HI Market View Commentary 04-03-2023

I ran into GS guys – Interns and first 5 year guys

They couldn’t believe what I was doing = team, resources, money to buy leads, building , the name

What do you do when you don’t know what to do?=go back to the basics, more research, go to protection

How do you think the government is going to bail out SVB? And found 480B so far

I need to start putting money to work for you? But did you change your mind on April

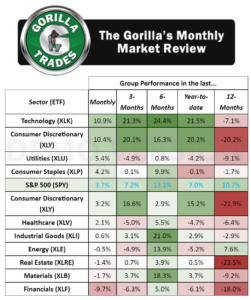

Looking at individual stocks, the tech sector’s strength becomes even more apparent, as AMD (AMD, +24.5%), Facebook parent Meta (META, +21.4%), Google parent Alphabet (GOOG, +15.5%), Nvidia (NVDA, +19.7%), and Microsoft (+14.9%) all stood head and shoulders above the border market. Gold miners like Newmont (NEM, +10.5%) and software companies Salesforce (CRM, +22.5 ) and Activision (ATVI, +11.5%) shined too, with GE (GE, +12.8%) and biotech companies Vertex (VRTX, +8.8% ) and Regeneron (REGN, +7.8%) pulling their weight too. The losses of First Republic (FRC,-88.2%), Keycorp (KEY, -31.3%), and Zions (ZION, -38.5%) illustrate the bloodbath among regional banks well, while energy stocks, such as ConocoPhillips (COP, -10.1%) and EOG (EOG, -9.8%), and airlines like United (UAL, -15.6%) and Delta (DAL, -9.6%) also dropped sharply in March.

So….. We have a huge opportunity this year because of how far great blue chip stocks fell last year, AAPL, DIS, BA, BAC, JPM, F, UAA, V, GOOGL, META, BIDU, COST, LMT, MU, SQ, TGT,

Earnings dates:

MU 03/28

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 17-Mar-23 15:37 ET | Archive

Banking crisis a soon-to-be shock to earnings estimates

Market participants have been clamoring for relief on the interest rate front, and, boy, have they gotten it. The question, though, is at what cost?

Something Shocking This Way Comes

The 2-yr note yield plunged 79 basis points this week to 3.80% and the 10-yr note yield dropped 31 basis points to 3.39%. A little over two weeks ago, the 2-yr note yield stood at 5.06% and 10-yr note yield hit 4.10%.

The rapid reversal wasn’t precipitated by some unequivocally friendly inflation data. It was precipitated by the shocking failures of Silicon Valley Bank and Signature Bank.

We say shocking because those failures happened almost overnight and because Fed Chair Powell didn’t give any hint in his semiannual monetary policy testimony the week before that he was concerned about systemic risk to the banking system.

It was not a good look for the Fed Chair and the Federal Reserve’s supervisory capacity. They missed it, but to be fair, so did just about everyone else. Prior to last week, there were no public calls or research notes screaming that a banking crisis was at hand.

Nope. The focus on March 8 was whether the Fed would raise the target range for the fed funds rate by 50 basis points at the March 21-22 FOMC meeting.

On March 10, before the close of trading, Silicon Valley Bank was taken over by regulators. On March 12 Signature Bank was closed by its state chartering authority, and later that evening Treasury Secretary Yellen, Fed Chair Powell, and FDIC Chairman Gruenberg issued a joint statement noting that all depositors at these banks would be made whole under a systemic risk exception.

The Fed also introduced a Bank Term Funding Program designed to stem deposit runs on other banks by accepting high-quality assets as collateral at par value.

And just like that, it was evident to the world that the U.S. banking sector had a crisis on its hands. The characterization that this is a crisis might be debatable. It certainly doesn’t have the same characteristics as the financial crisis of 2008-2009 (thankfully), but the Treasury Department, Federal Reserve, and FDIC have themselves deemed it a crisis by invoking the systemic risk exception.

Some of the more unnerving elements of this latest bank “crisis” are that the decline in Treasury yields accelerated, and that bank stocks continued to decline, after the depositor rescue plan was announced. Also, Credit Suisse (CS) was compelled to engage the Swiss National Bank to shore up its liquidity position.

Remarkably, what hasn’t gone down (yet) are earnings estimates.

A Loaded Question

On March 8 the forward twelve-month earnings estimate for the S&P 500 was $226.19. Today, it sits at $226.66.

We can’t help but ask the question: do you think the 12-month outlook for earnings got better or worse since this latest banking crisis came to light?

We’ll load that question with the added insight that just about everyone now is labeling this banking crisis a disinflationary/deflationary force beyond the short term and is suggesting that banks of all stripes will be tightening their lending standards, managing their balance sheets more conservatively, and facing net interest margin pressures as they are forced to raise interest rates on deposit accounts.

When banks go into protection mode so to speak, it is not a good thing for growth prospects. Credit is the lifeblood of economic expansion, and when there are blood clots in the flow of credit, the economy suffers.

Accordingly, calls for the economy to experience a recession have picked up since the dawn of this latest banking crisis and many pundits are again pointing to the Treasury yield curve as their guide, only not because the 2s10s spread is widening further but because it is steepening.

That is, short-term rates are falling more rapidly than long-term rates on the assumption that weak economic conditions are going to force the Fed to cut rates. The widening in the 2s10s spread might be looked at as the canary in the coal mine, but the steepening in the wake of an adverse development is seen as the canary dying in the mine.

There may still be a chance for the canary to escape, but its survival will have a lot to do with how this banking crisis resolves itself both in terms of form (an abatement of deposit concerns) and function (the extent of bank lending activity).

Nevertheless, there is little doubt that the economy has been harmed by this crisis, which has compounded an already high sense of uncertainty and has created excess volatility in the capital markets that should weigh further on consumer and business confidence.

Growth Concerns in the Mix

The concerns about a slowdown in growth on account of the banking crisis were not limited to the Treasury market. Since March 8, WTI crude futures prices have fallen 13% to $66.39 per barrel, copper futures have dropped 3.2% to $3.90/lb, the ICE BofA U.S. High-Yield Index Option-Adjusted Spread has widened 84 basis points to 4.93%, and the S&P 500 Materials Sector has declined 7.6%.

Conversely, the Vanguard Mega-Cap Growth ETF (MGK) has risen 2.2%, versus a decline of 1.8% for the S&P 500, in the equivalent of a flight-to-safety trade within the stock market, as mega-cap issues like Apple (AAPL) and Microsoft (MSFT) are seen as having fortress balance sheets, sufficient distance from the banking issues, and the ability to hold up better than most if economic times do get quite tough. Over the same period, the Invesco S&P 500 Equal Weight ETF (RSP) has declined 5.8%.

The uncertainty about how difficult things might get will impede spending decisions and lead to more conservative management overall by companies outside the banking industry.

That would be considered a textbook response, but relative to earnings expectations, it is a new revelation to account for that wasn’t accounted for as much a little more than a week ago. What market participants also have to account for is the potential for collateral damage beyond the banks.

To that end, a favored trade before the banking crisis was to be long oil and short Treasuries. Any money manager levered up on those positions would naturally have some exposure issues on their hands. That’s not to say they didn’t cut their risk, but it is not unusual after a crisis that leads to outsized movement in prices to hear that a fund is in trouble and/or that some forced liquidations are taking place.

Thus far, it has been quiet on that exposure front, but one shouldn’t be surprised if such a story arises knowing that talk of liquidity crunches has been injected into the market narrative.

We digress.

What It All Means

The collateral damage in a collective sense should be showing up soon enough in declining earnings estimates. That will be particularly true for the banks, but if the economy stumbles like many think it will because of the banking crisis, it will be true of most companies.

That thinking has yet to make its presence felt in the forward twelve-month earnings estimate, but the banking crisis should soon be forcing a recalibration of earnings models.

We suggested in mid-February that earnings estimates for the second half of 2023 would be at risk along with the economy. Admittedly, that view didn’t envision a banking crisis being part of the equation, but it is now.

Sure, it might strike some as hopeful that market rates have come way down in the last few weeks and that the Fed’s terminal rate might not stretch as high as previously feared only a week ago. Some might see that as a basis for multiple expansion.

The impetus for those shifts, however, hasn’t been anything good. On the contrary, the impetus has been a negative shock to the economy that is going to be worse for earnings prospects. That is a basis that should keep the stock market in check because it is difficult to find a bottom in stock prices when confidence is low that there has been a bottom in earnings estimates.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of April 3)

Where will our markets end this week?

Higher

DJIA – Bullish

SPX –Bullish

COMP – Bullish

Where Will the SPX end April 2023?

