HI Market View Commentary 06-17-2024

Let’s talk cash in accounts and how we keep creating cash for you:

We normally like 5-7 to 8% cash for protection.

How do we keeping adding cash? = Dividends, Taking profits (stocks&options), Creating cash through option strategies, deposits

MOST recently the sale of META and profits from puts are the cash creators

When you have a lot of cash I ALWAYS get the question, Kevin What are you going to do?= Invest it when I see a good opportunity – WE don’t just throw money into the market!!!

Just putting money into something (diversification) is NOT a smart investing opportunity

IS it easier to make money with more money?=YES of course

Why?= More opportunity at a higher risk/cost, more money allows for an easier investment opportunity , More money gives us as money mangers more time

Time give you the ability to adjust, make more opportunities, make it right, allow for things to come back, get lucky

DIS we added puts and then took them right off again,

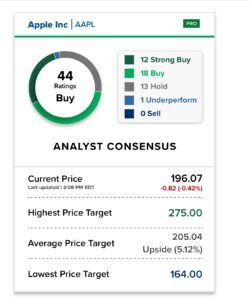

AAPL we played long calls, switched to puts and then lost money coming and going

AAPL today after less than 1 month of pay later loans, Cancelled the program

MU got into Micron around $68-$76 for most people – $147.83

We will sell out of MU when they announce and get the push higher for the Government chip program

So yes, it can still go higher so when we sell out we will add a stock replacement strategy

BIDU

NVDA $125.25 Purchase price closed today @$130.98 so we are up over $5 already

NVDA $125.25 Purchase price closed today @$130.98 so we are up over $5 already

This was purchased reluctantly to put money from the sale of META to work

Juneteenth This Wednesday the market is closed

Earnings Season:

MU 06/26

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 14-Jun-24 12:35 ET | Archive

Points of disruption

In the stock market it is a mega-cap world, and every other stock is just living in it. That can be better for some stocks and worse for others, but there is no mistaking in the performance metrics where investor interest is concentrated.

The market-cap weighted S&P 500 is up 13.6% year-to-date as of this writing. The equal-weighted S&P 500 is up 3.5%. The Russell 2000 is down 1.3% and the S&P Midcap 400 Index is up 3.7%.

It’s not that gains can’t be found outside the mega-cap space, it’s just that those gains in general pale in comparison to the returns found among the mega-cap stocks. To wit: the Vanguard Mega-Cap Growth ETF (MGK) is up 20.3% year-to-date.

We’ve said it before and we’ll say it again: for an index investor, it doesn’t matter how you get there. The gains count just the same whether they are fueled by a small group of stocks or all 500 stocks. That is true on the way down as much as it is on the way up, but fortunately for investors they are benefiting from a market in an uptrend.

That trend will be their friend… until it isn’t. So, with the S&P 500 and Nasdaq Composite trading at record highs, the question now is, what could go wrong to disrupt the trend?

From Right to Wrong

The answers to that important question are embedded in what has gone right:

- Earnings growth has been better than expected, prompting upward revisions to earnings estimates.

- Inflation remains sticky above the Fed’s 2% target, but has been trending lower.

- Economic growth remains on a soft landing/no landing track.

- The labor market is loosening from its extremely tight condition but remains relatively strong, which is key for consumer spending activity.

- Market rates, up for the year, have been trending lower since late April.

- The Federal Reserve hasn’t closed the door on the possibility of another rate hike, but it has deemed another rate hike as unlikely.

- AI hardware demand is booming, driving a massive capital investment cycle.

- The mega-cap stocks have been invincible as a leadership group.

- The Israel-Hamas War has not turned into a wider regional conflict.

- The Russia-Ukraine War has not turned into a wider regional conflict.

Take the opposite of any of those developments and there will be some disruption for the stock market. How much disruption is dependent on which, if any, of these factors shifts. In turn, there is also the “exogenous factor,” which is market parlance for something that takes the market by surprise in a negative way. China invading Taiwan this year would be an example of an exogenous factor.

No matter the surprise or the reversal of fortune of known factors, the market disruption would be proportional to what it is deemed to mean for earnings growth since earnings and earnings expectations drive the stock market.

Both are currently working in the market’s favor. If that remains the case, there can still be a correction. The difference, with growth expectations remaining intact, is that pullbacks will be seen as a buying opportunity; however, if a correction is precipitated by a reduction in earnings growth estimates, the conviction to buy on weakness won’t be strong.

Riding on Earnings

Another reason earnings growth is so important is that the market’s rich valuation is riding on it. The market-cap weighted S&P 500 trades at 20.8x forward 12-month earnings compared to a 10-yr average of 17.8x, which was cultivated over an extended period when interest rates held close to the zero bound.

