NEXT WEEK WE WILL DO THE COMMENTARY ON TUESDAY = Monday is Marttin Luther King Day

What I want to talk about today?

S.M.A.R.T. GOALS – A must read

As a Registered Investment Adviser I’ve heard two questions over and over again!

What do you think the market will do in 2026? – What are your goals for 2026?

LET’S TALK ABOUT GOALS !!!

Both questions are intertwined and here is my “two cents”. I believe more people will lose money in 2026 as they set unrealistic goals to make an unrealistic return trying to catch up to the last three years’ S&P 500 returns. Ego loses people money just as easily as fear and greed. There are no guarantees in the market. You don’t go broke by taking profits! You don’t go broke by collar trading! I would hate to see anyone in the market think they know more than the market does and try to outguess the market. It just doesn’t make any sense at all to put on risky trades to make back what you’ve lost in a week, month or last year? Let me introduce you to the idea behind being S.M.A.R.T. in your goal setting.

- S – Simple, Specific, Schedule – Keep it simple stupid just like old acronym says – KISS. Set a simple return just like you set your primary exits in your trade. Decide on a specific amount (I will talk about this later) and write it down. Schedule it in your planner! Remember your schedule is to make that return over a year’s period not in the month of Jan or in the first half of the year. Make sure you see your goal on a daily basis as you check you schedule on a daily basis.

- M – Measurable – Most people set what is called a “pinpoint” goal. We might decide that we want to make a simple market average return of 7% in a 1 year period. What happens in real life? We hit the goal and then we Quit or Stop trying as hard. Set a range goal. Maybe you always want a minimum return of 7%ish so set your goal to be between 7% to 20%. On the bullish years 7% is easy so I set a goal so If you do make it you still have something to shoot for.

- A – Attainable – Make a plan to how you will attain your goals. Start this step by asking yourself what or who do you want to become? ie… a better trader, a time trade, a stay at home dad, a millionaire. Too may people at the start of every year write down a wish list not a goal. I wish at the end of the year I can make this amount of money or lose this amount of weight. How will you do it and what will you do to get there? How much of your portfolio will be safe in collar trades? How much will be pure option strategies? How much will you use for vegas trades? Will you use margin to reach your goals? Figure out the details to how you will get to where you want to be at. Start with the end of the year goal on Dec 31st and walk yourself backwards.

- R – Realistic, Relevant – I always want to make a 50% return or more. Some years like this past year I wasn’t quite close to being at that goal. What happens in real life? We are nowhere close to our goal and we quit. We give up on the whole thing because we will never hit the goal. Step by step progression in trading is fine and make sure your goals remain relevant throughout the whole year. Don’t forget goals can be adjusted like a trade that may go south. S&P Ave 7.74

- T – Time – Set the time period that you want to accomplish your goals. Set short term, intermediate, long term, and life long goals you want to reach and hold your self accountable. Let others know the time period you expect to reach your goals and get the support needed to get there. Whether it is between you and your spouse, your kids, your parents, your education programor maybe the good Lord himself, find support during the tough times. I promise you they will come.

Conservative Trades (Perhaps 70% of your portfolio):

Cash or T-Bills –

Collar Trades –

Protective Puts (also known as Married Puts) –

Covered Calls with Long puts or DITM

Equities –

Medium Risk Trades (Perhaps 20% of your trades):

Bull Put –

Put Calendar –

Call Calendars –

Straddles / Strangles as a volatility play –

Put and / or Call Ratio Backspreads –

Winged Spreads –

Bull Calls (standard application) –

Bear Puts (standard application) –

Straddle / Strangle

Bear Calls –

High Risk Trades (Perhaps 10% or less)

Long Calls or Long Puts (as a non-hedged directional trade) –

Naked Short Put –

Naked Short Call – NEVER DO THIS UNLESS YOU ARE WILLING TO RISK AND LOSE EVERYTHING

Vegas Trades (Outside the box trades) –

New equity positions for 2026 that I am looking at – KEY, BA, BSX, F,

I still like my favorites – AAPL, GOOGL, META, DIS, NVDA,

BA, PLTR & UAA Are my wildcards

For smaller accounts following the SPY, QQQ, DIA, XLF, JEPI, O

So Let’s Talk about 2026?

Election Year = Mid Terms Nov3, 2026

Earnings

AAPL 01/29 AMC

BA 01/27 BMO

BIDU 02/18 est

DG 03/12 est

DIS 02/04 est

F 02/10 AMC

GE 01/22 BMO

GM 01/27 BMO

GOOGL 02/02 AMC

JPM 01/13 BMO

KEY 01/20 BMO

LMT 01/29 BMO

MA 01/29 BMO

META 01/28 est

MSTR 02/05 est

MU 03/18 est

NFLX 01/20 AMC

NVDA 02/05 AMC

O 02/23 est

PLTR 02/02 est

TXN 10/21 AMC

UAA 02/06 BMO

V 01/27 est

VZ 01/30 BMO

WMT 02/19 BMO

https://www.briefing.com/the-big-picture

The Big Picture

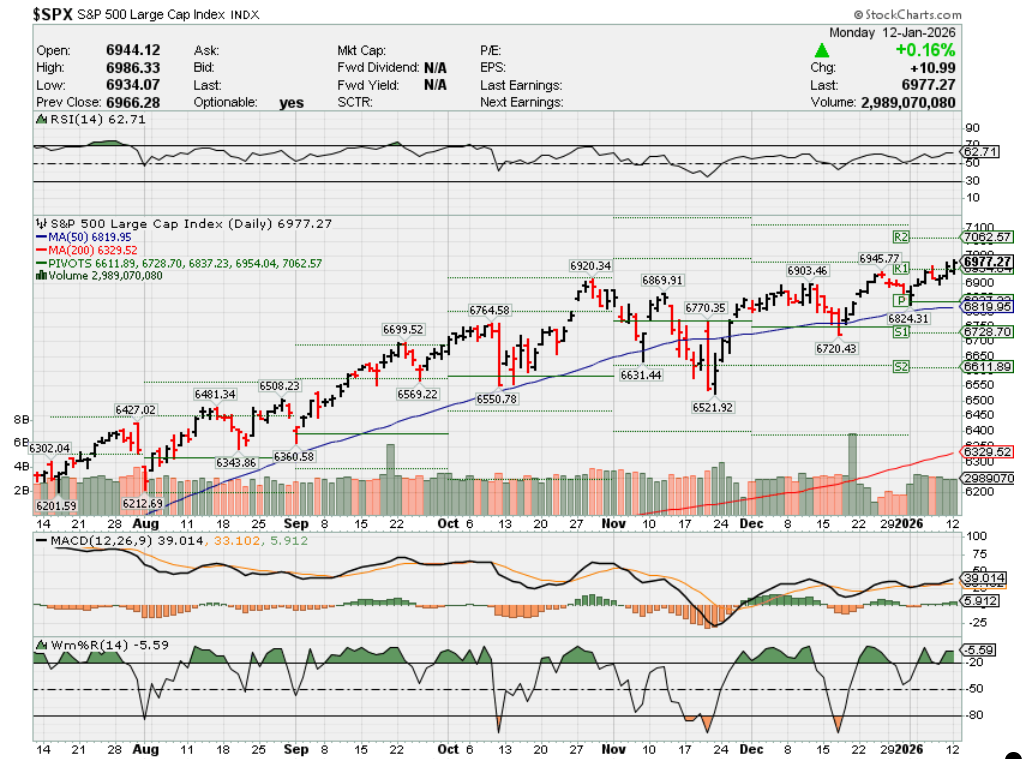

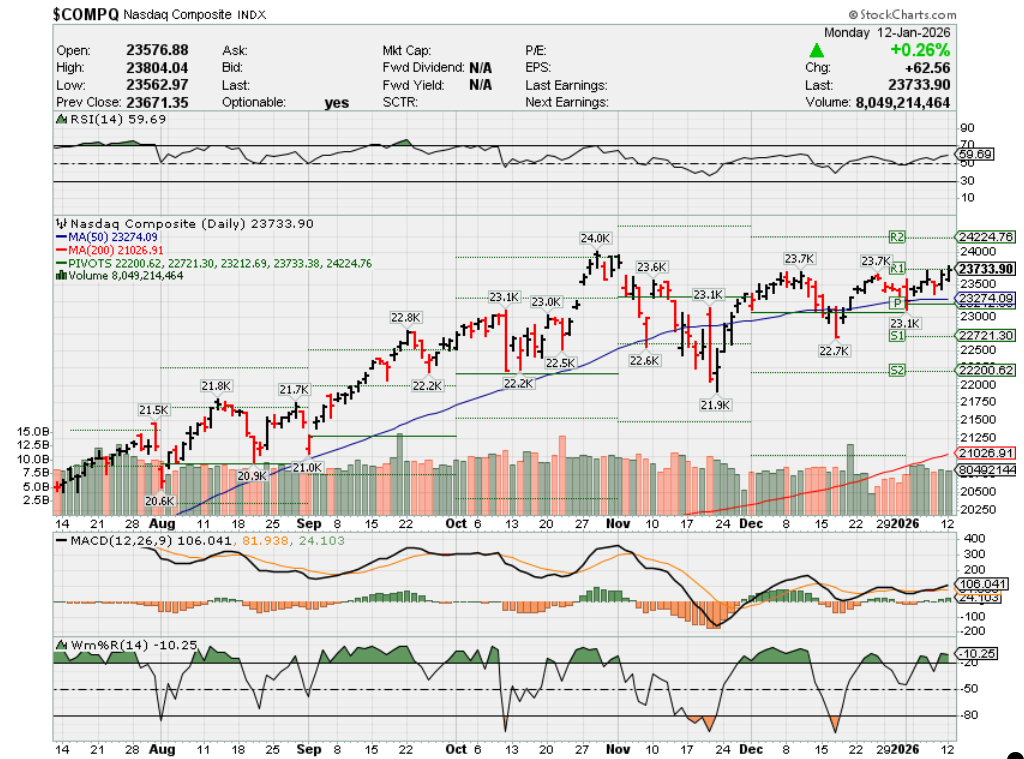

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end Jan 2026?

01-05-2025 +3.0%

01-12-2025 +3.0%

Earnings:

Mon:

Tues: BK, DAL, JPM

Wed: C, WFC, FUL, BAC,

Thur: FHN, GS, MS, BLK,

Fri: PNC

Econ Reports:

Mon:

Tue CPI, Core CPI, New Home Sales, Treasury Budget

Wed: MBA, Retail Sales, Retail Ex-Auto, PPI, Core PPI, Existing Home Sales, New Home Sales,

Thur: Initial Claims, Continuing Claims, Philadelphia Fed,

Fri: Industrial Production, Capacity Utilization, NAHB Housing Market Index

How am I looking to trade?