04-03-2023 -2.5%

03-27-2023 -2.5%

Earnings:

Mon:

Tues:

Wed:

Thur: LEVI

Fri:

Econ Reports:

Mon: Construction Spending, ISM Manufacturing

Tue Factory Orders, JOLTS

Wed: MBA, ADP Employment, Trade Balance, ISM Services

Thur: Initial Claims, Continuing Claims,

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Consumer Credit

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

You probably need to be defensive for the next quarter

2023 has been bad for the bears. Here are 5 reasons why it’s going to get even worse.

Last Updated: March 31, 2023 at 8:38 a.m. ETFirst Published: March 31, 2023 at 6:24 a.m. ET

By

Jamie Chisholm

Critical information for the U.S. trading day

It’s not been good for bears

LIONEL BONAVENTURE/AGENCE FRANCE-PRESSE/GETTY IMAGES

Friday’s session sees the end of the week, month and quarter. And what a quarter!

It contained bank failures that may deliver a credit crunch and worsen the expected economic downturn, thereby whacking corporate earnings; extreme uncertainty about the pace and trajectory of monetary policy that delivered volatility for the ages in government bonds; and increasingly taut geopolitical tensions.

The market’s response? The S&P 500 SPX is up 5.5%, the Nasdaq Composite COMP has surged 14.8%.

The Puritans first banned bear baiting in England in the middle of the 17th century. Nearly 400 years later and it seems the blood sport remains rife on Wall Street.

Tom Lee, head of research at Fundstrat, delivers his mauling with a gentle smile and forceful stats.

“Many skeptics (anecdotally, the majority of our clients) are likely sniffing at these gains, as mere noise until the bear market re-asserts itself. But…we believe 1Q23 gains now solidifies that bears are now trapped,” says Lee in his latest note.

The lows are in and stock market gains will continue in April, says Lee, and he gives five reasons why.

First, the banking blowup is more of a “clean up in aisle 7” than a full-blown crisis. It was a social media-generated bank run that has not spread from regional banks to a broader loss of confidence in the banking system, Lee reckons.

Second, traders are going to start perceiving monetary policy issues as more supportive. “The Fed made a ‘dovish hike’ in March and we expect incoming [softer] inflation data to support a further pause .”

Consumer inflation expectations of 3.8%, as observed in the latest University of Michigan survey, Lee notes, are now significantly below February’s CPI reading for February of 6%. At 220 basis points, it’s the largest negative spread since late 1982.

SOURCE: FUNDSTRAT

Next, some technicals. The S&P 500 has just recorded two successive positive quarters, a trend that over the past 50 years has not been seen in a bear market.

“Barring a big sell-off Friday (worse than -5.5%), two consecutive quarters of gains validate the start of a new bull market. This only solidifies our view that 10/12/22 was the bear market low and we are 6 months into a bull market,” says Lee.

SOURCE: FUNDSTRAT

Fourth, Lee has mentioned before that certain trends tend to follow when the markets begins a year with a rally of more than 1.4% over the first five days when the previous year was negative. Simplifying, this tends to mean the advance accelerates over March and April.

“April 2023 should see stronger gains of around 4% this would push S&P 500 to greater than 4,200.”

Finally, speculative positioning remains overly bearish. Traders are net short 202,000 E-mini S&P 500 futures contracts ES00, nearly the same level as seen when the market hit its recent trough in October.

And Lee finishes with a spot of ursinal teasing. Pointing to a tweet from fund manager Michael Burry in which he admitted he had been wrong to say “sell” two months ago, Lee wryly observes: “Notably, some bears are beginning to exit the ‘trap’.”

Here’s what went wrong with Virgin Orbit

PUBLISHED FRI, MAR 31 20233:20 PM EDTUPDATED FRI, MAR 31 20235:15 PM EDT

Michael Sheetz@IN/MICHAELJSHEETZ@THESHEETZTWEETZ

KEY POINTS

- Virgin Orbit is on the brink of bankruptcy, with its valuation tumbling from nearly $4 billion in 2021 to less than $100 million today.

- While it touted a flexible approach to launching small satellites, the Richard Branson-backed company was unable to reach the rate of launches necessary to generate enough revenue.

- CNBC collected insights from company insiders and investors over the past several weeks to explain where things went wrong for Virgin Orbit.

