HI Market View Commentary 03-03-2025

February -1.89 and now we are down roughly -0.50

Trading/Investing is ……. A PROCESS !!!

I can never with any true accuracy tell you “exactly” what the market is going to do.

Stocks go down and up on their own accord and there is “NOTHING” I can do to speed up the process of when they will move in the direction we want them to.

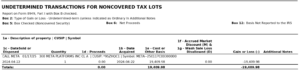

TAXES and 1099 Misc

IF you have a taxable accounts this section has to be LINE ITEM INPUTTED

NVDA – HOLY CRAP NVDA!!!

BTO NVDA $121.15 = Cost Basis = RISK

BTO 04Apr25 $127 Long Put = 10.25

New Cost BASIS the trade = $121.15 + 10.25 = $131.40

New RISK in the trade (protective put) $131.40 – Right to sell $127 = $4.40 or 3.35% TIC

STO 20Jun25 $145 Short Call = 9.00

Overall Risk until the long put expires = 4.40 -9.00 = $-4.60 the worst you can do is make a CREDIT of $4.60

Earnings dates:

DG 03/13 est BMO

MU 03/19 est AMC

TGT 03/11 BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 28-Feb-25 14:11 ET | Archive

Growth monster now more menacing than inflation bogeyman

The month of February started well for the stock market, but it didn’t end well. The month of February started poorly for the Treasury market, but it ended well — really well!

The reason February ended the way that it did for the stock market and the Treasury market was one in the same: growth concerns.

Distracted

The 10-yr note yield will be our guide for today’s discussion. It started the month at 4.55%, climbed to 4.63% by February 12, and stood at 4.22% as of this writing.

The 10-yr note yield is sensitive to inflation pressures and it responded accordingly when the preliminary University of Michigan Consumer Sentiment Index for February, released February 7, registered a big jump in year-ahead inflation expectations to 4.3% from 3.3%. That was the highest rate since November 2023 and only the fifth time in 14 years that there has been such a large one-month increase. The 10-yr note yield settled five basis points higher that day at 4.49%.

That was the same day the January employment report registered a larger-than-expected 0.5% month-over-month increase in average hourly earnings that resulted in a 4.1% year-over-year increase.

These reports followed on the heels of an ISM Manufacturing PMI that revealed an uptick in the Prices Index to 54.9% from 52.5%, reflecting an acceleration in prices from December, and an ISM Services PMI that saw the Prices Index decelerate to a still lofty 60.4% from 64.4% in December.

These reports all preceded the January Consumer Price Index on February 12 that showed total CPI bumping up to 3.0% year-over-year from 2.9% in December, and core CPI bumping up to 3.3% year-over-year from 3.2% in December.

And then, the inflation angst eased with the release of the January Producer Price Index on February 13 that featured some component breakdowns that left the market with an impression the January PCE Price Index wouldn’t ring any new inflation alarm bells. That was right. The PCE Price Index moderated to 2.5% year-over-year from 2.6% in December while the core PCE Index slipped to 2.6% year-over-year from 2.9% in December.

Good news to be sure, but still not “good” relative to the Fed’s 2.0% inflation target. By then, however, the Treasury market had been readily distracted by growth concerns wrapped up in disappointing retail sales in January, a slate of weak housing market data, weakening consumer confidence readings, President Trump’s tariff push, and his administration’s efforts to cut government spending.

A Directional Message

The stock market found itself distracted by those same factors, and as stock prices got rolled back in the latter half of February as it questioned the viability of achieving higher earnings growth projections in a slowing economy, the Treasury market rallied on some safe-haven positioning.

The gains in the Treasury market were presumably driven by some short-covering activity among participants who had been expecting lower prices (and higher yields) based on a belief that new tariffs will invite new inflation pressures that keep the inflation rate comfortably above the 2.0% target.

They could ultimately be right. Tariffs for Canada and Mexico are slated to go into effect March 4, an additional 10% tariff on imported goods from China will also take effect that day, the president has lobbed the idea of the EU soon facing a tariff in the neighborhood of 25%, and reciprocal tariffs for others are being implemented on a case-by-case basis beginning April 2.

Based on the 10-yr note’s behavior, though, we’d argue that the Treasury market isn’t living in fear of inflation heating up so much as it is existing on a belief that growth is primed to slow down because of the tariffs, the tariff uncertainty, government spending cuts that will include job losses for thousands of federal workers, and possibly a global trade war with the U.S. fighting on all fronts.

