HI Market View Commentary 08-26-2024

OK – HI updates: NO Thursday Trade Findings & Adjustments NO Monday Labor Day HI Market View Commentary because the markets closed Monday

Houston we have THREE MAJOR Problems !!!!

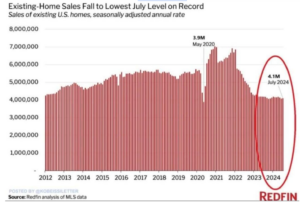

Lowest July inventory on record?= No one is moving due to interest rates=NOT Correct

It is also a supply and demand – Inflation in housing prices is still too high and will most likely remain higher Through the next year

More than a third of my mortgage is Property taxes 41.5% of my mortgage bill is property taxes

NVDA

Why is in NVDA a problem right now?

One of the largest Mag 7 stocks and has become a bellwether stock

Moved to quick to fast

ANY funds have to at this time reallocate the fund and NVDA due to the fund model

Funds have models to try predict future returns – EVERY model had to rebalance according to the fund allocations

IS good news good news or is it bad news? Is bad news bad news or is it good news ?

It probably will continue to crush the numbers, unfortunately when we get the initial pop higher we then need to see how the market reacts = A pop above $140 to $152 we will add a second set up puts to protect the initial bounce

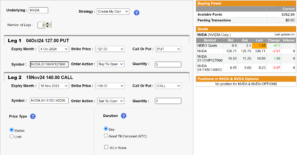

Collar trade

Buy to open 100 shares for $126.46 = $12,646

What is the risk in the investment?= Every freaking penny

We buy to open (BTO) long put = right the sell your stock at a certain price for a certain period of time

BTO 4 Oct 127 long put for $10.88

New Cost basis = Stock 126.46 + 10.88 = $137.34

Wha is the new risk in the trade per share?= New cost basis 137.34 – Right to sell @ $127 = 10.34 per share of 7.52% of the total invested capital

To lower the risk we could STO (sell to open) a short call = Obligated to sell your stock at a certain price for a certain period of time. We choose $140 short call for $9.23 credit

Overall risk in the trade until the long put protection expires in Oct 4th = 10.34 – 9.23 = $1.11 per share or 0.008 or 8 tenths of one percent at rick of your total invested capital

For every $1,000,000 invested in this collar trade you have $8,600 at risk

Max Reward = New cost basis 137.34 – Obl to sell @ $140 + 9.23 = $11.89 profit / 129 = 9.2% RIOR

TAXES are going up eventually

BUT we have a hugh problem with a platform on Taxes

The taxes are supposed to be on the ultra wealthy BUT they are written to screw the middle class

Capital gains for those “making” over 400K will pay a long term capital gains of 44%

ON the 100 Million or more capital gains (individuals and corporations) are subject to a 25%Unrealized capital gains tax

What are the majority of US workers classified as “Small Business” = LLC, S-Corp, C- Corp

What does this mean Corporate tax rates going to 28% or back to 35% = 33% to 66% higher taxes on your small business

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 23-Aug-24 15:06 ET | Archive

Warning – Implicit content

In The Big Picture column posted last week discussing inflation trends and their meaning for the Fed, we concluded with an expectation that the Fed will be buying what the market is selling.

What was the market selling? A rate cut at the September FOMC meeting.

The speech Fed Chair Powell gave at the Jackson Hole Economic Symposium was titled Review and Outlook. It could just as easily have been titled Sold!

The Time Has Come

Fed Chair Powell is not one to make specific promises when it comes to monetary policy settings. The refrain for some time is that the Fed is data dependent and will make decisions on a meeting-by-meeting basis.

In his Jackson Hole speech, however, he came about as close as ever to making an explicit statement that the Fed is going to cut rates in September.

And we quote:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Those two sentences packed a lot of implicit punch.

The first sentence is the nod to a September rate cut. The second sentence is arguably the more important of the two. It left an impression that there won’t be just one rate cut; moreover, it also left the door open for a policy adjustment that could exceed 25 basis points.

That won’t be the case at the September meeting, but beyond that, a 50-basis points adjustment could be seen. That isn’t a promise. Rather, it is an implicit possibility.

It sounds as if the labor market will be calling the shots on any 50-basis points adjustment. Fed Chair Powell noted that, “We do not seek or welcome further cooling in labor market conditions.”

