HI Financial Services Mid-Week Commentary 05-05-2015

In light of the Dow closing – 142, Cinco de Mayo has been renamed “Sink-o no Buy-o” – Michael Virden

Warren Buffett Tells You How to Turn $40 Into $10 Million

By Patrick Morris

The power of patience

I know that $40 in 1919 is very different from $40 today. However, even after factoring for inflation, it turns out to be $540 in today’s money. Put differently, would you rather have an Xbox One, or almost $11 million?

But the thing is, it isn’t even as though an investment in Coca-Cola was a no-brainer at that point, or in the near century since then. Sugar prices were rising. World War I had just ended a year prior. The Great Depression happened a few years later. World War II resulted in sugar rationing. And there have been countless other things over the past 100 years that would cause someone to question whether their money should be in stocks, much less one of a consumer-goods company like Coca-Cola.

The dangers of timing

Yet as Buffett has noted continually, it’s terribly dangerous to attempt to time the market:

Investing for the long term

Individuals need to see that investing is not like placing a wager on the Cavs to cover the spread against the Warriors, but instead it’s buying a tangible piece of a business.

What’s happening this week and why?

China PMI came in at 48.9 YET that stimulated the stock market on Monday with more easing expectations

Factory orders 2.1 vs est 2.1

Trade Balance -51.4B vs est -40.0B

ISM Services 57.8 vs estt 56.4

Disney ROCKED their earnings !!!!

Where will our market end this week?

Up for the week by 2% – Reason why is the Non-Farm Payroll will rebound this month

