HI Market View Commentary 12-08-2025

What a great return for Nov 0.13 YCharts and we seem to keep rolling for Dec 2025

Window Dressing = Funds and Money Managers putting positions into portfolios to ACT as IF they’ve been there all year

The Process gives us the opportunity to have the 30%+ gain in any given year.

YES we are exiting MU for most over a two year period of time with a 500% real return

BAC looking to get called away at $52.50 with a $1.01 of credit = Big banks seem to be going down right after rate cuts

KEY – Keycorp regional banks usually do much better with rate cuts

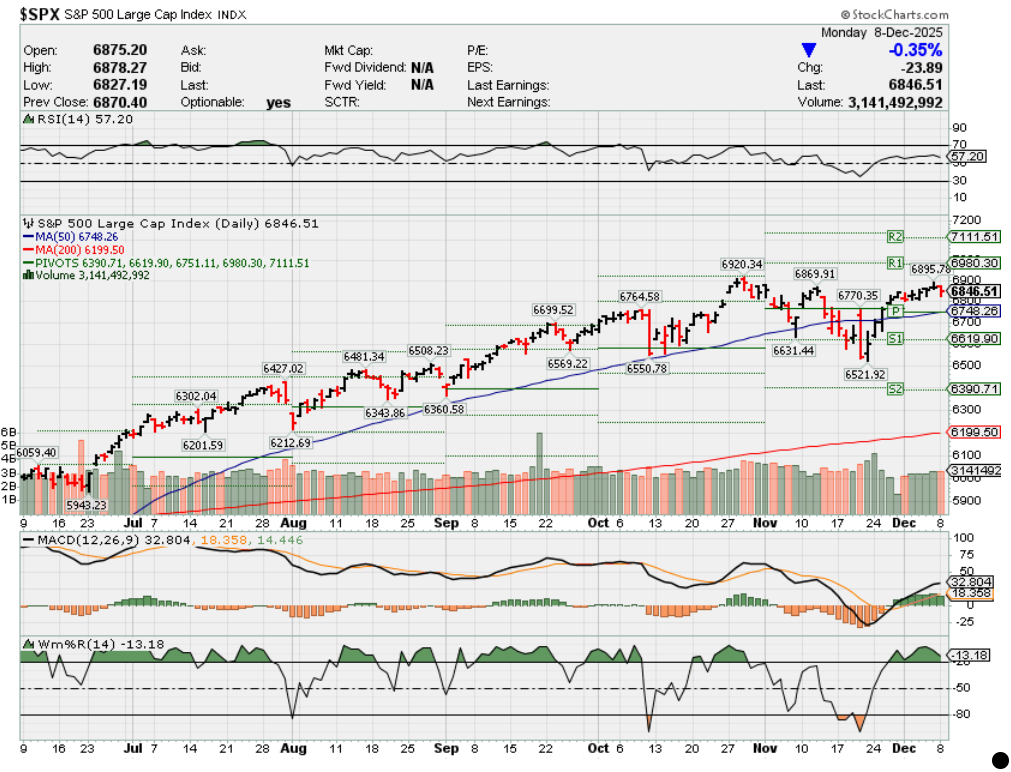

S&P 5000 was -0.35% yet most accounts were slightly positive up to +0.35%

Flat day tomorrow and the market will react to FOMC rate decision = -0.25% cut

META back up 15%, NVDA now allowed to sell the 200 series Blackwell Chip into China

Trump ban on wind power projects overturned by a federal judge = Lookup on YouTube the landman wind power

Earnings

MU 12/17 AMC

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 05-Dec-25 14:52 ET | Archive

Meet the 2026 FOMC

Briefing.com Summary:

*Several voting Fed bank presidents lean hawkish, creating a challenging rate-cut backdrop for the FOMC early in 2026.

*Potential turnover among Fed governors as 2026 unfolds is apt to lead to a more dovish-minded class of governors.

*Jerome Powell’s time as Fed chair is running out, and so may his time as Fed governor.

There are twelve voting members on the Federal Open Market Committee (FOMC): the seven members of the Board of Governors and five of the twelve Federal Reserve Bank presidents. The members of the Board of Governors are nominated by the President of the United States and are confirmed by the Senate.

The president of the Federal Reserve Bank of New York has a permanent vote on the committee, so the remaining four presidents with a vote rotate annually. They serve one-year terms beginning January 1 each year.

Other Federal Reserve bank presidents attend the FOMC meetings and contribute to the discussions, but they do not cast a vote for setting policy.

From the sound of things, the 2026 FOMC meetings will be ripe for dueling over the proper policy path—and that’s before a new Fed sheriff rides into town in the latter half of the year, who will undoubtedly be a rate-cut gunslinger.

Operating on Borrowed Time

Whose names will you be hearing a lot throughout 2026? The seven governors currently are Jerome Powell (Chairman), Michael Barr, Michelle Bowman, Lisa Cook, Philip Jefferson, Stephen Miran, and Christopher Waller.

Mr. Powell’s term as Chair of the Board of Governors ends in May 2026. His term as Fed governor, however, extends to January 31, 2028. He has not said if he will step down from the board when he is replaced as Fed chair by President Trump’s nominee, but pundits expect him to resign his governor position when his term as Fed chair ends.

President Trump has made it abundantly clear that Fed chair Powell is operating on borrowed time, saying he will name the replacement for the Fed chair’s position in early 2026. Press reports are buzzing with speculation that NEC Director Kevin Hassett, an advocate for a much lower policy rate, is going to get the president’s nod to be Chairman of the Board of Governors.

Fed governors typically vote in unison with the Fed chair. Fed Governor Bowman, however, shocked the world with a dissenting vote at the September 2024 FOMC meeting, preferring a smaller 25-basis-point rate cut. That was the first dissent by a Fed governor since 2005.