That’s a jarring statement with the unemployment rate still at a relatively low 4.3%, yet we suspect the rate of change in the unemployment rate (up almost a full percentage point above its level in early 2023, with most of that increase coming over the past six months) is what has caught the Fed’s concerned eye.

It is also worth noting that a 4.3% unemployment rate is above the Fed’s longer run median estimate of 4.2% seen in the Summary of Economic Projections provided in June.

A New Way of Thinking

Something else we think the Jackson Hole speech accomplished is that it likely altered the market’s handicapping of incoming economic data.

Not long ago, the fulcrum of economic reporting was whether a certain data point meant the Fed was going to cut 25 basis points or not at all. But since the “direction of travel is clear,” the market will adjust its thinking to ponder whether a certain data point means the Fed is going to lower the target range for the fed funds rate by 25 basis points or 50 basis points.

The CME FedWatch Tool shows the fed funds futures market is expecting the target range for the fed funds rate (currently 5.25-5.50%) to be cut by 100 basis points before the end of the year to 4.25-4.50%. There are only three scheduled meetings left this year, so it is implied that one of those three meetings will produce a 50-basis points rate cut.

Currently, the November 6-7 meeting, which ends two days after the election, is the odds-on favorite with a 59.2% probability of a 50-basis points rate cut. That is up from 47.1% the day before Fed Chair Powell gave his Jackson Hole speech.

What It All Means

The market was pleased by what it heard from Fed Chair Powell. It has been hanging its rally hat on the idea that rate cuts are coming and that the U.S. economy can avoid a hard landing.

That is a Goldilocks step down from a tightening campaign that began in March 2022 and peaked in July 2023. In total, there were 12 rate hikes over that period that raised the target range for the fed funds rate by 525 basis points.

It hasn’t been a painless process for the economy but, remarkably, the pain of those rate hikes in a broad economic sense has been tolerable.

With the Fed now looking to travel in a new direction with its policy setting, there is some abiding hope that it will escape its tightening campaign without killing the economic expansion.

If one wants to catch a glimpse of the market’s confidence in that outcome, watch the small-cap stocks and the value stocks. They stand to gain the most in our estimation from the Fed lowering rates because inflation trends are improving and not because the economy is coming off the rails.

Dividend-paying stocks will be another beneficiary in a lower interest rate environment, so they are seemingly well positioned, along with bonds, for a policy road ahead that is being managed in conjunction with a soft landing.

Should the economy take a hard landing turn for the worse, the playbook will change. In that situation, one could expect to see the mega-cap and large-cap stocks as relative strength leaders, and growth being favored over value. Since a downturn for the economy would ultimately invite more policy easing, higher quality dividend-paying stocks and bonds would also be poised to exhibit relative strength.

A hard landing or recession, though, isn’t good for stocks in general since that would lead to a downturn in corporate earnings.

That isn’t in the Fed’s outlook, and with the S&P 500 flirting with all-time highs amid a broadening out in buying efforts, it is fair to say that it isn’t the market’s prevailing outlook either. The market seems to be relishing that thought now that the time has come for policy to adjust.

—Patrick J. O’Hare, Briefing.com

Earnings dates:

DG 08/29 est

MU 09/25 est

TGT 08/21 BMO

Where will our markets end this week?

Higher to flat

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end September 2024?

08-26-2024 -2.00%

Earnings:

Mon:

Tues: HAIN, JWN

Wed: ANF, CHWY, FL, KSS, CRWD, FIVE, HPQ, CRM, NVDA

Thur: AEO, BBY, BURL, DG, DELL, GAP, LULU, MRVL, ULTA

Fri:

Econ Reports:

Mon: Durable Goods, Durable Ex-trans

Tue FHFA Housing Market Index, S&P Case Shiller, Consumer Confidence

Wed: MBA,

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator, Pending Home Sales,

Fri: PCE Index, PCE Core, Michigan Sentiment, Personal Income, Personal Spending

How am I looking to trade?

We Started taking protection off based on Technical Analysis

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

China Internet Giant Baidu Posts Earnings Beat While Sales Miss

- 07:02 AM ET 08/22/2024

Baidu (BIDU) edged higher early Thursday, after the Chinese internet services giant reported mixed second-quarter results. Earnings beat estimates while sales came in short of expectations.

