HI Market View Commentary 12-09-2024

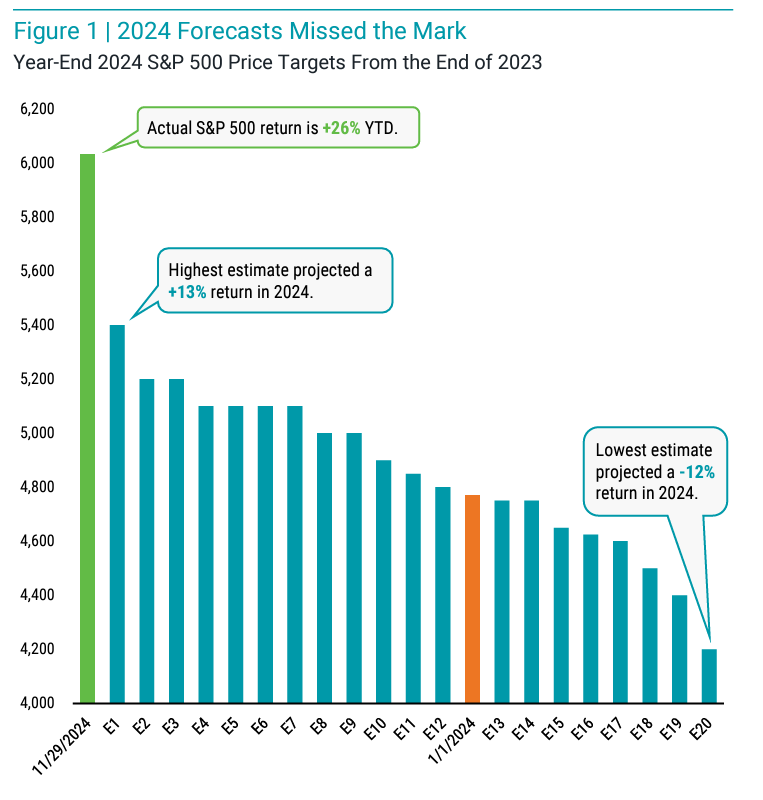

So who can remember the estimates for last year let alone this year?

What is so important on the estimates? Because the big guys base their models on these estimates

Because when they hit year end estimates lot’s of people are churned in their funds and go to treasuries or fixed income

Oppenheimer Predicts S&P 500 to Hit 7,100 by 2025 Amid AI and Economic Growth

Nauman khan

Mon, December 9, 2024 at 10:41 AM MST 1 min read

In This Article:

The S&P 500 is forecast to reach 7,100 by the end of 2025, according to Oppenheimer, a 16.7% increase from the last close of 6,090 and a 14.52% increase from the firm’s 2024 year-end target of 6,200. This is supported by a sustainable monetary policy, a still robust economic environment, and favorable labor markets.

S&P 500 earnings are projected to grow 10 percent to $275 in 2025 and $250 in 2024, which would make a forward price-to-earn (P/E) multiple of 25.8x. Equities are critical to long-term financial goals like retirement savings and education funding, and private investor engagement across demographic groups is a driving force, said Oppenheimer, who highlighted that.

Oppenheimer’s key sectors include information technology, consumer discretionary, industrials, financials, and communication services. The firm also pointed to further rallies in smalland mid-cap stocks as the Federal Reserve continues its rate-cutting trajectory.

The automobile is an apt analogy, he said, with AI being the next transformative force. “This technology could drive efficiency and productivity improvements across all sectors and contribute to solving some of the world’s challenges,” said Oppenheimer’s strategists.

Its outlook agrees with broader market sentiment as it sees sector rebalancing and rising economic activity encouraging a continuation of the bull market in 2025. The strategists warn that economic utopia is overstated, but a sound market foundation supports AI’s growth potential and equity markets.

This article first appeared on GuruFocus.

So we closed today at 6052 = 1048 points away or 17.32% return

Possible because of Pro America, Less Regulations, AI, Tax relief again, Fixes problems with the three wars going on

NOT Possible = Tariffs

We just did something that only happened 4 times now since the start of the stock market?=Back to back 20%+ returns

My Expectation for the S&P 500 for 2025 would be a single digit growth year 5-9% range

I do think there are a bunch (25) with 25% plus growth going into next year

The S&P 500 Is Set for Back-to-Back 20% Gains. What History Says Happens Next.

Story by Ian Salisbury

The S&P 500 Is Set for Back-to-Back 20% Gains. What History Says Happens Next.© Angela Weiss/ AFP

The stock market is headed into December poised to log its second straight year of stellar returns. History offers a mixed verdict on what’s in store for next year.

In 2023, the S&P 500 finished up 24%. It’s on course for a 26% gain this year. If that holds, it will be just the fourth time in the past 100 years the index logged 20%-plus returns two years in a row, according to research from Bank of America Securities. (It’s worth noting the report looks at price returns, not total returns which include dividends, and that the report counts a multi-year streak in the late 1990s as one instance.)

The stock market’s latest run pushed market valuations into a territory that resembles the late 1990s. The S&P 500 is currently trading at about 38 times cyclically-adjusted earnings. That’s below the 1999 peak of more than 43, but higher than any other era on record and about equal to where they were in late 1998. As a result, firms like Goldman Sachs and Vanguard have been warning investors of lackluster returns in coming years.

That doesn’t mean 2025 won’t be yet another bullish year for stocks. But it seems likely a reckoning is due sooner or later.

Write to Ian Salisbury at ian.salisbury@barrons.com

Earnings dates:

MU 12/18 est

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 06-Dec-24 11:17 ET | Archive

Meet the 2025 FOMC

There are twelve voting members on the Federal Open Market Committee (FOMC): the seven members of the Board of Governors and five of the twelve Federal Reserve Bank presidents. The members of the Board of Governors are nominated by the President of the United States and are confirmed by the Senate.

The president of the Federal Reserve Bank of New York has a permanent vote on the committee, so the remaining four presidents with a vote rotate annually. They serve one-year terms beginning January 1 each year.

Other Federal Reserve bank presidents attend the FOMC meetings and contribute to the discussions, but they do not cast a vote for setting policy.

The Lineup

Whose names will you be hearing a lot throughout 2025? The seven governors are Jerome Powell (Chairman), Michael Barr, Michelle Bowman, Lisa Cook, Philip Jefferson, Adriana Kugler, and Christopher Waller.

Fed governors typically vote in unison with the Fed Chair. Fed Governor Bowman, however, shocked the world with a dissenting vote at the September FOMC meeting, preferring a smaller 25-basis points rate cut. That was the first dissent by a Fed Governor since 2005. If there is going to be dissension in the ranks, it usually originates among the voting Federal Reserve Bank presidents.

The names you’ll want to be closely acquainted with in that realm include John Williams (New York), Austan Goolsbee (Chicago), Susan Collins (Boston), Alberto Musalem (St. Louis), and Jeffrey Schmid (Kansas City).

Each FOMC member would acknowledge that they are data dependent for their interest rate position, yet the market makes a living out of reading between their speech lines when thinking about what the FOMC will do with monetary policy.

Below we feature excerpts from recent speeches/interviews from the FOMC presidents rotating into a voting position (emphasis our own) to provide some flavor for their perceived policy tilt.

Austan Goolsbee

- In a December 3, 2024, keynote conversation moderated by Crain’s Chicago Business Editor in Chief:

“I don’t view the economy as perfect by any means. The strongest thing we’ve had going in the economy has been the job market. And the weakest thing in the economy by far has been the prices… You’re never going to hear me or any other economist say tariffs are good…. Tariffs raise prices.”

- In a November 21, 2024, Q&A at the Central Indiana Corporate Partnership:

“My view is that the long arc over the last year and a half shows inflation is way down and on its way to 2 percent. Labor markets have cooled to something close to stable full employment. Things are getting close to where we want to settle on both counts. It follows that we will probably need to move rates to where we think they should settle, too. We don’t need to get to that place immediately, but if we look out over the next year or so, it feels to me like rates will end up a fair bit lower than where they are today.

That’s my view of the general path ahead. But when there’s uncertainty or disagreement about where rates will eventually settle, it may make sense to slow the pace of rate cuts as we get close.”

Susan Collins

- In a November 20, 2024, speech: Perspectives on the Economy and Monetary Policy

“I expect additional adjustments will likely be appropriate over time, to move the policy rate gradually from its current restrictive stance back into a more neutral range. However, policy is not on a pre-set path. The FOMC will need to make decisions meeting-by-meeting, based on the data available at the time and their implications for the economic outlook and the evolving balance of risks… While the final destination is uncertain, I believe some additional policy easing is needed, as policy currently remains at least somewhat restrictive…

The intent is not to ease too quickly or too much, hindering the disinflation progress to date. At the same time, easing too slowly or too little could unnecessarily weaken the labor market… All told, I see the risks to my quite favorable baseline outlook as roughly in balance. Inflation is returning sustainably, if unevenly, to 2 percent, and to date, labor market conditions are healthy overall. Policy is well-positioned to deal with two-sided risks and achieve our dual mandate goals in a reasonable amount of time. The policy adjustments made so far enable the FOMC to be careful and deliberate going forward, taking the time to holistically assess implications of the available data for the outlook and the associated balance of risks.”

Alberto Musalem

- In a December 4, 2024, appearance at the Bloomberg and Global Interdependence Center Symposium: Remarks on the U.S. Economy and Monetary Policy:

“I expect that inflation will converge to the FOMC’s 2% target and that additional easing of moderately restrictive policy toward neutral will be appropriate over time. Along this baseline path, it seems important to maintain policy optionality, and the time may be approaching to consider slowing the pace of interest rate reductions, or pausing, to carefully assess the current economic environment, incoming information and evolving outlook.

I favor a patient approach that focuses on returning inflation sustainably to 2% for several reasons: In the current environment, core PCE inflation is above target, the economy is strong and growing above its long-term potential, and the labor market is consistent with full employment. Also, the balance of risks around the price stability and maximum employment goals has shifted, and there is uncertainty about the neutral policy rate and productivity trends.”

Jeffrey Schmid

- In a November 19, 2024, speech: Longer-Term Considerations for Growth and Monetary Policy

The decision to lower rates is an acknowledgement of the Committee’s growing confidence that inflation is on a path to reach the Fed’s 2% objective—a confidence based in part on signs that both labor and product markets have come into better balance in recent months. While now is the time to begin dialing back the restrictiveness of monetary policy, it remains to be seen how much further interest rates will decline or where they might eventually settle.

