HI Financial Services Mid-Week Commentary 10-13-2015

When trading in the stock market, money always involves an emotional decision – Seeking Alpha

can U squeeze in some tips on :-

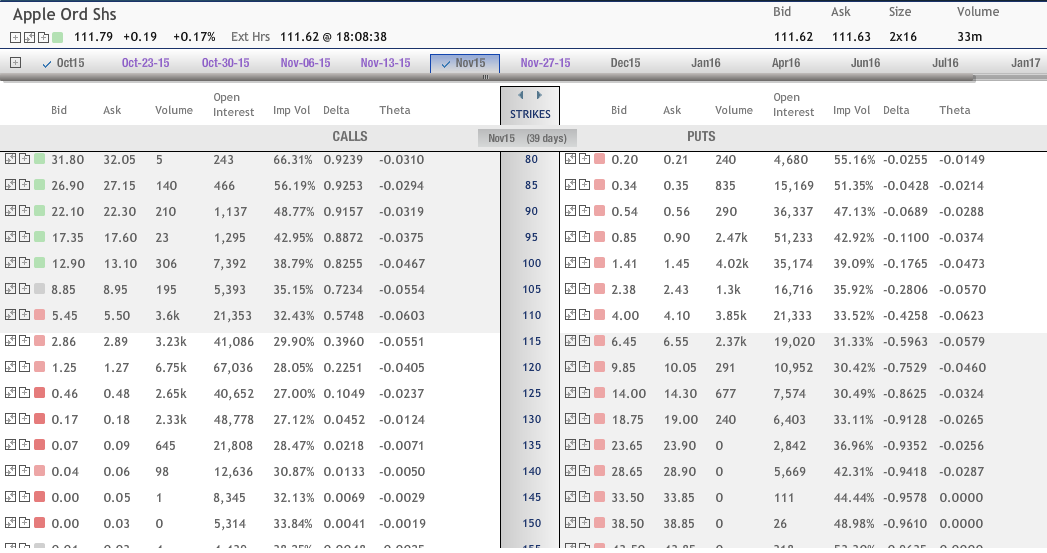

- Why U prefer debit to credit spreads ?

Bull Put Nov 105/100 = 2.38 Credit 1.45 debit = $0.93 Net Credit

Risk in the trade?= $5.00 spread minus 0.93 = $4.07

Bull Call 115/120 = 2.89 – sc credit 1.25 = $1.64

Risk in the trade?= Debit = $1.64

Max reward difference in strikes $5.00 – 1.64= $3.36

- What are some of the self-teaching methods, U have had used to remember the mechanics of credit / debit / calendar spreads ? I find it a hard to remember the strike prices of the spreads———-Long call / long put – higher strike, lower strike ?

———-expiry dates Is there some internal reason for why one chooses the above ?

To be successful with spreads YOU MUST know the options rights and/or responsibilities inside and out, always at the tip of your tongue

To Understand the mechanics I walk myself through what happens at expiration

Bull Put = Obligation to AAPL BP @ 105 and have the right to sell at $100

I ALWAYS write out of my trades on a piece of paper and post it on the wall of my office

Chart Analysis tells you the past history and current trend of the stock. Fit correct trend with strategy that YOU feel most comfortable with

The Mindless Stupidity of Negative Interest Rates

By LEE ADLER, Special Contributor, Money Morning • October 13, 2015

26

Top of Form

Editor’s Note: We’re sharing this Wall Street Examiner column with you today because negative interest rates are destroying trillions of dollars in wealth in Europe right now, cheered on by some of the “smartest” economists in the world – who want to bring NIRPhere. Here’s Lee Adler with some facts that show why negative rates are a horrible idea…

There are troubling signs that the doves at the Federal Reserve are considering a negative interest rate policy (NIRP) as a way to handle “the next crisis” – and there’s always a next crisis…

NIRP is a monetary policy tool that sets interest rates below zero. A recent MarketWatch article on NIRP said it has a “‘Dr. Strangelove’ feel.”

I have to agree. They’re a lot like nuclear warfare in that they’re so extreme, so irrational and destructive, that they fly in the face off all common sense and decency.

But this is the Great Stagnation Middle Class Elimination. You can bet that the “General Jack D. Ripper” faction at the Federal Reserve is thinking the unthinkable – and thinking about it incorrectly.

