HI Market View Commentary 08-25-2025

| Here’s a stat that stops a lot of people in their tracks: Less than 4% of all U.S. stocks have been responsible for the market’s net gains going back nearly 100 years.1 That’s from a landmark study by Professor Hendrik Bessembinder of Arizona State University, titled Do Stocks Outperform Treasury Bills?1 When it was first published in 2018, it made waves. And now, newly updated data through the end of 2024 confirms what the original research showed: A small handful of companies are responsible for almost all the market’s wealth creation.2 To put it in perspective, picking one of the long-term winners at random is a bit like rolling a 25-sided die and hoping to land on a single number. Even more eye-opening? Just one-third of one percent of stocks created half of all the market’s lifetime gains. We’re talking about names like Apple, Microsoft, and Nvidia.2 Apple alone has delivered nearly $4.7 trillion in shareholder wealth. That’s almost 6% of all the wealth generated by the entire U.S. stock market since 1926.2 The top five stocks together? Over 21% of lifetime market wealth.2 The rest of the market? Most stocks either underperformed safe government bonds or lost value altogether.2 This happens, Bessembinder believes, because most companies struggle to grow or maintain market share. A few, on the other hand, create breakthrough products, dominate industries, or ride powerful long-term trends. Those outliers deliver gains so large, they carry the whole market. That’s why stock returns aren’t distributed evenly. They’re lopsided. A small number of big winners end up covering for thousands of smaller or failing companies. So what does this mean for investors? To be clear, Bessembinder’s study is based on historical data. It’s always worth emphasizing that past results do not guarantee future returns. Additionally, the study also doesn’t say investors should avoid the stock market. Quite the opposite. Historically, equities have represented one of the most powerful ways to build long-term wealth. But the catch is this: most of those returns come from a very small number of companies, and it’s nearly impossible to know in advance which ones will be the standouts. Even professional investors, with research teams and advanced tools, rarely get it right year after year. For individual investors, chasing the next Amazon might feel exciting. But statistically, it’s much more likely to end in frustration. So instead of trying to guess which stocks will succeed, the study points to broad market exposure as a more reliable approach for capturing long-term gains. With a diversified portfolio, you don’t have to find the needles. You already own the haystack! That’s the beauty of broad market investing. You automatically capture the rare winners without needing to predict them. Want to know how your current strategy stacks up? This message is intended to educate, not to offer personalized advice. But if you’re unsure what this means for your specific situation, let’s talk about it. No pressure. Just a helpful conversation about investing with confidence. Sincerely, |

| P.S. Ever picked a stock that totally surprised you for better or worse? Hit reply and tell me about it. I’d love to hear your story. |

| Sources: Journal of Financial Economics, 2018 [URL: https://www.sciencedirect.com/science/article/abs/pii/S0304405X18301521?via%3Dihu]W. P. Carey School of Business, 2024 [URL: https://wpcarey.asu.edu/department-finance/faculty-research/do-stocks-outperform-treasury-bills#:~:text=Dec.%2031%2C%202022-,Updated%20spreadsheet,-%E2%80%94%20U.S.%20public] |

| Content prepared by Snappy Kraken. Investment advisory products and services made available through AE Wealth Management, LLC (AEWM), a Registered Investment Advisor. This material is intended to provide general information to help you understand basic financial planning strategies and should not be construed as financial advice. All investments are subject to risk including the potential loss of principal. No investment can guarantee a profit or protect against loss in periods of declining values. The information contained in this material is believed to be reliable, but accuracy and completeness cannot be guaranteed; it is not intended to be used as the sole basis for financial decisions. It is important that you do not use email to request, authorize or effect the purchase or sale of any security, to send fund transfer instructions, or to effect any other transactions. Any such request, orders, or instructions that you send will not be accepted and will not be processed. The text of this communication is confidential, and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Recipients should be aware that all emails exchanged with the sender are automatically archived and may be accessed at any time by duly authorized persons and may be produced to other parties, including public authorities, in compliance with applicable laws. 07/25-4710300 |

Earnings

MU 09/24 est

NVDA 08/25 AMC

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 22-Aug-25 12:52 ET | Archive

No fire in the (Jackson) hole

Briefing.com Summary:

*Hawkish fears fizzled after Fed Chair Powell’s speech signaled a nod toward policy easing.

