

http://www.cnbc.com/2017/04/21/beat-the-aging-trump-trade-using-this-strategy-investor-says.html

If the ‘Trump hype’ turns into the ‘Trump gripe,’ this is one way to beat the market – Strategist

Sunday, 23 Apr 2017 | 5:00 PM ETCNBC.com

Geopolitical uncertainty and gridlock in Washington could spark a pullback in the markets, but one strategist is recommending a way to beat the market regardless of what happens on the Hill.

On CNBC’s “Futures Now” last week, CFRA chief investment strategist Sam Stovall laid out his “winning investment approach” for trading equities year-round. As April winds down and markets head into the old “sell in May and go away” adage, Stovall advised that investors should actually rotate, rather than get out of, the market amid doubts about President Donald Trump’s policy agenda.

“You are better off rotating than retreating,” he said. “Basically, like whitewater rafting, you let the market take you where it needs to go and in the summertime, it traditionally wants to go defensive.”

As an example, Stovall suggests that if an investor had been in the market from November through to the end of April, they could rotate into a 50 percent exposure to consumer staples and a 50 percent exposure in health care, which they would then hold until October.

This strategy would have investors coming out of the more cyclical sectors such as financials and materials, which investors could then go back into once the cycle begins again.

This “six month defensive, six month cyclical” approach could be especially useful for investors if the so-called Trump rally were to come to a halt.

“What we’ve been experiencing right now is the Trump hype, and I think what we’re worried about is it morphing into the Trump gripe,” said Stovall. “Investors are basically excited, but nothing is really coming through.”

Stovall referred specifically to the failure of Trump’s health care reform plans, taken off the table before even a House vote could occur, and the uncertainty facing the tax reform and infrastructure policies that he had campaigned on.

The strategist believes that if Trump’s plans remain in limbo on the Hill into 2018, the standstill “could probably trigger a correction of 10 to 20 percent” in the market. But if that were to occur, a rotation into the defensive sectors could help investors during the pullback, as “it’s the defensive sectors that tend to lose less when the market itself goes down.”

Markets continued to hover near all-time highs on Friday, though the Dow Jones Industrial Average did recover from back to back triple digit losses during the week. Meanwhile, the Nasdaq closed at an all-time high on Thursday.