HI Market View Commentary 04-07-2025

Man oh man do we have a lot to go over

Snapshot taken Saturday 7:17 PM April 5th, 2025

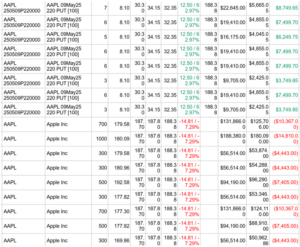

AAPL = 259.81 – 181.46 = 78.35/259.81 = 30.15%

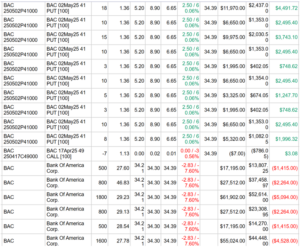

BA = 26.4%

BAC = 25.38

BIDU = 24.16%

MU = 38.82%

NVDA = 36.23

GOOGL = 29.04%

DIS = 29.76%

META = 30.26%

XYZ = 49.15%

MAG 7 Which was 80%+ of the growth over the last two ½ years just gave a lot of it up

How bad is it????

It’s Awe ful and on the third worst day in the market oiver the last 17 years we had some that were profitable in a -5.97% down day

Extra protection, volatility helped our options and we have been hit hard

Ep 2172 – What the Hell Happened on LIBERATION DAY

Ben Shapiro show is where I am getting my info fact checked against government websites

Tariffs don’t necessarily hurt us when placed properly

TRUMP through tariffs out all the way across the 180 countries instead of just targeting he top 20

Mistaking trade balance for tariffs even though he only did half or reciprocating tariffs

Poorer countries aren’t able to and can’t buy as much stuff to make the trade balance equal

He tariffed uninhabited islands with birds as the main inhabitant = BUT that was ok because they have hundreds of bank and companies that file their taxes through the island benefits

You can’t tell me 50 countries calling Trump and over 100 companies calling Trump don’t stroke that man’s ego

What happened today?= 50% more tariffs on China because they retaliated, fake news gave us a 90 day tariff halt window and the markets exploded for about 15 minutes, emergency FOMC rate meeting

WE HAVE A HUGE BUYING OPPORTUNITY SITTING RIGHT IN FRONT OF OUR FACES

WE HAVE HUGE CASH RESERVES TO PURCHASE MORE SHARE

MU

GOOL

BAC

AAPL

DIS

How much do stocks have to drop before trading is halted? The details on market ‘circuit breakers’

Published Sun, Apr 6 20258:46 PM EDTUpdated 41 Min Ago

When stock prices and stock futures fall rapidly in a single session, exchanges implement halts in trading to allow a moment for cooler heads to prevail and avoid market crashes we’ve seen in the past on Wall Street.

Such moves usually take place during times of extreme market volatility, such as March 2020 — when the Covid-19 pandemic sent global markets tumbling. This time, surging global trade tensions sparked by surprisingly high universal tariffs implemented by President Donald Trump are putting massive pressure on equities, with the sell-off continuing on Monday.

Circuit breakers

During the regular hours of 9:30 a.m. ET to 4 p.m. ET, trading in equities may be paused market-wide if declines in the S&P 500 trigger a “circuit breaker.” These occur when the benchmark index falls by a certain amount intraday, leading exchanges to briefly stop all trading. All major stock exchanges abide by these trading halts.

There are three circuit breaker levels:

- Level 1: The S&P 500 falls 7% intraday. If this occurs before 3:25 p.m. ET, trading is halted for 15 minutes. If it happens after that time, trading continues unless a level 3 breaker is tripped up.

- Level 2: The S&P 500 drops 13% intraday. If this occurs before 3:25 p.m. ET, trading stops for 15 minutes. If it happens after that time, trading continues unless a level 3 breaker is triggered.

- Level 3: The S&P 500 plunges 20% intraday. At this point, the exchange suspends trading for the remainder of the day.

