HI Market View Commentary 08-05-2024

What do you do when you first wake up and the market is getting crushed? – Stop, Drop and Relax

Wait the first hour – Let the E-Mini futures clear out

Look after the first hour for trend

Don’t jump for the sell button = YOU are not qualified to be trading after hours,

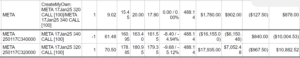

Sell order for META can only be done with a market order = $25 spread and 1000 shares sold with META down $52 this morning 52K down from the day before. META Closed only down -$12.41

What IF it continued down? Then yes TODAY you might have lost more than 52K

Investing/Trading/Life is a PROCESS and it goes up and down all the time

Sell High and Buy Low

DON’T push funds sales through = Typically close END OF DAY UNLESS someone pushes for an immediate sale

ON a -3.00% down S&P 500 someone lese lost roughly 10% of their total portfolio pushing the sales through

I UNDERSTAND because I’ve made some of these same mistakes or I have seen most of these mistakes happen in real life

Are you protected or not? = Percious Metals were NO protection today, Commodities were NO protection today, Energy was NO protection today, Crypto was NO protection today, FX offered NO protection Today

Last Wednesday a certain individual posted online a Half-Million dollar monthly gain in Bitcoin at 60K price

Mentioned “living the dream”, “You Suckers”, “You dummies”, “you will never be me”, “I don’t need anyone else not even God can make what I make”, = Today sold everything at the open for a net loss of 25% with Bitcoin down around 45K

Risks with trading right at the open = Fear and Greed

What’s causing this?= Valuations stretched or too high for Mag 7 and a few other, Russia vs Ukraine, Isreal vs most of the middle East vs Saudi Arabia,

Elections for the US – Edward Dowd BlackRock manager = 25-30% correction to the end of October welcome back then rally after election

Elections “Might” be a net loser for the USA

Kamala – Never been to the border nor met with any top Border Patrol official, 92% staff turnover rate, failed the Bar but boyfriends got her in anyway

Trump – Can’t stop being a Jerk, Won’t shut up and degrading to others he doesn’t like, Impulsive, Women lawsuits against him whether true or not, Stance on abortion, possible criminal penalties

Last Weeks Friday Results – S&P 500 down -1.84% BUT HI down -0.32

TODAY

Live In Play®

Updated: 01-Aug-24 16:36 ET

AAPL: Apple beats by $0.06, beats on revs (218.36 -3.72)

- Reports Q3 (Jun) earnings of $1.40 per share, excluding non-recurring items, $0.06 better than the FactSet Consensus of $1.34; revenues rose 4.9% year/year to $85.78 bln vs the $84.43 bln FactSet Consensus.

- Apple reports Q3 iPhone revenue of $39.3 bln vs. $38.8 bln ests and $39.7 bln last year.

- Apple reports Q3 Services revenue of $24.2 bln vs. $24.1 bln ests and $21.2 bln last year.

- Co reported Q3 Greater China revenue -6.5% yr/yr $14.73 bln.

- Co reported Q3 gross margin of 46.3%

- “Today Apple is reporting a new June quarter revenue record of $85.8 billion, up 5 percent from a year ago,” said Tim Cook, Apple’s CEO. “During the quarter, we were excited to announce incredible updates to our software platforms at our Worldwide Developers Conference, including Apple Intelligence, a breakthrough personal intelligence system that puts powerful, private generative AI models at the core of iPhone, iPad, and Mac. We very much look forward to sharing these tools with our users, and we continue to invest significantly in the innovations that will enrich our customers’ lives, while leading with the values that drive our work.”

- Apple CEO Tim Cook told CNBC that the company redeployed employees onto AI that previously worked on the now cancelled Apple Car. CapEx increased this quarter. Working on AI in China. He said the company will have to wait until AI launches to tell if demand for phones will increase.

https://www.briefing.com/the-big-picture

Earnings dates:

BABA 08/08 BMO

BIDU 08/22 BMO

DG 08/29 est

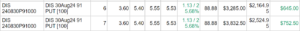

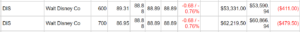

DIS 08/07 BMO

MU 09/25 est

O 08/05 AMC

SQ 08/01 AMC

TGT 08/21 BMO

UAA 08/09 est

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bearish

COMP – Bearish

Where Will the SPX end July 2024?