Fed Governor Miran, who took an unpaid leave of absence from his position as chairman of the Council of Economic Advisers under President Trump to fill the seat vacated by the resignation of Adriana Kugler, whose term expires January 31, 2026, dissented in favor of larger 50-basis-point cuts at the September and October FOMC meetings.

If there is going to be dissension in the ranks, it usually originates among the voting Federal Reserve bank presidents, but it is clear now that some governors are fine challenging the party line.

In terms of the bank president names you’ll want to be closely acquainted with in 2026, they are Beth Hammack (Cleveland), Neel Kashkari (Minneapolis), Lorie Logan (Dallas), Anna Paulson (Philadelphia), and John Williams (New York).

The Lineup

Each FOMC member acknowledges that they are data dependent for their policy view, yet the market makes a living out of reading between their speech lines when thinking about what the FOMC will do with monetary policy.

Below we feature excerpts from recent speeches/interviews from the FOMC presidents who hold a vote in 2026 to provide some flavor for their perceived policy tilt.

Beth Hammack

- November 20, 2025: Opening Remarks to 2025 Financial Stability Conference

- Inflation has been running above the Fed’s 2 percent objective for four and a half years. Lowering interest rates to support the labor market risks prolonging this period of elevated inflation, and it could also encourage risk-taking in financial markets. Financial conditions are quite accommodative today, reflecting recent gains in equity prices and easy credit conditions. Easing policy in this environment could support risky lending. It could also further boost valuations and delay discovery of weak lending practices in credit markets. This means that whenever the next downturn comes, it could be larger than it otherwise would have been, with a larger impact on the economy. At that point, policy would have less space to further reduce rates and offset weak demand.

Sometimes cutting rates is described in risk-management terms as taking out insurance against a more severe slowdown in the labor market. But we should be mindful that such insurance could come at the cost of heightened financial stability risks. There’s already a substantial body of research on how persistent inflation can increase risks for banks and put pressure on household finances. The challenging period we’re currently experiencing for monetary policy could well be the subject of future research on the financial stability implications of having both sides of the Fed’s mandate under pressure. - Note: In a CNBC interview later that day, Ms. Hammack said inflation is still high and trending in the wrong direction, and that she still believes policy needs to be “somewhat restrictive.”

- Tilt: Hawkish

- Inflation has been running above the Fed’s 2 percent objective for four and a half years. Lowering interest rates to support the labor market risks prolonging this period of elevated inflation, and it could also encourage risk-taking in financial markets. Financial conditions are quite accommodative today, reflecting recent gains in equity prices and easy credit conditions. Easing policy in this environment could support risky lending. It could also further boost valuations and delay discovery of weak lending practices in credit markets. This means that whenever the next downturn comes, it could be larger than it otherwise would have been, with a larger impact on the economy. At that point, policy would have less space to further reduce rates and offset weak demand.

Neel Kashkari

- November 13, 2025: Interview with Bloomberg News

- “The anecdotal evidence and the data we got just implied to me underlying resilience in economic activity, more than I had expected.” Available data have suggested “more of the same” for the economy, Kashkari said.

For the upcoming Dec. 9-10 rate decision, “I can make a case depending on how the data goes to cut, I can make a case to hold, and we’ll have to see.” - Note: Mr. Kashkari indicated that he did not support the Fed’s last rate cut in October.

- Tilt: Neutral

- “The anecdotal evidence and the data we got just implied to me underlying resilience in economic activity, more than I had expected.” Available data have suggested “more of the same” for the economy, Kashkari said.

Lorie Logan

- November 21, 2025: Opening remarks for panel titled ‘Economic uncertainty and the design and conduct of monetary policy’

- The FOMC has made two 25-basis-point rate cuts in recent months. While I supported the September rate cut, I would have preferred to hold rates steady at our October meeting…

Policy restriction is a function of real interest rates, not nominal ones. Forecasters expect about 2.7 percent inflation over the coming year. That puts the current real fed funds rate around 1.2 percent, which is toward the low end of typical model-based estimates of neutral, although all of these estimates are highly uncertain. Put another way, with inflation running persistently above target, a fed funds rate close to 4 percent isn’t nearly as restrictive as you might have thought.

Policy also has to account for headwinds and tailwinds hitting the economy. Elevated asset valuations and compressed credit spreads aren’t just indications that policy most likely isn’t very restrictive. They’re also indications that the fed funds rate needs to offset tailwinds from financial conditions.

Putting it together, even in September I was not certain we had room to cut rates more than once or twice and still maintain a restrictive stance. And having made two cuts, I’m not certain we have room for more. Monetary policy works with a lag. It’s too soon to directly assess the degree of restriction from the current stance of policy, with two rate cuts already on board. In the absence of clear evidence that justifies further easing, holding rates steady for a time would allow the FOMC to better assess the degree of restriction from current policy. Taking the time to learn more can help us avoid unnecessary reversals that might generate unwanted financial and economic volatility. - Tilt: Hawkish

- The FOMC has made two 25-basis-point rate cuts in recent months. While I supported the September rate cut, I would have preferred to hold rates steady at our October meeting…

Anna Paulson

- November 20, 2025: Economic Outlook

- So, with upside risks to inflation and downside risks to employment, monetary policy has to walk a fine line. In my judgement, the 25-basis-point rate cuts at the September and October meetings were appropriate and have helped to keep policy on that line. But each rate cut raises the bar for the next cut. And that’s because each rate cut brings us closer to the level where policy flips from restraining activity a bit to the place where it is providing a boost. So, I am approaching the December FOMC cautiously.

On the margin, I’m still a little more worried about the labor market than I am about inflation, but I expect to learn a lot between now and the next meeting. And, as I think about monetary policy over the longer arc, I’ll be focused on how to appropriately balance the risks to both inflation and the labor market, guided by my commitment to deliver on the FOMC’s price stability mandate and get inflation all the way back to 2 percent. - Tilt: Hawkish

- So, with upside risks to inflation and downside risks to employment, monetary policy has to walk a fine line. In my judgement, the 25-basis-point rate cuts at the September and October meetings were appropriate and have helped to keep policy on that line. But each rate cut raises the bar for the next cut. And that’s because each rate cut brings us closer to the level where policy flips from restraining activity a bit to the place where it is providing a boost. So, I am approaching the December FOMC cautiously.

John Williams

- November 21, 2025: Navigating Unpredictable Terrain

- I fully supported the FOMC’s decisions to reduce the target range for the federal funds rate by 25 basis points at each of its past two meetings.

Looking ahead, it is imperative to restore inflation to our 2 percent longer-run goal on a sustained basis. It is equally important to do so without creating undue risks to our maximum employment goal. I view monetary policy as being modestly restrictive, although somewhat less so than before our recent actions. Therefore, I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral, thereby maintaining the balance between the achievement of our two goals. My policy views will, as always, be based on the evolution of the totality of the data, the economic outlook, and the balance of risks to the achievement of our maximum employment and price stability goals. - Tilt: Dovish

- I fully supported the FOMC’s decisions to reduce the target range for the federal funds rate by 25 basis points at each of its past two meetings.

Briefing.com Analyst Insight

There is one more FOMC meeting to be held this year. It will take place December 9-10. Leading up to Thanksgiving week, there was less than a 40% probability of a 25-basis-point cut at the December meeting. That view changed overnight, though, when New York Fed President Williams, viewed by many as Fed chair Powell’s policy ally, said he sees room for a further adjustment in the near term to the target range for the federal funds rate to move closer to the range of neutral.

The probability of a rate cut in December spiked above 80% after that remark and is currently at 87.2%, which, for many, means a rate cut is a forgone conclusion.

It is not a foregone conclusion, however, that replacing Jerome Powell as Fed chair will instantly lead to lower interest rates. That is true for the policy rate as much as it is for market rates. It is possible that a new Fed chair, bent on arguing the case to cut rates, stokes inflation concerns that drive up long-term rates, which the Fed does not control.

It is also possible that other FOMC members balk at additional rate cuts, particularly if inflation accelerates. That could push short-term rates higher if the market thinks the higher inflation will prevent additional rate cuts.

We know that at least three of the voting bank presidents for 2026 have a hawkish tilt at this juncture. Minneapolis Fed President Kashkari has a more neutral stance going into the December meeting, but we’d say he leans hawkish knowing that he did not support the cut made at the October FOMC meeting and that PCE inflation remains close to 3.0%.

From our vantage point, 2026 has the makings of being a topsy-turvy year when it comes to the market divining policy moves. That is because the composition of the FOMC in the first half of the year won’t be the same in the second half of the year.

That thought is predicated on the idea that (1) there will be a new Fed chair (2) current Fed chair Powell will resign his governor position (3) the governor position held by Stephen Miran will be assumed by another nominee of President Trump, assuming Mr. Miran doesn’t keep the post, and (4) the possibility that the Supreme Court rules that President Trump has the power to fire Fed governor Lisa Cook, which opens the door for the president to nominate someone else to the Board of Governors.

That would leave the governor’s class with a predominately dovish disposition, which matters greatly because there are seven of them and only five voting bank presidents. That would make it easier presumably for a new Fed chair to forge a consensus that favors rate cuts.

The economic conditions on the ground will change, of course, so it isn’t a given that the governors will always coalesce around the need to cut rates. It’s just that, with a governor class that tilts dovish, the bar for a rate cut, certainly in the back half of the year, will be lower, all else equal.

According to the CME FedWatch Tool, the fed funds futures market expects two rate cuts in 2026: one in April and another in September based on a probability line that exceeds 50.0%.

Come January, four new voting presidents will be locked in with voting authority, but it looks like it will ultimately be the governors calling the shots as the year unfolds.

—Patrick J. O’Hare, Briefing.com

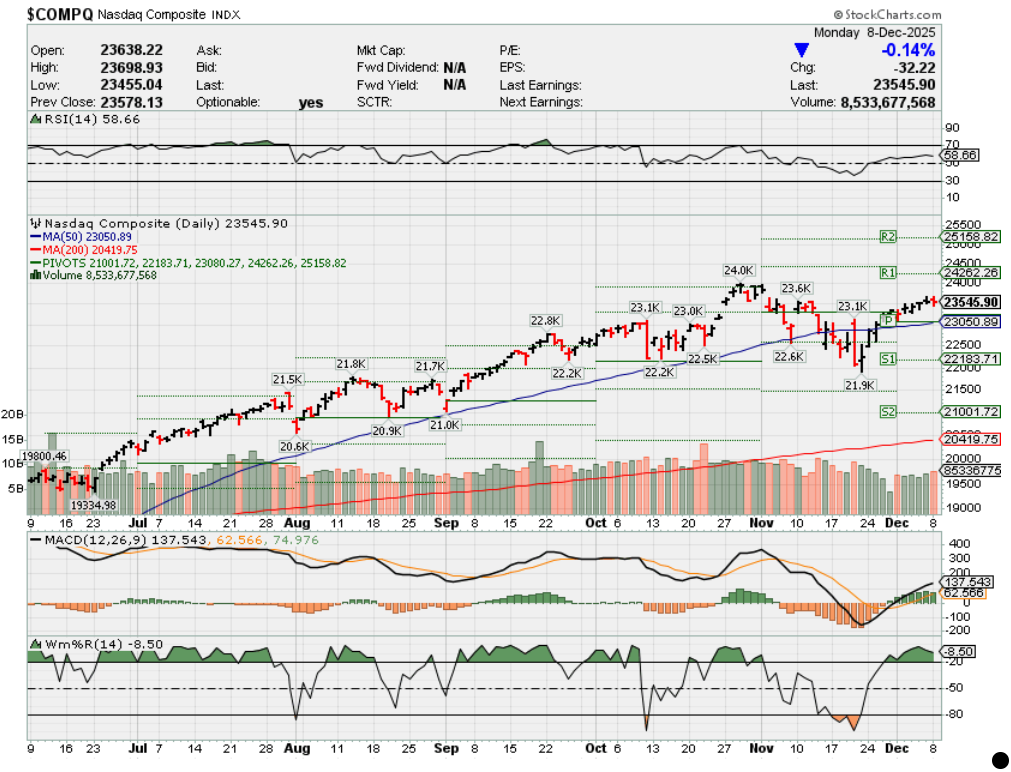

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end December 2025?

12-08-2025 +3.0%

12-01-2025 +3.0%

Earnings:

Mon:

Tues: AZO, CPB, PLAY, GME

Wed: CHWY, MTN, ADBE, ORCL

Thur: AVGO, COST

Fri:

Econ Reports:

Mon:

Tue Productivity, Unit Labor Costs,

Wed: MBA, Wholesale Inventories, Treasury Budget, Employment Cost Index, FOMC Meeting

Thur: Initial Claims, Continuing Claims, Trade Balance

Fri:

How am I looking to trade?

Time to let things continue to run

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Why do some banks do better than others with rate cuts/hikes when they seem to have the same business model.

Banking = Retail Mortgages, Commercial Mortgages, Investing, M&A, IPO’s, International Loans, Regional Banking

BIG banks are more likely with a shrinking spread there money goes into the Fed savings or other form of investments than loans

Chipmaker Marvell is soaring after an earnings beat. Here’s what analysts had to say

Published Wed, Dec 3 20258:02 AM EST

Marvell Technology cleared the earnings bar analysts set for it, yet Wall Street remains split between taking a neutral versus bullish stance on the semiconductor stock.

Marvell earned 76 cents per share on $2.08 billion in sales for its fiscal third quarter. Analysts polled by LSEG had forecast earnings of 73 cents per share and revenue of $2.07 billion.

The company said on its earnings call that it expects data center revenue to rise 25% next year. It estimates current-quarter revenue to come in at $2.2 billion, exceeding LSEG’s forecast of $2.18 billion.

Marvell also announced that it will acquire Celestial AI for at least $3.25 billion and could rise to $5.5 billion if Celestial hits certain revenue milestones.

Shares of Marvell rose 9% in Wednesday’s premarket session. The stock is down 16% on the year.

Overall, analysts across Wall Street remained divided between adopting a bullish versus neutral stance toward Marvell’s future, with most hiking their price targets. Here’s what analysts at some of the biggest sell-side shops had to say on the report.

Goldman Sachs: neutral rating, $90 price target

The bank’s $90 price target, up from $80, implies about 3% downside from Marvell’s Tuesday close.

“We remain Neutral on the stock as visibility into the expansion of Marvell’s custom silicon customer base (and volume expansion with existing customers) remains relatively low in the long run. We could be more constructive on the stock if we gain incremental confidence in the company’s custom compute revenue ramp in CY27 and beyond.”

Wells Fargo: overweight, $90

“We view MRVL as more of an idiosyncratic chip company, one that outperforms the overall chip industry growth rate in good and bad times. We believe MRVL is in a position to grow revenue at a 15-20% pace over the long term. In addition to this superior revenue growth, we see an opportunity to build on leading operating margins as the company grows in scale.”

Barclays: equal weight, $105

Analyst Tom O’Malley’s new target, raised from $80, corresponds to upside of around 13%.

“After a long period of uncertainty, the company lifted the veil on a FY27/28 guide well ahead of expectations … We are EW as the companies core business growth and ASIC expansion is largely baked into the stock and we wait for 2H CY26 for the business inflection.”

Bank of America: neutral, $105

Analyst Vivek Arya lifted his price target from $88 per share.

“Very confident tone and sales visibility on the call but we reiterate Neutral since: 1) FY27/CY26E EPS relatively unchanged given expected (~19c or mid-single digit % of EPS) dilution from planned Celestial AI acquisition, 2) The 25%+ YoY data center growth rate next year is strong yet below the 50%-100% YoY growth rate for AI compute peers, and 3) FY28E/CY27E growth depends on ramp at new customer Microsoft who does not have a history of large internal ASIC programs, and who already has choice of incumbent NVDA and partner OpenAI/AVGO design IP.”

Morgan Stanley: equal-weight, $112

Morgan Stanley’s target, up from $86, calls for 21% upside going forward.

“Marvell seems to be past the expectations reset on its ASIC business, posting solid October results and indicating material strength for the next 2 years. AI semis are strong everywhere, and MRVL is in the winners group, but we stay EW.”

Deutsche Bank: buy, $125

Analyst Ross Seymore’s forecast, lifted from $90, is 35% above Marvell’s Tuesday closing price.

“Overall, MRVL expressed increased optimism on nearly every aspect of its DC/AI businesses and provided reassuring details to its expected growth over the next few years. While qtr-to-qtr volatility is likely to persist in the naturally concentrated DC/AI markets, we continue to believe MRVL can deliver strong long-term growth that should lead to potential upside in its shares.”

JPMorgan: overweight, $130

JPMorgan’s new target, up from $120, equates to 40% upside.

“Overall, we see a solid setup for the company, driven by the continued recovery in its cyclical businesses and sustained AI growth tailwinds. We increase our forward estimates, and raise our Dec-26 PT to $130 (from prior $120).”

https://www.cnbc.com/2025/12/03/the-trade-in-silver-has-gone-parabolic-can-it-last.html

The trade in silver has gone ‘parabolic.’ Can it last?

Published Wed, Dec 3 20259:27 AM EST

Like gold, silver’s rally this year has been nothing short of astonishing.

The metal has doubled in 2025 and hit a record high on Wednesday. Supply deficits, a weaker dollar and concern over the state of the economy have pushed the metal to all-time highs. Silver got its latest boost after ADP reported a surprise decline in private payrolls for November.

However, the move higher in sliver this year may now have gone too far.

“Silver has gone parabolic,” warned Jonathan Krinsky, chief markets technician at BTIG, in a note to clients.

He pointed out that the iShares Silver Trust (SLV), which tracks the metal’s performance, posted three straight daily gains of 2.5% or more in the past week. “That’s only happened five other times in the ETF’s history (back to ’06). Four of the five occurred either at, or right before, a major peak for SLV,” he said.

SLV year to date

Indeed, SLV has also outpaced gold’s performance this year. The fund is up more than 100%, while the SPDR Gold Shares fund (GLD), which tracks gold, has gained around 60%.

Peter Boockvar, chief investment officer at One Point BFG Wealth Partners, wrote earlier this week that he remains “long and positive on silver, along with gold and platinum (as hybrid vehicles win the market share battle vs full [electric vehicles] and which use more platinum per hybrid than an [internal combustion engine] vehicle). Expectations of an Easy Money Man in the Fed next year is also helping.”

The message is, investors should tread carefully when charts start resembling hockey sticks.

https://www.cnbc.com/2025/12/04/nvidia-has-a-cash-problem-too-much-of-it.html

Nvidia has a cash problem — too much of it

Published Thu, Dec 4 20257:00 AM ESTUpdated Thu, Dec 4 20251:08 PM EST

Key Points

- When Nvidia this week said it would take a $2 billion stake in chip design company Synopsys, it was just the latest in a string of massive investments announced by the chipmaker this year.

- It’s a lot of money and a lot of deals, but Nvidia’s got the cash to write big checks.

- At the end of October, Nvidia had $60.6 billion in cash and short-term investments. That’s up from $13.3 billion in January 2023, just after OpenAI released ChatGPT.

In this article

When Nvidia this week said it would take a $2 billion stake in chip design company Synopsys, it was just the latest in a string of massive investments announced by the chipmaker this year.

Nvidia has also said it would take a $1 billion stake in Nokia, invest $5 billion in Intel and $10 billion in Anthropic — $18 billion in investment commitments from those four deals, not counting smaller venture capital investments.

That doesn’t even include the biggest commitment of all: $100 billion to buy OpenAI shares over a number of years, although there is still no definitive agreement, Nvidia finance chief Colette Kress said Tuesday at the UBS Global Technology and AI conference.

It’s a lot of money and a lot of deals, but Nvidia’s got the cash to write big checks.

At the end of October, Nvidia had $60.6 billion in cash and short-term investments. That’s up from $13.3 billion in January 2023, just after OpenAI released ChatGPT. That launch three years ago was key to making Nvidia’s chips the most valuable tech product.

As Nvidia has transformed from a maker of gaming technology into the most valuable U.S. company, its balance sheet has become a fortress, and investors are increasingly wondering what the company will do with its cash.

“No company has grown at the scale that we’re talking about,” said CEO Jensen Huang, when asked what the chipmaker plans to do with all its cash, on Nvidia’s earnings call last month.

Analysts polled by FactSet expect the company to generate $96.85 billion in free cash flow this year alone and $576 billion in free cash flow over the next three years.

Some analysts would like to see Nvidia spend more of its cash on share repurchases.

“Nvidia is set to generate over $600B in free cash flow over the next few years and it should have a lot left over for opportunistic buybacks,” wrote Melius Research analyst Ben Reitzes in a note on Monday.

The company’s board increased its share repurchase authorization in August, adding $60 billion to its total. In the first three quarters of the year, it spent $37 billion on share repurchases and dividends.

“We’re going to continue to do stock buybacks,” Huang said.

Nvidia is doing the buybacks, but it’s not stopping there.

Huang said that Nvidia’s balance sheet strength gives its customers and suppliers confidence that orders in the future, which he called offtake, will be filled.

“Our reputation and our credibility is incredible,” Huang said. “It takes a really strong balance sheet to do that, to support the level of growth and the rate of growth and the magnitude associated with that.”

Kress, Nvidia’s CFO, on Tuesday said the company’s “largest focus” is making sure it has enough cash to deliver its next-generation products on time. Most of Nvidia’s largest suppliers are equipment manufacturers like Foxconn and Dell, which can require that Nvidia provide working capital to manage inventory and build additional manufacturing capacity.

Huang called his company’s strategic investments “really important work” and said that if companies like OpenAI grow, it drives additional consumption of AI and Nvidia’s chips. Nvidia has said that it does not require any of its investments to use its products, but they all do anyway.

“All of the investments that we’ve done so far — all of it, period — is associated with expanding the reach of Cuda, expanding the ecosystem,” Huang said, referring to the company’s artificial intelligence software.

In an October filing, Nvidia said it had has already made $8.2 billion in investments in private companies. For Nvidia, those investments have replaced acquisitions.

Nvidia’s $7 billion acquisition of Mellanox in 2020 is the largest the company has ever made, and it laid the groundwork for its current AI products, which aren’t single chips but entire server racks that sell for around an estimated $3 million.

But the company faced regulatory issues when it tried to buy chip technology firm Arm for $40 billion in 2020.

Nvidia called off the deal before it could be completed after regulators in the U.S. and U.K. raised concerns about its effects on competition in the chip industry. Nvidia has purchased some smaller companies in recent years, to bolster its engineering teams, but it hasn’t completed a multibillion acquisition since the Arm deal failed.

“It’s hard to think about very significant, large types of M&A,” Kress this week said, speaking at an investor conference. “I wish one would come available, but it’s not going to be very easy to do so.”

Wall Street loves Meta’s reported metaverse cuts. Most analysts see 20%-plus gain for stock

Published Fri, Dec 5 20257:41 AM EST

Across Wall Street, analysts adopted a jovial response after Bloomberg News reported that Meta plans to make cuts to its metaverse unit.

Meta’s stock climbed 5% on Thursday following Bloomberg’s report, which said that executives are considering budget cuts as high as 30% for the unit, citing people familiar with the talks. The cuts would likely hit Meta’s virtual reality group and would likely include layoffs, Bloomberg wrote.

Analysts celebrated the news, saying that it suggested the company’s financial discipline remains in play and that Meta has ensured its continued focus on efficiency and growth.

“The news today, in our view, suggests Meta can deliver continued product-led growth as it reallocates resources to its greatest opportunities,” wrote Citi analyst Ronald Josey, who reiterated Meta as his top stock pick.

Here’s what analysts at some of Wall Street’s biggest shops had to say on the report.

JPMorgan: overweight, $800

JPMorgan’s target implies about 21% upside from Meta’s Thursday close.

“We are encouraged that Meta is hearing the message from the Street on expense discipline, though we still believe it is important to emphasize guardrails around GAAP EPS growth, operating income growth, and positive FCF amidst the heavy capex buildout.”

Wells Fargo: overweight, $802

Wells Fargo’s forecast corresponds to upside of around 21%.

“See press reports of potential 30% budget cuts at Reality Labs as clear sign that Meta leadership is taking an active approach to re-orient the cost structure to AI-related initiatives. Estimate potential savings of roughly $2 in EPS annualized.”

Bank of America: buy, $810

Bank of America’s forecast calls for 22% upside going forward.

“Our Take: While we assume costs will still grow materially in 2026, and at a faster rate than in 2025, we think it is constructive to think about the magnitude of flexibility that Meta may have with 2026 cost allocations. In other words, Meta likely has cost contingencies next year to help maintain EPS growth even if there are macro pressures on revenues.”

Citi: buy, $850

Analyst Ronald Josey’s forecast is 28% above Meta’s Thursday closing price.

“While a 10% annual expense reduction has been the norm at Meta since 2022, the potential significant cut from Metaverse investments clearly frees up resources for Super Intelligence Labs as newer AI products come to market in ’26. Since 3Q25 earnings, the debate has focused on the mix of investment across Meta’s core R&R improvements vs. Super Intelligence relative to revenue growth and the news today, in our view, suggests Meta can deliver continued product-led growth as it reallocates resources to its greatest opportunities.”

Rosenblatt: buy, $1,117

The firm’s price target was approximately 69% higher than where Meta closed on Thursday.

The news if true “could be meaningfully helpful for the equity … Our belief is that Reality spending, which drives we estimate $17.6B of operating losses in 2025E, is largely operating expense, not capex … So a pare back to focus on more imminent priorities could be very helpful for sentiment, and help relate the stock to a multiple more appropriate for its cash flow growth — i.e. closer to our $1,117 price target, which we believe is Street high, and which assumes an EV of 20x 2026E EBITDA.”

NewStreet Research: no rating, no price target

“The reported cuts are not only highly rational but help relieve growing investor anxiety ahead of the initial 2026 total expense guidance range on the late January, 4Q25 earnings call … Today’s report is reassuring investors that META is doubling down on efforts to rationalize costs and partially offset near-certain margin contraction in 2026, driven by accelerating depreciation growth and new employee compensation for Meta Superintelligence Lab (MSL) hires.”

$208 million wiped out: Yieldstreet investors rack up more losses as firm rebrands to Willow Wealth

Published Fri, Dec 5 20256:00 AM ESTUpdated Fri, Dec 5 20258:15 AM EST

Key Points

- Private markets investing startup Yieldstreet, now calling itself Willow Wealth, recently informed customers of new defaults on real estate projects in Houston and Nashville, Tennessee.

- The letters, obtained and verified by CNBC, account for about $41 million in new losses. They come on the heels of $89 million in marine loan wipeouts disclosed in September and $78 million in losses previously reported by CNBC.

- Willow Wealth also removed a decade of historical performance data from public view in recent weeks.

- The high-stakes rebranding is the latest chapter for a company that sought to empower retail investors, but instead left some of them saddled with losses and years of uncertainty.

As Yieldstreet tries to distance itself from a rocky past with a new name and ad campaign, its customers are dealing with a present reality that is increasingly dire.

The private markets investing startup, freshly rebranded as Willow Wealth, last week informed customers of new defaults on real estate projects in Houston and Nashville, Tennessee, CNBC has learned.

The letters, obtained and verified by CNBC, account for about $41 million in new losses. They come on the heels of $89 million in marine loan wipeouts disclosed in September and $78 million in losses revealed by CNBC in an August report.

In total, Willow Wealth investors have lost at least $208 million, according to CNBC reporting.

Willow Wealth also removed a decade of historical performance data from public view in recent weeks. A chart on the company’s website showing annualized returns of negative 2% for real estate investments from 2015 to 2025 — down from 9.4% gains just two years prior — has been taken down.

“They had to change their name,” said Mark Williams, a professor at Boston University’s Questrom School of Business. “Their old name had negative value to it, so they’re trying to do a 2.0 to restart things. They’re also making it harder to uncover their poor performance by removing the stats, which is alarming.”

The high-stakes rebranding is the latest chapter for a company that sought to empower retail investors, but instead left some of them saddled with deep losses and years of uncertainty.

Under its former name, Willow Wealth — backed by prominent venture firms and buoyed by aggressive online marketing — had been the best known of a wave of American startups that promised to broaden access to the alternative investments that are the domain of institutions and rich families.

But the still-unfolding collapse of its real estate funds demonstrates the risks the private markets hold for retail investors. By their very nature, private investments don’t trade on exchanges and lack standardized disclosures. That leaves investors especially reliant on private fund managers, both for information and to safeguard their interests for years while their money is locked up in deals.

Private markets have gained in prominence this year after President Donald Trump signed an executive order to allow the investments in retirement plans.

While critics say that opaque, illiquid investments with high management fees aren’t appropriate for ordinary investors, asset managers including BlackRock and Apollo Global Management see retail as a vast untapped pool of capital. Retirement giant Empower said in May that it would allow private assets into the 401(k) plans of participating employers with help from firms including Apollo and Goldman Sachs.