The benchmark closed Friday’s session at 5,074.08. Here are the thresholds the S&P 500 needs to reach during Monday’s session the different circuit breakers to be triggered:

- Level 1: 4,718.89

- Level 2: 4,414.45

- Level 3: 4,059.26

‘Limit down’ futures

In non-U.S. trading hours — between 6 p.m. ET and 9:30 a.m. ET the following day — if S&P futures are down 7%, then trading is halted until traders willing to buy the contract at the “limit down” level emerge.

Russell 2000 futures, which track the small-cap benchmark, briefly reached that threshold overnight, falling 7% before bouncing.

Wall Street is coming off a horrid session. On Friday, the S&P 500 dropped nearly 6%, its worst day since March 16, 2020 — when it sank 11.98%. The Dow Jones Industrial Average plunged 5.5%, its biggest one-day decline since June 11, 2020. The Nasdaq Composite tumbled 5.8% on Friday and ended the day in a bear market, down more than 20% from its record high set in December.

The selling continued Monday, with the S&P 500 losing 4.5% and entering bear market territory, down more than 20% from a record high set in February.

Correction: The Dow Jones Industrial Average plunged 5.5%, its biggest one-day decline since June 11, 2020. An earlier version misstated the percentage.

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange.

In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 28-Mar-25 10:30 ET | Archive

Hard data vs soft data explained

Column Summary:

* Hard data measures actions; soft data measures thoughts

* Consumer sentiment surveys are the best examples of soft data

* Hard data matters more as a guidepost for the economy, monetary policy, fiscal policy, and earnings prospects.

Economic data gets released every week. Most of it is “high-frequency” data, which means it is typically published monthly or weekly so that market participants can have a fair sense of economic conditions.

It is important information, too, not only because the data provide a view of how the economy is doing but also because that view shapes the stock market’s earnings outlook.

The economic reports, however, are not all equal as market movers. Some, like the monthly Employment Situation Report, are ignition points for the market. Others, like the monthly Wholesale Inventories Report, have no market-driving influence.

There are many nuances when it comes to economic data, one of which is the difference between “hard data” and “soft data.” Today, we will explain that difference.

The Simple Answer

In his press conference following the March 18-19 FOMC meeting, Fed Chair Powell acknowledged that “The hard data are still in good shape. It’s soft data, the surveys that are showing significant concerns, downside risks, and those kinds of things.”

He added that the Fed wants to focus on the hard data and that if the soft data is going to affect the hard data, we should know it quickly.

So, what is hard data, and what is soft data? In the simplest terms, hard data measures what consumers and businesses are doing, whereas soft data measures what consumers and businesses are thinking.

Hard data is quantitative. Soft data, which can be presented in a quantitative light, is qualitative at its core.

Thinking and Doing

The best examples of soft data are consumer sentiment surveys.

Each month, the Conference Board produces its Consumer Confidence Index, and the University of Michigan releases its Index of Consumer Sentiment. The former concentrates more on what consumers think about labor market conditions, whereas the latter tends to revolve around what consumers think about financial conditions and their income prospects. Both ask consumers about their inflation expectations.

In the charts below, one can see that consumer sentiment weakened in 2025. General takeaways from recent surveys are that consumers are worried about future employment prospects, personal finances, and inflation.

On the surface, these weakening consumer confidence reports sound ominous for economic growth prospects. What consumers think, though, doesn’t always correlate with what they do, not over the short run anyway. The Secrets of Economic Indicators, authored by Bernard Baumohl, notes that a six-month or nine-month moving average of consumer confidence levels has been a better determinant of future household spending.

The Conference Board’s Consumer Confidence Index has declined in each of the last four months. The University of Michigan’s Index of Consumer Sentiment has declined for three straight months.

We would add that employment status is another key variable when it comes to what one thinks and what one does. People with jobs will continue to spend, although if they feel their job isn’t secure and that finding a new job will be challenging, they may change their approach by cutting spending for discretionary items (e.g., vacations, concert tickets, apparel, eating out, electronics).

Real personal spending (i.e., inflation-adjusted) is hard data that captures what consumers are doing with their money and how they are allocating expenditures between goods and services.

Recently, there has been a pullback in real personal spending, but it is unclear if that is related simply to the aberrant winter weather in the south and the tragic wildfires in California or if it is something more. It would be remiss not to add that, despite the recent pullback, real personal spending was still up 2.7% year-over-year in February.