Interest rates are higher today, but importantly the economy has managed to weather the jump in rates quite well — so far anyway. Whether there is going to be some lag effect payback remains to be seen, and that is a source of angst relative to the Fed keeping rates higher for longer. The fear is that the Fed will overstay its welcome in restrictive territory and drive the economy into a recession.

That isn’t what anybody wants because recessions are bad for employment, bad for spending, and bad for earnings. The average peak-to-trough earnings drop in a recession since 1960 has been about 31%, according to Yale University professor Robert Shiller’s data.

Such a drop isn’t in the market’s immediate forecasting future. According to FactSet, calendar year 2024 earnings are expected to increase 11.6%, calendar year 2025 earnings are expected to increase 14.3%, and the early line on calendar year 2026 earnings suggests earnings are expected to increase 12.0%.

Of course, the bulk of the earnings growth has been provided by the mega-cap companies, which is a big reason why investors are concentrated in those stocks. Their mass appeal among retail and institutional investors alike is why there is often attention paid to the factor of concentration risk.

If they go down as a unit, much like they have gone up as a unit, it would presumably be a problem for index investors — but it doesn’t have to be entirely.

The key is if money rotates away from the mega-cap stocks and into the broader market in a rebalancing trade. Where the disruption for the market would arise is if the mega-cap stocks correct and there isn’t a rotation within the stock market. The bigger problem would be if the mega-cap stocks correct as a unit because of a fundamental catalyst.

Stocks that pull back on no news, and only because they have gone up a lot in price, are typically stocks that get bought on weakness. It becomes a different matter when there is a fundamental downshift in business prospects for stocks — and a market — trading with rich valuations that rest on a favorable earnings outlook.

What It All Means

From the vantage point of an index investor, things look pretty good. The S&P 500 and Nasdaq Composite have broken new record ground with the mega-cap stocks doing the shoveling. They have effectively set the tone for the rest of the market.

What that means is that the rest of the market has traded more conservatively as money flows have favored the biggest of the big for their earnings power, their financial strength, their leadership positions, and their momentum. It also means the market-cap weighted S&P 500 has been in an uptrend because of their leadership.

There is a lot working in the market’s favor, but it is clear the market is playing favorites, and, in doing so, has invited some rebalancing opportunities for long-term investors in other parts of the market that have been left behind. The balance of power, though, remains with the mega-cap stocks given how much weight they carry.

Ultimately, they are still beholden to economic trends that will flow from changes in interest rates, inflation, capital investment plans, and geopolitics, all of which have bearing on earnings prospects. Those things have been working in the market’s favor — and their favor — for the most part, so index investors have had a lot to feel good about when opening 401K and retirement account statements.

When everything feels good, though, is when there should be an appreciation for what can make things feel bad. That’s just part of the risk management process, which, at this point, revolves around the mega-cap stocks and earnings estimate trends.

—Patrick J. O’Hare, Briefing.com

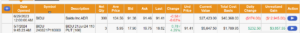

Earnings dates:

Where will our markets end this week?

Higher

DJIA – Bearish

SPX – Bullish and OVER-Bought

COMP – Bullish and way OVER-Bought

Where Will the SPX end June 2024?

06-17-2024 +1.00%

06-10-2024 0.00%

06-03-2024 0.00%

Earnings:

Mon: FOX,

Tues: GIS, FUL, LEVI

Wed: Market CLOSED

Thur: WBA, NKE

Fri:

Econ Reports:

Mon: Empire Manufacturing

Tue Retail Sales, Retail ex-auto, Industrial Production, Capacity Utilization, Business Inventories,

Wed: MBA, NAHB Housing Market Index

Thur: Initial Claims, Continuing Claims, Housing Starts, Building Permits, Phil Fed Index

Fri: Existing Home Sales, Leading Indicators,

How am I looking to trade?

Mostly letting stocks run = very little protection in place – BIDU $110

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

https://investorplace.com/2024/06/investor-alert-3-companies-poised-to-outshine-google-by-2032/

Investor Alert: 3 Companies Poised to Outshine Google by 2032

End-market growth potential and AI make these picks tech stocks to buy

8h ago · By Tyrik Torres, InvestorPlace Contributor

- Step aside Google (GOOG, GOOGL), these tech companies are poised to be among the greats.

- Baidu (BIDU): Baidu’s extensive history in researching and investing in AI will benefit from the immense opportunity set in mainland China.

- Advanced Micro Devices (AMD): Nvidia (NVDA) currently holds a monopoly over the AI chip market, but AMD’s entrance into the field will boost its market valuation.

- Meta Platforms (META): The social media platform foray into AI services could be immensely lucrative.

Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) is the holding company for the notable search engine and cloud computing giant Google. The software firm rose to prominence at the beginning of the 21st century as a search engine but has moved into burgeoning new economy sectors, the most recent being generative artificial intelligence (AI). Google’s cloud computing arm is finally scaling in terms of profitability after years of investment. In particular, Google Cloud more than quadrupled its operating income to $900 million in the first quarter of 2024, allowing the cloud platform to emerge as a viable competitor to AWS and Microsoft Azure.