Consider this quote from that MarketWatch article:

“…pushing rates into negative territory works in many ways just like a regular decline in interest rates that we’re all used to.”

That’s patently false – so much so that it borders on insanity.

They don’t work just like a “regular decline in interest rates” – not that a “regular decline in interest rates” does what economists think it does, but that’s another story.

The issue here is that central bankers don’t even seem to understand how negative interest rates work, or why they’re so destructive to individual wealth and entire economies…

The Rest of Us Learned This in “Money 101”

Negative interest rate proponents ignore the most basic tenets of double-entry accounting.

Because there are two sides to a bank balance sheet, negative interest rates are the mirror image of positive rates. The move to negative rates imposes new costs on the banks, unlike low positive or zero interest rates, which reduce bank costs.

The greater the negative interest rate, the higher the cost imposed, which is the same as a central bank raising interest rates when they are positive.

When the Fed lowers a positive interest rate, it lowers the bank’s cost.

But if the Fed were to lower the interest rate to below zero, those $2.3 trillion in banks’ excess reserves held on deposit at the Fed become a cost to the banking system.

Not only that, but it’s a cost banks cannot avoid, except by using those cash assets to pay down debt.

This isn’t just a theory…

We Have a Real-World Example to Go On

European banks did exactly what I said they would do in mid-2014 when the European Central Bank (ECB) announced the negative deposit rates.

The banks did what anybody with any common sense would do, and the ECB knew it… Under NIRP, anyone with the ability to pay off loans (and extinguish offsetting reserve deposits) does precisely that, thereby getting rid of the added cost.

So, as opposed to stimulating growth, from the time the ECB announced NIRP in June 2014 until January 2015, loans outstanding in the European banking system actually declined by $18 billion. That may not be a big drop, but it’s exactly the opposite of what the policy makers expected.

As opposed to encouraging borrowing and spending and economic growth (you know, the good stuff), the policy encouraged deleveraging.

In fact, the ECB was actually forced to institute outright quantitative easing (QE), to the tune of €1.1 trillion ($1.2 trillion), to try and reverse that shrinkage.

But then, exactly as I predicted, the banks just used part of that to pay off their outstanding ECB “credit” instead of stimulating lending.

And, month in, month out, that’s what European banks have done, steadily paying down more than €141 billion in long-term refinancing operation (LTRO) and main refinancing operations (MRO) credit, or 21% of the amounts outstanding when the NIRP was announced.

That cancels out a portion of the growth that would otherwise accrue to the ECB balance sheet from QE. Not that QE does an iota of good for the European economy – yet another story.

That’s why we know that it is categorically false that negative rates are working in Europe.

This is not rocket science. It’s just common sense and paying attention to facts instead of ridiculous economic myths.

But facts have a funny way of eluding mainstream economists and central bankers.

No One Will Take Responsibility

They can look at the shriveled husk that was the European banking system and somehow gloss over the fact that negative interest rates are to blame. Have you ever heard mainstream economists address the damage? I suspect not.

Because they either don’t know or don’t want to know. Or they just don’t understand that if you raise the costs of holding deposits, then the deposit holders will get rid of them.

And the only way the system as a whole accomplishes that is to pay off loans, using the existing deposits to do so.

Sooner or later the hot potato of the negative-interest-bearing deposit lands in the lap of someone who will… use a deposit to pay off a loan and extinguish the deposit. It would be funny if it weren’t so destructive.

You see, most of the ECB’s balance sheet was in the form of loans that could be voluntarily repaid. Not so here in the States.

In the United States, the banking system has no chance to escape paying the costs because the Fed has issued permanent reserves.

It bought assets with newly issued money that instantly became cash assets of the banks, held as reserve accounts at the Fed. The amount of cash in the system is fixed until the Fed decides it isn’t.

Now, the cash can move from the reserve account of one bank to that of another, but at the end of the day, the Fed’s balance sheet is like the Hotel California: You can never leave.

Here’s how it “works,” if you can call it that…

It’s All One Expensive Game of “Hot Potato”

The banks can unload their cash onto other banks by buying long term assets from them. That gets rid of their reserve deposit at the Fed, but the cash just ends up in the reserve account of the bank that sold the asset.

