HI Market View Commentary 03-10-2025

Today I Quote Star Trek – “DAMN IT JIM!!”

We trade individual stocks because….. Warren Buffett Proves it’s works, better returns, because it is easier to protect and pick up more shares,

We don’t day trade and we aren’t exclusively technical trades because IT DOESN’T Work

I’m frustrated today because we were smart and only took off half the protection meaning half the stocks weren’t protected this morning…..BUT we added protection quickly

Given that Feb was a losing month, was the monthly loss any worse that a usual Feb monthly loss? I’m just curious.

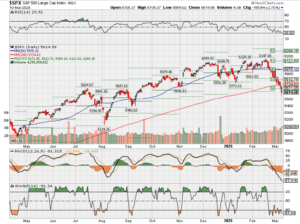

DOWN 8.67% from the Feb Highs SPX

DOWN 13.09 from the Feb highs NASDAQ

I was reading in Barron’s of the dire consequences of Trump’s policies. However, I wonder if things are really going to be that bad, or are their writings a reflection of the Wall Street Journal anti Trump position? I guess time will tell.

Sunday’s Fox news Trump – More pain to come and don’t look at the stock market

BTW I do think we need a market correction.

In 2023, the United States imported 28.1 million cubic meters of softwood lumber from Canada. This is about 30% of the softwood lumber the US uses each year.

Explanation

- Canada is one of the world’s largest producers and exporters of softwood lumber.

- The US is heavily dependent on Canada for lumber because the US needs more than its domestic supply can provide.

- Lumber is a vital component of the US homebuilding industry.

- The US imports lumber from Canada primarily for residential and commercial construction.

- The US imports lumber from Canada subject to countervailing and anti-dumping duties of 14.5%.

Home prices rise by $7,500 to 10K per US Home Builders Assn, IF tariffs are longer than 6 months

6 Bear Market Stops

- Canada & Mexico come to terms with Trump

- A Ukraine/Russia Resolution

- Tax Breaks – Doge found us money = Deficit Cut or Cash in our pockets

- Better China relations

- 20-35% drop makes the market cheap

- The US economy resets – Entitlement problem

Earnings dates:

DG 03/13 est BMO

MU 03/19 est AMC

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 07-Mar-25 16:41 ET | Archive

President Trump and friends put it to the stock market

Column summary:

- There is no “Trump put.”

- The stock market doesn’t like the cadence of the tariff news.

- The absence of a “Trump put” heightens the market’s sense of uncertainty.

It has been said that there has never been a president more in tune with the performance of the stock market, as a proxy for the job the president is doing, than President Trump.

If that is how he chooses to look at things, so be it. What bears repeating here is that the stock market is not the economy. Ultimately, how the economy performs is how the voting populace assesses the job the president is doing.

Be that as it may, market participants have a unique ability to steer the stock market as if it is the economy — or at least the economy they expect to see. Right now, the stock market is steering for a slower economy, and it has come off the rails a bit because, ironically, the president doesn’t seem interested in steering the stock market.

What’s Not to Like?

President Trump has been aggressive with his tariff plans, just as he said he would be on the campaign trail. The approach has been frustrating for stock market participants to digest, because it has featured some on again-off again directives.

For instance, 25% tariffs were announced on February 1 for Canada and Mexico, but after some discussion with government leaders there, the tariff actions were delayed for one month. Those tariffs were implemented, as advertised, on March 4, and for good measure the president told China that there will be an additional 10% tariff on goods imported from China, taking its tariff rate to 20%.

The 25% tariff action for Canada and Mexico got massaged, however, with the administration first suggesting it would exempt autos from the tariffs and then subsequently clarifying that all USMCA compliant goods and services will be exempt for… one month. The remainder of goods and services not USMCA compliant — roughly 60% for Canada and 50% for Mexico — would be hit with the 25% tariff.

Not surprisingly, Canada, Mexico, and China all responded with retaliatory tariff actions for imported U.S. products (mostly agricultural products in the case of China).

President Trump, meanwhile, has stuck to his tariff guns and has indicated that “reciprocal tariffs” for countries with higher tariffs on imported U.S. goods than what the U.S. charges for their imported goods are coming. The drop date was indicated to be April 2, but President Trump said on March 7 that they could start “as early as today” or maybe early next week.

In a nutshell, the stock market hasn’t liked the tariff news. It hasn’t liked the cadence of the announcements, which has injected added uncertainty for companies trying to make investment decisions, and it hasn’t been convinced these tariff actions won’t lead to higher inflation and/or weaker growth.

Its misgivings have manifested themselves in the following ways:

- The countercyclical health care and consumer staples sectors have exhibited relative strength.

- The consumer discretionary and financial sectors have underperformed.

- There has been a stark unwinding of momentum trades.

- The Treasury market has rallied, driving yields lower.

- The dollar has sold off.

- Oil prices have weakened.

- The fed funds futures market has priced in the likelihood of three rate cuts in 2025 versus two only a short time ago.

Three’s Company

With every stair step down in the major indices, there has been a residual claim that the president won’t allow the losses to continue since he is so in tune with what the stock market is doing. That is the rudiment of the so-called “Trump put.” That is, if losses mount, he will announce a policy move of some kind that will convince the market to squelch its selling interest and ramp up its buying efforts.

That confident and otherwise calming expectation got steamrolled this week by none other than President Trump and a few of his cabinet friends.

- After the most recent back-and-forth on the tariffs for Canada and Mexico, the president was asked if his decision to provide certain exemptions was due to the stock market’s performance. His reply, according to CNBC, was that the decision had “…nothing to do with the market. I’m not even looking at the market, because long term the United States will be very strong with what is happening here.”

- Commerce Secretary Lutnick told CNBC, “The president wants American growth and American prosperity, OK? And the fact that the stock market goes down half a percent or percent, it goes up half a percent or percent, that is not the driving force of our outcomes.”

- Treasury Secretary Bessent was the most explicit, also telling CNBC, “There’s no put… The Trump call on the upside is, if we have good policies, then the markets will go up.”

The market hasn’t liked the cadence of the tariff announcements and, well, let’s just say it isn’t enamored with the thought that there is no “Trump put.”

What It All Means

Undoubtedly, there will be doubts as to whether the president truly means it when he says he is not even looking at the market. Will that same insouciant perspective apply if the stock market enters into a bear market (generally defined as a 20% drop from a prior peak)?

We suppose that is the question, yet it is just one more answer that is unknown. It is also one more element adding to the heightened sense of uncertainty in the market that has reined in its complacent disposition.

The result has been lower stock prices, lower confidence, and a lower floor for the president’s tolerance of stock market losses because there is reportedly no “Trump put.”

The notion that there isn’t a “Trump put” flies in the face of what the stock market had been counting on coming into the year. It is one more thing the stock market will have to get its mind around as it continues to contend with tariff uncertainty and growth concerns, which means it is one more thing that will keep this market trading in a fitful manner.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end March 2025?

03-03-2025 -1.5%

Earnings:

Mon: ORCL, MTN,

Tues: DKS, KSS

Wed: AEO, ADBE

Thur: DG, DOCU, ULTA,

Fri: BKE,

Econ Reports:

Mon:

Tue

Wed: MBA, CPI, Core CPI, Treasury Budget

Thur: Initial Claims, Continuing Claims, PPI, Core PPI,

Fri: Michigan Sentiment

How am I looking to trade?

Now we are protecting for technical crossovers to the downside AND tariff risk.

XYZ – Added $56 puts and still way over sold

VZ – Puts are off and it’s trading a $46.49

NVDA – In a bear put 112/110 with short call protection against the long 34% protection M

MU – $89 Puts

META –$615 Puts Spreads have 50% roughly short call protection

GOOGL – $165 Puts

F –

DIS – $110 puts

BIDU – Holding $92 and we are looking at adding close to the money short calls

BAC – $40 puts

AAPL – $ Added $225 long puts with 260 Short call probably rolling for more credit $245

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Kevin how did I lose over 10% in MSTR = All A stop loss is, it becomes a market order when the stock falls below that price

YES if we do fall another 10% to S&P 500 5000 level we will be adding extra puts and SPY puts to make up more on the way down

Trump says a transition period for the economy is likely: ‘You can’t really watch the stock market’

Published Mon, Mar 10 202511:46 AM EDTUpdated An Hour Ago

Jeff Cox@jeff.cox.7528@JeffCoxCNBCcom

Key Points

- With fears brewing over tariffs and jobs, President Donald Trump and his top lieutenants are acknowledging there could be some short-term pain for the economy and markets before it gets better.

- “What I have to do is build a strong country,” the president said Sunday. “You can’t really watch the stock market.”

- An emerging theme from the administration is that any slowdown or reversal in growth is a legacy from Trump’s predecessor, Joe Biden.

NEC Director Kevin Hassett: A lot of reasons to be extremely bullish about the economy going forward

President Donald Trump and other senior White House officials have spent the past several days bracing Americans for a potential economic slowdown that they say will then lead to stronger growth ahead.

With fears brewing over the potential tariff impact, the labor market slowing and indicators pointed toward possible negative growth in the first quarter, the president and his top lieutenants are projecting a mostly optimistic outlook tempered with warnings about near-term churning.

