HI Financial Services Mid-Week Commentary 09-15-2015

DON’T Fight the FED !!!! – khurley@hurleyinvestments.com

Let’s talk puts for today and some comments that have been made to me recently:

Heard of an individual who lose over 50 % YTD on primarily two strategies:

Naked puts and Iron condors ?!?!?!!!

Naked Puts – Obligated to buy the stock at a certain price (strike) after a certain period of time

IS anyone going to make you buy their stock at a lower price than where it is currently trading?=NO

Which means the directional short put option needs to move bullish to expire worthless

I am leaning towards ( in the future ) selling cash secured puts on some underlying that I wouldn’t mind owning.

IF you are willing to own the stock why not collar trade for less risk and more return?

A credit, is a credit, is a credit when I would rather make dollars than credits

Please deal with PUTS as (protective ) insurance:I Protect for news events ie… earnings and advanced notice filings – new CEO, New product, FOMC meeting

I place two weeks before the event ATM Long puts to make the best bang for the buck

and “PUTS ” as hedging,

I use the SPY long puts as a portfolio hedge seldom if ever but it is a good idea in freefall markets.

The collar trade is my true hedge for portfolio on an individual stock basis

“PUTS” as income producing.

A directional option is a lucky income producing position

I do use straddles and strangles in wild markets to produce a 10% ROI for profit/income

USO, & OIH – too hard to trade without any fixed news events. Oil will NOT go out of business but it may be awhile until the price comes back. VLO, MUR, MRO, CVX, XOM,

QID – Leveraged ETF, INDEXES are the kiss of death

You prefer stocks rather than ETS’s ? YES YES YES because there is no fixed earnings for the ETF’s which means they are 100% news driven or headline risk is too great for me. ALSO they have the best of the best and the worst of the worst included in the ETF

What’s happening this week and why?

All economic reports came out today and actually were pretty bad

Retail sales .2 vs est .3

Retail ex-trans .1 vs est .2

Empire manufacturing -14.7 vs est .5

Industrial production -.4 vs est -.2

Cap Utilization 77.6 vs est 77.8

Business Inventories .1 vs est .1

So why did our stock market go up 228 points today ?

Maybe the Fed won’t raise rates, Yellen is Dovish in her market beliefs and she doesn’t want to place the economy back into a recession like what happened after the great depression

Where will our market end this week?

IT 100% depends on the FOMC rate decision reaction by the market

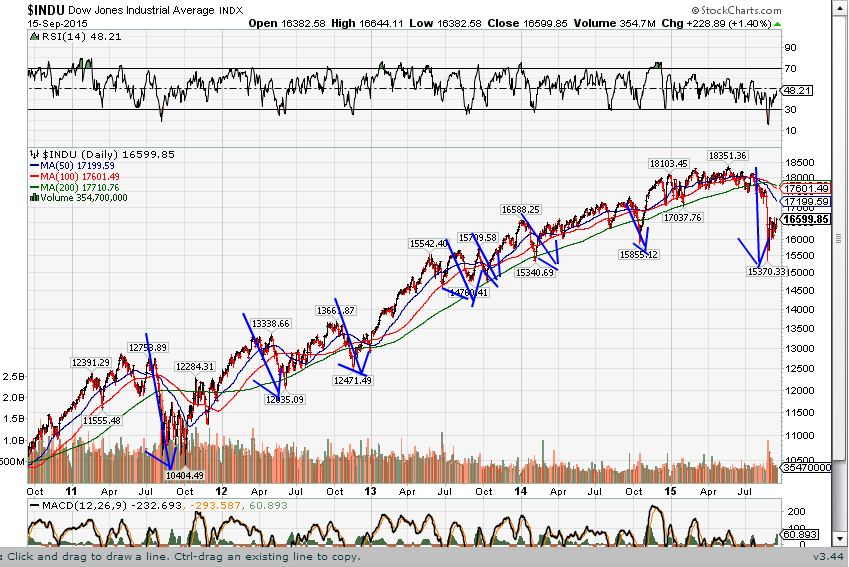

DJIA – Bearish but we have a well formed, expected breakout triangle

SPX – Bearish but we have a well formed, expected breakout triangle

COMP – Almost bullish but no catalyst – FOMC could make a difference to break above the SMA resistance

Where Will the SPX end September 2015?

09-15-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

09-08-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

09-01-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

08-25-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

What is on tap for the rest of the week?=

Earnings:

Tues:

Wed: FDX, MLHR

Thur: RAD, ADBE

Fri: OPTIONS EXPIRATION FOR SEPTEMBER

Econ Reports:

Tues: Retail Sales, Retail Sales ex-trans, Empire, Industrial Production, Capacity Utilization, Business Inventories,

Wed: MBA, CPI, Core CPI, NAHB Housing Index

Thur: Initial Claims, Continuing Claims, Housing Starts, Building Permits, Phil Fed

Fri: Leading Indicators, OPTIONS EXPIRATION

Int’l:

Tues –

Wed – EMU: HICP JP: Merchandise Trade

Thursday – JP: BOJ Minutes

Friday –

Sunday –

How I am looking to trade?

Currently in Protective puts or collars except for a couple of stocks. I Feel I want to be protected thru the Fed meeting

If you can’t do it I can for you !!!

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley