Risk Adjusted Performance

Many people have wondered over the last several years about how the last financial crisis came to be. There is obviously plenty of blame to go around. Monetary policy, legislative, banking, corporate, individual, and other entities all played a part in the over-leveraged mania that manifested itself in the housing market. Not to pick on any single entity, as many were incentivized to take large risks at the time, some more than others. CEOs at many of the largest banks understood that their pay was directly linked to the profit that their bank posted. Additionally, they realized that if the bank were to incur losses that they wouldn’t personally be responsible for them. Everyone seemed to realize that the banks were too systemically important to the overall function of worldwide economies to fail. The ultimate outcome from all of this was that many of the biggest banks sold more and more MBS (mortgage backed securities) to whoever would buy them to drive up profitability at their institution. The bank down the street couldn’t be outdone and be less profitable, so they followed along least their stock price suffered and the executive compensation package not perform to the maximum. So what was the risk/reward in this massive trade? Many bank execs and others stood to make many millions of dollars. The downside risk, everything as it turns out. The risk adjusted performance (RAP) was massively skewed and certainly not favorable for anyone, except for the banks. They had all the upside and everyone else had all the downside.

So what does this have to do with you and your portfolio? A lot as it turns out. As many market participants will clearly remember during the market downturns of 2000 and 2008, it is quite possible to lose 50% or more of the money invested in your portfolio. Many individuals were stunned to learn that their diversified portfolio of mutual funds failed to protect their money. As time goes on I believe many will ascertain that the asset allocation models that they’ve traditionally invested in will not work as intended going forward. Why didn’t the inversely correlated assets of the traditional asset allocation model better protect people’s investments? That’s a good question. Maybe a better question is: how can an overall portfolio’s returns be measured relative to the risk being taken? People are fond of comparing the historic performance of the overall market vs their portfolio over the same time frame. The comparisons are not always apples to apples. Let me explain.

Hurley Investments invests customer assets in long-term investments. As the stock market goes up we make money. But when the stock market turns bearish and stocks start to fall, we sell premium and buy insurance on stocks to protect our positions. So what’s the difference between what you’re doing now with your investments and how we manage our client’s money? It’s a matter of your risk adjusted performance. It’s a simple matter of fact that for people who are invested in the market that when the market goes up they make money and when the market goes down they lose money. At Hurley Investments, we make money when the market is going up like everyone else, but it’s what we do during market declines that really matters.

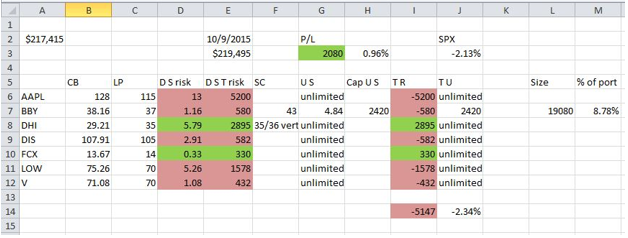

Here is an example of the typical portfolio that we manage and the risk we currently are taking.

The spreadsheet is a snapshot of a client’s holding as of the close on 10/9/15. The few main points I want to make are that the client currently has $217,415 in the account. The account is +2080 (or 0.96%) vs the SPX being -2.13%,. That’s interesting but the most important point to make is that the client is only risking $5147 (or 2.34%) of his entire portfolio right now. Additionally, we have only sold premium in one position which would cap the upside on only 8.78% of the portfolio. That’s an incredible outperformance on a risk adjusted basis. Put another way, Hurley Investments is outperforming the overall market with currently only 2.34% of investable assets at risk. Our adjustments on our holdings are always changing and at times we won’t hedge any of the risk in the market, it simply depends on current market conditions and other factors. For most individuals, the only hedge they have in their investment account is the theoretical hedge of bonds. I say theoretical because after the 30+ year bull run in bonds it is debatable as to whether bond prices will continue to go higher. If bond prices continue higher from here it is either because the Federal Reserve will, instead of ending QE, start the next iteration of QE; or because the investment community will conclude that things are so bad in the economy that bond prices will continue higher. Either way, there will be massive volatility in the markets going forward. Given the probable volatility going forward, are you sure you want to sit through more potential market downturns again? That is not to say that the market can’t go higher. If the Fed concludes that they need to continue their efforts in their bond buying program, stocks may very well go higher. I have been of the belief for years that the Fed wouldn’t raise rates regardless of what they say publicly. A few days ago Minneapolis Fed President Narayana Kocherlakota stated that the Fed should consider making their policy more accommodative, including negative interest rates.

