HI Market View Commentary 11-11-2024

Post election next steps for the market = Trump winning what are the expectation:

Taxes on relalized gains not “phantom gains”

Taxes lower for middle class and corporations

Tariffs against China, Iran & Russia

Military Spending = More US Contracts for US Companies

Exiting Wars = Gasoline Drill baby drill for lower gas prices BUT it hurt the CVX, XOM, VLO with their earnings

He cut prices on medications and medical “charges”

Eanring for some stocks have HUGE upside potential right now = DIS, BIDU, NVDA, SQ, MU, BA, BAC, GOOGL, KEY, META, O, UAA, VZ,

Deregulation in industries will spark future growth

Musk is getting favors with Bitcoin and deregulation already

Earnings dates:

BABA 11/21 BMO

BIDU 11/26 est

DG 12/05 est

DIS 11/14 BMO

JCI 11/06 AMC

MU 12/28 est

NVDA 11/20 est

TGT 11/20 BMO

The Big Picture

Last Updated: 08-Nov-24 15:01 ET

A rally of epic political proportions

The stock market doesn’t like uncertainty. That is a silly expression, because there is always uncertainty, which would mean the stock market is never in a likable mood. Judging by the past two years alone, that could not be further from the truth.

In the past two years the S&P 500 has increased 57%, excluding dividends, which is another way of saying it has found a lot to like amid a lot of uncertainty.

One thing that had the nation — if not the stock market — riddled with uncertainty was the outcome of the 2024 presidential election. It was deemed by many polls as too close to call, and some pundits averred that it could be a contested election that might take weeks to settle.

That uncertainty was cleared out this week, however, when the election results showed a decisive victory for Donald Trump and a likely GOP sweep of the House and Senate.

What followed was a rally of epic political proportions.

Feeling Energized

The day after the election, the Dow Jones Industrial Average gained more than 1,500 points, the Russell 2000 soared 5.8%, the Nasdaq Composite surged 3.0%, and the S&P 500, with a 2.5% gain, logged its best post-election performance ever!

There were record highs for the Dow Jones Industrial Average, Nasdaq Composite, S&P 500, and S&P Midcap 400.

One could cite any number of outsized moves in nearly ever corner of the stock market. Tesla (TSLA), for instance, gained 14.8%, and Dow component Goldman Sachs (GS) advanced 13.1%.

Why was there so much energy behind the gains?

- There was relief that the election wouldn’t be contested.

- There was excitement that a GOP sweep would pave the way for lower corporate tax rates and less regulation.

- There was confidence that the economy will continue to grow above potential, which bodes well for the corporate profit outlook.

- There was short-covering activity.

- There was a fear of missing out on further gains that squeezed cash in from the sidelines.

We probably didn’t capture every reason, but the point is that stock market participants had visions of good things dancing in their head.

There was a “pull-forward” element in the rally. After all, Inauguration Day doesn’t happen until January 20, 2025. That is the first day president-elect Trump’s administration can get to work delivering on campaign promises. Members of Congress will be sworn in on January 3, so they will have a head start on the people’s business.

An Easier Path

It is often said that governing is harder than campaigning. That is especially true for a president when there is a split Congress. That is unlikely to be the case this time.

Several House races still need to be decided, but polling indications suggest the final results will settle out in the majority favor of Republicans. Accordingly, president-elect Trump should have an easier time governing with his party controlling both houses of Congress, assuming deficit hawks in his own party don’t stand in his way.

An easier path toward governing, though, could make it harder for long-term rates to come down if president-elect Trump’s policies fuel increased deficit spending that drives up the national debt, as some economists suggest will be the case.

Borrowing another silly expression: time will tell.

All eyes will be on the Treasury market as a gauge of investors’ view of the fiscal situation. We’ll be silly enough to say the market could go up or down. Lately, the Treasury market has been going down more than up since the Fed cut rates on September 18, so prices have fallen and yields have risen.

The latter point notwithstanding, it would be remiss not to mention that the 10-yr note yield, which kissed 4.48% the day after the election, was down seven basis points for the election week to 4.30% as of this writing.

There is a narrative that the Trump administration, with Elon Musk’s help, will work diligently to cut government spending and that lower tax rates and deregulation will promote stronger growth that leads to increased tax receipts that keep the deficit in check. Again, time will tell, yet the bond vigilantes and deficit hawks aren’t throwing down the gauntlet yet.

What It All Means

No matter one’s political affiliation, the best thing for the country is that this wasn’t a contested election. There will be a new administration taking over January 20 that will pursue plans that it thinks are best for the country.

Clearly, not everyone will agree with those plans, but for our purposes here, what matters is how the capital markets respond to those plans.

