Trade Findings or Adjustments 02-14-2019

Time to focus on Adjusting right now understanding the market daily, weekly and monthly set-up.

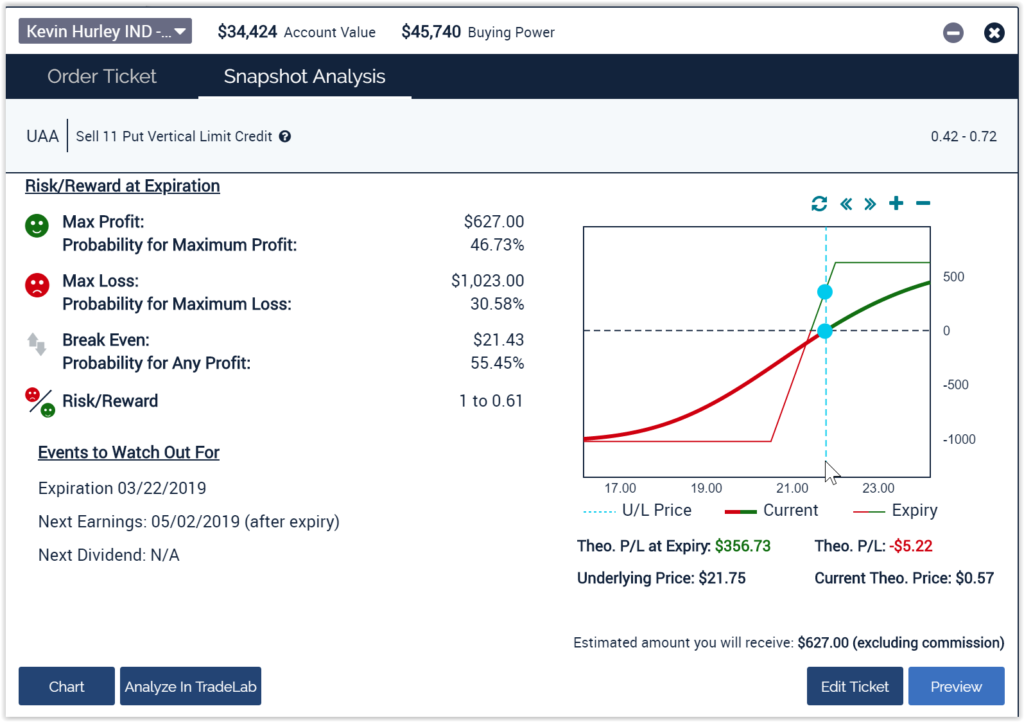

UAA Bull Put adjustment from my collar trade

NVDA shot in the dark trade – Little to NO Adjustments available

Daily headline like = China deal extended 60 more days due to good progress

Retail Sales down for Dec ….. Duh… 1.4 million without paychecks and most of us bought Christmas early this year

Options Monthly Expiration this Friday

Will Trump sign the deal for the wall and gov’t funding?

Weekly – Monday Stock market closed for Presidents Day

Expect a larger than normal sell off Friday afternoon

Monthly –

China Deal, End of Earning Season, Executive order to FUND THE WALL

Global Risks – China Slowdown, Brexit,

I had a 20.50 Long put to protect stock ownership the currently trades at $21.90

The stock is up $1.40

Paid 20.50 Long puts $0.47 and NOW I shorted $22 puts for $1.04

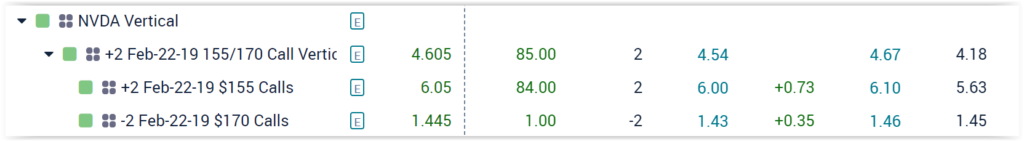

I put in today a short term Bull Call for earnings this afternoon on NVDA

BTO Feb-22-19 $155 Long call for $5.63

STO Feb-22-19 $170 Short Call for $1.45 Credit

Ned Debit for the trade = 5.63 – 1.45 = $4.18 Net net $840 for the two contracts

Max Reward = Diff in strikes $15 – 4.18 = 11.88

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com