HI Financial Services Commentary 04-18-2017

YouTube Video Link

What’s happening this week and why?

Short term downtrend – Dave

GS and JNJ missed earnings badly

NVDA pricing

EPS $2.51 * 39.56 = $99.29

EPS $2.51 * 29.35 = $73.66

RPEG 3.38 * 21 std tech valuation = $70.98

Where will our market end this week?

Higher

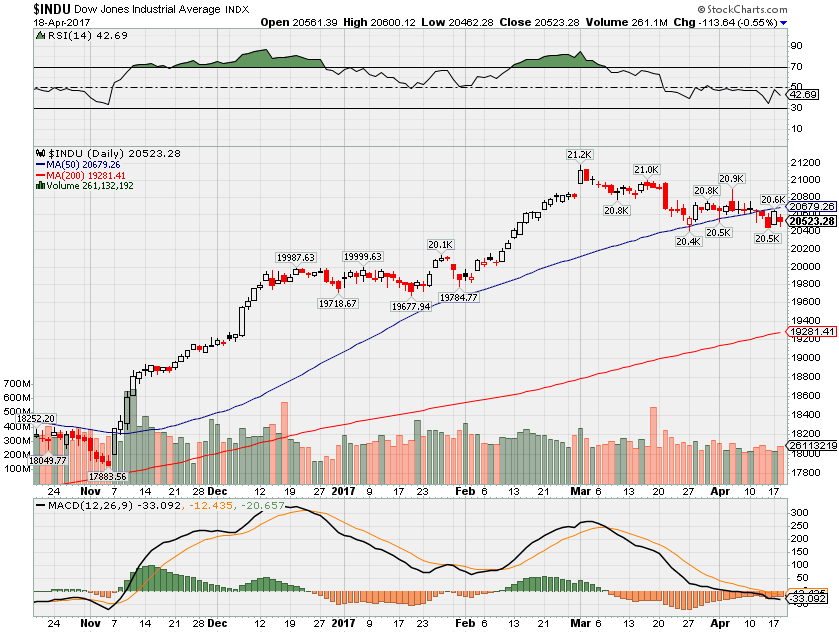

DJIA – Bearish

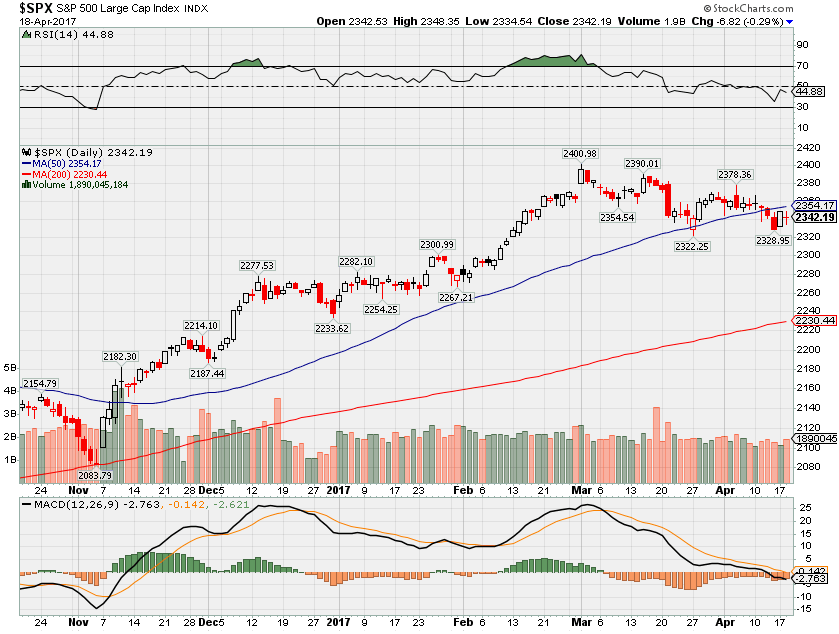

SPX – Bearish

COMP – Unknown but bearish

Where Will the SPX end April 2017?

04-18-2017 -2.0%

04-11-2017 -2.0%

04-04-2017 -2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: SCHW, GS, HOG, ISRG, IBM, JNJ, KMI, LVS, GWW, YHOO, BAC

Wed: ABT, AXP, BLK, CSK, LAD, MS, QCOM, USB, EBAY

Thur: DOV, ETFC, KEY, VZ, V, DHI

Fri: GE, HON, SLB, SWK

Econ Reports:

Tues: Housing Starts, Building Permits, Industrial Production, Capacity Utilization,

Wed: MBA, Crude, Fed Beige Book

Thur: Initial, Continuing Claims, Phil Fed, Leading Indicators

Fri: Existing Home Sales

Int’l:

Tues –

Wed – JP: Merchandise Trade

Thursday – JP: PMI Manufacturing Index Flash

Friday – JP: Tertiary Index, FR,DE: PMI Composite, GB: Retail Sales

Sunday –

How I am looking to trade?

Preparing for earnings

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

http://www.cnbc.com/2017/04/18/since-1990-market-gains-double-when-this-happens–and-it-just-did.html

Since 1990, market gains double when this happens — and it just did

If investors have been sitting on the sidelines while the market rallies, then it may be high time to jump in, according to one technical analyst.

The CBOE Volatility index recently hit its highest level of the year, just above 16, as global geopolitical concerns pressure the markets, sending the S&P 500 sliding modestly toward the end of last week. This may signal a prime buying opportunity, according to Oppenheimer’s head of technical analysis, Ari Wald, who points to an intriguing relationship between the market’s moves and spikes in the VIX.

Historically, when the VIX spikes while the market is in an uptrend, above-average returns tend to be seen in stocks over the next three to six months, Wald said. He defines a VIX “spike” as a reading that is 50 percent higher than its three-month low; he marks the S&P 500 in an uptrend when it trades above its 200-day moving average.

“We think you have to use these market pullbacks to add to your exposure; we think the bull market is intact,” Wald said Monday in an interview on CNBC’s “Trading Nation.”

Since 1990, when this signal between the VIX and the market is triggered as it was last Thursday, the average gain over the next six months has been 8 percent, versus 4 percent for any six-month period.

“The numbers speak for itself; we think this pullback is an opportunity to buy,” Wald added Monday.

The volatility index, often referred to as a measure of traders’ “fear” in the market and up 7 percent so far this year, recently did something that gives Susquehanna’s Stacey Gilbert pause about the market now.

The VIX last week went inverted; the front month’s reading of expected volatility is higher than the reading of the next two months’ expected volatility. In other words, traders are anticipating higher volatility in the near-term than they are in the long-term.

“That typically doesn’t happen; it’s very rare for it to happen. But when it does, and at the levels that we saw on Thursday, over the next 30 days the market typically is higher, let’s say on average around 2.3 percent higher,” Gilbert commented Monday on CNBC’s “Trading Nation.”

“So if things succeed and Trump gets through fiscal policy changes, you could have this notable upside pop over, let’s call it the next year to two years. And then the downside, obviously, it’s when everything doesn’t work out, or the geopolitical issues get crazier,” Gilbert said.

What is important for investors to consider is that this comes while the VIX is at relatively low levels, Gilbert said. She expects that the market will continue to vacillate in a pattern of “small pullbacks, little rallies, small pullbacks, little rallies,” until more information about expected tax policy reform comes from the Trump administration.

The S&P 500 was modestly lower in Tuesday trading as the VIX was higher around the 15 mark.

Rebecca UngarinoAssociate Producer

The French election is a big deal — and it has more than one scary outcome for markets

France’s presidential election is a major test for euro zone unity, and the first round Sunday could bring on intense market volatility, depending on which candidates make it to the final leg of the race.

French stocks slumped 1.6 percent Tuesday, after recovering from the worst selloff since the U.K. voted to leave the European Union last June. Investors globally have been hedging ahead of the vote by piling into safe haven assets like U.S. Treasurys and gold, and buying yen against the euro.