Fortunately, the labor market remains in solid shape. The unemployment rate (a lagging indicator) remains near a 30-year low at 4.1%, and initial jobless claims (a leading indicator) are at levels consistent with positive economic growth.

Initial jobless claims running above 400,000 for several weeks is more indicative of an economy at risk of a meaningful slowdown because of a weaker labor market that will adversely impact spending activity. The latest report showed the four-week moving average at 224,000.

As an aside, the unemployment rate is derived from a household survey conducted each month that asks respondents their employment status, whereas initial jobless claims are hard data culled from the filings made at state agencies.

Briefing.com Insight

The soft survey data provides valuable insight into what consumers and businesses are thinking, yet it has its shortcomings. The biggest one for consumer surveys, arguably, is how the respondent feels when they are logging a response to a survey question.

For instance, they might answer the question on the tenth day of the month after learning on the ninth day that their company is announcing layoffs. Naturally, that would make them predisposed to feeling more negative about their job security and income prospects.

However, when they went to work on the eleventh day of the month, they were told that not only is their job secure, but they were being promoted and getting a raise to compensate for the additional responsibility that came with the new role. Their view on job security and income prospects would be drastically different. That might get captured in revisions to the preliminary reports, yet it goes to show how survey data is based on what one is thinking and not on what one is doing.

Still, a prolonged weakening in soft data is not to be dismissed. It can mark an important inflection point in the economy, particularly if there is a coincident increase in layoffs and a rising unemployment rate.

The adage that “actions speak louder than words” rings true in the examination of hard data and soft data. Hard data captures the action, while soft data captures the words. Both matter, yet hard data matters more as a guidepost for the economy, monetary policy, fiscal policy, and earnings prospects.

—Patrick J. O’Hare, Briefing.com

(Editor’s note: The next installment of The Big Picture will be published the week of April 7.)

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end April 2025?

04-07-2025 -4.0%

03-31-2025 -4.0%

Earnings:

Mon: PLAY, LEVI,

Tues: CALM,

Wed: DAL, STZ,

Thur: KMX,

Fri: BLK, BK, FAST, MS, WFC, JPM

Econ Reports:

Mon: Consumer Credit,

Tue

Wed: MBA, Wholesale Inventories,

Thur: Initial Claims, Continuing Claims, CPI, Core CPI, Treasury Budget

Fri: PPI, Core PPI, Michigan Sentiment

How am I looking to trade?

Rolling down puts for huge profits and adding more shares,

We took off META = because want to add 550/650 = 650/800

For 725/800 we are adjusting the 800 short calls, taking a profit and dollar cos averaging the 725

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

‘Absolutely nothing good’ coming out of Trump’s tariff announcement: Analysts react to latest U.S. levies

Published Thu, Apr 3 20252:17 AM EDTUpdated Thu, Apr 3 20253:32 AM EDT

Key Points

- Analysts generally had a pessimistic take on the announcement, with some even predicting an increased risk of a recession for the U.S.

- Most note that the tariff will raise rates to levels not seen since the early 20th century, when the U.S. enacted the Smoot/Hawley Act.

Charts that show the “reciprocal tariffs” the U.S. is charging other countries are on display at the James Brady Press Briefing Room of the White House on April 2, 2025 in Washington, DC.

Alex Wong | Getty Images

U.S. President Donald Trump on Wednesday laid out the “reciprocal tariff” rates that more than 180 countries and territories will face under his sweeping new trade policy.

The announcement sent stocks tumbling and prompted investors to seek refuge in assets perceived to be safe.

Analysts generally had a pessimistic take on the announcement, with some even predicting an increased risk of a recession for the U.S.

Here is a compilation of reactions from experts and analysts:

Tai Hui, APAC Chief Market Strategist, J.P. Morgan Asset Management

“Today’s announcement could potentially raise U.S. average tariff rates to levels not seen since the early 20th century. If these tariffs persist, they could materially impact inflation, as U.S. manufacturing struggles to ramp up capacity and supply chains pass on costs to consumers. For instance, advanced semiconductor manufacturers in Taiwan may not absorb tariff costs without viable substitutes.

