What happened today?= Threat of Tariff because of Greenland BUT Denmark Dumping 100 Billion of US Treasuries

Governments can only borrow from/against US treasuries

IF all of Europe was to do this then we would have a VERY hard time selling our treasuries

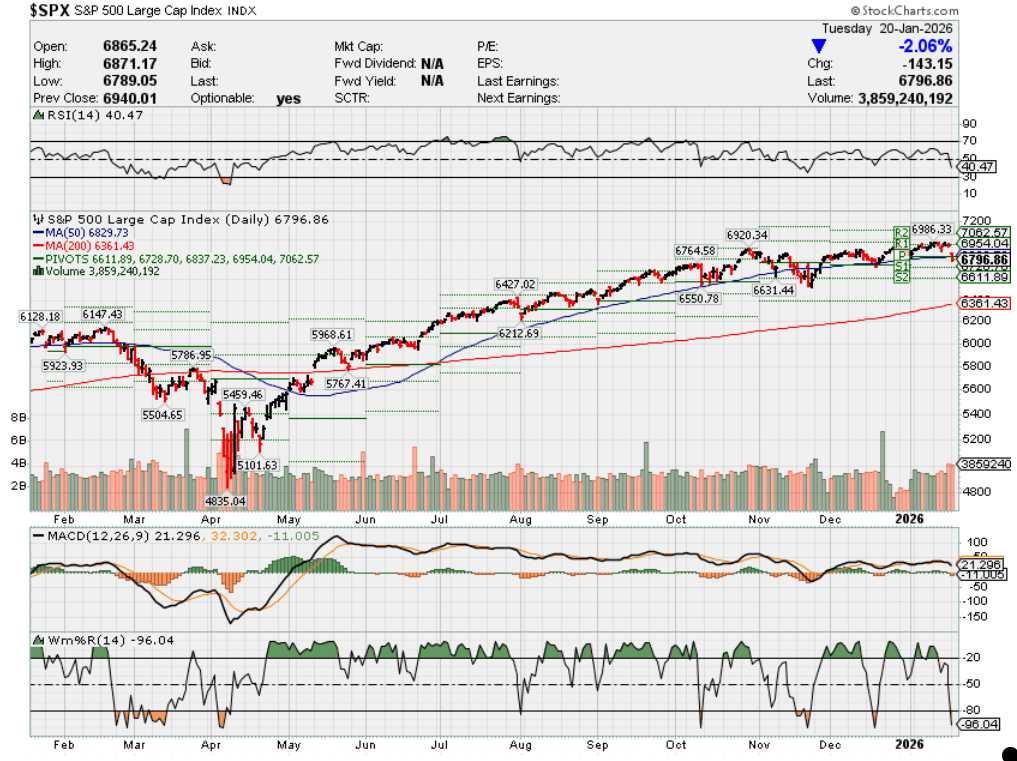

The market is looking for a reason to pullback

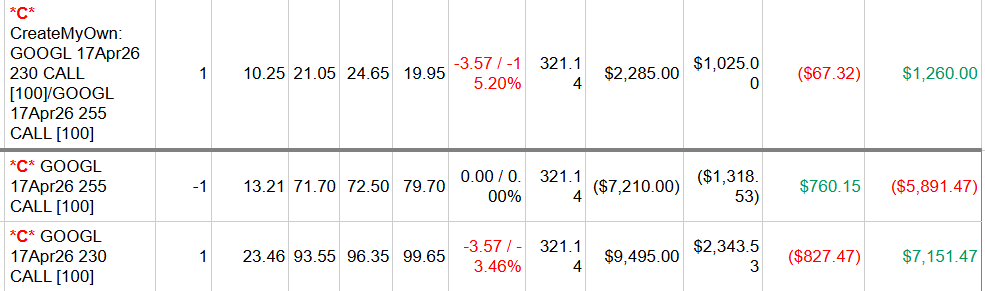

We were mostly protected already for earnings

We took huge profits last year were sitting in stock replacement strategies with protection already on

We did Add $110 DIS Puts, NVDA $180 Puts, PLTR $165 Puts OTM very close to real Cost Basis

Meta 615, GOOGL 340 Mar covered calls 16.50, BA 240 puts, Appl 260 puts, Key 21 puts, V

The economy is broadening out with investments moving from technology to other areas

We like AAPL, BA, DIS, GOOGL, JPM, KEY, META, MU, NVDA, PLTR, UAA, V, WMT

BA, PLTR & UAA Are my wildcards

Stocks to Double in Value = KEY, BA, NVDA, UAA

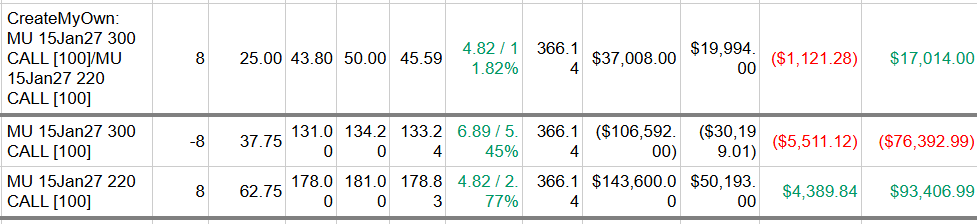

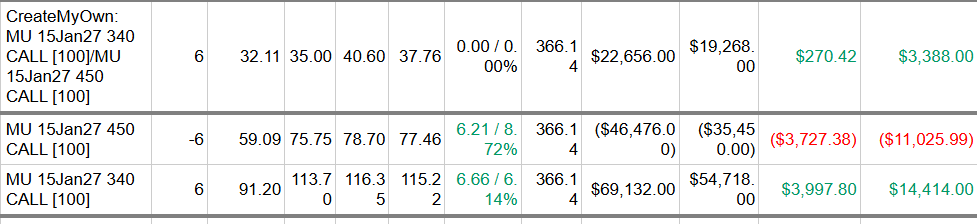

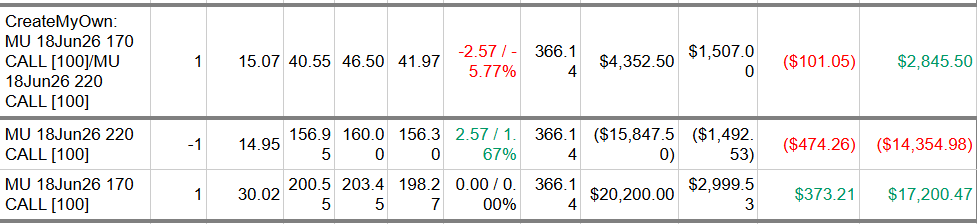

Let’s talk stock replacement and why we are working on moving to that within portfolios:

We took huge profits last year and we are ready to take more profits this year: BAC already and GOOGL Soon

We are taking risk out of your portfolios because we feel the start of 2026 could be a huge correction in our markets

Could we just add puts? YES but then we don’t make up every penny on the way down and we still lose some value in portfolios

Stock replacement strategies: Leap Long Calls or Leap Bull Calls

Leap long Call = Right to buy a stock at a certain price for a certain period of time

Unlimited upside but no protection unless we add some long puts

Leap Bull Call = Both Long call and a SHORT CALL

Long Call = Right to buy a stock at a certain price for a certain period of time = Debit

Short Call = Obligation to Sell a stock at a certain price for a certain period of time = Credit

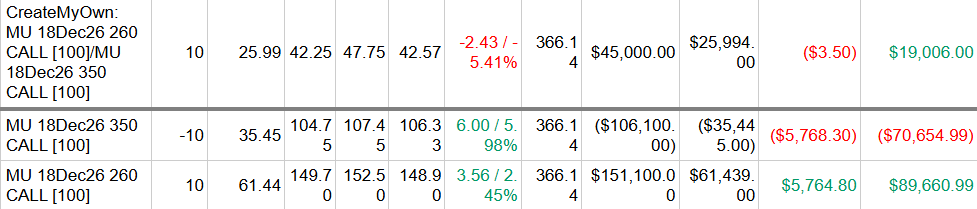

We currently have 250/300, 230/300 Bull calls for MU in place

Earnings

AAPL 01/29 AMC

BA 01/27 BMO

BIDU 02/18 est

DG 03/12 est

DIS 02/02 BMO

F 02/10 AMC

GE 01/22 BMO

GM 01/27 BMO

GOOGL 02/02 AMC

LMT 01/29 BMO

MA 01/29 BMO

META 01/28 AMC

MSTR 02/05 AMC

MU 03/18 est

NFLX 01/20 AMC

NVDA 02/05 AMC

O 02/23 est

PLTR 02/02 AMC

TXN 10/21 AMC

UAA 02/06 BMO

V 01/29 AMC

VZ 01/30 BMO

WMT 02/19 BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 09-Jan-26 11:04 ET | Archive

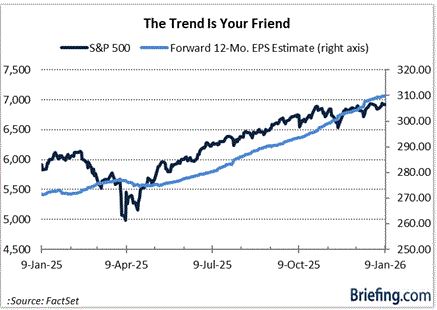

A lot is riding on the earnings estimate trend

Briefing.com Summary:

*Fourth-quarter earnings expectations are high, led by technology, with S&P 500 growth projected at 8.1% and estimates rising, not falling.

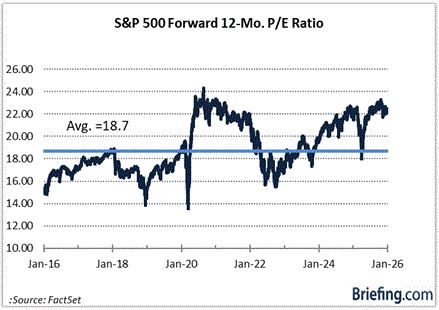

*Market valuation is stretched, making guidance critical; stocks risk selling pressure if outlooks disappoint despite solid reported results.

*Banks may kick off earnings positively, but sustained market gains depend on 2026 earnings growth meeting optimistic forecasts.

The start of 2026 hasn’t lacked excitement on the news front, and it is about to get even more exciting for the stock market when the fourth quarter reporting period begins. Starting next week and continuing through March (yes, March!), there will be a steady stream of earnings results for the December quarter.

The heart of the reporting period will be the late-January to early-February timeframe, but things will get pumping next week when the banks start spreading their news.

Earnings are always important for the stock market, but they are exceptionally important at this juncture, along with the guidance, because nothing other than good news is embedded in the market’s premium multiple.

Looking Good on Paper

The good news, statistically speaking, boils down to this:

- The fourth-quarter blended earnings growth for the S&P 500 is 8.1%, up from 7.2% at the end of September. This will mark the tenth consecutive quarter of earnings growth.

- The vast majority of this growth is expected to be driven by the information technology sector. Its blended earnings growth rate is 25.8%, according to FactSet, which translates into an earnings growth contribution of 6.39 percentage points (pp).

- The next largest contributions are anticipated to flow from the financials (1.21 pp) and communication services (0.65 pp) sectors.

- The consumer discretionary (-0.31 pp), energy (-0.07 pp), health care (-0.03 pp), and industrials (-0.03%) sectors are expected to be drags on the blended earnings growth rate.

- Earnings in the first quarter are projected to increase 13.2%, up from 11.7% at the end of September.

- The forward 12-month EPS estimate is currently $309.80, according to FactSet, up from $292.44 at the end of September.

- The estimated earnings growth rate for CY26 is 15.0%, which is above the trailing 10-year average of 8.6%, according to FactSet, and on pace to be the third consecutive year of double-digit growth.

Everything looks good on paper in terms of earnings. All that has to happen now is for the companies to deliver. This is the part where it seems natural to say, “easier said than done,” only that would be disingenuous. The fact of the matter is that S&P 500 companies, in aggregate, typically exceed the earnings growth forecast going into a reporting period by at least two percentage points.

The nuance is that, sometimes, they are beating lowered expectations. Analysts typically lower their earnings estimates as a quarter unfolds. That hasn’t been the case this time, however. FactSet reports that estimated earnings for the fourth quarter on a per-share basis have increased by 0.4% since the end of the third quarter.

It can be said, then, that the bar for fourth-quarter earnings has been set high. Many companies have high stock prices to show for it, and to be sure, the fall from higher levels hurts more when a company doesn’t live up to expectations. The degree of hurt, however, is proportional to the degree of disappointment when it comes to earnings guidance.

Companies are rewarded or penalized far more on their guidance than their actual results, albeit with some exceptions for companies that don’t provide guidance or that materially underperformed in the quarter being reported.

That is a good segue to the banks and the financial companies. They don’t typically provide specific EPS and revenue guidance, so they will be judged more on their performance in the fourth quarter and comments on industry conditions from management that will be more qualitative in nature.

The good news is that the banks and financial companies are primed to report good news. That is the message emanating from stock prices and industry/sector ETFs, many of which are at, or near, record highs.

There is certainly a sense that capital markets activity is robust, that credit conditions overall are in a good state, and that the economy, bolstered by an easier Fed and fiscal tailwinds, is continuing on a growth trajectory.

Briefing.com Analyst Insight

The reporting period should start on a good note in terms of absolute numbers thanks to the banks, but what remains to be seen is if that good news translates into positive price action or serves as a catalyst for selling into the news.

That is a risk many stocks run with the market, at 22.4x forward 12-month earnings, trading at a 20% premium to its 10-year average. It’s not as much of a risk, however, if the earnings growth materializes as expected.

As it so happens, the S&P 500 traded at 22.4x forward twelve-month earnings as 2025 approached, and the market managed a 16.4% price gain in 2025, with earnings increasing approximately 13%.

Earnings, therefore, drove returns in 2025, garnering some extra support from falling interest rates, deregulation, pro-cyclical fiscal plans, and, of course, easier monetary policy.

Those elements are all up for renewal, so to speak, in 2026, which is why earnings optimism is running high. We should get another taste of the good earnings backdrop in 2025 with the fourth-quarter reports, yet market participants are looking straight ahead at the 2026 outlook.

They like what they see now, but the earnings estimate trend is going to determine just how much they like what they see at year’s end. The road there starts with this reporting period.

—Patrick J. O’Hare, Briefing.com

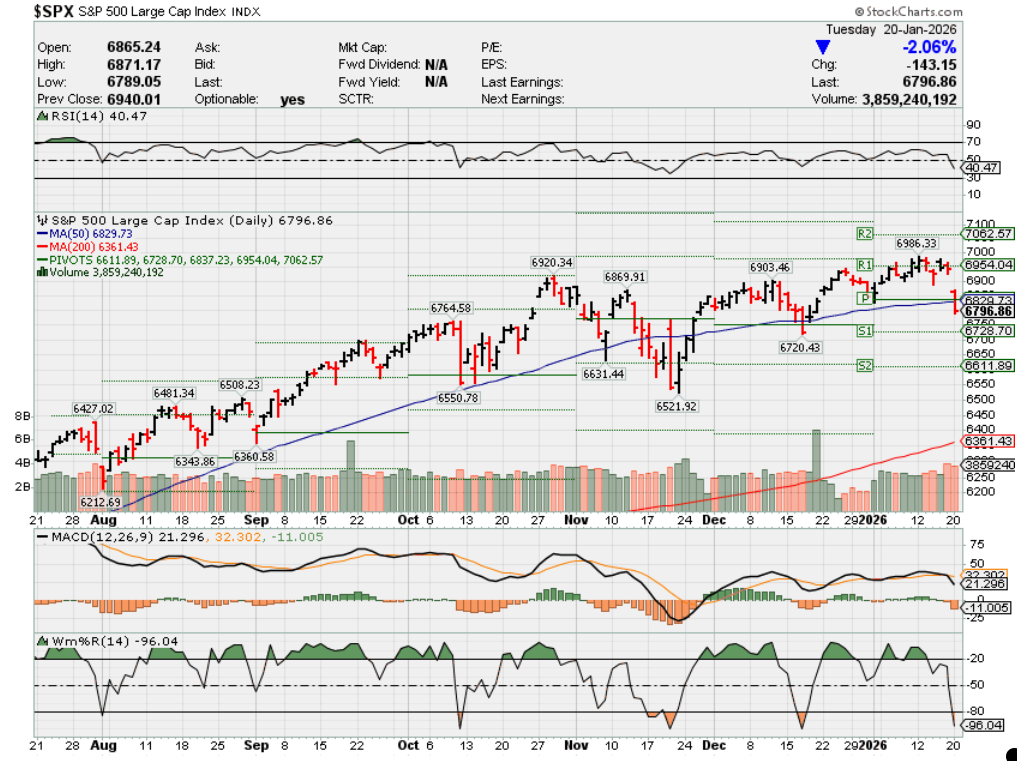

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end Jan 2026?

01-20-2026 +1.0%

01-12-2025 +3.0%

01-05-2025 +3.0%

Earnings:

Mon: Martin Luther King Day

Tues: KEY, DHI, USB, NFLX, ZION, UAL,

Wed: SCHW, HAL, JNJ, KMI,

Thur: GE, PG, AA, COF, CSX

Fri: SLB

Econ Reports:

Mon:

Tue

Wed: MBA, Housing Starts, Building Permits, Pending Homes Sales,

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator,

Fri: Michigan Sentiment

How am I looking to trade?

Time to let things continue to run

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Why Trump wants Greenland — why the White House thinks it’s so important for national security

Published Wed, Jan 7 20262:26 AM ESTUpdated Thu, Jan 8 202611:36 AM EST

Sam Meredith@in/samuelmeredith@smeredith19

Key Points

- Greenland, a vast and sparsely populated self-governing Danish territory, has been thrust into the geopolitical spotlight once again.

- “We need Greenland from the standpoint of national security,” U.S. President Donald Trump told reporters onboard Air Force One on Sunday.

- The president, who has long advocated for control over Greenland, could annex the territory by using military force, according to the White House.

Three key reasons why President Trump wants Greenland

U.S. President Donald Trump is fixated on taking control of Greenland, a vast, sparsely populated and mineral-rich island situated between the Arctic Ocean and the North Atlantic Ocean.

“It’s so strategic,” Trump told reporters onboard Air Force One on Sunday. “Right now, Greenland is covered with Russian and Chinese ships all over the place. We need Greenland from the standpoint of national security.”

His comments, which came hot on the heels of an audacious military operation in Venezuela, sounded the alarm across Europe, with Denmark warning that an American takeover of Greenland would mark the end of the NATO military alliance.

The U.S. president, however, is yet to waver. Indeed, the White House ramped up trans-Atlantic tensions even further on Tuesday, saying that Trump and his team are considering “a range of options” to make the self-governing Danish territory a part of the United States — including “utilizing the U.S. Military.”

Positioned between the U.S. and Russia, Greenland has long been viewed as an area of high strategic importance, particularly when it comes to Arctic security.

The territory of nearly 57,000 people is in close proximity to emerging Arctic shipping routes, with the rapid melting of ice creating opportunities to substantially reduce Asia-Europe travel time when compared with the Suez Canal.

Greenland also sits astride the so-called GIUK Gap, a naval choke point between Greenland, Iceland and the U.K. that links the Arctic to the Atlantic Ocean.

Alongside its strategic geopolitical position, Greenland is known for an abundance of untapped raw materials, from oil and gas reserves to critical mineral deposits and a treasure trove of rare earth elements.

These critical minerals and rare earth elements are vital components in emerging technologies, such as wind turbines, electric vehicles, energy storage technologies and national security applications. China repeatedly sought to leverage its near monopoly of rare earths to exert pressure on the U.S. last year.

“Trump is a real estate guy,” Clayton Allen, head of practice at Eurasia Group, a political risk consultancy, told CNBC by video call.

“Greenland is sitting on some of the most valuable real estate in terms of economic advantage and strategic defense for the next three to five decades.”

Shipping routes

To be sure, the U.S. already has a presence in Greenland. The Pituffik Space Base, formerly Thule Air Base, is located in the northwest of Greenland, just across the Baffin Bay from Nunavut, Canada.

It is estimated that around 150 U.S. service members are permanently stationed there, down from around 6,000 during the Cold War era.

Trump’s Greenland threats sparks European condemnation

“For good reasons, the U.S. has an early warning air base in northwestern Greenland because the shortest route for a Russian ballistic missile to reach the continental United States is via Greenland and the North Pole,” said Otto Svendsen, associate fellow with the Europe, Russia and Eurasia Program at the Center for Strategic and International Studies, or CSIS, a Washington-based think tank.

The base, which also has an active airfield and is home to the world’s northernmost deep-water port, has traditionally been pivotal to the monitoring of Russian submarines traversing the GIUK Gap, Svendsen said.

“A more recent and emerging threat or factor is the fact that Greenland straddles two potential shipping routes through the Arctic, the Northwest Passage and the Transpolar Sea Route,” Svendsen told CNBC by telephone.

“And as climate change continues to render those routes more viable, there are commercial interests there as well that add to the national security value of the island,” he added.

Opinion polls have previously shown that Greenlanders overwhelmingly oppose U.S. control, while a strong majority support independence from Denmark.

‘Golden Dome’

Analysts say Greenland could prove useful to the U.S. as a staging ground for a greater defensive presence and as a location for U.S. missile interceptors — particularly in the context of one of the Trump administration’s key policies: a “Golden Dome” missile defense system.

The multibillion-dollar initiative, rolled out in May last year and often compared to Israel’s “Iron Dome” system, is a visionary plan designed to shield the U.S. from all missile attacks.

Read more

“The U.S. needs access to the Arctic and it doesn’t really have that much direct access today. Greenland has a tremendous amount. The U.S. needs air defenses deployed closer and closer to Russia to combat next-generation weapons that are not currently defensible with what we have available. Greenland provides that,” Eurasia Group’s Allen said.

“Trump wants to build a Golden Dome over the U.S.,” he continued. “Part of that is going to have to depend on Greenland.”

National or economic security?

For some, Trump’s assertion that annexing Greenland is a core part of U.S. national security has raised eyebrows. The declaration marks a notable shift in tone from almost a year ago, when the then president-elect cited “economic security” as a primary factor for annexing the island.

Marion Messmer, director of the International Security Programme at London’s Chatham House think tank, acknowledged that it is true to say that both Russia and China have increased their military activities in the Arctic in recent years — and, if Moscow launched missiles at the U.S., they would likely fly over Greenland.

“However, what is not clear is why Washington needs full control over Greenland to defend itself,” Messmer said in a written analysis published Tuesday.

U.S. actions in Greenland would end transatlantic partnership: EU commissioner

She cited the fact that the U.S. already has a presence at Pituffik Space Base, as well as a decades-old defense agreement with Denmark that allows Washington to continue to use it.

“During the Cold War, the US stationed up to 6,000 troops across a range of camps across the island,” Messmer said. “It could presumably surge troop presence again if it felt it needed a greater presence in the region – without disputing Danish sovereignty.”

Trump says Venezuela to give up to 50 million barrels of oil to U.S.

Published Tue, Jan 6 20266:54 PM ESTUpdated Wed, Jan 7 20266:29 PM EST

Key Points

- President Donald Trump said interim authorities in Venezuela will turn over between 30 million to 50 million barrels of oil to the United States.

- Trump said that the oil will be sold at market price, and the “money will be controlled by me … to ensure it is used to benefit the people of Venezuela and the United States!”

- U.S. crude futures fell 1.3% to $56.39 per barrel after the announcement.

- The Wall Street Journal reported Trump plans to meet with representatives from Chevron, ConocoPhillips, Exxon Mobil and other domestic oil producers at the White House on Friday “to discuss making significant investments in Venezuela’s oil sector.”

President Donald Trump said Tuesday evening that the interim authorities in Venezuela will be turning over between 30 million to 50 million barrels of oil to the United States on the heels of the U.S.’s dramatic ouster of the South American country’s authoritarian leader, Nicolás Maduro.

Trump, in a social media post, said the oil will be sold at its market price, “and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States!”

“I have asked Energy Secretary Chris Wright to execute this plan, immediately,” Trump wrote. “It will be taken by storage ships, and brought directly to unloading docks in the United States.”

Trump said that the oil being turned over the U.S. was “high quality” and “sanctioned.”

U.S. crude futures fell 1.3% to $56.39 per barrel on the heels of Trump’s announcement.

The announcement came three days after U.S. forces captured Maduro and his wife in Caracas and took them to New York, where they are charged in a federal drug-trafficking conspiracy indictment.

The Wall Street Journal reported Tuesday that Trump plans to meet with representatives from the major U.S. oil companies Chevron, ConocoPhillips and Exxon Mobil, along with other domestic producers, at the White House on Friday “to discuss making significant investments in Venezuela’s oil sector.”

Trump has said that U.S. oil companies would end up investing billions of dollars to rehabilitate Venezuela’s aging oil production capabilities.

Chevron currently operates in Venezuela, the only U.S. oil company to do so. The assets of ConocoPhillips and Exxon were nationalized by Venezuela’s then-President Hugo Chávez in the mid-2000s.

Maduro and his wife, Cilia Flores, pleaded not guilty on Monday during their arraignment in U.S. District Court in Manhattan.

During that proceeding, Maduro told Judge Alvin Hellerstein that he had been “kidnapped” and that he was a “prisoner of war.”

Why buying Berkshire was Warren Buffett’s biggest mistake

Published Thu, Dec 25 20258:12 AM ESTUpdated Fri, Dec 26 202510:51 AM EST

In this article

(This is the Warren Buffett Watch newsletter, news and analysis on all things Warren Buffett and Berkshire Hathaway. You can sign up here to receive it every Friday evening in your inbox.)

Why buying Berkshire was Buffett’s biggest mistake

Warren Buffett is going into his last week as CEO of Berkshire Hathaway, the vehicle he has used to generate incredible wealth for himself, and for the company’s loyal longtime shareholders, over the past six decades.

Since he took control in 1965, Buffett has transformed a struggling textile company into a massive conglomerate worth more than $1 trillion.

His Class A shares account for almost all of his estimated total net worth of $151 billion, which puts him in the #10 slot of the Bloomberg Billionaires Index.

He would be No. 2 on that list with roughly $359 billion if he held onto the hundreds of thousands of Berkshire B shares, currently valued at $208 billion, that he’s been giving away since 2006, with more donations to come.

Given all the success he’s had with the company, it may be surprising to hear him call Berkshire “the dumbest stock I ever bought” … a blunder that has cost him hundreds of billions of dollars.

From the deep recesses of CNBC’s Warren Buffett Archive, here’s a rare clip of Buffett in 2010 with an in-depth explanation for Becky Quick of why he never should have bought Berkshire Hathaway and the important lesson he learned from his costly mistake.

BECKY QUICK: All right. Warren, thank you very much for joining us today.

WARREN BUFFETT: My pleasure.

BECKY QUICK: What we’re trying to get to the bottom of is what was the worst trade you ever made and what’d you learn from it?

WARREN BUFFETT: The dumbest thing I ever did? (LAUGHTER)

BECKY QUICK: Yeah, the dumbest thing you ever did.

WARREN BUFFETT: The — the dumbest stock I ever bought — was — drum roll here — Berkshire Hathaway. And — that may require a bit of explanation. It was early in — 1962, and I was running a small partnership, about seven million. They’d call it a hedge fund now.

And here was this cheap stock, cheap by working capital standards or so. But it was a stock in a — in a textile company that had been going downhill for years. So, it was a huge company originally, and they kept closing one mill after another. And every time they would close a mill, they would — take the proceeds and they would buy in their stock. And I figured they were going to close; they only had a few mills left, but that they would close another one. I’d buy the stock. I’d tender it to them and make a small profit.

So I started buying the stock. And in 1964, we had quite a bit of stock. And I went back and visited the management, Mr. (Seabury) Stanton. And he looked at me and he said, ‘Mr. Buffett. We’ve just sold some mills. We got some excess money. We’re going to have a tender offer. And at what price will you tender your stock?’

And I said, ’11.50.′ And he said, ‘Do you promise me that you’ll tender at 11.50?’ And I said, ‘Mr. Stanton, you have my word that if you do it here in the near future, that I will sell my stock to — at 11.50.’ I went back to Omaha. And a few weeks later, I opened the mail —

BECKY QUICK: Oh, you have this?

WARREN BUFFETT: And here it is: a tender offer from Berkshire Hathaway — that’s from 1964. And if you look carefully, you’ll see the price is —

BECKY QUICK: 11 and —

WARREN BUFFETT: — 11 and three-eighths. He chiseled me for an eighth. And if that letter had come through with 11 and a half, I would have tendered my stock. But this made me mad. So I went out and started buying the stock, and I bought control of the company, and fired Mr. Stanton. (LAUGHTER)

And we went on from there.

Now, that sounds like a great little morality table — tale at this point. But the truth is I had now committed a major amount of money to a terrible business. And Berkshire Hathaway became the base for everything pretty much that I’ve done since.

So in 1967, when a good insurance company came along, I bought it for Berkshire Hathaway. I really should — should have bought it for a new entity.

Because Berkshire Hathaway was carrying this anchor, all these textile assets. So initially, it was all textile assets that weren’t any good. And then, gradually, we built more things on to it. But always, we were carrying this anchor.