I am a believer that weather affected our economy

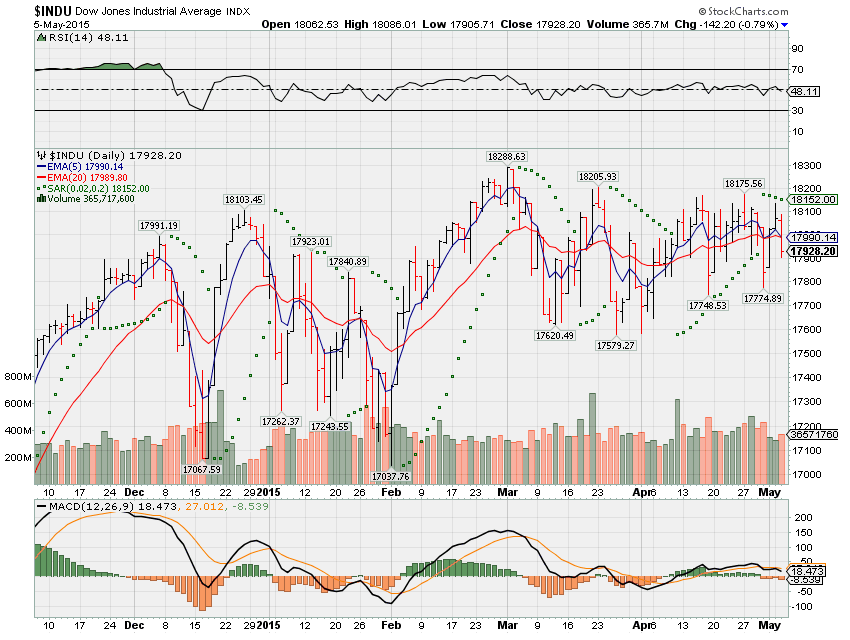

DJIA – Crossovers on RSI, MACD and touching on the 5/20 EMA

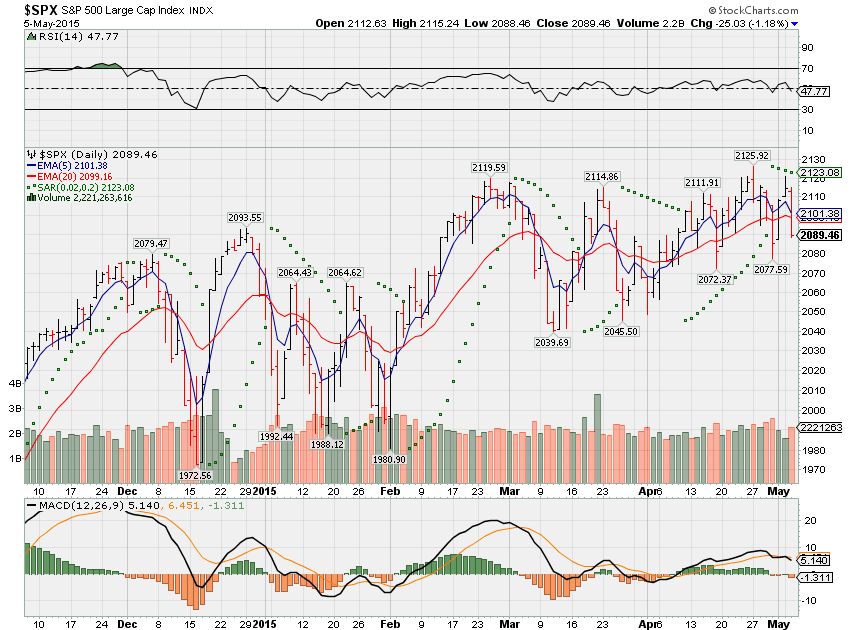

SPX – RSI and MACD bearish crossover and the 5/20 EMA are touching

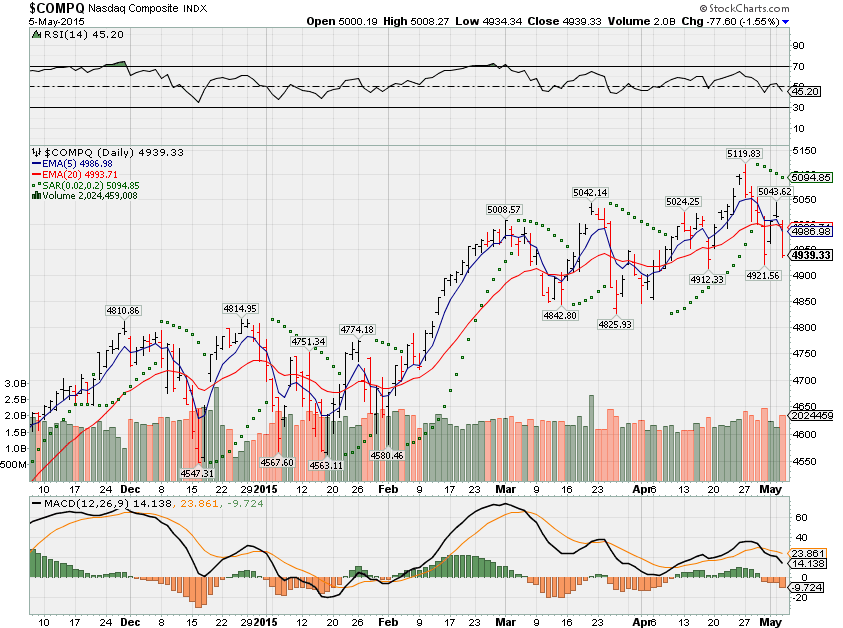

COMP – Today confirmed all three crossovers to the bearish side

Where Will the SPX end May 2015?

05-05-2015 Sell in May and go away down 3 to 6% 2050 level

04-28-2015 Sell in May and go away down 3 to 6% 2050 level

What is on tap for the rest of the week?=

Earnings:

Tues: DIS, CTRP, DVN, EA, EMR, EL, FOSL, GRPN, HLF, K, MOC, NBL, NDLS, ODP, PZZA, SCTY, S, Z, ZU

Wed: ATVI, DDD, CF, CHK, NUS, TSLA, RIG, WEN

Thur: BABA, CBS, MNST, TAP, NVDA, TSO, ZNGA

Fri: AOL, CROX

Econ Reports:

Tues: Trabe Balance, ISM Services,

Wed: MBA, Crude, ADP Employment, Unit Labor Costs

Thur: Initial Claims, Continuing Claims, Consumer Credit, Challenger Job Cuts

Fri: Ave Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Wholesale Inventory

Int’l:

Tues – CN: PMI Composite

Wed – FR:DE:EMU PMI Composite, EMU:Retail Sales, JP: PMI Composite

Thurs – DE: Manufacture Orders, FR: Industrial Production, Merchandise Trade

Friday – CN: PPI, CPI, DE: Industrial Production, Merchandise Trade

Sunday –

How I am looking to trade? Let me Show you what I changed and why?

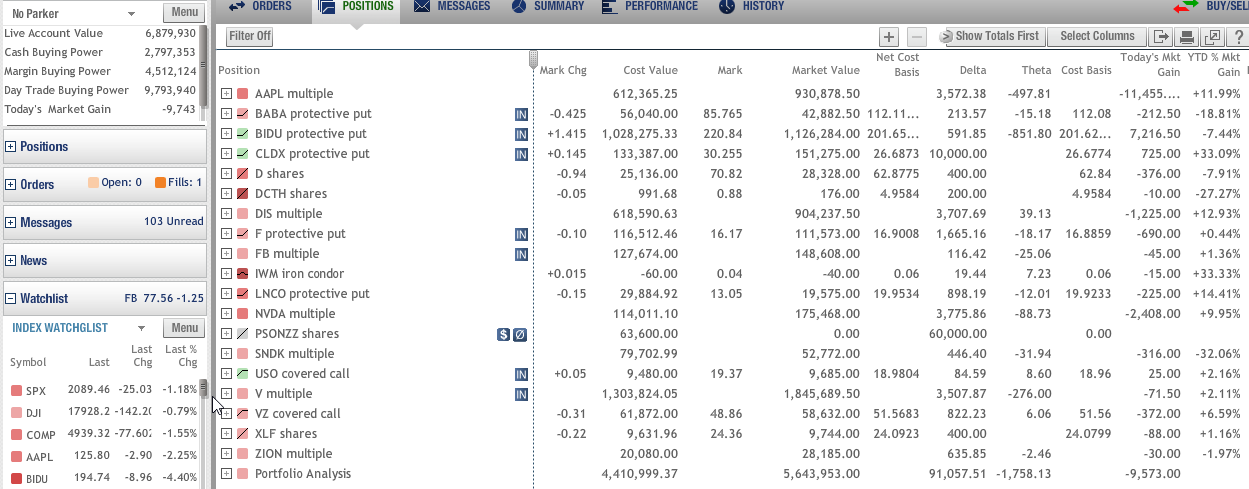

The Markets were down big and accounts are down 0.1% !!! Are you being protected by your broker?

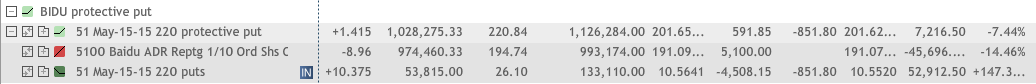

BIDU Protective Put Position and what I have to do next is close for a profit and roll the protection out in time. Nice to make a $10.37 profit on ONLY a $8.96 drop in the stock price !!!

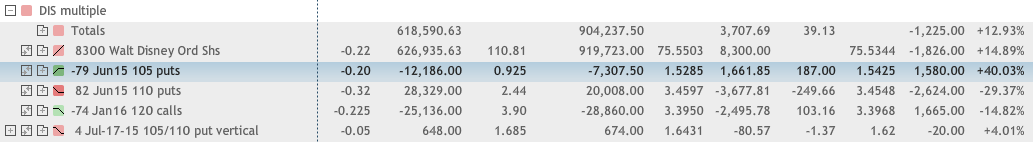

DIS

Questions???

www.hurleyinvestments.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014