07-29-2024 -2.00%

07-22-2024 +2.00%

07-15-2024 -2.00%

07-08-2024 -2.00%

07-01-2024 -2.00%

Where Will the SPX end August 2024?

07-29-2024 -2.00%

Earnings:

Mon: JELD, YUMC, CHGG

Tues: CAT, DUK, H, OC, UBER, YUM, JACK, MOS, RDDT, VFC, WYNN, TAP

Wed: CVS, HLT, LYFT, RL, BYND, CF, ZG, DIS

Thur: LNG, NUS, YELP, LLY

Fri:

Econ Reports:

Mon: IMS Service Index,

Tue Trade Balance,

Wed: MBA, Consumer Credit,

Thur: Initial Claims, Continuing Claims, Wholesale Inventories

Fri:

How am I looking to trade?

Protection On Everything, Will take some off for the day but add it back on ATM by the end of the day, NOT planning on taking everything off due to volatility

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Are your decisions already made? NO

https://www.cnbc.com/2024/08/05/crypto-market-today.html

Bitcoin tumbles below $50,000 for the first time since February

Published Mon, Aug 5 20245:53 AM EDTUpdated 34 Min Ago

Key Points

- Bitcoin dipped to $49,111.10 at one point — its lowest level and first time under $50,000 since February — after trading close to $70,000 a week ago.

- The moves follow a broader market sell-off that began last week, when a weaker-than-anticipated July jobs report renewed investor fears of a recession.

- Crypto companies Coinbase and MicroStrategy were among the hardest-hit stocks.

- Ether erased its year-to-date gain.

Bitcoin fell sharply after a sell-off of major U.S. stock indices. Bitcoin has been correlated closely to the price movement of the Nasdaq index.

Luke MacGregor | Bloomberg | Getty Images

Cryptocurrencies tumbled amid a global market sell-off spurred by recession fears.

The price of bitcoin sank more than 15% on Monday to $50,193.00, according to Coin Metrics, and is on pace for its worst day since June 2022. At one point, it fell to $49,111.10, its lowest level since Feb. 13.

Bitcoin has lost nearly 15% since Saturday. A week ago, on July 20, it climbed as high as $69,982.

“Thirty percent slumps, as scary as they are, are par for the course during bull markets and it’s encouraging bitcoin bounced back above $50,000,” said Nexo co-founder Antoni Trenchev. “But make no mistake, we are in a choppy, volatile market environment … the moment to turn bullish will be when bitcoin retakes its 200-day moving average, which typically tells us if we are in a bull or bear market, at $61,500.”

Ether losses were even steeper. The crypto asset dropped almost 19% to $2,211.83, bringing its three-day loss to 24% and erasing its 2024 gain.

Crypto stocks were among the hardest hit. Coinbase took a 19% dip, while MicroStrategy slid 26%. Mining stocks suffered double-digit losses, too.

The moves follow a broader market sell-off that began last week, when a weaker-than-anticipated July jobs report renewed investor fears of a recession. The tech-heavy Nasdaq Composite entered a correction. Japan stocks entered a bear market Monday after plunging more than 12% overnight, its worst one-day sell-off since 1987.

Bitcoin has tumbled more than 15% since Saturday.

“Until last Wednesday, everybody was thinking that inflation was going down gradually and the economy was relatively strong, so the Fed would start cutting rates with successful soft landing of the economy,” said Yuya Hasegawa, crypto market analyst at Japanese bitcoin exchange Bitbank. “However, July’s U.S. manufacturing PMI and jobs report came in way weaker than the market expected — and now [investors] are worrying about the possibility of recession and dumping risk assets.”

“That said … the market’s reaction has been a tad excessive, given there is no absolute evidence that the economy is in recession yet,” he continued. “We will likely see some recoil this week.”

On top of economic and geopolitical concerns, crypto investors have been contending with sell pressure from Mt. Gox distributions and decreasing odds of a second Donald Trump presidency in the U.S. Polls on Polymarket, an Ethereum-based prediction market platform, show the gap between Trump and Vice President Kamala Harris has narrowed significantly since President Joe Biden dropped out of the race on July 21.