*Fed Chair Powell leaned more on employment risk than inflation risk.

*The market had a textbook response to a speech it viewed as being more dovish-minded.

Leading up to Fed Chair Powell’s speech at the Jackson Hole Symposium, a fuse had been lit in the fed funds futures market that was burning away at the probability of a 25 basis-point rate cut at the September 16-17 FOMC meeting. Specifically, the probability had been trimmed to 71.3% from 92.1%, as there was a budding fear that Fed Chair Powell might ignite a bomb with a hawkish-sounding speech.

That fear began to build after the release of the July Producer Price Index, and it continued to build following recent remarks from other Fed officials signaling their reluctance to cut rates and the release of the minutes for the July 29-30 meeting, which stipulated that the majority of participants judged the upside risk to inflation as greater than the downside risk to employment.

That was before the release of the July Employment Situation Report, which showed large downward revisions for May and June that left the three-month average for nonfarm payrolls at a lowly 35,000.

In listening to Fed Chair Powell’s speech, he sounded more attentive to the downside risk to employment than the upside risk to inflation. Accordingly, he snuffed out the fuse, and the only bomb that went off was the one that got dropped on short sellers.

A Handshake Deal

The stock market has been clamoring for a rate cut, and it now believes (again) that it will get one at the September FOMC meeting, barring some real inflation shock in the August CPI and PPI reports or a major upward surprise for August nonfarm payrolls, all of which will be released before the September FOMC meeting.

In the wake of Fed Chair Powell’s speech, the probability of a 25 basis-point rate cut in September returned to north of 90.0%, stock prices surged, with small-cap stocks leading the charge, the 2-yr note yield dropped 10 basis points to 3.68%, and the U.S. Dollar Index declined 0.9% to 97.70.

Those are textbook responses for a market anticipating a friendlier interest rate environment. Just how friendly the Fed gets remains to be seen, but the market effectively has a handshake deal with Fed Chair Powell on a rate cut in September.

So, what was said that prevented things from blowing up?

- Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

- Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising.

- GDP growth has slowed notably in the first half of this year to a pace of 1.2 percent, roughly half the 2.5 percent pace in 2024. The decline in growth has largely reflected a slowdown in consumer spending.

- A reasonable base case is that the effects [of tariffs] will be relatively short-lived—a one-time shift in the price level.

- Given that the labor market is not particularly tight and faces increasing downside risks, that outcome [workers demanding and getting higher wages] does not seem likely.

- Measures of longer-term inflation expectations, however, as reflected in market- and survey-based measures, appear to remain well anchored and consistent with our longer-run inflation objective of 2 percent.

- Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance.

- In the absence of inflationary pressures, it might not be necessary to tighten policy based solely on uncertain real-time estimates of the natural rate of unemployment.

These remarks are not arranged in any specific order, although it is fair to say that the remark following the first bullet point is what kept the bomb from detonating. That was Fed Chair Powell’s tacit signal to the market that he is on board with a rate cut in September based on what he knows today.

Briefing.com Analyst Insight

It is possible that the employment and inflation reports for August light the fuse again, yet that determination will have to wait.

Fed Chair Powell reminded everyone, however, that the Fed cannot take the stability of inflation expectations for granted and that it will not allow a one-time increase in the price level to become an ongoing inflation problem. That was a nod toward the understanding that tariffs, and any related price adjustments, could still become problematic if they force a shift in inflation expectations, meaning the Fed would operate with a restrictive policy if that was the case.

That case will be litigated at another time. The market wanted one thing and one thing only out of the Jackson Hole speech. It wanted a signal that a September rate cut is more likely than not.