Time to let things continue to run

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

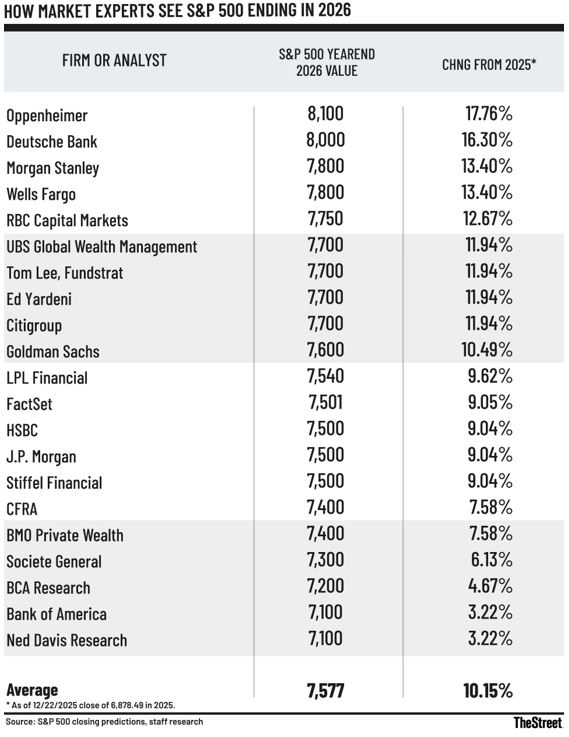

Advisors See Double-Digit Equity Gains in 2026 — With a Bumpy Ride

Most advisors expect stocks to grind higher but not without turbulence in 2026. According to the Fall 2025 InspereX Pulse Survey of 856 financial advisors, 60% believe the S&P 500 will be at least 10% higher by the end of 2026 versus its early November range of 6,720–6,851, while 18% see a 10% or greater decline and 22% expect flat returns. More than half (54%) say equities will be the top-performing asset class next year, well ahead of bonds/fixed income (12%) and alternatives (10%).

That optimism is tempered by expectations for choppier trading. Nearly half of advisors (48%) cite cryptocurrencies as the most volatile asset class in 2026, followed by equities (31%) and commodities (6%). An overwhelming 91% expect at least a 10% market drawdown at some point next year, including 34% who see a 15% drop and nearly 30% who anticipate a 20% or larger decline; only 9% do not foresee a major pullback. In response, 81% say they will probably or definitely add more protection strategies to client portfolios.

The Fed looms large in those plans. Two-thirds of advisors (66%) expect two to three rate cuts in 2026, while 21% see a single cut and just 3% foresee four or more; 8% expect no change and 2% anticipate at least one hike. To combat the drag from lower yields, 81% are preparing to, or already have, discussed adding more risk to client portfolios to meet return targets, with half aiming for 6–8% annual returns and more than a third targeting above 8%.

Advisors and their clients share a similar “wall of worry,” led by geopolitics, volatility, inflation, and recession risk. Yet three in four advisors say volatility creates opportunities to demonstrate value, and nearly as many say it deepens client engagement—critical at a time when average client anxiety scores have ticked up to 5.6 on a 10-point scale from 5.1 a year earlier.

“Advisors are cautiously optimistic about market returns in 2026, but expect a high degree of market volatility along the way, with some even bracing for a potential U.S. recession,” said Chris Mee, Managing Director of InspereX.

https://www.ccn.com/education/crypto/banks-silver-shorts-725m-truth-rumors-bitcoin-risk

8 Banks vs. The Silver Squeeze: As $50B Bailout Rumors Swirl, What Happens When Traders ‘Paper Short’ a Finite Asset Like Bitcoin?

Published December 30, 2025 1:44 PM

Edited by Ryan James

8 Banks vs. The Silver Squeeze: As $50B Bailout Rumors Swirl, What Happens When Traders ‘Paper Short’ a Finite Asset Like Bitcoin?

Share on

Key Takeaways

- Official CFTC reports show banks collectively net short about 212M oz in COMEX silver futures as of December 2, 2025, across 22 banks, not eight.

- Repo facility usage near $25–26B occurred during year-end liquidity pressures and is not evidence of emergency support tied to silver losses or bank distress.

- Large short positions often reflect hedging, market-making, and risk transfer, not bearish speculation or manipulation.

- In silver, stress emerges through delivery and inventory constraints; in Bitcoin, it appears through custody and redemption – different mechanics, same leverage dynamic.

In late December 2025, a dramatic narrative spread across social media and niche investment forums: eight major banks were supposedly under pressure from massive silver short positions, triggering repo facility drawdowns of over $50 billion to keep them afloat.

The rumor gained traction on X and Reddit, fueled in large part by posts from broadcaster Hal Turner, a figure previously flagged for promoting unverified claims.

The banks most frequently named in the viral threads were:

- JPMorgan Chase

- HSBC

- Scotiabank

- BNP Paribas

- UBS

- Deutsche Bank

- Citigroup

- Goldman Sachs

Some posts even added State Street to the list.

The core of the story was twofold: that these banks were excessively short silver, and that a coincident rise in repo facility usage signaled a secret bailout tied to those losses. That narrative holds dramatic appeal, especially when markets have been volatile, but the evidence tells a different story.