I have discussed three long-term trends today: productivity, demographics, and debt. All three have implications for the long-run path of monetary policy, interest rates, and growth, but in different directions. Faster productivity growth could lead to relatively high interest rates and high growth; demographic trends point to low interest rates and slow growth; while debt dynamics suggest a combination of high interest rates and slow growth. All three factors are likely to be in effect, and the outcome for interest rates and the economy will be determined by the balance between them. As an optimist, my hope is that productivity growth can outrun both demographics and debt. But as a central banker, I will not let my enthusiasm get ahead of the data or my commitment to the Fed’s dual mandate of price stability and full employment.”

What It All Means

The newcomers to the FOMC in 2025 are largely aligned in their thinking, which is that they seem to believe more easing is needed but that the Fed can afford to be more deliberate in removing policy restraint. In sum, we would categorize this presidential grouping as being more dovish-minded than hawkish-minded.

Of course, their policy leaning is based on what they know in more current terms. That could change if future data show inflation heating up since they are also aligned with the Fed’s overarching view that policy is not on a preset course and that the risks to achieving the Fed’s dual mandate of maximum employment and price stability are roughly in balance.

That is a helpful perspective for Fed Chair Powell who works intently on building a consensus at the Fed, as he won’t have to start the new year anyway with some real “troublemakers” in the voting presidential mix. We jest with that description, but it can be said that none of the incoming presidents for the 2025 FOMC sound as if they are going to run strong interference with Fed Chair Powell’s aim of building consensus.

They’ll have their first vote at the January 28-29 FOMC meeting, but it won’t be their first FOMC rodeo. They’ve already been in the room where it happens. The difference now is that they are the ones who will directly make monetary policy moves happen. That is why their thoughts will carry more weight with the market in the coming year.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end December 2024?

12-09-2024 +2.0%

12-02-2024 +2.0%

Earnings:

Mon: ORCL, TOL, MTN

Tues: AZO, PLAY, GME

Wed: ADBE,

Thur: AVGO, COST

Fri:

Econ Reports:

Mon: Wholesale Inventories

Tue Productivity, Unit Labor Costs

Wed: MBA, CPI, Core CPI, Treasury Budget,

Thur: Initial Claims, Continuing Claims, PPI, Core PPI,

Fri: Export, Import

How am I looking to trade?

RIGHT NOW is the time to get ready to back the truck up and load up stocks if the market has a “interest rate or inflation fear” !!!

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

DOGE’s Musk, Ramaswamy want Congress to pass huge spending cuts. That’s a tough sell

Published Fri, Dec 6 202411:21 AM ESTUpdated

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Key Points

- Elon Musk and Vivek Ramaswamy are seeking major cuts to federal spending.

- Any meaningful reductions will be near impossible without legislation to cut Social Security benefits, Medicare and Medicaid — long considered a third rail in Congress.

- The duo had a day of meetings on Capitol Hill with hundreds of Republican lawmakers.

Musk, Ramaswamy visit Capitol Hill to discuss Trump’s vision for DOGE

WASHINGTON — Entrepreneurs Elon Musk and Vivek Ramaswamy have an ambitious agenda to cut federal spending with the help of their outside advisory council, the Department of Government Efficiency (DOGE).

But on their first joint visit to Congress on Thursday, the pair also likely saw some of the limits of outside influence on the workings of the legislative branch.

Crisscrossing Capitol Hill together on a marathon day of meetings with lawmakers, Musk and Ramaswamy got warm welcomes from Republicans.

Their overall message was popular, too: A smaller federal government, looser regulations and a private sector approach to the public sector have long been cornerstones of conservative governance.

But there was also an elephant in the rooms they visited: An unspoken understanding that Musk’s stated goal of slashing federal spending by $2 trillion is already DOA.

The reason for this comes down to math.

In fiscal 2023, for example, the federal government spent a total of $6.1 trillion, according to the nonpartisan Congressional Budget Office.

Of that $6.1 trillion, about $3.8 trillion was already off limits for cuts on day one, legally obligated to go toward mandatory spending programs like Social Security benefits for retired workers, Medicare coverage and veterans benefits.

After that, roughly $650 billion was set aside to pay the interest on the national debt.

This left $1.7 trillion for everything else, known as discretionary funding. $805 billion of this was spent on national defense, a largely untouchable pot of money. Finally, the remainder was divided up among the federal departments that perform much of the visible, daily work of government, agencies like FEMA, NASA, and Customs and Border Protection.

House Majority Leader Rep. Scalise on DOGE, GOP House majority and top legislative priorities

While Musk and Ramaswamy went from meeting to meeting, Republicans close to the government funding process, like House Appropriations Committee member Rep. Steve Womack, Ark., said that while some cuts were possible, the $2 trillion that Musk talks about would likely be a bridge too far.

“If you’re going to leave the social safety net programs alone and not touch them, that means you’re going to try to cut hundreds of billions of dollars out of discretionary spending” if you want to achieve massive, DOGE-style reductions, he told CNBC in an interview.

“It would be very difficult to do that without cutting national security,” said Womack.

Even proposing small cuts or changes to mandatory programs like Social Security, Medicare or Medicaid can prove politically dangerous for members of Congress who must run for reelection every few years.

