HI Financial Services Commentary 03-07-2017

HI Financial Services Commentary 03-07-2017

Click the link above to watch the video

My Thoughts to go over with you

Right now our market seems to be in a wait and see mode:

Over-bought, Rate Hike – Bearish,

Tax Reformation, Repatriation – Bullish

How do you trade a “conflicted” market??!?!?!?!!!!

TOUGH to trade like NVDA

Don’t get whipped around, and longer time frame gives you time to make a decision.

SNAP had buying price for Institutions $17

When it opened @ $24

Closed today 03/07 $21.44

Protection = Long put

NO NO Short call !!! 2% credit on the value of the stock = 98% total invested capital is at risk.

You pay 5% for three months for a long put ATM, slightly ITM = 5% of my total invested capital

What’s happening this week and why?

Factory 1.2 vs e vs est -t 1.0

Trade Balance – -48.5B vs est -48.5B

Consumer Credit 8.8B vs est 17.0B

Wait see week because of FOMC, Ave Workweek

3rd week of retail earnings,

Where will our market end this week?

Down / Flat

DJIA – technically overbought bullish

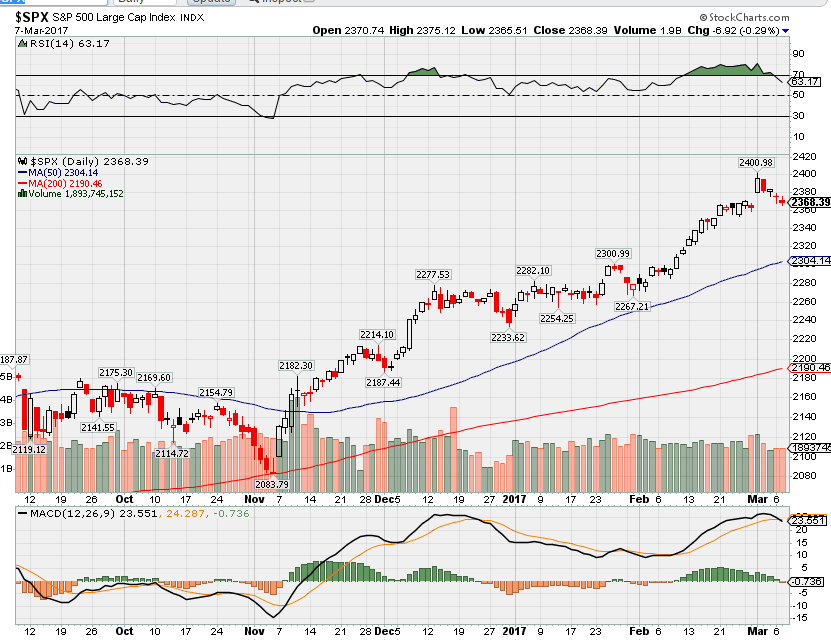

SPX – technically NO LONGER over-bought bullish

COMP – technically over-bought bullish

Where Will the SPX end Mar 2017?

03-07-2017 +2.0%

02-28-2017 +2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: DKS, URBN, ZAGG

Wed: SMRI

Thur: BKE, JSDA

Fri: KIRK, MTN

Econ Reports:

Tues: Trade Balance, Consumer Credit

Wed: MBA, Crude, ADP Employment, Productivity, Labor Costs, Wholesale Invenetories

Thur: Initial, Continuing Claims,

Fri: Average Workweek, Non-Farm Payroll, Private Payrolls, Hourly Earnings, Unemployment Rate, Treasury Budget

Int’l:

Tues – DE: Manu Orders, JP: GDP, CN: Merchandise Trade Balance,

Wed – CN: PPI, CPI

Thursday –

Friday –

Sunday – JP: Machine Orders

How I am looking to trade?

Right now I’m not trying to have Short Calls in the portfolio!!!

ANY Tax reform or repatriation

AAPL, DIS, F, V, DHI, AOBC, FB,

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

http://www.cnbc.com/2017/03/06/cramers-no-1-sign-that-a-stock-is-too-dangerous.html

Cramer’s No. 1 sign that a stock is too dangerous

Abigail Stevenson | @A_StevensonCNBC

16 Hours AgoCNBC.comJim Cramer reminded investors that when they see a stock with an absurdly high yield, they need to stay the heck away from it.

“I don’t care how tempting the dividend looks or how cheap the stock seems. A super-high yield that is totally out of whack with its peers is almost always a sign that something is very, very wrong and you need to run, not walk away as fast as you can,” the “Mad Money” host said.

A classic case of this is with Frontier Communications, a small telecommunications provider with a monstrous 14.6 percent dividend yield that closed at $2.76 per share on Monday.

The stock might seem tempting, but buying a stock for that big of a yield is almost always a mistake.

The key, Cramer said, is to figure out how Frontier became a $2.76 stock with a 14.6 percent yield. The answer is that the share price was crushed. After peaking around $8 in 2015, the stock has lost more than two-thirds of its value.

Frontier managed to rebound from late 2013 to early 2015 when it seemed that the demand for fast internet service was lifting everyone in the group. The company spent millions upgrading its network, but then decided to buy Verizon‘s California, Texas and Florida wireline business for $10.5 billion in cash and the assumption of $600 million in debt.

This was just a few years after Frontier bought Verizon’s wireline operations in 14 other states in 2010 for $5.3 billion. Verizon would not have sold its wireline business if they thought it was worth owning, Cramer said. In the end, Frontier spent more than $15 billion buying declining assets.

After reporting positive earnings in the fourth quarter of 2014, a big decline began. Yet despite the decline, many analysts continued to remain bullish about Frontier’s ability to keep paying its dividend and turn the business around.

The truth, Cramer said, is that Frontier was simply fighting the rising tide of popularity of mobile, and it all came to a head when the company had an ugly top and bottom line miss in November. That was when analysts finally downgraded the stock.

Again, Frontier reported a shortfall in earnings in its most recent quarter, a 12 cent per share earnings loss when analysts were only looking for a 5 cent loss, weaker-than-expected revenue, and a large cut to the full year free cash flow forecast for 2017.

While the 14.6 percent yield could seem compelling to some, Cramer warned that the dividend is only compelling if Frontier can turn things around. If its sales and earnings continue to decline, sooner or later the dividend will have to be cut.

A year ago, Frontier had nearly an 8 percent yield. An investor who bought the stock then would have received its 42 cent annual dividend, but the share price dropped from $5.79 to now $2.76. The losses would have overshadowed anything an investor received from the dividend.

Cramer added that the management at Frontier isn’t the problem; the company is just stuck in a terrible industry, the wireless phone business, which is in a long-term decline. He said to use this story as a means to know what red flags to look for.

“Chasing super high yielders is a dangerous game. A sky-high yield is almost always a sign that something is wrong,” Cramer said.

http://www.cnbc.com/2017/03/06/why-trade-worries-could-hit-markets.html

Why trade worries could hit markets

For U.S. stocks stuck in a holding pattern ahead of Friday’s jobs data, a report on trade due Tuesday will give markets something to chew on.

“Does the trade data cause the president to tweet about trade? That would get it into the market’s consciousness again,” said John Canally, chief economic strategist at LPL Financial.

The worry has been that President Donald Trump‘s calls for tariffs and renegotiation of major trade agreements would prompt a trade war that would slow global growth.

January figures on the U.S. trade balance in goods and services are scheduled for release Tuesday morning. The deficit is expected to expand to $47.3 billion to start the year, according to the consensus of economists polled by Reuters. The deficit was $44.3 billion in December.

LPL’s Canally is particularly focused on any changes in the services sector surplus, which was $21.4 billion in December. Travel is a component of services trade, and the U.S. Travel Association said last week the Trump’s administration policies are hurting tourism.

Trump on Monday signed a new executive order that blocks travel to the U.S. for 90 days from Sudan, Syria, Iran, Libya, Somalia and Yemen — countries the president says pose high risk of terrorism. The order takes effect March 16.

U.S. stocks closed slightly lower Monday, with financial and materials stocks the worst performers in the S&P 500. The index closed 7.8 points lower at 2,375.3 with only the energy sector gaining. All three major indexes ended about 1 percent below their all-time highs hit last week.

“What we’re seeing is the global economy has stabilized and sometimes improving and that should be positive for stocks,” said Peter Donisanu, investment strategy analyst at Wells Fargo Investment Institute.

“One of the key risks top of mind for anyone right now is U.S. trade policy,” he said.

On the trade front, analysts are also keeping an eye Chinese foreign exchange reserves, scheduled for release overnight. The holdings fell below the psychologically key $3 trillion level in January and are watched for indications on the pace of money leaving China and how much Beijing is trying to prevent sharp weakness in the yuan.

“Overall, capital outflows so far in 2017 have turned out to be much better than expected, thanks to tightened capital controls and a weaker US $,” Larry Hu of Macquarie said in a March 1 note. He expects foreign exchange reserves to drop $30 billion in February to $2.97 trillion.

Chinese trade data is due for release Wednesday Beijing time. The U.S. reported a $27.8 billion deficit in goods trade with China in December, for a total $347 billion in 2016.

Trump had promised to label the country a currency manipulator and threatened a tariff on goods imported from China, but so far has not taken such action.

Peter Navarro, head of the National Trade Council and author of the book “Death by China,” wrote in an op-ed in The Wall Street Journal on Sunday that the U.S. trade deficit needs to be brought back into balance for economic and national security reasons. That includes limiting foreign investment in the U.S., he said. China is a major source of such investment.

“The thing that’s missing from everything is details. It’s very important to understand until you have an actual policy that’s put in place,” said Rob Lutts, president and CIO at Cabot Wealth Management.

Trump “has already in his two months here, I think, created a different mindset of a business leaders where they are thinking more build and invest here,” Lutts said.

Trade matters aside, the key focus for markets this week is Friday, when the monthly employment report is scheduled for release.The report should affirm the case for the Federal Reserve to raise interest rates next week.

Treasury yields were little changed on the day. The two-year Treasury note yield was last near 1.31 percent, while the 10-year yield was around 2.50 percent.

On Tuesday, the Treasury is set to auction $23 billion in three-year notes. Consumer credit for January is also scheduled for release.

Earnings due before the bell Tuesday include Brown-Forman, Dick’s Sporting Goods, Michaels and Momo. H&R Block, Red Rock Resorts, Bojangles and Urban Outfitters are scheduled to report after the close.

Wall St. is misreading Trump, and a market bloodbath is imminent: Stockman

Sunday, 5 Mar 2017 | 4:53 PM ET

Former top federal budget official David Stockman has a stark warning for investors: There’s going to be a disaster in Washington and you’re not going to see it coming.

Stockman, an ardent critic of President Donald Trump, has strong doubts that the rosy view investors are taking on the economy can hold water in the near-term. As usual, he didn’t mince words when explaining his perspective to CNBC.

Last week, the Dow Jones Industrial Average and S&P 500 Index jumped following Trump’s speech to Congress, with markets growing more bullish about the Trump policy agenda. Yet since Wednesday, both indexes have failed to continue the trend of new highs.

The stall in the rally has Stockman, former OMB director under the Reagan administration, labeling Trump’s address as “irrelevant” to what will happen to the market and the economy.

“Wall Street is totally misreading Washington,” Stockman told CNBC’s “Futures Now”in a recent interview. “It’s pricing in a fantasy about a Trump stimulus that simply isn’t going to happen. There will be no tax cut, there will be no 15 or 20 dollar a share reduction in the corporate rate.”

According to Stockman, the main catalyst for his pessimism about Trump’s policies is the “debt ceiling trap” that he contended will prevent tax reform, infrastructure and defense spending that have excited so many investors.

Given the “factions” among the Republican Party today, the former Reagan aide also believed that the political turmoil could result in a gridlock the markets don’t see coming.

“We will have a government shutdown,” said Stockman. “It is totally unexpected, unpriced in by Wall Street, [and] it will spook everybody.”

At least for now, the Federal Reserve believes current economic conditions — bolstered in part by Trump’s policy agenda—justify tighter monetary policy as a preemptive strike on price pressures. On Friday, Fed chair Janet Yellen strongly hinted that a rate hike was on the table when the Fed meets this month.

Yellen told an audience that “gradual increases in the federal funds rate will likely be appropriate in the months and years ahead: Those increases would keep the economy from significantly overheating, thereby sustaining the expansion and maintaining price stability.”

Stockman, however, remained unimpressed.

“I see nothing to re-accelerate the economy or profits, and I see a huge mess, bloodbath, fiscal stalemate in Washington that will remove any of the stimulus that any of the traders are expecting from infrastructure and big tax cuts and all the rest,” he added.

HI Financial Services Mid-Week 06-24-2014