“I think it’s potentially huge, or it could be nothing, and we’ll know that Sunday night before the market opens,” said Andrew Brenner, global head of emerging market fixed income at National Alliance. He said the spread between French and German 10-year bonds continues to widen, a signal of market unease.

The big fear is that far-right National Front candidate Marine Le Pen will win, since she has run on a platform to divorce France from the euro — an action that could threaten the future of the entire euro zone. As it stands now, there is a good chance Le Pen will emerge from the first round pitted against one of three candidates: far-left candidate Jean-Luc Melenchon, conservative Francois Fillon and centrist Emmanuel Macron, a former economy minister.

“It is true that four candidates are coming all within a margin of error. It is impossible to know for sure whether the French electorate will look at these polls and decide to vote with their hearts or get excited by the underdogs,” said Charles Lichfield, associate, Europe at Eurasia Group. “Something we can say is Mrs. Le Pen is most likely of those four candidates to make the second round. They’re all between 18 and 22 percent. Ninety percent of Mrs. Le Pen’s 22 percent will vote for her.”

The candidate favored by markets is Macron, who is expected to beat Le Pen in the final vote. “If it appears Macron is in the race, all of this goes away for the near term,” said Brenner.

The disruptive candidate not named ‘Le Pen’

However, Lichfield said Melenchon also stands a chance to win. Like Le Pen, he would be considered a disruptive candidate. A fan of Venezuela’s Hugo Chavez, he would like to tax individuals who earn 400,000 euros ($430,000) or more at a tax rate of 100 percent. He also would like to renegotiate France’s relationship with the European Union, and if it fails, he would seek to leave the EU.

“Depending on how high [Le Pen] is, the market could react quite violently. If her runner-up is 6, 7 points behind her, many people would see that it’s possible she wins,” Lichfield said. The runoff election is set for May 7.

“You hear people saying if Le Pen gets elected, France pulls out of the euro and the EU collapses. That’s utter nonsense. For France to pull out, there has to be a vote of Parliament and they’re overwhelmingly against leaving the euro,” said Robert Sinche, chief global strategist at Amherst Pierpont.

There is a parliamentary election in June, and it in fact could be the more important election. Le Pen’s far-right National Front isn’t seen making much in the way of inroads.

“I still expect Macron and Le Pen to be in the runoffs,” said Marc Chandler, chief foreign exchange strategist at Brown Brothers Harriman. “A lot of people think the French election is about the presidential election. It’s also about the parliamentary election in June. The president is a figurehead. The problem is none of the candidates have a strong parliamentary presence. The key to the outcome is going to be the parliamentary elections. Political risk is going to subside, but it can’t go away.”

Chandler said a Le Pen victory could foster other nationalist groups in Europe, but it could also be a problem for Italy. Germany also has an election later this year.

“The key would be not so much the German election, but the Italian election,” he said. Italy, under Prime Minister Paolo Gentiloni, has undertaken steps to provide emergency liquidity guarantees and capital injections for its banks. Former Prime Minister Matteo Renzi resigned in December, after Italy voted down a key constitutional referendum.

The views on how France’s election could affect markets diverge as much as do potential outcomes.

Lichfield said he sees a 35 to 40 percent chance for Le Pen to win. He said there are very slight odds, perhaps 10 percent, that financial market chaos erupts after the election. It could be so volatile it would send French yields skyrocketing and hurt the country’s banks.

The long-shot scenario could even be extended to consider a French default at which point, France could be forced to leave the euro zone, Lichfield said.

More likely is that European Economic and Monetary Union officials keep the situation under control and panic does not set in. Even so, a Le Pen win would not be a positive.

“It will be negative because there’s this now complacent view that Brexit wasn’t so bad. Trump hasn’t been so bad, so why are we worried about Le Pen? But if you look at what she wants to do, if suddenly the market slowing into what her actual policies are and realize she’s right at the center of a vulnerable monetary union, then it becomes much more troubling,” said Lichfield.