Nonetheless, some Republicans are open to considering limited reforms to these programs. House Majority Leader Steve Scalise of Louisiana, for example, said he was open to exploring potential work requirements for Medicaid recipients, and requiring stricter verification for Social Security benefits.

“Those are the kinds of things that we’re also going to be looking at,” Scalise told reporters after his meeting with Musk and Ramaswamy.

House Speaker Mike Johnson, R-La., kept expectations low, saying Thursday’s meetings with Musk and Ramaswamy were “brainstorming” sessions, a chance to float some ideas with no pressure to reach a consensus.

Only when Republican President-elect Donald Trump takes office in January, and Senate Republicans take control of their chamber, can plans really begin to move ahead.

Cutting spending will not be easy. Johnson’s hair’s breadth of a vote margin means he will only be able to afford a few defections from his conference on any given bill, and still pass it on a party-line vote.

Some Republicans have begun to coalesce around a different way to cut government costs: by requiring federal employees to come back to the office in person five days a week.

“One of the things I’m most excited about is requiring people to show up for work,” Sen. John Cornyn, R-Texas, told reporters. “And if they don’t, then they can voluntarily leave and we can save a lot of money.”

Sen. Susan Collins, R-Maine, the Senate’s top appropriator, also embraced the idea of calling federal employees back into the office. “It’s amazing to walk through some federal buildings,” she said, “and it’s just empty offices everywhere.”

“If the federal government’s truly going to change the way people work, then we’ve got [to address the] excess buildings and space,” said Collins.

Sen. Joni Ernst, R-Iowa, who leads the newly created Senate DOGE Caucus, also highlighted the issue of underutilized federal office space due to employee telework in a new report she unveiled Thursday at the first Senate DOGE Caucus meeting.

“Over $81 million is being wasted every year for the underutilized government office space alone,” the report found.

Yet findings like this also serve to underscore how limited the impact of changes to federal office space would be on the massive spending cuts that Musk is looking for.

Nonetheless, the idea is gaining steam in the GOP. Federal return-to-work policies were the most frequently mentioned example of potential cost cutting by Republicans who spoke with CNBC on Capitol Hill this week.

It is not clear yet whether federal employees would quit en masse if they were forced to come back into the office five days a week, thereby freeing up their current salaries for other uses.

What is clear, however, is that unions representing hundreds of thousands of federal workers nationwide are gearing up to fight any effort to change their members’ working conditions.

For the DOGE team, these battles could present a whole new set of challenges.

Correction: This story has been updated to correct the name of the U.S. Customs and Border Protection agency.

INVESTOR OPTIMISM: BofA says that its investor conversations suggest considerable optimism around U.S. economic outlook on the back of the Trump agenda. Importantly, banks viewed as significant beneficiaries of Trump’s business friendly policy priorities – deregulatory regime, increased M&A, lower taxes, pick-up in domestic capex. The firm believes that the potential for positive EPS revisions combined with improved valuation multiples support the case for bank stocks to outperform the S&P.

BofA believes Trump policy priorities combined with U.S. soft landing is bullish for bank stocks. While valuations are pricing in good news, regime shifts vs. post-GFC period, investor desire to add exposure and valuations that still screen attractively relative to potential for positive EPS revisions and compared to the S&P are all supportive of a continued move higher in bank stocks. The firm sees best value in MAG 5 GSIBs – Wells Fargo (WFC), JPMorgan (JPM), Goldman Sachs (GS), Morgan Stanley (MS); SMID-CAP regionals – First Horizon (FHN), Synovous Financial (SNV), Webster Financial (WBS), Western Alliance (WAL), and East West Bancorp (EWBC).

Nvidia and Microsoft: Why This Top Investment Firm Decided to Dump Shares

Marty ShtrubelDec 02, 2024, 03:12 PM

The AI trend has been the theme behind the current bull market, driven mostly by Big Tech. However, in certain corners, some of the biggest names appear to be losing their luster.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

London-based investment firm Findlay Park, which managed $10.7 billion in assets by the end of Q3 and whose sole fund, the American Fund, outperformed 86% of its peers, has been slashing its holdings of Nvidia (NASDAQ:NVDA) and Microsoft (NASDAQ:MSFT).

Findlay Park CEO Simon Pryke acknowledges the outsized growth that has propelled the ‘Magnificent Seven’ stocks to extraordinary heights. However, he points out that “earnings growth expectations are pretty tepid and valuations are still pricing in as if that growth pattern’s going to continue.”

“One of those numbers is wrong,” Pryke went on to further add, and that makes these high-flying stocks unappealing to Findlay Park right now.

But does the Street agree with these bold moves? We turned to the TipRanks database to gauge the sentiment around these two market heavyweights. Here’s what we discovered.

Nvidia

It’s quite a statement to bid farewell to the stock that has been this bull market’s poster boy but that’s exactly what Findlay Park has done. The fund exited its position in Nvidia during Q3, selling its 3,065,280 shares. That’s a big change of heart as the stock had comprised 5% of the fund’s total holdings earlier this year.

It’s a bit of an understatement to say Nvidia has been a key beneficiary of the AI boom as its success in the field has turned it into one of the world’s most valuable companies. While once its GPUs were primarily aimed at the gaming sector, over the past few years, its data center segment has turned into a monster business. That is down to one simple reason; no one has yet to make better AI chips than Nvidia. Such is its dominance that it has practically cornered the market for itself.