Not too long ago, Virgin Orbit was in rarified air among U.S. rocket builders, and executives were in New York celebrating its public stock debut.

The scene was true to the marketing pizazz that has helped Sir Richard Branson build his Virgin empire of companies, showcasing with a rocket model in the middle of Times Square.

The deal, facilitated by a so-called blank check company, gave Virgin Orbit a valuation of nearly $4 billion. But that moment in December 2021 – when the craze surrounding public offerings centered on special purpose acquisition companies, or SPACs, was dying out – previewed the pain to come.

Now, Virgin Orbit is on the brink of bankruptcy. The company on Thursday halted operations and laid off nearly all of its staff. Its stock was trading around 20 cents Friday, leaving it with a market value of about $74 million.

When Virgin Orbit closed its SPAC deal, it raised less than half of the nearly $500 million expected due to high shareholder redemptions, shortening its runway. With the broader markets turning against riskier yet-unprofitable assets like many new space stocks, Virgin Orbit shares began a steady slide, further limiting its ability to raise substantial outside investment.

Branson, Virgin Orbit’s largest stakeholder, was unwilling to fund the company further, as CNBC previously reported. Instead, he began hedging against his 75% equity stake through a series of debt rounds. That debt gives the flashy British billionaire first priority of Virgin Orbit assets in the event of the now-impending bankruptcy.

While Virgin Orbit touted a flexible and alternative approach to launch small satellites, the company was unable to reach the rate of launches necessary to generate the revenue it sorely needed.

Virgin Orbit’s technical staff acquitted themselves well over the company’s brief existence, but were ultimately undone in by its leaders’ financial mismanagement. It’s a story too often told in the history of the space industry: Exciting, or even innovative, technologies do not necessarily equal great businesses.

It became one of a few U.S. rocket companies to successfully reach orbit with a privately developed launch vehicle. It launched six missions since 2020 — with four successes and two failures — through an ambitious and technically difficult process known as “air launch,” with a system that uses a modified 747 jet to drop a rocket mid-flight and send small satellites into space.

But Virgin Orbit had dug a nearly $1 billion hole, flying missions just twice a year while its payroll expenses climbed. The company’s leadership was aware of the deteriorating situation and lack of progress, and even considered changes last summer to make the business more lean. But no clear or dramatic plan came to fruition – leading to Thursday’s fall.

This story collects insights from CNBC’s discussions with company insiders and industry investors over the past several weeks, as well as from regulatory disclosures, to explain where things went wrong for Virgin Orbit. Those people asked to remain anonymous in order to discuss internal or competitive matters.

A Virgin Orbit spokesperson declined to comment for this story.

Lacking execution

Virgin Orbit was spun-off from Branson’s space tourism company, Virgin Galactic, in 2017, after a team within the latter sister company saw potential in using an aircraft as a platform to launch satellites. While “air launching” satellites was not a novel idea to Virgin Orbit, the company aimed to surpass the air-launched Pegasus rocket – developed by Orbital Sciences, which is now owned by Northrop Grumman –for a fraction of the cost per mission.

Headquartered in Long Beach, California, Virgin Orbit flew most of its missions out of the Mojave Air and Space Port. The exception to that was its most recent launch, which took off from Spaceport Cornwall in the United Kingdom. Virgin Orbit had been working with other governments to provide launches by flying out of airports around the world, signing agreements with Japan, Brazil, Australia and the island of Guam.

The advertised flexibility and potential of Virgin Orbit’s approach attracted quite a bit of attention from leaders in the U.S. national security community. Following meetings with top Pentagon brass in 2019, Branson proclaimed that Virgin Orbit is “about the only company in the world that could replace [satellites] in 24 hours” during a military conflict.

At the time, the Air Force’s acquisition lead, Will Roper, said he was “very excited about small launch” after meeting with Branson. He said the U.S. military had “huge money to invest” in buying rocket launches.

The company had hoped to launch its debut mission as early as 2018, but that goal kept moving every six months or so. Eventually, Virgin Orbit launched its first mission in May 2020, which failed shortly after the rocket was released from the jet. It got to orbit successfully for the first time in January 2021.

Given the company’s burn rate near $50 million a quarter, Virgin Orbit was targeting profitability once it got beyond a launch rate, or cadence, of a dozen missions per year. When it went public, Virgin Orbit CEO Dan Hart told CNBC that the company was aiming to launch seven rockets in 2022, to build on that momentum.

At the same time, Virgin Orbit was already in a deep financial hole – with a total deficit of $821 million at the end of 2021, due to steady losses since its inception. While Virgin Orbit had aimed to launch seven missions last year, that number was steadily guided down quarter after quarter, closing out 2022 with just two completed lunches – the same as the year before.

Some people within the company who had been critical of Virgin Orbit’s execution pointed to several executives’ backgrounds at Boeing, which has had its share of space-related snags over the years.

Virgin Orbit CEO Dan Hart had spent 34 years at Boeing, where he was previously the vice president of its government space systems. COO Tony Gingiss joined Virgin Orbit from satellite broadband company OneWeb, but before that had spent 14 years in Boeing’s satellite division. And Chief Strategy Officer Jim Simpson had also spent more than eight years in Boeing’s satellite division before joining Virgin Orbit.

As one person emphasized, the company launched the same amount of rockets in a year with a staff of 500 as it did with a workforce of over 750 people. Others complained of a lack of cross-department coordination, with projects and spending done in silo of each other – leading to a disconnect in schedules.

Two people mentioned wastefulness in ordering materials. For example: The company would buy enough expensive items with limited shelf-life to build a dozen or more rockets, but then only build two, meaning it would have to throw away millions of dollars’ worth of raw materials away.

When Virgin Orbit announced an employee furlough March 15, people familiar with the situation said the company had about half a dozen rockets in various states of production in its Long Beach factory.

As the lack of a financial lifeline made the situation increasingly more desperate, multiple Virgin Orbit employees voiced frustration with how Hart communicated the company’s position – and even more so with the lack of clarity after the furlough.

The day of the initial pause in operations, people described company leadership running around frantically while many employees stood around waiting for word on what was happening. One person emphasized the tumultuous and sudden furlough happened because executives tried to keep the company alive as long as possible. Several employees expressed disappointment with Hart holding the March 15 all-hands meeting virtually, speaking from his office rather than face-to-face, and not taking any questions after announcing the pause in operations.

That frustration continued after the pause, with employees confused by the lack of specifics about which investors were speaking to Virgin Orbit leadership. Thursday’s update that a deal fell through came as little surprise to a workforce that was largely in limbo. Many were already hunting for new jobs.

Deal efforts fall apart

A pivot in Virgin Orbit’s strategy became apparent and necessary shortly after it went public.

Virgin Orbit aimed to raise $483 million through its SPAC process, but significant redemptions meant it raised less than half of that, bringing in $228 million in gross proceeds. The funds it did raise came from the minority of SPAC shareholders who stuck around, as well as private investments from Virgin Group, the Emirati sovereign wealth fund Mubadala, Boeing, and AE Industrial Partners.

Unlike its sister company Virgin Galactic, which built its cash reserves to more than $1 billion through stock and debt sales after going public in October 2019, Virgin Orbit did not build its cash coffers. And that meant leadership should have buckled down and made changes to run the company in a more lean way, one person emphasized, to rebuild momentum.

And then Virgin Orbit’s apparent strength in the national security sector began to falter. Despite half of its missions flying Space Force satellites, the company lost out to competitor Firefly Aerospace for a launch contract under the “Tactically Responsive Space” program. Awarded in October, the mission seemed right up Virgin Orbit’s alley, especially since the prior mission under that Space Force program flew on the similarly air-launched Pegasus rocket.

As the financial situation worsened, a few bankers who spoke to CNBC wondered why the search for a deal was dragging on. According to one banker, Virgin Orbit could raise anywhere from $10 million to $15 million quickly to stop-gap the situation while it found a larger buyer. Another investor estimated that Virgin Orbit had about $270 million in net tangible assets, further sweetening the potential for a wholesale deal even despite its plunging market value.

A white knight seemed to appear last week in the form of Matthew Brown, who discussed making an 11th-hour deal with Virgin Orbit, to reportedly inject as much as $200 million into the company. However, within days, the talks fell apart. The company continued to discussions with another, unnamed investor this past week.

But in the words of Hart on Thursday, Virgin Orbit was “not been able to secure the funding to provide a clear path for this company.”

And while the 675 employees laid off Thursday likely have strong job prospects, Virgin Orbit seems now destined for bankruptcy.

https://www.cbsnews.com/miami/news/desantis-board-says-disney-stripped-them-of-power-3/

DeSantis’ board says Disney stripped them of power

MIAMI – Board members picked by Florida Gov. Ron DeSantis to oversee the governance of Walt Disney World said Wednesday that their Disney-controlled predecessors pulled a fast one on them by passing restrictive covenants that strip the new board of many of its powers.

The current supervisors of the Central Florida Tourism Oversight District said at a meeting that their predecessors last month signed a development agreement with the company that gave Disney maximum developmental power over the theme park resort’s 27,000 acres in central Florida.

The five supervisors were appointed by the Republican governor to the board after the Florida Legislature overhauled Disney’s government in retaliation for the entertainment giant publicly opposing so-called “Don’t Say Gay” legislation that bars instruction on sexual orientation and gender identity in kindergarten through third grade, as well as lessons deemed not age-appropriate.

In taking on Disney, DeSantis furthered his reputation as a culture warrior willing to battle perceived political enemies and wield the power of state government to accomplish political goals, a strategy that is expected to continue ahead of his potential White House run.

The new supervisors replaced a board that had been controlled by Disney during the previous 55 years that the government operated as the Reedy Creek Improvement District. The new board members held their first meeting earlier this month and said they found out about the agreement after their appointments.

“We’re going to have to deal with it and correct it,” board member Brian Aungst said Wednesday. “It’s a subversion of the will of the voters and the Legislature and the governor. It completely circumvents the authority of this board to govern.”

In a statement, Disney said all agreements were above board and took place in public.

“All agreements signed between Disney and the District were appropriate, and were discussed and approved in open, noticed public forums in compliance with Florida’s Government in the Sunshine law,” the statement said.

Separately, Disney World service workers on Wednesday were voting on whether to accept a union contract offer that would raise the starting minimum wage to $18 an hour by the end of the year.

The agreement covers around 45,000 service workers at the Disney theme park resort, including costumed performers who perform as Mickey Mouse and other Disney characters, bus drivers, culinary workers, lifeguards, theatrical workers and hotel housekeepers.

Workers could see their hourly wages rise between $5.50 and $8.60 an hour by the end of the five-year contract if it’s approved, according to union leaders.

A contract approved five years ago made Disney the first major employer in central Florida to agree to a minimum hourly wage of $15, setting the trend for other workers in the region dominated by hospitality jobs.

Bank of America’s model with a good track record predicts S&P 500′s annual return for the next decade

PUBLISHED THU, MAR 30 202310:44 AM EDTUPDATED THU, MAR 30 202311:43 AM EDT

The recent volatility has kept investors on edge, but Bank of America advised equity investors to focus on the long term, as its trusty model suggests a sizable return for the next 10 years.

The Wall Street firm said price-to-normalized earnings has explained 80% of S&P 500 returns over a 10-year time horizon since 1987, and the current valuations suggest a 7% annual total return (a 5% price return) for the S&P 500 for the next decade.

“Valuations may not explain much in the near term, but they may be all that matters over the long-term for the S&P 500,” said Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America, in a note.

“We have yet to find any factor with such strong predictive power for the market over the short or medium term,” she added.

The S&P 500 is still up 5% this year despite the banking crisis and recession fears. Wall Street strategists on average see the equity benchmark end the year at 4,127, about 2% higher from here, according to CNBC’s Market Strategist Survey, which rounds up 15 top strategists’ forecasts.

Subramanian said long-term investors have a far better chance of making a profit. Based on data going back to 1929, the probability of losing money in the S&P 500 over one day is 46%, but the chance declines to just 6% over a 10-year time horizon, she said.

“For stocks, the best recipe for loss avoidance is time,” Subramanian said.

My younger sister asked me for money advice. Here are 5 answers I gave to improve her life

PUBLISHED SUN, APR 2 20238:30 AM EDTUPDATED SUN, APR 2 202310:30 AM EDT

KEY POINTS

- As my younger sister, Janna, gets older into her 20s, she’s been coming to me more frequently with questions about how to spend and save money.

- To get the best answers for her, I consulted with financial advisors and experts.

When my younger sister, Janna, and I hang out — which is a lot because we live on different floors of the same apartment building — what we talk about usually doesn’t involve money.

We exchange stories about our friends and therapists, commiserate over the latest thing we’re trying to write or go over funny memories.

Yet as Janna, who is a filmmaker, gets older, she’s been coming to me more frequently with financial questions. It seems that when money is causing stress, everything else can feel fraught.

“I think with each year in your 20s, you take on more freedoms,” Janna said. “But to exercise and really enjoy those freedoms, you need a certain amount of financial stability.”

To get the best answers for Janna about how she should be spending and saving, I consulted with financial advisors and experts.

Here’s how they answered 5 of her questions.

1. How much should I have in savings?

To begin, Carolyn McClanahan, a certified financial planner and founder of Life Planning Partners in Jacksonville, Florida, recommends always having at least one month of your bills in your checking account. “This way if something happens to my paycheck, I don’t have to scramble,” said McClanahan, who is also a member of CNBC’s Financial Advisor Council.

Beyond that, you should have at least three months of expenses easily available in an emergency fund, McClanahan said. “If they have a less stable job, they should aim for six months to a year’s worth of easy to access savings,” she added.

This cash should be in a high-yield savings account, experts say. These accounts offer higher-than-average returns. You can find an online savings account with an interest rate of 3% or more, for example, while the typical savings account rate is around 0.4%.

Make sure the savings account you choose is insured by the Federal Deposit Insurance Corp., which means up to $250,000 of your deposit is protected from loss.

2. Where should I invest money?

Douglas Boneparth, a certified financial planner and founder of Bone Fide Wealth in New York City, recommends people start investing in tax-advantaged accounts designated for retirement.

First of all, starting to invest early for your old age gives you the long time horizon that’s ideal for reaping the benefits of compound interest, experts say.

Retirement accounts, including workplace 401(k) plans and Roth IRAs, also offer tax benefits that you can’t get elsewhere, said Boneparth, another member of CNBC’s Financial Advisor Council.

For example, traditional 401(k) contributions reduce your current taxable income, while after-tax contributions to a Roth IRA can be withdrawn in retirement tax-free.

Before you move on to any other goals, McClanahan says people should make sure they’re saving in their 401(k) at work, especially if their employer offers a match on their contributions. If you meet income qualifications, it’s also smart to salt away as much as you can each year in a Roth IRA (in 2023, the limit is $6,500).

For other things you hope to be able to accomplish, such as buying a house or returning to school, you’ll want to consider your timeline to decide if you should save or invest for it.

Typically, you don’t want to invest for anything you’ll have to come up with the money for within five years, McClanahan said. Money for those purposes should instead also be in your high-yield savings account.

If you are on track for retirement and any near-term goals and still have money available to invest, you should look to put that cash into low-cost index funds that are offered through robo-advisors and brokerage houses, experts say.

3. How many credit cards should I have? How do I find one with the best benefits?

As long as you use them carefully, credit cards can help you to build credit and pick up different perks, said Ted Rossman, senior analyst at Bankrate.com.

“I’d vote for starting small,” Rossman said. To do that, he recommends getting a credit card with no annual fee and putting some routine expenses on there, and always paying your balance in full every month. (Carrying a balance is incredibly expensive because of the high interest rates.)

You can pretty easily find a card that offers 2% cash back on your purchases, Rossman said.

Beyond that, he said, you want to think about where you spend most of your money. If a lot of your income goes to groceries, look for a card that pays back 6% at supermarkets. Other cards have more generous cash back offers on dining or travel.

“Know what you want to get out of your rewards,” Rossman said.

4. How do I budget without becoming obsessive?

To get a better understanding of your spending, experts recommend looking back at your purchases over the past couple of months.

McClanahan then breaks down spending into three main categories: “needs,” “wants” and “savings.”

When you look at your spending on “wants,” she said, “make sure that that spending is really bringing value to your life. Too many people spend thoughtlessly.”

One helpful rule of thumb is the 50/30/20 budget, which allocates 50% of your take-home pay toward essential expenses, 30% toward discretionary purchases and 20% toward savings and debt.

Automating your savings each month can help you stay on track, McClanahan said.

5. How do I draw boundaries with friends and family who earn more?

If someone is asking you to do something you can’t afford, McClanahan recommends being as direct as possible with them.

“Say that you are working on saving for other goals and suggest a less expensive alternative,” she said. “This shows them your backbone and might actually encourage them to start saving.”

You might also take control of the plans yourself, McClanahan said.

“Instead of waiting for people to invite you to an expensive place, invite them to something that fits within your budget.”

Any other questions, Janna? You know where to reach me.

If you use these 13 phrases every day, you have higher emotional intelligence ‘than most people’: Psychology experts

Published Sat, Apr 1 202310:00 AM EDTUpdated Sat, Apr 1 202310:03 AM EDT

Kathy and Ross Petras, Contributors@KANDRPETRAS

Do you have a knack for connecting with people? Emotional intelligence is the ability to identify and understand emotions — both your own and the emotions of others.

Research has shown that this is a rare and valuable asset. Emotional intelligence can help you build and strengthen relationships, defuse conflict, and improve overall job satisfaction.

Psychology experts say that if you use these 13 phrases every day without even thinking about it, you have higher emotional intelligence than most people:

1. “Could you tell me more about that?”

People who lack self-awareness only care about their own thoughts and opinions. But emotionally intelligent people are interested in how others feel and what they have to say.

Communicate in a way that encourages people to talk about their feelings and experiences, and use their responses as a learning opportunity.

2. “I hear you.”

By telling someone that you understand them, you set up a cooperative environment perfect for team-building.

Other similar phrases like “I see what you mean” and “I get what you’re driving at” signal that you’re truly listening and opens up the lines of communication.

3. “I understand what you’re saying, but…”

This phrase highlights another important aspect of emotional intelligence: the ability to act diplomatically when dealing with difficult people and situations.

If you disagree with someone, express it in a tactful, non-confrontational way. The goal is to make it easier to arrive at a mutually agreeable solution.

4. “How do you feel about that?”

To make people feel acknowledged and respected, pay attention and take time to understand and empathize with them. As you listen, make an effort to put yourself in their shoes in a meaningful way.

5. “I’m not sure what’s wrong. Could you explain the problem?”

With this phrase, you know that someone is having an issue, and instead of reacting negatively, you invite them to share their thoughts.

Similar alternatives: “Can you clarify that for me?” or “What I’m hearing from you is that [X]. Is that right?”

6. “What do you mean?”

When you ask someone for clarification, you are asking them to say something in a different way or provide more information so that you understand them better. This is different from asking a person to repeat something.

7. “Great job!”

Showing appreciation goes a long way. It acknowledges other people’s efforts and accomplishments.

When you compliment someone, you immediately set up a positive vibe. Saying “I appreciate you” makes others appreciate you more.

8. “You both have good points. Let’s see how we can work together.”

This phrase can help you diplomatically work through trouble spots by acknowledging differing points of views.

Once you’ve encouraged everyone to share their concerns, you can more easily solve a potential problem. Studies show that the ability to resolve conflicts is a trademark of emotional intelligence.

9. “I’d love your input on this.”

This phrase, and similar ones like “Can I get some advice from you?” or “Do you mind if I ask for some input?”, are golden.

You’re allowing someone else to feel proud of themselves, which makes them think very positively about you.

10. “This situation makes me worried [or confused or upset].”

When there is a problem, emotionally intelligent people don’t focus on the person who created it, but on the overall situation.

This way, you’re not blaming someone or putting them on the defensive side. Instead, you’re explaining how you feel about what happened, which helps you avoid sounding passive-aggressive or antagonistic.

11. “I feel this way about…”

When you’re emotionally intelligent, you connect with your emotions as they happen, in the moment.

This type of self-awareness allows you to better share your own emotions and impressions with other people, which both makes them feel closer to you and encourages them to do the same.

12. “I’m sorry.”

Having a healthy dose of humility is common among people with high emotional intelligence. Don’t be afraid to say “I’m sorry.” When you make a mistake, admit it and genuinely apologize to whomever deserves it.

13. “Thank you!”

Don’t forget those “magic words” you were taught when you were a kid. “Please,” “thank you” and “you’re welcome” are always appreciated.

Common courtesy is, sadly, not that common these days, according to studies. Being polite isn’t only a mark of high emotional intelligence, it’s also a way of showing respect for others, which makes them regard you more highly.

Kathy and Ross Petras are the brother-and-sister co-authors of “Awkword Moments: A Lively Guide to the 100 Terms Smart People Should Know,” “You’re Saying It Wrong” and “That Doesn’t Mean What You Think It Means: The 150 Most Commonly Misused Words and Their Tangled Histories.” They’ve also been featured in media outlets including The New York Times, The Chicago Tribune, The Washington Post and Harvard Business Review.