Where the Bank Collapse Rumor Started

The first wave of the viral claim can be traced to December 28 posts by Hal Turner, asserting a “systemically important bullion bank” had defaulted on a margin call and was rescued with heavy liquidity injections, with timing and identity concealed. These posts spread rapidly in online investing communities.

Shortly thereafter, an X account called @silvertrade amplified the claim, pointing to the Federal Reserve’s overnight repo facility usage, which hit about $25.95 billion over a weekend, framing it as “emergency liquidity” tied to silver losses.

What the posts did not provide, and what regulators and major news organizations have not confirmed, is any official filing, bank disclosure, or evidence tying those repo draws to specific bank losses or a silver shorts collapse.

Why Banks Are Short Silver — and Why That Isn’t Automatically a Scandal

Large short positions in commodity futures often sound alarming, especially during periods of sharp price moves. But in most cases, a bank being “short” silver does not mean it is betting against the metal. More often, it reflects how modern financial markets transfer and manage risk.

To understand why, it helps to look at several well-established theories and principles in finance.

1. Hedging Theory: Futures as Risk Transfer, Not Speculation

At the foundation is hedging theory, which explains why futures markets exist in the first place.

- A miner wants to lock in future selling prices.

- An industrial user wants to lock in future buying costs.

- A bank or dealer steps in as an intermediary, taking the opposite futures position and managing that exposure dynamically.

When a bank is short silver futures in this context, it is often offsetting price risk elsewhere on its balance sheet, not expressing a bearish view. This is the essence of risk transfer, where price risk moves from those who don’t want it (producers and users) to those equipped to manage it (dealers and speculators).

This structure underpins the CFTC’s Commitment of Traders (COT) and Bank Participation Report (BPR) classifications, which separate hedging activity from purely speculative positioning.

2. Market-Making Theory: Inventory Risk and Client Flow

Banks that act as market makers absorb client orders on both sides of the market.

If clients are collectively buying silver exposure:

- The dealer may temporarily become short futures

- That short is hedged through other derivatives, physical inventory, or time-based adjustments

This behavior aligns with inventory risk models in market microstructure theory. Dealers manage inventories dynamically to keep markets liquid, even if it leaves them with positions that look lopsided in static snapshots.

In this framework, a large short position reflects liquidity provision, not distress.

3. Keynes–Hicks Theory of Normal Backwardation

John Maynard Keynes’ theory of normal backwardation offers another explanation.

Producers often hedge by selling futures to lock in prices, which can create persistent short pressure in futures markets. To entice buyers to take the other side, futures may trade at a discount to expected future spot prices, a phenomenon known as risk premium compensation.

Banks and speculators who take the opposite side are compensated for bearing that risk. Over time, this naturally results in commercial entities holding large short positions without implying manipulation or imbalance.

4. Gross vs. Net Exposure: A Common Misunderstanding

One reason bank shorts look alarming is confusion between gross and net exposure.

- Gross shorts: the total number of short contracts held

- Net shorts: shorts minus longs and other offsets

Banks often carry large gross positions on both sides of the market, with relatively modest net exposure after hedging. This is consistent with portfolio theory, which emphasizes managing overall risk rather than eliminating individual positions.

Snapshots that highlight only gross shorts can misrepresent a bank’s actual risk.

5. Why Hedging Can Still Create Stress

None of this means hedging eliminates risk.

Financial stress emerges through leverage and margin mechanics, not intent.

- Futures are leveraged instruments.

- Rising prices increase margin requirements.

- Sudden volatility can force rapid position adjustments, even for hedged players.

This aligns with Minsky’s Financial Instability Hypothesis, which argues that stability breeds leverage, and leverage amplifies shocks when conditions change.

6. Liquidity vs. Solvency: Where Tension Actually Appears

Most market stress episodes are about liquidity, not solvency.

A bank can be economically hedged but still face:

- Short-term funding needs

- Higher collateral requirements

- Temporary mismatches in cash flows

This distinction comes from classic liquidity preference theory and is why tools like repo facilities exist: to smooth funding shocks without implying insolvency.

In other words, banks don’t need to be “wrong” or reckless to experience pressure, they just need markets to move faster than their hedges can adjust.

They become controversial only when viewed outside that context.

The real question is not why banks are short, but how leverage, liquidity, and delivery constraints interact during periods of extreme volatility. That’s where genuine stress can emerge, even in a market functioning exactly as designed.

Repo Rumors vs. Reality: Liquidity Operations and Silver’s Fundamental Rally

Repo Usage: Not Evidence of a Silver Bailout

The Federal Reserve’s Standing Repo Facility is designed to provide short-term liquidity to banks and financial institutions. It regularly sees elevated usage around quarter- and year-ends due to seasonal and regulatory balance-sheet pressures. A usage figure of $25–26 billion is historically high, but not unprecedented in the context of routine liquidity management.

Importantly, the Fed is not obliged (and routinely does not) disclose which banks access the facility. There is therefore no public confirmation that any specific bank tapped the repo window due to silver-related losses.

Silver Price Action & Fundamentals

Silver has been among the standout performers in 2025, with prices climbing sharply from around $29–30/oz at the start of the year to brief highs above $80/oz before easing back.

This strong move has been attributed by analysts to a combination of robust industrial demand (including solar, EVs, and electronics), ongoing supply deficits, ETF inflows, and tightness in physical markets, not to collapsing bullion banks.

Mainstream coverage attributes these gains to real market dynamics rather than derivatives stress: analysts note structural supply-demand imbalances, export curbs, and central bank and investor buying.

Rumored Silver Shorts vs. What’s Reported

The viral discourse often claims that the eight listed banks are collectively short 725 million ounces of silver, nearly equal to the annual global mine production, typically cited near 820–830 million ounces.

However, no public regulator report (like the CFTC Bank Participation Report) names banks as holders of such positions. Public positioning data is provided only in aggregate, and while banks and dealers do hold significant futures exposure in silver markets, the exact positions of specific institutions, especially in over-the-counter (OTC) venues, aren’t published by name.

In other words, the 725 million-oz number is not traceable to an official dataset but is a social-media or forum aggregation that cannot be verified publicly.

Public Data About “Bank Shorts”

The cleanest official window into banks’ silver positioning comes from the CFTC’s monthly Bank Participation Report (BPR). The report has one crucial limitation: it is aggregate. It does not identify individual banks by name.

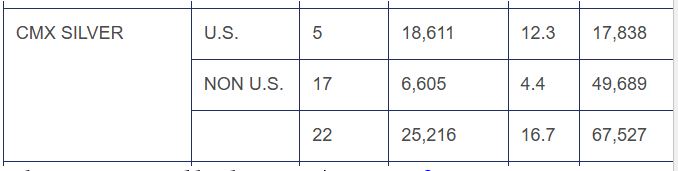

In the December 2, 2025 BPR (futures, “in contract”), the line for COMEX Silver (CMX) shows:

- U.S. banks: 5

- Non-U.S. banks: 17

- Total banks reporting: 22

Collectively, these banks held:

- 25,216 long silver futures contracts

- 67,527 short silver futures contracts

Each COMEX silver futures contract represents 5,000 troy ounces, which translates to:

- Gross short: 67,527 × 5,000 = 337.6 million ounces

- Gross long: 25,216 × 5,000 = 126.1 million ounces

- Net short (futures only): (67,527 − 25,216) × 5,000 = 211.6 million ounces

Silver shorts as reported by the CFTC. | Source: cftc.gov

So, the official “banks” number in COMEX futures (net) is 212M oz on that date, not “8 banks net short 725M oz.

This is the key takeaway: The official, bank-only snapshot from the CFTC is not “eight banks short 725 million ounces.” It is 22 banks net short roughly 212 million ounces in COMEX silver futures on that reporting date — before accounting for options, OTC hedges, physical inventories, or offsetting exposures.

That distinction matters.

It doesn’t mean “nothing to see here.” It means the 725M-ounce / 8-bank claim is not supported by named, public CFTC data. Anyone asserting that figure is likely doing one or more of the following:

- Using a different category (e.g., broader “commercials,” not banks alone)

- Combining multiple venues (COMEX plus OTC/London estimates)

- Mixing gross and net exposure in ways that are difficult to verify independently

<150M oz COMEX Registered’ Claim: This Part Is Real

On the physical side, the COMEX warehouse system publishes daily inventory data. As of December 29, 2025, CME data shows registered silver at approximately 127.6 million ounces, with additional metal classified as “eligible.”

Two definitions are critical:

- Registered silver: Metal that is warranted and available to meet futures delivery requirements.

- Eligible silver: Metal that meets exchange specifications but is not currently registered for delivery (it can be registered later at the owner’s discretion).

Popular “silver squeeze” narratives often compare paper short exposure to registered inventory. That comparison can be directionally informative, but it is incomplete. Eligible inventory exists, and the vast majority of futures contracts are closed or rolled, not settled via physical delivery.

What Is “Paper Shorting” in Commodities and Bitcoin Markets

The reason these stories resonate is because of a broader concept: the difference between physical supply and paper exposure.

In Commodities (Silver)

- In futures markets, traders “short” a contract when they believe prices will fall. A short position doesn’t necessarily mean someone owns that metal and sells it; it often reflects derivative exposure that can be offset before delivery.

- The notional amount of contracts can appear large relative to available physical stocks, even if actual deliverable metal is much smaller.

- This is a feature of how derivatives markets work (liquidity provision, hedging, and speculation), not prima facie evidence of insolvency or a systemic failure.

In Bitcoin

- Bitcoin’s total supply is capped at 21 million coins by protocol design, an unalterable rule enforced by the network’s consensus mechanism. This finite supply is often invoked in comparisons with “paper assets.”

- But like commodities, Bitcoin also has a large derivatives market: futures, options, perpetual swap contracts, and other structured products allow traders to take long or short exposure without delivering or transferring actual coins.

- The finance principle at play here is leverage and settlement risk: when a market’s paper exposures grow large relative to physical or deliverable supply, and if prices move sharply, margin calls and forced liquidations can create cascading moves. This isn’t unique to crypto or precious metals, it’s a core idea in market microstructure.

- Unlike a direct commodity delivery squeeze, the stress point in Bitcoin markets tends to occur around custody and redemption risk: whether a trading platform can honor withdrawals and transfer coins on-chain when users demand them.

Rumors vs. Reality: Lessons for Markets

The silver saga of late December 2025 illustrates how quickly narrative can outpace verifiable data:

- Repo facility usage — significant, but a known tool of liquidity management, not proof of a metal-induced bailout.

- Rumored bank shorts — widely shared online, but not backed by named regulatory filings or confirmed disclosure.

- Silver price drivers — consistent with macroeconomic, industrial, and supply-demand factors reported by established financial outlets.

- Bitcoin and finite assets — demonstrate that even truly capped supplies can be exposed to “paper” leverage via derivatives, with stress manifesting through different mechanisms.

In both silver and Bitcoin markets, leverage, margin requirements, and liquidity mechanics matter far more than catchy rumors.

Markets frequently experience volatility and speculative narratives, but extraordinary claims about collapses or secret bailouts require extraordinary evidence, which remains absent in this case.

FAQs

There is no public regulatory report confirming that eight named banks hold net short positions totaling 725 million ounces. That figure originates from social media aggregation, not official disclosures. The CFTC’s Bank Participation Report only provides aggregate data, showing 22 banks net short about 212 million ounces in COMEX silver futures at the time.

https://www.cnbc.com/2026/01/12/apple-google-ai-siri-gemini.html

Apple picks Google’s Gemini to run AI-powered Siri coming this year

Published Mon, Jan 12 202610:19 AM EST

Updated 4 Min Ago

In this article

Follow your favorite stocks

Apple is joining forces with Google to power its artificial intelligence features for products such as Siri later this year.

The multi-year partnership will lean on Google’s Gemini models and cloud technology for for future Apple foundational models, according to a statement obtained by CNBC’s Jim Cramer

“After careful evaluation, we determined that Google’s technology provides the most capable foundation for Apple Foundation Models and we’re excited about the innovation.

https://www.cnbc.com/2026/01/12/alphabet-4-trillion-market-cap.html

Alphabet hits $4 trillion market capitalization

Published Mon, Jan 12 202610:30 AM EST

Jennifer Elias@in/jennifer-elias-845b1130/

Key Points

- Google parent company Alphabet has become the fourth member of the $4 trillion club

- Alphabet’s stock climbed to record highs after investment firms said they see more upside for Google in 2026.

- The company is well-positioned to capture revenue in its cloud unit thanks to rise in demand for AI products, analysts say.

Google parent company Alphabet has become the fourth member of the $4 trillion club.

Alphabet shares popped about 1% Monday, after Apple said it had picked Google’s Gemini to be the foundation for its artificial intelligence models and the next generation of Siri.

The search company joins Nvidia, Microsoft and Apple as the few companies that have crossed the $4 trillion mark.

Both Nvidia and Microsoft topped the $4 trillion milestone for the first time in July, while Apple crossed the threshold for the first time in October. Since then, however, Apple and Microsoft have dropped well below the $4 trillion line.

Alphabet’s entry into the elite club comes after the company ended 2025 as one of the top performers on Wall Street. Its shares jumped 65% in 2025, Alphabet’s sharpest rally since 2009, when the stock doubled coming out of the financial crisis.

The search company has been on the rise after putting together the pieces for its AI comeback and overcoming key regulatory hurdles last year. In November, the company unveiled Ironwood, the seventh generation of its tensor processing units, a custom AI chip that has emerged as a potential alternative to Nvidia’s offerings. Then in December, Google introduced Gemini 3 to rave reviews.

Despite OpenAI’s ChatGPT and Sora services capturing an increasing amount of consumer engagement and concerns swirling around the future of online advertising in a world of AI chatbots and agents, Alphabet has managed to ward off fears that its most innovative days are in the past.

In a Jan. 8 note, analyst Deepak Mathivanan upgraded Alphabet’s stock.

“We believe the technological advantages of the Gemini assistant app — powered by Google’s ‘grounding’ assets — vs. ChatGPT (powered by Bing and partner integrations) are underappreciated,” Mathivanan wrote. Google “arguably, has the strongest footprint across several layers in the AI tech stack, and the company’s decade-long investments have enabled deep competitive moats.”

Citi analysts named Google a top internet pick for its 2026 outlook in a recent note. Analysts said 70% of Google Cloud customers use its AI products, adding “Google has the chip, the infrastructure capacity, and the model amid growing demand.”

Citi says Palantir’s rally isn’t over, upgrades stock on accelerating enterprise and government demand

Published Mon, Jan 12 20268:33 AM EST

In this article

Citi believes that accelerating enterprise artificial intelligence adoption and government spending could drive further gains for Palantir, even after the stock’s sharp run.

The bank upgraded the software analytics provider to a buy rating from neutral. Analyst Tyler Radke also raised his price target to $235 from $210.

Shares of Palantir have surged 164% over the last 12 months. Radke’s revised price forecast implies an additional upside of 32% from here.

The analyst noted that Palantir has minted spectacular returns in the last few years, citing “vicious growth acceleration and equally impressive margin expansion” as drivers. However, Palantir’s impressive rally seems to have plateaued in the last few months.

“Despite our 2025/26 revenue numbers moving up 10%+ since mid-year, the stock is ~flat,” Radke wrote.

“Our upgrade is premised on our view that 2026 is poised to be another year of significant positive estimate revisions, with recent CIO + industry conversations suggesting AI budget and use cases are accelerating in the enterprise,” the analyst added. “We also see significant tailwinds in the Government driven by accelerating defense budgets and modernization urgency.”

Radke said there could be an upside case for Palantir’s total revenue growth to reach between 70% to 80% in 2026.

An increased government defense budget also paints a strong upside case, Radke noted, with his government growth estimates for 2026 at 51% year over year. Besides a ramping defense super cycle, other possible tailwinds include lasting ramifications from the 2025 government shutdown and the modernization of U.S. allies. The analyst added that he will be closely watching the Golden Dome missile defense project and other major defense initiative announcements as potential catalysts for Palantir.