“The scale of these tariffs raises concerns about growth risks. U.S. consumers may cut back on spending due to pricier imports, and businesses might delay capital expenditures amid uncertainty about the tariffs’ full impact and potential retaliation from trade partners.”

David Rosenberg, President and founder of Rosenberg Research

“There are no winners in a global trade war. And when people have to realize, when you hear this clap trap about how consumers in United States are not going to bear any brunt. It’s all going to be the foreign producer. I roll my eyes whenever I hear that, because it shows a zero understanding of how trade works, because it is the importing business that pays the tariff, not the exporting country.

And a lot of that will get transmitted into the consumer, so we’re in for several months of a very significant price shock for the American household sector.”

Anthony Raza, Head of Multi-Asset Strategy, UOB Asset Management

“They’ve come up with the most extreme numbers that we can’t even comprehend. How they’re coming up with these? And then in terms of timing, I think we were hopeful that maybe this would be something that was rolled out over the course of a year, that would allow like time for negotiations or whatever. But it does seem like the timing is much more immediate and is, again, worse than our worst-case type scenario in terms of flexibility.”

David Roche, Strategist, Quantum Strategy

”These tariffs are not transitional. They are core to President Trump’s beliefs. They mark the shift from globalisation to isolationist, nationalist policies – and not just for economics. The process will last several years and be felt for decades. There will be spillovers into multiple policy domains such as geopolitics.

Right now, expect retaliation, not negotiation by the EU (targeting U.S. services) and China (focusing on U.S. strategic and business interests). The Rose Garden tariffs will cement the bear market. They will cause global stagflation as well as U.S. and EU recession.”

Shane Oliver, Head of Investment Strategy and Chief Economist, AMP

“Our rough calculation is that the 2nd April announcement will take the U.S. average tariff rate to above levels seen in the 1930s after the Smoot/Hawley tariffs which will in turn add to the risk of a U.S. recession – via a further blow to confidence and supply chain disruptions – and a bigger hit to global growth.

“The risk of a US recession is probably now around 40% and global growth could be pushed towards 2% (from around 3% currently) depending on how significant retaliation is and how countries like China respond with policy stimulus.”

Tom Kenny, Senior International Economist, ANZ

“Today’s announced US reciprocal tariffs are worse than expected. The effective tariff rate on U.S. merchandise imports is likely to climb to the 20-25% range, the highest since the early 1900s.

Yields on inflation-indexed bonds were higher and equities sold off after the announcement, suggesting the market thinks these tariffs will hurt growth and add to inflation. Market pricing of the federal funds rate points to cuts from the Federal Reserve coming sooner.”

Trump’s tariffs risk a global trade war, as leaders plan next steps

This was CNBC’s coverage of President Donald Trump’s April 2, 2025, announcement of new tariffs targeting dozens of U.S. trade partners. Read the continuing coverage of tariffs and their global impact.

What you need to know

- President Donald Trump signed an aggressive and far-reaching “reciprocal tariff” policy at the White House.

- Trump said his plan will set a 10% baseline tariff across the board.

- The plan imposes steep tariff rates on many countries, including 34% on China, 20% on the European Union, 46% on Vietnam and 32% on Taiwan.

- Economists and U.S. trade partners are raising questions about how the White House calculated the tariff rates it claimed other countries “charge” the United States.

- Stocks were poised to open down sharply Thursday morning.

CNBC’s reporters covered the tariffs and their effect, on air and online from our bureaus in Washington; London; Singapore; San Francisco; and Englewood Cliffs, New Jersey.

Small-cap benchmark Russell 2000 becomes first major U.S. stock measure to enter bear market

Published Thu, Apr 3 202512:45 PM EDTUpdated Sun, Apr 6 202511:18 PM EDT

Key Points

- The Russell 2000 benchmark entered a bear market on Thursday, down more than 20% from a 52-week high.

- The index’s decline marks the first major U.S. benchmark to reach that territory following a monthlong market sell-off that was accelerated by President Donald Trump’s tariff rollout.

- Small-cap stocks had seen gains immediately following Trump’s election victory on deregulation hopes.