Fortunately for investors, plenty of successful technology companies are in the stock market. Some of these could very well eclipse Google over the coming years. These firms operate in similar spaces to the software giant and will see their market caps rise as they capture growth opportunities in their respective sectors. Add these to your stocks-to-buy list.

Baidu (BIDU)

Baidu (NASDAQ:BIDU) is a Chinese internet giant and has also been a pioneer of research into artificial intelligence (AI) technologies. The software firm began its foray into AI research and development over a decade ago. Subsequently, Baidu moved to establish the Institute of Deep Learning (IDL) in Beijing and the Silicon Valley AI Lab (SVAIL) in California to focus on advancing AI technologies. While Silicon Valley tech giants get all the credit for how AI has advanced over the years, Chinese firms and their American counterparts began heavily investing in the space around the same time.

Baidu is relying upon its ERNIE chatbot, which it began developing in 2019, to build up its market position in China where ChatGPT is available. The software company also expects its AI Cloud business to grow over the coming years as AI companies within China demand more server power to develop their own large language models.

Being based in Beijing, Baidu has an immense market opportunity before it. The company is trading at 9.6x forward earnings, below all of its American internet and cloud counterparts. With that said, as China’s economy recovers, Baidu has the potential to eclipse Big Tech firms, including Google.

Advanced Micro Devices (AMD)

Advanced Micro Devices (NASDAQ:AMD) is a designer of CPUs and GPUs that power PCs, laptops and high-tech servers. The chipmaker has remained in the spotlight ever since the AI craze hit the market last year. Mostly, AMD’s chief competitor, Nvidia (NASDAQ:NVDA), has enjoyed fame and record growth for providing the world with advanced chips for building AI models. As a result, Nvidia’s market cap is floating around $2.8T and continues to rise.

As AMD scales up its launch into the AI chip world, the chipmaker’s valuation will definitely benefit. At Computex 2024, a tech conference based in Taipei, Taiwan, AMD unveiled the next generation of Ryzen laptop processors that will handle generative AI workloads: the Ryzen AI 300 Series. Moreover, AMD announced the MI325X chip that will launch later in the year. While this chip is beyond Nvidia’s Blackwell chips in terms of performance, AMD’s advancements in the space are always welcome.

AMD’s market capitalization is only $268 billion. Nonetheless, as the chipmaker creates a space for itself in the AI chip market, investors can bet the valuation will increase.

Meta Platforms (META)

Meta Platforms (NASDAQ:META), formally known as Facebook, is probably the closest entry on this list to eclipsing Google in terms of market valuation. The social media platform boasts a market cap of $1.2 trillion, while Google has a market cap of $2.1 trillion. Along with many Big Tech companies, Meta Platforms plans to build out AI tools and services to spur long-term revenue growth. Meta has earmarked $35 to $40 billion worth of capital expenditures for 2024 as the company looks to build up the infrastructure it needs to train and launch AI models. More investments into AI will probably have a higher return on investment for the software platform, especially when considering its virtual reality investments have yet to pay off. On an earnings call, CEO Mike Zuckerberg noted how monetizable the company’s AI services would be when launched at scale.

Q1 results for fiscal year 2024 came in above Wall Street estimates, with quarterly revenue increasing 27% year-over-year to $36.4 billion, while net income for the quarter more than doubled to $12.4 billion.

As Meta finds more ways to incorporate artificial intelligence technologies into its social media platforms, the software firm could see its market value increase so much that it rises well past Google.

On the date of publication, Tyrik Torres did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Tyrik Torres has been studying and participating in financial markets since he was in college, and he has particular passion for helping people understand complex systems. His areas of expertise are semiconductor and enterprise software equities. He has work experience in both investing (public and private markets) and investment banking.

https://investorplace.com/2024/06/the-3-most-undervalued-long-term-stocks-to-buy-in-june-2024/

The 3 Most Undervalued Long-Term Stocks to Buy in June 2024

Grab giants on a discount

1d ago · By Josh Enomoto, InvestorPlace Contributor

- Build your portfolio with these undervalued long-term stocks.

- Deere (DE): Deere may be fading in the market but its relevant business is now priced more attractively.

- TotalEnergies (TTE): TotalEnergies could benefit cynically from geopolitical dynamics, making it a possible discount.

- Baidu (BIDU): Baidu is a powerhouse in China’s internet market, making it a worthwhile platform for speculation.

While it may be comfortable betting alongside the consensus opinion, investors seeking enhanced returns should consider undervalued long-term stocks. If you have the time to spare, these ideas should be relevant for the entire marathon, not just a sprint or two.

One of the advantages of targeting enterprises that could expand over an extended period is the predictability aspect. Typically, you’re looking at entities that are already deeply established. That offers comfort, number one. Number two, by specifically looking for fundamental discounts, you can potentially enjoy greater returns.