“There is a period of transition, because what we’re doing is very big,” Trump said Sunday on the Fox News show “Sunday Morning Futures.” “We’re bringing wealth back to America. That’s a big thing. … It takes a little time, but I think it should be great for us.”

Asked whether he thinks a recession is imminent, Trump said, “I hate to predict things like that.” He later added, “Look, we’re going to have disruption, but we’re OK with that.”

The comments come during a tumultuous period for markets, with stocks riding a continuing roller coaster depending on the news of the day. Major averages slid again Monday, with the most recent White House assurances doing little to assuage jangled market nerves.

While Trump used Wall Street as a continuous barometer of his progress during his first term in office, he discouraged making it a yardstick this time around.

“What I have to do is build a strong country,” he said. “You can’t really watch the stock market.”

‘A detox period’ from spending

An emerging theme from the administration is that any slowdown or reversal in growth is a legacy from Trump’s predecessor, Joe Biden, and his debt-and-deficit fueled stimulus. Treasury Secretary Scott Bessent has called for a “rebalancing” of the economy away from fiscal and monetary largesse.

“There’s going to be a natural adjustment as we move away from public spending to private spending,” Bessent said Friday on CNBC. “The market and the economy have just become hooked and we’ve become addicted to this government spending, and there’s going to be a detox period.”

That adjustment could come sooner rather than later.

The Atlanta Federal Reserve’s closely followed GDPNow gauge of incoming economic data is tracking a 2.4% decline in the growth rate for the first quarter. If it holds up — the measure can be volatile, particularly early in the quarter — it would be the first quarter to go negative in three years and the biggest retrenchment since the Covid pandemic.

National Economic Council Director Kevin Hassett, in a Monday interview with CNBC, called the GDPNow outlook “a metric of the inheritance of President Biden” and “a very, very temporary phenomenon.”

“There are a lot of reasons to be extremely bullish about the economy going forward,” he said. “But for sure, this quarter, there are some blips in the data, including the negative GDPNow, which are related both to the Biden inheritance and to some timing effects that are happening ahead of tariffs.”

Speaking Sunday to NBC’s “Meet the Press,” Commerce Secretary Howard Lutnick said: “There’s going to be no recession in America. … If Donald Trump is bringing growth to America, I would never bet on recession, no chance.”

Worries about jobs and the consumer

One big mover for the Fed model was a surge in the trade deficit to a record $131.4 billion in January, in part the product of a jump in gold imports as well as companies stockpiling ahead of the tariffs.

However, there also are rising concerns about consumer spending following a pullback in January. Consumer activity accounts for more than two-thirds of GDP, so any further decline would be added cause for concern.

At the same time, a decent headline payrolls gain in February of 151,000 masked some underlying trouble spots for the economy.

While the commonly cited unemployment rate just nudged up to 4.1%, the so-called real rate that measures discouraged workers and those at work part time but would rather have full-time jobs soared to 8%, a half percentage point gain to the highest level since October 2021.

The increase came as rolls of those holding part-time jobs for economic reasons rose by 460,000, a 10% jump to the highest level since May 2021. Most of the move in the category came from those citing slack work or business conditions. Further, the level of those reporting at work full time slumped by 1.2 million while part-timers spiked by 610,000.

Market veteran Jim Paulsen, a former economist and strategist with Wells Fargo and other firms, noted in a Substack post that the labor market is approaching “stall speed” and that the gains in the real unemployment rate are consistent with a recession, though that’s not necessarily his forecast.

The rise, he wrote, “highlights increasing stress in the U.S. jobs market. Moreover, this is yet another indicator which will fan recession fears among investors and boost worries about a potential bear market.”

Few economists on Wall Street are expecting a recession. Goldman Sachs, for instance, cut its GDP outlook for 2025 to 1.7%, down half a percentage point from the previous forecast, while nudging up the 12-month recession probability to just 20%, from 15%.

Trump administration officials insist the current soft patch, including the tariff uncertainty, is part of a broader strategy.

“What we’re doing is we’re building a tremendous foundation,” Trump said on the Fox show.

Trump rejects pleas from business for more clarity on tariffs: ‘They always say that’

Published Mon, Mar 10 20258:43 AM EDTUpdated An Hour Ago

Christina Wilkie@in/christina-wilkie-6004564/@christinawilkie

Kevin Breuninger@KevinWilliamB

Key Points

- President Donald Trump has shrugged off appeals from the business community for greater clarity on tariffs, saying they have plenty already.

- Trump’s tariffs and the broader strength of the U.S. economy are front and center this week as a slew of new economic data is released.

- Federal Reserve Chairman Jerome Powell says the U.S. central bank is “well positioned to wait for greater clarity” on Trump’s policies.