Small-cap stocks, which were once thought to be primary beneficiaries of President Donald Trump’s policies, entered bear market territory on Thursday amid a massive stock market rout that followed the administration’s sweeping and aggressive tariff rollout.

The Russell 2000 Index was down about 6.6% during Thursday’s session, bringing its losses from a 52-week high to 22.5%. On Wall Street, a 10% pullback is considered a correction, but a 20% decline is a bear market. The S&P 500 and Nasdaq Composite are both firmly in correction territory, while the Dow Jones Industrial Average is around that mark.

“They’re getting hit because the economy is softening. That’s going to hurt profits,” Keith Lerner, co-chief investment officer at Truist, told CNBC. “On the other side, they’re still paying high levels of interest payments on debt because they have more of this floating-rate debt.”

“They’re getting squeezed on both sides,” he said.

This is a sharp reversal from the gains seen in the trading days following November’s election, with small caps viewed as beneficiaries of deregulation, lower tax rates and even tariffs since the group has fewer multinationals than large-cap stocks.

The Russell 2000 closed out that election week with an 8.6% advance, almost four percentage points higher than the 4.7% weekly gain of the S&P 500. Along with that, small caps became one of the hottest Trump trades. In fact, Tom Lee – managing partner and head of research at Fundstrat – said at that time that those stocks could outperform by more than 100% over the next couple of years.

Russell 2000 since November 25 record

But the Russell 2000 was dragged lower Thursday by names like Victoria’s Secret and Urban Outfitters, which source a lot of products from other countries and could see significantly higher costs and lower margins from the tariffs.

And the group is particularly sensitive to economic shifts given their small size, and therefore less financial flexibility as large-cap stocks. JPMorgan predicted that if Trump’s sweeping new reciprocal tariffs remain, the U.S. economy will likely fall into a recession.

The Russell 2000 previously neared bear market territory in March against the backdrop of a monthlong market sell-off spurred by uncertainty surrounding Trump’s tariffs plans and growing concern on the Street of a slowing economy.

“Small caps, in the first half of an economic recession, are usually down 13%, so it’s already worse than where we were for the average recession,” said Steven DeSanctis, an equity strategist covering small- and mid-cap companies at Jefferies, in an interview with CNBC. “For the average bear market, small caps are down 26%, so we’re nearing that number.”

Where’s the bottom?

While small caps are in turmoil right now, DeSanctis believes the group could eventually find a bottom, especially if the Federal Reserve starts lowering interest rates again.

Traders are currently pricing in a more than 71% chance of four quarter percentage point cuts by year-end 2025, with nearly 100% odds of the next reduction being at the central bank’s June meeting, per the CME FedWatch Tool.

“If the economy gets weak enough, do we get support from the Fed? We say yes. That’s usually good for small caps,” the equity strategist said.

DeSanctis added that the path from here might look like a “tough” first two quarters, though no recession, before the Fed possibly comes to the rescue in the summer. From there, he anticipates that some of the concerns surrounding tariffs – which could raise input costs for businesses – may be resolved, prompting the market to focus on deregulation once again.

Lerner, who is underweight small caps, is similarly constructive. He noted that in addition to deregulation, a greater focus on tax cut extensions and a return of animal spirits leading to a pickup in mergers and acquisitions should provide an opportunity for small caps to do well later in the year, or whenever investors feel that the worst of the economic outlook is behind them.

What’s more, because things “don’t move in a straight line,” it “wouldn’t be surprising” for small caps as well as large caps to soon see an “oversold bounce,” Lerner said.

Lerner doesn’t believe large caps will face a similar fate of entering bear market territory as small caps. The S&P 500 is still a considerable distance away from a bear market, being more than 12% off its Feb. 19 high.

“With small caps being down 20%, it tells you they’ve already been down – the bear market didn’t start here. It’s been going on for several months,” the co-CIO said. “Correspondingly, large caps are also down, but they are down about half relative to small caps. Our base case for large caps is you may see further downside, but we’re not calling for a bear market.”

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange.

In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles, and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!