Baidu said early Thursday that it earned an adjusted 21.02 yuan per American depositary share on sales of 33.9 billion yuan, or $4.7 billion, for its June-ending quarter. On average, analysts projected the Beijing-based company would post adjusted earnings of 18.57 yuan per ADS on sales of 34.1 billion yuan, according to FactSet.

For the same period a year earlier, Baidu posted adjusted earnings of 22.55 per ADS on sales of 34 billion yuan.

Baidu Stock Down 25% Year-To-Date

In premarket action on the stock market today, U.S.-listed Baidu stock rose 0.5% to at 90.21. Baidu gained 2% in Wednesday trading. But shares have lost 25% year-to-date and are down nearly 30% compared to 12 months ago.

BIDU stock has struggled as a slumping economy in China has weighed on digital marketing revenue. Baidu is looking to generative artificial intelligence to help drive growth. Last year, the firm launched a ChatGPT-like artificial intelligence chatbot called Ernie.

Founded in 2000, Baidu operates the largest internet search platform in China. Similar to Google parent company Alphabet (GOOGL), Baidu derives revenue from online marketing while also offering cloud-computing services. The company also operates a streaming service and has an autonomous vehicle division, among other lines of business.

Coming into the report, Baidu stock had an IBD Composite Rating of 43 out of a best-possible 99, according to IBD Stock Checkup. The score combines five separate proprietary ratings into one rating. The best growth stocks have a Composite Rating of 90 or better.

Further, Baidu’s IBD Relative Strength Rating was 14 out of 99. The RS Rating means that Baidu stock has outperformed just 14% of all stocks in IBD’s database over the past year.

https://www.prnewswire.com/news-releases/baidu-announces-second-quarter-2024-results-302228460.html

Baidu Announces Second Quarter 2024 Results

News provided by

Aug 22, 2024, 05:00 ET

BEIJING, Aug. 22, 2024 /PRNewswire/ — Baidu, Inc. (NASDAQ: BIDU and HKEX: 9888 (HKD Counter) and 89888 (RMB Counter)), (“Baidu” or the “Company”), a leading AI company with strong Internet foundation, today announced its unaudited financial results for the second quarter ended June 30, 2024.

“AI Cloud continued to accelerate in the second quarter, offsetting the ongoing macro headwinds for online marketing revenue and resulting in modestly positive topline growth for Baidu Core. Operationally, we fast-tracked the renovation of Baidu search, which we believe will drive long-term success despite the short-term impact on monetization. We also achieved new breakthroughs with Apollo Go, which now offers 100% fully driverless ride-hailing services in practically the entire Wuhan municipality, and has started scalable testing of the latest RT6 vehicles,” said Robin Li, Co-founder and CEO of Baidu. “Gradually, the transformative impact of Gen-AI and foundation models is becoming more tangible in business and everyday life. Throughout all layers of our AI technology stack and with the rapid adoption of applications built on top of ERNIE, we are scaling AI to address real-world problems and generate substantial value both for external customers and our own product portfolio.”

“As we speeded up the AI-native transformation of our products in the second quarter, we continued to optimize our operations and maintained a healthy margin,” said Rong Luo, CFO of Baidu. “For AI Cloud in particular, we expect growth to maintain a strong momentum.”

| Second Quarter 2024 Financial Highlights[1] | ||||||||||

| Baidu, Inc. | ||||||||||

| (In millions except per | Q2 | Q1 | Q2 | |||||||

| ADS, unaudited) | 2023 | 2024 | 2024 | YOY | QOQ | |||||

| RMB | RMB | RMB | US$ | |||||||

| Total revenues | 34,056 | 31,513 | 33,931 | 4,669 | (0 %) | 8 % | ||||

| Operating income | 5,210 | 5,484 | 5,944 | 818 | 14 % | 8 % | ||||

| Operating income (non-GAAP) [2] | 7,334 | 6,673 | 7,500 | 1,032 | 2 % | 12 % | ||||

| Net income to Baidu | 5,210 | 5,448 | 5,488 | 755 | 5 % | 1 % | ||||

| Net income to Baidu (non-GAAP) [2] | 7,998 | 7,011 | 7,396 | 1,018 | (8 %) | 5 % | ||||

| Diluted earnings per ADS | 14.17 | 14.91 | 15.01 | 2.07 | 6 % | 1 % | ||||

| Diluted earnings per ADS (non-GAAP) [2] | 22.55 | 19.91 | 21.02 | 2.89 | (7 %) | 6 % | ||||

| Adjusted EBITDA [2] | 9,116 | 8,244 | 9,147 | 1,259 | 0 % | 11 % | ||||

| Adjusted EBITDA margin | 27 % | 26 % | 27 % | 27 % | ||||||

| Baidu Core | ||||||||||

| Q2 | Q1 | Q2 | ||||||||

| (In millions, unaudited) | 2023 | 2024 | 2024 | YOY | QOQ | |||||

| RMB | RMB | RMB | US$ | |||||||

| Total revenues | 26,407 | 23,803 | 26,687 | 3,672 | 1 % | 12 % | ||||

| Operating income | 4,568 | 4,538 | 5,608 | 772 | 23 % | 24 % | ||||

| Operating income (non-GAAP) [2] | 6,516 | 5,586 | 7,005 | 964 | 8 % | 25 % | ||||

| Net income to Baidu Core | 5,012 | 5,150 | 5,462 | 752 | 9 % | 6 % | ||||

| Net income to Baidu Core (non-GAAP) [2] | 7,694 | 6,628 | 7,290 | 1,003 | (5 %) | 10 % | ||||

| Adjusted EBITDA[2] | 8,229 | 7,118 | 8,617 | 1,186 | 5 % | 21 % | ||||

| Adjusted EBITDA margin | 31 % | 30 % | 32 % | 32 % | ||||||

| [1] Unless otherwise noted, RMB to USD was converted at an exchange rate of RMB7.2672 as of June 28, 2024, as set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. Translations are provided solely for the convenience of the reader. |

||||||||||

| [2] Non-GAAP measures are defined in the Non-GAAP Financial Measures section (see also “Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measures” for more details). |

||||||||||

Operational Highlights

Corporate

- Baidu expanded the ERNIE family of models with the launch of ERNIE 4.0 Turbo in June 2024, offering superior capabilities for typical use cases, and designed to run faster and at lower cost compared to ERNIE 4.0.

- Baidu returned US$301 million to shareholders since the beginning of Q2 2024, bringing the cumulative repurchase to about US$1.2 billion under the 2023 share repurchase program.

- Baidu earned a position in the China edition of the S&P Global Sustainability Yearbook, in recognition of its exceptional ESG performance. The selection stems from a comprehensive evaluation of 1,700 Chinese companies as part of the S&P Global 2023 Corporate Sustainability Assessment, underscoring Baidu’s sustainability practices.

AI Cloud

- PaddlePaddle and ERNIE developer community grew to 14.7 million in June 2024.

Intelligent Driving

- Apollo Go, Baidu’s autonomous ride-hailing service, provided about 899K rides in the second quarter of 2024, up 26% year over year. As of July 28, 2024, the cumulative rides provided to the public by Apollo Go surpassed 7 million.

- On June 19, Apollo Go started offering 100% fully driverless operations in practically the entire Wuhan municipality, its largest operational city, marking a significant milestone.

- The sixth-generation of our autonomous vehicle, the RT6, is now undergoing scalable testing.

Mobile Ecosystem

- In June 2024, Baidu App’s MAUs reached 703 million, up 4% year over year.

- Managed Page accounted for 51% of Baidu Core’s online marketing revenue in the second quarter of 2024.

Second Quarter 2024 Financial Results

Total revenues were RMB33.9 billion ($4.67 billion), which was basically flat from last year.

- Revenue from Baidu Core was RMB26.7 billion ($3.67 billion), increasing 1% year over year; online marketing revenue was RMB19.2 billion ($2.64 billion), decreasing 2% year over year, and non-online marketing revenue was RMB7.5 billion ($1.03 billion), up 10% year over year, mainly driven by AI Cloud business.

- Revenue from iQIYI was RMB7.4 billion ($1.02 billion), decreasing 5% year over year.

Cost of revenues was RMB16.4 billion ($2.26 billion), increasing 1% year over year, primarily due to an increase in traffic acquisition costs and costs related to AI Cloud business.

Selling, general and administrative expenses were RMB5.7 billion ($784 million), decreasing 9% year over year, primarily due to a decrease in expected credit losses, channel spending and promotional marketing expenses and personnel related expenses.

Research and development expenses were RMB5.9 billion ($810 million), decreasing 8% year over year, primarily due to a decrease in personnel related expenses.

Operating income was RMB5.9 billion ($818 million). Baidu Core operating income was RMB5.6 billion ($772 million), and Baidu Core operating margin was 21%. Non-GAAP operating income was RMB7.5 billion ($1.03 billion). Non-GAAP Baidu Core operating income was RMB7.0 billion ($964 million), and non-GAAP Baidu Core operating margin was 26%.

Total other income, net was RMB771 million ($106 million), decreasing 44% year over year, primarily due to a decrease in net foreign exchange gain and disposal gain, partially offset by the decrease in fair value loss and impairment loss from long-term investments.

Income tax expense was RMB1.1 billion ($156 million), compared to RMB1.3 billion in the same period last year.

Net income attributable to Baidu was RMB5.5 billion ($755 million), and diluted earnings per ADS was RMB15.01 ($2.07). Net income attributable to Baidu Core was RMB5.5 billion ($752 million), and net margin for Baidu Core was 20%. Non-GAAP net income attributable to Baidu was RMB7.4 billion ($1.02 billion). Non-GAAP diluted earnings per ADS was RMB21.02 ($2.89). Non-GAAP net income attributable to Baidu Core was RMB7.3 billion ($1.00 billion), and non-GAAP net margin for Baidu Core was 27%.

Adjusted EBITDA was RMB9.1 billion ($1.26 billion) and adjusted EBITDA margin was 27%. Adjusted EBITDA for Baidu Core was RMB8.6 billion ($1.19 billion) and adjusted EBITDA margin for Baidu Core was 32%.

As of June 30, 2024, cash, cash equivalents, restricted cash and short-term investments were RMB162.0 billion ($22.29 billion), and cash, cash equivalents, restricted cash and short-term investments excluding iQIYI were RMB155.0 billion ($21.32 billion). Free cash flow was RMB6.3 billion ($862 million), and free cash flow excluding iQIYI was RMB5.9 billion ($810 million).

Conference Call Information

Baidu’s management will hold an earnings conference call at 8.00 AM on Aug 22, 2024, U.S. Eastern Time (8.00 PM on Aug 22, 2024, Beijing Time).

Please register in advance of the conference call using the link provided below. It will automatically direct you to the registration page of “Baidu Inc. Q2 2024 Earnings Conference Call”. Please follow the steps to enter your registration details, then click “Register”. Upon registering, you will then be provided with the dial-in number, the passcode, and your unique access PIN. This information will also be emailed to you as a calendar invite.

https://finance.yahoo.com/news/2-reasons-baidu-stock-watch-130000350.html

2 Reasons Baidu Is the Stock to Watch Now

Lawrence Nga, The Motley Fool

Wed, Aug 21, 2024, 7:00 AM MDT5 min read

In this article:

It has been a tough time for investors in Baidu (NASDAQ: BIDU). After shares of the Chinese search engine reached their peak of $340 in 2021, they have, gone nowhere but down. Worse, in the last 12 months, when most artificial intelligence (AI) stocks like Nvidia and Palantir have outperformed massively, Baidu’s stock has gone down by 38%.

Baidu’s poor stock performance has attracted bargain hunters (myself included) to the opportunity of getting a good bargain. Here’s what I have found after digging into the company.

Image source: Getty Images.

- Baidu’s core business remains highly profitable

Baidu is a classic example of how a high-growth company reached a relatively mature state and began to grow at a slower, less predictable pace. It was the de facto search engine in China in the early days, especially after its main competitor, Alphabet’s Google, exited the market entirely in 2010.

Yet, thanks to the emergence of smartphones and social media networking apps like WeChat, the rapidly evolving tech landscape has gradually eroded Baidu’s dominance in the search and advertising business. On top of that, a series of poorly executed investments in areas like food delivery and entertainment further impacted investors’ confidence in the company’s ability to regain its hyper-growth status.

While these are valid reasons to be concerned, investors should also consider the positive side of Baidu’s core businesses, which consist of its online marketing (mainly search-related businesses) and non-marketing business, which consists of cloud computing and other businesses. This core business segment grew by 7% in 2023 and another 4% in the first quarter of 2024. This segment also generated 18.8 billion yuan ($2.7 billion) in operating profit in 2023, with a 19% operating margin. In other words, Baidu’s core business remains healthy (and growing).

Baidu’s core business has a vast user base of 676 million, covering close to half of the Chinese population. With such a massive number of users, Baidu’s app has become indispensable to advertisers looking to reach their audiences, especially given the increasingly competitive technology industry, where companies try their best to capture user screen share and mind share.

