HI Market View Commentary 12-15-2025

Merry Christmas, Happy Holidays and Happy New Year’s!!!

Taking a break to work fundamentals on companies for next year’s Jan 5th Commentary when we start up again.

We too huge profits as MU was called away!!! Cash Heavy going into next year.

We co have the leap 220/300 Bull Call Stock Replacement strategy for Wednesday’s earnings

First article below talks about being in cash and looking for “the opportunity”.

S&P move 70% over a three year period of time then the expectation is a 35% ISH pullback

PLEASE call me immediately IF you want to be more fully INVESTED

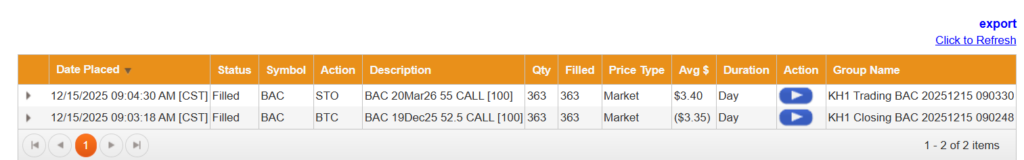

We are expecting BAC and GOOGL to also get called away

GOOGL in January

BAC in December BUT…..

We rolled the BAC $52.50 covered call for $1.01 Credit

BTC 3.35 and opened a $55 20 Mar Covered call for $3.40

We opened the upside by $2.50, and we still have the original $1.01 of credit

Upside for BAC $62

Fed meeting tells us…….

Fed Chair Miran told the Columbia Student body today as a speaker for the University

He sees the shelter inflation coming way down = Rent and Home Prices

People don’t want to give up the lower 2.75 – 3.50% refinanced home interest rates

Bigger concern is job loss = AI but

One of the only people that thinks Tariffs caused higher inflation = Fed Chair Powell !!!!