Traders betting Fed will cut rates at least 4 times this year to bail out economy

Published Fri, Apr 4 20259:12 AM EDTUpdated Fri, Apr 4 20259:52 AM EDT

Traders are now betting the Federal Reserve will cut interest rates at least four times this year, amid fears President Donald Trump’s tariffs could tip the U.S. into a recession.

Odds of five quarter-point reductions coming this year jumped to 37.9%, up from 18.3% one day prior, according to data from the CME Group on Friday morning. That would put the federal funds rate at 3.00% to 3.25%, down from 4.25% to 4.50% where it has been since December.

Markets are also pricing in a roughly 32% chance the federal funds rate will fall to 3.25% to 3.50%, which would mean four quarter-point cuts from the Fed.

At the same time, the likelihood of a half-percentage point trim coming in June also jumped, to 43.8% from 15.9% previously.

The implied odds the Federal Reserve will cut aggressively rose after Trump’s tariffs raised fears of a global trade war, and hurt economists’ forecasts for both growth and inflation. Investors are expecting that a slowdown in economic growth could spur the Fed to lower rates in a bid to avoid a recession.

However, many worry the Fed has a tough road ahead of it, as the central bank would have to cut rates in an environment where inflation has yet to go down to its 2% target. If implemented, the tariffs are expected to drive core inflation north of 3%, possibly even as high as 5% according to some forecasts.

On Friday, Roger W. Ferguson, economist and former Fed vice chair, told CNBC the central bank may not cut at all this year, saying the Fed has to worry about the inflation part of its mandate.

— CNBC’s Jeff Cox contributed to this report.

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!|

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange. In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles, and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!

President Donald Trump says Fed Chair Powell should cut interest rates and ‘stop playing politics’

Published Fri, Apr 4 202511:15 AM EDTUpdated Fri, Apr 4 20252:22 PM EDT

Jesse Pound@/in/jesse-pound@jesserpound

President Donald Trump on Friday called for Federal Reserve Chair Jerome Powell to cut interest rates, even as his tariff blitz roiled markets and raised fears of a rebound in inflation.

“This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates. He is always ‘late,’ but he could now change his image, and quickly,” Trump said in a post on Truth Social. “Energy prices are down, Interest Rates are down, Inflation is down, even Eggs are down 69%, and Jobs are UP, all within two months – A BIG WIN for America. CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!”

Trump’s post comes as global equity markets are selling off sharply. The president’s new tariff policy, unveiled Wednesday, has raised concerns about a global economic slowdown.

The new trade policies may also be a barrier that keeps the Federal Reserve from cutting. The central bank has paused its rate cuts in recent meetings, in part because progress on reducing inflation appeared to have plateaued. The new tariffs could lead to a widespread rise in prices, at least temporarily, that further complicates the inflation picture.

On Friday, Powell told business journalists in Arlington, Virginia, that the Fed was “well positioned to wait for greater clarity” before making changes like rate reductions. He also said that the tariffs announced were “significantly larger than expected.”

Market-based interest rates have already fallen sharply this week, with the 10-year U.S. Treasury yield now below 4%. Treasury yields often fall when investors are worried about a potential recession.

Movement in the fed funds futures market implies that traders now expect at least four rate cuts of 0.25 percentage point from the central bank this year, according to the CME’s FedWatch tool. At a meeting last month, central bankers projected just two rate reductions.

Trump has downplayed concerns about this week’s market volatility, at one point comparing the reaction to a patient who undergoes surgery.

When asked about those comments Friday, Powell said, “I make it a practice not to respond to any elected officials comments, so I don’t want to be seen to be doing that. It’s just not appropriate for me.”

Trump regularly commented on central bank policy during his first term as president and was often at odds with Powell. That has led to speculation that he might look to remove the Fed chair before his term ends next year. Trump said in December that he does not intend to fire Powell, and the Fed chair has said he doesn’t think the president is legally allowed to do so.

The Fed has two main goals in promoting price stability and maximizing employment. The March nonfarm payrolls report released Friday showed a slight increase in unemployment to 4.2%, but the rise of 228,000 jobs was more than expected.

Friday’s jobs report does not reflect any impact of the tariffs announced this week.

Charts suggest S&P 500 sell-off will continue until this level, says Carter Worth

Published Fri, Apr 4 20252:20 PM EDT

Carter Braxton Worth@CarterBWorth

(Check out Carter’s worthcharting.com for actionable recommendations and live nightly videos.)

The 4,850 level is a key reference point for the S&P 500 Index, which is about 5% from here.

The market’s peak in 2021 following its post-Covid surge was 4,850. Our work continues to suggest that the market is headed down to the 2021 peak.

S&P 500 weekly bar chart

FactSet

The 4,850 level is also a key reference point in terms of where the market’s 5-year uptrend line comes into play — the uptrend line in effect since the 2020 Covid low.

S&P 500 weekly bar chart with trendline

FactSet

Our work continues to suggest that the market is headed down to the 5-year trendline.

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange.

In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles, and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!

DISCLOSURES: (None)

All opinions expressed by the CNBC Pro contributors are solely their opinions and do not reflect the opinions of CNBC, NBC UNIVERSAL, their parent company or affiliates, and may have been previously disseminated by them on television, radio, internet or another medium.

Is Trump Intentionally Crashing the Stock Market? Yes, and It’s All Part of His Brilliant Plan

by Rich Welsh

April 6, 2025 in America First, Donald Trump, Economy, MAGA, Opinion, Politics, Populist, Trump Administration

Alright, guys, let’s talk about the stock market. You may have noticed it’s been acting like a caffeinated squirrel on a trampoline lately. Wild swings, red numbers, financial pundits hyperventilating on TV, the fake news pouncing on the story to throw trash at the president. But what if… that chaos is actually part of the plan?

Yes, President Trump might be crashing the stock market on purpose—and not because he accidentally bumped into the big red “CRASH” button at Mar-a-Lago. According to a video he posted yesterday on Truth Social, “Trump is crashing the stock market by 20% this month but he’s doing it on purpose.”

Now, before you start yelling at your 401(k), hang on. The video also claims that Warren Buffett reportedly said, “Trump is making the best economic moves he’s seen in over 50 years.” So either Trump’s playing 5D chess while we’re still stuck on checkers, or this is the most patriotic economic demolition derby ever staged.

Let’s break this down. The video lays it out like this: Trump is flooding cash into US Treasuries. That move forces the Federal Reserve Bank to lower interest rates in May. Lower rates mean the government can refinance trillions in debt on the cheap. The dollar weakens, mortgage rates drop, and suddenly refinancing looks as sexy as a tax refund.

They even call it “a wild chess move”—which is honestly the most polite way anyone’s described a market plunge in years.

And the tariff plan? Get ready for this. The video claims it’s a “genius play” because it pressures companies to manufacture in the US again. Plus, it makes farmers sell their stuff locally, which is going to lower grocery prices. Eggs were the chosen poster child for this one. The libnuts started screaming egg prices were still up only days after Trump was sworn in. Not a good look for the party unless they wanted to look dumb. Yep—cheap eggs, guys, thanks to Trump.

And just to really stick it to the elites: “94% of all stocks are owned only by 8% of Americans.” So if the market goes down? That’s a Gucci-level problem. According to the video, Trump is “taking from the rich short-term and handing it to the middle class through lower prices.” He’s Robin Hood with a red tie.

Here’s the method to the madness: tank the market, spook investors, and send them running into the warm, safe arms of US Treasury bonds. The Fed reacts by lowering interest rates (as they do), and boom—President Trump gets to refinance the US national debt like it’s a Black Friday sale.

And here’s the best part: the Fed is already in the middle of a massive refinance operation. Coincidence? Maybe. Or maybe this is all part of the Trump Economy Universe—Phase II.

Let’s talk about the ugly truth about the debt. Right now, the U.S. spends more money on interest payments than on anything else. [See chart below] Think of it as maxing out a credit card and then paying just the interest… forever. That’s what the Democrats and the establishment RINOs have given us after decades of irresponsible spending.

Trump’s apparent realization? If he can get those interest rates down, he can cut hundreds of billions from the annual federal budget. That’s not small potatoes.