The early response by the stock market is undeniable. It is excited by pro-growth policies rooted in lower tax rates and less regulation, and it isn’t trading in fear of tariff reprisals. The early response by the Treasury market is arguable. It might be more about adjusting for a better growth outlook than it is about deficit and inflation concerns.

Time will tell what the implications of the 2024 election will be. The stock market at least likes what it thinks will happen in the uncertain future.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Higher

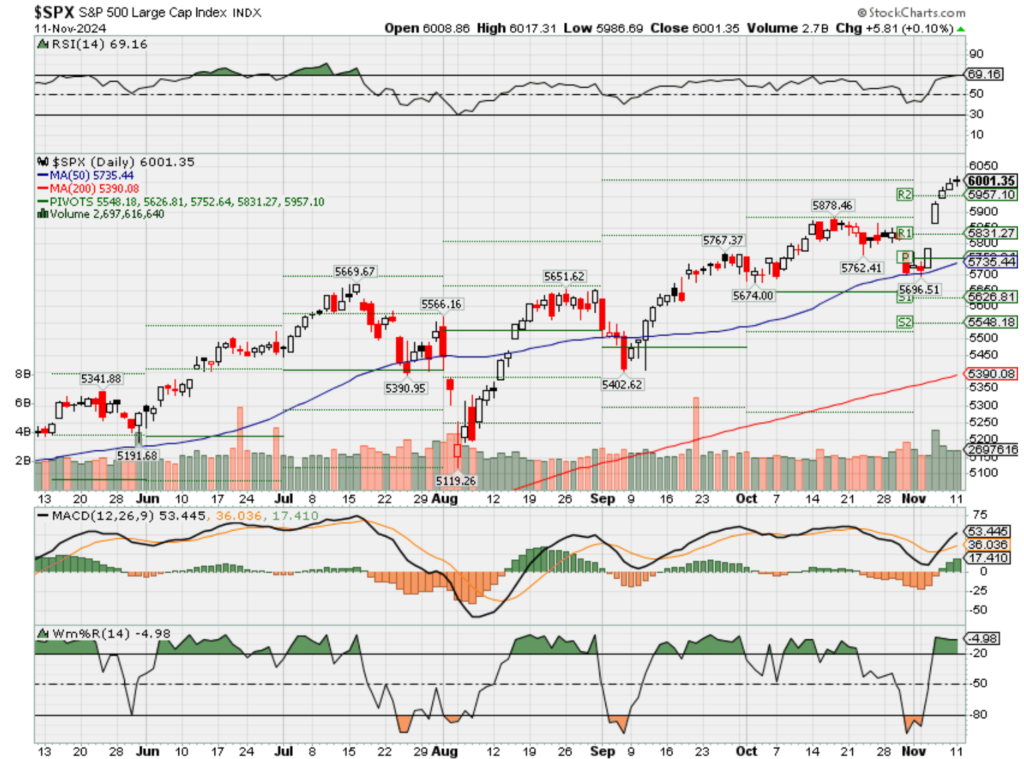

DJIA – Bullish and overbought

SPX – Bullish and almost overbought

COMP – Bullish and almost overbought

Where Will the SPX end November 2024?

11-11-2024 +2.00

11-04-2024 ????

10-28-2024 ????

Earnings:

Mon:

Tues: HTZ, HD, TME, SWKS, SPOT

Wed: CSCO,

Thur: JD, NTES, DIS

Fri: BABA

Econ Reports:

Mon:

Tue Treasury Budge

Wed: MBA, CPI, Core CPI

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Retail Sales, Retail Ex-auto, Import, Export, Capacity Utilization, Industrial Production, Business Inventories

How am I looking to trade?

Protection thru earnings and we are ALSO protecting at previous highs

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Are you expecting a Christmas rally even though market are basically overbought = YES

Trump win and threat of more tariffs raises expectations for more China stimulus

Published Wed, Nov 6 20249:45 PM ESTUpdated Thu, Nov 7 202412:00 AM EST

Evelyn Cheng@in/evelyn-cheng-53b23624@chengevelyn

Key Points

- Donald Trump has threatened to impose additional tariffs of 60% or more on Chinese goods sold to the U.S. on the campaign trial.

- These levies could come at a pivotal time for Beijing. The country is relying more on exports for growth as it battles with a real estate slump and tepid consumer spending.

- It could reduce China’s exports by $200 billion, causing a 1 percentage point drag on GDP, said Zhu Baoliang, a former chief economist at China’s economic planning agency.

BEIJING — Donald Trump’s 2024 presidential win has raised the bar for China’s fiscal stimulus plans, expected Friday.

On the campaign trial, Trump threatened to impose additional tariffs of 60% or more on Chinese goods sold to the U.S. Increased duties of at least 10% under Trump’s first term as president did not dent America’s position as China’s largest trading partner.

But new tariffs — potentially on a larger scale — would come at a pivotal time for China. The country is relying more on exports for growth as it battles with a real estate slump and tepid consumer spending.