Custom cabinets=Wood, Fishing line, fishing lures, Chinese rods,

ANF has upside

Interesting =

Earnings

MU 12/17 AMC

https://www.briefing.com/the-big-picture

The Big Picture

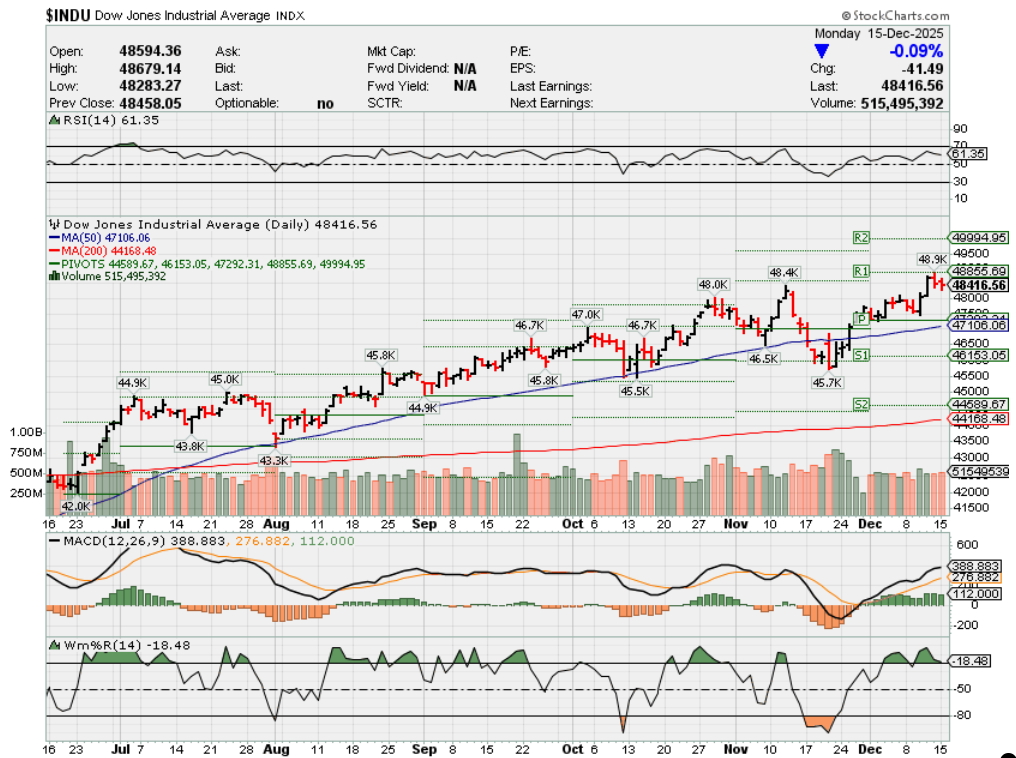

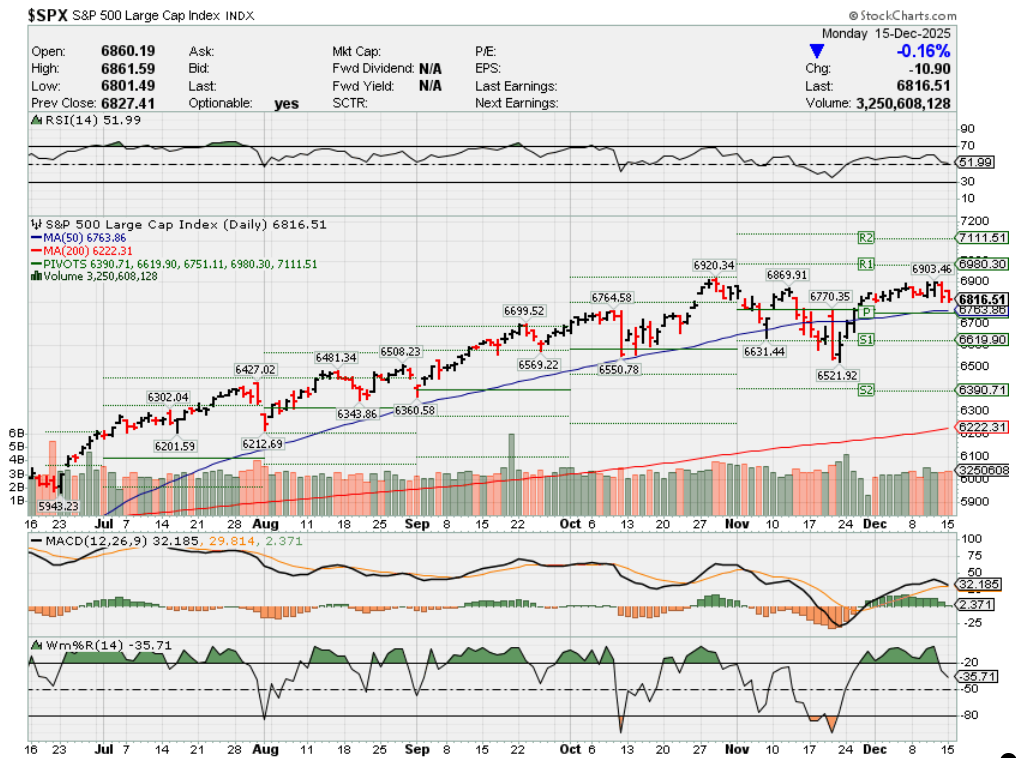

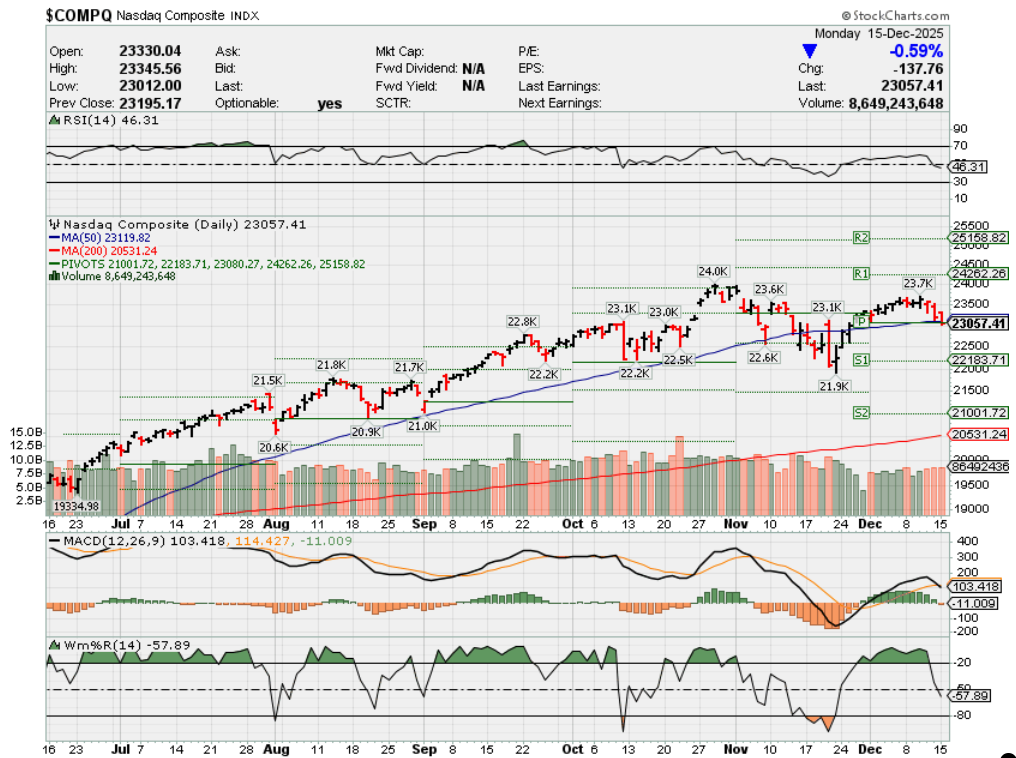

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end December 2025?

12-15-2025 +3.0%

12-08-2025 +3.0%

12-01-2025 +3.0%

Earnings:

Mon:

Tues: LEN,

Wed: GIS, JBL, MU

Thur: KMX, DRI, BB, FDX, NKE

Fri:

Econ Reports:

Mon: Empire Manufacturing, NAHB Housing Market Index,

Tue Building Permits, Housing Starts

Wed: MBA, Retail Sales, Retail ex-auto, Business Inventories,

Thur: Initial Claims, Continuing Claims, CPI, Core CPI, Phil Fed, Leading Indicators,

Fri: Existing Home Sales, Michigan Sentiment

How am I looking to trade?

Time to let things continue to run

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

IF we see an end of the year of course we will add puts

We just booked 100% return (400-500%) Leaps, Leap Bull Calls gives a huge credit to use in a pullback scenario

Stock replacement strategy is our protection in case we are wrong with fully valued stocks

Dan Niles says his best idea right now is cash. Here’s what else he likes

Published Wed, Dec 3 20254:02 PM EST

In a market that could soon be topping out, the best investment idea right now is cash, according to Dan Niles, founder of Niles Investment Management.

The market moved higher on Wednesday, but Microsoft shares fell after The Information reported the company was slashing software sales quotas tied to artificial intelligence. Microsoft denied the report. Several other AI-related names sank in sympathy.

Shares of Alphabet, however, rose nearly 2%. The moves were the latest in the autumn’s volatile AI trade, which started after investors began to grow concerned over sky-high valuations.

“The market is starting to go, ‘you know everybody is not going to win so I need to start differentiating between the Google complex of companies and the OpenAI complex of companies and go, how many winners are there actually going to be. Maybe there will be two or three; it is not going to be 10,’” Niles said in an interview on CNBC’s “Power Lunch.” “That is why this market feels fragile.”

Within tech, he thinks Alphabet-owned Google will be among those that come out on top in the AI race. Alphabet recently released its Gemini 3 AI model and its latest custom silicon chip.

Another interesting stock right now is Apple, Niles said. While it doesn’t have a particularly great AI product right now, that will change.

“Next year you are going to have a good product with AI on the system and you are going to have a foldable phone,” he said.

Still, with the market broadening out to other sectors, the best thing investors can do is stay diversified — especially since the now-rocky AI trade and Federal Reserve rate cuts have been what’s been pushing the market to new highs.