We’re talking about a $1.9 trillion deficit every year. If Trump manages to refinance and shave off just 25% of that, we’re saving over $400 billion annually. That’s your money back, not going to line the pockets of bondholders in Davos. Inflation drops, the budget breathes, and maybe—just maybe—gas prices won’t look like your college tuition anymore.

So, who actually owns the stock market? According to Trump’s Treasury Secretary Scott Bessent: “The top 10% of Americans own 88% of equities. The next 40% owns 12% of the stock market. The bottom 50% has debt—credit card bills, rent, auto loans—and we’ve got to give them some relief.”

Bottom line? The people sipping champagne on yachts are panicking. The rest of us? Not so much. The theory is simple: rich folks take a temporary hit, while the middle and lower classes get long-term benefits. Again, that’s the plan. No promises about the execution. Remember, we have a political party that is totally dedicated to taking Trump down, even if it means taking you down with it.

And then there’s the hot-button issue of tariffs. Secretary Bessent hits us with some logic-flavored sass: “If tariffs are so bad, why do they [other countries] have them? Or if the American consumer is going to pay all the tariffs, then why do they care about tariffs?”

Solid point. If other countries hate US tariffs so much, maybe it’s because they’re working. Maybe tariffs aren’t the villain—they’re more like the bouncer at the door of Club America.

Tariffs hurt the globalist elite more than they hurt Joe and Jane Taxpayer. For decades, these multinational elites have been trying to bleed America dry. Trump saw the wealth drain, and he yanked the plug.

The takeaway? This is exactly what voters signed up for. While the left is busy wringing their hands and forecasting doom, Trump’s team is calm, collected, and steering the ship. His economic game plan? Aggressive. Borderline crazy. And somehow… it’s working.

The closing line of the video says it all: “Is this what you voted for?”

The answer from supporters? “Yes, this is exactly why we voted for President Trump. We are getting exactly what we wanted.”

MAGA

Why the ‘Magnificent Seven’ could be hit harder than rest of S&P 500 on Trump’s tariffs

Published Mon, Apr 7 202512:41 PM EDT

Pia Singh@in/piasingh72/@pia_singh_

The “Magnificent Seven” stocks are likely to be more impacted by retaliatory tariffs given that they get a substantial chunk of their revenue from foreign countries, according to an analysis from Apollo.

“Roughly 50% of earnings in the Magnificent 7 come from abroad … that is higher than for the S&P 500, where the share is 41%,” Apollo chief economist Torsten Slok wrote in a note to clients on Monday. “As a result, the Magnificent 7 will be hit harder on their global earnings than other S&P 500 companies.”

Six of the seven companies got at least half of their revenues from outside the U.S. in 2024, Apollo data shows. In 2023, around 70% of Nvidia’s revenue came from abroad. The Magnificent Seven consists of Nvidia, Amazon, Apple, Microsoft, Meta Platforms, Tesla and Alphabet.

The seven megacap technology stocks have tumbled since U.S. President Donald Trump unveiled his long-awaited tariff policy on Wednesday. CNBC’s Magnificent Seven index has lost more than 11% since that day.

CNBC Mag Seven index since April 2

The Trump administration’s plans include a unilateral 10% levy that took effect this weekend, as well as steeper tariffs on countries including China, Vietnam and Taiwan — nations that manufacture a significant number of devices and machine components for major U.S. tech companies.

The levies have prompted retaliation from several trading partners. Beijing’s decision last week to match the U.S. levies has increased the risk of a more extreme U.S.-China trade war, piling onto worries that could hit the once high-flying group of tech stocks.

According to Slok, the Magnificent Seven could see its earnings get “even more negatively impacted” if Europe retaliates in the form of a digital services tax, or a DST. Several European Union member countries have already implemented or proposed DSTs to tax revenues from large multinational digital companies, which have significantly impacted the market value of U.S. companies.

To be sure, the Slok said resulting trade wars from Trump’s tariffs will still hit other countries greater than they will impact the U.S.

“With trade making up a bigger share of GDP in the rest of the world than in the U.S., the trade war will have a disproportionately more negative impact on the rest of the world,” Slok said.

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange. In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12. Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles, and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!