Fed Chair Powell delivered the goods in that respect. Consequently, the stock market rallied, feeling a great deal of relief that Fed Chair Powell didn’t ignite a fire in the hole.

—Patrick J. O’Hare, Briefing.com

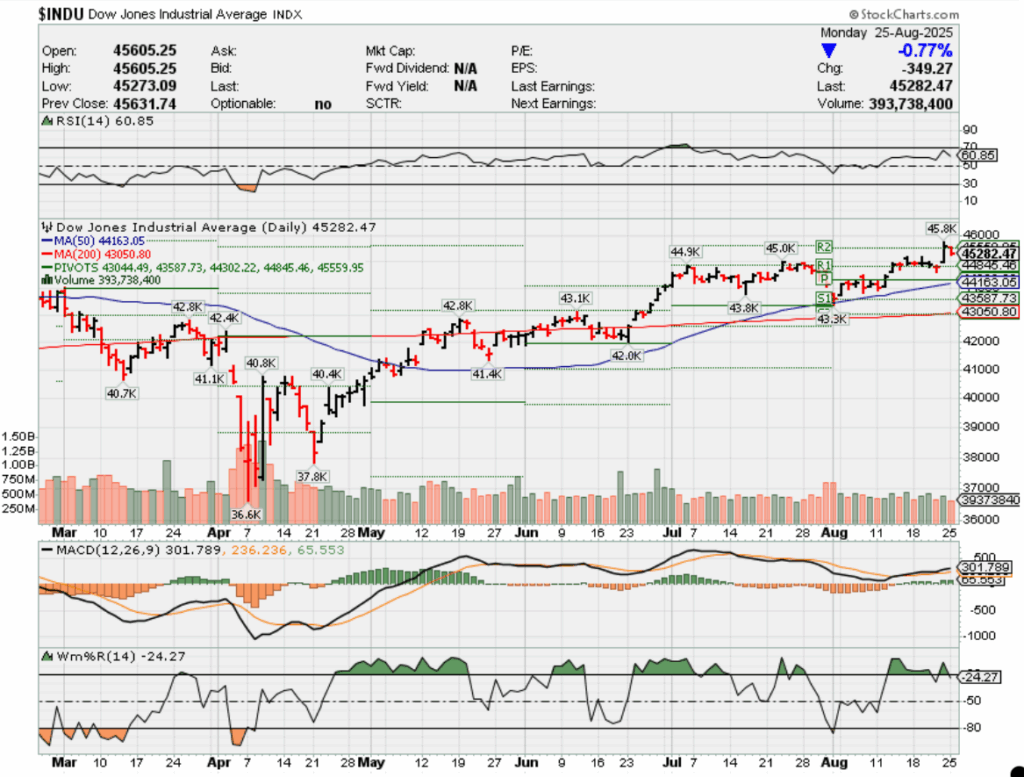

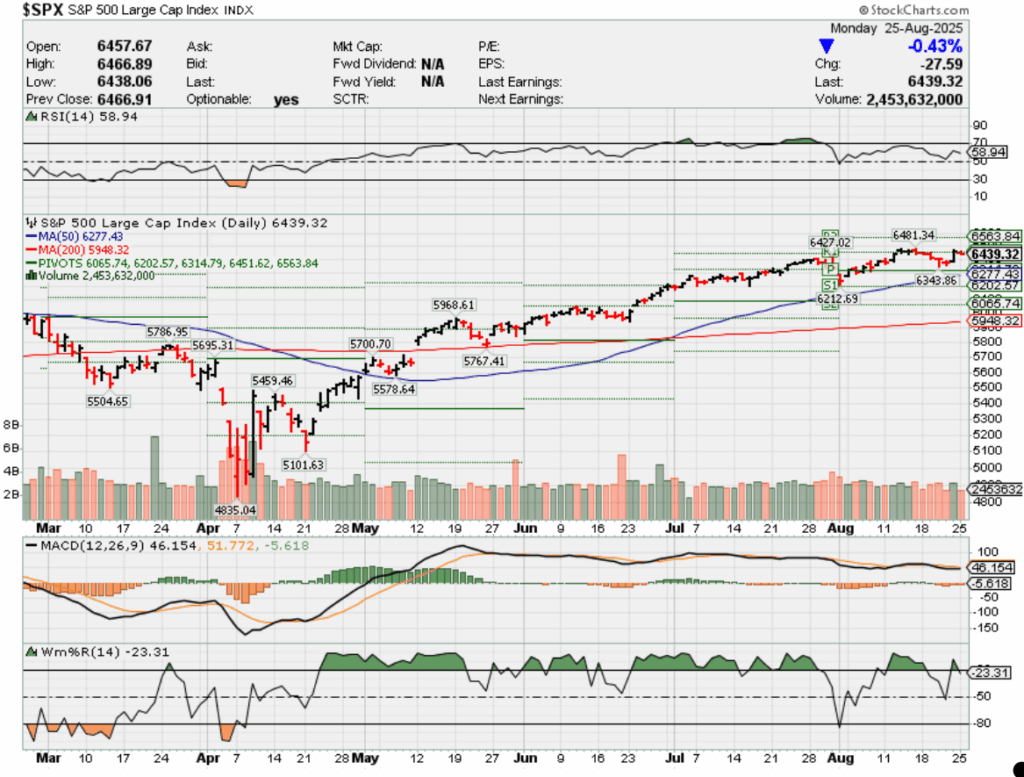

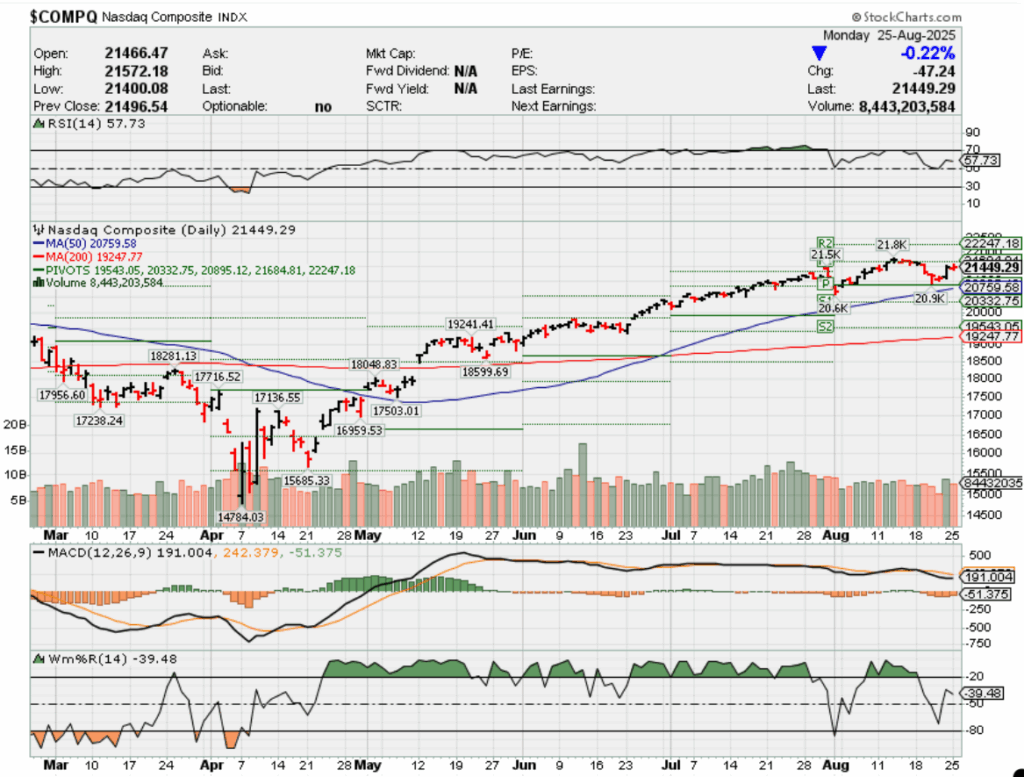

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2025?

08-25-2025 1.0%

08-18-2025 0.0%

08-11-2025 -1.0%

08-04-2025 -2.0%

Earnings:

Mon:

Tues:

Wed: ANF, KSS, A, HPQ, TCOM, URBAN, NVDA

Thur: BBY, BURL, DKS, DG, GCO, LI, ADSK, DELL, GAP, MRVL, ULTA,

Fri: BABA

Econ Reports:

Mon: New Home Sales,

Tue Durable Goods, Durable ex-trans, FHFA Housing Price Index, S&P Case-Shiller, Consumer Confidence,

Wed: MBA,

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator, Pending Home Sales,

Fri: PCE Prices, CORE PCE, Chicago PMI, Personal Income, Personal Spending, Michigan Sentiment,

How am I looking to trade?

Time to start protecting for historical downturn,

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

https://fortune.com/2025/08/12/trump-tariffs-revenue-crfb

Trump is bringing in enough revenue from tariffs to have a serious impact on the $37 trillion national debt, budget watchdog says

By Nick Lichtenberg Fortune Intelligence Editor

August 12, 2025 at 2:29 PM EDT

Since his return to the White House, Donald Trump has unleashed a wave of “reciprocal tariffs” on almost every major U.S. trading partner.

Chip Somodevilla—Getty Images

President Donald Trump’s sweeping new tariffs are raking in unprecedented sums for the federal government—so much, in fact, that a top budget watchdog says the revenue rivals the impact of creating a brand-new payroll tax or slashing the entire military budget by nearly one-fifth. (These are rough estimates, to be sure, conveyed to communicate the magnitude of the tariffs, not precise contributions to the budget.) But can these massive cash flows, already topping tens of billions monthly, truly put a dent in America’s $37 trillion national debt?

Actually, yes, according to the Committee for a Responsible Federal Budget (CRFB), which alternately calls the revenue being generated by the tariffs to be “meaningful” and “significant.”

Since his return to the White House, Trump has unleashed a wave of “reciprocal tariffs” on almost every major U.S. trading partner. Roughly $25 billion was collected in July, the CRFB calculated, more than triple the amount from late last year, and surely a fraction of what forthcoming months will yield. The D.C.-based think tank estimates the tariffs will bring in an estimated $1.3 trillion of net new revenue through the end of Trump’s current term and $2.8 trillion through 2034. That represents a $600 billion leap forward from the tariffs in effect as of May.

For context, in fiscal 2025 so far, tariffs have accounted for 2.7% of all federal revenue—more than double typical levels. Some analysts project that figure climbing as high as 5% if current policies remain in place.

Impact on the national debt

In theory, pouring $2.8 trillion from tariffs into the national coffers could markedly slow the growth of the federal debt. Congressional Budget Office figures and CRFB models suggest that, if kept permanent, Trump’s tariff regime could reduce the deficit by up to $2.8 trillion in the next decade. “The recent tariff increases are likely to meaningfully reduce deficits if allowed to remain in effect or replaced on a pay-as-you-go…basis,” the CRFB wrote in its analysis.

Experts still caution the impact, though real, remains limited when compared to the sheer scale of the U.S. government’s finances: a whopping $37 trillion. Even with historic tariff gains, these revenues represent only a fraction of total federal income—nowhere near enough to replace income taxes or close the debt gap. In fact, during fiscal year 2025, income taxes and payroll taxes covered over three-quarters of federal revenue.

Then there’s the question of who is really paying the price, or as Trump likes to put it, who is eating the tariffs. The government is getting revenue from whom, exactly?

Eating the tariffs

While Washington enjoys a flood of new revenue, the reality on the ground is more complex. Businesses typically pass the cost of tariffs through to consumers in the form of higher prices. Economic research shows the new tariffs function much like a regressive tax, hitting lower- and middle-income households particularly hard. The average family in the second-lowest income tier faced an annual cost increase of $1,700; those in the top income decile paid upwards of $8,100 more per year, according to Yale Budget Lab.

Moreover, defense and infrastructure experts warn rising costs from tariffs may invite higher prices for critical hardware and components needed by the military and national security agencies. Tariffs “make it more expensive to meet national defense requirements,” the Council on Foreign Relations wrote in early July.

Trump floats ‘tariff dividend checks’—but debt likely to grow

President Trump has floated the idea of distributing “tariff dividend checks” to American families on top of debt-reduction promises. But most economists say the math doesn’t quite add up: While the government is enjoying record-breaking revenues, those gains are still dwarfed by annual spending and existing commitments. Even under the most optimistic scenarios from the Trump administration and its budget watchdogs, tariffs will only slow—not reverse—the upward march of the national debt.

The CRFB is a respected nonpartisan institution that dates back to 1981, with a board consistently made up of former members and directors of key budgetary, fiscal, and policy institutions, such as the Congressional Budget Office, the House and Senate Budget Committees, the Office of Management and Budget, and the Federal Reserve. The CRFB regularly produces analyses of government spending and debt and deficit trends, as well as the solvency of programs such as Social Security.

The CRFB regularly advocated for reducing federal deficits and controlling the growth of national debt. It typically favors reforms to federal “entitlement” programs and functions as a deficit hawk, which draws the ire of left-wing figures. For instance, Paul Krugman characterized it as a “deficit scold” while he was still with the New York Times.

[This headline has been updated to clarify the CRFB’s finding that the tariffs are likely to have a meaningful impact on the national debt, rather than significantly reduce it overall.]

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.

Court teaches Letitia James big lesson about lawfare, hands Trump a HUGE victory

August 21, 2025

support us

A New York state appeals court delivered Letitia James a major disappoint worth over $500 million to Trump.

A Democrat New York judge ordered President Donald Trump and his sons in February to pay hundreds of millions of dollars over a lawsuit filed by New York Attorney General Letitia James.

The civil lawsuit claimed that the president defrauded banks and other organizations by overestimating the value of his properties in order to secure favorable bank loans and other benefits. The bank denied any wrongdoing, and critics attacked the case for comically devaluing the president’s iconic and profitable properties.

A New York state appeals court delivered to Trump a major boon on Thursday, noting that while the injunctive relief ordered by New York Judge Arthur Engoron “is well crafted to curb defendants’ business culture, the court’s disgorgement order, which directs that defendants pay nearly half a billion dollars to the State of New York, is an excessive fine that violates the Eighth Amendment of the United States Constitution.”

Appellate Division Judge Peter Moulton called out Letitia James in his concurring opinion, writing that the “Attorney General did not carry her initial burden” of establishing an approximate total of the profits directly linked to Trumps’ supposed violations.

Moulton added, “Indeed, the calculation of the disgorgement in this case was far from a reasonable approximation.”

The president celebrated the ruling, writing on Truth Social:

TOTAL VICTORY in the FAKE New York State Attorney General Letitia James Case! I greatly respect the fact that the Court had the Courage to throw out this unlawful and disgraceful Decision that was hurting Business all throughout New York State. Others were afraid to do business there. The amount, including Interest and Penalties, was over $550 Million Dollars. It was a Political Witch Hunt, in a business sense, the likes of which no one has ever seen before.

Trump further characterized this instance of lawfare as a case of election interference and emphasized that Engoron was a “Political Hack” and that James is a “Corrupt and Incompetent Attorney General who only brought this Case in order to hurt me politically.”

‘NO MORE LAWFARE!’

The president thanked the court, especially David Friedman, associate justice of the New York Appellate Division of the Supreme Court, First Judicial Department.

Eric Trump, who operates the Trump Organization with his brother Donald Trump Jr., said of the ruling, “Total victory in the sham NY Attorney General case!!! After 5 years of hell, justice prevailed!”