That might be a better strategy than focusing on high-risk, high-reward names, most of which could end up falling flat. With that in mind, below are undervalued long-term stocks to consider.

Deere (DE)

Based in Moline, Illinois, Deere (NYSE:DE) falls under the farm and heavy construction machinery category. Per its public profile, the company engages in the manufacture and distribution of various agricultural equipment worldwide. At first glance, DE might sound like a boring idea among undervalued long-term stocks. However, the sectors Deere serves are obviously critical for human health.

Not surprisingly, analysts rate shares a consensus moderate buy with a $424.07 average price target. That implies an upside of over 14%. Further, the high-side target lands at $495. During the trailing 12 months (TTM), Deere posted a net income of $9.47 billion, translating to earnings per share of $33.20. Revenue during the period reached $58.6 billion.

For fiscal 2024, covering experts believe EPS could come in at $25.40 on sales of $45.56 billion. Admittedly, that’s disappointing compared to last year’s results of EPS of $34.69 on sales of $55.56 billion. However, with DE’s modest performance in the market, it’s currently trading at 11.18X trailing-year earnings and 1.83X trailing-year sales.

About one year ago, these metrics stood at 14.05X and 2.11X, respectively. Given the importance of agriculture, DE represents one of the undervalued long-term stocks to buy.

TotalEnergies (TTE)

Based in France, TotalEnergies (NYSE:TTE) represents a multi-energy firm that produces and markets primarily oil. However, it also specializes in biofuels, natural gas, green bases, renewable energy sources and electricity generation. Along with its home market, Total serves the rest of Europe, North America, Africa and other regions. Fundamentally, TTE’s narrative as one of the undervalued long-term stocks comes down to this: the world continues to run on oil.

Not only that, the world may continue to run on oil for a very long time. For example, at the present juncture, the pivot toward electric vehicles is being stymied by a lack of infrastructure. That may take a while to resolve. In the meantime, hybrid vehicles offer a critical compromise. And that probably means hydrocarbon players like Total will be in business for the foreseeable future.

For fiscal 2024, analysts are looking at EPS to reach $9.29 on sales of $244.24 billion. That’s a mixed outlook given last year’s results of EPS of $9.40 on revenue of $237.13 billion. However, the geopolitical backdrop and the threat of global supply chain disruptions seem to favor a higher valuation for TTE.

Therefore, its present metrics of 7.95X trailing-year earnings and 0.8X trailing-year sales could be undervalued compared to future global dynamics.

Baidu (BIDU)

Headquartered in Beijing, China, Baidu (NASDAQ:BIDU) falls under the broad communication services space. In particular, it serves in internet content and information. Essentially, Baidu is the Google of China, mainly providing internet search services. In addition, the company offers what’s called Baidu Feed, which provides users with personalized data based on their demographics and interests.

Thanks to the massive scope of China’s consumer economy, BIDU ranks among the top undervalued long-term stocks to buy. Yes, its market performance has been disappointing recently. Further, questions exist about the health and stability of Chinese consumers. Still, we’re talking about a nation which is about four times the size of the U.S. Should a recovery occur, it could potentially send BIDU stock soaring.

During the TTM period, Baidu posted net income of $19.22 billion, translating to $6.48 per share. Revenue reached $134.97 billion. Looking out to the end of this fiscal year, experts believe EPS could come in at $11.40 on sales of $19.76 billion.

Admittedly, that’s a mixed picture. However, BIDU’s trailing-year earnings and sales fell to 15.04X and 1.77X, respectively. That’s well below the levels seen almost one year ago at 25.7X and 2.78X, respectively. Thus, it may be one of the undervalued long-term stocks to consider.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global 500 companies. Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare. Tweet him at @EnomotoMedia.

India’s GDP growth likely to outpace China’s in 2024-28, says EIU

The report suggests that as India’s economic heft expands, there would be a crossover in the mid-2040s with BRICS nations taking over the G7 in terms of nominal gross domestic product (GDP)

Ruchika Chitravanshi New Delhi

2 min read Last Updated : May 30 2024 | 11:21 PM IST

Listen to This Article

Play

1x

The Economist Intelligence Unit’s (EIU) Global Outlook report has forecast India to be the fastest growing major economy in 2024-2028, with its growth expected to outpace China’s.

The report suggests that as India’s economic heft expands, there would be a crossover in the mid-2040s with BRICS nations taking over the G7 in terms of nominal gross domestic product (GDP).

Click here to connect with us on WhatsApp

The EIU has revised its forecast for real GDP growth for 2024 to 2.5 per cent compared to 2.4 per cent previously. “…growth will be unchanged rather than slowing from 2023. Growth is proving surprisingly resilient in the face of high interest rates and geopolitical risks,” the EIU Global Outlook report said.