And for 20 years, I fought the textile business before I gave up. As instead of putting that money into the textile business originally, we just started out with the insurance company, Berkshire would be worth twice as much as it is now. So —

BECKY QUICK: Twice as much?

WARREN BUFFETT: Yeah. This is $200 billion. You can — you can figure that — comes about. Because the genius here thought he could run a textile business. (LAUGHTER)

BECKY QUICK: Why $200 billion?

WARREN BUFFETT: Well, because if you look at taking that same money that I put into the textile business and just putting it into the insurance business, and starting from there, we would have had a company that — because all of this money was a drag. I mean, we had to — a net worth of $20 million. And Berkshire Hathaway was earning nothing, year after year after year after year.

And — so there you have it, the story of — a $200 billion —

Incidentally, if you come back in ten years, I may have one that’s even worse. (LAUGHTER)

BECKY QUICK: If you — if you had to look at a moral for that story, though, is it don’t cut off your nose to spite your face?

WARREN BUFFETT: I would say — I would say that no matter whether you cut off your nose to spite your face or whatever, if you get in a lousy business, get out of it. I mean, it — it was — it was a terrible mistake, just because I drifted into it, in a sense.

And — and I’ve always said that if you want to be known as a good manager, buy a good business. (LAUGHTER)

That’s the way to do it. And everyone will think you’re smart.

And when I’m in a good business, like people think, ‘Boy that guy’s smart.’ And when I’m in a dumb business, like textiles, and don’t know what I’m doing, you know, or shoes later on, or whatever it may be, you know, all that other — if you think you’re a managerial genius, just try yourself in a bad business.

BECKY QUICK: Is that the lesson that you learned from it?

WARREN BUFFETT: Sure.

BECKY QUICK: But — and that is something that you’ve actually put into practice?

WARREN BUFFETT: I’ve actually put a line in my annual report many, many, many decades late — ago, after doing this. And I said, ‘When a manager with a reputation for brilliance, meets up with a business with a reputation for bad economics, it’s the reputation of the business that remains intact.’

BECKY QUICK: (LAUGHTER) So that is a lesson you carried with you? And yet, it’s one that is — you’re reminded of every single day. It’s Berkshire Hathaway.

WARREN BUFFETT: Yeah. And every now and then, I get tempted. Because I started out with Ben Graham in 1950 or so. And his whole idea was buying things that were cheap.

You don’t want to buy things that are cheap. You want to buy things that are good. It’s much better to buy something that’s good at a fair price, than something that is cheap at a bargain price.

And I wasn’t — I didn’t start out that way. I — I was taught a different system.

But — but if I didn’t learn from Berkshire Hathaway, I’ll never learn. (LAUGHTER)

BECKY QUICK: How long did it take you to figure out this lesson? You said it was —

WARREN BUFFETT: Well, it took me 20 years to give up on the textile business. I — I had a wonderful guy running it after — after Seabury Stanton — a fellow named Ken Chase ran it. And he was terrific. Honest and able, hardworking. And he couldn’t make it go.

But we just kept working at it, trying — we bought another textile company called Waumbec Mills in Manchester, New Hampshire. Another mistake.

If you’re going to be brilliant with a lousy business, why not be brilliant with a good business?

BECKY QUICK: But really, how — it took 20 years for you to finally give up on it. When did you kind of figure, oh, this is not working? Was it — did it — was it really 20 years? Or did you kind of know —

WARREN BUFFETT: Well, it was — no. I figured it out fairly soon. But I just kept thinking I’m not going to give up on this. And incidentally, we had a work force that was terrific. I mean, it — it was — we weren’t done in by anything except competitive dynamics. And I — we’d buy new equipment, or we would move — we would add this mill in Manchester, and we’d say, ‘Look at all those synergies,’ and all that. Nothing works.

I — In fact, I used to have a desk in my drawer. And they would keep sending me these things that if we buy this machine, we’ll save 14 people. If we buy this machine, we’ll save 12 people. I kept putting it in my drawer. With all those machines, we’d save more people than we had at the start of the — supposedly, we were operating with zero people. But it doesn’t work that way.

BECKY QUICK: Is there any business that you didn’t get into because you thought, wait a second, I’ve been down this road before? Where you were tempted and you kind of pulled back?

WARREN BUFFETT: I get calls on them every day. You know, I mean, I get calls — not every day. I mean, it’s an exaggeration. But I get calls frequently on businesses that are just too tough. And — and people say, you know, why don’t you tackle it? You know, got all these resources now and good managers.

But the interesting thing about business, it’s not like the Olympics. In the Olympics, you know, if you do some dive off the — on a high board and have four or five twists — (LAUGHTER) on the way down, and you go in the water a little bad, there’s a degree of difficulty factor. So you’ll get more points than some guy that just does a little headfirst dive in perfectly.

So degree of difficulty counts in the Olympics. It doesn’t count in business. Now, you don’t get any extra points for the fact that something’s very hard to do. So you might as well just step over one-foot bars instead of trying to jump over seven-foot bars.

BECKY QUICK: You know, people will say, well, wait a second. You’re in some businesses that some people have written off for dead: the newspaper business. How is that different?

WARREN BUFFETT: You’re right. (LAUGHTER) But — but we bought that [The Buffalo Evening News] in 1977. And — and we’ve done very well over the years. At — at first, we didn’t do so well. But then we did very well.

But I — the newspaper business of 2010 is not the newspaper business of 1977. I mean, it is diametrically different. [Berkshire sold the newspaper in 2020.]

And it is true, and we put it in the annual report, that we run Berkshire in a way that they don’t teach in business schools. Because in business schools, they say sell off your so-so businesses and keep buying new businesses. I call that gin rummy management.

And when I — if I had 50 kids, you know, and one of them isn’t doing quite as well as the others, I’m not going to put him up for adoption. Unless they are going to lose us money permanently, or if they have major labor difficulties, we keep the businesses that aren’t as good as the others.

So, if I’m going to follow that philosophy, I’d better be very careful about what I buy, right?

BECKY QUICK: Exactly. What about your business partner, Charlie Munger? What would he say your biggest mistake is?

WARREN BUFFETT: Well, he would probably repeat this. And I would say I’ve learned a lot about what I just got through talking about — I’ve learned a lot from Charlie.

Charlie told me this from the first moment I met him in 1959. He said — he said exactly — I could have — I could have saved myself a lot of trouble if I’d just listened to him. But what did Charlie know? (LAUGHTER)

BECKY QUICK: OK. Warren, thank you very much. We really appreciate your time.

WARREN BUFFETT: Thanks. Thanks for having me.

BUFFETT AROUND THE INTERNET

BERKSHIRE STOCK WATCH

Four weeks

12 months

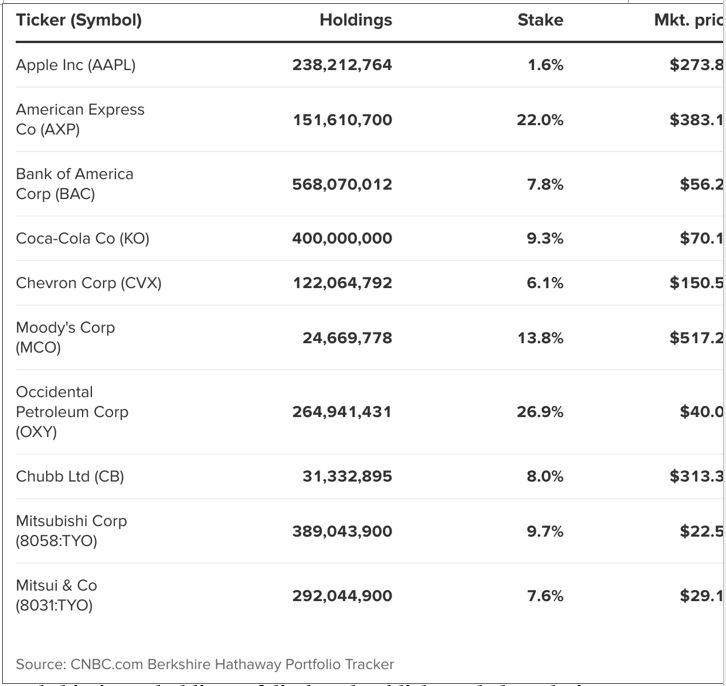

BERKSHIRE’S TOP EQUITY HOLDINGS – Dec. 24, 2025

Berkshire’s top holdings of disclosed publicly traded stocks in the U.S. and Japan, by market value, based on the latest closing prices.

Holdings are as of Sept. 30, as reported in Berkshire Hathaway’s 13F filing on November 14, 2025, except for:

- Itochu, which is as of March 17, 2025, and Mitsubishi, which is as of August 28, 2025. Tokyo Stock Exchange prices are converted to U.S. dollars from Japanese yen.

The full list of holdings and current market values is available from CNBC.com’s Berkshire Hathaway Portfolio Tracker.

Bank of America boosts Micron price target, sees upside driven by tight memory supply

Published Tue, Jan 13 20267:17 AM EST

Rising memory prices and disciplined capital spending across the industry should provide tailwinds for Micron, according to Bank of America.

Analyst Vivek Arya, who has a buy rating on the stock, raised his price target to $400 from $300. That implies that shares could rise 16% from here.

Shares of Micron Technology have climbed nearly 264% over the past 12 months.

Arya pointed to a continued increase in spot price for dynamic random access memory, or DRAM, as a tailwind for the stock.

“The last few weeks, spot/contract pricing for both DRAM and NAND have been exceptionally strong. While we view the near-term pricing trends as potentially abnormal and aggressive, we expect the current strong price outlook to generally continue into 1Q26, before decelerating (still growing a lot) in 2Q26,” he wrote.

Still-disciplined capex spend from competitor Samsung could continue to keep supply tight as well.

“While SK Hynix and Micron have planned for substantial capex hikes this year, we flag industry clean room space remains limited, with material equipment installation and volume production still likely 2-3 years away,” Arya said.

The analyst added that his price objective, at three times Micron’s price-to-book ratio for the 2027 calendar year, is historically expensive. However, an ongoing memory upcycle and earnings expansion justifies this premium.

Micron Technology Inc

Micron shares are well liked by the Street. Of the 44 analysts who cover the stock, 40 rate the stock a buy or strong buy, according to LSEG. However, the stock may be over its skis, as the average price target signals a 12% pullback.

Danish pension fund to sell $100 million in Treasurys, citing ‘poor’ U.S. government finances

Published Tue, Jan 20 202612:10 PM ESTUpdated 4 Hours Ago

Key Points

- Danish pension operator AkademikerPension said it is exiting U.S. Treasurys over finance concerns tied to America’s budget shortfall.

- The move comes amid increasing tensions with the U.S. over Greenland as President Donald Trump pushes for control of the island.

- AkademikerPension said it plans to have closed its position of around $100 million in U.S. Treasurys by the end of the month.

Danish pension operator AkademikerPension said it is exiting U.S. Treasurys because of finance concerns as Denmark spars with President Donald Trump over his threats to take over Greenland.

Anders Schelde, AkademikerPension’s investing chief, said the decision was driven by what it sees as “poor [U.S.] government finances” amid America’s debt crisis. But it also comes as tensions escalate between the U.S. and Denmark after Trump’s latest threats to tariff European countries if Greenland, an arctic territory of Denmark, isn’t sold to the U.S.

“It is not directly related to the ongoing rift between the [U.S.] and Europe, but of course that didn’t make it more difficult to take the decision,” Schelde said in a statement to CNBC.

The fund currently has a position of around $100 million in U.S. Treasurys, an AkademikerPension spokesperson confirmed to CNBC. The academics-focused fund plans to have exited that holding by the end of the month.

Schelde chiefly cited the ballooning debt bill facing the U.S. after decades of government overspending. The U.S. recorded a budget shortfall of $1.78 trillion last year, down just over 2% from 2024′s fiscal year as Trump’s broad and steep tariffs took effect.

Moody’s Ratings cut the United States’ sovereign credit rating down to Aa1 from Aaa in May, citing the budget deficit and high borrowing costs associated with rolling over debt at lofty interest rates.

The U.S.′ finances made “us think that we need to make an effort to find an alternative way of conducting our liquidity and risk management,” Schelde said. “Now we have found such a way and we [are] executing on that.”

Denmark has grown increasingly hostile toward the U.S. as Trump has ratcheted up his calls for control of Greenland to be given to the U.S. Trump said over the weekend that he would institute tariffs on several European nations beginning Feb. 1 if the U.S. did not take control of Greenland and that those levies could rise to 25% on June 1.

European leaders have reportedly considered using counter-tariffs and other punitive economic measures as a result. Some investors have worried that European countries could dump their U.S. asset holdings in response to Trump’s new tariffs.

Greenland Prime Minister Jens-Frederik Nielsen said Monday that it would “not be pressured” and “stand firm on dialogue, on respect and on international law.”

Treasury yields in the U.S. and abroad surged Tuesday, a sign of investors feeling geopolitical turmoil rising. The U.S. dollar and stocks fell, and gold rose to new all-time highs in a session defined by the “sell America” trade.

Bridgewater Associates founder Ray Dalio told CNBC on Tuesday that sovereign funds could start to dump U.S. investments if they stop seeing the U.S. as a stable trading partner.

“On the other side of trade, deficits, and trade wars, there are capital and capital wars,” Dalio told CNBC’s “Squawk Box” at the World Economic Forum in Davos, Switzerland. “If you take the conflicts, you can’t ignore the possibility of the capital wars. In other words, maybe there’s not the same inclination to buy … U.S. debt and so on.”

Reuters first reported the Danish pension fund’s Treasury exit.

‘This is sell America’ — U.S. dollar, Treasury prices tumble and gold spikes as globe flees U.S. assets

Published Tue, Jan 20 20268:49 AM ESTUpdated 2 Hours Ago

Key Points

- The “sell America” trade is in full swing Tuesday morning.

- President Donald Trump’s latest threats around Greenland pushed global investors to shift exposure away from U.S.-centric investments.

- The U.S. dollar index headed for its biggest decline since April. U.S. bond prices tumbled, sending yields spiking.

The “sell America” trade is in full swing Tuesday morning after President Donald Trump and European leaders escalated tensions over Greenland.

U.S. bond prices tumbled, sending yields spiking. The U.S. Dollar Index, which weighs the greenback against a basket of six foreign currencies, fell nearly 1%. The euro jumped 0.6% against the dollar.

“This is ‘sell America’ again within a much broader global risk off,” Krishna Guha, head of global policy and central banking strategy at Evercore ISI, wrote in a note to clients.

Precious metals gold and silver marched to fresh highs. Gold, which has long been viewed as a safe-haven investment during periods of geopolitical turmoil, was on track for its biggest one-day gain since 2020.

U.S. stocks tumbled as investors mitigated exposure to American assets. The Dow Jones Industrial Average slid more than 800 points, while the S&P 500 and Nasdaq Composite each dropped more than 2%. The Cboe Volatility Index (VIX), known Wall Street’s “fear gauge,” spiked to a highs last seen in November.

The latest flare-up in so-called sell America positioning follows Trump’s threats to impose 10% tariffs on eight European countries as part of his push to take over Greenland. Representatives from the 27-nation European Union gathered for an emergency meeting in response to Trump’s tariff call, which he said would start Feb. 1 and then rise to 25% on June 1.

Why investors are brushing off Washington headlines

Greenland has repeatedly rejected Trump’s request to purchase the arctic island, with Prime Minister Jens-Frederik Nielsen saying Monday that it would “not be pressured” and “stand firm on dialogue, on respect and on international law.” European officials are reportedly considering using a salvo of counter-tariffs and other punitive economic measures against the U.S. in retaliation.

The “sell America” trade suggests that global investors will place higher risk premiums on U.S. investments amid fears that the U.S. is no longer a reliable trading partner. Following Trump’s latest threats, some investors worry that European countries could dump U.S. assets in a show of power.

“On the other side of trade, deficits, and trade wars, there are capital and capital wars,” Bridgewater Associates founder Ray Dalio told CNBC’s “Squawk Box” at the World Economic Forum in Davos, Switzerland. “If you take the conflicts, you can’t ignore the possibility of the capital wars. In other words, maybe there’s not the same inclination to buy … U.S. debt and so on.”

Bridgewater’s Ray Dalio on ‘capital war’ fears: The monetary order is breaking down

The drop in the U.S. Dollar Index was the largest since Trump’s so-called Liberation Day rollout of sharply higher tariffs in April, many of which were subsequently pared back.

International markets continued to slide Tuesday after starting to retreat on Monday, when U.S. markets were closed for the Martin Luther King Jr. Day holiday. Trump’s latest threats to tariff French wine and other imported goods rattled investors who feared the U.S. would no longer act as an unwavering commercial ally of Europe. The pan-European Stoxx 600 extended its recent decline, following Asian markets into the red.

Evercore ISI’s Guha said the dollar falling and the euro rising suggests that global investors are “looking to reduce or hedge their exposure to a volatile and unreliable” United States. Impacts on the dollar and other U.S. assets could be severe and long-term, if Trump does not walk back his plans — a trade known as “TACO,” or “Trump Always Chickens Out,” that was coined last spring — or find a compromise, Guha said.

“What remains to be determined is the magnitude and duration of these dynamics,” Guha said.

More broadly, investors may be looking for ways to diversify away from U.S. stocks at a time when indexes are near all-time highs and American equities take up a majority of the world’s total market capitalization, according to Russ Mould, investment director at AJ Bell.

“Markets may already be pricing in full the concept of American exceptionalism, at least barring an epic, crack-up economic boom,” Mould said. “It may therefore not take too much to persuade investors to hedge their bets and diversify.”

— CNBC’s Jeff Cox, Yun Li and Chloe Taylor contributed to this report.