Donald Trump Jr. wrote, “It was always a witch hunt, election interference, and a total miscarriage of justice[,] and even a left leaning NY appeals court agrees! NO MORE LAWFARE!”

Trump ally and Turning Point USA CEO Charlie Kirk noted, “They tried to impeach him, bankrupt him, imprison him, and assassinate him. They failed.”

This is a developing story.

Trump says government will make deals like Intel stake ‘all day long’

Published Mon, Aug 25 20259:00 AM EDTUpdated Mon, Aug 25 202510:03 AM EDT

Jeff Cox@jeff.cox.7528@JeffCoxCNBCcom

Key Points

- The government’s stake in Intel is part of a broader strategy to create a sovereign wealth fund that could include more companies, White House economic advisor Kevin Hassett said Monday.

- “I’m sure that at some point there’ll be more transactions, if not in this industry then other industries,” he said in a CNBC interview.

NEC Director Kevin Hassett on Intel deal: It’s possible government will take stake in more companies

President Donald Trump on Monday boasted about the government’s new stake in Intel and said he’s determined to do similar deals.

“I will make deals like that for our Country all day long,” the president posted on Truth Social.

Trump added that “stupid people” are upset with a move that he said will bring more money and jobs to the U.S.

“I will also help those companies that make such lucrative deals with the United States. … I love seeing their stock price go up, making the USA RICHER, AND RICHER,” he said. “More jobs for America!!! Who would not want to make deals like that?”

Earlier in the morning, White House economic advisor Kevin Hassett said the Intel move is part of a broader strategy to create a sovereign wealth fund that could include more companies.

In a deal that marked a further incursion of federal involvement with private companies, the White House on Friday announced that it was taking a 10% share of the chipmaking giant. The stake is worth around $8.9 billion, some of which will come from grant funding associated with the CHIPS Act while the rest will be under separate government allocations for programs associated with making secure chips.

While stressing that the government won’t involve itself in company operations, Hassett said the move is part of an ongoing plan.

“Well, I think this is a very, very special circumstance because of the massive amount of CHIPS Act spending that was coming in,” Hassett, the director of the National Economic Council, said in an interview on CNBC’s “Squawk Box.” “But the president has made it clear all the way back to the campaign, he thinks that in the end, it would be great if the U.S. could start to build up a sovereign wealth fund. So I’m sure that at some point there’ll be more transactions, if not in this industry then other industries.”

Trump signed an executive order in early February to start a sovereign wealth fund, a mechanism primarily used by smaller countries with vast natural resources that are used as funding backstops for transactions. Norway leads the world in such funds with some $1.8 trillion in assets, according to the Sovereign Wealth Fund Institute. China is next, and multiple Middle East nations also have large funds.

Though the U.S. government taking large positions in corporations is unusual it is not unheard of, said Hassett, citing the stakes in Fannie Mae and Freddie Mac following the financial crisis.

“We’re absolutely not in the business of picking winners and losers,” he said. “But this is not a thing that is unprecedented.”

Hassett added that the move is part of the administration’s strategy that includes tariffs to encourage more companies to onshore their production.

Market concentration around AI darlings persists. It’s making investors worried

Published Sat, Aug 16 20258:15 AM EDTUpdated Sat, Aug 16 202510:27 AM EDT

The stock market continues to be extraordinary in the face of distressing headlines, but the growing concentration risk has more investors on edge.

The S&P 500 is back at all-time highs as the bull case on Wall Street plays out. The artificial intelligence buildout is ramping up. Corporate earnings are topping expectations. Interest rate cuts seem inevitable, likely coming next month. On top of all that, the One Big Beautiful Bill will be stimulative for an economy where consumers are still spending.

But the market’s ascent at a time of seasonal weakness and ongoing inflation concerns has many investors worried. They fear that a stock market priced for perfection, with the S&P 500 currently trading at a 12-month forward multiple of 22, is vulnerable to some sort of setback. And that could come from anywhere.

