RECORDING Market Commentary 04-26-2016

HI Financial Services Commentary 04-26-2016

AAPL Stock Sucks big time!!! Hurley Investments Client

186 S&P 500 Earnings this week

Some big names were today and ALL seemed to disappoint – WYNN, TWTR, AAPL, BWLD, CMG,

Right now Futures for DJIA – 33 S&P -4.25 and NAS 42.25

$1.90 vs est $2.00 per share earnings

“Diluted” Share total revenues $50.56 vs est $51.97

That ten cent earnings miss on outstanding shares = 277 Million Dollars

10.25 M Ipads vs est 10.1 M

4 M Macs

6B in the services sector = iWatches, iPay

Iphone 51.2M vs est 50.3 M

Next Quarter as they prepare for the iPhone 7 41-43 B in revenue vs est 47B

AAPL will give an increase of 50 Billion capital give back – Means dividend and stock buybacks

What about the dividend yield – When the stock performs poorly your dividend yield increases because the stock loses value

Example

4% yield on $100 = $4

When the stock loses 10% the yield is now different 4/new $90 stock price = 4.4% yield now on the same “Real” dollar dividend amount

MOD – I think that shows the central banks are supporting the market…lousy earnings, lousy economy, and almost at the highs of the markets

Still don’t think the market is over-valued?

Here’s a 4 year chart of the S&P 500 vs the S&P 500 GAAP earnings.

Earnings are flat over the last 4 years but the market is up 50%.

Everything is great…. Buy stocks.

Our Economy is in trouble even IF it is the best house on the block. BUT it can’t end well for those countries who are so in debt that the revenues barely cover the interest owed on the debt

What’s happening this week and why?

New Home Sales 511 vs est 522

Durable Goods 0.8 vs est 1.7

Durable Goods ex-trans -0.2 vs est 0.5

Case Shiller home Prices 5.4 vs est 5.6

Consumer Confidence 94.2 vs est 96.2

Where will our market end this week?

Down 1% from here

DJIA – Bullish but with the run what is the expectation? PULLBACK

SPX – Bullish but with the run what is the expectation? PULLBACK

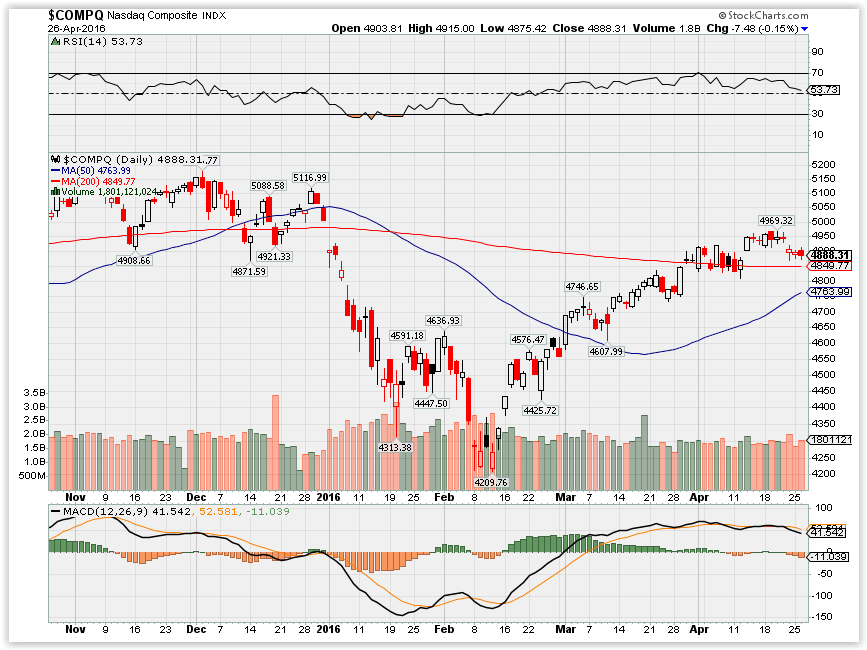

COMP – Bullish just by as bit but heading down tomorrow most likely

Where Will the SPX end April 2016?

04-26-2016 +2.5%

04-19-2016 +2.5%

04-13-2016 +2.5%

04-06-2016 +2.5%

What is on tap for the rest of the week?=

Earnings:

Tues: MMM, AFL, AKS, T, CMG, GLW, EBAY, LMT, ODP, PG, SVU, TMUS, AAPL, FCX, X, WYNN, WHR, AAPL

Wed: ADT, BSX, FSLR, HES, IP, NE, TXN, BA, FB, CLDX, PYPL,

Thur: AMGN, BMY, CAB, CAH, CELG, LNG, CME, CL, COP, DNKN, FLS, GRPN, LNKD, MA, PPL, RTN, BIDU, F,

Fri: AMC, CVX, XOM, KBR, MNST, PSX, VFC

Econ Reports:

Tues: Durable Goods, Durable ex-trans, Case-Shiller, Consumer Confidence

Wed: MBA, Crude, Pending Home Sales, FOMC Rate Decision

Thur: Initial, Continuing Claims, GDP-Adv, GDP Deflator,

Fri: Employment Cost Index, PCE Prices, Personal Income, Personal Spending, Chicago PMI, Michigan Sentiment

Int’l:

Tues –

Wed – JP: BOJ Announcement, All Industry Index, Unemployment Rate, Household Spending, Industrial Production, Retail Sales

Thursday – EMU: EC Economic Sentiment

Friday – FR:EMU: GDP Flash , EMU: HICP Flash, DE: Retail Sales.

Sunday –

How I am looking to trade?

Prepared for earnings and thinking of rolling up the Long Puts to protect at a higher strike price

Rolled Protection on DIS to 105 June Strike from 97.50 June Strike cost $2.85 ish

Rolled F from 12.75 to 13.50 and 13.75

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Visa Inc. Strong Long-Term Growth Ahead

http://seekingalpha.com/article/3966321-visa-strong-bull-case#alt1

What If You Could Buy 100% Of Apple?

Apple: Its Cheap For A Reason

Apple’s Fundamental Problem

How Strong Could China Be For Apple?

Visa: Free Cash Flow Guidance May Be Due A Revision Too (Don’t Worry Though)

Visa Inc.: It Won’t Be Long Before The Share Price Breaks Through The $100 Mark