If Trump raises tariffs to 60%, that could reduce China’s exports by $200 billion, causing a 1 percentage point drag on GDP, Zhu Baoliang, a former chief economist at China’s economic planning agency, said at a Citigroup conference.

China is very ‘concerned’ about the rhetoric around tariffs, says Longview’s Dewardric McNeal

Since late September, Chinese authorities have ramped up efforts to support slowing economic growth. The standing committee of the National People’s Congress — the country’s parliament — is expected to approve additional fiscal stimulus at its meeting this week, which wraps up Friday.

“In response to potential ‘Trump shocks,’ the Chinese government is likely to introduce greater stimulus measures,” said Yue Su, principal economist at the Economist Intelligence Unit. “The overlap of the NPC meeting with the U.S. election outcome suggests the government is prepared to take swift action.”

She expects a stimulus package of more than 10 trillion yuan ($1.39 billion), with about 6 trillion yuan going towards local government debt swaps and bank recapitalization. More than 4 trillion yuan will likely go towards local government special bonds for supporting real estate, Su said. She did not specify over what time period.

Stock market divergence

Mainland China and Hong Kong stocks fell Wednesday as it became clear that Trump would win the election. U.S. stocks then soared with the three major indexes hitting record highs. In Thursday morning trading, Chinese stocks tried to hold mild gains.

That divergence in stock performance indicates China’s stimulus “will be slightly bigger than the baseline scenario,” said Liqian Ren, who leads WisdomTree’s quantitative investment capabilities. She estimates Beijing will add about 2 trillion yuan to 3 trillion yuan a year in support.

Ren doesn’t expect significantly larger support due to uncertainties around how Trump might act. She pointed out that tariffs hurt both countries, but restrictions on tech and investment have a greater impact on China.

Trump, during his first term as president, put Chinese telecommunications giant Huawei on a blacklist that restricted it from using U.S. suppliers. The Biden administration expanded on those moves by limiting U.S. sales of advanced semiconductors to China, and pressuring allies to do the same.

Both Democrats and Republicans supported the passage of those newer export controls and efforts to boost semiconductor manufacturing investment in the U.S., Chris Miller, author of “Chip War,” pointed out earlier this year. He expected the U.S. to increase such restrictions regardless of who won the election.

China has doubled down on bolstering its own tech by encouraging bank loans to high-end manufacturing. But the country had long benefited from U.S. capital as well as the ability to use U.S. software and high-end parts.

Republicans gained a majority in the Senate for the next two years, according to NBC News projections, though control of the House of Representatives remains unclear.

“If the Republican Party gains control of Congress, protectionist measures could be accelerated, amplifying impacts on the global economy and presenting significant downside risks,” Su said.

She expects Trump will likely impose such tariffs in the first half of next year, and could speed up the process by invoking the International Emergency Economic Powers Act or Section 122 of the Trade Act of 1974, which allows the president to impose tariffs of up to 15% in response to a serious balance-of-payments deficit.

U.S.-China relations: ‘No question’ Trump will intensify tariffs, economist says

U.S. data shows that the trade deficit with China narrowed to $279.11 billion in 2023, from $346.83 billion in 2016.

Su estimated that a 10% tariff increase on Chinese exports to the U.S. could reduce Beijing’s real GDP growth by an average of 0.3 to 0.4 percentage points in the next two years, assuming other factors remain constant.

China’s exports to the U.S. fell by 14% last year to $500.29 billion, according to customs data on Wind Information. That’s still up from $385.08 billion in 2016, before Trump was sworn in for his first term.

Meanwhile, China’s annual imports from the U.S. climbed to $164.16 billion in 2023, up from $134.4 billion in 2016, the Chinese data showed.

Other analysts believe that Beijing will remain conservative, and trickle out stimulus over the coming months rather than release a large package on Friday.

China’s top leaders typically meet in mid-December to discuss economic plans for the year ahead. Then, officials would announce the growth target for the year at an annual parliamentary meeting in March.

“China will likely face much higher tariff from the U.S. next year. I expect policy response from China to also take place next year when higher tariff is imposed,” Zhiwei Zhang, chief economist at Pinpoint Asset Management, said in a note Wednesday afternoon.

“I also don’t think the government will change the policies they already proposed to the NPC because of US election,” he said.

China’s growing global trade influence

Regardless of tariffs, China remains an export powerhouse to markets outside the U.S.

“Chinese exports have indeed shifted a bit in the past few years in terms of destination, with the U.S. representing less than 15% of total Chinese exports in 2023, compared with nearly 18% on average in the 2010s,” Francoise Huang, senior economist for Asia-Pacific and global trade at Allianz Trade, said in September.

