How does anyone beat the S&P 500 Benchmark

Let me start out by saying it is not easy and it rarely happens! For some dumb reason years ago the benchmark to beat was not a number, the amount of risk, or the timing when the funds will be needed. Everyone is out to beat the S&P 500 and is judged accordingly. It is the pretty comical that the industry has tons of funds created to beat the S&P 500 and 90% plus are unable to beat the benchmark.

So why didn’t the industry choose the Dow Jones Industrial Average, the Russell 2000 or the Nasdaq composite. It really doesn’t matter in my opinion. In all honesty, the “risk” is the key to success and the ability to beat the benchmark. We all know that the market drops much faster than the market moves higher. What kind of difference does it make? A ton over time and let me give you a couple of examples:

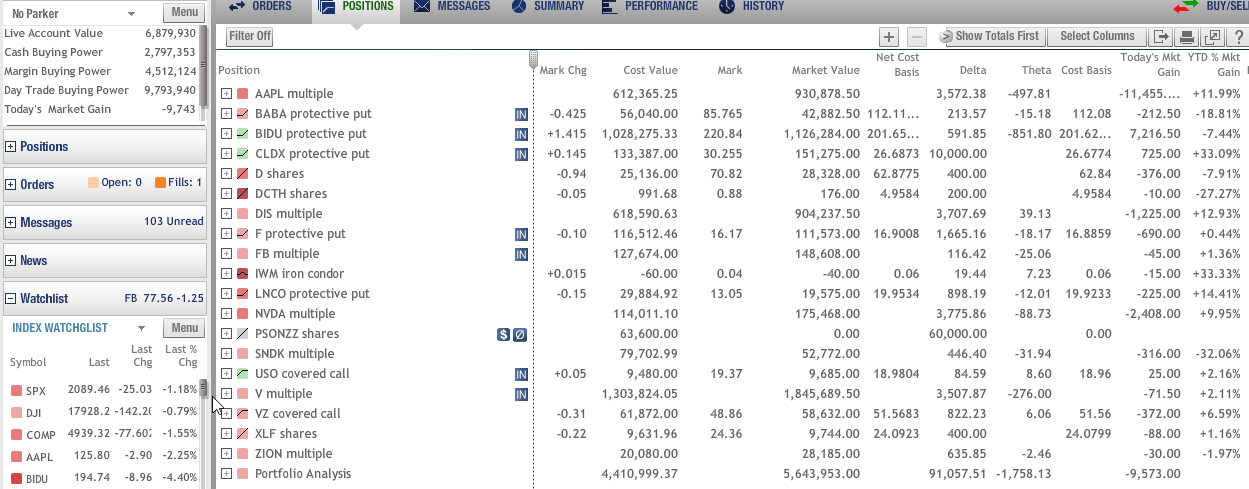

05-05-2015

This is the mix on the portfolio with the core positions being AAPL, BIDU, V, DIS., F and NVDA. Look at the protective puts or multiple positions. A multiple position is a collar trade with a leap short call and a two to three month long put as insurance on the stock. On a 1.18% drop on the S&P 500 we took a 0.14% drop. Anything made on the way down is profit on the way back up and it protects the clients’ money.

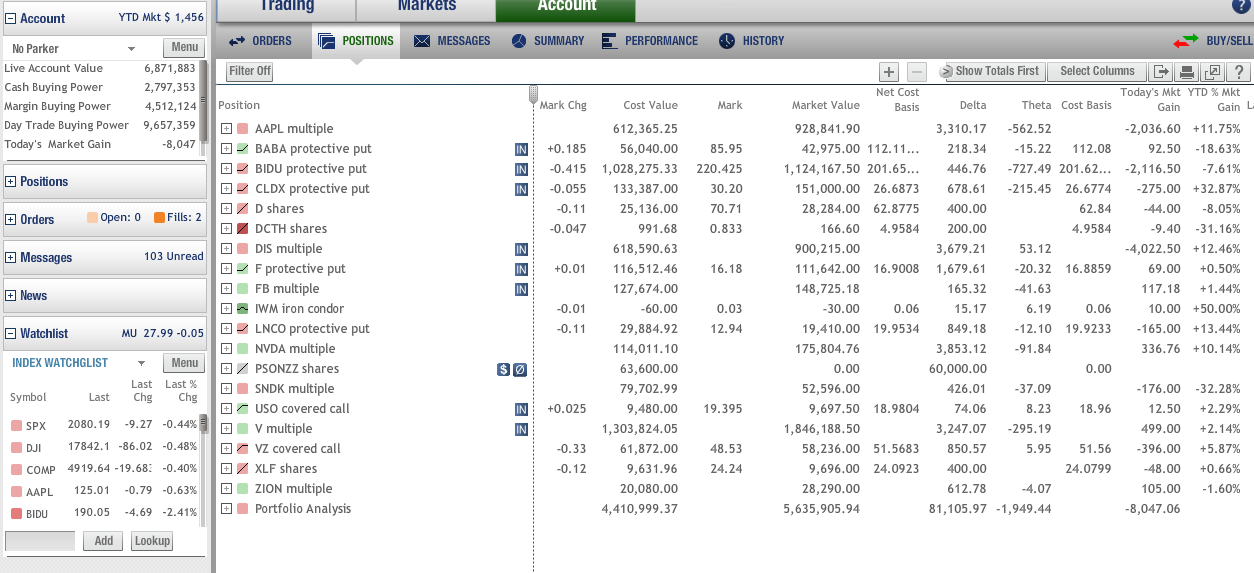

05-06-2015

Another drop of 0.44% the next day and we lost 0.11%! We are going to cash these profits in and add more shares. I love dollar cost averaging without having to ask for more money from the clients, get out of continuing winning trades or trying to manufacture money within the portfolio.

Everyone makes money when the market is going up. Ask yourself what a money manager is actually doing to when the market is not making any sense? This is what active management should do. It is so important because we have more money to make money and we don’t have to make up the losses. Everyone makes mistakes. The key is to limit the losses and to find more winners than losers. Those that try to outguess the market will continue to fail to beat the S&P 500 year in and year out.