So as long as Baidu can continue to delight its users and keep them engaged with its search engine or innovate to build new services or features to improve its product offerings, it stands a good chance to keep minting money from its core businesses.

- AI presents massive optionality for Baidu to grow

Investors have been mainly bullish about AI companies since 2023, which explains the significant increase in the share price of these companies. Yet despite Baidu’s massive investments and utilization of AI technologies in its business, investors have largely avoided the company.

However, they shouldn’t, since AI could propel Baidu to the next stage of its evolution. Statista predicts that the AI market in China will reach $34 billion in 2024 and grow to $155 billion by 2030. As a leading player in AI cloud offerings, Baidu stands a good chance of capturing a reasonable market share.

For instance, Baidu launched its ChatGPT-like service called ERNIE Bot, which has already attracted 200 million users, is used 200 million times daily, and has reached 85,000 enterprises. ERNIE also started making money for the company. While impressive, this is probably just the tip of the iceberg of the enormous opportunities ahead.

Another example of Baidu’s leading AI-related services is its autonomous driving service, Apollo Go. What started as a research project in 2013 has become a fully operational service. In the first quarter of 2024, Apollo Go provided 826,000 rides, 25% higher than the previous year. Cumulatively, the rides provided to the public have exceeded 6 million.

As Apollo continues to grow its cumulative rides, its AI system would likely improve further, fueling even better ride experiences in aspects like safety, area coverage, and cost. Eventually, robotaxis could become a substitute for taxis and car ownership, so if Apollo can maintain its leading position, it would generate enormous value for Baidu and its shareholders.

What it means for investors

Baidu is an established tech giant in China with a long track record of profitability and tremendous optionality to grow by leveraging the AI tailwind. The risk, however, lies in whether the company can execute to capture the immense opportunities ahead. Besides, investors must endure the risks of investing in a Chinese company, dealing with regulatory uncertainties, geopolitical tension, etc.

For those who can stomach those risks, Baidu is a stock to watch.

Traders are confident Nvidia stock will rise after earnings, according to options market

Published Fri, Aug 23 20249:01 AM EDT

Jesse Pound@/in/jesse-pound@jesserpound

The logo of Nvidia Corporation is seen during the annual Computex computer exhibition in Taipei, Taiwan.

Tyrone Siu | Reuters

Wall Street traders think next week’s earnings report from Nvidia is likely to give the chip stock another boost, according to one interpretation of options market pricing.

A Piper Sandler research note on Thursday from Benson Durham and Melissa Turner said short-term options on Nvidia look expensive, but that high cost is tilted toward options that serve as bets the stock will rise.

“What’s noteworthy is that near-term upside is the dearest, not the downside. So, expensive NVDA options in general don’t connote very much investor angst heading into the release,” the Piper Sandler report said.

Nvidia is set to report fiscal second-quarter results Aug. 28 for the quarter that ended in July, and the results could serve as a gut check not only for the chipmaker, but also for the entire stock market. The stock is up 171% over the past year and is one of the three largest stocks in the S&P 500 measured by market value, along with Apple and Microsoft.

Nvidia’s meteoric rise suffered a bit of a swoon this summer. The stock closed at $98.91 per share on Aug. 7, about 27% below its all-time high in June. But the stock has since erased most of those losses, closing at $123.80 per share on Thursday.

Nvidia’s rally has been a key driver of this bull market.

The market optimism about Nvidia extends beyond the immediate period after the earnings report, according to Piper Sandler.

“We focused on shorter-dated options, largely on account of next week’s release. However, the rest of the surface isn’t necessarily priced fairly, either. E.g., upside is also rich over the longer haul, again strictly based on volatility forecasts (over corresponding horizons) rather than fundamental,” the note said.

The Piper Sandler researchers did not take a fundamental position on Nvidia’s earnings report.

There are several ways investors could use options to bet on upside for Nvidia. One of the simplest ways would be to purchase a call option with a strike price that is “out of the money.” If Nvidia rises above that strike price before the options expires, then the trade could be executed, allowing the investor to buy it at a discount.

However, the market pricing described by the Piper Sandler note means that the up-front premium for this strategy would be higher than usual for a stock with Nvidia’s volatility profile. This would in turn create a higher bar for the trade to be profitable, and mean that the trade would be more costly if the option expires worthless.