“While China has lost market share in the U.S., it’s clearly been gaining in other places,” she said. “For example, China now represents more than 25% of ASEAN imports, compared with less than 18% in the 2010s.”

China’s exports have also grown to countries that sell to the U.S., a Federal Reserve report found in August.

— CNBC’s Dylan Butts contributed to this report.

The Fed is expected to cut interest rates again Thursday. Here’s everything you need to know

Published Wed, Nov 6 20242:33 PM ESTUpdated Wed, Nov 6 20243:14 PM EST

Jeff Cox@jeff.cox.7528@JeffCoxCNBCcom

Key Points

- The Federal Reserve likely will stick to the business at hand when it wraps up its meeting Thursday with another interest rate cut.

- Market attention probably will turn to what Chair Jerome Powell has to say about the future.

- In keeping with policymakers’ historical desire to stay above the political fray, Powell likely will avoid direct commentary about what to expect from President-elect Donald Trump.

Tom Brenner | Reuters

The Federal Reserve likely will stick to the business at hand when it wraps up its meeting Thursday with another interest rate cut, but will have its eye on the future against a backdrop that suddenly has gotten a lot more complicated.

Financial markets are pricing in a near-certainty that the central bank’s Federal Open Market Committee will lower its benchmark borrowing cost by a quarter percentage point as it seeks to “recalibrate” policy for an economy that is seeing the inflation rate moderate and the labor market soften.

The focus, though, will turn to what’s ahead for Chair Jerome Powell and his Fed colleagues as they navigate a shifting economy — and the political earthquake of Donald Trump’s stunning victory in the presidential race.

“We think Powell will refuse to give any early judgment on the implications of the election for the economy and rates, and will seek to be a source of stability and calm,” Krishna Guha, head of global policy and central bank strategy at Evercore ISI, said in a note issued before the election’s outcome was known.

In keeping with policymakers’ historical desire to stay above the political fray, Powell “will say the Fed will take the time it needs to study the new administration’s plans” then will “refine this assessment as actual policies are developed and enacted,” Guha added.

So while the immediate action will be to stay the course and enact the cut, which equals 25 basis points, the market’s attention likely will turn to what the committee and Powell have to say about the future. The fed funds rate, which sets what banks charge each other for overnight lending but often influences consumer debt as well, is currently targeted in a range between 4.75%-5.0%.

Market pricing currently favors another quarter-point cut in December, followed by a January pause then multiple reductions through 2025.

Preparing for Trump

But if Trump’s agenda — tax cuts, higher spending and aggressive tariffs — comes to fruition, it could have a meaningful impact on a Fed trying to right-size policy after the mammoth rate hikes aimed at controlling inflation. Many economists believe another round of isolationist economic moves by Trump could reignite inflation, which held below 3% during Trump’s entire first term despite a similar recipe.

Trump was a frequent critic of Powell and the Fed during his first term, which ran from 2017-21, and is in favor of low interest rates.

“Everyone is on the lookout for future rate cuts and whether anything is telegraphed,” said Quincy Krosby, chief global strategist at LPL Financial. “Also, however, there’s the question of whether or not they can declare victory on inflation.”

Any answers to those questions would be largely left to Powell’s post-meeting news conference.

Though the committee will release its joint decision on rates, it will not provide an update on its Summary of Economic Projections, a document issued quarterly that includes consensus updates on inflation, GDP growth and unemployment, as well as the anonymous “dot plot” of individual officials’ interest rate expectations.

Beyond the January pause, there’s considerable market uncertainty about where the Fed is heading. The SEP will be updated next in December.

“What we’re going to hear more and more of is the terminal rate,” Krosby said. “That’s going to come back into the lexicon if yields continue to climb higher, and it’s not completely associated with growth.”

So where’s the end?

Traders in the fed funds futures market are betting on an aggressive pace of cuts that by the close of 2025 would take the benchmark rate to a target range of 3.75%-4.0%, or a full percentage point below the current level following September’s half percentage point cut. The Secured Overnight Financing Rate for banks is a bit more cautious, indicating a short-term rate around 4.2% at the end of next year.

“A key question here is, what’s the end point of this rate cut cycle?” said Bill English, the Fed’s former head of monetary affairs and now a finance professor at the Yale School of Management. “Fairly soon, they’ve got to think about, where do we think this rate cut period changes with the economy looking pretty strong. They may want to take a pause fairly soon and see how things develop.”

Powell also may be called on to address the Fed’s current moves to reduce the bond holdings on its balance sheet.

Since commencing the effort in June 2022, the Fed has shaved nearly $2 trillion off its holdings in Treasurys and mortgage-backed securities. Fed officials have said that the balance sheet reduction can continue even while they cut rates, though Wall Street expectations are for the run-off to end as soon as early 2025.

“They’ve been happy to just kind of leave that percolating in the background and they probably continue to do that,” English said. “But there’s going to be a lot of interest over the next few meetings. At what point do they make a further adjustment to the pace of runoffs?”

Want to dodge the market volatility and capture the upside? This JPMorgan ETF’s manager reveals how he’s doing it

Published Wed, Nov 6 20246:24 PM ESTUpdated Thu, Nov 7 20241:43 AM EST

In a week when investors are grappling with policy uncertainty surrounding President-elect Donald Trump’s decisive victory, JPMorgan has launched its popular Equity Premium Income ETF in Europe to help ride out the volatility while capturing some of the upside.

The JPMorgan Asset Management’s U.S. fund, already the largest active ETF in the world, returned 21.5% in 2021, including 8.15% as income.

In 2022, when the S&P 500 index nearly fell into a bear market, the fund lost just 3.5% in value. Over the past couple of years, the fund has returned 7% to 9% in income on top of capital appreciation.

The fund achieves such steady returns for investors using sophisticated options strategies that create what the fund manager calls “asymmetric” returns.

“There’s an asymmetry associated with this strategy,” the fund’s lead portfolio manager Hamilton Reiner told CNBC. “Having a strategy that gives you a positive, up-down capture differential is incredibly valuable, not in down markets, not in flat markets, not in up markets, but actually in all markets.”

The fund maintains a portfolio of stocks that loosely tracks the S&P 500 index. It then overlays this with an options strategy, selling index call options contracts on roughly 80% of the portfolio to generate additional income.

While the fund doesn’t aim to outperform the S&P 500 in strong bull markets, the strategy typically operates with about two-thirds of the market’s volatility and lowers the downside while still capturing a significant portion of the upside.

JPMorgan launched the ETF on the London Stock Exchange, Deutsche Borse in Germany and the Six Swiss Exchange this week to enable European investors to take advantage of the popular strategy. It currently manages $36 billion worth of assets in the U.S., with $4 billion flowing to the fund in the past year alone.

The strategy’s expansion into Europe comes as investors on the continent are increasingly seeking income-generating alternatives. “Income as an outcome is something that investors across Europe have had a great desire for,” said Travis Spence, global head of ETFs at JPMorgan Asset Management.

Spence stressed that JPMorgan did not intentionally time its entry into Europe on one of the most volatile weeks of the year for global markets. In addition to the U.S. Presidential elections moving markets, the Federal Reserve interest rate decision on Thursday is expected to impact stocks.

“Regardless if it’s this week or last week or 10 weeks from now, the long portfolio is going to have [stocks] that’s going to be higher in quality, more defensive in nature, stocked with predictable earnings. Our holdings are not leaning red, blue or purple,” Reiner emphasized, highlighting the strategy’s political indifference to U.S. politics. “Our holdings are meant to have this fundamental bottoms-up type of approach,” he added.

The strategy’s success has also increased investors’ interest in similar funds from competitors.

One such fund is Global X’s covered call ETF XYLD, which marginally outperformed JPMorgan’s JEPI over the past two years. However, the Global X ETF, active since 2013, significantly underperformed JEPI in 2021 and 2022. Global X’s ETF is also listed across Europe in London, Germany, the Netherlands, Italy, and Switzerland.

Reiner dismissed concerns about rising competition, saying JPMorgan’s size and infrastructure give it an edge.

“At a place like JPMorgan, if you want to do an options strategy, you need a robust middle office, back office, clearance, custody, collateral management, cash management, corporate action, markets team and trading team to do something like this,” he explained. “Many of our copycats or competitors actually sub advise out the most important part of investing: investing!”

“We don’t lead on income level or fees. We lead with the experience that’s consistent for our clients, and I think that is one of the key differentiators,” Spence added.

52-year-old CEO: As I became a billionaire, my wife brought our kids to my office for playtime—then I went back to work

Published Mon, Nov 4 20249:15 AM ESTUpdated Mon, Nov 4 202410:26 AM EST

Starting a business takes dedication. Making it successful requires you to “multiply that by infinity,” says billionaire Raising Cane’s co-founder and CEO Todd Graves.

Graves would know: He worked 90-hour weeks at a California oil refinery and fished for salmon in Alaska just to get his Baton Rouge, Louisiana-based chicken finger restaurant chain off the ground in 1996. Nearly three decades later, Raising Cane’s has more than 800 locations worldwide and could finish this year with nearly $5 billion in sales, a spokesperson says.

“I can’t tell you how many 15, 16-hour days I’ve worked in a row,” Graves, 52, tells CNBC Make It. “I had to miss a lot of stuff.”

DON’T MISS: The ultimate guide to negotiating a higher salary

At times, Graves worked so much that his wife would bring their two kids to his office for dinner and playtime — after which he’d go back to work, he says. Today, he runs a company reportedly worth billions: Much of his estimated $9.5 billion in net worth is due to his 90% ownership stake in Raising Cane’s, according to Forbes.

As such, he’s still busy — but he’s configured his workload to make time for family and friends anyway, he says. During vacations, for example, he’s occasionally woken up at 4:30 a.m. to work so he could join his family by 11 a.m. and spend the rest of the day with them, he notes.

“I’m as busy as anybody I know, I travel as much as anybody I know, but I can work my schedule where I can make most of the things I need to be at with kids, family or important friends,” says Graves.

‘You just accept that sometimes it’s going to be really hard work’

Few entrepreneurs expect to have a healthy work-life balance in a business’ early days. That’s not necessarily bad: Trying to balance your work and life can add extra stress to an already-busy schedule, according to Jackie Bowie, a managing partner at financial risk management firm Chatham Financial.

“If you’re doing something that’s really worthwhile to you, and you enjoy it, you just accept that sometimes it’s going to be really hard work and you have to make sacrifices,” Bowie told CNBC’s “My Biggest Lessons” last year.

When Graves opened the restaurant’s first location, he rented an apartment behind the storefront and had a coordinated nap schedule with co-founder Craig Silvey to maintain their long workdays: 8:30 a.m. to 5:30 a.m. the next day, he told the “How I Built This” podcast in 2022.

You need that level of commitment as long as you’re trying to grow your business, Graves says. If you ever become comfortable with your company’s level of success, you can hire people to take some work off your plate, he adds.

That’s easier said than done: The act of delegation can be difficult for anyone used to working long hours or covering a wide range of responsibilities, from CEOs down to first-time managers. Trust the people around you to do their jobs, especially if you hired them — and remember that other people can effectively complete tasks in ways that differ from your approach, career experts recommend.

“It can certainly be tempting to get lost in the details of your team’s work, especially if you enjoy that discipline and genuinely find it interesting,” career expert Amanda Augustine told CNBC Make It in 2017. “However, don’t get so wrapped up in the little details that you neglect your management duties, such as setting the strategy and developing your people, and delay a project because you just can’t let go.”

Want to earn more money at work? Take CNBC’s new online course How to Negotiate a Higher Salary. Expert instructors will teach you the skills you need to get a bigger paycheck, including how to prepare and build your confidence, what to do and say, and how to craft a counteroffer. Start today and use coupon code EARLYBIRD for an introductory discount of 50% off through November 26, 2024.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.

Square Stock Falls On Q3 Revenue Miss, Disappointing Outlook

Square-parent Block (SQ) reported third-quarter earnings that met Wall Street estimates while revenue missed. Square stock tumbled on Friday as some key financial metrics missed estimates and guidance also came in below views.

Released after the market close on Thursday, Square earnings for the period ended Sept. 30 were 88 cents per share on an adjusted basis, up 60% from the year-earlier period. Analysts had projected earnings of 88 cents a share.

Also, Square said net revenue came in at $5.98 billion, up 6% from a year earlier, including Cash App transactions for Bitcoin. Square stock analysts had predicted revenue of $6.24 billion.

Square Stock: Gross Profit, EBITDA

Financial analysts also view gross profit as a key metric for SQ stock. In Q3, gross profit rose 19% to $2.25 billion vs. estimates of $2.24 billion.

Cost-cutting boosted earnings before interest, taxes, depreciation and amortization, a key metric known as EBITDA. It came in at $807 million, up 69% from a year earlier, vs. estimates of $708 million.

In Q3, gross payment volume from the transactions of merchant customers rose 7.5% to $59.9 billion, missing estimates of $64.33 billion.

“Q4 outlook was shy of consensus, but embeds transitory headwinds to gross profit growth from a delay in transaction cost benefit from a Square partner and push-out of expansion of Cash App Borrow,” said TD Cowen analyst Bryan Bergin in a report. “Importantly, management sees these landing in 2025 and supports Square’s preliminary 2025 outlook for 15% gross profit growth, satisfying the Street bogey.”

On the stock market today, Square stock tumbled 4.4% to 71.96 in early trading.

For the fourth quarter of 2024, Square said it expects EBITDA of $725 million. Analysts had projected September-quarter EBITDA of $750 million.

Square predicted gross profit of $2.31 billion versus estimates of $2.35 billion.

In 2025, the company forecast 15% gross profit growth.

“Q4 gross profit guide is the primary surprise as expected drivers (transaction costs) are pushed into 2025,” said Jefferies analyst Trevor Williams in a report, “though U.S. GPV expected to accelerate based on October trends.”

Block Stock: Technical Ratings

Also, SQ stock was about even in 2024 heading into the Block earnings report. San Francisco-based Block’s earnings included consumer lending firm Afterpay.

In its core businesses, Square operates a two-sided digital payments ecosystem, with products designed for both merchant sellers and consumer buyers.

Follow Reinhardt Krause on Twitter @reinhardtk_tech for updates on artificial intelligence, cybersecurity and cloud computing.

The Fed just cut interest rates by another 25 basis points—here’s what will get cheaper

Published Thu, Nov 7 20242:03 PM EST

As widely expected, the Federal Reserve lowered its benchmark interest rate on Thursday, which will make it a bit cheaper to borrow money via credit cards, loans and auto financing.

The rate dropped by 25 basis points to a range of 4.50% to 4.75%. This follows a larger 50-bps cut in September, which brought the rate down from a peak of 5.25% to 5.50% for most of 2024.

The Fed began cutting rates in September to help boost the economy as inflation cools and the job market softens. Before that, it spent two years raising rates to curb inflation, which peaked at 9.1% in June 2022. Since then, inflation has fallen to 2.4%, bringing it much closer to the Fed’s 2% target.

In a September speech, Fed Chair Jerome Powell indicated that another 25-bps cut could happen before 2025 if current economic trends hold steady.

The Fed expects the benchmark rate to dip to 3.4% by the end of 2025, which would further increase savings on borrowing costs.

Below is a breakdown of how the recent rate cuts could impact your monthly borrowing costs. The breakdown includes today’s 25-bps cut and the cumulative 75-bps reduction since the Fed began cutting rates in September, as estimated by Bankrate.

China announces $1.4 trillion package over five years to tackle local governments’ ‘hidden’ debt

Published Thu, Nov 7 20249:56 PM ESTUpdated Fri, Nov 8 20247:46 AM EST

Evelyn Cheng@in/evelyn-cheng-53b23624@chengevelyn

Key Points

- China on Friday announced a five-year package totaling 10 trillion yuan ($1.4 trillion) to tackle local government debt problems, while signaling more economic support would come next year.

- The debt swap program, however, fell short of many investors’ expectations for more direct fiscal support.

China announces $1.4 trillion package over five years to address local governments’ ‘hidden’ debt

BEIJING – China on Friday announced a five-year package totaling 10 trillion yuan ($1.4 trillion) to tackle local government debt problems, while signaling more economic support would come next year.

Minister of Finance Lan Fo’an told reporters Friday that authorities planned to “actively use” the available deficit space that can be expanded next year. He called back to October, when he had said that the space to take this step was “rather large.”

His comments, translated by CNBC, came after the standing committee for China’s parliament, the National People’s Congress, on Friday wrapped up a five-day meeting that approved a proposal to allocate an additional 6 trillion yuan to increase the debt limit for local governments.

The program takes effect this year and will run through the end of 2026 for around 2 trillion yuan a year, Lan told reporters.

He added that, starting this year, central authorities would issue an annual 800 billion yuan in local government special bonds over a five-year stretch, for a total of 4 trillion yuan.

The policies would contribute to local governments’ efforts to reduce their so-called “hidden debt,” which Lan estimates could drop from 14.3 trillion yuan as of the end of 2023 to 2.3 trillion yuan by 2028, Lan said. He noted how the new measures would alleviate pressure on local authorities and free up funds for supporting economic growth.

“The local government’s hidden debt resolution measures introduced by China today are a concrete manifestation of the central government’s economic policy shift, with a total debt amount beating market expectations, to a certain extent,” said Haizhong Chang, executive director for corporates at Fitch Bohua.

“Compared with the amount of debt resolution in recent years, the scale is significantly larger this time,” he said.

The debt swap program, however, fell short of many investors’ expectations for more direct fiscal support. The iShares China Large-Cap ETF (FXI) was nearly 5% lower in premarket trading.

“While the market may have to wait for more substantial policy changes, the potential for future monetary and fiscal measures remains,” Chaoping Zhu, Shanghai-based global market strategist at J.P. Morgan Asset Management, said in a note. “Factors such as a deep stock market correction, export headwinds, or mounting fiscal pressures on local governments could serve as catalysts for policy escalation.”

Stimulus steps

Authorities here have ramped up stimulus announcements since late September, fueling a stock rally. On Sept. 26, President Xi Jinping led a meeting that called for strengthening fiscal and monetary support and stopping the real estate market slump.

While the People’s Bank of China has already cut several interest rates, the country’s fiscal policy governed by the Ministry of Finance would require major increases in government debt and spending, which need parliamentary approval.

During a similar meeting in October of last year, authorities had approved a rare increase in China’s deficit to 3.8%, from 3%, according to state media. This year’s gathering did not announce such a change.

Daily official readouts of the parliamentary meeting this week had said officials were reviewing the proposal to increase the local government debt limit to address hidden debt.

Analysts expect an increase in the scale of fiscal support after Donald Trump — who has threatened harsh tariffs on Chinese goods — won the U.S. presidential election this week. But some are still cautious, warning that Beijing may remain conservative and not issue direct support to consumers.