Over the next five years, EIU has projected the global economy to grow by 2.8 per cent, with more fragmentation and regionalisation in the world economy dragging the growth potential.

“The return of industrial policy, including sanctions and the provision of new incentives, will push firms to adopt more inefficient supply chains, stoke trade tensions in strategic sectors and make it difficult to compete across the global marketplace,” the EIU report said.

The finance ministry’s monthly economic review for April said that after a strong growth which surpassed market expectations in FY24, early indications suggest a continuation of the economic momentum in the first quarter of FY25.

S&P Global Market Intelligence in its October 2023 report projected India will become the world’s third-largest economy, overtaking Germany and Japan, by 2030 on the strength of its youthful demographic profile and rapidly rising urban household incomes.

S&P Global Ratings on Wednesday had also revised its outlook on India to positive from stable, citing robust economic expansion.

Rating agencies including Fitch and Barclays have revised India’s GDP growth projection for FY24 to 7.8 per cent due to strong domestic demand and persistent growth in business and consumer confidence levels.

The International Monetary Fund in April had raised India’s GDP growth projection for FY25 by 30 basis points to 6.8 per cent in its update to the World Economic Outlook, amid buoyant domestic demand.

Apple faces pressure to show off AI following splashy events at OpenAI, Google and Microsoft

PUBLISHED FRI, JUN 7 20249:00 AM EDTUPDATED FRI, JUN 7 20246:38 PM EDT

KEY POINTS

- Apple’s Worldwide Developers Conference (WWDC) takes place on Monday at Apple’s campus in Cupertino, California.

- Apple long avoided using the acronym AI when talking about its products. But this year, after Microsoft, OpenAI and Google revealed their work in artificial intelligence, investors and customers want to see the iPhone maker embrace the technology.

- “The AI strategy is the missing piece in the growth puzzle for Apple,” said Dan Ives, an analyst at Wedbush.

For years, Apple avoided using the acronym AI when talking about its products. Not anymore.

The boom in generative artificial intelligence, spawned in late 2022 by OpenAI, has been the biggest story in the tech industry of late, lifting chipmaker Nvidia to a $3 trillion market cap and causing a major shifting of priorities at Microsoft, Google and Amazon, which are all racing to add the technology into their core services.

Investors and customers now want to see what the iPhone maker has in store.

New AI features are coming at Apple’s Worldwide Developers Conference (WWDC), which takes place on Monday at Apple’s campus in Cupertino, California. Apple CEO Tim Cook has teased “big plans,” a change of approach for a company that doesn’t like to talk about products before they’re released.

WWDC isn’t typically a major investor attraction. On the first day, the company announces annual updates to its iOS, iPadOS, WatchOS and MacOS software in what’s usually a two-hour videotaped keynote launch event emceed by Cook. This year, the presentation will be screened at Apple’s headquarters. App developers then get a week of parties and virtual workshops where they learn about the new Apple software.

Apple fans get a preview of the software coming to iPhones. Developers can get to work updating their apps. New hardware products, if they appear at all, are not the showcase.

But this year, everyone will be listening for the most hyped acronym in tech.

With more than 1 billion iPhones in use, Wall Street wants to hear what AI features are going to make the iPhone more competitive against Android rivals and how the company can justify its investment in developing its own chips.

Investors have rewarded companies that show a clear AI strategy and vision. Nvidia, the primary maker of AI processors, has seen its stock price triple in the past year. Microsoft, which is aggressively incorporating OpenAI into its products, is up 28% over the past year. Apple is only up 9% over that same period, and has seen the other two companies surpass it in market cap.

“This is the most important event for Cook and Cupertino in over a decade,” Dan Ives, an analyst at Wedbush, told CNBC. “The AI strategy is the missing piece in the growth puzzle for Apple and this event needs to be a showstopper and not a shrug-the-shoulders event.”

Taking the stage will be executives including software chief Craig Federighi, who will likely address the real-life uses of Apple’s AI, whether it should be run locally or in massive cloud clusters and what should be built into the operating system versus distributed in an app.

Privacy is also a key issue, and attendees will likely want to know how Apple can deploy the data-hungry technology without compromising user privacy, a centerpiece of the company’s marketing for over half a decade.

“At WWDC, we expect Apple to unveil its long-term vision around its implementation of generative AI throughout its diverse ecosystem of personal devices,” wrote Gil Luria, an analyst at D.A. Davidson, in a note this week. “We believe that the impact of generative AI to Apple’s business is one of the most profound in all of technology, and unlike much of the innovation in AI that’s impacting the developer or enterprise, Apple has a clear opportunity to reach billions of consumer devices with generative AI functionality.”

Upgrading Siri

Last month, OpenAI revealed a voice mode for its AI software called ChatGPT-4o.