‘Beyond Insane’: Economists slam Biden-Harris proposal to tax unrealized investment returns

‘This is truly a tax on optimism and innovation’ said Heritage Foundation economist Richard Stern

Published August 26, 2024 4:00am EDT | Updated August 26, 2024 8:10am EDT

Fox News contributors Kellyanne Conway and Marie Harf discuss the Harris-Walz economic agenda on ‘Hannity.’

The Biden administration’s proposal – which the Harris campaign has indicated it supports – to tax investment returns that have not yet been realized is “insane” and “absurd,” economists told Fox News Digital.

The Biden-Harris administration’s Treasury Department released its 2025 fiscal year revenue proposals earlier this year, in March. Among the list of tax revenue proposals is a plan to include unrealized investment returns as part of someone’s taxable income if their net worth is greater than $100 million. The move to tax unrealized gains is in line with the Biden-Harris administration’s promise to raise taxes on the wealthy and corporations.

Meanwhile, the Harris-Walz campaign reportedly told Marc Goldwein, vice president of the Committee for a Responsible Budget, that it supports all tax increases on high earners proposed by President Joe Biden.

“The proposal would impose a minimum tax of 25% on total income, generally inclusive of unrealized capital gains, for all taxpayers with wealth (that is, the difference obtained by subtracting liabilities from assets) greater than $100 million,” the Treasury Department stated in its FY25 revenue proposals. The same proposal was also put forth by the Biden-Harris administration in fiscal year 2024 and in fiscal year 2023, but the minimum taxable amount was 20%.

“This [proposal] is beyond insane,” said E.J. Antoni, a public finance economist at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget. “This proposal by Harris’ handlers would literally force people to sell off a portion of their investments every year in order to pay the taxes due on unrealized gains. Until an asset is actually sold, any increase in value is purely speculative. It isn’t real, hence the classification of unrealized. The people pushing this idea are demonstrating their complete and total ignorance of both finance and economics.”

Despite some concern about the proposal, others have welcomed the idea of new taxes on wealthy Americans, corporations and business owners. Upon learning of the Harris campaign’s support for all of Biden’s tax increases on high earners and corporations, University of California – Berkeley economist Gabriel Zucman wrote on X, “Let’s go!” “And that includes, yes, the amazing 25% billionaire tax,” he noted.

In a statement to Fox News Digital, Zucman reiterated that the unrealized gains tax proposal is “important” because it addresses “a fundamental problem with the U.S. tax system, namely that billionaires can get away with paying extremely little tax, when everybody else has to contribute.”

“The proposal is squarely focused on the super-rich,” he insisted.

However, according to Richard Stern, the director of the Grover M. Hermann Center for the Federal Budget, the move would also impact businesses.

“A tax on unrealized gains may be filed by an individual, but it is truly paid for by the workers and customers of the underlying business, and in the form of diminished economic growth,” Stern said.

“Ultimately, an unrealized gains tax falls most heavily on companies with the highest price-to-earnings ratio … which is to say, companies with the most to offer in terms of future growth and technological innovation. So, this is truly a tax on optimism and innovation.”

A woman prepares her taxes ahead of the April filing deadline. In 2023, the federal government collected $4.44 trillion, according to the Treasury Department. (Kurt “CyberGuy” Knutsson)

Stern pointed to the multinational technology company NVIDIA as an example of how speculating unrealized gains can be problematic for corporations. This year, Stern said, NVIDIA went from roughly a $1.18 trillion market capitalization to $3.16 trillion. He added further that if this proposed tax were extended to all unrealized gains, that would equate to a $495 billion tax bill on shareholders for a company whose annualized earning rate is only around $40 billion.

Stern concluded that the tax would be an “absurd” move, and argued this proposed redistribution of productive capabilities would be “a blatant ratchet to socialism” if implemented by a potential Harris-Walz administration.

In a statement Friday, Trump said, in part, of the proposed tax on unrealized capital gains: “In other words, the appraisers are going to make a lot of money, which will soon be applied to small business owners, and you will be forced to sell your restaurant immediately. And the new owner won’t do the job, and this restaurant will be closed.”

Meanwhile, Antoni asserted that such a tax could also upend the financial markets by compelling investors to “unload everything at rock bottom prices to avoid taxes.” Subsequently, market valuations would plunge, as well.

“That kind of extreme volatility, even if predictable, is highly inefficient and can have devastating secondary effects.”