So maybe this starts a buying frenzy that pushes long-term rates to zero, because the banks will all want to exchange cash assets (reserves) for long-term assets. That’s apparently what happened in Europe as the banking system there shrank.

But in the United States, some banks always end up holding that hot potato – the reserve deposit on which they must pay the cost.

Well, then what?

Then, if they’re rational, with any common sense, Mr. or Mrs. Banker tries to recoup the cost. So they charge their depositors to hold deposits.

Well then, what to the depositors do?

Rather than pay the interest on deposits, some depositors pay off loans and extinguish their deposits.

They pay off their credit cards, their auto loans, even their mortgages, because there’s an incentive not to hold deposits.

Then the banks start to shrink, just like they shrank (and continue to shrink) in Europe. And so as their balance sheets shrink, their cash assets grow as a percentage of assets. Ultimately, the cost of the negative deposit rate on reserves at the Fed grows as a drag on earnings.

How can anything positive come from this?

Seriously… has anyone thought this through?

Can anyone show a clear, connect-the-dots example where negative interest rates have stimulated an economy? Can anyone clearly explain how charging an institution or business to hold deposits is in any way stimulative – not “net stimulative,” but stimulative at all?

No one can… because it defies all common sense.

Lee Adler writes the facts nearly every day at WallStreetExaminer.com

Join the conversation! Follow Money Morning on Facebook and Twitter.

What’s happening this week and why?

Earnins season start in fall with the first week of financials being the main sector reporting

We’ve ignored overseas news – Headline risk is off the table

Where will our market end this week?

Options Expiration week so My Vote is higher than we are today due to earnings and short covering

DJIA – Technically Bullish and it is no man’s land between the 50 & 200 SMA

SPX – Technically Bullish and it is no man’s land between the 50 & 200 SMA

COMP – Technically Bullish and fighting to stay above the 50 SMA

Where Will the SPX end October 2015?

10-06-2015 I think the market will give us a 2% increase as the market bottoms, earnings take the stage and we have a Christmas Rally

10-06-2015 I think the market will give us a 2% increase as the market bottoms, earnings take the stage and we have a Christmas Rally

What is on tap for the rest of the week?=

Earnings:

Tues: CSX, FAST, INTC, JNJ, KMI

Wed: BAC, DAL, NFLX, PNC, WFC, XLNX

Thur: AMD, C, GS, MAT, SLB, USB, WDFC,

Fri: GE, HON, GWW

Econ Reports:

Tues: Treasury Budget

Wed: MBA, PPI, Core PPI, Retail Sales, Retail ex-auto, Business Inventories, Beige Book

Thur: Initial Claims, Continuing Claims, CPI, Core CPI, Empire, Phil Fed

Fri: Industrial Production, Capacity Utilization, Jolts, Michigan Sentiment, Net Long Term TIC Flows, OPTIONS EXPIRATION

Int’l:

Tues – CN: CPI, PPI

Wed – EMU: Industrial Production

Thursday –

Friday –

Sunday – CN: Industrial Production, GDP, Retail Sales

How I am looking to trade?

Currently in Protective puts or collars except for a couple of stocks – F, NVDA, D. When earnings come around AA October 8th, I will cash in profits on Long puts and place my puts ATM for the opportunity to catch a Christmas bounce higher

AAPL – 10/27 AMC

ADBE – 12/10 estimated

BABA – 11/04 estimated

BIDU – 10/29 estimated

CLDX – 11/04 estimated

D – 10/29 estimated

DIS – 11/05 AMC

F – 10/27 BMO

FB – 11/04 AMC

NVDA – 11/05 AMC

SNDK – 10/21 AMC

V – 10/28 estimated

VZ – 10/20 BMO

WBA – 10/28 BMO

ZION – 10/19 AMC

SBUX – 10/29 estimated

MS – 10/19 BMO

NKE 12/17 estimated

RHT 12/17 estimated

If you can’t do it I can for you !!!

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

http://www.trulia.com/blog/hidden-costs-refinancing/?ecampaign=cnews&eurl=www.trulia.com%2Fblog%2Fhidden-costs-refinancing%2F

Black swan risk rises to highest level ever

http://www.cnbc.com/id/103073883