President Donald Trump has dismissed the growing chorus of CEOs, investors and policymakers who are pleading with the White House for greater clarity about his sweeping tariff agenda.

“They always say that. ‘We want clarity,’” Trump said in a Fox News interview that aired Sunday.

“They have plenty of clarity,” the president told “Sunday Morning Futures” host Maria Bartiromo.

Appeals to the White House from the business community to provide more concrete guidance, Trump said, are little more than talking points. “They just use that — like almost a sound bite.”

Pressed by Bartiromo on whether there would be “clarity for the business community,” Trump’s reply was telling.

“I think so, but you know, the tariffs could go up as time goes by, and they may go up, and you know, I don’t know if it’s predictability.”

Bartiromo interjected: “That’s not clarity.”

A day after the full interview aired, the start of a new week of tariff-fueled fears and heightened economic uncertainty sent stocks lower at Monday’s opening.

The Dow Jones Industrial Average dropped 400 points, or 1%. The S&P 500 slipped 1.4% and the Nasdaq Composite shed 2%. Later in the morning, both the 500-stock S&P and tech-heavy Nasdaq dropped to their lowest levels since September 2024.

Trump’s comments capped off a week marked by unpredictability about both his tariffs and the broader strength of the U.S. economy.

The S&P 500 fell 3.10%, for its worst weekly mark since September. The Dow fell 2.37%, while the Nasdaq Composite shed 3.45%.

At the center of the storm were Trump’s stiff 25% tariffs on imports from Canada and Mexico, which were initially paused for a month, then restarted Tuesday, only to be reined in Wednesday and then partially paused for another month on Thursday.

AlixPartners’ Simon Freakley on CEO anxiety around tariff uncertainty

Meanwhile, Trump and multiple officials in his administration warned that Americans could be in store for some economic strain — including higher prices. But they insisted any adverse impacts would be temporary.

Confusion surrounding Trump’s constantly shifting trade plans has left investors uncertain about what’s coming next.

While Trump has downplayed the impact of his unpredictable trade policies on domestic markets, Wall Street analysts have not.

“We still have no clarity on the economy moving forward with the Trump turmoil,” wrote Byron Anderson, head of fixed income at Laffer Tengler Investments.

“The longer we have chaos and turmoil from Trump, the higher the probability that we will eventually have data trend negative,” he wrote in a Friday note.

The White House did not respond to a request for comment on Trump’s latest remarks about his tariffs, or about the widespread confusion surrounding his agenda.

The coming week promises plenty of new economic data to test the competing theories.

Due out Monday is the New York Fed survey of consumer expectations, followed by the Wednesday release of February’s consumer price index.

Thursday will see a fresh set of producer price data, before finishing the week with a University of Michigan consumer sentiment reading on Friday.

Now, as the Trump administration embarks on a monthlong reassessment of America’s trade relationships around the world, the negative impacts of uncertainty, felt over the past few weeks, could be magnified.

“Markets fear uncertainty more than they fear bad news,” wrote Mark Malek, chief investment officer at Siebert Financial. “25% tariffs are easier to price in than ‘maybe 10%, maybe more, maybe less.’”

It’s not just companies and investors who need greater clarity before they make major decisions.

Powell says Fed is awaiting ‘greater clarity’ on Trump policies before making next move on rates

The Federal Reserve does, too.

Chairman Jerome Powell on Friday said the central bank is “well positioned to wait for greater clarity” while the Trump administration implements “significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation.”

Speaking at the U.S. Monetary Policy Forum, Powell said it would be “the net effect of these policy changes that will matter for the economy and for the path of monetary policy.”

For now, he said, “uncertainty around the changes and their likely effects remains high.”

The Fed, like so many others, is “focused on separating the signal from the noise as the outlook evolves,” he added.

— CNBC’s Jesse Pound contributed reporting.

Trump ‘an agent of chaos and confusion,’ economists warn — but a U.S. recession isn’t in the cards yet

Published Mon, Mar 10 20257:15 AM EDTUpdated 6 Hours Ago

Key Points

- Global market volatility and geopolitical turbulence in the wake of President Donald Trump’s return to the White House have led to warnings that the U.S. economy could be heading for a recession.

- Economists say Trump is proving to be an “agent of chaos” with his unpredictable trade tariff policies — but note that a downturn isn’t in the cards just yet.

Global market volatility and geopolitical turbulence in the wake of President Donald Trump’s return to the White House have led to warnings that the U.S. economy could be heading for a recession — but economists say that a downturn isn’t in the cards just yet.

“I don’t think we will talk about a U.S. recession. The U.S economy is resilient, I would say, largely despite Donald Trump,” Holger Schmieding, chief economist at Berenberg Bank, told CNBC’s “Squawk Box Europe” on Monday.

Dubbing Trump an “agent of chaos and confusion,” Schmieding said the president’s “zigzagging on tariffs shows that he has little idea of the potential consequences of his tariff policies.”

Nonetheless, “U.S. consumers have money to spend, [and] they probably will. The labor market in the U.S. remains reasonably firm, and with energy prices coming down a bit and probably some tax cuts and deregulation coming, I don’t think there’s an imminent recession risk,” according to Schmieding.

U.S. economy resilient despite ‘agent of chaos’ Trump, economist says

“But what is becoming ever clearer in the long run, Trump is hurting U.S. trend growth, that is growth in the years beyond 2026. And he stands for higher prices for U.S. consumers, which means, in my view, the Fed [Federal Reserve] has no reason to cut rates with Trump as president, and Trump sowing chaos and confusion,” he noted.

CNBC has contacted the White House for a response and is awaiting a reply.

International stock markets have been rocked to their foundations in recent weeks amid fears that Trump intended to revive a global trade war after announcing hard-hitting import tariffs on goods from China, Mexico and Canada.

Confusion and uncertainty have followed, as the president last Friday announced that there would be a reprieve and delay to April 2 on some tariffs on the U.S.′ neighbors and closest trading partners.

Trump’s unconventional approach to trade and international diplomacy has left markets unimpressed, with U.S. indexes whipsawing, while strategists warned that negative market sentiment was bound to continue in the Trump 2.0 era. U.S. stock futures fell earlier Monday morning, indicating another rocky ride for American markets at the start of the new trading week.

Business leaders and economists have voiced concerns that tariffs will lead to further inflationary pressures on the U.S., with consumers likely to bear the brunt of higher prices on imported goods.

They also warn that investment, jobs and growth could suffer, as consumers tighten their belts and hunker down to wait out a period of economic unpredictability and potential “stagflation” marked by high inflation and high unemployment.

That would put pressure on the Fed to keep interest rates on hold, rather than cutting from their current benchmark rate in a range between 4.25%-4.5%, in a bid to stimulate the economy. Lower interest rates can fuel more spending, and, in turn, inflation.

Fed Chairman Jerome Powell on Friday said that the central bank can wait to see how Trump’s aggressive policy actions play out before it moves again on interest rates.

‘A period of transition’

Recent economic data showing consumer confidence has taken a hit in February will be food for thought for the Trump administration. The Federal Reserve Bank of Atlanta’s GDPNow tracker of incoming metrics also indicated last week that the U.S. gross domestic product could shrink by 2.4% for the period between January and March. A technical recession is defined as taking place when at least two consecutive quarters log negative growth.

Last week’s jobs data also showed that while the U.S. labor market is still expanding, signs of weakness could also be starting to creep in. Nonfarm payrolls data indicated employment growth was weaker than expected in February and while jobs growth is still stable, the data comes amid Trump’s efforts to cut the federal workforce.

Nonfarm payrolls increased by a seasonally adjusted 151,000 on the month, exceeding the downwardly revised 125,000 of January, but coming in below the 170,000 consensus forecast from Dow Jones, the Labor Department’s Bureau of Labor Statistics reported Friday. The unemployment rate edged higher to 4.1%.

TS Lombard’s chief U.S. economist, Steven Blitz, said the latest jobs data “tell us the economy continues to grow” and did not signal “increased recession risks created by the array of Trump’s policies.”

However, he said in a note Friday that “the sum of Trump’s actions can yet skew the economy in any which way, including an implosion of capital spending.”

“Keep in mind that presidents have been known to accept downturns in year one of their presidency. It is a free pass, they blame the previous president and take credit for the recovery. My base case is still growth and the Fed holding still. My base concern comes from the capital markets side, break trade and you will break the capital inflows that support the economy,” Blitz said.

Trump has refused to rule out the possibility of a recession this year, but insisted this weekend that the economy was in a “period of transition.”

Asked about the Atlanta Fed’s warning of an economic contraction on Fox News Channel’s “Sunday Morning Futures,” Trump seemed to acknowledge that his tariff plans could affect U.S. growth.

“I hate to predict things like that,” he said in an interview aired Sunday, when asked if the recession warning was a concern.

“There is a period of transition because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing.” The White House leader added, “It takes a little time. It takes a little time.”

JPMorgan’s U.S. Market Intelligence unit last week noted that the U.S. economy was entering “another period of uncertainty” given the unpredictable nature of tariffs. The analysts said they were taking a “bearish” position on U.S. stocks, expecting markets to see more volatility and for U.S. growth to potentially “crater.”

“We have already seen the negative impact that policy/trade uncertainty has had on both household and corporate spending, so it seems likely that we see a larger magnitude of this over the next month. Keep an eye on the unemployment rate, layoffs, WARN notices, etc. If we start to see the unemployment rate rising rapidly, then that likely which push the market back into the ‘Recession Playbook,’” JPMorgan noted.

While a U.S. recession was not the bank’s base-case scenario, JPMorgan analysts warned that “the undetermined length of tariffs and the potential for the trade war to see an acceleration in new tariffs [means] we think stocks will be challenged as U.S. GDP growth estimates are cut.”

“Given the lack of a potential end to this escalation, the expectation is that tariffs of these magnitude with drive both Canada and Mexico into a recession. Look for U.S. GDP growth expectations to crater and for earnings revisions to be materially lower, forcing a re-think of year-end forecasts. With this in mind, we are changing our view to Tactically Bearish,” they noted.

Layoff announcements soar to the highest since 2020 as DOGE slashes federal staff

Published Thu, Mar 6 20257:30 AM ESTUpdated Thu, Mar 6 20258:35 AM EST

Jeff Cox@jeff.cox.7528@JeffCoxCNBCcom

Key Points

- U.S. employers announced 172,017 layoffs for February, up 245% from January and the highest monthly count since July 2020, Challenger, Gray & Christmas reported.

- More than one-third of the total came from billionaire entrepreneur Elon Musk’s efforts to reduce the federal headcount. Challenger put the total of announced federal job cuts at 62,242.

President Donald Trump’s efforts to pare down the federal government workforce left a mark on the labor market in February, with announced job cuts at their highest level in nearly five years, outplacement firm Challenger, Gray & Christmas reported Thursday.

The firm reported that U.S. employers announced 172,017 layoffs for the month, up 245% from January and the highest monthly count since July 2020 during the heightened uncertainty from the Covid pandemic. In addition, it marked the highest total for the month of February since 2009 during the global financial crisis.

More than one-third of the total came from billionaire entrepreneur Elon Musk’s efforts, with Trump’s blessing, to reduce the federal headcount. Challenger put the total of announced federal job cuts at 62,242, spanning 17 agencies.

“With the impact of the Department of Government Efficiency [DOGE] actions, as well as canceled Government contracts, fear of trade wars, and bankruptcies, job cuts soared in February,” Andrew Challenger, the firm’s workplace expert, said in the release.

January’s planned reductions brought the total through the first two months of the year to 221,812, also the highest for the period since 2009 and up 33% from the same time in 2024.

Impact of DOGE layoffs on the jobs report: Here’s what to know

The report comes amid heightened concern about the state of the labor market and the economy in general as Trump’s plans for tariffs, slashing the size of government, and mass deportations and stringent immigration restrictions take shape.

There has been a slew of mixed indicators about where things are heading, with consumer surveys showing concern over inflation and layoffs while other data shows economic strength continuing. Payrolls processing firm ADP reported Wednesday that private sector hiring grew by just 77,000 in February.

According to the Challenger report, it’s not just government cutting back.

Retail saw 38,956 cuts for the month as companies such as Macy’s and Forever 21 announced sharp staff reductions. The sector’s cuts in 2025 are up nearly sixfold from where they were in 2024. Technology firms also listed another 14,554 in reductions, though the sector’s cuts are actually lower from a year ago.

On the upside, firms announced plans in February to hire a total of 34,580 new workers, putting the year to date total up 159% from a year ago.

Initial unemployment claims have perked up in recent weeks, particularly in Washington, D.C., with its large share of government workers.

Correction: ADP reported Wednesday that private sector hiring grew by just 77,000 in February. An earlier version misstated the day.

I have 5 income streams and make over $1 million from Amazon alone: My No. 1 advice for starting a side hustle

Published Mon, Mar 10 20259:00 AM EDT

The idea of working a traditional 9-to-5 in a corporate environment was never for me. I always wanted financial freedom and the flexibility to work on my own terms.

So, over the past two decades, while I was a student, a full-time employee, an academic researcher and a stay-at-home mom, I started a variety of side hustles.

Now I have multiple streams of passive income, which include selling card games on Amazon, creating online courses, speaking at companies about emotional intelligence, lecturing at universities and impact investing.

Whether selling goods or providing services, my No. 1 advice for anyone starting a side hustle is to develop a clear profitability plan. All too often, I see people diving into their passions without considering how and when they will turn a profit. This oversight can make or break your success.

Here are three things to keep in mind:

DON’T MISS: How to start a side hustle to earn extra money

- Know your numbers

How much are you willing to invest, and potentially lose, before becoming profitable? Knowing this requires a realistic understanding of your initial net profit margin and ways to boost your profitability.