That is the message of the inflation-sensitive 10-yr note’s direction, the flattening of the 2yr note-10-yr note spread, and the renewed inversion of the spread between the 10-yr note (yielding less) and 3-month T-bill (yielding more), which the Fed reportedly monitors closely as an economic gauge.

The prior inversion, as we all know, was a red herring for the U.S. economy, which never acquiesced to the recession monster. Will the second time be the charm? Let’s hope not, yet the Atlanta Fed’s GDPNow model estimate for Q1 real GDP took a negative turn in the wake of a large widening in the International Trade in Goods deficit and 0.5% decline in real personal spending reported for January.

Specifically, the model cut the Q1 real GDP growth estimate from 2.3% to -1.5%.

What It All Means

The growth concerns are running ahead of the growth promises linked to deregulation and lower tax rates. One important reason why is that the latter have not come to fruition yet in the forceful manner that they have been advertised.

They might, but the GOP-controlled Congress has a big weight on its shoulders to work out a tax plan that won’t increase the deficit — or at least creates an impression that it won’t increase the deficit. Ten years is a long projection horizon when anything can happen. There is some heavy lifting still to do there in the coming months.

In the meantime, the weight of economic evidence of late, as seen via the Citi Economic Surprise Index, has not been on the side of a stronger growth outlook. That could be because economists simply got overly optimistic with their forecasts, or it could mean the economy is hitting a wall for a variety of reasons.

We will know more in time, but the direction of the 10-yr note yield suggests that there is a growth monster now that is more menacing than the inflation bogeyman.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end March 2025?

03-03-2025 -1.5%

Earnings:

Mon: MTN,

Tues: DKS, KSS,

Wed: AEO,

Thur: DG, DOCU, ULTA,

Fri:

Econ Reports:

Mon: ISM Manufacturing, Construction Spending, SP Global US Manufacturing PMI

Tue

Wed: MBA, ADP Employment, ISM Services, Factory Orders,

Thur: Initial Claims, Continuing Claims, Trade Balance, Productivity, Unit Labor Costs, Wholesale Inventory,

Fri: Average Workweek, Non-Farm Payroll, Private Payrolls, Hourly Earnings, Unemployment Rate, Consumer Credit,

How am I looking to trade?

Now we are protecting for technical crossovers to the downside AND tariff risk.

XYZ – Took off $88 puts and letting it run because way over sold

VZ – Puts are on and the stock was up today

NVDA – Collared or in a bull put with short call protection against the long 34% protection M

MU – $107 Puts

META – 700 Puts Spreads have 50% roughly short call protection

GOOGL – 180 Puts and “sprinkled 170 puts

F – 9.35 Puts

DIS – NO Protection

BIDU – $87 Puts

BAC – $45 puts

AAPL – 260 Short call

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

NVDA unfairly punished BUT it is your buying opportunity and maybe we can add more shares

Gas prices are expected to move higher by $0.043

Ford Trucks coming from Mexico 83K-100K, 122K – 135K

2025 – US Based sales $117.90, Overseas (Mexico) $970

Warren Buffett calls Trump’s tariffs a tax on goods, says ‘the tooth fairy doesn’t pay ‘em’

Published Sun, Mar 2 202512:28 PM ESTUpdated 4 Hours Ago

Legendary investor Warren Buffett made a rare comment on President Donald Trump’s tariffs, saying punitive duties could trigger inflation and hurt consumers.

“Tariffs are actually, we’ve had a lot of experience with them. They’re an act of war, to some degree,” said Buffett, whose conglomerate Berkshire Hathaway has large businesses in insurance, railroads, manufacturing, energy and retail. He made the remarks in an interview with CBS News’ Norah O’Donnell for a new documentary on the late publisher of The Washington Post, Katharine Graham.

“Over time, they are a tax on goods. I mean, the tooth fairy doesn’t pay ’em!” Buffett said with a laugh. “And then what? You always have to ask that question in economics. You always say, ‘And then what?’”

This marks the first public remark from the 94-year-old “Oracle of Omaha” on Trump’s trade policies. Last week, Trump announced that the sweeping 25% tariffs on imports from Mexico and Canada will go into effect March 4 and that China will be charged an additional 10% tariff on the same date. China has vowed to retaliate.

During Trump’s first term, the Berkshire chair and CEO opined at length in 2018 and 2019 about the trade conflicts that erupted, warning that the Republican’s aggressive moves could cause negative consequences globally.

When asked about the current state of the economy by CBS, Buffett refrained from commenting on it directly.

“Well, I think that’s the most interesting subject in the world, but I won’t talk, I can’t talk about it, though. I really can’t,” Buffett said.

Buffett has been in a defensive mode over the past year as he rapidly dumped stocks and raised a record amount of cash. Some read Buffett’s conservative moves as a bearish call on the market and the economy, while others believe he’s preparing the conglomerate for his successor by paring outsized positions and building up cash.

Market volatility has ramped up as of late as concerns grew about a slowing economy, unpredictable policy changes from Trump as well as overall stock valuations. The S&P 500 is up just about 1% this year.

- Rowe Price: Stay invested in AI as more opportunities ahead for U.S. and China

Thomas Poullaouec, head of multi-asset solutions, Asia Pacific at T. Rowe Price remains bullish on China’s strong performance, with the second half of 2025 looking promising for tech stocks in China, Korea and Taiwan.

Nvidia sales grow 78% on AI demand, company gives strong guidance

Published Wed, Feb 26 202512:00 PM EST

Updated Thu, Feb 27 20251:35 PM EST

Key Points

- Nvidia reported fourth-quarter earnings after the bell on Wednesday that beat Wall Street expectations.

- The company’s revenue in the quarter rose 78%, and full fiscal-year revenue for Nvidia rose 114% to $130.5 billion.

- Nvidia said it expected about $43 billion in first-quarter revenue, plus or minus 2%, versus $41.78 billion expected per LSEG estimates.

Nvidia reported fiscal fourth-quarter earnings after the bell on Wednesday that beat Wall Street expectations. The company also provided strong guidance for the current quarter.

The company’s report and guidance signals that the chipmaker is confident it will be able to continue its historic run of growth driven by artificial intelligence well into 2025. Shares were flat in extended trading.

Here’s how the company did, compared with estimates from analysts polled by LSEG:

- Revenue: $39.33 billion vs. $38.05 billion estimated

- Earnings per share: 89 cents adjusted vs. 84 cents estimated

Nvidia said it expected about $43 billion in first-quarter revenue, plus or minus 2%, versus $41.78 billion expected per LSEG estimates. The first-quarter forecast implies year-to-year growth of about 65% from a year earlier, a slowdown from 262% annual growth in the same period a year prior.

Chief Financial Officer Colette Kress said the company expects “a significant ramp” of sales of Blackwell, its next-generation AI chip, in the first quarter.

Net income during the quarter rose to $22.09 billion, or 89 cents per diluted share, versus $12.29 billion, or 49 cents per share, in the year-ago period.

Nvidia reported a 73% gross margin in the quarter, which was down three points on an annual basis. The company said the decline in gross margin was due to newer data center products that were more complicated and expensive.

Revenue continues to surge at Nvidia as the company rides the AI boom with its data center graphics processing units, or GPUs, which comprise the vast majority of the market for AI accelerators. Nvidia’s revenue in the quarter rose 78% from $35.1 billion, and full fiscal-year revenue for Nvidia rose 114% to $130.5 billion.

However, Nvidia’s growth is slowing as the company becomes larger. During the fourth-quarter of fiscal 2024, Nvidia sales more than tripled.

Much of the focus this calendar year is on how quickly the company can ship its next-generation AI processors, called Blackwell.

Nvidia beats on revenue and earnings, data center revenue beats

Nvidia said it had $11 billion in Blackwell revenue during the fourth quarter. Nvidia CEO Jensen Huang said demand for Blackwell is “amazing” in a statement, and Kress called it “the fastest product ramp in our company’s history.”

“Blackwell sales were led by large cloud service providers which represented approximately 50% of our Data Center revenue,” Kress said in a statement.

Blackwell sales, as well as sales of the previous generation Hopper AI chips, are reported in the company’s data center business. That unit now represents 91% of the company’s total sales, up from 83% a year ago and 60% in the same period of 2023. In total, data center revenue has increased about tenfold over the past two years.

Nvidia said it had $35.6 billion in data center revenue in the fourth quarter, which was up 93% on an annual basis. That also surpassed StreetAccount expectations of $33.65 billion.

Nvidia officials told investors that while its chips were previously used to develop, or train, artificial intelligence, its new chips such as Blackwell would be used to deliver AI software, a process often called inference.

Kress also addressed investor concerns that efficient models such as DeepSeek’s R1 may limit the need for additional Nvidia chips. New ways of running AI models that ask the AI to generate additional information to “think” through responses could require as much as 100 times the amount of Nvidia chips, she said.

“Long-thinking, reasoning AI can require 100 times more compute per task compared to one shot inferences,” Kress said.

“The vast majority of our compute today is actually inference,” Huang told investors. He said next-generation AI algorithms could even need millions of times the current amount of computing capacity.

Huang also addressed questions about whether Nvidia’s business could be threatened by custom chips being developed by technology companies such as Amazon, Microsoft and Google.

“Just because the chip is designed doesn’t mean it gets deployed,” Huang said.

The company’s data center business this quarter also included $3 billion in sales for the company’s networking parts, which are used to connect hundreds of thousands of GPUs together. However, while Nvidia had signaled that networking was a growth opportunity for the company, networking sales were down 9% from a year ago.

The company’s gaming business, which includes graphics processors for playing 3D games, reported $2.5 billion in sales versus StreetAccount expectations of $3.04 billion. Nvidia’s graphics sales actually declined 11% on an annual basis. The company announced new graphics cards for consumers during the quarter that share the same Blackwell architecture as the company’s AI chips.

One of the company’s growth categories is its business selling chips for cars and robots. Nvidia said on Wednesday that it had $570 million in automotive sales during the quarter, which is a small fraction of the company’s AI business, but which represents a 103% rise on a year-over-year basis.

Nvidia said it spent $33.7 billion on share repurchases in its fiscal 2025.

These S&P 500 stocks are deeply oversold and may be due for a rebound

Published Sat, Mar 1 20258:14 AM EST

In this article

The S&P 500 may have just notched its second down week in a row, but there’s good news for investors: plenty of companies are oversold and due for a rally on a technical basis.

The 500-stock benchmark slipped 1% this week, while the tech-heavy Nasdaq Composite plunged 3.5%. The blue-chip Dow Jones Industrial Average was the best-performing index on the week, registering a gain of 1%.

Additional tariff promises from the Trump administration have rattled investors in recent days, alongside signs of a potential economic softening. AI poster child Nvidia fell 8.5% on Thursday, in the wake of its latest earnings report, further trampling the market’s optimism to start the new year.

Against this background, CNBC Pro used its stock screener tool to identify the most oversold and overbought stocks on Wall Street as measured by their 14-day relative strength index, or RSI.

Stocks with a 14-day RSI below 30 are considered oversold, which indicates that a potential rebound may be on the horizon. Conversely, a reading above 70 signals that a stock is overbought, meaning that shares might soon be due for a pullback.

WALL STREET’S MOST OVERSOLD STOCKS

| Symbol | Company | RSI | Analyst Consensus | Upside to avg PT (%) |

| TFX | Teleflex Inc | 18 | Hold | 62 |

| VTRS | Viatris Inc | 23 | Hold | 68 |

| TECH | Bio-Techne Corp | 24 | Buy | 40 |

| CE | Celanese Corp | 24 | Hold | 38 |

| SWKS | Skyworks Solutions Inc | 25 | Hold | 13 |

| TSLA | Tesla Inc | 25 | Hold | 21 |

| PYPL | PayPal Holdings Inc | 26 | Buy | 34 |

| DECK | Deckers Outdoor Corp | 26 | Buy | 60 |

| LW | Lamb Weston Holdings Inc | 26 | Hold | 34 |

| NTAP | NetApp Inc | 27 | Hold | 32 |

Source: CNBC Pro Stock Screener

Electric vehicle maker Tesla, with an RSI of 18, is among the most oversold stocks on Wall Street.

Shares ended the week 13% lower, with Tesla sinking 8% on Tuesday alone. Following Friday’s close, the stock has now fallen 40% from its record closing high on Dec. 17 of $479.86.

This move lower followed a Monday report from Reuters that said Tesla’s autopilot software upgrades in China left owners disappointed. Barclays analyst Dan Levy said in a Wednesday note that Tesla’s sell-off may also be caused by a reversal of technical factors that drove the previous rally.

“Our best explanation is that there is an unwind of the powerful run that it had last fall post the U.S. elections, which reflected a combination of sharp euphoria and technical factors — with fundamentals largely dismissed,” he wrote. “Bitcoin has also traded down since mid-December, and has largely mirrored Tesla’s decline in the last month. We believe this may reflect a general pull-back from speculative assets/Trump beneficiaries.”

However, on Thursday, Morgan Stanley reiterated its overweight rating on Tesla, with analyst Adam Jonas saying that it was the original equipment manufacturer that would most likely “help ‘transplant’ a Chinese EV maker into the U.S.”

Similarly, investors are overwhelmingly bearish around PayPal. The financial payments stock ended the week 5.2% lower following its first investor day in four years, and is now down 17% on the year.

At the investor day, CEO Alex Chriss laid out a turnaround strategy at the company that would see payments app Venmo topping $2 billion in revenue by 2027. This compares to PayPal’s last annual revenue estimate for Venmo in 2021 of around $900 million.

WALL STREET’S MOST OVERBOUGHT STOCKS

| Symbol | Company | RSI | Analyst Consensus | Up/downside to avg PT (%) |

| T | AT&T Inc | 86 | Buy | -2 |

| BRO | Brown & Brown Inc | 81 | Hold | -1 |

| ICE | Intercontinental Exchange Inc | 79 | Buy | 12 |

| ABBV | AbbVie Inc | 78 | Buy | 1 |

| GILD | Gilead Sciences Inc | 78 | Buy | -5 |

| PM | Philip Morris International Inc | 78 | Buy | -4 |

| EVRG | Evergy Inc | 78 | Buy | -2 |

| VZ | Verizon Communications Inc | 78 | Buy | 8 |

| LNT | Alliant Energy Corp | 77 | Buy | -1 |

| EXC | Exelon Corp | 77 | Buy | 1 |

Source: CNBC Pro Stock Screener

On the other hand, Philip Morris International made the list of overbought stocks, with an RSI of 78. Year to date, the tobacco giant has surged 29%.

The stock rallied 19% this month after the Marlboro owner reported its fourth-quarter results had exceeded analyst expectations, boosted by sales of its Zyn nicotine pouches, which are especially popular with younger populations.

In January, Morgan Stanley initiated Philip Morris at an overweight rating, citing the smoke-free product as a major catalyst.

“We see continued upside for PMI’s stock as its reduced-risk smoke-free portfolio drives stronger than expected LT sales and earnings growth and becomes an even larger percentage of the mix, which should drive upward re-rating for the stock,” the firm wrote.

Biopharma stock Gilead Sciences also clocked an RSI of 78.

Shares popped 18% this month after Gilead posted a fourth-quarter earnings and revenue beat earlier in February. Last week, Deutsche Bank upgraded the name to a buy rating from hold.

“We’re upgrading GILD to a Buy and raising our DCF-based PT to $120 — our upgrade is based on GILD life cycle managing its core HIV treatment franchise to yield steady revenue growth deep into to the 2030s,” the bank said.

Shares of Gilead Sciences are now up 24% on the year.

— CNBC’s Fred Imbert contributed to this report.

Jamie Dimon calls U.S. government ‘inefficient’ and says Elon Musk’s DOGE effort ‘needs to be done’

Published Mon, Feb 24 20252:46 PM ESTUpdated Mon, Feb 24 20253:41 PM EST

Key Points

- JPMorgan Chase CEO Jamie Dimon on Monday said the U.S. government is inefficient and in need of work as the Trump administration terminates thousands of federal employees.

- Dimon was asked by CNBC’s Leslie Picker whether he supported efforts by Elon Musk’s Department of Government Efficiency.

- “The government is inefficient, not very competent, and needs a lot of work,” Dimon told Picker. “It’s not just waste and fraud, its outcomes.”

In this article

JPMorgan CEO Jamie Dimon: Consumers are back, almost normal

JPMorgan Chase CEO Jamie Dimon on Monday said the U.S. government is inefficient and in need of work as the Trump administration terminates thousands of federal employees and works to dismantle agencies including the Consumer Financial Protection Bureau.

Dimon was asked by CNBC’s Leslie Picker whether he supported efforts by Elon Musk’s advisory body, the Department of Government Efficiency. He declined to give what he called a “binary” response, but made comments that supported the overall effort.

“The government is inefficient, not very competent, and needs a lot of work,” Dimon told Picker. “It’s not just waste and fraud, it’s outcomes.”

The Trump administration’s effort to rein in spending and scrutinize federal agencies “needs to be done,” Dimon added.

“Why are we spending the money on these things? Are we getting what we deserve? What should we change?” Dimon said. “It’s not just about the deficit, its about building the right policies and procedures and the government we deserve.”

Dimon said if DOGE overreaches with its cost-cutting efforts or engages in activity that’s not legal, “the courts will stop it.”

“I’m hoping it’s quite successful,” he said.

In the wide-ranging interview, Dimon also addressed his company’s push to have most workers in office five days a week, as well as his views on the Ukraine conflict, tariffs and the U.S. consumer.

Nvidia CEO Huang says AI has to do ‘100 times more’ computation now than when ChatGPT was released

Published Wed, Feb 26 20257:16 PM ESTUpdated Thu, Feb 27 202511:05 AM EST

Key Points

- Nvidia CEO Jensen Huang said next-generation AI will need 100 times more compute than older models as a result of new reasoning approaches that think “about how best to answer” questions step by step.

- Huang spoke with CNBC’s Jon Fortt following the chipmakers quarterly earnings report on Wednesday.

- Nvidia reported a 78% increase in sales from a year earlier and a 93% jump in data center revenue.

In this article

Nvidia CEO Huang: DeepSeek incident underscored the substantial demand for AI compute power

Nvidia CEO Jensen Huang said next-generation AI will need 100 times more compute than older models as a result of new reasoning approaches that think “about how best to answer” questions step by step.

“The amount of computation necessary to do that reasoning process is 100 times more than what we used to do,” Huang told CNBC’s Jon Fortt in an interview on Wednesday following the chipmaker’s fiscal fourth-quarter earnings report.

He cited models including DeepSeek’s R1, OpenAI’s GPT-4 and xAI’s Grok 3 as models that use a reasoning process.

Nvidia reported results that topped analysts’ estimates across the board, with revenue jumping 78% from a year earlier to $39.33 billion. Data center revenue, which includes Nvidia’s market-leading graphics processing units, or GPUs, for artificial intelligence workloads, soared 93% to $35.6 billion, now accounting for more than 90% of total revenue.

The company’s stock still hasn’t recovered after losing 17% of its value on Jan. 27, its worst drop since 2020. That plunge came due to concerns sparked by Chinese AI lab DeepSeek that companies could potentially get greater performance in AI on far lower infrastructure costs.

Huang pushed back on that idea in the interview on Wednesday, saying DeepSeek popularized reasoning models that will need more chips.

“DeepSeek was fantastic,” Huang said. “It was fantastic because it open sourced a reasoning model that’s absolutely world class.”

Nvidia CEO Huang: Revenue in China before export controls was twice as high as it is now

Nvidia has been restricted from doing business in China due to export controls that were increased at the end of the Biden administration.

Huang said that the company’s percentage of revenue in China has fallen by about half due to the export restrictions, adding that there are other competitive pressures in the country, including from Huawei.

Developers will likely search for ways around export controls through software, whether it be for a supercomputer, a personal computer, a phone or a game console, Huang said.

“Ultimately, software finds a way,” he said. “You ultimately make that software work on whatever system that you’re targeting, and you create great software.”

Huang said that Nvidia’s GB200, which is sold in the United States, can generate AI content 60 times faster than the versions of the company’s chips that it sells to China under export controls.

Nvidia CEO Huang: Across the world, AI has become better as a result of the last several months

Nvidia counts on billions of dollars of infrastructure spend annually from the largest tech companies in the world for an outsized amount of its revenue. The company has been the biggest beneficiary of the AI boom, with revenue more than doubling in five straight quarters through mid-2024 before growth decelerated slightly.

Apple to open AI server factory in Texas as part of $500 billion U.S. investment

Published Mon, Feb 24 20257:28 AM ESTUpdated Mon, Feb 24 202511:17 AM EST

Key Points

- Apple said it will work with partners to open a 250,000-square-foot AI server manufacturing facility in Houston.

- The new factory, which is slated to open in 2026, will form part of a $500 billion investment in the U.S. over the next four years.

- In addition to the new Texas facility, Apple said it also plans to hire around 20,000 employees across the U.S. over the period.