New mascot, same pitch

Against this backdrop, Willow Wealth CEO Mitch Caplan, a former E-Trade chief who took the helm in May, said the company was heading toward a new model. Instead of only offering deals sourced by the startup, it would also sell private market funds from Wall Street giants including Goldman and Carlyle Group.

The company no longer provides the historical performance of its offerings because of the pivot to third party-managed funds, according to a person with knowledge of the situation who asked for anonymity to discuss internal strategy.

“Transparency is paramount to us, and we consistently provide strategy-specific performance information for each manager at the offering level to support informed decision making,” said a Willow Wealth spokeswoman.

As for CNBC’s reporting on the new real estate defaults and rising tally of losses, the Willow Wealth spokeswoman called it a “rehash” of news on “investments from five years ago.”

“The investments in question represent a very small portion of our overall portfolio and do not reflect the current nature of our offerings or business focus,” she said.

The firm declined to say how much it manages in assets.

The startup — founded in 2015 by Michael Weisz and Milind Mehere, who remain on Willow Wealth’s board of directors — told customers that private investments would provide both higher returns and lower volatility than traditional assets.

Willow Wealth’s pitch hasn’t changed much, despite the rebrand.

In a new ad campaign, a character called Hampton Dumpty says that he’s “learned a thing or two about crashes” and therefore uses Willow Wealth to diversify his portfolio with private market assets including real estate.

The mascot, a play on the Humpty-Dumpty nursery rhyme, tells viewers that “portfolios including private markets have outperformed traditional ones for the past 20 years.”

Compounding fees

On its revamped website, the firm has a chart showing a hypothetical portfolio made of private equity, private credit and real estate outperforming traditional stocks and bonds over the decade through 2025.

But the chart doesn’t include the impact of fees, which are typically far higher for private investments than for stock ETFs and mutual funds. The company also notes in a disclosure that customers can’t actually invest in the private market indexes listed.

While most stock ETFs carry fees below 0.2%, Willow Wealth typically charges 10 times more than that, or 2% annually on unreturned funds, for its real estate offerings, according to product documents.

Willow Wealth also charged an array of one-time fees associated with the creation of the funds, including for structuring the deal and arranging the loans.

Fees for Willow Wealth’s new products are even higher. The company charges about 1.4% annually for access to portfolios made up of private funds from Goldman Sachs, Carlyle and the StepStone Group, according to its website.

Those firms also charge their own fees, leading to all-in annual costs ranging from about 3.3% to 6.7% per fund, according to the providers’ documents.

That makes Willow Wealth’s products among the most expensive in the retail investing universe.

‘Difficult news’

For customers still coming to terms with their losses and who remain in limbo on funds that the firm says are on “watchlist” for possible default, Yieldstreet’s transformation into Willow Wealth looks like an effort to evade accountability, the customers told CNBC.

After last week’s disclosures, nine out of the 30 real estate deals reviewed by CNBC since August are now in default. That 30% failure rate is high, even by the standards of the private assets world, said Boston University’s Williams.

Though the realm of private credit is more opaque, making average default rates difficult to pinpoint, some in the industry estimate typical failure rates of between 2% and 8%.

Whether they were apartments in hot downtown areas or established cities, or single-family homes scattered across Southern boomtowns, projects that Willow Wealth put its customers into struggled to hit revenue targets and fell behind on loan payments.

Willow Wealth has blamed the failures on the Federal Reserve’s interest rate hiking cycle in 2022, which made repaying floating-rate debt harder.

Among newly disclosed defaults are a pair of funds tied to a 268-unit luxury apartment building in East Nashville called Stacks on Main.

Investors hoping to earn the advertised 16.4% annual return put a combined $18.2 million into the two funds, according to documents reviewed by CNBC. They later added another $2 million in a member loan meant to stabilize the deal.

“Your equity investment is expected to incur a full loss” after selling Stacks on Main on Nov. 25, Willow Wealth told customers in a letter dated that same day. Investors in the member loan will lose up to 60%, the company said.

“We understand this is difficult news to receive,” Willow Wealth told customers. “We share in your disappointment.”

Documents for the 2022 transactions listed Nazare Capital, the family office of former WeWork CEO Adam Neumann, as the sponsor for the deal. Real estate sponsors typically source, acquire and manage deals on behalf of investors.

In 2022, after his WeWork tenure ended, Neumann founded property startup Flow, which took on some of the real estate deals from his family office.

In public comments to news outlets over the past year, representatives from Flow have sought to distance the company from the travails of then-Yieldstreet.

But according to the 2022 investment memo, Nazare purchased Stacks on Main in July 2021 for $79 million and then offloaded a majority stake to Yieldstreet members through a joint venture.

Crucially, the transaction saddled the joint venture with $62.1 million in debt, a burden which would later prove instrumental in the deal’s failure, CNBC found.

“This building was majority-owned by YieldStreet and the property was never operated either by Flow or anyone associated with Adam,” a spokeswoman for Neumann told CNBC. “In any event, the building has been sold and Flow no longer has a minority interest nor any involvement in this property.”

Nazare was also listed as sponsor for another Nashville project that went sideways for retail investors, an apartment complex at 2010 West End Ave. That project resulted in $35 million in losses across two funds, wipeouts that were previously reported by CNBC.

Besides the deals tied to Nazare, there were other defaults.

A project called the Houston Multi-Family Equity fund, made up of apartments across suburban Texas, resulted in a loss of all $21 million of customer funds, the startup told investors in a Nov. 25 letter.

“The property was unable to generate sufficient revenue to pay monthly debt service and operating expenses” and went into foreclosure, resulting in a “full loss of the equity,” Willow Wealth said.

A ‘high-risk’ trap

The tally of Willow Wealth’s investor losses is likely to rise further.

For instance, an $11.6 million loan made by Willow Wealth customers for a Portland, Oregon, multifamily project is “currently in default” after an appraisal found that the borrower owed more than the real estate was worth, the company told investors.