The growth has been on display in a series of highly impressive earnings reports, and that trend continued with the latest quarterly readout. In the fiscal third quarter, the semiconductor giant posted year-over-year revenue growth of 93.6%, reaching a record $35.08 billion and exceeding analyst expectations by $1.95 billion. The Data Center segment, home to its AI chips, contributed $30.8 billion, marking a 112% increase from the previous year. At the other end of the spectrum, adjusted EPS hit $0.81, beating the consensus estimate by $0.06. For the upcoming January quarter (FQ4), the company forecasts revenue of $37.5 billion (with a 2% margin of error), surpassing Wall Street’s projection of $37.1 billion.

With all that growth underway, is Findlay’s move a bit of a head-scratcher? Not entirely, according to D.A. Davidson analyst Gil Luria. While Luria holds an optimistic view of Nvidia’s short-term prospects, he takes a skeptical stance when looking further ahead.

“NVIDIA is well within its means to extend growth into next year given hyperscaler commentary around additional investments in AI compute and the company’s ability to deliver even with production setbacks,” the 5-star analyst said. “Despite demand in the near-term continuing to be strong, we still believe a decline in demand for NVIDIA compute is inevitable as customers begin to scrutinize their ROI on AI compute.”

To this end, Luria rates NVDA shares as Neutral while his $135 price target implies the stock is fully valued at current levels. (To watch Luria’s track record, click here)

That said, most of the Street is in disagreement with that view and still sees Nvidia as a winner. The stock claims a Strong Buy consensus rating, based on a mix of 37 Buys vs. 3 Holds. At $176.14, the average price target factors in one-year returns of 27%. (See NVDA stock forecast)

Microsoft

Talk of AI and Microsoft must get a mention. The tech giant has been pouring billions into building out its AI infrastructure, particularly through its partnership with OpenAI, the maker of ChatGPT. From integrating AI tools like Copilot into Office products to expanding Azure’s AI capabilities, the company is positioning itself as a leader in the AI revolution.

However, all this ambition comes at a price; capacity constraints and questions about whether the rapid investment can deliver the expected returns have soured sentiment somewhat recently. While its AI initiatives are exciting, investors are wondering if the growth will truly keep pace with the spending.

That was sort of the main story when the company reported fiscal first-quarter earnings (September quarter). The results exceeded expectations but along with increased spend, the outlook failed to impress.

Revenue grew by 16.1% y/y to reach $65.59 billion, beating the forecast by $1.03 billion and EPS of $3.30 outpaced analyst expectations by $0.19. However, CapEx reached $14.92 billion, slightly surpassing Wall Street’s estimate of $14.74 billion and marking a big increase from the $9.9 billion spent in the same quarter last year.

Microsoft also tempered its revenue expectations for the Azure cloud service in FQ2, forecasting growth of 31% to 32% (in constant currency). This represents a decline from the 34% growth reported in the first quarter, signaling a slowdown in one of its key business segments.

Findlay Park is obviously getting a bit jittery here. During Q3, the company offloaded 540,100 MSFT shares, amounting to more than 40% of its position.

We’ll turn again to D.A. Davidson’s Gil Luria, who applauds Microsoft’s positioning in AI but offers a cautious take on what’s coming next.

“While growing AI revenue to $10bn in such a short timeframe is an impressive feat, we do not believe investors have had a chance to wrap their head around the staggering levels of investment that have led to this revenue,” Luria said. “We believe Microsoft will generate a loss on AI its revenue this year on a total investment of $81bn, thus generating a negative ROI. More importantly, at the current rate of investment, we believe the ROI will remain subpar even if the revenue from AI reaches $50bn at full margins within 5 years.”

Quantifying his stance, Luria recommends a Neutral rating on MSFT along with a $425 price target, suggesting the shares have no room left to run right now.

Once again, Findlay Park and Luria’s views are at odds with the general consensus on Wall Street. Based on a lopsided 26 Buys versus 3 Holds, the analyst consensus rates MSFT shares as a Strong Buy. The forecast anticipates 12-month returns of 15%, considering the average price target stands at $496.92. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

What Trump’s mass deportation plan would mean for immigrant workers and the economy

Published Sun, Nov 10 20249:25 AM ESTUpdated Mon, Nov 11 20247:34 AM EST

Key Points

- President-elect Trump has said he has “no choice” but to pursue mass deportation after the election results, and told NBC News there is “no price tag.” On Sunday night he named Tom Homan, the former acting director of U.S. Immigration and Customs Enforcement, as his administration’s “border czar.”

- Homan has vowed to run the largest deportation force in U.S. history and has said workplace operations will resume. If the plan targets undocumented workers and temporary workers in addition to migrants who have recently crossed the border, the construction industry will be hit hard, as will housing and agriculture sectors.

- By one estimate from an immigration policy group, GDP could shrink by $1.1 trillion to $1.7 trillion, but in his recent comments Trump has also said his plan will bring more businesses into the country and the U.S. needs more workers to grow.

President-elect Donald J. Trump won the White House based partly on his promises to rein in immigration, with targeted policies that range from sending criminals to their home countries to more sweeping ones like mass deportations. During the campaign, Trump pledged to end the Temporary Protected Status that allows workers from select countries to come to the U.S. to work. If some of the larger deportation efforts, like rolling back TPS, come to fruition, experts say that there will be ripple effects felt in most sectors of the economy, in particular construction, housing and agriculture.

