Trade Findings and Adjustments 1-23-2020

BA – We have Feb 20th 330 Puts to protect shares which are

In The Money.

Why not roll 330 puts down?

– We want to make more on the way down with 330 puts than 315 or 310 strike puts.

- The news is bad enough in the present that it will be difficult for BA to get back above 320 resistance.

- May have rough earnings report on the 29th

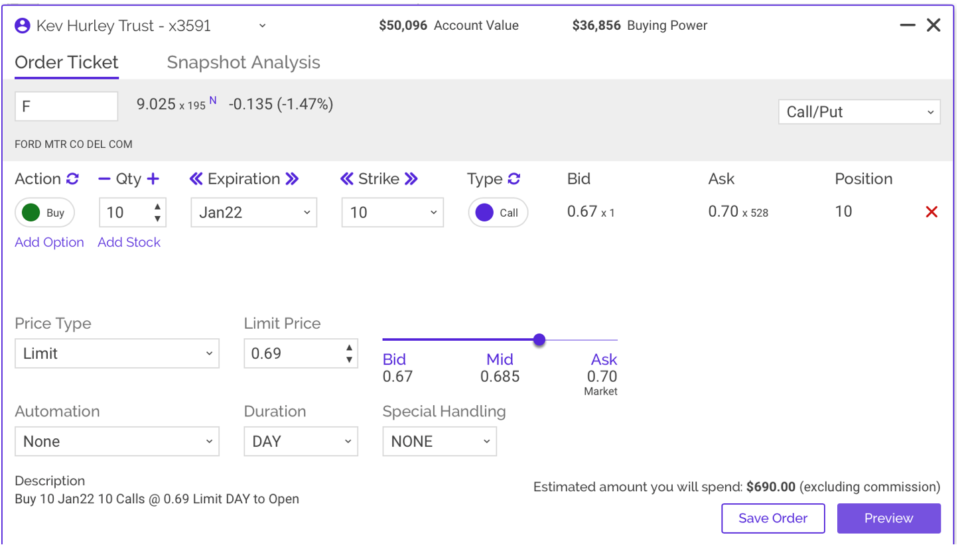

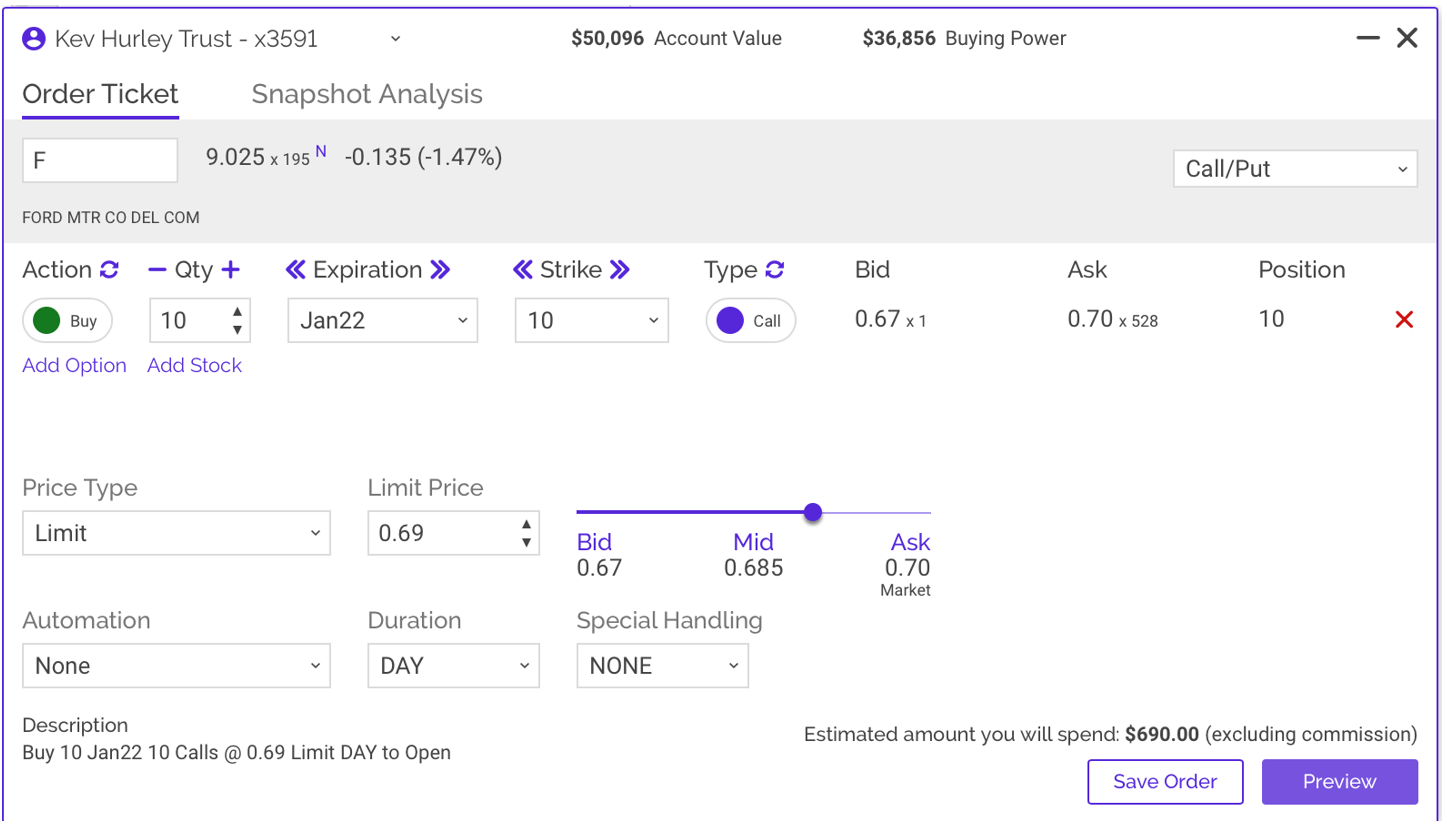

F – Buy 10 more contracts of Leap Long Calls to lower cost basis on the 10 calls we already have, and “leg in” to put more money to work.

Jan22 $10 strike Long Calls

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com