Bitcoin is already down about 23% for the month of August, a typically sluggish month for risk assets, and below the $55,000 floor that has supported it for much of the year. If it fails to recover, it could be its worst month since June 2022, when it lost about 37%.

Bitcoin is still holding on to a year-to-date gain of 18%, but the current turmoil in crypto prices has investors doubting the validity of the coin’s narrative as a hedge against uncertainty.

“The bitcoin as a hedge narrative is misleading,” Hasegawa said. “It does work as a hedge against fiat currency but it still is a risk asset. In the long run, I believe it is better to hold bitcoin than any fiat currencies, but investors tend to sell high-volatility assets first when risk arises.”

— CNBC’s Gina Francolla contributed reporting.

Here’s what usually happens to stocks when the Fed cuts rates

Published Tue, Jul 30 20247:09 PM EDT

Stock markets are likely to react decisively after a cut to interest rates if history repeats itself, according to a CNBC Pro analysis.

The U.S. central bank is expected to keep interest rates steady this week but could hint at relaxing its monetary policy stance as soon as September.

Any September decision to lower the Fed’s target range would be the first time interest rates have fallen since the hiking cycle began in March 2022.

CNBC Pro analyzed stock market data over the past six tightening cycles since 1982, when the Federal Reserve switched to targeting the federal funds rate. The analysis found that, on four occasions the S&P 500 had risen by double digits within a year after a rate cut

The analysis also revealed that the S&P 500 had set the direction of travel for annual returns within three months after a rate cut. When stocks rose, on average, they were up 6% in the quarter immediately after the cut and up 16% in the 12 months after the cut.

However, stocks fell soon after the rate cut in 2001 and 2007 by 13.5% and 20.6%, respectively, due to the dotcom crash and the global financial crisis. Three months after the cut, the S&P 500 was down by 11% on average on those two occasions.

The current tightening episode is the seventh in the past 40 years. Historically, the Fed has cut rates because the U.S. economy was heading into a recession or experiencing a notable growth slowdown. Uniquely, under current economic conditions, the Fed will be cutting when the economy continues to grow.

The latest data shows that the U.S. real GDP increased at a 2.8% annualized pace adjusted for seasonality while inflation declined 0.1% month-on-month in June, putting the annual rate at 3%, around its lowest level in more than three years.

While nominal rates peaked at 11.5% at the end of the 1983-84 episode, the current target range of 5.25%-5.50% is the highest this millennium. Rates peaked at 2.375% in the 2015-18 episode but were close to the current peak rate at the end of the 2004-06 episode at 5.25%.

The current tightening cycle is also notable for being the most aggressive. The Fed’s target range was raised by 525 basis points in roughly 17 months, “thus larger than the cumulative increases in the other six episodes,” according to Kevin Kliesen, economist at the Federal Reserve Bank of St. Louis.

Fed Chair Powell gives the market exactly what it wanted to hear

Published Wed, Jul 31 20243:53 PM EDTUpdated Wed, Jul 31 20244:31 PM EDT

Federal Reserve Chair Jerome Powell ended a press conference in which he gave markets exactly what they anticipated he would say. The Fed left rates unchanged, noted that job growth was weaker but still strong and hinted it was slowly winning the war on inflation.

Stocks have been positioned for a three-stage process from the Fed: 1) setting the stage for rate cuts at today’s meeting, 2) examine data in the next month and perhaps fine-tune the response at the Jackson Hole conference in August, and 3) begin rate cuts in September.

The first stage is unfolding as expected.

Powell, in his press conference, said “the labor market has come into better balance, and the unemployment rate remains low. Inflation has eased substantially from a peak of 7% to 2.5%.”

If there was any doubt he was feeling better about inflation, Powell later said, “we have growing confidence that we are on a sustainable path to two percent,” the Fed’s long-term target for inflation.

That’s exactly what the markets wanted to hear. Markets are now pricing in a 100% chance of a rate cut in September.

What’s next?

The good news is the two or three months leading up to a rate cut are usually good for the markets.

Next up: the July jobs report on Friday, and then Jackson Hole in late August.

The risk to the market is we may get a series of aberrant inflation reports that would keep rates high and cause Powell to make cautious comments at Jackson Hole.

Maybe, but it seems unlikely. We are not hearing about weird outlying signals. We are not hearing about skyrocketing rents, or airfares or hotel rooms. The inflation data seems to be narrowing.

It’s also possible we may see sudden economic deterioration, but that too seems unlikely, and at any rate that would drive rates even lower.

Despite the fact that August is usually a rocky month, and assuming the data is unsurprising, the most-likely path is more of the same, more of the rotation we have seen for the past several weeks.

Remember what happened in July

That said, this is a very tricky time for the markets, and if you doubt that, look at what has happened over the past three weeks.

The consensus as we entered July was that inflation was still a very real danger and that the Fed may keep rates higher. Investors were flocking to high-price tech stocks and ignoring everything else.

On July 11, the June CPI report came out, which showed inflation moderating more than expected.

Boom. Turned out the consensus was wrong. Inflation wasn’t such a clear and continuing danger, and a lot of investors were caught offside. Megacap tech sold off and investors turned to small caps and value stocks instead. Ten-year yields have gone to 4.12% today from 4.28%.

That trend continues today.

If the consensus can be wrong about something as big as where the Fed is going, it certainly argues for everyone to be a lot more humble about their opinions going into the notoriously difficult month of August.

The 10 worst states to retire in the U.S.—No. 1 isn’t California or New York

Published Tue, Jul 30 202412:23 PM EDTUpdated Tue, Jul 30 20243:34 PM EDT

While the best state to retire in the U.S. is also one of the smallest in the country, the worst state to retire is the largest.

Alaska ranks as the worst state in the U.S. to retire for the third year in a row, according to Bankrate’s study of the best states to retire in 2024.

To compile its list of the best and worst places to retire in the U.S., Bankrate ranked all 50 states across five weighted categories:

- Affordability (40%): Analyzes factors such as local and state sales taxes, cost of living and average annual property taxes

- Overall wellbeing (25%): Includes factors such as the number of adults over 62 per 100,000 residents and access to food and health care

- Quality and cost of health care (20%): Looks at factors such as the cost of health care at the state level and the performance of each state’s health system

- Weather (10%): Evaluates data on factors such as a state’s average annual temperature and average number of tornado strikes, earthquakes and hurricane landfalls

- Crime (5%): Examines factors such as the amount of property crimes and violent crimes per 100,000 residents

Bankrate analyzed datasets from a number of sources, including the Council for Community and Economic Research, the U.S. Census Bureau, the Tax Foundation and the National Oceanic and Atmospheric Administration.

Here are the 10 worst states to retire, according to Bankrate.

Notably, Alaska ranks last in the weather category. Although temperatures in Alaska can range from 45 degrees to 75 degrees Fahrenheit in the summer, they can sink as low as negative 10 degrees Fahrenheit in the winter.

Alaska can be an expensive place to live, especially for retirees with a fixed income. On average, the cost of living in Alaska is about 30% higher than the rest of the country, according to RentCafe. Housing costs are about 17% higher than the national average, and utilities and health-care expenses are both nearly 50% higher.

On the upside, Alaska can be a very tax-friendly location for retirees. The state doesn’t have income tax, estate taxes or inheritance taxes and doesn’t tax pension payments or retirement benefits from Social Security.

Lack of affordability appears to be a common thread among the other low-ranking states on the list, which include New York, Washington and California — all known for being relatively pricey.

However, just because a state has a higher cost of living doesn’t necessarily mean you should write it off as a potential retirement destination. You may just need to plan to set aside more money for retirement than you would if you were planning to retire somewhere less expensive.

CNBC Make It’s retirement calculator can help you estimate how much you’ll need to save for retirement based on factors like your current age, savings, income and when you’d like to stop working.

And while living costs can be a key determinant in deciding where you may want to retire in the future, it’s also good to keep other non-financial aspects in mind. For example, access to social and community-building activities is an important, but often overlooked, consideration for retirees, according to Bankrate.

“Having that sense of community and human connection is huge to healthy aging,” Kerry Hannon, a retirement expert and Author of “In Control at 50+: How to Succeed in the New World of Work,” says in Bankrate’s study.

“Isolation and loneliness are not something you want to move toward, so look for your community,” she says.

HI Financial Services Mid-Week 06-24-2014