FOMC Meeting this Wednesday !!!! Probably a non-issue unless Powell gets pissed off at Trump and says something like no more cuts until he is out of office.

DHS funding issue due to ICE shootings has the potential to cause a government shutdown this week.

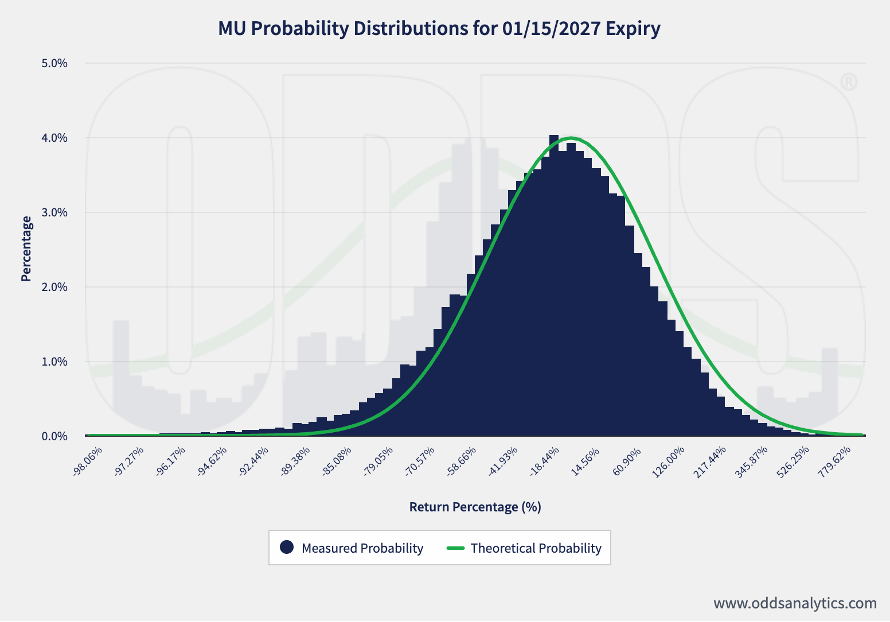

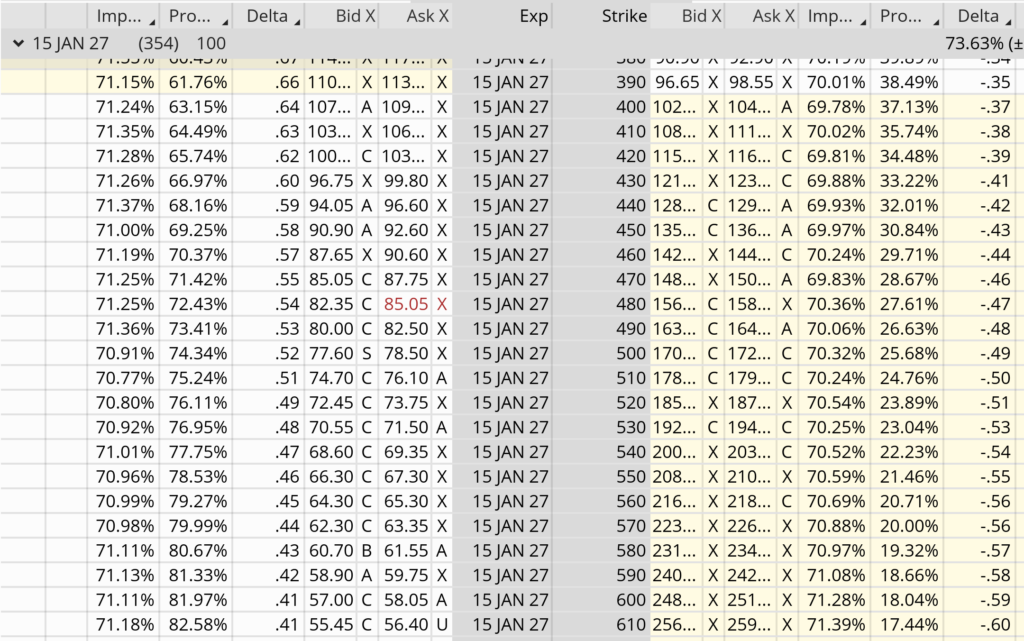

Let me explain in a bit more detail what Kevin didn’t explain last week on how options pricing works!!!

Chart provided by ThinkOrSwim.

Implied Volatility is a measure of the expectations of future volatility based on the current price of an option. This is the markets best guess at future volatility.

Chart provided by ODDSAnalytics.

Chain provided by ThinkOrSwim.

Earnings

AAPL 01/29 AMC

BA 01/27 BMO

BIDU 02/18 est

DG 03/12 est

DIS 02/02 BMO

F 02/10 AMC

GM 01/27 BMO

GOOGL 02/02 AMC

LMT 01/29 BMO

MA 01/29 BMO

META 01/28 AMC

MSTR 02/05 AMC

MU 03/18 est

NVDA 02/05 AMC

O 02/23 est

PLTR 02/02 AMC

UAA 02/06 BMO

V 01/29 AMC

VZ 01/30 BMO

WMT 02/19 BMO

The Big Picture

Last Updated: 23-Jan-26 15:03 ET | Archive

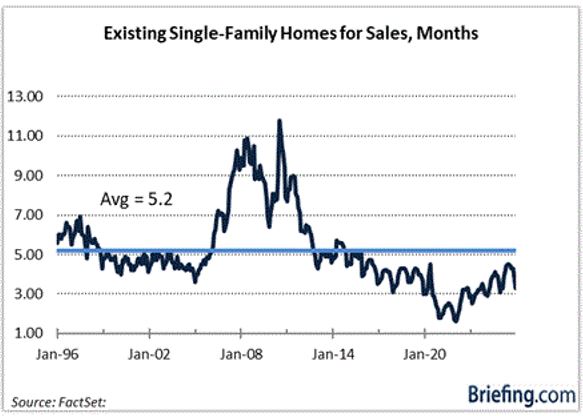

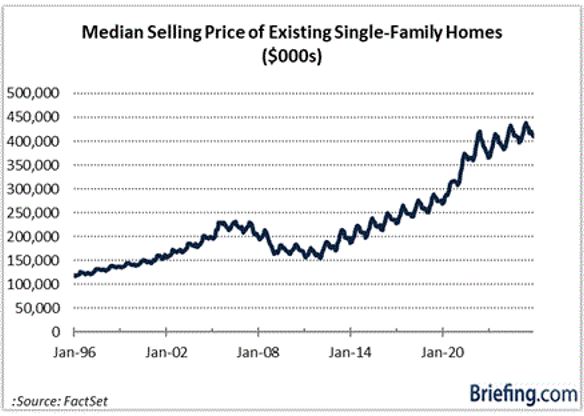

Housing market has a pesky supply-side problem

Briefing.com Summary:

*Housing affordability hinges more on increased existing-home supply than lower mortgage rates, given pent-up demand and limited inventory.

*Existing-home inventory remains well below balanced and long-term averages, keeping prices elevated despite modest recent supply improvements.

*Lower mortgage rates may boost activity, but without more supply they risk fueling demand and sustaining high home prices.

You know what would help existing home sales? Lower mortgage rates. You know what would help even more? An increased supply of existing homes for sale.

More supply will do more to ease affordability constraints than lower mortgage rates. The reason being is that there is pent-up demand, so if mortgage rates go down and unleash some of that demand, selling prices will remain elevated and bidding wars will ensue if there isn’t a larger supply of existing homes for sale.

A Fundamental Problem

The supply situation for existing homes right now isn’t good–at least not for buyers. A 4-6 months’ supply is typically associated with a more balanced market. Unsold inventory in December, however, stood at a 3.3-month supply, down from 4.2 months in November.

That is basically double the record-low 1.6-month supply seen in January 2022, yet it remains well below the 30-year average of 5.2 months.

The interesting anecdote to the improved supply situation is that there hasn’t been any real price relief. The median price for a single-family home has risen for 30 consecutive months. Granted, the 0.2% year-over-year increase in December was the smallest over than span, but until more homes hit the market, prices are going to remain elevated.

Lower mortgage rates alone, then, won’t be the elixir for the housing market many hope they will be since an even bigger fundamental problem is the lack of available supply. There just isn’t enough supply on the market.

Sure, regulations can be relaxed and new homes can be built, but the fact of the matter is that new home sales account for approximately 15% of total home sales, which is to say the housing market rises and falls on the state of the existing home market.

At this juncture, lower mortgage rates would do more to help new home sales than existing home sales, because there is more supply. The most recent new home sales report revealed that there was a 7.9-months supply at the October sales pace.

Briefing.com Analyst Insight

It is well known that many homeowners are enjoying low single-digit mortgage rates (i.e., under 5.00%), and that most of those homewoners don’t want to relinquish that low cost of financing for a higher-rate mortgage. Most won’t either, unless compelled by a life event such as a job loss, a divorce, or a necessary transition to an assisted living situation.

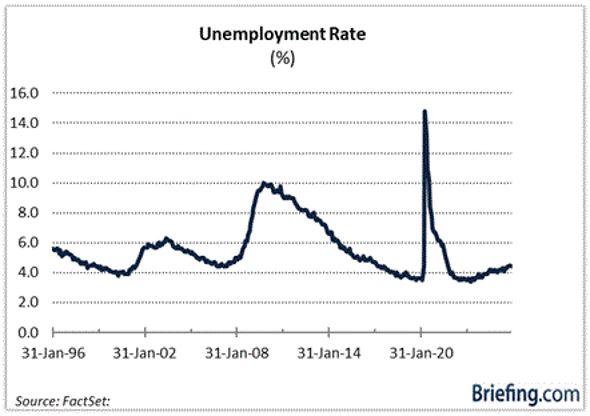

The labor market, ironically, may just be the biggest impediment to more supply coming on the market. A 4.4% unemployment rate isn’t high historically speaking, so rising unemployment isn’t expediting the arrival of new supply, not that we want it to.

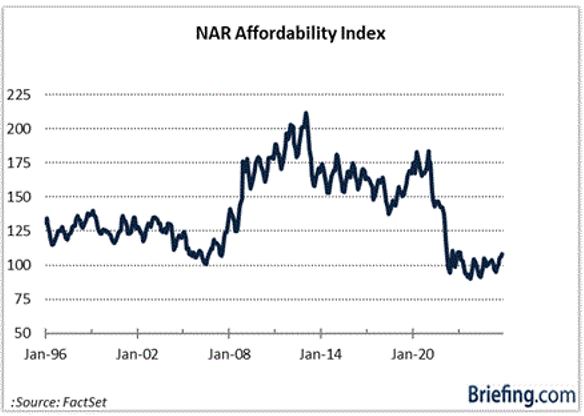

As mortgage rates come down, there will be more sales activity in the housing market, but if the affordability constraint is going to be relaxed more fully, it is going to take a lot more supply coming online; otherwise, low mortgage rates alone will simply spur more demand… and higher prices that make affordability a lingering problem for prospective buyers.

(Note: An index above 100 means a family earning the median income has enough income to qualify for a mortgage loan on a median priced home with a 20% down payment.)

—Patrick J. O’Hare, Briefing.com

Where Will the SPX end Jan 2026?

01-20-2026 +1.0%

01-12-2025 +3.0%

01-05-2025 +3.0%

SPX started January at 6878.11 closed today at 6950.23 up 1.04%

Note most of our accounts are doing much better than that.

| Monday, January 26th | |

| 8:30 AM | Durable Goods Orders |

| 8:30 AM | Chicago Fed National Activity Index |

| 10:30AM | Dallas Fed Manufacturing Survey |

| Tuesday, January 27th | |

| 9:00 AM | Case-Shiller Home Price Index |

| 9:00 AM | FHFA House Price Index |

| 10:00AM | Consumer Confidence |

| 10:00AM | New Home Sales |

| 10:00AM | Richmond Fed Manufacturing Index |

| Wednesday, January 28th | |

| 7:00 AM | MBA Mortgage Applications |

| 8:30 AM | (delayed) Durable Goods Orders |

| 8:30 AM | (delayed) International Trade in Goods (advance) |

| 8:30 AM | (delayed) Retail Inventories (advance) |

| 8:30 AM | (delayed) Wholesale Inventories (advance) |

| 10:30AM | EIA Petroleum Status Report |

| 2:00 PM | FOMC Announcement |

| 2:30 PM | Fed Chair Press Conference |

| Thursday, January 29th | |

| 8:30 AM | (delayed) Internation Trade in Goods and Services |

| 8:30 AM | Jobless Claims |

| 8:30 AM | (delayed) Productivity and Costs |

| 10:00AM | (delayed) Factory Orders |

| 10:30AM | EIA Natural Gas Report |

| 4:30 PM | Fed Balance Sheet |

| Friday, January 30th | |

| 8:30 AM | PPI Final Demand |

| 9:45 AM | Chicago PMI |

| 1:30 PM | Alberto Musalem Speaks |

| 3:00 PM | Farm Prices |