The market is pricing in 89% odds of another rate cut at the conclusion of the central bank’s two-day meeting December 10, according to the CME FedWatch tool. However, Niles doesn’t expect any more cuts after that until a new Fed chair is installed in May.

“You have to start thinking a little bit more,” he said. “If you are concerned that December 10 might be the top because that is the last rate cut for the next five months, other than being broadly diversified, cash is not a bad option.”

Layoff announcements top 1.1 million this year, the most since 2020 pandemic, Challenger says

Published Thu, Dec 4 20257:48 AM ESTUpdated Thu, Dec 4 20259:20 AM EST

Jeff Cox@jeff.cox.7528@JeffCoxCNBCcom

Key Points

- Challenger, Gray & Christmas said layoff plans totaled 71,321 in November, a step down from the massive cuts announced in October but still enough to bring the 2025 total up to 1.17 million.

- The most-cited reason for the month was restructuring, followed by closings and market or economic conditions.

Announced job cuts from U.S. employers moved further ahead of 1 million for the year in November as corporate restructuring, artificial intelligence and tariffs have helped pare job rolls, consulting firm Challenger, Gray & Christmas reported Thursday.

The firm said layoff plans totaled 71,321 in November, a step down from the massive cuts announced in October but still enough to bring the 2025 total up to 1.17 million. That total is 54% higher than the same 11-month period a year ago and the highest level since 2020, when the Covid pandemic rocked the global economy.

In November, Verizon’s announcement that it would slash more than 13,000 jobs helped drive the total. Tech companies, driven by innovations in artificial intelligence, listed 12,377 reductions, pushing the sector’s 2025 total up 17% from a year ago. AI itself has been cited for 54,694 layoffs this year.

Tariffs were cited as the driver of more than 2,000 cuts in November and nearly 8,000 year to date. The most-cited reason for the month was restructuring, followed by closings and market or economic conditions.

“Layoff plans fell last month, certainly a positive sign. That said, job cuts in November have risen

above 70,000 only twice since 2008: in 2022 and in 2008,” said Andy Challenger, workplace expert and chief revenue officer at Challenger, Gray & Christmas.

Challenger also pointed out that since the financial crisis in 2008, companies have shifted away from end-year layoff announcements.

“It was the trend to announce layoff plans toward the end of the year, to align with most companies’

fiscal year-ends. It became unpopular after the Great Recession especially, and best practice dictated layoff plans would occur at times other than the holidays,” said Challenger.

November offered some relief from the more than 153,000 cuts announced in October, which was the highest total for the month in 22 years.

The numbers come with concerns rising over the state of the U.S. labor market.

ADP reported Wednesday that private employers cut 32,000 jobs in November, the biggest decline in more than 2½ years.

Hiring prospects have been dim this year as well, according to the Challenger report. Employers have announced 497,151 planned hires, off 35% from the same point in 2024.

Despite signs of weakness elsewhere, Labor Department data has yet to reflect a surge in layoffs.

The department on Thursday reported that weekly jobless claims unexpectedly tumbled to 191,000, the lowest in more than three years. Official data showed the decline of some 27,000 from the prior week was driven by unusually large drops in California and Texas and likely was influenced by the Thanksgiving holiday.

Strategist reveals an ‘asymmetric AI’ trade: ‘A lot of upside without much downside’

Published Mon, Dec 1 20258:00 PM EST

Convertible bonds are a way to play bet on AI with less risk, according to one strategist.

Schroders’ head of multi-asset income Dorian Carrell said convertible bonds were an asset class “people don’t talk about enough” and were up around 15% so far this year.

“We think that’s an asymmetric AI story. Very high risk-return, very high components of supply chain and AI, but you get a lot of upside with not much downside,” he told CNBC’s “Squawk Box Europe” on Monday.

Convertible bonds are corporate bonds that can be converted into company shares, meaning they have the features of a regular bond but with an equity component.

It has been a rollercoaster few weeks in global equities, as the push and pull between economic data, earnings and AI-fueled bubble fears played out in the markets. There has been an uptick in tech firms issuing debt, which added further pressure on the market — whether it’s healthy or not has split experts.

While Carrell didn’t name specific stocks, big tech firms Alphabet, Meta and Amazon are among those that have raised debt to ramp up AI efforts. Oracle, too, has been increasingly reliant on debt to fund its AI infrastructure build; analysts have flagged its tight free cash flow as investors keep an eye on how such companies are net cash positioned.

Carrell said that “Europe looks like a beacon of stability” given its 2% rates and 2% inflation “give or take,” while for AI “the picks and shovels are much cheaper in Asia, including a little bit in Japan as well.”

He added: “So we think you’ve got to look elsewhere. You’ve got to broaden out by asset class, broaden out by region as well.”

Nvidia can sell the more advanced H200 AI chip to China — but will Beijing want them?

Published Tue, Dec 9 20257:26 AM ESTUpdated 3 Hours Ago

Key Points

- Nvidia got the green light from President Donald Trump to sell its more advanced H200 AI chip to China.

- But there are questions over whether Beijing will want to buy them given its drive for self-sufficiency.

- But the H200′s superiority could make it too tempting for the nation’s tech companies to resist.

Nvidia has approval from the U.S. government to sell its more advanced H200 AI chips to China. But the question is whether Beijing wants it or will let companies buy it.

The company can now ship its H200 chip to “approved customers”, provided the U.S. government gets a 25% cut of those sales. It had been effectively banned from selling any semiconductors to China earlier this year, but since July sought to resume H20 sales, a less advanced chip designed specifically to comply with export restrictions.

Reports had suggested Beijing prohibited local companies from buying the H20. Nvidia is not baking in huge China sales into its forecasts as a result. After the ban was lifted, the Financial Times reported China would “limit access” to the H200, citing unidentified sources.

Nvidia gets green light to sell to China — but does China want the chips?

Look at what Nvidia CEO Jensen Huang has said this year, and what Chinese tech giants and Beijing have done, and you’ll see potential hints as to how this lifting of the ban will play out.

Why China might push back against the H200

The H200 is one of Nvidia’s most advanced chips for training and running AI on the market, but China has been on a drive to wean itself off American technology and boost local semiconductor development for AI.

“While this move reopens the door for U.S. revenue, the strategic train has already left the station,” Neil Shah, partner at Counterpoint Research, told CNBC on Tuesday.

Huang said in a Bloomberg interview in May that Chinese tech giant Huawei’s semiconductor products for AI are “probably comparable” to Nvidia’s H200.

Alibaba and Baidu, as well as other Chinese startups, are also racing to bring competitive products to Nvidia to the market.

Huawei has been ramping up its Ascend line of AI products and using massive clusters of chips to try to get performance that is on par with Nvidia.

Huang told CNBC in June that Huawei would have the country’s chip needs covered if Nvidia were never allowed to sell there.

Meanwhile, Alibaba, Tencent and Baidu have been using stockpiled Nvidia chips from before the ban, combined with local semiconductors, to develop models that have become advanced.

Jensen Huang, chief executive officer of Nvidia Corp., departs following a meeting with members of the Senate Banking, Housing, and Urban Affairs Committee in Washington, DC, US, on Wednesday, Dec. 3, 2025. Huang said he’s unsure whether China would accept the company’s H200 artificial intelligence chips should the US relax restrictions on sales of the processors, following a meeting Wednesday with President Donald Trump.

With China’s drive to self-sufficiency resulting in advanced products, will Beijing want to allow its local companies to buy American products from Nvidia?

“Capability wise, the Chinese ecosystem is catching up fast from semi to stack with models optimized on the silicon and software for significant local consumption,” Shah said. He added that China getting “locked in” to Nvidia chips is a “liability with a hanging sword of political uncertainty.”

“This makes domestic self-sufficiency the only viable long-term strategy for Beijing,” Shah said.

Reasons for China to buy the H200

Trump said Chinese President Xi Jinping “responded positively” to the approval of H200 exports to China.

And while China held off on H20 purchases, there are reasons the country’s companies could want to purchase the H200 product.

The H200 is far more advanced than the H20, which could be tempting for China. Meanwhile, Alibaba CEO Eddie Wu said there were supply shortages across the entire semiconductor supply chain.

“I think there will be demand for H200 as it is a better chip than H20 and there is a shortage of chips in China,” Ben Barringer, head of technology research at Quilter Cheviot, told CNBC on Tuesday. “The big Chinese tech companies will want to use Nvidia and AMD if possible.”

China’s semiconductor industry remains behind that of the U.S. and elsewhere. In particular, China struggles to manufacture the most advanced chips, putting it behind the world’s largest chipmaker Taiwan Semiconductor Manufacturing Co. China is also restricted from buying chipmaking tools that could advance its capabilities.

Meanwhile, domestic alternatives to Nvidia remain behind in performance. This makes Nvidia’s H200 an attractive proposition.

“What is not in China’s favor right now is the supply — ramping up advanced AI chips in terms of performance or yields still remains elusive, making it a less economically efficient push,” Shah said.

“The gap between Nvidia, AMD and Huawei and others is still quite wide when it comes to performance and power efficiency.”

Even if Chinese firms begin buying Nvidia’s product, Beijing’s longer-term trajectory of self-sufficiency will continue.

“In the long run, for the next five to ten years, China’s ‘self-reliance’ strategy for its own tech and innovation won’t change. Jensen Huang of Nvidia has a good time window to sell H200 but it won’t be … forever,” George Chen, partner and co-chair, digital practice, The Asia Group, told CNBC on Tuesday.

“Xi will not be foolish that today Trump can sell H200, and then China just totally relies on U.S. chips. Huawei, Alibaba and other Chinese tech developers remain strategically important for China’s marathon to win the AI race and this will be a long race,” he added.

Trump scared Europe with his national security strategy. That’s no bad thing, ex-CIA chief says

Published Thu, Dec 11 202510:15 PM ESTUpdated Fri, Dec 12 202512:18 AM EST

- Former CIA Director General Petraeus discussed the White House’s national security strategy with CNBC, as well as the prospects for peace in Ukraine.

- He said Trump’s strategy “going after the Europeans but, frankly, some of the Europeans needed to be gotten” for failing to heed warnings to up their defense spending.

- Using frozen Russian assets to support Kyiv would be a “game changer,” Petraeus said.

The White House’s new national security strategy gave Europe a scare last week as it warned the region faced “civilizational erasure” and questioned whether it could remain a geopolitical partner for America.

The document shocked allies on the continent as it criticized its leaders as “weak” and slammed the region’s stance on immigration, democracy, freedom of speech, while adding its waning economic and military power was waning.

“It is far from obvious whether certain European countries will have economies and militaries strong enough to remain reliable allies,” it said, adding that the region suffered from a lack of self-confidence. The document also called for the U.S. to re-establish “strategic stability” with Russia, despite its war against Ukraine.

But David Petraeus, the former CIA Director and four-star US Army general, told CNBC it was no bad thing for European nations to get a wake-up call to look after their defense and security.

The strategy was, “in a way, going after the Europeans but, frankly, some of the Europeans needed to be gotten after because I watched as four different presidents tried to exhort the Europeans to do more for their own defence and now that’s actually happening,” he told CNBC’s Dan Murphy in Abu Dhabi on Thursday.

Petraeus said President Donald Trump had been “very, very substantial” in getting the Europeans to spend more on defense.

“He’s gotten them to commit to what they should have done years ago,” Petraeus said. He pointed to European members of NATO agreeing earlier this year to increase defense spending to 5% of their gross domestic product, after sustained pressure from the Trump administration.

Petraeus: Tapping €200 billion in frozen Russian assets would be a “game changer”

‘Putin is not going to budge’

Petraeus’ comments come as diplomatic efforts continue to end the war in Ukraine, with U.S. officials holding talks regarding peace proposals with Russian and Ukrainian counterparts in recent weeks.

Both Russia and Ukraine, and its European allies, have promoted different peace plans with contradictory demands and “red lines.” The biggest obstacles to peace remain disagreements over post-war security guarantees for Ukraine and Russian demands that Kyiv cede the eastern region of Donbas.

Washington is reportedly urging both sides to come to an agreement before Christmas, but there is also skepticism that this is possible. Russia, meanwhile, appears to be enjoying the increasing pressure that Europe and Ukraine are coming under from Washington.

Petraeus said he had little faith that Russia could compromise over a peace plan with Putin showing little sign of compromise over war objectives such as territorial control, regime change, and a “demilitarized” Ukraine with no prospect of NATO membership.

“I’m encouraged that there is an effort spurred by the United States and backed by President Trump, personally, in many respects, and his direct negotiators to try to bring the war to an end. I’m not encouraged by Moscow’s response,” Petraeus said.

“Vladimir Putin just continues to reiterate that his goals are the maximalist objectives he’s held all along, which essentially denies independence to Ukraine. He wants to get a pro-Russian president to replace President Zelenskyy … He wants to demilitarize Ukraine [and] … he wants to be given ground that is in the most fortified area of Ukraine,” he added.

Putin “is not going to budge,” Petraeus added.

Frozen assets

Ukraine’s European allies have been looking at ways to continue funding its war against Russia, as well as considering its eventual post-war reconstruction, which is likely to cost over $500 billion, according to the United Nations, and Russian reparations.

The EU is believed to be close to a deal to mobilize a sizable chunk of the estimated 210 billion euros (around $244 billion) worth of Russian sovereign assets currently frozen in European financial institutions.

There are, however, concerns over the legal ramifications and the potential retaliation from Moscow; Russia’s security council chief warned last week that using Russian assets would be tantamount to a justification for war.

Petraeus said if the EU did go ahead with using frozen Russian reserves, it would be a “game changer.”

“We’ve heard a lot of game changers before. I’ve never bought into those. But … $200 billion or even 100 billion euros of money for Ukraine would be a game changer. It solves their fiscal and economic problems for a couple of years,” he said.

Divided Fed approves third rate cut this year, sees slower pace ahead

Published Wed, Dec 10 20252:00 PM ESTUpdated Wed, Dec 10 20253:53 PM EST

Jeff Cox@jeff.cox.7528@JeffCoxCNBCcom

- A Federal Reserve split over where its priorities should lie cut its key interest rate Wednesday in a 9-3 vote, but signaled a tougher road ahead for further reductions.

- The FOMC’s “dot plot” indicated just one more reduction in 2026 and another in 2027, amid considerable disagreement from members about where rates should head.

- In addition to the rate decision, the Fed also announced it will resume buying Treasury securities. The central bank will start by buying $40 billion in Treasury bills, beginning Friday.

Fed cuts interest rates by a quarter percentage point

A Federal Reserve split over where its priorities should lie cut its key interest rate Wednesday, but signaled a tougher road ahead for further reductions.

Fulfilling expectations of a “hawkish cut,” the central bank’s Federal Open Market Committee lowered its key overnight borrowing rate by a quarter percentage point, putting it in a range between 3.5%-3.75%.

However, the move carried caution flags about where policy is headed from here and featured “no” votes from three members, which hasn’t happened since September 2019.

The 9-3 vote again featured hawkish and dovish dissents – Governor Stephen Miran favored a steeper half-point reduction while regional Presidents Jeffrey Schmid of Kansas City and Austan Goolsbee of Chicago backed holding the line. In Fed parlance, hawks are generally more concerned about inflation and favor higher rates while doves focus on supporting the labor market and want lower rates.

This was the third consecutive “no” vote from Miran, who leaves the Fed in January, and the second straight from Schmid. The previous three-dissent meeting also featured a 2-1 divide from members conflicted between the need for tighter and looser monetary policy.

The post-meeting rate statement repurposed language from the FOMC meeting a year ago.

“In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks,” the statement said.

When the language was used in December 2024, it signaled that the committee likely was done cutting for the time being. The FOMC then did not approve any reductions until the September 2025 meeting.

Fed Chair Jerome Powell, at his post-meeting news conference, said the reduction puts the Fed in a comfortable position as far as rates go.

“We are well positioned to wait and see how the economy evolves,” Powell said.

Stocks rose following the decision, with the Dow Jones Industrial Average adding 500 points. Treasury yields moved mostly lower.

“We’re in the high end of the range of neutral,” Powell added. “It’s so happened that we’ve cut three times. We have we haven’t made any decision about January, but as I said, we think we’re well positioned to wait and see how the economy performs.“

With a third consecutive cut now made, the focus turns to where the FOMC heads from here.

The closely watched “dot plot” of individual officials’ expectations on rates indicated just one cut in 2026 and another in 2027 before the federal funds rate hits a longer-run target around 3%. Those projections were unchanged from the September update, but the plot reflected divisions within the committee about where rates should head.

Along with the two “no” dovish votes on the rate cut, four other nonvoting meeting participants registered “soft dissents” indicating that they did not go along with the decision. Seven officials also indicated they want no cuts next year. FOMC meetings feature 19 participants among the governors and regional presidents, 12 of whom vote.

“The discussions we have are as good as any we’ve had in my 14 years at the Fed, very thoughtful, respectful, and you just have people who have strong views, and we come together and we reach a place where we can make a decision,” Powell said.

On the economy, the committee raised its collective view of gross domestic product growth for 2026, boosting its September projection up by half a percentage point, to 2.3%. The committee continues to expect inflation to hold above its 2% target until 2028.

On inflation, prices remain stubbornly high, with the Fed’s preferred gauge putting the annual rate at 2.8% in September, the most recent month for which data is available. While that’s considerably off the peaks of a few years ago, it’s still well north of the central bank’s 2% target.

In addition to the rate decision, the Fed also announced it will resume buying Treasury securities, following up on an announcement at the October meeting that it would halt its balance sheet runoff this month. The move comes amid concerns about pressures in overnight funding markets.

The central bank will start by buying $40 billion in Treasury bills, beginning Friday. From there, purchases are expected to “remain elevated for a few months” and then likely will be “significantly reduced.“

The moves come at a sensitive time for the Fed.

As he seeks to maintain consensus among policymakers, Powell is nearing the end of his second term as chair. He has just three meetings left before he makes way for President Donald Trump’s nominee.

Trump has signaled he will litmus test his choice, using a preference for lower rates as a barometer, rather than someone committed to the Fed’s dual mandate of stable prices and full employment. The president told reporters Tuesday evening he expects to make a choice soon.

Predictions markets are betting the nominee will be National Economic Council Director Kevin Hassett, who is viewed in some corners of the financial markets as a Fed chair who will seek to do Trump’s bidding. As of Wednesday morning, Kalshi had Hassett’s chances of getting the nod at 72%, with former Fed Governor Kevin Warsh and current Governor Christopher Waller trailing far behind.

Fed officials have had to operate in an environment where much of the official data they use in decision-making either has been trickling in well behind schedule or missing entirely, due to the government shutdown that lasted about six weeks, until Nov. 12.

What data they have seen has indicated a low-hire, low-fire labor market, with employers reluctant both to add to payrolls or to lay off large numbers of workers. However, recent signs from unofficial data point to heavier jobs reductions to come, with announced layoffs through November topping 1.1 million, according to employment placement firm Challenger, Gray & Christmas.

Correction: Kevin Hassett is director of the National Economic Council. An earlier version misstated his title.

17 comments

I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

Awesome! Its genuinely remarkable post, I have got much clear idea regarding from this post

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

This was beautiful Admin. Thank you for your reflections.

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

Awesome! Its genuinely remarkable post, I have got much clear idea regarding from this post

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

Great article! I really appreciate the way you explained everything so clearly – it feels like you put a lot of effort into making it useful for readers. I’ve been exploring different tools and resources myself, It’s been a game changer for me, and reading your post actually gave me even more ideas on how to apply it. Thanks for sharing such valuable insights!

Great article! I really appreciate the way you explained everything so clearly – it feels like you put a lot of effort into making it useful for readers. I’ve been exploring different tools and resources myself, It’s been a game changer for me, and reading your post actually gave me even more ideas on how to apply it. Thanks for sharing such valuable insights!