HI Financial Services Mid-Week Commentary 07-28-2015

“It’s enabled me to live more comfortably. I don’t have to worry if the stock market goes up or down”– Carol L. a Michigan Resident.

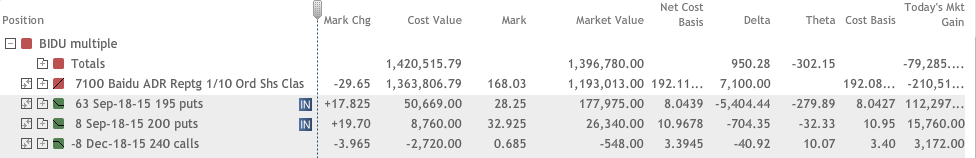

BIDU lost almost $30 today and almost $60 over the last 6 weeks. Most people book losses and try to get back in at a bottom. That would have been at $205 or $195 or $185 or $178 to only have it fall farther and book more losses. The collar trade or protective puts allow you to take most of the market risk out of investing. Being able to make up some of the downward movement allows the portfolio to not fluctuate so much and makes the drawdowns more tolerable. How much have I been able to make on the way down? Almost $50 of the $60 drop !!!

Put call ratio on BIDU 118K calls to 60K puts

My long puts act as insurance on the positions to make money on the way down

My long puts act as insurance on the positions to make money on the way down

BIDU lost $29.65 today after beating top and bottom line estimate for earnings Monday Evening

Hello Everyone,

China is causing some problems in the world right now. The world wanted China to be more capitalistic and now that the country is, the world doesn’t like the slower growth too much. The poor country can’t win for losing right now. They also bought up commodities thinking that they would corner the market and now those commodities are in a free fall worth a lot less than the prices China bought them at years ago.

BIDU – The Chinese Google beat the earnings on the top and bottom line. That means they did pretty darn good last quarter and all the channel checks said they would. They were a slam dunk to go higher but they didn’t. The second part of earnings was the guidance. What they could do next quarter. The company said next quarter they would make $2.93 to $3 billion instead of the analysts’ expectations of $3.03 Billion. It represents a growth of 34.4-37.4% year over year growth which is pretty darn good in a world looking for growth. Especially in a country where things seem to be following apart.

So I am telling you all this because we have protection on and made up 2/3 of the drop of $30 today. Please realize trading is a process. Looking at the charts they usually bounce from where they are right now and my job is to cash in the profits on the stock insurance to buy more shares at a lower cost basis. When they bounce higher we have made up some of the downside movement and have converted profits on insurance to more shares without me asking for more money to dollar cost average like other firms. A Little bounce higher and we will be at the same portfolio value we were when the shares traded $50 higher. It is the beauty of what we do to make money on the way down and to then make more money on the way back up. If there are any questions please give me a call. We are probably in for a 6 week turn around here based on technical charts and the speed of the drop down.

What’s happening this week and why?

Bounce back from the huge losses and worst week in the market since February

Durable Goods 3.4 vs est 3.0

Durable goods ex-trans 0.8 vs est 0.5

Case Shiller 4.9 vs est 5.6

Consumer confidence 90.9 vs est 100.0

Another 25% of the S&P report this week

Where will our market end this week?

Probably up 2% which would be the gains for the month based on no new info from the Fed during tomorrows FOMZC Announcement