On Sunday night, Trump announced in a social media post that Tom Homan, the former acting director of U.S. Immigration and Customs Enforcement, will be his administration’s “border czar.” Homan had said at a conservative conference earlier this year “No one’s off the table. If you’re here illegally, you better be looking over your shoulder.” He vowed to “run the biggest deportation force this country has ever seen.”

Economists and labor specialists are most worried about the economic impact of policies that would deport workers already in the U.S., both documented and undocumented.

Staffing agencies were watching the election especially closely.

“The morning after the election, we sat down as a leadership team and explored what does this mean for talent availability?” said Jason Leverant, president and COO of the AtWork Group, a franchise-based national staffing agency. AtWork provides commercial staffing in immigrant-heavy verticals like warehouses, industrial, and agriculture in 39 states.

Workers – “talent” in industry parlance – are already in short supply. While the worst of the labor crisis spurred by the post-Covid economic boom has passed, and labor supply and demand has come back into balance in recent months, the number of workers available to fill jobs across the U.S. economy remains a closely watched data point. Mass deportation would exacerbate this economic issue, say employers and economists.

“If the proposed immigration policies come into reality, there could be a significant impact,” Leverant said, pointing to estimates that a mass deportation program could leave as many as one million difficult-to-fill potential job openings.

How many undocumented immigrants work in the U.S.

There are various statistics offered up about the undocumented immigrant population in the United States. The left-leaning Center for American Progress puts the number at around 11.3 million, with 7 million of them working. The American Immigration Council, an advocacy group in favor of expanding immigration, citing data from an American Community Survey, also puts the number of undocumented people in the United States around 11 million. The non-partisan Pew Research Center puts the number at closer to 8 million people.

“There are millions, many millions who are undocumented who are in the trades; we don’t have the Americans to do the work,” said Chad Prinkey, the CEO of Well Built Construction Consulting, which works with construction companies. “We need these workers; what we all want is for them to be documented; we want to know who they are, where they are, and make sure they are paying taxes; we don’t want them gone.”

Leverant says it is still being determined how jobs lost from a mass deportation would be filled.

“Do we pull talent from one area to another, but then someone else loses it,” Leverant said. “This is pretty significant and we have to stay ahead of it.”

Leverant says he is not concerned about losing any of the 20,000 workers AtWork sends to various places because document status is strenuously checked, but if other companies lose workers, they will be leaning even more heavily on staffing agencies like AtWork for talent that is already in short supply. And supply and demand dictate worker wages, which will be forced upwards. And that will ripple throughout the supply chain right into the supermarket or sporting goods store.

“We are playing the long game now, the pain will be felt and we will see shortages, and slow-downs and delays on every front,” he said.

Produce not making it to market because there are not enough workers to bring it to distribution, or delayed construction projects, are among likely outcomes from limited labor supply.

Worries about workforce extend to skilled labor, tech

There are also concerns about how stricter immigration policy could negatively impact skilled workers.

“This is more than low-skilled labor; this ripples into tech workers and engineers. We don’t have enough skilled talent there either to fill the jobs,” Leverant said, adding that he is not envisioning doctors and scientists being rounded up and deported, but restrictions on H-1B visas and a generally more unwelcoming atmosphere could deter talent from coming.

Janeesa Hollingshead, head of expansion at Uber Works, an on-demand staffing arm of the ride-share company, agrees tech will be impacted, if past is prologue.

“The tech industry relies heavily on immigrants to fill highly technical, crucial roles,” Hollingshead said, recalling that Uber informed all tech workers on H-1B visas during Trump’s first presidency that if they went to their home countries for holidays, they may not be able to return.

According to the American Immigration Council, during the first Trump administration, the government’s U.S. Citizenship and Immigration Services denied a larger percentage of H-1B petitions than in the preceding four years, but many of the denials were overturned, leading to a lower level of denials by fiscal 2020, 13%, versus 24% in 2018. Fiscal years 2021and 2022 had the lowest denial rates ever recorded.

Hollingshead says that tech companies in the United States are going to be forced to find tech talent from currently overlooked pools of people already in the country.

“U.S. companies are going to need to figure out how to do this or face an even more dire labor shortage,” Hollingshead says.

At his Madison Square Garden rally in New York right before the election, Trump said: “On Day 1, I will launch the largest deportation program in American history to get the criminals out.”

“I would not write off his mass deportation process as rhetoric. We have to assume he means what he says,” according to David Leopold, chair of the immigration practice group at law firm U.B. Greensfelder.

Still, despite the impact that could churn through the labor market, in practice, the mass deportations might be difficult to pull off.

“It is very expensive to remove 11 million people,” Leopold said, predicting that Trump will use ICE and federal agencies but also lean on local law enforcement to round up immigrants.

In a phone interview with NBC News’ Kristen Welker shortly after the election results, Trump invoked the darker rhetoric on migrants that proved successful during the campaign while saying he isn’t opposed to people coming into the country — in fact, he said more people will be required if his administration’s strategy of requiring businesses to set up operations within the U.S. is successful. “We want people to come in,” Trump said. “We’re gonna have a lot of businesses coming into our country. They want to come into our country. … We want companies and factories and plants and automobile factories to come into our country, and they will be coming. And therefore we need people, but we want people that aren’t necessarily sitting in a jail because they murdered seven people.”