Your net profit — calculated by subtracting expenses from sales — is the lifeblood of your side hustle. Examples of expenses include materials, labor, equipment, packaging, shipping, advertising, traveling and business subscriptions.

Your profit margin represents the percentage of each sales dollar you keep as net profit. For example, if your product or service sells for $10 and your expenses amount to $8, then your net profit is $2, resulting in a profit margin of 20%. If you’ve invested $100 upfront, then you need to sell 50 units to break even.

To fund my first card game and boost early profitability, I launched a Kickstarter campaign with a $1,500 goal. This funding covered essential expenses like product manufacturing and jump-started my sales by getting products into the hands of early adopters.

I needed to sell 60 units to break even but ended up selling over 400 units. This higher sales volume allowed me to manufacture at a reduced cost per unit, which improved my profit margin by lowering my cost of goods sold (COGS).

- Avoid common traps that can harm profitability

I found that there are three traps that can severely undermine the profitability of a side hustle:

- Underpricing your services

When I was selling handmade goods on Etsy, I made the mistake of chasing sales over tracking profit. Hoping to establish credibility, I underpriced my products aggressively and went above and beyond in customer service.

But I soon realized how difficult it was to raise prices once you’ve set a low-cost precedent. Despite making thousands of sales on Etsy over the course of five years, I ended up having to close my shop due to slim profit margins.

- Failing to accurately account for your time

That experience helped me grasp the difference between running a passion project versus a profitable business.

Recognizing the need for scalability and efficiency, especially when it came to the time I was putting into it, I pivoted to selling products on Amazon and utilized the automated Fulfillment by Amazon (FBA) service to handle logistics.

- Overlooking opportunity costs

I’ve also stumbled upon similar dilemmas when pricing my speaking and consulting services. When I first started out, I lowered my fee in hopes of securing contracts from big names like Accenture and Google.

But when they came back the following year, I had to raise my fees significantly because my opportunity costs — the cost of what I could have been doing and earning with my time — outweighed what I was charging. I learned the importance of valuing my work from the start.

- Begin with the end in mind, and put yourself first

Over the years, I’ve developed a more expansive definition of profitability. It isn’t just about money. Profitability is also about how this venture affects your quality of life. Your physical and mental well-being come first.

To see if your side hustle is truly profitable, ask yourself:

- How much money am I willing to invest in my side hustle?

- How much time am I prepared to dedicate to my side hustle?

- Is my goal to make my side hustle into my main hustle?

- At which point do I pivot if the reality is not matching my answers to these questions?

It’s been exhilarating to see my hard work pay off. But this process has also required me to have a very clear understanding of what I value the most, and to get comfortable with saying “no.” Without that foundation, none of my success would have been possible.

Dr. Jenny Woo is a Harvard-trained educator, EQ researcher, and founder/CEO of Mind Brain Emotion. She created a series of educational card games and mental health tools to help kids and adults develop human skills in the age of AI. Her award-winning card games, the 52 Essential Coping Skills, 52 Essential Relationship Skills, and 52 Essential Conversations are used in 50+ countries. Follow her on LinkedIn, YouTube, and Instagram.

Here’s how tariffs will hit the U.S. housing market

Published Tue, Mar 4 20251:29 PM ESTUpdated Tue, Mar 4 20253:16 PM EST

Diana Olick@in/dianaolick@DianaOlickCNBC@DianaOlick

Key Points

- Lumber, gypsum for drywall and home appliances are expected to be impacted by tariffs on Canada, Mexico and China.

- The new tariffs could increase builder costs anywhere from $7,500 to $10,000 per home, said Rob Dietz, chief economist at the National Association of Home Builders, citing estimates from U.S. homebuilders.

- The greatest impact to homebuilders will be from lumber cost increases, which are expected to total about $4,900 per home on average, according to Leading Builders of America.

From lumber to drywall to appliances to finishings, much of what goes into a U.S. home comes from outside American borders.

The cost of those products is about to go up, as President Donald Trump’s administration imposes tariffs on China, Mexico and Canada. Goods from China are now subject to a 20% tax, an increase from a previous 10% tax, and those from Canada and Mexico face a 25% tax. Canadian lumber was already subject to separate duties of 14.5%.

The new tariffs could increase builder costs anywhere from $7,500 to $10,000 per home, said Rob Dietz, chief economist at the National Association of Home Builders, citing estimates from U.S. homebuilders. Last year the NAHB estimated that every $1,000 increase in the median price of a new home prices out roughly 106,000 potential buyers.