In a short demo, OpenAI researchers held an iPhone and spoke directly to the bot inside the ChatGPT app, which was able to do impressions, speak fluidly and even sing. The conversation was snappy, the bot gave advice and the voice sounded like a human. Further demos at the live event showed the bot singing, teaching trigonometry, translating and telling jokes.

Apple users and pundits immediately understood that OpenAI had demoed a preview of what Apple’s Siri could be in the future. Apple’s voice assistant debuted in 2011 and since has gained a reputation for not being useful. It’s rigid, only able to answer a small proportion of well-defined queries, partially because it’s based on older machine learning techniques.

Apple could team up with OpenAI to upgrade Siri next week. It’s been discussing licensing chatbot technology from other companies, too, including Google and Cohere, according to a report from The New York Times.

Apple declined to comment on an OpenAI partnership.

One possibility is that Apple’s new Siri won’t compete directly with fully featured chatbots, but will improve its current features, and toss off queries that can only be answered by a chatbot to a partner. It’s close to how Apple’s Spotlight search and Siri work now. Apple’s system tries to answer the question, but if it can’t, it turns to Google. That agreement is part of a deal worth $18 billion per year to Apple.

Apple might also shy away from a full-throated embrace of an OpenAI partnership or chatbot. One reason is that a malfunctioning chatbot could generate embarrassing headlines, and could undermine the company’s emphasis on user privacy and personal control of user data.

“Data security will be a key advantage for the company and we expect them to spend time talking about their privacy efforts during the WWDC as well,” Citi analyst Atif Malik said in a recent note.

OpenAI’s technology is based on web scraping, and ChatGPT user interactions are used to improve the model itself, a technique that could violate some of Apple’s privacy principles.

Large language models like OpenAI’s still have problems with inaccuracies or “hallucinations,” like when Google’s search AI said last month that President Barack Obama was the first Muslim president. OpenAI CEO Sam Altman recently found himself in the middle of a thorny societal debate about deepfakes and deception when he denied accusations from actress Scarlett Johansson that OpenAI’s voice mode had ripped off her voice. It’s the kind of conflict that Apple executives prefer to avoid.

Efficient vs. large

Outside of Apple, AI has become reliant on big server farms using powerful Nvidia processors paired with terabytes of memory to crunch numbers.

Apple, by contrast, wants its AI features to run on iPhones, and iPads, and Macs, which operate on battery power. Cook has highlighted Apple’s own chips as superior for running AI models.

“We believe in the transformative power and promise of AI, and we believe we have advantages that will differentiate us in this new era, including Apple’s unique combination of seamless hardware, software, and services integration, groundbreaking Apple Silicon with our industry-leading neural engines, and our unwavering focus on privacy,” Cook told investors in May on an earnings call.

Samik Chatterjee, an analyst at JPMorgan, wrote in a note this month that, “We expect Apple’s presentation at WWDC keynote to be focused on the features and the on-device capabilities as well as the GenAI models being run on-device to enable those features.”

In April, Apple published research about AI models it calls “efficient language models” that would be able to run on a phone. Microsoft is also publishing research on the same concept. One of Apple’s “OpenELM” models has 1.1 billion parameters, or weights — far smaller than OpenAI’s 2020 GPT-3 model which has 175 billion parameters, and smaller even than the 70 billion parameters in one version of Meta’s Llama, which is one of the most widely used language models.

In the paper, Apple’s researchers benchmarked the model on a MacBook Pro laptop running Apple’s M2 Max chip, showing that these efficient models don’t necessarily need to connect to the cloud. That can improve response speed, and provide a layer of privacy, because sensitive questions could be answered on the device itself, rather than being sent back to Apple servers.

Some of the features built into Apple’s software could include providing users a summary of their missed text messages, image generation for new emojis, code completing in the company’s development software Xcode, or drafting email responses, according to Bloomberg.

Apple could also decide to load up its M2 Ultra chips in its data centers to process AI queries that need more horsepower, Bloomberg reported.

Green bubbles and Vision Pro

WWDC won’t strictly be about AI.

The company has more than 2.2 billion devices in use, and customers want improved software and new apps.

One potential upgrade could be Apple’s adoption of RCS, an improvement to the older system of text messaging known as SMS. Apple’s messages app diverts texts between iPhones to its own iMessage system, which displays conversations as blue bubbles. When an iPhone texts an Android phone, the bubble is green. Many features such as typing notifications aren’t available.

Google led development of RCS, adding encryption and other features to text messaging. Late last year Apple confirmed that it would add support for RCS alongside iMessage. The debut of iOS 18 would be the logical time to show its work.

The conference will also be the first anniversary of Apple’s reveal of the Vision Pro, its virtual and augmented reality headset, which was released in the U.S. in February. Apple could announce its expansion to more countries, including China and the U.K.

Apple said in its WWDC announcement that the Vision Pro would be in the spotlight. Vision Pro is currently on the first version of its operating system, and core features, such as its Persona videoconferencing simulation, are still in beta.

For users with a Vision Pro, Apple will offer some of its virtual sessions at the event in a 3D environment.

Weak US gasoline demand compounds pressure on oil ahead of OPEC+ meet

By Shariq Khan

May 31, 20241:32 PM MDTUpdated 10 days ago

NEW YORK, May 31 (Reuters) – The U.S. gasoline market is flashing signs of weakness at the start of summer driving season, a time it generally picks up strongly, and analysts say this clouds the picture for oil demand ahead of the OPEC+ group policy meeting that kicks off this weekend.

U.S. gasoline demand fell about 2% week-over-week to 9.15 million barrels a day, even as refiners ramped up to their highest run-rate in nine months, government data for the week ended May 24 showed. That led to a surprise jump in gasoline inventories, which pushed futures prices for the fuel to a three-month low on Thursday.

The difference between gasoline futures and U.S. oil futures , a measure of refiners’ margins on gasoline, also slipped to a three-month low on Thursday. Softer refining margins could lead to run cuts at refineries, Citi analysts wrote on Friday.

“Weak refined product markets could drive the entire complex lower, including for crude,” they wrote.

U.S. gasoline consumption represents roughly 10% of global oil demand. Rising oil stocks over the past few months due to soft fuel demand had already strengthened the case for OPEC+ to extend supply cuts at the meeting, delegates and analysts said.

“OPEC+ is looking at all incoming data points, so they will take note of the latest developments,” UBS analyst Giovanni Staunovo said on Friday.

Weakness in U.S. gasoline demand is likely due to a mix of factors, including a record number of travelers choosing to fly over the holiday weekend instead of driving long distances, Staunovo said. More fuel-efficient cars and electric vehicles also cut gasoline usage, he added.

The move shows how much former CEO Bernard Looney’s sudden departure last year is still felt.

“There were almost 3 million people at the airport last Saturday, a new record high. So despite many on the road, the miles driven might have been lower than a year ago and eventually more-efficient cars weighed on demand,” Staunovo noted.

The market structure for U.S. gasoline futures flipped briefly to a ‘contango’ on Friday , a structure where gasoline available immediately is priced lower compared to deliveries later in the future.

A contango for U.S. gasoline in May is rare, last recorded in 2021. It is a sign of how weak the market is and a gasoline trader called it a signal to “store now, sell later”.

I audited my Amazon Prime membership to see if the $139 annual fee is still worth it

Published Sun, Jun 16 202410:00 AM EDT

To renew, or not to renew?

That’s the question I’ve been asking myself every June since Amazon Prime first hooked me more than 10 years ago with a deeply discounted rate for college students.

Most years, my renewal date sneaks up on me before I even realize it. The notification from my credit card pops up on my phone and I realize that I’ve committed another $139 to the Seattle-based e-tail giant.

But last year, when I yet again let auto-renew make my decision for me, I set a calendar alert for 2024 so that I could properly review my Amazon Prime subscription and see if I’m actually getting my money’s worth.

After tax, my $151.34 membership comes out to $12.61 a month, less than what I pay for services like Netflix, Max or Spotify. Let’s audit the Prime perks that I do — and don’t — use, and see if it’s worth keeping around for another year.

Free shipping, easy returns

Amazon’s free two-day shipping guarantee isn’t quite as impressive as it used to be, with some other retailers offering similar delivery speeds these days. But the convenience of being able to find most products I’m shopping for and receive them in a timely manner is still a huge value for me. Without Prime, I’d need to hit certain order minimums to qualify for free shipping, and it would take an extra day or two to get to me.

I also like how Prime incentivizes me to choose later delivery dates in exchange for digital credits that can be used on movie rentals or Kindle purchases. When I’m not in a hurry to receive a package — and let’s be honest, I don’t usually need anything that urgently — it’s nice to accumulate my digital cash and get a free book or movie rental out of it. It’s a perk that is difficult to put a dollar figure on, but goes a long way toward making the annual fee feel worthwhile.

Even better than Amazon’s shipping, however, is how easy it makes returns. I try to be conscious of my environmental footprint and not make unnecessary returns when I don’t have to. But in the event that I do need to send something back, few companies make the process easier than Amazon. Walking over to my local UPS store or Whole Foods and dropping a product off is a lot less of a hassle than printing out a label and packaging it up myself.

Prime Video

Stand-alone price: $8.99/month, $107.88/year

Unless there’s a new season of “Reacher” airing, Amazon’s streamer isn’t the first app I boot up when looking for something to watch. It’s probably not even the third or fourth. If I didn’t have Prime, I probably wouldn’t spend $8.99 every month for the service.

But as it stands, I use Prime Video enough that I pay the extra $2.99 per month to avoid ads when I’m watching movies and shows. Plus, as a Yankees fan, 21 of my team’s games are available exclusively on Prime this season.