Willow Wealth is trying to restructure the borrower’s loan to avoid selling the property for a loss, the company said in a letter to investors.

The company has also warned investors that a Tucson, Arizona, apartment complex and two projects made up of single-family rental homes across Southern states were likely to result in future losses of unspecified amounts, according to separate letters. Investors put more than $63 million combined into those deals.

Williams, the Boston University professor and a former Federal Reserve bank examiner, said he taught a class this fall on how Willow Wealth and other fintech firms failed to protect their customers.

“They claimed they were going to democratize access to the types of deals only the rich had,” Williams said. “In reality, they created a high-risk trap for investors.”

Netflix to buy Warner Bros. film and streaming assets in $72 billion deal

Published Fri, Dec 5 20257:11 AM ESTUpdated Fri, Dec 5 202512:42 PM EST

Sara Salinas@in/saracsalinas@saracsalinas

Key Points

- Netflix announced Friday it’s reached a deal to buy pieces of Warner Bros. Discovery, bringing a swift end to a dramatic bidding process that saw Paramount Skydance and Comcast also vying for the legacy assets.

- The deal is for WBD’s film studio and streaming service, HBO Max. Warner Bros. Discovery will still spin out its TV networks, which includes TNT and CNN, as previously planned.

- The acquisition is expected to close in 12 to 18 months.

Netflix co-CEO on Warner Bros. Discovery deal: ‘It sets us up for success for decades to come’

Netflix announced Friday it’s reached a deal to buy pieces of Warner Bros. Discovery, bringing a swift end to a dramatic bidding process that saw Paramount Skydance and Comcast also vying for the legacy assets.

The transaction is comprised of cash and stock and is valued at $27.75 per WBD share, the companies said. That puts the equity value of the deal at $72 billion, with a total enterprise value of approximately $82.7 billion.

Netflix will acquire Warner Bros.′ film studio and streaming service, HBO Max. Warner Bros. Discovery will move forward with its previously planned spinout of Discovery Global, which includes its massive portfolio of pay TV networks, such as TNT and CNN.

The blockbuster deal brings together the streaming giant Netflix, which has upended the media industry in recent years, and the storied Warner Bros. film studio, known for its library including “The Wizard of Oz,” the Harry Potter franchise and the DC comics universe. It will also include the content of HBO Max, including “The Sopranos” and “Game of Thrones.”

“I know some of you’re surprised that we’re making this acquisition, and I certainly understand why. Over the years, we have been known to be builders, not buyers,” Netflix co-CEO Ted Sarandos said on an investor call Friday morning.

“We already have incredible shows and movies and a great business model, and it’s working for talent, it’s working for consumers and it’s working for shareholders. This is a rare opportunity,” he said. “It’s going to help us achieve our mission to entertain the world and to bring people together through great stories.”

Netflix’s initial bid for WBD’s studio and streaming assets was for $27 a share, according to a person familiar with the matter. That trumped Paramount’s offer at the time and turned the trajectory of the sales talks in Netflix’s direction, said the person, who asked not to be named because the discussions were private.

The acquisition is expected to close after the TV networks separation takes place, now expected in the third quarter of 2026. The companies estimated the transaction would close in 12 to 18 months.

CNBC has reached out to Comcast and Paramount for comment.

As part of the deal, every Warner Bros. Discovery shareholder will receive $23.25 in cash and $4.50 in shares of Netflix common stock for each share of WBD common stock outstanding following the close of the deal.

Netflix and Warner Bros. Discovery said each of their boards of directors unanimously approved the deal, which is subject to regulatory approval as well as approval of WBD shareholders.

Netflix has agreed to pay a $5.8 billion reverse break-up fee if the deal is not approved, according to a Securities and Exchange Commission filing. Warner Bros. Discovery would pay a $2.8 billion breakup fee if it decides to call off the deal to pursue a different merger.

Edging out Paramount

The merger could invite regulatory scrutiny given the size of the expansive streaming businesses for each company. Netflix said it surpassed 300 million global streaming subscribers at the end of 2024, the last time it publicly reported its customer count. Warner Bros. Discovery said it had 128 million global subscribers as of Sept. 30.

Paramount raised the potential for antitrust concerns earlier this week in a letter to Warner Bros. Discovery management as second-round bids came in, The Wall Street Journal reported.

The newly merged Paramount Skydance made its initial run at Warner Bros. Discovery in September, submitting three bids before WBD launched a formal sale process. The David Ellison-run company was the only suitor bidding for the entirety of WBD’s portfolio — the film studio, streaming business and TV networks.

Paramount’s final bid, received Thursday evening, was for $30 per share, all cash, people close to the matter told CNBC, speaking on the condition of anonymity about confidential dealings. Paramount’s offer included a $5 billion breakup fee if the transaction didn’t win regulatory approval after roughly 10 months, the people said.

Earlier this week, Paramount raised questions about the “fairness and adequacy” of the sale process, contending Warner Bros. Discovery favored Netflix.

“It has become increasingly clear, through media reporting and otherwise, that WBD appears to have abandoned the semblance and reality of a fair transaction process, thereby abdicating its duties to stockholders, and embarked on a myopic process with a predetermined outcome that favors a single bidder,” Paramount attorneys said in a letter to Warner Bros. Discovery management.

— CNBC’s David Faber, Kasey O’Brien and Laya Neelakandan contributed to this report.

Disclosure: Comcast is the parent company of NBCUniversal, which owns CNBC. Versant would become the new parent company of CNBC upon Comcast’s planned spinoff of Versant.

16 comments

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

Awesome! Its genuinely remarkable post, I have got much clear idea regarding from this post

This was beautiful Admin. Thank you for your reflections.

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

I like the efforts you have put in this, regards for all the great content.

There is definately a lot to find out about this subject. I like all the points you made

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I appreciate you sharing this blog post. Thanks Again. Cool.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I do not even understand how I ended up here, but I assumed this publish used to be great

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav