Silver & Gold thoughts: I typically Do NOT invest because they are news driven.

Silver has run 300% before the 32%

Silver should NOT go to $480ish,

What has 97% of the conductivity of silver = Copper

Make believe short covering by major institutions = JPM, GS

Legacy and/or Living Trust: Trust is much cheaper for the kids to probate = The directions and it can but mostly won’t go to court

A legacy Trust part of the Living will = Amendments = distributing your funds over a period of time.

When the funds are totaled 25% get’s divided among the kids

5 million payout = 128K per kids

3.75 million pays out over the next 9 years and on the 10th year it gets divided out equally for whatever is left.

Meta Earnings Results: Beat top and Bottom

8.8 vs 8.21 EPS

59,555B vs 58,378B

Zuckerberg is cutting down on wasteful programs = 116-120B on AI = BUT not going to Metaverse, wearables,

Earnings

BIDU 02/18 est

DG 03/12 est

DIS 02/02 BMO

F 02/10 AMC

GOOGL 02/02 AMC

MSTR 02/05 AMC

MU 03/18 est

NVDA 02/05 AMC

O 02/23 est

PLTR 02/02 AMC

UAA 02/06 BMO

WMT 02/19 BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 30-Jan-26 15:16 ET | Archive

Kevin Warsh is the number one pick

Briefing.com Summary:

*Kevin Warsh’s nomination limited market fears about political influence or loss of central bank independence.

*Markets reacted calmly, suggesting confidence policy decisions remain committee-driven, with no immediate shift in rate-cut expectations.

*Kevin Warsh will be viewed as dovish but skeptical of aggressive QE, implying a softer “Fed put” and perhaps more measured policy responses.

With the number one pick in the 2026 Fed Chair draft, the President of the United States of America selects… Kevin Warsh! And that concludes (we think) this year’s Fed Chair draft.

The pre-draft combine was a buzz of activity, with close to a dozen candidates in the running to be the number one selection. Early cuts whittled that list down to five: Kevin Hassett, Christopher Waller, Michelle Bowman, Rick Rieder, and Kevin Warsh.

Then, it was four, with a fair amount of jockeying in the prediction markets as to who would get the nod. Kevin Hassett was the frontrunner for a good bit, then Kevin Warsh, then Rick Rieder up until recently, but in the end it was the candidate from “central casting” that got the nod.

Kevin Warsh, who has been a Fed Governor in the past (2006-2011), will be returning to K Street as the Chair of the Board of Governors once he is confirmed by the Senate. The markets seem to like this pick, but it is also fair to say that it hasn’t been celebrated like a number one draft pick typically is.

Decision by Committee

The good news is that Kevin Warsh will be a starter from day one. He knows the offense and the defense and has been battle-tested given his tenure at the Fed during the Great Financial Crisis and the concomitant Great Recession. There won’t be much of a learning curve, other than the brief time it takes to helm the FOMC meetings and conduct his press conference.

Reports suggest he is interested in being a change agent for the Fed. What that ultimately means remains to be seen, yet past comments suggest he is not a proponent of excessive quantitative easing and rock-bottom interest rates.

The latter would seemingly put him at odds with President Trump, but the market knows full well the president wouldn’t have made this selection if he wasn’t assured that Mr. Warsh would advocate for a lower policy rate. That said, President Trump said in a press conference that he did not ask Kevin Warsh to commit to lower rates, because that would be “inappropriate,” but that he thinks Kevin Warsh will lower rates anyway.

That begs the reminder that the Fed Chair himself doesn’t lower rates. It is a decision by committee, with the majority dictating the path of the policy rate. So, if Mr. Warsh is going to lower rates, he will need to be persuasive with his argument as to why the Fed should lower rates.

If things go smoothly during the confirmation process, Mr. Warsh would be Fed Chair for the June 16-17 FOMC meeting. Jerome Powell’s term as Fed Chair ends in May, but he retains the right to finish his term as a Fed Governor, which ends January 31, 2028. He has not made it known yet if he will continue as a Fed Governor after his term as Fed Chair ends.

That’s an interesting subplot. Another interesting subplot is that Senator Thom Tillis (R-NC), who sits on the Senate Banking Committee, has declared that he will oppose any nominee until the DOJ investigation into the Fed is concluded.

Briefing.com Analyst Insight

The market, though, seems to have concluded that the selection of Mr. Warsh is arguably the least threat to the Fed losing its independence. We say as much, knowing that, following his selection, a red-hot metals trade imploded (silver futures dropped more than 30%), that longer-dated Treasuries were little changed, that the dollar strengthened, and that stocks languished more in response to earnings news and valuation concerns than anything else.

If it was thought that Mr. Warsh would be at the Fed only to do the president’s bidding, as was thought to be the case with Kevin Hassett, long-term rates likely would have risen appreciably and the dollar would have weakened.

In a certain respect, we see it as a healthy development that the stock and bond markets in particular didn’t overreact to the news of Mr. Warsh’s nomination. The same can be said for the fed funds futures market, which had been pricing in the likelihood of two more rate cuts before the end of the year and continues to after this news, without any big swings in the probabilities underlying those expectations.

In one sense, these markets recognize that Mr. Warsh isn’t necessarily going to be doing their bidding either and that the notion of a Fed put has softened a bit given his seeming aversion to falling back on QE so readily during times of distress.

Nevertheless, if/when Kevin Warsh steps into his role as Fed Chair, he will do so carrying the label of being a “dove.” That is inevitable given the president’s current stance on interest rates and his desire to name a Fed Chair who favors lower interest rates.

That should placate the market for the time being, but a stronger judgment will be reserved for when Kevin Warsh takes over the starting job as the number one draft pick, who always faces exceedingly high expectations. The combine is over, training camp starts now, and the season begins in June.

—Patrick J. O’Hare, Briefing.com

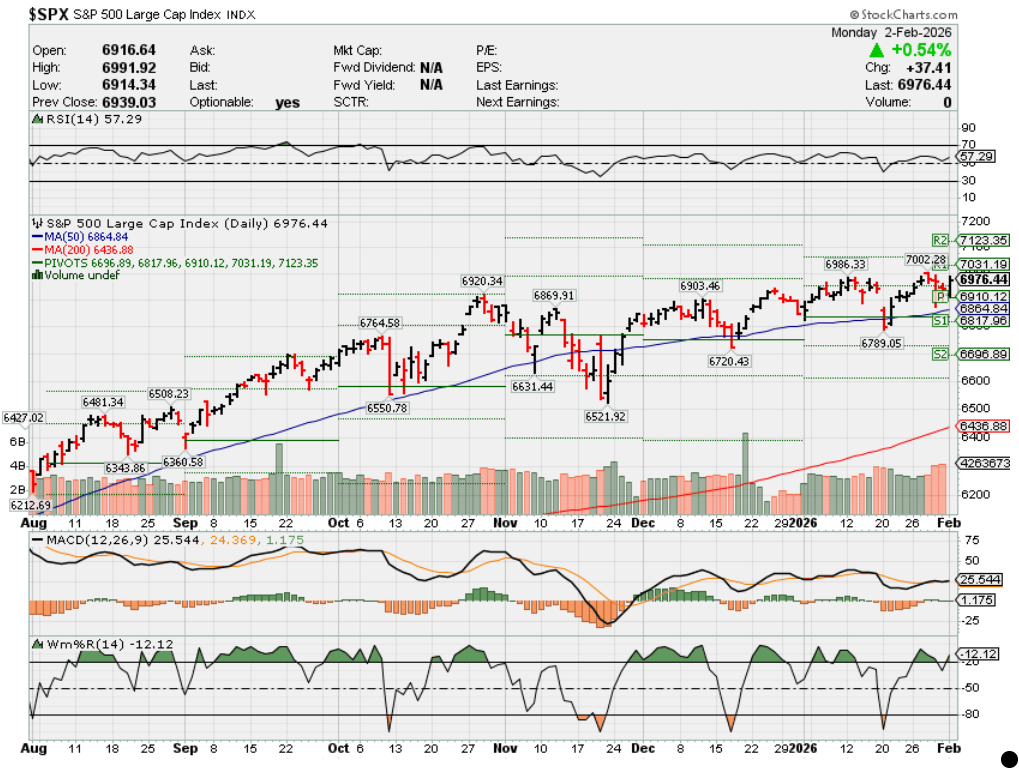

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end Feb 2026?

02-02-2026 +1.5%

Earnings:

Mon: DIS, PLTR

Tues: MRK, PFE, AMGN, CLX, EA, SWKS, CB

Wed: BSX, CME, PSX, UBER, YUM, QCOM, SNAP, JCI, GOOGL

Thur: BMY, CAH, COP, EL, RL, TPR, AMAZN, MSTR

Fri: PM

Econ Reports:

Mon: ISM Manufacturing,

Tue JOLTS

Wed: MBA, ISM Services, ADP

Thur: Initial Claims, Continuing Claims,

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Michigan Sentiment, Consumer Credit,

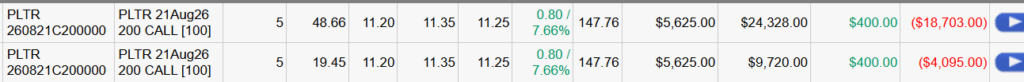

How am I looking to trade?

Protected for earnings

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Zelenskyy lays into ‘lost’ Europe for trying to ‘change’ Trump and not dealing with global threats

Published Thu, Jan 22 202610:31 AM ESTUpdated Thu, Jan 22 202612:39 PM EST

Lucy Handley@in/lucy-handley-b2b0a61a/@lucyhandley

Key Points

- Ukraine’s president, Volodymyr Zelenskyy, has attacked Europe as weak in the face of the U.S. and President Donald Trump.

- In a strongly worded address at the World Economic Forum in Davos, Switzerland, on Thursday, he said the bloc looked “lost.”

- Zelenskyy also revealed there would be trilateral meetings in the United Arab Emirates on Friday and Saturday between Ukraine, Russia and the U.S. over ending the war in his country.

Ukraine’s president, Volodymyr Zelenskyy, has accused Europe of being “lost” and trying to convince U.S. President Donald Trump to help them, rather than uniting to defend itself.

“Instead of taking the lead in defending freedom worldwide, especially when America’s focus shifts elsewhere, Europe looks lost trying to convince the U.S. president to change,” he said in a strongly worded address at the World Economic Forum in Davos, Switzerland, after nearly four years of war with Russia.

“President Trump loves who he is, and he says he loves Europe, but he will not listen to this kind of Europe,” Zelenskyy said. He had met Trump in private shortly before his speech.

“Europe still feels more like geography, history, a tradition, not a real political force, not a great power,” Zelenskyy added.

“Some Europeans are really strong, it’s true, but many say ‘we must stand strong’, and they always want someone else to tell them how long they need to stand strong, preferably until the next election.”

Trump and Zelenskyy hold talks in Davos: ‘We had a good meeting’

Zelenskyy also revealed there would be trilateral meetings in the United Arab Emirates on Friday and Saturday involving Ukraine, Russia and the U.S. He added the Russians “have to be ready for compromises” for the war to end.

‘Nothing has changed’

In a week where the focus in Davos has been on U.S. threats to annex Greenland, its tariffs on European countries and a new Gaza “Board of Peace,” Zelenskyy began his speech saying Europe’s inaction left his country feeling like it was living through “Groundhog Day.”

Zelenskyy said: “Just last year here in Davos, I ended my speech with the words, ‘Europe needs to know how to defend itself.’ A year has passed and nothing has changed. We are still in a situation where I must say the same words.”

“When united, we are truly invincible, and Europe can and must be a global force, not one that reacts late,” he added.

Trump’s maneuvering on Greenland was the backdrop to many politicians’ speeches at the gathering. Zelenskyy criticized the small number of soldiers NATO countries sent to the Arctic island amid Trump’s threats.

“If you send 30 or 40 soldiers to Greenland, what is that for? What message does it send? What’s the message to Putin? To China? And even more importantly, what message does it send to Denmark?

“You either declare that European bases will protect the region from Russia and China …. or you risk not being taken seriously, because 30 or 40 soldiers will not protect anything.”

Other pressing issues have been sidelined while European leaders were “waiting for America to cool down” on Greenland, Zelenskyy suggested.

“There was so much talk about the protests in Iran, but they drowned in blood. The world has not helped enough the Iranian people,” he said.

Meta’s Mark Zuckerberg gets green light from Wall Street to keep pouring money into AI

Published Wed, Jan 28 20267:43 PM EST

Updated Thu, Jan 29 20268:28 AM EST

Jonathan Vanian@in/jonathan-vanian-b704432/

Key Points

- Mark Zuckerberg plans to ramp up Meta’s artificial intelligence-related spending in the new year, even with a strategy that’s appeared scattershot relative to competitors.

- Although investors have previously expressed concern about Meta’s AI spending spree, they took comfort in the company’s latest results, which were driven by online ads.

- Zuckerberg on Wednesday said Meta will keep investing in “infrastructure to train leading models and deliver personal super intelligence to billions of people and businesses around the world.”

Meta CEO Mark Zuckerberg plans to ramp up his company’s spending on artificial intelligence in 2026. Wall Street seems fine with that strategy.

In its fourth-quarter earnings report Wednesday, Meta beat on the top and bottom lines while also revealing that its AI-related capital expenditures this year will be between $115 billion and $135 billion. That’s nearly twice the amount Meta spent on capex last year, when the company revamped its AI unit.

Although investors have previously expressed concern about Meta’s AI spending spree, they took comfort in the company’s latest results, which showed 24% year-over-year revenue growth, driven by online ads. Meta shares, which trailed the market last year, popped as much as 10% in after-hours trading.

“As we plan for the future, we will continue to invest very significantly in infrastructure to train leading models and deliver personal super intelligence to billions of people and businesses around the world,” Zuckerberg told analysts during the earnings call.

Zuckerberg was referring to Meta’s ambitious data center build-outs intended to anchor both current and future AI projects.

Meta finance chief Susan Li told analysts that the company continues to be “capacity constrained,” meaning it needs more computing power to further improve its core ad business while also providing its AI team the necessary resources to create more advanced models and products.

“Our teams have done a great job ramping up our infrastructure through the course of 2025, but demands for compute resources across the company have increased even faster than our supply,” Li said.

Zuckerberg said 2026 will be a major year for AI, with Meta’s investments geared toward supporting his mission for “building personal super intelligence.”

Whether Meta will have much by way of new AI products that can generate revenue remains a major question, and one Zuckerberg hasn’t clearly answered.

“I mean, we’re going to roll out new products over the course of the year,” Zuckerberg said on the call. “I think the important thing is, we’re not just launching one thing, and we’re building a lot of things.”

Perhaps Zuckerberg’s biggest swing last year was the $14.3 billion investment in Scale AI, which brought founder and CEO Alexandr Wang and some of his top engineers and researchers to Meta. Wang is now leading Meta’s TBD AI unit, which has been testing a new frontier model code-named Avocado that’s intended to be a successor to the company’s Llama family of models, CNBC reported.

“I expect our first models will be good but, more importantly, will show the rapid trajectory that we’re on,” Zuckerberg said Wednesday. “And then I expect us to steadily push the frontier over the course of the year as we continue to release new models.”

Asked on the call why Meta needs to develop its own powerhouse AI foundation model, Zuckerberg said it’s important because Meta is a “deep technology company.”

Meta can’t risk being “constrained to what others in the ecosystem are building or allow us to build,” he said, adding that controlling a model allows you to help “shape the future of these products.”

In the meantime, online advertising still accounts for the overwhelming majority of Meta’s revenue. As long as that business continues to dominate in mobile, exceed expectations and throw off billions of dollars of cash a quarter, Zuckerberg is likely to get plenty of leeway to pursue his AI ambitions.

Financial guru, Tucker Carlson discuss what really is causing Americans to be shackled by high prices

Investor Peter Schiff told Daily Caller News Foundation co-founder Tucker Carlson on Monday that the amount of money printed by the government has caused Americans to suffer from inflation.

During an appearance on “The Tucker Carlson Show,” Schiff blamed inflation on the government for expanding credit and the money supply, stating that it is “obvious” that the Federal Reserve is causing rising prices. He argued that prices began to surge under President Donald Trump’s first term and continued to escalate under former President Joe Biden due to the massive spending during the COVID pandemic and other massive spending packages, such as the Inflation Reduction Act.

“The real reason for getting out of the dollar is we’re going to destroy its value. We have these runaway deficit spending that is the source of all the inflation that we have. It’s the Fed monetizing the debt that the government is creating,” Schiff said. “A lot of people don’t know what inflation is. They just think it’s prices going up because that’s what the governments tell them or some economists tell them. But prices going up are a consequences of inflation. They’re not inflation. Inflation is an expansion of the supply of money and credit. And when you expand money, you expand credit, that bids up prices.”

Schiff said the government needs inflation to raise revenue and pay off its debts, adding that they make up all sorts of reasons why inflation is a necessity. He told Carlson that the Federal Reserve’s rationale is that inflation is needed because people will not buy if prices get too low, which Carlson called “deranged.”

“I’m not questioning your knowledge, which is obvious, it’s on display, but is that actually their rationale? Because that’s so deranged that I have trouble believing it,” Carlson said.

“I know, that’s how stupid they think we are,” Schiff added.

Schiff also disputed the claim that businesses make more money when prices rise and argued that no one can work at the Federal Reserve if they have any common sense. He also argued that inflation spiked to record-highs because of the stimulus checks handed out during Trump’s first term and because the Federal Reserve continued to print money “like crazy” during the Biden administration, despite people not working during the pandemic.

“When we got COVID in 2020, the government basically implemented the most inflationary combination of monetary and fiscal policy that I have ever seen … When COVID hit, we shut down the economy. We told people, ‘don’t go to work, stay at home, don’t produce anything.’ But then we said, ‘but don’t stop shopping.’ So, everyone’s gonna get a bunch of money. We had the paycheck protection, we had these enhanced unemployment benefits, we ran massive deficits. The Fed printed money like crazy, we doubled the Fed’s balance sheet from like $4 trillion to $8 trillion. Everybody stayed home and got money to spend. So we had all this money to spend, but we weren’t making anything,” Schiff added. “And so I knew that the consequence of that was gonna be soaring prices.”

Prices rose more than 20% during Biden’s term in office, jumping from 1.4% at the beginning of Biden’s presidency to its peak of 9% and finally falling below 3% for the first time in two years in July 2024. Many economists blamed the soaring inflation on the Biden administration spending $1.9 trillion and $750 billion on the American Rescue Plan and the Inflation Reduction Act at the beginning of his administration.

The economy remains a top issue for American voters and helped Trump get reelected in the 2024 election. Both Democrats and the Trump administration have prioritized affordability as a central campaign issue ahead of the 2026 midterms.

Trump’s approval on the economy has fallen since the 2024 election, which stands at an average of -13.6 points, according to RealClearPolitics. Affordability messaging was largely credited with helping Democrats, including Virginia Gov. Abigail Spanberger and New Jersey Gov. Mikie Sherril, win their elections in November 2025.

Trump is due to speak about the economy in Iowa on Tuesday.

Cetera Fined $1.1 Million Over Supervisory, Anti-Money Laundering Lapses

January 20, 2026

The Financial Industry Regulatory Authority censured and fined independent broker-dealer Cetera Financial Group $1.1 million over lapses in its supervisory system and anti-money laundering program.

From March 2019 to August 2021, three subsidiary broker-dealers—Cetera Advisors, Cetera Wealth Services and Cetera Investment Services—failed to identify, investigate and report potentially suspicious transactions in millions of shares of low-priced securities, Finra said in a settlement letter finalized on Friday.

The Cetera firms did not follow up on signs of market manipulation, including when customers’ trading activity represented a large portion of a stock’s daily trading volume, the customers were acting as promoters for the issuers or customers with limited or no other assets at the firm deposited large amounts of penny stocks, according to Finra.

For example, Cetera Advisors in 2019 failed to flag an instance where three ostensibly unrelated customers deposited and immediately began liquidating over 100 million shares of an over-the-counter stock in a way that signaled manipulative trading.

In 2020, a Cetera Wealth Services client deposited 75,000 shares of a low-priced security and sold them less than two weeks later despite the customer acknowledging that they were a promoter for the issuer, according to the settlement. Cetera did not investigate or review the issues until its clearing firm inquired about the account, according to Finra.

During the two-year period, Cetera customers had sold around 800 million shares of penny stocks, according to Finra. Those trades represented around a tenth of each firm’s total revenue.

Finra said the Cetera firms violated its Rule 3110 requiring supervisory systems that are designed to achieve compliance with securities laws and its catch-all Rule 2010 requiring high standards.

Separately, Finra said Cetera Advisors from 2017 to 2021 failed to reasonably supervise the creation and distribution of consolidated financial reports for customers and to preserve tens of thousands of these reports in violation of books-and-records requirements, according to the settlement. Cetera brokers created consolidated performance reports for customers that included assets held away and manually entered the value of some of those assets, according to Finra. Cetera did not check to confirm the accuracy or fairness of the values that the brokers input, the regulator said.

Cetera Advisors in 2021 updated its supervisory system, including its written supervisory procedures, to address issues concerning its consolidated reports, according to the settlement.

Cetera Financial Group, which has around 11,400 advisors at its four broker-dealer subsidiaries, accepted the censure and fine without admitting or denying Finra’s allegations. The firms also agreed to fix supervisory deficiencies and develop and implement compliant written AML programs within 180 days.

“The issues identified have already been remediated, and we have further strengthened our supervisory and compliance programs since that time,” a spokesperson for Cetera said in a statement. “We take our regulatory responsibilities seriously and continue to invest in robust controls to support our advisors and protect clients.”

Here are the five key takeaways from Wednesday’s Fed rate decision

Published Wed, Jan 28 20264:59 PM EST

Jeff Cox@jeff.cox.7528@JeffCoxCNBCcom

The Federal Reserve wrapped up a two-day policy meeting Wednesday, delivering pretty much what the market expected and no major surprises from Chair Jerome Powell’s news conference. Here are five things worth remembering:

- The decision: To no one’s surprise, the rate-setting Federal Open Market Committee held its benchmark funds rate in a range between 3.5%-3.75%. The move broke a string of three straight cuts and could be a harbinger of a central bank not of a mind to ease again anytime soon.

- The dissents: As has been the custom for the past six months or so, multiple committee members broke ranks. This time, Governors Stephen Miran and Christopher Waller wanted another quarter percentage point cut. For Miran, though, it represented a bit of a turn as he deviated from three prior dissents in favor of half-point reductions.

- Powell’s post-meeting news conference was, in a word, a snoozer. On five separate occasions, the chair delivered variations on “I have nothing for you on that” to questions from reporters looking to bait him into commenting on the multiple political kerfuffles surrounding the Fed. Asked for the advice he would give his successor, Powell responded, “Stay out of elected politics.”

- From an economic standpoint, the FOMC statement and Powell’s commentary reflected expectations for solid growth, a near-term tariff-fueled boost for inflation that ultimately will recede, and a labor market in stasis as the labor force participation rate plus less immigration keep hiring in check while layoffs are also muted.

- And the markets yawned. With little to go on, the major stock averages closed little changed. Traders are still pricing in about a 60% chance of two additional, quarter percentage point rate cuts this year.

What they’re saying

“The Fed delivered a rate cut, but it arrived in a somewhat hawkish package. The Fed hasn’t shut the door on further cuts, but Chair Powell has raised the bar for further action. We expect the economy to grow at a solid pace next year, but it must be accompanied by job gains. The next round of jobs data may point to the exact opposite.” — Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management.

“It’s détente at the Fed for now. But a shakeup is coming with the new Fed Chair in May.” — Heather Long, chief economist at Navy Federal Credit Union.

“Perspectively speaking, we saw this meeting as an affirmation from the Fed of what investors were already thinking. Labor conditions are not worsening, growth has accelerated and inflation has steadied for now. To put it in other words, policy rates are much closer to neutral against the current backdrop and it’s time for a long pause.” — Charlie Ripley, senior investment strategist for Allianz Investment Management.

Highly successful people do 3 things that many neglect, says Harvard career expert

Published Mon, Jan 26 202610:12 AM EST

Gorick Ng, Contributor@GorickNg

The minute you step into an interview or new role, everyone around you will start asking themselves three questions:

- Can you do the job well?

- Are you excited to be here?

- Do you get along with us?

Your job is to convince your interviewer, manager, and coworkers that the answer to all three questions is a resounding “Yes!”

As a Harvard career advisor who’s worked with thousands of early career professionals, I know that when you demonstrate all three Cs — competence, commitment, compatibility — you’ll unlock opportunities and accelerate your career. Fail to master them and you’ll find yourself getting looked over for projects, promotions, and full-time job offers.

In my experience, highly successful people:

1. Demonstrate competence

Competence means you can do your job fully, accurately, and promptly without needing to be micromanaged — and without making others look bad. This means not undershooting to the point of looking clueless and not overshooting to the point of looking overbearing. Try:

- Taking ownership: Don’t stop at “What do I do next? Help!” Share your thought process, your proposal, or your point of view.

- Minimizing errors: Don’t just submit your first draft. Double-check your work for typos, miscalculations, and formatting inconsistencies first.

- Managing expectations: Don’t say “yes” and then forget what you promised. Do what you said you’d do. And if you can’t, deliver bad news early.

True competence can be difficult to measure. Managers often rely on proxies like how much progress it looks like you are making on a project, how confidently you speak in meetings, and how well you promote yourself. Your actual competence matters, but your perceived competence can be just as important, especially if your daily output is hard to quantify.

Ask yourself: Compared to others around me, especially those near or at my level, am I being complete, thorough, and responsive?

2. Show commitment

Commitment means you are fully present and eager to help your team achieve its goals, but not so eager that you put others on the defensive. This means not undershooting to the point of looking apathetic and not overshooting to the point of looking threatening. Try:

- Being present: Ahead of meetings, brainstorm questions you might be asked and show up with a point of view (or at least a notebook to take notes).

- Replying promptly: Don’t wait until you’re done with your work to let others know. Reply at least as quickly as others around you (or let people know if you need more time).

- Showing curiosity: Don’t say “nope!” when someone asks if you have any questions. Share what you already know — and then ask a question that can’t be easily answered with an online search.

Perception and reality don’t always align. Little actions like showing up late, looking away on video chat, not volunteering for tasks, not speaking up enough, or not replying to emails as quickly as your coworkers do can be enough to cast doubt on how committed you are.

Ask yourself: Compared to others around me, especially those near or at my level, am I being proactive and present?

3. Aim for compatibility

Compatibility means you make others comfortable and eager to be around you — without coming across as inauthentic or trying too hard. This means not undershooting to the point of looking passive and not overshooting to the point of looking like a poser. Try:

- Building relationships: Don’t just do your work. Introduce yourself and show an interest in people.

- Showing deference: Don’t just say anything to anyone at any time. Uncover the unspoken hierarchy of your new team and approach those higher up with an extra dose of seriousness.

- Uncovering norms: Don’t assume the working style of your last job will work for this one. Show an interest in adapting to how the team operates.

What’s challenging about compatibility is that it depends on whom you’re with and what norms and unconscious biases they have. People like people who are similar to themselves, so they tend to hire, hang around, and promote those who look like, talk like, and have the same backgrounds and interests as they do.

Ask yourself: Am I adopting the behaviors I see that feel authentic to me?

The workplace is not a level playing field

For some, competence is expected; for others, incompetence is expected. For some, commitment is assumed; for others, it’s questioned. For some, compatibility is effortless; for others, it’s tiresome.

If you’re joining a team where people are different from you — in terms of race, ethnicity, socioeconomic background, gender, sex, sexual orientation, dis/ability, religion, age, degree of introversion or extroversion, or other characteristics — then your identity can influence how others judge your three Cs.

Women, for example, often walk a tightrope of needing to be both likable and competent. Black people tend to be more closely monitored at work than white people are. And people with easy-to-pronounce names tend to be evaluated more positively than people with difficult-to-pronounce names.

Is this fair? No. Do we need a better system? Yes. Might we have a better system by the time you start your job? If only.

Until that better world arrives, knowing the three C’s can help you diagnose what’s happening around you and arm you with the tools to become the professional you have the potential to be.

Gorick Ng is the Wall Street Journal bestselling author of ”The Unspoken Rules: Secrets to Starting Your Career Off Right″ and the How to Say It® flashcards for professional communication. He’s a first-gen professional turned Harvard career advisor turned keynote speaker across the Fortune 500.

Join Make It’s book club discussion! Request to join our LinkedIn group, drop your questions for the author in the comments of this post, and come chat with us and Gorick Ng on Wednesday, January 28, at 10 a.m. ET.

Excerpt adapted from ”The Unspoken Rules: Secrets to Starting Your Career Off Right.” by Gorick Ng (and ”The 3 C’s: The Unspoken Rules of Career Success″). Copyright © 2021. Reprinted with permission. All rights reserved.

Intermountain Health freezes pension plans. What does it mean for employees?

By Art Raymond, Deseret News | Posted – Jan. 31, 2026 at 5:02 p.m.

Primary Children’s Hospital celebrates the opening of the new Autism Clinic for kids at the Intermountain Riverton Hospital, on April 8. The health care provider announced its intention to freeze its pension plans last week. (Scott G Winterton, Deseret News)

- Intermountain Health will freeze its pension plans by Dec. 31, 2026, it announced last week.

- The decision affects a third of 68,000 employees in six Western states.

- Funds saved will enhance 401(k) contributions and a new Retiree Medical Savings Account.

SALT LAKE CITY — Utah-based Intermountain Health announced last week that it plans to bring its long-running pension program to an end. The move puts the health care services giant into a group that includes an overwhelming majority of U.S. companies that have phased out pensions over the past few decades in favor of contribution-based retirement plans.

The company cited “ongoing financial pressures, including lower government payments, inflation, and major market volatility” as factors behind the decision by Intermountain Health’s board of trustees to freeze the plan.

“The decision comes after careful evaluation and supports both Intermountain’s long-term stability and the retirement security for current and past caregivers,” the announcement on its website reads.

In an email interview, Intermountain told the Deseret News its pension plan is as old as the company itself, launching in 1975. Beginning in the early 1990s, the health care services provider started offering both a 401(k) plan and a pension plan, but the pension option closed to new employees in 2020, and currently only a third of the company’s 68,000 employees in six Western states are eligible for pension benefits.

What one doctor says

An Intermountain physician, who asked not to be identified, told the Deseret News that none of the pension-eligible employees, which include administrators, are really happy about the decision but are at a loss as to what to do about it.

The doctor noted that tens of thousands of employees are impacted by the change, and those workers stand to lose hundreds of thousands of dollars in future earnings. The physician also highlighted that pension benefits were “heavily advertised and promised” as part of Intermountain’s previous recruitment efforts.

Intermountain officials said the entirety of pension benefits earned by eligible employees up to the end of the year will be protected, and those funds will earn interest until payout.

“The pension benefit employees have earned up to the freeze date (Dec. 31, 2026) will be preserved. This means the benefit — or money — they’ve already earned will not be lost,” Intermountain wrote in response to a Deseret News inquiry. “Those earned pension benefits remain legally protected, backed by federal law under (the Employee Retirement Income Security Act of 1974), and held in a trust that prevents the money from being touched or redirected for anything other than payment of future pension benefits to caregivers.

“Employees’ pension will remain part of their total retirement benefit and will be paid to them when they leave Intermountain Health or when they are eligible to retire, based on the plan rules.”

Intermountain says the vast majority, about 97%, of U.S. health care organizations only offer 401(k) retirement plans, and the decision to freeze the pension offering was the result of “a long and careful review of all options to ensure we are making the best possible choice for caregivers and the organization’s future.”

What’s behind the demise of the pension?

Pension plans were once a cornerstone of the American career journey, promising loyal, long-term workers a secure retirement through company-funded savings paid out as monthly checks.

But starting in the 1980s, U.S. companies began phasing out pension programs, also known as defined benefit plans, as a cost-saving measure. The paradigm shift was eased by the freshly created 401(k) plan, a provision of the Revenue Act of 1978, that created a new pathway for employees to invest a portion of their compensation before taxes are assessed.

David McEntire, senior financial planner for Deseret Mutual Benefit Administrators, said the primary differences between defined benefit programs, like pension plans, versus defined contribution plans, like a 401(k), are a transfer of both risk and the majority of the costs from employer to employee.

“In a defined benefit plan, the employer makes all of the contributions, and they take on all of the investment risk with the expectation that (the employee) has a guaranteed payout when they reach retirement,” McEntire said in a Deseret News interview.

“In a defined contribution plan, the majority of the contribution is coming from the participant or employee with some matching contributions, in some cases, from the employer. And in the defined contribution, the employee is taking on all of the investment risk.”

Intermountain declined to share how much money it would save as a result of freezing the pension program but offered some insight into how those funds would be redeployed.

“Some of these funds will be redirected to alternative employee benefits, including adding the new 2% automatic retirement contribution to the 401(k), and offering the new Retiree Medical Savings Account for caregivers who previously participated in the pension plan,” the company said. “Remaining funds will be used to help care for our patients.”

McEntire noted that, unlike company pensions, defined contribution retirement plans like a 401(k) are portable, meaning they follow the contributor in the event of a job change.

McEntire also underscored the importance of seeking out professional financial consultation for those facing an unexpected change in retirement plans.

Intermountain noted that its 401(k) program offers employee contribution matching up to 4% and is offering support services to those who will be migrating from the pension plan. Those services, according to the company, will include a series of financial planning webinars; opportunities for one-on-one retirement consultations; access to a tool that will help employees calculate benefits following the pension freeze; and other financial and personal well-being services.

Intermountain Health, a nonprofit organization, operates 33 hospitals and over 400 clinics in Utah, Idaho, Nevada, Colorado, Montana and Wyoming.

The Key Takeaways for this article were generated with the assistance of large language models and reviewed by our editorial team. The article, itself, is solely human-written.