The American Immigration Council estimates that in a longer-term mass deportation operation targeting one million people per year — which it said reflects “more conservative proposals” made by mass-deportation proponents — the cost would average out to $88 billion annually, for a total cost of $967.9 billion over the course of more than a decade.

In his interview with NBC News, Trump dismissed concerns about cost. “It’s not a question of a price tag,” he said. “We have no choice. When people have killed and murdered, when drug lords have destroyed countries and now they’re going to go back to those countries because they’re not staying here. … there is no price tag,” Trump said.

Leopold says depending in the severity of the plan, changes could reach consumers in the form of increasing prices, supply problems, and restricted access to goods and services.

Construction and housing damage

Nan Wu, research director of the American Immigration Council, echoes the concerns of others in predicting turmoil for consumers if deportations tick upward under Trump.

“Mass deportation would exacerbate ongoing U.S. labor shortages, especially in industries that rely heavily on undocumented immigrant workers,” Wu said, citing AIC’s research that shows the construction industry would lose one in eight workers, citing AIC”s research that 14 percent of construction workers in the United States are undocumented.

“The removal of so many workers within a short period would push up construction costs and lead to delays in building new homes, making housing even less affordable in many parts of the country,” Wu said.

The same, she says, applies to the agriculture industry which would also see a loss of one in eight workers.

“Looking at specific occupations, about one-quarter of farm workers, agricultural graders, and sorters are undocumented workers. Losing the agricultural workers who grow, pick, and pack our food would hurt domestic food production and raise food prices,” Wu said.

Figures from the USDA put the number of undocumented farm workers at 41 percent in 2018, the most recent year figures are available, with California having the highest number.

The AIC estimates that the U.S. GDP would shrink by $1.1 trillion to $1.7 trillion.

Conservative think tank American Compass argues for a “skills-based immigration policy” which it says would require “serious immigration enforcement that prevents people from working illegally. Such enforcement will need to deal prospectively with the future flow of immigrants as well as grapple with the millions of illegal workers already here,” it stated in a policy brief.

Among its policy priorities are mandatory use of the E-Verify system by all employers, along with severe criminal penalties for repeated or willful violations; short-term work permits available to illegal immigrants who have already been in the country for a significant period of time — but with establishment of a timeline for when they must leave the country based on how long they’ve already been residing in it; and for those who have resided in U.S. for the longest, the ability to obtain permanent legal status after paying a substantial fine.

Homan said in a recent “60 Minutes” interview that “work-site enforcement operations” — he rejected the use of the word “raids” — will resume. “That’s gonna be necessary,” he said, though he added public safety threats and national security threats are the first priorities.

Prinkey says the impact of a mass deportation program would be dramatic. “One of the natural problems with undocumented workers, we don’t know how many are here because they are undocumented. It isn’t straightforward. I would wager that half or more of on-site labor is undocumented in specific geographic regions,” he said.

“If you are building a nuclear facility or colleges and universities, you might be working with very few undocumented workers because there is a much higher level of oversight,” Prinkey said. “Those are sectors that will shrug and go forward.” He expected the same for union workers.

But there will be big impacts on single-family and multi-family housing construction, according to Prinkey, sectors of the housing market which he thinks could be “paralyzed.”

“There will be incredible delays; the average 18-month project could take five years to complete because there are so few bodies,” Prinkey said. “It will be less devastating in Boston than Austin; in Austin, it would shut down every project,” he added.

Despite the dire forecast, Prinkey doesn’t think mass deportation will come to pass. “Donald Trump is a developer; he understands what is going on. A mass deportation is not possible without crippling economic impact,” he said.

To join the CNBC Workforce Executive Council, apply at cnbccouncils.com/wec.

Meta Platforms (META) Stock Rises as U.S. Court Upholds Ruling on TikTok Sale

Joel BagloleDec 06, 2024, 03:39 PM

A ban on the TikTok app in the U.S. is seen as beneficial to Meta Platforms.

The stock of Meta Platforms META -2.14% ▼ is marching higher on news that a U.S. federal appeals court upheld a law requiring that China’s ByteDance sell social media app TikTok or face a ban in America.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

META stock closed 2% higher on December 6 on news of the U.S. appeals court’s decision. The popular TikTok app competes against Meta Platforms social media apps such as Facebook and Instagram. Other U.S. social media stocks were also rising on the news, including Snap SNAP +0.56% ▲ and Pinterest

TikTok is one of Meta’s main rivals and has soared in popularity throughout the U.S., particularly with younger audiences. Today, TikTok has 170 million users in America. However, there are concerns that the short videos on TikTok are harming the mental health of teenagers, and that the app is used by the Chinese government to spy on users.

Presidential Action

In April of this year, U.S. President Joe Biden signed a law that would require privately held ByteDance to divest the TikTok app, or companies such as Apple AAPL +1.38% ▲ and Alphabet GOOGL +0.91% ▲ will have to stop supporting it through their app stores.

The unanimous ruling on Friday by a three-judge panel of the U.S. Court of Appeals in Washington, D.C. rejected TikTok’s argument that the law is unconstitutional and violates the First Amendment rights of its users. TikTok said after the latest ruling that it will take its case to the U.S. Supreme Court.

Meta Platforms and other U.S. social media companies are widely viewed to be beneficiaries of any ban in the U.S. of the TikTok app. META stock has gained 77% this year.