DJIA – Bearish and it gave up the 200 SMA YTD return is down -2.15

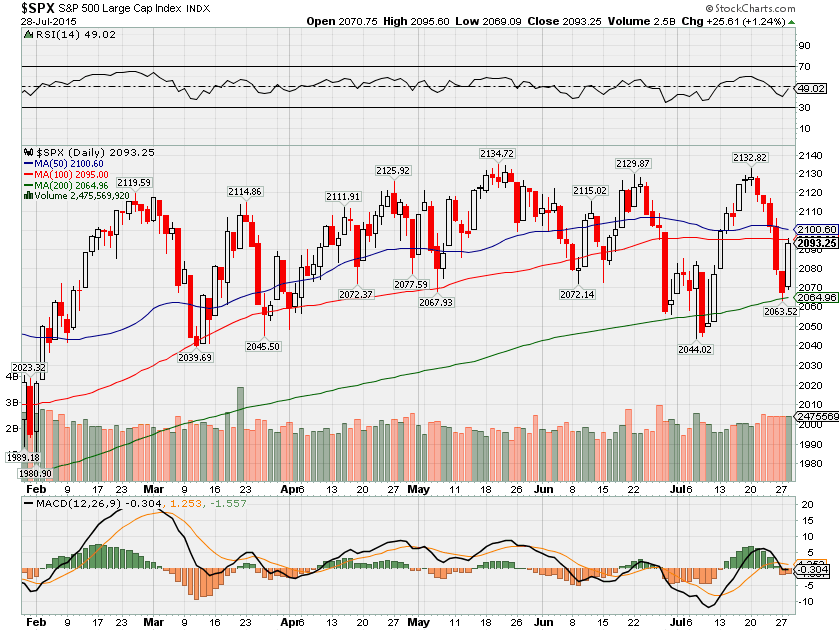

SPX – Bearish but held the 200 SMA YTD return is +0.42

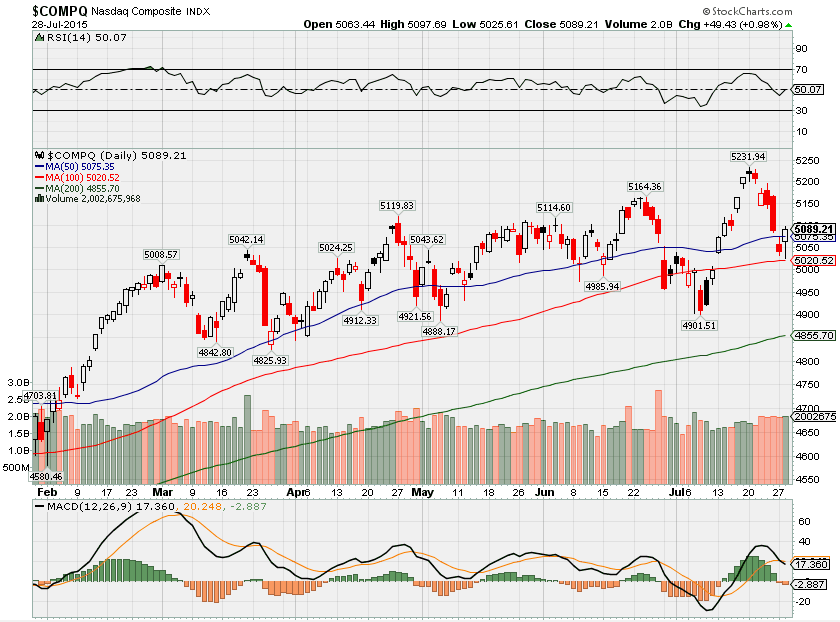

COMP – Bearish but held the 100 SMA and YTD 6.14% return

Where Will the SPX end July 2015?

07-28-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

07-21-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

07-14-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

07-07-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

What is on tap for the rest of the week?=

Earnings:

Tues: F, AKS, BGFV, GLW, DHI, GRUB, MRK, PNRA, PFE, TWTR, YELP

Wed: FB, ADT, ELY, LNG, CLF, GRMN, GT, HES, HUM, IP, MA, MET, MUR, PSA

Thur: LNCO, AMGN, ACI, BLL, CAH, COP, CL, DBD, EA, EXPE, FEYE, FLS, FLR, IM, MWW,

Fri: XOM, PSX

Econ Reports:

Tues: Case-Shiller, Consumer Confidence

Wed: MBA, Pending Homes Sales, FOMC Rate Decision

Thur: Initial Claims, Continuing Claims, Chain Deflator, GDP-adv

Fri: Employment Cost Index, Chicago PMI, Michigan Sentiment

Int’l:

Tues – JP: Retail Sales,

Wed – JP: Industrial Production

Thursday – EMU: EC Economic Sentiment, JP: CPI, Household Spending, Unemployment Rate

Friday – CN: CFLP Manufacturing PMI, EMU: Unemployment Rate, HICP Flash

Sunday – JP: Manufacturing Index, CN: PMI Manufacturing Index

How I am looking to trade?

I was prepared for earnings and have had my hedges in place. If you can’t do it I can for you !!!

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014