HI Financial Services Mid-Week 03-24-2015

Trading is very competitive and you have to be able to handle getting your butt kicked. Paul Tudor Jones

Smart money vs Dumb Money thinking – I will blog my comments here tonight at www.myhurleyinvestment.com

What are the differences?

The only difference between smart money and dumb money is….. Time that they can wait for stocks to come back !!!!

Sometimes Smart money hedges better, “knows” they are trading a fundamentally sound company

Last week – spoke 2 people about LNCO

What’s happening this week and why?

Stock market can’t hold its gains !!! Why? Uncertainty still on Rates, Greece, Earnings, Economic Data, Strong Dollar,

Existing Home sales 4.88 vs est 4.90

CPI .2 vs est .2

Core CPI .2 vs est .1

FHHFA Housing Price index .3 vs est .8

New Home Sales 539 vs est 470

Price of oil may go up?!?!?!!!! HOW

Oil is lower per barrel today than 6 weeks ago and I am pay $2.39 vs 1.65 6 weeks ago

Where will our market end this week?

Go higher from here but not a whole lot 1%

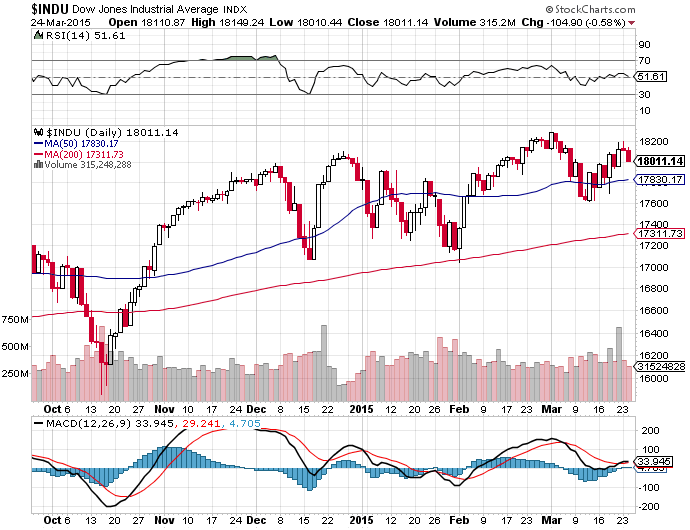

DJIA – Rolling over and almost technically bearish

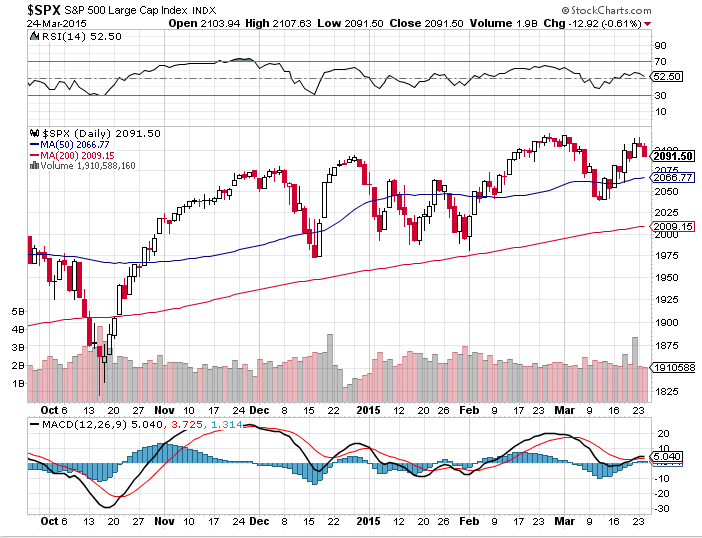

SPX – Ditto as the DJIA

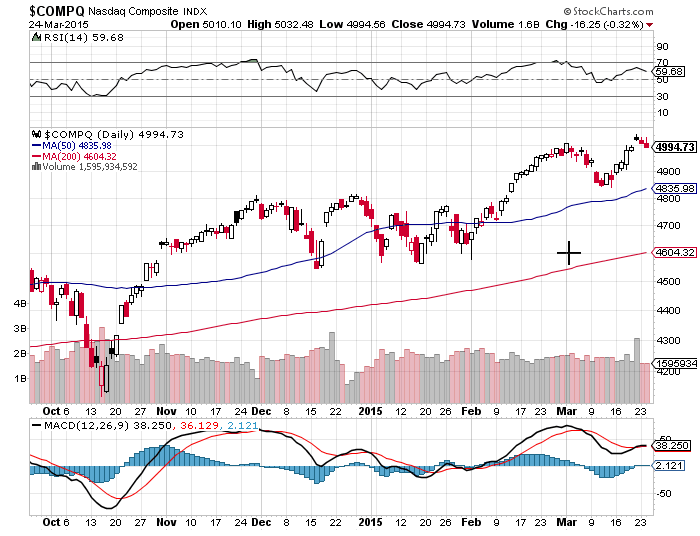

COMP – Remains Bullish

Where Will the SPX end March 2015?

03-24-2015 March will finish flat with a 3.5% move down and back up

03-17-2015 March will finish flat with a 3.5% move down and back up

03-10-2015 March will finish flat with a 3.5% move down and back up

03-03-2015 March will finish flat with a 3.5% move down and back up

02-25-2015 March will finish flat with a 3.5% move down and back up

What is on tap for the rest of the week?=

Earnings:

Tues: DANG, FUL

Wed: APOL, FIVE, PVH, RHT

Thur: ACN, CAG, GME, RH

Fri: CCL

Econ Reports:

Tues: CPI, Core CPI, FHFA Housing Price Index, New Home Sales

Wed: MBA, Crude, Durable Goods, Durable ex-trans

Thur: Initial Claims, Continuing Claims,

Fri: GDP-3rd Est., GDP Deflator, Michigan Sentiment

Int’l:

Tues – DE:FR:EMU: PMI Composite

Wed – FR: Business Climate

Thurs – DE: Consumer Climate, GB: Retail Sales, EMU: M3 Money Supply

Friday –

Sunday – JP: Industrial Production

How I am looking to trade? Let me Show you what I changed and why?

Most of my stocks are thru earnings:

I have some stock only positions – DIS, NVDA, F, SBUX, D, LNCO, ZION, BABA

I have Protective puts on AAPL, CLDX

Still IN collars for – BIDU, FB,

Covered Calls on – VZ, WBA, SNDK, P

Bull Puts – DIS, NVDA, AAPL, BABA

Put Calendar – LNCO

AAPL Bear put calendar with long puts

1st I am creating my earnings list so I don’t miss an earnings for a company I trade

WBA – 03/24

PCLN – 02/19

NKE – 3/19

RHT – 3/26

MU- 4/2

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley