HI Market View Commentary 10-07-2024

Lots to go over:

Politics:

Harris= Higher Taxes and I feel she also will mean higher deficit

Trump= Lower taxes, name calling and lower deficit

Election= Will cause the volatility for October and you are going to vote for either

Higher taxes for helping “less fortunate or not willing”

Lower taxes on those who have earned what they have

Best for US citizens is a split government

Isreal vs 7 fronts of war

There were these comments today in universities across the US: Jews killed 44,000 when only 1200 were killed by Hamas, Primarily 10% of the Jewish people were affiliated with the military where as only 10% of the Hamas were citizens

We added protection

S&P 500 WARNING

21.5 Future Earnings vs Historic Earnings 17.1x

If you are expecting the market to be overvalued by 19% the downside risk is 28.4%

GS upgraded the S&P 500 to reach 6000 by years end 6300 by end of next year

Downgrades today on AAPL, Amazon, and NFLX

Oct 7, 2024 Ex-Dividend Date, Payable Date Oct 23, 2024=MU

Earnings dates:

AAPL 10/31 AMC

BA 10/23 BMO

BABA 11/21 BMO

BAC 10/15 BMO

BIDU 11/26 est

DG 12/05 est

DIS 11/14 BMO

F 10/28 AMC

GM 10/22 BMO

GOOGL 10/22 AMC

JCI 11/06 AMC

JPM 10/11 AMC

KO 10/23 BMO

LMT 10/22 BMO

META 10/30 AMC

MU 12/28 est

O 11/04 AMC

SQ 11/07 AMC

TGT 11/20 BMO

UAA 11/11 est

V 10/22 AMC

VZ 10/22 BMO

ZION 10/21 AMC

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 04-Oct-24 15:05 ET | Archive

Ready or not, Q3 earnings reporting period is upon us

We know from the September Employment Situation Report that the labor market is holding up fine. That should bode well for the economy, and what bodes well for the economy should bode well for earnings growth.

We’re using a conditional tense because we won’t know for sure if earnings live up to the market’s expectations until… well, until we know. Fortunately, we are on the cusp of knowing.

The third quarter earnings reporting period is upon us.

A Cut Too Deep

According to FactSet, the blended third quarter earnings growth rate (accounts for reported results and estimates for companies that have yet to report) stands at 3.9%. The estimated earnings growth rate stood at 7.8% on June 30, so clearly analysts have reined in their expectations.

A manufacturing sector in contraction, sliding energy prices, some signs of weakening in the labor market, a struggling Chinese economy, fading pricing power, and various reports highlighting a pullback in discretionary spending by lower and middle-income consumers were among the factors contributing to the cut in the earnings growth estimate.

With lots of history to draw on, that cut will likely prove to be too deep. Earnings growth typically exceeds the estimate going into the start of the reporting period by at least two percentage points.

With the earnings growth estimate being where it is today, it’s a stretch to suggest the market has high expectations for this reporting period. It doesn’t. The high expectations are rooted in the quarters to come, which is why the guidance coming out of the third quarter earnings reporting period will be key.

FactSet estimates show fourth quarter earnings are expected to be up 14.2% followed by 14.5% growth and 13.6% growth in the first and second quarters of 2025, respectively. For calendar 2025, S&P 500 earnings growth is projected to be 15.1%.

Making a Contribution

Not surprisingly, the information technology sector is where the bulk of third quarter growth is expected to be concentrated. The blended growth rate for the sector is 15.0% and it is expected to contribute 2.99 percentage points to growth.

The other big growth contributors are the health care (1.28 percentage points) and communication services (1.00 percentage point) sectors. Sectors that are expected to detract from growth are the energy (-1.61 percentage points), financial (-0.15 percentage points), and materials (-0.09 percentage points) sectors.

There will be a better line on the financial sector’s contribution soon enough. JPMorgan Chase (JPM), Wells Fargo (WFC), BNY Mellon (BK), and BlackRock (BLK) will step to the reporting plate on October 11, and they will be followed by a large portion of their sector brethren the following week.

The reports from the banks will be looked at carefully, with a special emphasis on their characterization of credit quality. With the market’s high earnings expectations for coming quarters, it will want to hear that credit quality is holding up and not driving large provisions for loan losses.

The Amazing NVIDIA

This reporting period will be no different from other reporting periods in that the so-called “Magnificent 7” will be the fulcrum for determining if this reporting period amazes or disappoints the market.

The latter has been full of amazement for some time now and for good reason. None of the Magnificent 7 has been more amazing recently than NVIDIA. Expectations for this company are sky high.

According to FactSet, if NVIDIA is excluded, the estimated year-over-year earnings growth rate for the the information technology sector would be 8.2%. Below one will see the comparable estimated year-over-year third quarter earnings growth rates for the Magnificent 7 based on FactSet estimates:

- Apple (AAPL): 7.5%

- Microsoft (MSFT): 3.7%

- NVIDIA (NVDA): 85.0%

- Alphabet (GOOG): 18.1%

- Amazon.com (AMZN): 21.3%

- Meta Platforms (META): 18.2%

- Tesla (TSLA): -10.6%

These stocks command most of the attention, but Berkshire Hathaway (BRK.B) and Broadcom (AVGO) can’t be overlooked as “mega caps.” Their market capitalization exceeds Tesla’s; and Eli Lilly (LLY) is another heavyweight with a market cap that rivals Tesla’s. These three stocks and the Magnificent 7 account for 38% of the S&P 500’s total market capitalization.

Netflix (NFLX), meanwhile, isn’t a mega-cap stock. Its market capitalization is “just” $308 billion, yet it still has ample pull as a driver of market sentiment.

What It All Means

Earnings and earnings expectations are what drive the stock market. There are high hopes for what it is to come. That point is borne out in a forward 12-month P/E multiple of 21.5x for the market-cap weighted S&P 500 that is 19% above the 10-yr average of 18.0x.

The forward 12-month P/E multiple for the equal-weighted S&P 500 is 17.1x. That looks better in absolute terms, but it is also a slight premium to the 10-yr average of 16.4x; moreover, there isn’t a distinct value advantage over the market-cap weighted S&P 500 when taking into account that both trade with a PEG rate (price-to-earnings growth) of 1.5. In effect, one is paying a comparable premium for the projected earnings growth.

The good earnings news priced into these indices needs to keep coming or they will be at increased risk of multiple compression knowing stock prices tend to go down faster than they go up, especially when an earnings disappointment occurs.

Like any earnings reporting season, there will be surprises during the third quarter reporting period. How the market responds will hinge on what companies are doing the surprising and whether they are doing it in a positive or negative manner.

All eyes will be on the Magnificent 7 in that regard, yet the other 493 companies in the S&P 500 will have some say in things, and what is said needs to meet the market’s high earnings expectations.

—Patrick J. O’Hare, Briefing.com

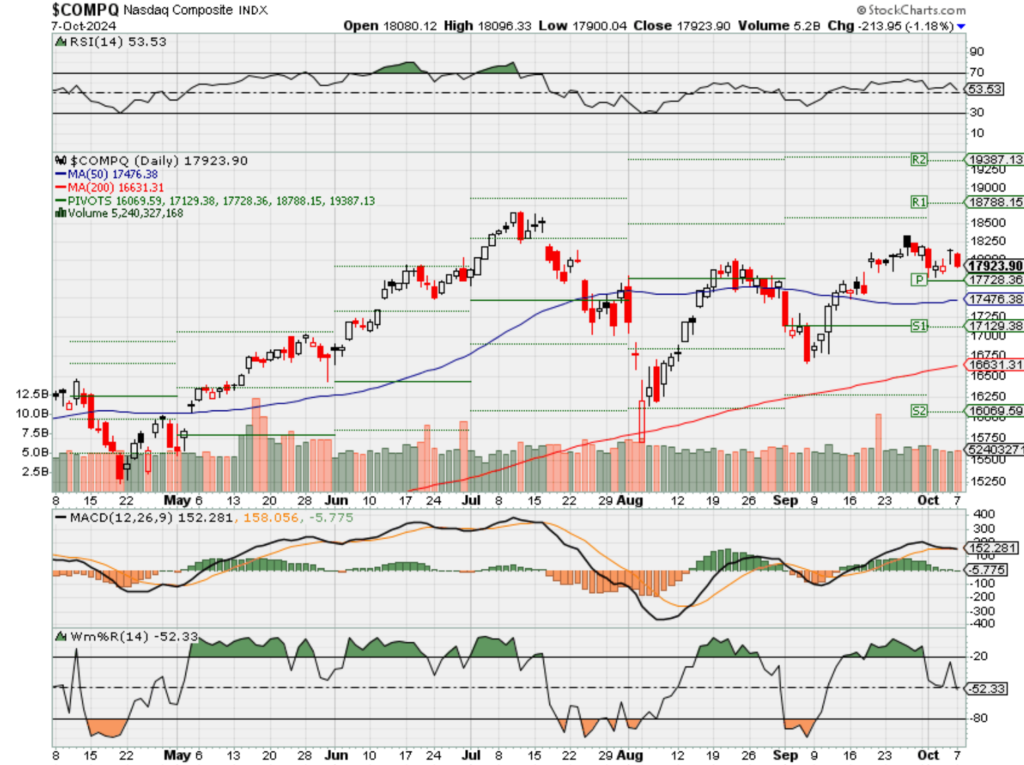

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end October 2024?

10-07-2024 -2.50%

09-30-2024 -2.50%

Earnings:

Mon:

Tues: PEP

Wed:

Thur: DAL, DPZ

Fri: BLK, FAST, WFC, JPM

Econ Reports:

Mon: Consumer Credit

Tue Trade Balance

Wed: MBA, Wholesale Inventories, FOMC Minutes

Thur: Initial Claims, Continuing Claims, CPI, Core CPI, Treasury Budget

Fri: PPI, Core PPI, Michigan Sentiment

How am I looking to trade?

We added protection to: AAPL, DIS, BAC, GOOGL, VZ, CB, LMT

Already HAD sq

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

October is already living up to its volatile reputation

Published Wed, Oct 2 20249:03 AM EDTUpdated Thu, Oct 3 202410:45 AM EDT

Historical trends heading into October pointed to a choppy month ahead. Tuesday’s session confirmed that.

The S&P 500 fell nearly 1% to kick off the new month of trading. The Nasdaq Composite shed more than 1.5%, and the Dow Jones Industrial Average lost 0.4%, or 173 points.

Those declines came as tensions in the Middle East escalated after Iran launched ballistic missiles at Israel. Meanwhile, Israeli forces began a ground operation into southern Lebanon.

The news sent crude prices spiking, and investors are shoring up protection. West Texas Intermediate futures popped 2% on Tuesday. On Wednesday, oil jumped another 3%. The Cboe Volatility Index, Wall Street’s preferred fear gauge, swelled above 20 — its highest level since Sept. 11. The VIX traded above 19 on Wednesday.

Scott Rubner, tactical specialist at Goldman Sachs, expects this choppiness to persist over the next few weeks.

“I am tactically bearish on U.S. equities over the next 3 weeks. I am bracing for added volatility and the market to over-trade daily headlines and themes,” he said in a note to clients Wednesday. “There is a supply and demand mismatch, and skew is to the downside.”

Seasonal pressures are also likely to remain in place. CNBC Pro found that the S&P 500 averages a daily move of 1.3% in either direction in October, based on FactSet data going back to 1950.

On top of that, the benchmark index has seen an average October decline of nearly 1% for the entire month during election years, according to the Stock Trader’s Almanac.

Bottom line: This may just be the beginning of a topsy-turvy period for the market.

Elsewhere on Wall Street this morning, Baird downgraded Milwaukee-based motorcyle maker Harley-Davidson to neutral from buy.

“We contacted Harley-Davidson dealers for an update on Q3 trends. Dealers reported weak retail, excess inventory and caustic sentiment – all of which suggest risk to guidance,” Baird wrote.

Apple (NASDAQ:AAPL) CEO Tim Cook Sells Over $50M in Stock

Shrilekha PetheOct 03, 2024, 07:54 AM

Story Highlights

Apple CEO Tim Cook has sold off more than $50 million worth of AAPL stock and other company executives have followed suit.

Apple AAPL -2.25% ▼ CEO Tim Cook has sold over $50 million worth of AAPL stock, with other company executives following suit. Apple stock has long been considered a solid long-term investment. In fact, over the past year, AAPL has increased by more than 30%. However, even with the stock’s strong performance, company executives occasionally choose to sell portions of their holdings.

AAPL CEO Tim Cook Sells Stock

According to the company’s filing, CEO Tim Cook sold 223,986 shares worth over $50 million. This stock sale was part of Cook’s rule 10b5-1 trading plan, where the instructions to sell were set on May 21, with the sale executed yesterday. A rule 10b5-1 trading plan, like the one used by Cook, ensures that stock trades are executed automatically when preset conditions, such as price or volume, are met. This mechanism is designed to prevent insiders from gaining an unfair advantage through material nonpublic information.

Additionally, several key AAPL executives have recently sold shares. COO Jeff Williams sold 59,370 shares, generating $13.5 million. Meanwhile, Deirdre O’Brien, SVP of Retail, sold 61,019 shares worth $13.8 million. Similarly, Katherine Adams, Apple’s General Counsel and SVP of Legal and Global Security, sold 61,019 shares, also netting $13.8 million.

Is Apple a Buy, Hold, or Sell?

Analysts remain cautiously optimistic about AAPL stock, with a Moderate Buy consensus rating based on 24 Buys, nine Holds, and one Sell. The average AAPL price target of $248.07 implies an upside potential of 9.4% from current levels.

Alphabet’s (GOOGL) Google Introduces Ads in AI-Powered Search Summaries

Radhika SaraogiOct 04, 2024, 12:35 AM

Story Highlights

Google has introduced ads in AI Overview that will be visible to mobile users in the United States.

Alphabet’s GOOGL -2.44% ▼ Google is introducing advertisements within its AI Overviews, the AI-generated summaries for certain search queries, allowing users to shop for relevant products or services directly from their search results. These ads will be available to all Google app users in the United States.

It should be noted that the ads will be clearly labeled as “Sponsored,” and will appear alongside other content in the summaries. Also, the company stated that the ads will be drawn from existing Google Shopping and Search campaigns.

Google’s AI Overviews Ads Gain Popularity

Google began testing ads within AI Overviews in May to address concerns that its generative AI might negatively impact its core search business. So far, data suggests that users find these ads useful for discovering relevant businesses and products, making these AI-generated summaries increasingly popular.

To improve the user experience, Google has added inline links to the sources used in the summaries, boosting traffic to those websites. Additionally, Google is working on a feature called AI-organized search results, which will display search results in scrollable lists based on user queries and account history.

Google Lens Enhances Ads and Features

In another significant move, Google Lens, the company’s visual search app, will display shopping ads above and alongside visual search results later this year. With 20% of all Lens searches being related to shopping, this presents a significant opportunity for advertisers to reach highly engaged consumers.

Moreover, Google Lens will be able to process video and voice input in addition to photos and text, making it a more flexible tool for users.

Is GOOGL Stock a Good Buy?

Turning to Wall Street, GOOGL has a Strong Buy consensus rating based on 30 Buys and nine Holds assigned in the last three months. At $202.11, the average Alphabet price target implies 21.86% upside potential. Shares of the company have gained 10.46% in the past six months.

From Pearl Harbor to Sept. 11, here’s how stocks typically react to the outbreak of wars

Provided by Dow Jones

Oct 2, 2024 7:47am

By Steve Goldstein

It typically takes 22 days for markets to bottom after a big event

“Buy to the sound of cannons and sell to the sound of trumpets,” was the purported quote of Baron Nathan Rothschild during the Napoleonic wars (that he probably did not utter).

That’s kind of what oil traders did on Tuesday, with the light sweet crude contract jumping from the low $67 per barrel range when media reports said that Iran was about to send missiles to Israel, up to as high as $71.80, after Iran’s mission to the United Nations said it was done for the day.

But the U.S. stock market did not enjoy the ride, with the S&P 500 index SPX at its worst falling 1.4% after Iran sent hundreds of ballistic missiles into Israel, on concerns spiraling Middle Eastern violence could disrupt oil supplies.

Adam Kobeissi, of the Kobeissi Letter, broke down how stocks fared during wars, in a social-media thread. The initial stock-market response, he says, drawing on LPL Financial data, is not great. The total average drawdown in the S&P 500 SPX to these major events is 8.2%.

But looking at it further, what really matters is if the economy is in a recession or not. The average 12-month gain when a war breaks out outside of a recession is 9.2%; the average 12-month loss when a war breaks out during one is 11.5%, he says. With the Atlanta Fed’s GDPNow estimating 2.5% third-quarter growth, it’s unlikely the U.S. is currently in a recession.

Looking at an even broader range of geopolitical events and stock-market reactions, the market bottom typically takes 22 days, with a recovery time of 47 days.

Of course, Middle East unrest is just one input into a whole host of unknowns right now, that include the economy, interest rates, a U.S. port strike and an election. “Sum this all up and you have a very dynamic situation which largely depends on recession outlook,” he says. “Markets that have many different moving parts almost always come with severe volatility.”

https://seekingalpha.com/article/4725281-a-more-bullish-sentiment-could-push-baidu-much-higher

A More Bullish Sentiment Could Push Baidu Much Higher

Oct. 06, 2024 11:30 AM ETBaidu, Inc. (BAIDF) Stock, BIDU Stock8 Comments

12.48K Followers

Follow

Play(16min)

Summary

- The most recent sentiment change in China pushed Baidu’s stock higher – along with other technology companies like Tencent or Alibaba.

- Revenue from online advertising is still struggling, but AI Cloud is growing in the double digits and intelligent driving might also be a long-term driver of revenue growth.

- Baidu is still deeply undervalued even when calculating with rather low growth rates.

- Additionally, Baidu is sitting on huge cash reserves that are almost matching the current market capitalization of the business.

V2images

My last article about Baidu, Inc. (NASDAQ:BIDU) was published about seven months ago on February 29, 2024, and similar to my other articles about Baidu I have written in the last few years, I was bullish once again. And since my last article was published, the stock actually gained 4% in value, but when looking at the numbers in more detail we can see that Baidu was rather in a downtrend most of the time and only in the last two weeks the picture turned, and Baidu jumped – similar to many other Chinese technology stocks.

Data by YCharts

In the following article, I will look at the business and stock once again and answer the question if Baidu is still a good investment at this point.

Quarterly Results

While sentiment is important in the short-to-mid term and driving the stock market, in the long term the fundamental performance of the business will be important and in almost every case the stock performance over several decades is also matching the business performance.

Therefore, let’s look at the last quarterly results once again and Baidu continues to struggle a little bit. On August 22, 2024, Baidu reported second quarter results and while the company missed revenue estimates slightly, it could beat expectations for earnings per share by $0.29. When looking at total revenue it declined slightly from RMB 34,056 million in Q2/23 to RMB 33,931 million in Q2/24 – resulting in 0.4% year-over-year decline. But while the top line declined a little bit, operating income increased 14.1% year-over-year from RMB 5,210 million in the same quarter last year to RMB 5,944 million this quarter. And finally, diluted earnings per share increased from RMB 1.77 in Q2/23 to RMB 1.88 in Q2/24 – resulting in 6.2% year-over-year bottom line growth.

Baidu Q2/24 Earnings Release

And while the earnings per share increased in the low single digits, free cash flow – one of the most important metrics – declined from RMB 7,926 million in the same quarter last year to RMB 6,261 million this quarter resulting in a decline of 21.0% year-over-year.

Looking at the different segments, Baidu is often reporting its revenue in two different categories. On the one side, we have the so-called “Baidu Core”, which generated RMB 26,687 million in revenue (resulting in 1.1% year-over-year growth). Operating income increased even 23% year-over-year from RMB 4,568 million in the same quarter last year to RMB 5,608 million this quarter.

The second segment is IQIYI, which reported a declining revenue as well as a declining operating income in the second quarter. Revenue declined 4.7% year-over-year from RMB 7,802 million to RMB 7,439 million and operating income declined 43.9% year-over-year from RMB 610 million to RMB 342 million.

Online Advertising

Now let’s look in more detail at the core business and a huge part of the core business of Baidu was online advertising, but in the last few years the advertising business was rather under pressure. This pressure is stemming from competition as well as low levels of customer spending, which is resulting in low advertisement spending. This is especially visible in small-and medium-sized advertisers and especially in real estate and automobile. Baidu’s Core online marketing revenue declined by 2% year-over-year, but the online marketing revenue was still RMB 19.2 billion and therefore responsible for more than half of total revenue.

One of the “problems” Baidu is facing right now is the shift towards GenAI search results. About 18% of the search results contain GenAI content (the ratio is up from 11% in mid-May) and although the AI-generated search results deliver more accurate and direct answers, the content is not monetized so far. Of course, this content will also be monetized at some point in the future and management is pointing out that these search results provided by GenAI are in many ways better. Not only are users able to refine their questions and follow-up through multi-round conversations, but Baidu can also recommend other content and services leading to a high users’ time spent and retention.

Statcounter

When looking at the search market in China, we see one major problem that Baidu is facing right now. Although the search engine is still clear market leader, we can see it losing market shares in the last 2-3 years. And on the other hand, we can see Microsoft’s Bing gaining market shares and becoming a serious competitor to Baidu.

But according to studies the online advertising market in China is expecting to grow in the double digits. GrandViewResaerch for example is expecting a CAGR of 16% between 2024 and 2030 and we can assume that Baidu might also be able to profit from the overall growing market (provided it does not lose further market share at a high pace).

Cloud AI

While the online advertising business is struggling a bit, the cloud business combined with the company’s push towards artificial intelligence is contributing to growth. And as management underlined during the earnings call once again, Baidu is one of the leading companies in China regarding AI:

Our decade-long investment in AI provided us with the first-mover advantage and technological leadership. We were the first public company globally to launch a GPT-like model in March of last year. And since then, we kept leveraging our self-developed four-layer AI architecture for model upgrade. Last October, we launched ERNIE 4.0. That’s China’s first GPT-4-type model. And this June, we launched ERNIE 4.0 Turbo, which offers superior capabilities over 4.0.

In the second quarter, AI Cloud generated RMB 5.1 billion in quarterly revenue and grew 14% year-over-year. Management is attributing growth mostly to two different factors: One, the introduction of diverse high-grade training data science – spanning from general to specialized industry-tailored data sets. Second, the cross-selling of CPU Cloud services to existing GPU cloud customers. During the earnings call, management was also pointing out that Ernie is used in different industries – in the healthcare industry for example it is helping to automatically generate medical records for doctors, which significantly reduced the administrative burden on doctors. In the recruitment industry, customers could upgrade the matching process between job descriptions and resumes and therefore reduce the labor costs in this process by over 50%.

Baidu is also launching additional ERNIE models, including models to make Ernie more affordable. In June, the company introduced ERNIE 4.0 Turbo, which offers superior capabilities compared to ERNIE 4.0 for typical use cases, but it is cheaper and faster to run.

And ERNIE handles about 600 million API calls and generated about 1 trillion tokens every day and management believes this is the highest in China. While this was the information provided in the last earnings call, Ernie is now processing over 700 million inquiries daily (according to a recent news story). And Baidu’s AI Cloud Platform Quiafan has helped user fine-tune over 30,000 large models and built more than 700,000 enterprise applications.

Intelligent Driving – Apollo Go

Baidu is also among the leading companies when it comes to intelligent driving. In the second quarter, Apollo Go provided about 899,000 rides to the public in the second quarter – resulting in 26% year-over-year growth (cumulative rides have surpassed 7 million in the second quarter). Of course, management also pointed out during the last earnings call, that Baidu’s market share in the entire ride-hailing service market is still very small (even in China). And similar to Alphabet (GOOG), we don’t really know how profitable this business can be, but I remain confident that we are looking at a huge contributor to revenue (and also the bottom line) in the future.

Stock: Undervalued

In case of Tencent (OTCPK:TCEHY), another Chinese technology company and great long-term investment, it is rather the growth story that is compelling (see my last article). In case of Baidu, it is not so much the growth potential, which is also existing but with question marks attached. It is rather the extremely compelling valuation.

When looking at simple valuation multiples, we can already see that Baidu is not really expensive. At the time of writing, Baidu is trading for a price-earnings ratio of 13.77, which is not only below the average of the last ten years, but also a rather low valuation multiple on an absolute basis. And while we can still argue how cheap the stock really is when using the P/E ratio, the price-free-cash-flow ratio seems to be an absolute no-brainer as Baidu is trading for only 7.65 times free cash flow.

Data by YCharts

To get a more precise result if Baidu is a good investment at this point and what an intrinsic value could be, we once again use a discount cash flow calculation. As always, we calculate with a 10% discount rate and use the last reported number of diluted shares outstanding (2,804 million but as we are calculating an intrinsic value for the ADS, we must divide the number by 8 resulting in 350.5 million shares). Additionally, we are calculating with the free cash flow of the last four quarters. According to Y-Charts, the free cash flow is $4,856 million (this is also the amount used to calculate the P/FCF ratio above). However, according to the company’s financial reports the free cash flow in the last four quarters is only $3,243 million and this is the number we will use for our calculation.

In my last article I was rather cautious about growth rates for Baidu – and the business clearly struggled in the last few years. Therefore, let’s remain cautious about the growth potential of Baidu and assume only 3% growth from now till perpetuity. This is a great target that should be reasonable and achievable for Baidu as the Chinese economy is already expected to grow with a higher pace in the years to come. When calculating with these assumptions, we get an intrinsic value of $132.18.

We can also point out that 3% growth till perpetuity is rather cautious and analysts for example are expecting earnings per share to grow with a CAGR of 8.10% in the next six years till fiscal 2029. So, let’s also be a little more optimistic and calculate with 4% growth till perpetuity. With all other assumptions the same, we get an intrinsic value of $154.21 for the stock and therefore we can argue that Baidu is still deeply undervalued at this point.

Don’t Forget The Balance Sheet

By the way, I also mentioned the price-to-book-value-ratio in previous articles about Baidu and this is a metric I am not using very often in my articles. The reason why I mentioned this ratio when writing about Baidu is simple. It is showing us how absurd the valuation of Baidu is right now. At the time of writing, Baidu is trading for 1.06 times book value (and in the last few weeks, it has been trading as low as 0.8 times book value).

Data by YCharts

And the low price-book-value-ratio is hinting towards another topic we already mentioned in the past but must talk about again. The intrinsic value calculation above, which already concluded that Baidu is undervalued, has one short-coming. It is only looking at the future free cash flow Baidu might be able to generate. However, it is excluding the fact that Baidu already has huge amounts of cash on its balance sheet – and this is money we should not really ignore as it can either be distributed to investors (via dividends) or used to invest in the business and make investments in other businesses, which should generate additional cash flow in the years to come.

Baidu Earnings Release Q2/24

When looking at the balance sheet (and I will look at the numbers in USD as the stock we are looking at is also trading in USD), Baidu has $5,990 million in cash and cash equivalents as well as $14,699 million in short-term investments. Additionally, Baidu has $9,976 million in long-term time deposits and held-to-maturity investments on its balance sheet and there are in my opinion also rather liquid investments that can be converted to cash quite easily.

Data by YCharts

On the other hand, Baidu a total of $10,260 million in long-term debt, but even when subtracting these amounts $20,405 million in rather liquid assets remain. This is resulting in about $58 in liquid assets per share Baidu can use. And not only is this almost enough to justify the current share price, but we also should add this amount to the intrinsic value calculated above resulting in a fair share price around $210 for Baidu.

Technical Picture

Finally, we can also look at the chart and we see Baidu currently pressing against a resistance level that has been in place for several quarters. If Baidu can jump over the white trendline, it would be a first good sign that the downtrend and bear market could have come to an end. However, before the stock cannot jump over $160, the stock will remain in its downtrend, and we should also remain rather cautious.

TradingView

On the other hand, I am pretty confident that Baidu found its bottom between $70 and $80 as the stock has now bounced off that level for several times – recently in 2024, in 2022, in 2020 and in 2013. And we can see the price level between $70 and $80 certainly as a strong support level for the stock.

Conclusion

I remain long-term bullish about the stock and business. I still think the business has growth potential in the years to come. But even with low growth rates, the stock remains undervalued and the huge cash reserves and liquid assets alone should make the stock a screaming bargain at this point.

Of course, we should not expect the stock prices to keep soaring like many Chinese technology stocks did in the last two weeks. At this point, a correction is not unlikely, and it might take some time before we see even higher stock prices. On the other hand, I would also not be surprised if several Chinese technology stocks – including Alibaba (BABA) and JD.com (JD) – continue to soar as many are extremely undervalued and with sentiment changing, valuation multiples could also change quickly

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

https://www.aol.com/ignore-social-media-harris-unrealized-160037188.html

Ignore social media. Here’s what Harris’ unrealized capital gains tax proposal means for you

Katie Lobosco, CNN

October 6, 2024 at 9:00 AM

Carolyn Kaster/AP

A tax proposal embraced by Vice President Kamala Harris that’s meant to target the wealthy is getting attention in an unlikely place for wonky policy debate: social media.

But many posts ignore the fact that the plan would only impact those whose net worth is more than $100 million, or less than 1% of taxpayers, and falsely suggest that all homeowners should fear a new massive tax bill. One TikTok user, for example, claimed that people will “lose their homes” and that “the IRS will bankrupt them.”

At issue is a proposal often referred to as a billionaire minimum tax. It would treat the increase in the value of assets – like real estate, stocks and private businesses – as taxable income each year, even if they are not sold. This is known as an unrealized capital gain.

One way to think of it is as a tax on a gain, or profit, that exists only on paper.

“It’s quite a transformational proposal,” said Mark Friedlich, vice president of government affairs at Wolters Kluwer Tax & Accounting.

On the campaign trail, Harris has said she supports a billionaire minimum tax. She hasn’t outlined the specifics, but the Biden-Harris administration’s most recent budget proposal lays out details.

A billionaire minimum tax is one of several proposals pushed by Democrats in recent years to tax the rich. Both President Joe Biden and Harris have consistently said that they want to make the “wealthiest Americans pay their fair share” and that the additional tax revenue raised could be used to pay for social spending programs, like helping families pay for child care or down-payment help for first-time homebuyers.

Currently, some middle- and high-income people are subject to a tax on realized capital gains, which results when an asset – like a stock or home – is sold for more than what the owner originally paid for it. Essentially, it’s a tax on the profit. Harris has specifically called for raising the top tax rate on millionaires with long-term realized capital gains from 20% to 28%.

Here are key things to know about how these tax changes could work:

Most taxpayers would not be impacted

A billionaire minimum tax on unrealized capital gains would apply to taxpayers whose net worth is above $100 million, as proposed by the most recent Biden-Harris administration’s budget proposal.

To help put that in context, just 20,209 taxpayers – or about 0.01% – had net worth valued at $50 million or more in 2019, according to the latest IRS data available.

More recent data from Altrata, a private firm, suggests the number of high-net worth individuals has grown over the past five years. But the share of all US taxpayers earning more than $100 million is still likely to be small.

Harris’ proposal to increase the tax rate on realized capital gains to 28% would apply to taxpayers with income over $1 million. About 875,500 taxpayers – or 0.54% – reported having that much income in 2021, according to the IRS.

Those who would be impacted are “the smallest slice of the very wealthy,” said Erica York, a senior economist and research director at the right-leaning Tax Foundation.

How a tax on unrealized capital gains would work

Let’s discuss how a billionaire minimum tax – which is, on a basic level, a tax on unrealized capital gains – would impact a homeowner.

Currently, a homeowner pays a tax on the growth in the value of the home when it is sold, or realized. But a tax on unrealized capital gains would require a homeowner to pay a tax on the appreciated value of the home each year – even if the house hasn’t been sold.

For example, if a home was purchased for $500,000 and it appreciates in value to $520,000 the next year, the owner would owe some tax on the $20,000 increase.

The tax would also apply to other kinds of assets like stocks and private businesses. But again, the Biden-Harris administration’s proposal would only impact those whose net worth is more than $100 million.

Another misconception is about how much wealthy taxpayers would owe. It would not be a new, separate tax bill.

Under the Biden-Harris administration’s proposal, impacted taxpayers would be required to pay a minimum effective tax rate of 25% on all of their income – including unrealized capital gains. If their effective tax rate on this recalculated income amount fell below 25%, they would owe additional taxes.

A tax on unrealized gains would cause a headache for the IRS

To implement a tax on unrealized gains, the IRS would likely have to create a way to measure the change in value of a private business and real estate on an annual basis. The agency does not currently track these values.

“This creates an enormous administrative burden on the IRS, as if it’s not already challenged enough,” Friedlich said.

The new challenge could take away the agency’s core responsibilities of processing returns in a timely fashion and providing customer service help.

There could be ways to alleviate the burden on the IRS, depending on the details of the proposal. For example, a 2021 proposal from Senate Finance Committee Chairman Ron Wyden, an Oregon Democrat, would not have taxed non-tradable assets like real estate or businesses annually.

The new tax is a long shot in Congress

Even if Democrats control both the House and Senate during a potential Harris presidency, it may be hard to get the votes to pass the billionaire minimum tax or the increase to the long-term capital gains tax rate through Congress.

In 2021, Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona – both former Democrats who have since turned independent – blocked similar tax measures from moving forward.

If passed, a billionaire minimum tax – an unprecedented tax on income not yet received – would likely face many legal challenges.

Some critics of Democrats’ wealth tax proposals have suggested that people can’t trust that they would not eventually be expanded to middle-class households.

If history is any indication, there are examples to show that the government has both expanded and narrowed taxes after first implementing them. The federal income tax, for example, has expanded to more people over time. The impact of the estate tax, on the other hand, has narrowed.

Consistent with Biden’s policies, Harris has said nothing to suggest that she intends to raise taxes for people who earn less than $400,000 a year.

Another tax proposal could impact inheritances

Harris hasn’t talked specifically about this, but there’s a provision in Biden’s budget that would change the way inherited assets are taxed.

Currently, you don’t have to pay a capital gains tax when you inherit a home, stocks or a business that have increased in value, thanks to a provision called “step-up in basis.”

But the Biden proposal would make some wealthy people pay that tax when an appreciated asset is passed on after death. The argument is that the step-up in basis primarily benefits the rich, whose wealth is more often tied up in real estate and stocks. It currently allows some wealth to avoid ever being taxed as it’s passed down from one family member to another.

Biden’s proposed change would only apply to inheritances where the appreciated value is worth more than $5 million for individuals or more than $10 million for married couples. Assets donated to charity would also be excluded from the tax.

For more CNN news and newsletters create an account at CNN.com

Israel bombs Lebanon, Gaza ahead of 1-year anniversary of Oct. 7 attacks

By Laila Bassam, Timour Azhari and Steven Scheer, Reuters | Posted – Oct. 6, 2024 at 8:31 p.m.

Smoke and flames rise over Beirut’s southern suburbs after a strike, amid ongoing hostilities between Hezbollah and Israeli forces, as seen from Sin El Fil, Lebanon, Sunday. (Amr Abdallah Dalsh, Reuters)

KEY TAKEAWAYS

- Israel bombed Hezbollah targets in Lebanon and the Gaza Strip on Sunday, marking an escalation ahead of the anniversary of the Oct. 7 attacks, with the Israeli Defense Minister stating all options, including actions against Iran, were on the table.

- In response, Hezbollah rockets breached Israeli defenses, causing damage and injuries in Haifa.

BEIRUT — Israel bombed Hezbollah targets in Lebanon and the Gaza Strip on Sunday ahead of the first anniversary of the Oct. 7 attacks that sparked its war, as Israel’s defense minister declared all options were open for retaliation against arch-enemy Iran.

Hezbollah rockets launched late on Sunday got past Israeli air defense systems and landed in Haifa, Israel’s third-largest city, causing damage to buildings, police said. Israeli media reported 10 people wounded in rocket strikes in Haifa and the city of Tiberias.

Hezbollah said it had targeted a military site south of Haifa with a salvo of “Fadi 1” missiles.

Israeli air strikes battered Beirut’s southern suburbs on Sunday in the most intense bombardment of the Lebanese capital since Israel sharply escalated its campaign against Iran-backed group Hezbollah last month. Large fireballs lit the darkened skyline and booms reverberated across Beirut.

The Israeli military said fighter jets struck targets in Beirut belonging to Hezbollah’s Intelligence Headquarters and weapons storage facilities. It said strikes also targeted Hezbollah in southern Lebanon and the Beqaa area.

Report ad

Hamas-led militants launched rockets into Israel from Gaza at the start of the Oct. 7 attacks last year.

The Hamas attacks that day killed 1,200 people and more than 250 were taken hostage, according to Israeli figures. They provoked an Israeli offensive in Gaza that has laid waste the densely populated coastal enclave and killed almost 42,000 people, according to Palestinian health authorities.

On the eve of the anniversary, pro-Palestinian demonstrators protested against Israel around the world from Jakarta to Istanbul and Rabat after rallies in major European capitals, Washington and New York on Saturday.

Iran launched a missile attack on Israel last week in response to its operations in Lebanon and Gaza, where Hezbollah and Hamas militants are Tehran’s allies in a so-called Axis of Resistance.

Israel, which says its objective is the safe return of tens of thousands of citizens to homes in northern Israel, vowed retaliation amid fears that tensions will escalate into an all-out regional conflict.

Israeli Defense Minister Yoav Gallant said on Sunday Israel would decide independently how to respond to Iran even though it was closely coordinating with longtime ally the U.S.

“Everything is on the table,” Gallant, who is due to meet U.S. Defense Secretary Lloyd Austin on Wednesday, said in an interview with CNN. “Israel has capabilities to hit targets near and far — we have proved it.”

While the U.S. has said it would not support strikes on Iranian nuclear sites, President Joe Biden said last week that Israeli attacks on Iran’s oil facilities were being discussed.

Israel snubbed a U.S.-backed push for a cease-fire in launching ground operations in Lebanon.

On Sunday, the U.S. government reacted to Israel’s heavy bombardment there by saying that military pressure can enable diplomacy but can also lead to miscalculations.

French President Emmanuel Macron said over the weekend that shipments of arms to Israel should be stopped. Israel said such a step would serve the purposes of Iran.

The Israeli military issued new evacuation orders for residents of southern Beirut late on Sunday in advance of further strikes.

On Sunday night, Israel declared three more areas on its northern border as closed military zones in addition to more than five closed last week as military staging areas.

An Israeli strike on a building in the mountain town of Kayfoun in central Lebanon killed six people and wounded 13, Lebanon’s health ministry said. A strike in the nearby town Qmatiye killed six more, including three children, and wounded 11, it said.

In the Gaza Strip, at least 26 people were killed and 93 others wounded when Israeli airstrikes hit a mosque and a school sheltering displaced people on Sunday, according to the Hamas-run Gaza government media office. The Israeli military said it had conducted “precise strikes on Hamas terrorists”.

‘Joint command’ leads Hezbollah

In attacking Israel last week, Iran also cited assassinations of militant leaders, which have devastated Hezbollah’s senior ranks.

Hezbollah official Hashem Safieddine was targeted by Israeli strikes in southern Beirut last week and his fate remains unclear. He is considered a likely successor to leader Sayyed Hassan Nasrallah, who was killed in an Israeli attack last month.

Senior Hezbollah political official Mahmoud Qmati told Iraqi state television on Sunday that Israeli bombing was obstructing search efforts in an area where Safieddine had reportedly been targeted. He said Hezbollah was being led by a joint command until a leader was designated.

Iran’s Quds Force commander Esmail Qaani also has not been heard from since Israeli strikes on Beirut late last week, two senior Iranian security officials told Reuters.

The conflict in Lebanon, which started a year ago with cross-border strikes by Hezbollah in solidarity with Hamas, has rapidly expanded in the past couple of weeks.

More than 2,000 people have been killed in Lebanon in nearly a year of fighting, most in the past two weeks, according to the Lebanese health ministry. The ministry said on Sunday that 25 people were killed on Saturday.

“Last night was the most violent of all the previous nights,” said Hanan Abdullah, a resident of Beirut’s southern suburbs. “There were dozens of strikes — we couldn’t count them all — and the sounds were deafening.”

The United Nations’ refugee chief said on Sunday there were “many instances” where Israeli airstrikes had violated international law by hitting civilian infrastructure and killing civilians in Lebanon.

Israel says it targets military capabilities and takes steps to mitigate the risk of civilian harm, while Lebanese authorities say civilians have been targeted. Israel accuses both Hezbollah and Hamas of hiding among civilians, which they deny.

Contributing: James Mackenzie, Maayan Lubell, Maya Gebeily, Phil Stewart, Suleiman al-Khalidi, Jaidaa Taha, Hatem Maher, Elwely Elwelly, John Davison, Cynthia Osterman and David Brunnstrom