Free, unlimited photo storage

Stand-alone price: $1.99/month, $23.88/year for 100GB photo storage

All Amazon customers get 5GB of storage for their photos and videos whether they pay for Prime or not. Prime members, however, can save as many photos to Amazon’s cloud as they want.

It’s not a perk that’s top of mind when I think of my membership benefits, but with a photo archive dating back more than a decade, it’s nice to not have to pay extra for my digital storage space.

What about the perks I don’t use?

On paper, there’s value that I’m leaving on the table with my Prime membership. I’m a Spotify subscriber, so I never use Amazon Music. Likewise, I don’t do my grocery shopping at Whole Foods, so the “exclusive” deals only available to Prime members don’t move the needle for me.

Prime Day is billed as a shopping extravaganza for Prime members, but to me it just feels engineered to get me to spend more money on deals that aren’t actually all that great.

I get most of my Kindle books from the New York Public Library, so having access to Prime Reading’s rotating collection of books isn’t something I take into consideration when assessing how much I pay for my membership each year. The newly added Grubhub+ membership is nice to have, but spending more money on take-out because of Amazon Prime will only make my membership feel more expensive, not less.

To renew, or not to renew?

Between free shipping, easy returns, some fun offering on Prime Video and all the photo storage I need, I still feel like I get enough value out of my membership to make the annual fee worthwhile. I’ll let my subscription renew for another year.

That said, over the next 11 months I’ll still be keeping a close eye on how often I’m using the perks listed above. My Prime subscription may be worth it this year, but I won’t let auto-renew make my decision for me anymore.

Nvidia to get 20% weighting and billions in investor demand, while Apple demoted in major tech fund

PUBLISHED MON, JUN 17 202412:21 PM EDTUPDATED 3 HOURS AGO

Jesse Pound@/IN/JESSE-POUND@JESSERPOUND

KEY POINTS

- Microsoft and Nvidia will likely have a weight of around 21% in this tech ETF, while Apple will be down to about 4.5%, according to Matthew Bartolini, head of SPDR Americas Research.

- The rebalance will be in effect for one quarter, even if Apple outperforms Nvidia significantly ahead of the official date.

- The ETF has about $71 billion in assets under management, so a 15-percentage-point change in the fund equates to more than $10 billion.

Nvidia’s blistering rally will force a major technology exchange-traded fund to acquire more than $10 billion worth of shares of the chip giant while cutting dramatically back on Apple.

The index that the Technology Select Sector SPDR Fund (XLK) follows will soon rebalance, based on an adjusted market cap value from Friday’s close. The new calculations show Microsoft as the top stock in the index, followed by Nvidia and then Apple, according to Matthew Bartolini, head of SPDR Americas Research.

All three stocks would have a weight above 20% in the index if there were no caps in place. But diversification rules for the index limit how big the cumulative weight of stocks with at least a 5% share of the fund can be.

As a result, Microsoft and Nvidia will likely have a weight of around 21%, while Apple will fall sharply to about 4.5%, Bartolini said.

That is a change from the prior weightings, which saw Nvidia’s weight be kept artificially low by index rules. As of June 14, Microsoft and Apple were both at about 22% each in the fund, while Nvidia was just 6%.

XLK SHAKE-UP

| COMPANY | PORTFOLIO WEIGHT AS OF 6/14 | ESTIMATED WEIGHTING POST-REBALANCE |

| MICROSOFT | 22% | 21% |

| NVIDIA | 6% | 21% |

| APPLE | 22% | 4.5% |

Source: SPDR

The race to finish in the top two came down to the final day. As of Monday, market cap data from FactSet shows that all three companies are over $3.2 trillion and within $50 million of each other, though that data does differ slightly from the calculations used in the index.

The XLK has about $71 billion in assets under management, so a 15-percentage-point change in the fund equates to more than $10 billion. SPDR does not comment on specific trading strategies around rebalances.

The big shift in the XLK is an extreme example of how even passive index funds can diverge, especially when focusing on narrow slices of the market.

“Understanding how they might be weighted, where they’re allocated, what the rebalance frequency is, is really important because it can create differences in exposures and make what’s beneath the label seem different from fund to fund,” Bartolini said.

The fund follows the Technology Select Sector Index from S&P Dow Jones Indices, which uses a float-adjusted calculation to determine market cap. The rebalance officially takes effect at the end of this week.

The free-float adjustment for market cap accounts for large holders of an individual stock unlikely to be trading on a daily basis. For example, Warren Buffett’s Berkshire Hathaway owns more than 5% of Apple, which could count against it in the index, Bartolini said.

“Its free-float market capitalization is reduced because you have so many controlled interests in the company,” Bartolini said.

The rebalance will be in effect for one quarter, even if Apple outperforms Nvidia significantly ahead of the official date.

On Monday, shares of Apple were up 2%, while Nvidia dipped 0.7%.