In this article

Apple plans to open a new factory for artificial intelligence servers in Texas as part of a $500 billion investment in the U.S., the company said Monday.

The U.S. technology giant said it would work with partners to launch a 250,000-square-foot server manufacturing facility in Houston to produce servers for Apple Intelligence, its AI personal assistant for iPhone, iPad and Mac computers.

The new factory, which is slated to begin operations in 2026, will form part of a major investment plan Apple is committing to over the next four years. In addition to the new Texas facility, Apple said it also plans to hire around 20,000 new employees across the U.S.

Most of the new hires will be focused on research and development, or R&D, silicon engineering, software development, and AI and machine learning, Apple said.

“We are bullish on the future of American innovation, and we’re proud to build on our long-standing U.S. investments with this $500 billion commitment to our country’s future,” Apple CEO Tim Cook said in a statement Monday.

The move comes after Apple’s chief executive met with President Donald Trump last week.

The iPhone maker faces pressure from the Trump administration over where it chooses to manufacture its products. Apple assembles most of its products in China.

Earlier this month, Trump signed an order imposing long-threatened 10% tariffs on Chinese goods on top of existing tariffs of up to 25% levied during his first presidency.

Apple said its $500 billion investment plan will include work with suppliers across the U.S. and production of content for its Apple TV+ media streaming service in 20 states, as well as new hires and research and development spending.

Apple said it “remains one of the largest U.S. taxpayers, having paid more than $75 billion in U.S. taxes over the past five years, including $19 billion in 2024 alone.”

The tech giant also said it would double its U.S. Advanced Manufacturing Fund to $10 billion from $5 billion currently, create a new manufacturing academy in Michigan, and grow its R&D investments in the U.S. to support cutting-edge fields such as silicon engineering.

How to produce income from Nvidia while waiting for a rebound

Published Fri, Feb 28 202511:16 AM ESTUpdated Fri, Feb 28 20253:38 PM EST

Volatility has returned as the Magnificent 7′s valuation is finally repricing.

I want to embrace the volatility and produce income based upon the higher premiums investors are now paying for downside protection. I want to use options on the crown jewel of the Mag 7, Nvidia (NVDA).

Nvidia, the leader in the AI chip space, has been the backbone of the Mag 7′s performance over the past couple of years, with its stock surging nearly 1,800% over five years due to the AI boom. The “repricing” of the Mag 7 reflects the market reassessing their valuations which in turn is creating opportunity on the high beta stock Nvidia. NVDA had its worst post earnings reaction since August 22, dropping roughly 9% intraday which erased nearly $350 billion in market cap on the day. For perspective, Johnson & Johnson (JNJ) is a $350 billion market cap company.

With NVDA nearly 20% off its all-time highs, I want to use options to express a bullish view after what looks like a post earnings shake out.

The trade

Selling a put spread in the high-flying name will produce an income stream and also potentially establish a long position in Nvidia. However, I want to define my risk in this trade in the event further liquidation of the GPU chip making King turns lower.

Trade (Selling a put spread):

- Sold the 3/21/2025 $118 put for $6.50

- Bought the 3/21/2025 $110 put for $3.50

- This spread was established when NVDA was roughly trading $118

- An investor will collect $3 or $300 per one put spread (collecting 2.5% over the next 21 days or 43% annualized)

- An investor risks being “put” to NVDA or owning the stock at $115

DISCLOSURES: (Jeff owns the spread.)

All opinions expressed by the CNBC Pro contributors are solely their opinions and do not reflect the opinions of CNBC, NBC UNIVERSAL, their parent company or affiliates, and may have been previously disseminated by them on television, radio, internet or another medium.

THE ABOVE CONTENT IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY. THIS CONTENT IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSITUTE FINANCIAL, INVESTMENT, TAX OR LEGAL ADVICE OR A RECOMMENDATION TO BUY ANY SECURITY OR OTHER FINANCIAL ASSET. THE CONTENT IS GENERAL IN NATURE AND DOES NOT REFLECT ANY INDIVIDUAL’S UNIQUE PERSONAL CIRCUMSTANCES. THE ABOVE CONTENT MIGHT NOT BE SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES. BEFORE MAKING ANY FINANCIAL DECISIONS, YOU SHOULD STRONGLY CONSIDER SEEKING ADVICE FROM YOUR OWN FINANCIAL OR INVESTMENT ADVISOR.

Click here for the full disclaimer.