“What’s going to happen, I think, is some shock will occur. I don’t know what shock, but some shock will occur, which undercuts the thesis of continued economic growth,” said David Kelly, chief global strategist at JPMorgan Asset Management. “And when that happens, I think you’ll see a selloff in markets, and that’ll probably be concentrated in those areas that look most overvalued right now.”

“So, I think investors ought to be pretty cautious here, because what’s going on is the market slowly getting more and more overvalued,” Kelly said.

Top-heavy market

More than anything, it’s the top-heavy nature of the market raises concern.

Goldman Sachs pointed out this week that the top 20% of quality companies in the S&P 500 — those with massive cash piles and fortress balance sheets — are trading at a 57% price-to-earnings premium to the lowest quality stocks — a gap in the 94th percentile going back to 1995.

In practice, that means that the megacaps — which already benefit from AI tailwinds — get a further boost from investors seeking safety from economic uncertainty.

Yet, the influence the tech giants wield on the market is troubling in the event of a pullback.

AI superstar Nvidia alone now accounts for roughly 8% of the S&P 500, the biggest weighting of any individual stock in the cap weighted benchmark going back to 1981, according to Torsten Slok, chief economist at Apollo Global Management. The stock is easily a key reason for the bull market, after rallying more than 36% this year, surging more than 170% in 2024, and soaring more than 200% in 2023.

But, if the bull case for the beloved stock falters, that could spell trouble for the broader benchmark. China, for example, is a key weak point for the stock, as any curbs on Nvidia’s sales of its graphics processing units to Beijing will likely hurt the stock — and also the market.

An incoming reversal?

The top stocks look especially bloated when you consider this: While the S&P 500 has gained more than 10% in 2025, the median stock has only risen 3%, and remains 12% off its recent high, according to a note from Goldman Sachs this week.

To be sure, that could set up the market for big rotations. Small-cap stocks outperformed their large-cap counterparts this week. Value-factor stocks also outpaced growth, while Nvidia slid and Apple advanced. Health care, a recent laggard, led the S&P 500.

If the dovish outlook for Fed policy holds, or the macroeconomic picture improves, then the rotation trade could continue to work for investors. And yet, even optimistic investors continue to remain cautious, and are diversifying their holdings.

JPMorgan’s Kelly said he prefers assets with limited downside in the event of a pullback. The strategist prefers U.S. value stocks over growth, and said he’s looking abroad to Europe, which he expects has further to run even after its gains this year. Some alternatives such as real estate could also add value to a portfolio, he said.

Eventually, Kelly expects some “violent” reaction — a sustained bear market of 20% or more — is overdue for the stock market, whether it comes within a week or in the next three years.

“It’s just imperative that investors diversify some of that risk into other industries and other regions in particular,” said Nanette Abuhoff Jacobson, global investment strategist at Hartford Funds.

Reversal beneficiaries

This past week, Goldman Sachs identified some lower quality stocks with weak balance sheets that could benefit from a reversal trade, if macroeconomic conditions improve or if the Fed turns dovish. Here are five of them.

| ALB | Albemarle Corp | ALB | -0.06% |

| CPB | Campbell’s Co | CPB | -1.87% |

| CZR | Caesars Entertainment Inc | CZR | UNCH |

| EL | Estee Lauder Companies Inc | EL | -2.80% |

| PSKY | Paramount Skydance Corp | PSKY | -0.25% |

Add All To Watchlist

View Latest News and Peer-Related Stocks

Estee Lauder was one lower quality stock identified. The stock is higher by more than 21% in 2025 but is in the midst of a multiyear turnaround plan that could cost between $1.2 billion and $1.6 billion.

Paramount Skydance surged 33% this week alone, after it became a “play for momentum goons” after Paramount Global’s merger with Skydance Media finalized.

— CNBC’s Sean Conlon and Gabriel Cortes contributed to this story.