HI Financial Services Mid-Week Commentary 11-02-2015

I heard you rarely use limit orders and I was wondering why?

I rarely use limit orders to enter trades because, I collar trade, because I am placing the trade while the market is open and I am watching the fill prices after the first hour of trading has occurred. I “try” not to place trades with in the first hour of trading.

I do place limits on exiting trades to make sure I get the profit I want when I am not in front of the computer

Do you really go over all the stocks you list on the individual days that have earnings?

Yes of course. I put a + sign if the met or beat both top and bottom line. I then draw and arrow for what direction the stock moved. It looks like this in my planner

ETF link from Mad Money and Jim Kramer

What does the trader look for:-

- Optimal amount of days —in other words 30, 60, 90 days? 90 Days gets you from earnings date to earnings date and the long position you KNOW are going to have to be adjusted for the following earnings event

- What Technical Analysis to do before entering in the Exploding Collar Trade where the SC is 1-2-3 years out in time. I would look at the previous earnings reactions. The short call is irrelevant !!!! The money is made on the stock and the strangle/straddle placed before earnings. I’m looking for stocks that MOVE = 15% of the value of the stock within 30 days of the earnings date

- What are the characteristics of the underlying stock and the market outlook to examine before writing the SC? Stocks that move to capture a non-directional trade with profitability going in either direction

As usual if U have the time to incorporate the above into today’s session would be appreciated.

What’s happening this week and why?

China PMI came in at 48.3 vs est 47.2

ISM Index – 50.1 vs est 50.0

Construction Spending .6 vs est .4 and NO revisions to the previous .7 growth last month

V reported before the market opened and of course missed EPS by $0.01 beat on revenues, buying back 5 billion odf stock and purchased Visa Europe for 18.1 billion dollars (which was more expensive than the market expected)

Where will our market end this week?

Lower because I feel the week mostly is an energy reporting week and I think their results are going to suck.

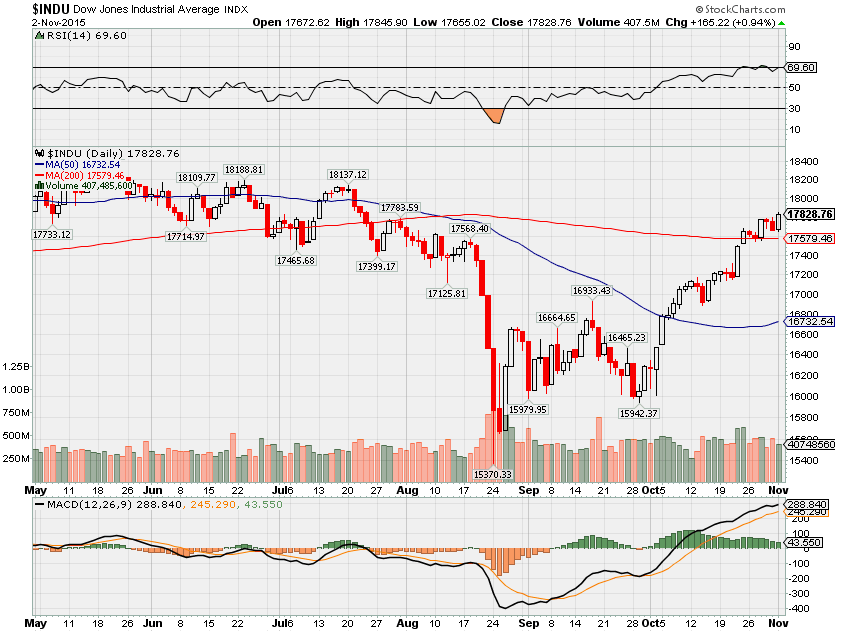

DJIA – Almost overbought, bullish and the DJIA does NOT stay overbought for long

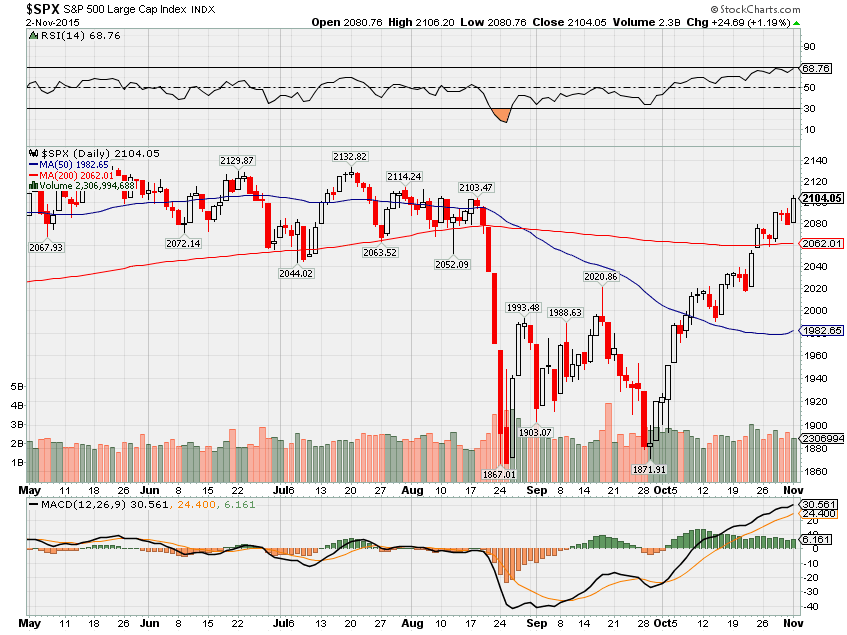

SPX – Bullish, Overbought and also doesn’t stay overbought for long

COMP – bullish, overbought and it does stay overbought for periods of time

Where Will the SPX end November 2015?

11-02-2015 Christmas Rally is on 2.5%

10-27-2015 Christmas Rally is on 5%

What is on tap for the rest of the week?=

Earnings:

Tues: CBS, DENN, DVN, GRAV, HLF, K, MOS, MYGN, ODP, S, SLW, ZG, ZNGA, TSLA

Wed: DDD, CDW, CTL, CF, FEYE, LL, MET, FRSH, TWX, RIG, WEN, FB

Thur: AES, AIRM. CNK, CROX, DUK, KHC, RL, SHAK, SWKS, TRIP, NVDA, DIS

Fri: CI. HUM

Econ Reports:

Tues: Factory orders, Auto, Truck

Wed: MBA, ADP Employment, Trade Balance, ISM Services

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs

Fri: Average Workweek, Non-Farm Payroll, Private Payrolls, Hourly Earnings, Unemployment Rate, Consumer Credit

Int’l:

Tues – JP: PMI Composite

Wed – JP: BOJ MPB Minutes, FR:DE:EMU: PMI Composite, GB: CIPS/PMI Services Index, ALL: Global PMI Composite, Services PMI

Thursday –DE: Manufacturing Orders, EMU: Retail Sales, GB: BOE Announcement and minutes

Friday – DE:GB: Industrial Production

Sunday –

How I am looking to trade?

Currently in Protective puts or collars for everything !!! for the opportunity to catch a Christmas bounce higher

Adbe

ADBE – 12/10 estimated

CLDX – 11/04 estimated

DIS – 11/05 AMC

FB – 11/04 AMC

NVDA – 11/05 AMC

V – 11/02 AMC

TSLA – 11/03 AMC

NKE 12/17 estimated

RHT 12/17 estimated

If you can’t do it I can for you !!!

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email