The greatest impact to homebuilders will be from lumber cost increases, which are expected to total about $4,900 per home on average, according to Leading Builders of America, the trade group representing most of the nation’s publicly traded homebuilders.

Roughly a third of the lumber used in U.S. homebuilding comes from Canada, and domestic lumber producers are expected to raise their prices to match the imported supply.

“Since Trump first imposed the tariffs on Feb. 1, which were then delayed, we’ve seen some increase in buying with prices for Western Spruce-Pine-Fir two-by-fours increasing 13%,” said Paul Jannke, principal at Forest Economic Advisors. “With the re-imposition of the 25% tariff on Canadian goods shipped to the U.S., we expect Canadian producers will stop shipping lumber to the U.S. Meanwhile, dealers, who have been hesitant to buy given uncertainty around the tariffs, will need to step up purchases ahead of the coming building season. This will drive prices higher.”

Lumber futures are up 5% in the past week and were rising steadily Tuesday.

Trump on Saturday issued an executive order to increase domestic lumber production through a streamlining of regulatory and permitting processes. The homebuilding industry took that as a win.

“A stable and affordable supply of lumber is critically important for our industry to address the country’s housing supply crisis,” wrote Ken Gear, CEO of the LBA, in a statement. “The domestic lumber industry cannot meet current demand, so we applaud President Trump for exploring opportunities to increase domestic supply as a long term solution.”

The NAHB, which represents small to mid-sized private builders, “welcomed” the move, but said in a statement, “Any additional tariffs on lumber could further increase the cost of construction and discourage new development, and consumers end up paying for the tariffs in the form of higher home prices.”

As for ramping up domestic production immediately, that’s easier said than done. Jannke estimates it would take up to three years to build multiple new mills. He explained that there are a limited number of companies that manufacture sawmill machinery and even fewer, perhaps one or two, that can build a mill top to bottom.

High demand during the first years of the Covid-19 pandemic, when homebuilders were going gangbusters, had lumber producers rushing to expand.

“However, so many folks wanted to build [or] expand mills, that the lead times from equipment manufacturers moved out to two years,” Jannke said. “On top of that, once a mill was built, labor had to be found to operate the mill. These mills are in rural areas that tend not to have the skilled labor force needed to operate a modern sawmill. This added another year before the mill was operating at full capacity.”

The labor force, from logging to hauling, is already lean and decreasing. Opening up new land and deregulating the industry is one thing, but finding the workers to bring U.S. lumber to market is another.

“In the short term it is going to be very volatile from a pricing perspective,” said Kyle Little, chief operating officer at Melville, New York-based Sherwood Lumber. As for increasing production, “that won’t be a flip of a switch. You’re taking a 40-year supply chain and trying to switch overnight – that’s hard.”

Homebuying landscape

Beyond lumber, the homebuilding industry is subject to rising costs across the sector.

China is the market leader in household appliances. And, the majority of drywall, or gypsum, used in both commercial and residential construction is imported from other countries. In 2023, the U.S. imported $215 million in gypsum, becoming the largest importer of the product in the world, according to OEC World, a trade data platform. It primarily comes from Spain, Mexico and Canada.

“Rising costs due to tariffs on imports will leave builders with few options. They can choose to pass higher costs along to consumers, which will mean higher home prices, or try to use less of these materials, which will mean smaller homes,” said Danielle Hale, chief economist at Realtor.com.

Hale noted that while new construction will see the biggest impact, tariffs will change the landscape of the housing market overall, including existing homes.

“We may see buyers’ willingness to pay rise for existing homes as newly built homes get pricier, which would mean rising prices for existing homes, too. We may also see a lower appetite for major remodeling projects that would rely on these tariff affected inputs, hamstringing the ability of consumers to remake their homes to fit their current needs,” she added.

While costs for home construction will certainly rise, the Trump administration is touting lower mortgage interest rates in the past few weeks. The average rate on the 30-year fixed hit its most recent high of 7.26% on Jan. 13, according to Mortgage News Daily. It is now down to about 6.64%.

“I think thus far, one of the biggest wins for the American people is since Election Day, and since Inauguration, mortgage rates have come down dramatically,” said Treasury Secretary Scott Bessent in an interview Tuesday on Fox News.

Bessent noted the spread between the 10-year Treasury and mortgage rates narrowed, though that spread has in fact widened significantly since Trump took office.

The tariffs come at a time when the U.S. housing market is already under pressure. Signed contracts on existing homes dropped to the lowest level on record in January, according to the National Association of Realtors. Sales of newly built homes fell 10% in January, compared with December, according to the U.S. Census. And prices are still stubbornly high, with the inventory of homes for sale still historically low.

HI Financial Services Mid-Week 06-24-2014