Is META Stock a Buy?

The stock of Meta Platforms has a consensus Strong Buy rating among 44 Wall Street analysts. That rating is based on 40 Buy, three Hold, and one Sell recommendations issued in the last three months. The average META price target of $662.62 implies 6.23% upside from current levels.

Box Office Battle: ‘Moana 2’ wins weekend with record $52M

Investors Rotate Back into Magnificent 7 Stocks, including Amazon (AMZN) and Microsoft

Joel BagloleDec 06, 2024, 01:21 PM

Investors are rotating capital back into growth stocks.

The Magnificent 7 stocks are back.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

After months of trading sideways or slumping, the mega-cap tech stocks collectively known as the Magnificent 7 are marching higher once again as investors rotate back into growth securities amid the continued rally in U.S. equities.

The Roundhill Magnificent Seven ETF MAGS -0.53% ▼ that tracks the stocks of Apple AAPL +1.37% ▲ , Alphabet GOOGL +0.74% ▲ , Amazon AMZN +0.93% ▲ , Nvidia NVDA -2.25% ▼ , Meta Platforms META -2.26% ▼ , Microsoft MSFT +0.57% ▲ , and Tesla TSLA -1.75% ▼ is up 5% this week. The strong performance of these mega-cap tech stocks helped push the Nasdaq Composite index to its 35th record close earlier this week.

Rotation Into Growth

Among the Magnificent 7, Meta Platforms, Amazon, and Tesla had the strongest performances over the last five trading sessions, with each stock gaining more than 7%. Apple and Alphabet each rose 3% on the week, while the stocks of Nvidia and Microsoft increased 4%. It was a big reversal for several of the stocks, with Meta and Microsoft posting their biggest one-week gains since the spring.

The rise in the Magnificent 7 stocks comes as investors rotate back into growth stocks. Analysts are attributing this rotation to expectations that interest rates may not be lowered as quickly as expected. For all of 2025, Wall Street currently expects only two 25-basis point rate cuts from the U.S. Federal Reserve.

Some tech analysts see more gains ahead for tech stocks. Daniel Ives, a four-star rated analyst at Wedbush Securities, recently forecast that tech stocks will rise another 20% in 2025. The MAGS ETF is up 62% year-to-date.

Is the MAGS ETF a Buy?

Analysts currently rate the MAGS ETF that tracks the Magnificent 7 stocks a consensus Hold. That rating is based on 12 Buy and eight Hold recommendations assigned in the past 12 months. The average MAGS price target of $55.30 implies 0.95% upside from current levels.

Three stocks forming the bullish ‘Golden Cross’ pattern heading into 2025

Published Wed, Dec 4 20242:00 PM EST

Pia Singh@in/piasingh72/@pia_singh_

A handful of stocks could see a rally ahead, according to a bullish price chart pattern closely watched by technical analysts.

Disney and Cadence Design Systems are among the few companies that have recently formed or are about to signal the “golden cross” pattern, a phenomenon that’s used to identify stocks that could be breaking out into a new long-term trend. The pattern occurs when an asset’s 50-day moving average rises above its 200-day moving average, and analysts typically want to see the 200-day upwardly sloping as well.

Outperformance from these names could occur as the three major U.S. indexes race ahead this year. The S&P 500 and Nasdaq Composite also notched fresh record highs Wednesday.

Take a look below at the stocks we found, using FactSet data:

FactSet

Disney is one of the companies that is about to form a “golden cross.” The stock has ripped ahead this year, climbing more than 28.5% — just slightly higher than the broader-market’s gains.

Daiwa reiterated Disney as a buy in late November, expecting “streaming margin expansion” for the movie studio and theme park operator. The firm believes the company stands out compared to its peers in that its streaming revenues are offsetting the industry’s declining linear business.

Disney’s stock has taken off over the past month after posting stronger-than-expected earnings and guidance, helped by growth in its streaming business. The company forecasted high-single-digit adjusted earnings growth in fiscal 2025.

FactSet

Cadence Design Systems is another stock that could soon form the chart pattern. Shares have jumped more than 12% over the past month, driven by its strong third-quarter earnings report. The company had also increased the midpoint of its outlook for non-GAAP earnings per share in 2024.

This year, the stock is up nearly 19.3%.

Wells Fargo recently initiated coverage of Cadence Design Systems with an overweight rating and $350 price target, which suggests nearly 12% potential upside for the computational software provider. Longer term, analyst Joe Quatrochi said the company is “well-positioned” to benefit from its artificial intelligence-related products, such as its AI chip offerings and the integration of AI features in its existing software-based products.

“We think a ramping hardware cycle looking into 2025 can drive accelerating revenue growth (including China), which we view as not fully factored into Street ests,” Quatrochi said in a Nov. 22 note.

FactSet

Chevron has already formed a golden cross, indicating future upside ahead.

Indeed, analysts polled by FactSet have an overweight rating and $173.05 price target on shares, which implies a possible gain of 6.9%. Chevron shares are up just more than 6% this year.

Looking at the oil giant’s performance this year, Citi analyst Alastair Syme upgraded shares to buy from neutral on Nov. 26, on the belief that Chevron’s discount relative to peers has opened up an attractive entry point for investors.

HI Financial Services Mid-Week 06-24-2014