I make the points above only to illustrate that nobody really knows where the market is headed next. This is mostly because the traditional ways of valuing the market have not worked in years as the Fed has distorted the free market mechanism of price discovery in the bond market. As a result of lower rates, people have been forced into the stock market in the never ending search for yield in the current ZIRP (zero interest rate policy) world we find ourselves in. It has been estimated by some that as much as 40% of the stock market run up is due to the Fed’s easy money policy, although nobody really knows. That may or may not be true, but do you want to risk almost half of your portfolios value to find out?

Here’s what I do know for certain: given all the uncertainty in the market, wouldn’t you like to know that you have people working every day to protect your investments? At Hurley Investments we don’t invest your assets in the traditional asset allocation model and forget about them as does the majority of financial firms out there. If you chose to invest your money that way good luck, it may work out for you, it may not- we wish you the best.

At Hurley Investments our primary goal is to protect client assets. Our secondary goal is to make our client’s money. We do this by protecting client assets in bearish or volatile markets, adding shares for free when able, and lowering the cost basis on positions in client portfolios. We manage client portfolios based on the current perceived risk in the market and our individual holdings. This is in stark contrast to the buy and hope strategy that you are currently invested in. If you call your financial advisor and ask them how they are going to protect your assets going forward all you are going to hear is: “don’t worry, you’re invested in a diversified portfolio of mutual funds,”, or maybe the old standby “you’re in for the long haul, it will be ok.” Let me translate that for you, what they’re saying is that they aren’t going to do anything because they think their job was done when they invested your money. How did that work out for you in the past?

What we do is to constantly try to lower your risk while increasing your upside in a position. We don’t always make all the upside in the market but we certainly don’t expose our clients to all the downside in the market either. We manage our client accounts to make money in any market. While our risk adjusted performance is constantly changing given how we manage every trade, I hope it is clear that we are taking much less risk than the typical market participant. The example given above I would consider a fairly extreme example of very little risk being taken at any given time. At times, Hurley Investments will take much greater risk in a portfolio, but the risk will be commiserate with the current market conditions. Believe it or not, at time we will take even less risk than the 2.34% being taken in the example given. We have some accounts with fully hedged winning positions that are profitable in risk free trades. That is to say that no matter what happens in the market, the client will be profitable. The clients in these accounts have a guaranteed profit but the still have unlimited upside. The positions are all currently protected for many macro reasons, but the main reason is we are entering earnings season and there is some cause for concern given much of the recent economic data.

The traditional investing models may continue to work going forward, and if that’s how you chose to invest your assets you better learn to cheer for more stimulus from the Fed. There are obvious outcomes that may be favorable for the investing methodology that most people are used to going forward, but are you sure you that you want to risk your money to find out? Given the uncertainty of world economies going forward and the potential effects of policy makers, wouldn’t you like to know that your financial advisor is actually protecting your money?

If you want a detailed explanation of why the traditional asset allocation model that you’ve always been invested in is broken going forward, call Michael Virden with Hurley Investments at 901-870-7187.

Michael Virden Investment Advisor Representative Michael@hurleyinvestments.com Mvirden.blogspot.com 901-870-7187

HI Financial Services Mid-Week 04-29-2014