“We don’t expect policymakers to increase stimulus this year, as they need to know more about the new U.S. trade policy,” Larry Hu, chief China economist at Macquarie, said in a report Friday. “As such, the NPC meeting this week focused on debt swap rather than new stimulus.”

When discussing planned fiscal support at a press conference last month, Lan emphasized the need to address local government debt problems.

China’s $1.4 trillion package isn’t going to actually stimulate growth, says China Beige Book COO

Nomura estimates that China has 50 trillion yuan to 60 trillion yuan ($7 trillion to $8.4 trillion) in such hidden debt, and expects Beijing could allow local authorities to increase deb issuance by 10 trillion yuan over the next few years.

That could save local governments 300 billion yuan in interest payments a year, Nomura said.

In recent years, the country’s real estate slump has drastically limited a significant source of local government revenues. Regional authorities have also had to spend on Covid-19 controls during the pandemic.

Even before then, local Chinese government debt had grown to 22% of GDP by the end of 2019, far more than the growth in revenue available to pay that debt, according to an International Monetary Fund report.

SEC Warned of More Challenges to Its Regulatory, Oversight Work

A report from the Office of the Inspector General outlined challenges for the Securities and Exchange Commission based on recent judicial, regulatory and enforcement-related changes.

By Mela Seyoum|November 8, 2024

A report from the Office of the Inspector General identified the biggest obstacles to the Securities and Exchange Commission’s work, including judicial challenges, monitoring market participants, changes to enforcement abilities and crypto-related fraud. The report was released Monday, before Republican Donald Trump, who has vowed to fire current SEC Chair Gary Gensler, was re-elected U.S. president.

SEC rules have been increasingly challenged in courts in recent years, with some resultantly being voluntarily stayed or vacated, according to the report.

Another challenge to the SEC’s rulemaking powers is the Supreme Court’s decision in June in Loper Bright Enterprises v. Raimondo, which overturned 40 years of precedent that mandated courts to defer to the administrative agency’s interpretation of a statute or rule.

Considering these cases, the SEC must be more careful about its rulemaking, said Igor Rozenblit, managing partner at Iron Road Partners, a New York–based provider of compliance support and advisory services. But one of the biggest developments to affect these challenges is the incoming Trump administration.

Rozenblit said he anticipates that there will not be very aggressive rulemaking in the next administration.

“I am not sure how many legal challenges there are going to be in an environment that’s deregulatory in nature, so I think those might actually naturally fall off and not need resources,” Rozenblit said.

Transitions are expected at the chair, commissioner and senior levels at the SEC, Clifford Kirsch, partner at Eversheds Sutherland, said. And while some proposed rulemaking may happen in the next few months, it is unlikely that there will be anything controversial, he said.

To improve the rulemaking process, the OIG report recommends creating opportunities for public comment, which must also have “reasoned responses” from the SEC.

The SEC might consider issuing a greater number of proposals based on concept releases, to create more meaningful participation, Kirsch said. This would allow the SEC to put out a concept before a proposal, then get a narrower focus and gather comments, he said, adding that there’s nothing that “requires” the SEC do more concept releases.

Another judicial challenge came from the Supreme Court’s decision in SEC v. Jarkesy, in which justices ruled that in cases in which the SEC seeks civil monetary penalties for securities fraud, defendants have a right to a federal jury trial and the SEC can no longer use administrative, or in-house, proceedings.

This ruling did not come as a surprise, and the SEC has already significantly decreased its use of administrative proceedings, Rozenblit said.

He added that this might result in less aggressive enforcement cases, as the SEC was more successful in administrative proceedings than in district court, especially for complex enforcement actions.

The report also found that the SEC’s Division of Examinations’ program metrics and planning for the selection and scoping of broker-dealer examinations was too numerically focused.

A stronger adherence to the division’s stated risk-based approach would be beneficial and would lead to deeper exams, more findings and more enforcement referrals, Rozenblit said. But he added that he’s doubtful this will happen under a Trump administration.

The SEC is also fighting a growing sector of cryptocurrency-related investment-fraud schemes, with nearly $4 billion in losses in 2023, according to the Federal Bureau of Investigation. Many people are susceptible to these schemes because of a lack of familiarity with technology, and people beyond the age of 60 are even more vulnerable, according to the OIG report.

This has led to an increase in enforcement actions from state regulators related to digital assets, and the SEC has seen the same with 18% of the tips, complaints and referrals in 2024 being crypto-related, according to the report. The SEC’s examinations unit has labeled crypto assets a priority risk area in 2025.

Rozenblit said he expects the SEC to continue fighting crypto-related fraud, though he also expects a more crypto-friendly SEC under Trump, with the possibility for an exception from the custody rule for crypto.