Recording Coming Soon

Merry Christmas, Happy Holidays and Happy New Year’s!!!

Taking a break to work fundamentals on companies for next year’s Jan 5th Commentary when we start up again.

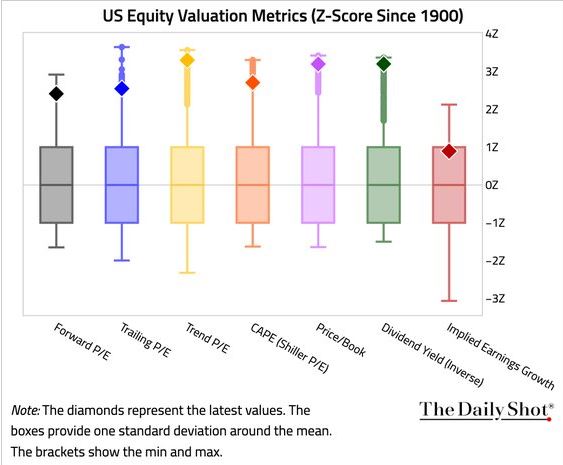

LET’S LOOK AT VALUATIONS FOR STOCK PRICES

https://www.investopedia.com/terms/v/valuation.asp

What Is Valuation? How It Works and Methods Used

By

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

Updated July 13, 2025

Reviewed by

Fact checked by Patrice Williams

Part of the Series

How to Value a Company

Definition

Valuation is the process of estimating the current or projected value of an asset or a company.

What Is Valuation?

Valuation is a process in which an analyst uses a company’s latest financial statements to determine its current or projected value. Many techniques are used during a valuation. Among other metrics, an analyst placing a value on a company looks at the business’s management, the composition of its capital structure, the prospect of future earnings, and the market value of its assets.

Fundamental analysis is often employed in valuation although several other methods may be employed such as the capital asset pricing model (CAPM) or the dividend discount model (DDM).

Key Takeaways

- Valuation is a quantitative process of determining the fair value of an asset, investment, or firm.

- A company can generally be valued on its own on an absolute basis or a relative basis compared to other similar companies or assets.

- Several methods and techniques can be used to arrive at a valuation, each of which may produce a different value.

- Valuations can be quickly impacted by corporate earnings or economic events that force analysts to retool their valuation models.

- Valuation is quantitative in nature but it often involves some degree of subjective input or assumptions.

A common way to value a business is determining the fair value of all of its assets minus all of its liabilities.

Investopedia / Mira Norian

Understanding Valuation

A valuation can be useful when you’re trying to determine the fair value of a security determined by what a buyer is willing to pay a seller ,assuming that both parties enter the transaction willingly. Buyers and sellers determine the market value of a stock or bond when a security trades on an exchange.

The concept of intrinsic value refers to the perceived value of a security based on future earnings or some other company attribute. It’s unrelated to the market price of a security and this is where valuation comes into play. Analysts do a valuation to determine whether a company or asset is overvalued or undervalued by the market.

Open a New Account

Advertiser Disclosure

Types of Valuation Models

- Absolute valuation models attempt to find the intrinsic or “true” value of an investment based only on fundamentals. You would focus only on things such as dividends, cash flow, and the growth rate for a single company. You wouldn’t worry about any other companies. Valuation models that fall into this category include the dividend discount model, discounted cash flow model, residual income model, and asset-based model.1

- Relative valuation models operate by comparing the company in question to other similar companies. These methods involve calculating multiples and ratios such as the price-to-earnings multiple and comparing them to the multiples of similar companies.2

The original company might be considered undervalued if the P/E is lower than the P/E multiple of a comparable company. The relative valuation model is typically a lot easier and quicker to calculate than the absolute valuation model. This is why many investors and analysts begin their analysis with this model.

Types of Valuation Methods

You can do a valuation in various ways.

Comparables Method

The comparable company analysis looks at companies similar in size and industry and how they trade to determine a fair value for a company or asset. The past transaction method looks at past transactions of similar companies to determine an appropriate value. There’s also the asset-based valuation method which adds up all the company’s asset values to get the intrinsic value, assuming that they were sold at fair market value.

Fast Fact

A comparables approach is often synonymous with relative valuation in investments.

Sometimes doing all these and then weighing each is appropriate to calculate intrinsic value but some methods are more appropriate for certain industries. You wouldn’t use an asset-based valuation approach to valuing a consulting company that has few assets. An earnings-based approach like the DCF would be more appropriate.

Discounted Cash Flow Method

Analysts also place a value on an asset or investment using the cash inflows and outflows generated by the asset. This is called a discounted cash flow (DCF) analysis. These cash flows are discounted into a current value using a discount rate which is an assumption about interest rates or a minimum rate of return assumed by the investor.

Important

DCF approaches to valuation are used in pricing stocks such as with dividend discount models like the Gordon growth model.

The firm analyzes the cash outflow for the purchase and the additional cash inflows generated by the new asset if a company is buying a piece of machinery. All the cash flows are discounted to a present value and the business determines the net present value (NPV). The company should invest and buy the asset if the NPV is a positive number.

Precedent Transactions Method

The precedent transaction method compares the company being valued to other similar companies that have recently been sold. The comparison works best if the companies are in the same industry. The precedent transaction method is often employed in mergers and acquisition transactions.

How Earnings Affect Valuation

The earnings per share (EPS) formula is stated as earnings available to common shareholders divided by the number of common stock shares outstanding. EPS is an indicator of company profit because the more earnings a company can generate per share the more valuable each share is to investors.

Analysts also use the price-to-earnings (P/E) ratio for stock valuation. This is calculated as the market price per share divided by EPS. The P/E ratio calculates how expensive a stock price is relative to the earnings produced per share.

An analyst would compare the P/E ratio with other companies in the same industry and with the ratio for the broader market if the P/E ratio of a stock is 20 times earnings. Using ratios like the P/E to value a company is referred to as a multiples-based or multiples approach valuation in equity analysis. Other multiples such as EV/EBITDA are compared with similar companies and historical multiples to calculate intrinsic value.

Limitations of Valuation

It’s easy to become overwhelmed by the number of valuation techniques available to investors when you’re deciding which valuation method to use to value a stock for the first time. Some valuation methods are fairly straightforward. Others are more involved and complicated.

Unfortunately, no one method is best suited for every situation. Each stock is different and each industry or sector has unique characteristics that can require multiple valuation methods. Different valuation methods will produce different values for the same underlying asset or company which can lead analysts to employ the technique that provides the most favorable output.

What Is an Example of Valuation?

A common example of valuation is a company’s market capitalization. This takes the share price of a company and multiplies it by the total shares outstanding. A company’s market capitalization would be $20 million if its share price is $10 and the company has two million shares outstanding.

How Do You Calculate Valuation?

You can calculate valuation in many ways. They’ll differ based on what’s being valued and when. A common calculation in valuing a business involves determining the fair value of all of its assets minus all of its liabilities. This is an asset-based calculation.

What Is the Purpose of Valuation?

The purpose of valuation is to determine the worth of an asset or company and compare that to the current market price. This is done for a variety of reasons, such as bringing on investors, selling the company, purchasing the company, selling off assets or portions of the business, the exit of a partner, or inheritance purposes.

The Bottom Line

Valuation is the process of determining the worth of an asset or company. It’s important because it provides prospective buyers with an idea of how much they should pay for an asset or company and how much prospective sellers should sell for.

Valuation plays an important role in the M&A industry as well as the growth of a company. There are many valuation methods, all of which come with their pros and cons.

SO what do we like: KEY. MU, META, GOOGL, AAPL

Sectors to avoid= Energy = Oil/Gas, Airlines, Healthcare, Solar,

NEXT YEAR the S&P 500 will close around 7680 after a pullback (10-20%)

Lower Taxes, Lower Gas prices, Easier to do business, Past Tariffs,

2026 will look a lot like this year

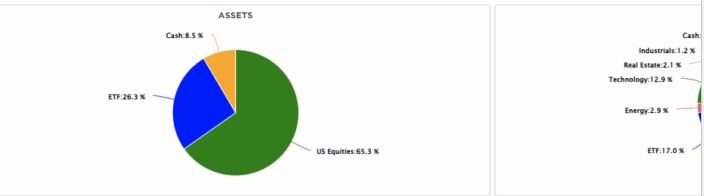

We took huge profits as MU was called away!!! Cash Heavy going into next year.

We have the leap 220/300 Bull Call Stock Replacement strategy for Wednesday’s earnings

We added 260/350 Leap Bull Call Strategy as well for MU

First article below talks about being in cash and looking for “the opportunity”.

S&P move 70% over a three year period of time then the expectation is a 35% ISH pullback

PLEASE call me immediately IF you want to be more fully INVESTED

We are expecting BAC and GOOGL to also get called away

GOOGL in January

BAC in December BUT…..

Earnings

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 31-Dec-25

2025 Year in Review

Briefing.com Summary:

*Tariff fears drove extreme volatility in early 2025, but negotiations restored confidence and fueled a powerful, broad-based bull market rally.

*Mega-cap stocks and AI leadership paced the gains, but strong earnings, resilient consumer spending, and Fed rate cuts supported market momentum.

*Once the market got past its main tariff concerns, a fear of missing out on further gains and momentum trading took over.

2025 is a year investors won’t soon forget. It was a year the stock market had to play politics, so to speak, but more to the point, it was a year chock-full of gains and record highs for the major indices. At its conclusion, the market cap-weighted S&P 500 was up 16.4% in price and had recorded its third straight year with a double-digit percentage gain.

The themes that drove the stock market in 2024 carried over into 2025, namely the AI trade, mega-cap leadership, an expectation of lower interest rates, strong earnings growth, and a U.S. economy that continued to operate on a growth trajectory.

What was new in 2025 was President Trump occupying the Oval Office for his second stint as president and a rapid-fire policy push to impose tariffs, negotiate new trade deals, cut government costs, crack down on illegal immigration, force deregulation, drive AI and cryptocurrency adoption, stifle Iran’s nuclear ambitions, lower drug prices, pass a tax stimulus package, and end the wars between Israel and Hamas and Ukraine and Russia.

If there was a singular happening that commanded the stock market’s performance in 2025, though, we’d have to say it was the tariffs. They were at the center of everything, both the bad and the good.

First the Bad, Then the Good

The tariff noise started in early February when the U.S. imposed a 25% tariff on imported goods from Canada and Mexico (only 10% for Canadian energy) and a 10% tariff on imported goods from China. President Trump subsequently added that tariffs for the EU would also likely be seen fairly soon.

From there, it was “game on,” as the affected countries and blocs, many of which were U.S. allies, soon announced retaliatory tariffs or threats of retaliatory tariffs that triggered major growth concerns and worries about a pickup in inflation. Things hit a fevered pitch on April 2 in what was dubbed by the president to be “Liberation Day.”

That is when a 10% baseline tariff on imports was established for all countries that didn’t face other sanctions and was supplemented by additional, country-specific reciprocal tariffs that, in China’s case, accrued to more than 100%. Between April 2 and the low on April 7, the S&P 500 plunged 14.7%, and then… well, the rest is bull market history.

Following the news on April 9 that the administration would pause the reciprocal tariffs for 90 days for most countries, excluding China most notably, and be open to tariff negotiations, the S&P 500 soared 9.5% on April 9, marking the third-largest single-day gain since World War II, and the Nasdaq Composite surged 12.2% for its second-best day ever.

The willingness to negotiate was the true turning point for the stock market, along with the U.S. and China coming to a tariff détente of sorts. The low on April 7 (4,835.04) was the low for the stock market this year, and it isn’t an exaggeration to say it was nearly straight up from there and where this year’s market found its true bull market identity.

From their April lows to their closing levels on December 31, the Nasdaq, Russell 2000, S&P 500, S&P 400, and Dow Jones Industrial Average skyrocketed 57%, 43%, 42%, 32%, and 31%, respectively.

Coming to an Understanding

To understand the push and pull of the tariff announcements, it is important to understand how the view of the tariff developments impacted the stock market’s bull market psyche.

- With the tariffs, the U.S. expects to generate about $300 billion per year in customs duties that will, reportedly, offset the cost of extending the 2017 tax cuts and other fiscal concessions agreed to as part of the One Big Beautiful Bill Act.

- When the president quickly communicated a willingness to negotiate tariffs after the Liberation Day stock market rout, participants once again embraced the notion of there being a “Trump put” in the market.

- Incoming economic data in the ensuing months revealed that the economy was holding up much better than feared following the tariff announcements.

- Inflation proved to be sticky, yet that stickiness was concentrated mostly on the goods side of the economy, paving the way for a view that it should be short-lived.

- Although many companies raised prices, many also worked to absorb the cost of the tariffs to ensure end demand did not decline in a marked manner. Stronger-than-expected earnings results calmed investors’ concerns about a consumer spending slowdown and tariffs causing a major hit to profit margins.

- The Federal Reserve refrained at first from cutting its policy rate but eventually cut the target range for the fed funds rate three times (75 basis points), starting in September, on a belief that a slowdown in the labor market, versus a pickup in inflation, was the bigger risk in terms of satisfying its dual mandate.

- Consumers have been confronted with affordability issues, particularly lower- to middle-income consumers, but robust spending activity by upper-income consumers fortified by bull market returns and rising home prices has been the great offset that has fueled the U.S. economy’s continued growth. To that end, real GDP in the third quarter increased at an annual rate of 4.3%, which was the best in two years and well above the prior 10-quarter average of 2.6%.

Game On

When the stock market saw its worst tariff fears assuaged, it was again “game on,” only this time it was more fun and games than fear and loathing.

Investors plowed back into the mega-cap stocks, which paced the recovery off the April lows along with the so-called AI trade that was led by the semiconductor stocks. Their outperformance was part of a feast on high-beta stocks that got jubilant when the market sensed the Fed would be cutting rates again.

That, in turn, resuscitated interest in the so-called meme stocks, which are high on growth prospects but lack profitability. That includes areas like quantum computing, space, and air taxi transportation.

Their runs were a byproduct of animal spirits kicking in that fueled waves of momentum investing and an indefatigable buy-the-dip mantra. The thing is, there was never any real dip of note to buy once the recovery got going in April. There were 2-5% pullbacks here and there at the broad market level, but nothing that would qualify as an actual correction (i.e., a decline of 10-20% from a high).

The lack of a correction became its own buying catalyst, triggering a fear of missing out on further gains and short-covering activity that pushed the indices higher. That also triggered calls of an AI bubble, along with some circular financing arrangements, that served to cool off some of the worshiping of AI leaders as the fourth quarter unfolded.

The remarkable aspect of that is that it did not sink the broader market. Instead there was some rebalancing activity, catalyzed by a positive growth outlook for 2026, that kept the bull market intact. The health care sector, in fact, was the market’s best-performing sector in the fourth quarter.

Another Tough Act to Follow

While the mega-cap stocks and growth stocks spearheaded this year’s winning campaign, there was ample participation in the bull market action. The Dow Jones Industrial Average rose 13.1%, the Russell 3000 Value Index jumped 13.4%, the Russell 2000 added 11.3%, and the equal-weighted S&P 500 increased 9.3%. The S&P MidCap 400 Index trailed with a more modest gain of 5.9%.

There wasn’t any definitive K-shaped action in the stock market like there was in the economy. For the stock market, returns across the market-cap spectrum by year’s end were up and to the right. There were no negative returns.

The stock market isn’t the economy, but it is undeniable that it played a major part in supporting the economy through the wealth effect that powered spending by upper-income holders of stocks and homes. That wealth effect is integral to the economy’s performance in 2026. Take that away, and earnings growth prospects will diminish along with stock prices.

That isn’t the consensus view as 2025 closes out. The consensus view is that the economy will be supported in 2026 by the tailwinds of tax refunds, productivity gains driven by AI, and additional rate cuts by the Federal Reserve. Therefore, the consensus view is that it will be another good year for the stock market in 2026. S&P 500 price targets proffered by Wall Street strategists generally fall in the range of a 10-15% gain for the S&P 500, which effectively follows the earnings estimate trend.

It will be tough to follow a year like 2025, especially if the earnings growth doesn’t materialize as envisioned. That is key given the full, if not rich, valuations for the market entering 2026. To be fair, the same criticism applied going into 2025, and it ended up being another great year underpinned by falling interest rates and rising earnings estimates.

The stock market will have its share of issues to contend with in 2026, starting perhaps with the Supreme Court’s ruling on President Trump’s tariff authority, but that will be a matter for a different day. On this day—the last day of 2025—the matter at hand is the year that was, and what a year it was for traders and investors who continued to ride the bull market.

Happy New Year!

—Patrick J. O’Hare, Briefing.com

| Market | 2025 Price Return |

| Nasdaq Composite | 20.4% |

| S&P 500 | 16.4% |

| Dow Jones Industrial Average | 13.1% |

| Russell 2000 | 11.3% |

| S&P MidCap 400 | 5.9% |

Source: FactSet

| Sector | 2025 Price Return |

| Communication Services | 32.4% |

| Information Technology | 23.3% |

| Industrials | 17.7% |

| Financials | 13.3% |

| Utilities | 12.7% |

| Health Care | 12.5% |

| Materials | 8.4% |

| Consumer Discretionary | 5.3% |

| Energy | 5.0% |

| Consumer Staples | 1.3% |

| Real Estate | -0.3% |

Source: FactSet

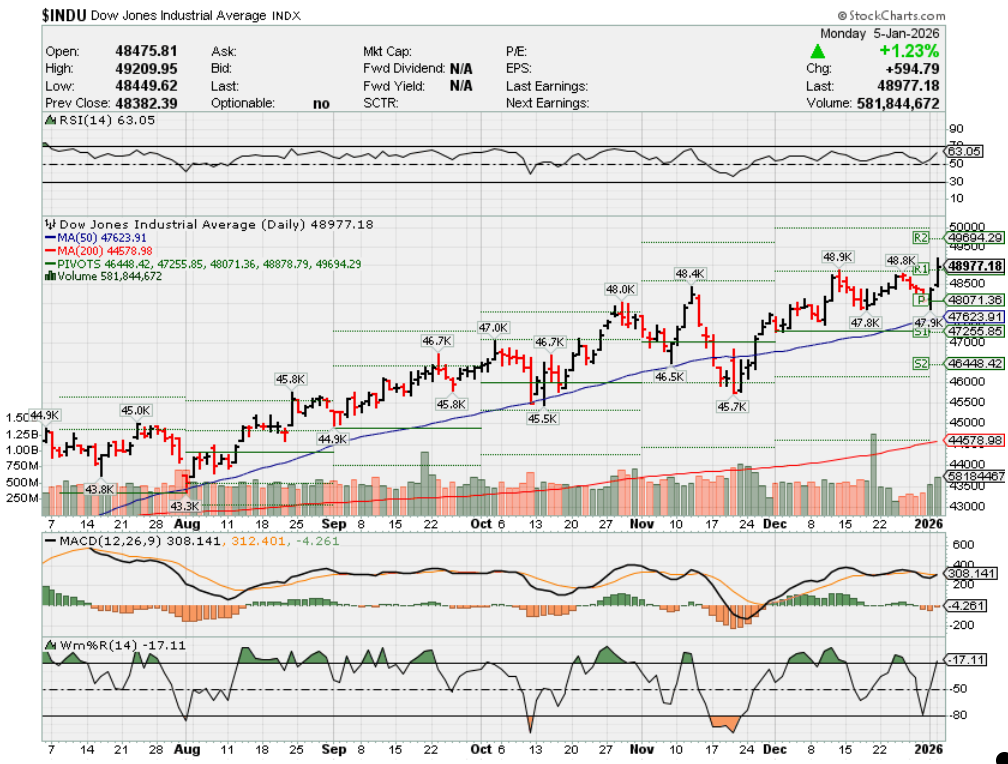

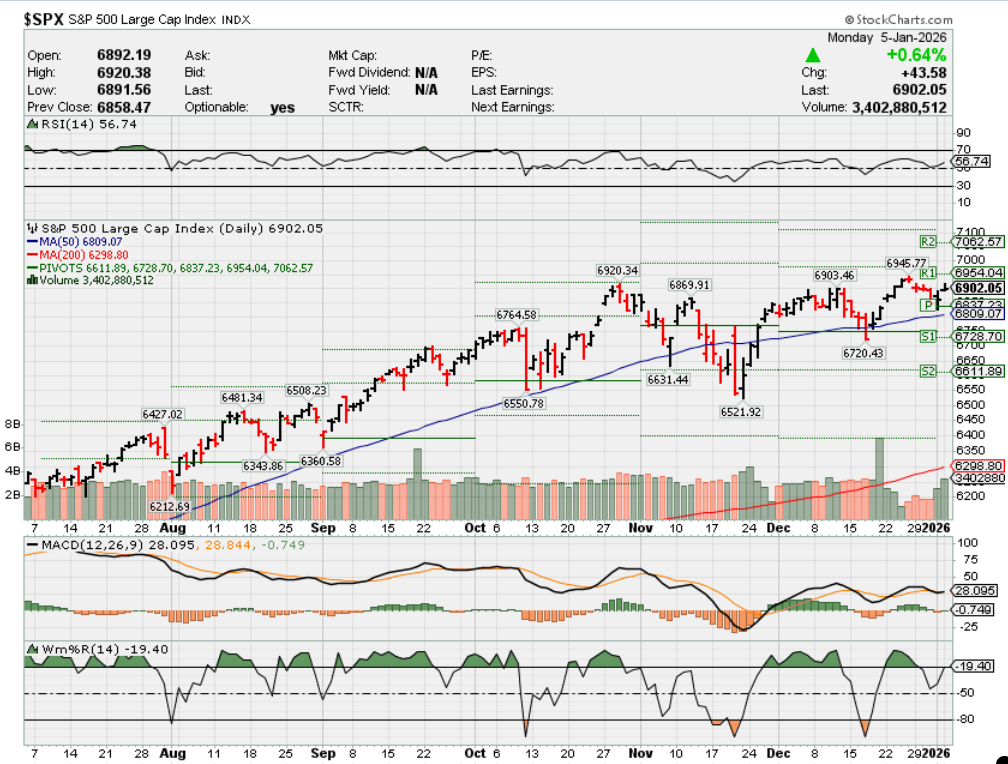

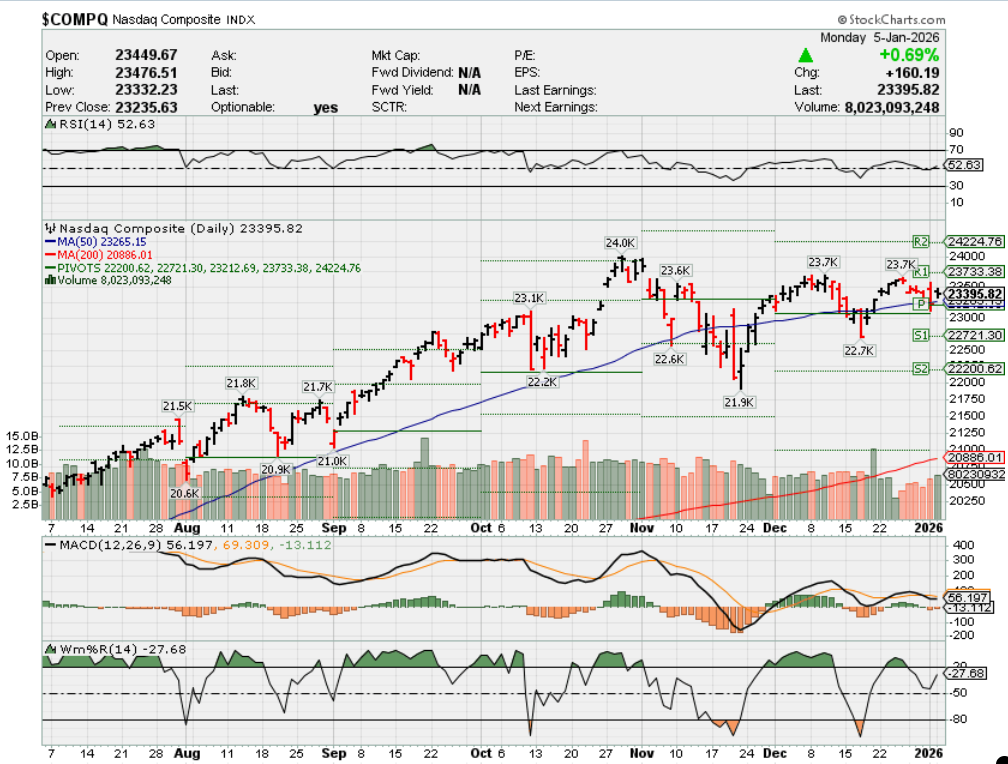

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end January 2026?

01-05-2026 +3.0%

Earnings:

Mon:

Tues:

Wed: ACI, CALM, STZ

Thur:

Fri:

Econ Reports:

Mon: ISM Manufacturing,

Tue

Wed: MBA, ADP Employment, ISM Services, Factory Orders, JOLTS

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs, Trade Balance, Consumer Credit

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Building Permits, Michigan Sentiment,

How am I looking to trade?

Time to let things continue to run

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Micron stock pops 10% as AI memory demand soars: ‘We are more than sold out’

Published Thu, Dec 18 20259:15 AM ESTUpdated Thu, Dec 18 20254:03 PM EST

Key Points

- Micron Technology beat Wall Street’s fiscal first-quarter estimates and issued blowout guidance as demand for AI memory outstrips supply.

- The company said it expects the total addressable market for high-bandwidth memory to hit $100 billion by 2028, growing at a 40% compounded annual growth rate.

Micron Technology’s stock jumped 10% after the company signaled robust demand for its memory chips and blew away fiscal first-quarter estimates.

During an earnings call with analysts, Micron, which makes memory storage used for computers and artificial intelligence servers, said rapid AI infrastructure scaling has fueled greater demand for its products.

Micron said it expects the total addressable market for high-bandwidth memory to hit $100 billion by 2028, growing at a 40% compounded annual growth rate.

Management also upped its capital expenditures guidance to $20 billion from $18 billion and guided to 68% gross margins as memory prices rise and the company passes on costs to customers.

“We are more than sold out,” said business chief Sumit Sadana. “We have a significant amount of unmet demand in our models and this is just consistent with an environment where the demand is substantially higher than supply for the foreseeable future.

Micron topped Wall Street estimates for the fiscal first quarter and issued blowout guidance.

The company reported adjusted earnings of $4.78 per share on $13.64 billion in revenue, surpassing LSEG estimates for earnings of $3.95 per share and $12.84 billion in sales.

Revenues in the current quarter are expected to hit about $18.70 billion, blowing past the $14.20 billion expected by LSEG. Adjusted earnings are forecast to reach $8.42, versus expectations of $4.78 per share.

JPMorgan upped its price target on the stock following the results, citing the favorable pricing setup, while Bank of America upgraded shares to a buy rating.

Morgan Stanley called the results the best revenue and net income upside in the “history of the U.S. semis industry” outside of Nvidia.

“If AI keeps growing as we expect, we believe that the next 12 months are going to have broader coat tails to the AI trade than just the processor names and memory would be the biggest beneficiary,” analysts wrote.

Fed’s Soft Landing Narrative Meets Economic Data

By Lance Roberts | Dec 20, 2025

🔎 At a Glance

- Is “Santa Claus” Still Coming?

- Fed’s Soft Landing Narrative

- Portfolio Tactics For Next Week

- From Lance’s Desk: What Inflation Alarmists Missed In Their Warnings

- Portfolio updates & sector strategy shifts

- Market stats, screens, and risk indicators

💬 Ask a Question

Have a question about the markets, your portfolio, or a topic you’d like us to cover in a future newsletter?

📩 Email: lance@riaadvisors.com

🐦 Follow & DM on X: @LanceRoberts

📰 Subscribe on Substack: @LanceRoberts

We read every message and may feature your question in next week’s issue!

🏛️ Market Brief – “Santa,” Are You Still Coming?

Administrative Note: Next week, I will be traveling for the Christmas holiday, so I will only provide a brief market update. The full newsletter will return the following week.

The short answer appears to be “yes.” However, it seems to be narrower, later, and more fragile than the headline mythology suggests. Importantly, the official “Santa Claus rally” window has not even started yet, as it is statistically measured as the last five trading days of the year plus the first two of January. Historically, that seven-session stretch has produced an average gain of about 1.3% and finishes positive “nearly 80% of the time,” according to data analysis from the long-running Stock Trader’s Almanac.

However, given the recent sloppy and weak trading in the market, it is unsurprising that investors are questioning whether “Santa Will Visit Broad & Wall” this year. So, don’t give up hope just yet that investors’ stockings will be filled with Christmas cheer. According to Goldman Sachs, absent anything actively bad, stocks seem to drift upward for a variety of reasons such as year-end window dressing, share buybacks, and performance chasing. However, a rosier 2026 economy, deregulation, AI, and the fundamental premise that corporate stories will improve are also tailwinds.

“Barring any major shocks, it will be hard to fight the overwhelmingly positive seasonal period we are entering and the cleaner positioning set-up,” Goldman’s Gail Hafif

Currently, what matters is whether the market is positioned to enter the “Santa Rally” window with sufficient internal support to sustain a year-end bid. After a weak and volatile first half of December, price action improved as the week drew to a close, with both employment and inflation reports supporting further Fed rate-cutting policies. U.S. equities rebounded on renewed strength in mega-cap/AI leadership, following the UAE’s commitment of $100 billion. According to the WSJ, OpenAI aims to raise as much as $100 billion from sovereign-wealth funds. Given that the UAE was a previous investor, it now has little choice other than to continue funding further commitments.

Furthermore, Reuters captured the tone shift succinctly: “we’re beginning to see some stabilization… for the Christmas year-end rally to resume,” noting that tech had been under pressure before the bounce.

However, “intact” does not mean “easy.”

First, breadth is not uniform, and conviction remains selective. Schwab described the market’s posture as “selective, rather than broad,” while noting roughly 56% of S&P 500 stocks were above their 50-day moving averages. That is a healthy level, but not the kind of participation that makes rallies durable without interruption.

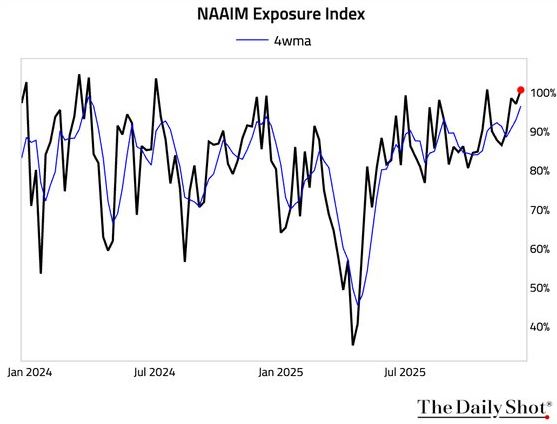

Secondly, sentiment is elevated, and positioning risk is creeping back in. As shown, the National Association of Investment Managers Index surged to levels that have usually preceded pullbacks. However, that does not negate Santa seasonality; it does, however, raise the odds that any rally could be short-lived in January.

Bottom line: The Santa Rally remains viable because the overall trend remains constructive and liquidity expectations are supportive. However, the market is also priced for good news. In such an environment, the rally likely depends on continued stabilization in leadership, contained yields, and no surprise shocks that force de-risking into thin holiday liquidity.

Which brings us to the market.

📈Technical Backdrop – Market Rallies As Expected

Following a 4-day “sell off” into mid-week, which broke both supports at the 20- and 50-day moving averages, investors mustered the courage to once again “buy the dip,” reversing early-week losses and pushing the market to 6,835 on Friday. That recovery keeps the broader uptrend intact, but the market is now pressing directly into a zone where prior momentum stalled, making the next week critical for determining whether the year-end advance can extend.

From a trend perspective, the index finished the week above its 20- and 50-day moving averages, confirming that sellers failed to regain control after the post-FOMC volatility. However, upside progress has repeatedly stalled at the 6,900 resistance level, which coincides with prior highs and the upper boundary of the near-term consolidation range. Until price can close decisively above that level, upside should be viewed as incremental rather than impulsive. Historically, failed breakouts near year-end often lead to short, sharp retracements rather than prolonged declines, particularly when liquidity thins into the holidays.

Momentum indicators are consistent with that interpretation. Relative strength has improved from the oversold conditions of early December, but is now approaching levels where rallies have stalled. Furthermore, the negative divergence of relative strength since September suggests an increasing fragility to market rallies. Notably, volatility has decreased, with the VIX falling back into the mid-teens, suggesting that complacency is returning. While low volatility often supports higher prices, it also leaves markets vulnerable to abrupt price declines if expectations are not met.

Key Support and Resistance Levels

| Level Type | Price Area | Technical Significance |

| Resistance | 6,900 | Previous highs and top of the consolidation range. |

| Resistance | 6,865 | Previous peak in early November during the corrective process. |

| Current Price | 6,835 | Friday close |

| Support | 6,767-6,810 | 20- to 50-day moving averages. |

| Support | 6,647 | 100-DMA / intermediate trend support |

| Support | 6,539 | November reaction low |

Looking into next week and the remainder of the year, support levels are clearly defined and relatively close to current prices. A pullback toward initial support would be technically normal and even constructive if buyers step in near the trend. Conversely, a failure to hold intermediate support would raise the risk that investors once again receive a “lump of coal” for Christmas.

In summary, the technical backdrop suggests that the market remains positioned for a year-end advance, provided bulls can defend near-term support and eventually reclaim the overhead resistance. Without a breakout, the most likely outcome is continued consolidation, accompanied by increased volatility, as investors adjust their positions ahead of year-end.

🔑 Key Catalysts Next Week

As the market enters the final week of regular trading before year-end, the calendar shifts from heavier macro releases to a mix of critical economic data, light earnings, and holiday-impacted sessions. With major U.S. stock exchanges remaining open through December 26 (including trading on December 24 with an early close and a full session on December 26), positioning will increasingly reflect seasonal flows as well as reactions to late-cycle indicators that can impact rate expectations and risk appetite. Markets continue to digest recent economic developments amid ongoing uncertainty about rates and inflation, meaning that even a limited slate of catalysts can trigger outsized reactions.

The economic docket for the week is anchored by key inflation and spending releases that feed directly into the Fed’s policy framework. The Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, is scheduled for Monday and will be one of the most closely watched data points of the entire week, given its potential influence on expectations for 2026 monetary policy. Alongside that, personal spending and the broader PCE measure will provide insights into consumer demand at the close of 2025. Outside of macroeconomic activity, earnings are light due to the proximity of year-end; institutional and retail focus will likely shift toward any surprises in the few reported results, as well as guidance, with notable corporations historically scheduled earlier in the month having already reported.

In conclusion, while next week’s catalyst list is lighter than typical “earnings-heavy” periods, the scheduled economic releases, especially inflation measures, carry asymmetric risk for equities. Combined with compressed liquidity into the holidays, the market could exhibit heightened sensitivity to even modest deviations from expectations, guiding positioning into year-end and the “Santa Rally” window.

Need Help With Your Investing Strategy?

Are you looking for comprehensive financial, insurance, and estate planning services? Need a risk-managed portfolio management strategy to grow and protect your savings? Whatever your needs are, we are here to help.

💰 Fed’s Soft Landing Talk Meets Hard Data

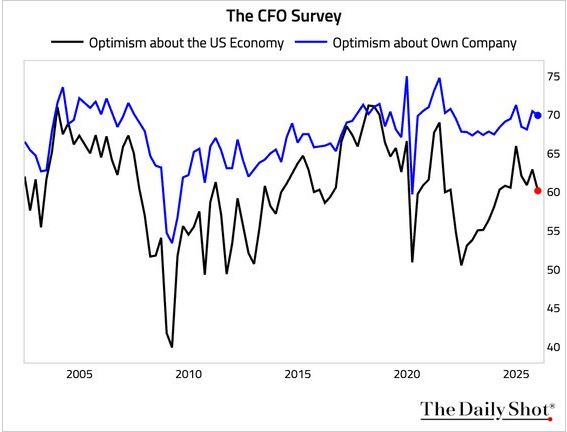

The Fed’s soft landing narrative is a key theme in financial media, particularly on Wall Street, which expects a resurgence in economic activity in 2026 to justify increasing forward earnings expectations.

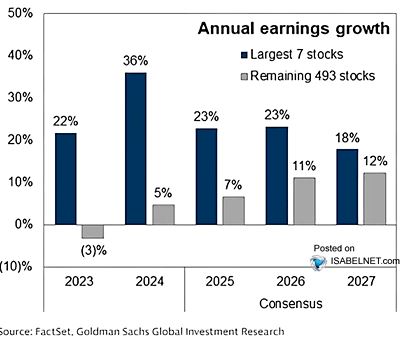

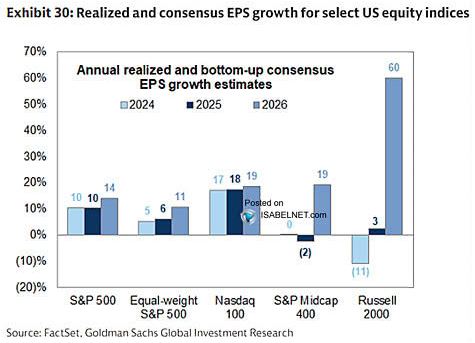

As shown, Wall Street currently expects the bottom 493 stocks to contribute more to earnings in 2026 than they have in the past 3 years. This is notable in that, over the past three years, the average growth rate for the bottom 493 stocks was less than 3%. Yet over the next 2 years, that earnings growth is expected to average above 11%.

Furthermore, the outlook is even more exuberant for the most economically sensitive stocks. Small and mid-cap companies struggled to produce earnings growth during the previous three years of robust economic growth, driven by monetary and fiscal stimulus. However, next year, even if the Fed’s soft landing narrative is valid, they are expected to see a surge in earnings growth rates of nearly 60%.

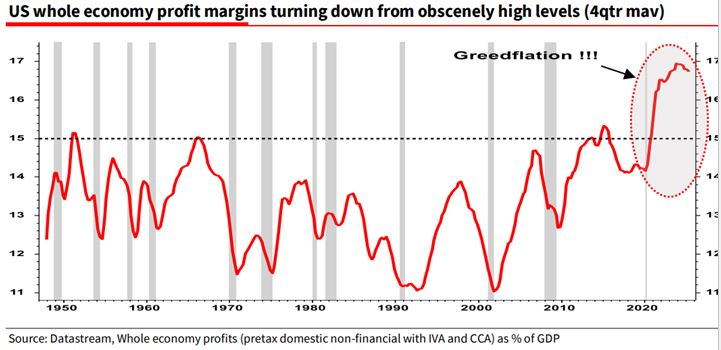

Notably, all this is occurring at a time when the entire economy’s profit margins have peaked and may potentially be turning lower.

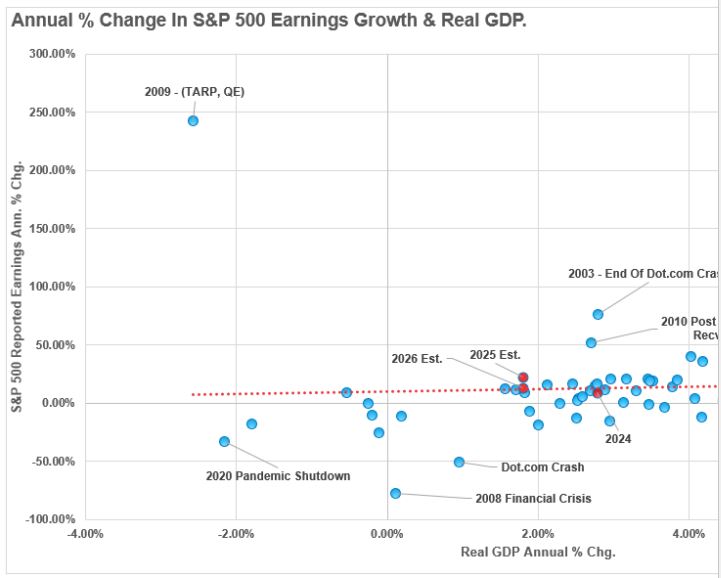

It should come as no surprise that there is a high correlation between economic growth and earnings, given that in a demand-driven economy, consumption is what generates revenues, and revenues ultimately develop earnings.

“A better way to visualize this data is to look at the correlation between the annual change in earnings growth and inflation-adjusted GDP. There are periods when earnings deviate from underlying economic activity. However, those periods are due to pre- or post-recession earnings fluctuations. Currently, economic and earnings growth are very close to the long-term correlation.”

The problem currently facing the Fed’s soft landing narrative is that it hopes the economy can slow without a recession, allowing inflation to return to its target. For now, investors have held the markets higher, hoping the Fed’s soft landing narrative comes to fruition, which would lead to a surge in economic activity. However, the latest employment, retail sales, and inflation trends suggest a potentially worse outcome, characterized by weakening demand and shaky consumer strength.

Those factors weaken the case for the Fed’s hopes of a soft landing and suggest an increase in market fragility.

Falling Inflation Tells a Demand Story

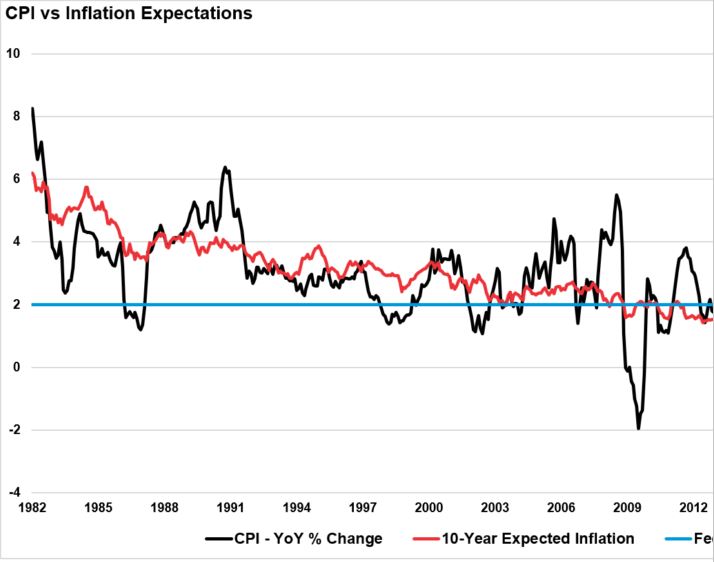

Let’s start with inflation. If economic growth were on the cusp of resurgence, expectations for inflation would be rising. However, as shown, those expectations never rose with “printed inflation,” because it was the “transitory effect” of massive monetary stimulus. The bond market’s view was that inflation would revert to its normalized levels as that monetary excess left the system, which has been the case. This is particularly notable, as inflation expectations have always been more accurate than the “inflation” bears we discussed yesterday.

In the Fed’s narrative of a soft landing, the trend in inflation expectations is crucial. Here is an essential point:

“The Federal Reserve WANTS inflation.”

Here is another critical point: So do you.

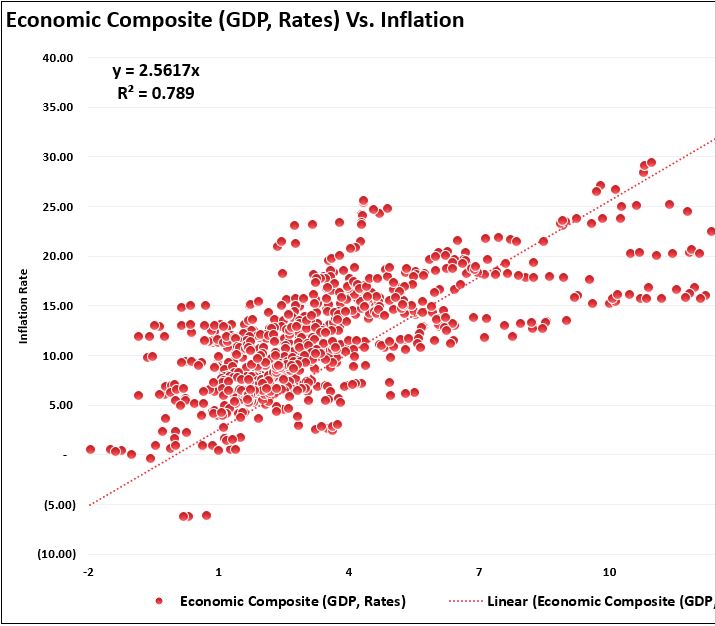

Without inflation, there can not be economic growth, increasing wages, and an improving standard of living. In other words, prices must always rise over time, which is why the Fed targets a 2% inflation rate, thereby supporting 2% economic growth. What we don’t want is “disinflation” or “deflation,” which would occur in conjunction with a recession, leading to job losses, falling wages, and reduced prosperity overall. As shown in the chart below, there is a high correlation between inflation, economic growth, and interest rates over time.

When inflation eases because demand weakens, the economy slows, producers lower prices to clear unsold goods, and employers become more restrictive in hiring and wage increases. Services that rely on discretionary spending lose pricing power, and banks become more stringent in their lending practices. These are not signs of a healthy expansion, but rather reflect a decline in spending power among households.

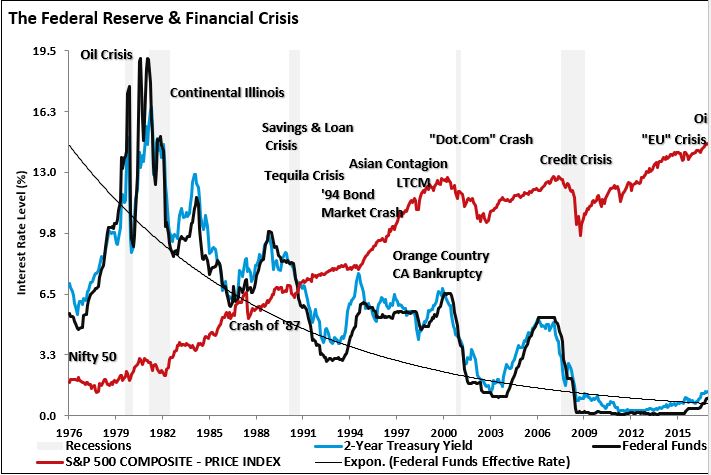

The Fed’s soft landing narrative is predicated on the hope that it can achieve its 2% inflation target without causing a more widespread slowdown. Historically, the Fed has failed in such attempts, as shown by the relationship between Fed rate-cutting cycles and economic and financial consequences.

As an investor, you need to distinguish between inflation caused by temporary supply/demand shocks, as we saw following the Pandemic, and inflation caused by organic economic activity. Supply/demand imbalances, such as higher input costs or a lack of supply caused by a geopolitical shock, can create a spike in inflation, which resolves itself when the shock is over. However, inflation caused by organic demand provides insight into the strength or weakness of the economy. Currently, we are focused on potential demand erosion as consumers cut back, employment weakens, and wages decline.

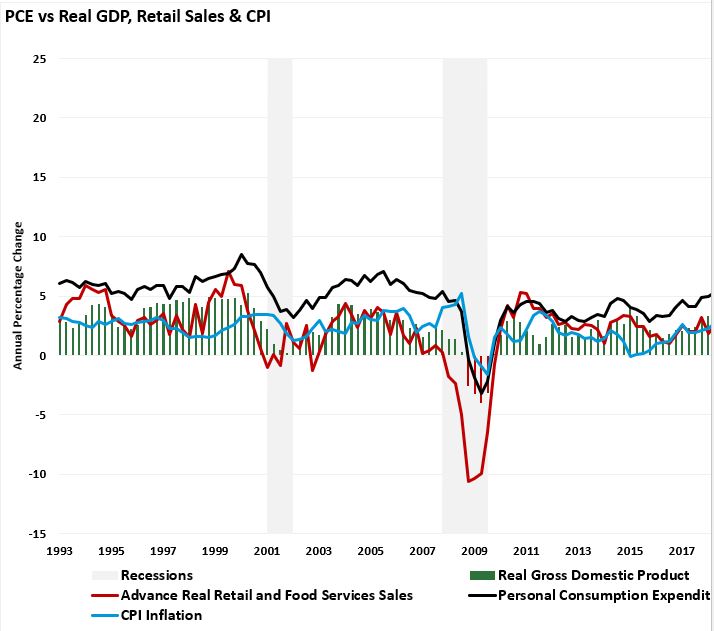

The retail sector provides early signals of demand weakness. Housing-related spending, auto sales, and discretionary purchases show stress, and many consumers face higher borrowing costs and lower savings. As shown, PCE, which accounts for nearly 70% of the GDP calculation, slowing inflation rates, and weak retail sales growth, all suggest that demand destruction is present in the economy. Such a development may further weigh on the Fed’s narrative of a soft landing.

As noted, the Fed’s soft landing narrative requires demand to slow moderately while avoiding recession. However, falling inflation driven by weakening demand and sluggish employment growth suggests a more profound weakness.

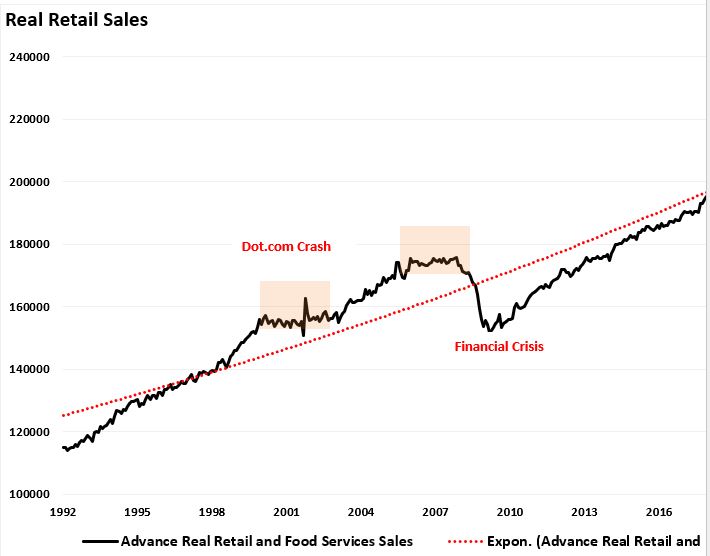

Retail Sales Growth Is Not What It Appears

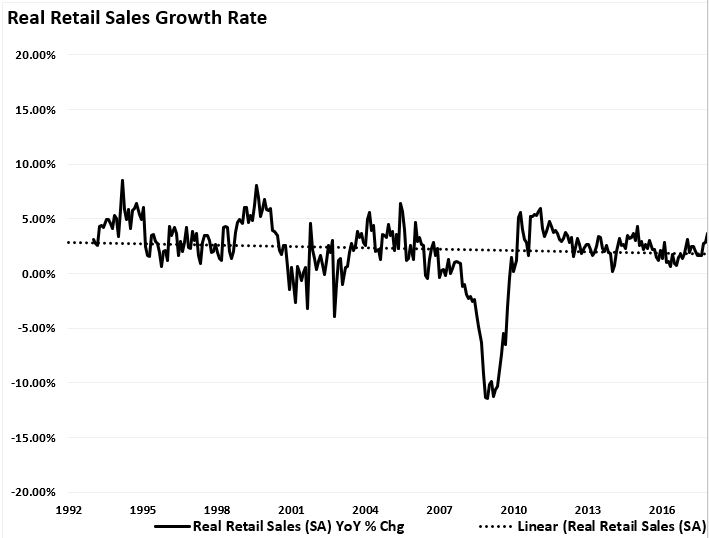

Headline retail sales reports often show month-over-month increases, which reporters interpret as evidence of resilient consumer strength. However, a look at the data tells a different story. For example, since 2022, real retail sales growth has effectively not grown. In fact, previous periods of flat retail sales growth were pre-recessionary warnings.

Secondly, the annual rate of change in real retail sales is at levels that have typically preceded weaker economic environments and recessions.

Notably, retail sales figures are subject to seasonal adjustments, which correct for typical spending patterns. During the holiday and back-to-school seasons, spending increases and the “adjustments” attempt to remove these effects. However, if the adjustment process overestimates normal seasonal strength, the adjusted result will appear firmer than it actually is. Secondly, another distortion comes from changes in price levels. If prices fall because demand weakens, nominal sales may rise while real volumes fall. Consumers buy less but pay lower prices. Nominal retail sales can mislead when viewed without context.

This is what we are currently seeing in the economy. As consumers pull back, businesses face the prospect of weaker revenue. That leads to slower hiring, lower investment, and falling confidence.

This matters for the Fed’s view of a soft landing. If consumer demand remains weak, the economy may slow more than expected, which increases the risk of recession. A “soft landing” requires growth to slow without tipping over, but current economic data points suggest a risk to that growth story.

The Market Risk If The Fed Is Wrong

If the Fed’s soft landing narrative proves incorrect, the downside risk to investors increases significantly. The soft landing narrative has been factored into market prices, earnings expectations, and economic projections. Any deviation exposes valuations and portfolios to sharp repricing. With valuations already very elevated, the risk of a repricing event is not insignificant.

Wall Street’s forward expectations hinge on a growth rebound in 2026. Those projections assume that demand will return and margins will remain stable. However, there is no guarantee that either of those assumptions are accurate. If margins have already peaked, inflation declines as demand erodes, and employment falls, negative earnings revisions could be substantial. The year-over-year change in real retail sales, as shown in the chart, has hovered near recessionary warning levels. With consumers already strained by high debt service costs, weak wage growth, and declining savings, discretionary spending is under pressure, which directly affects earnings across cyclical sectors.

If demand weakens further, companies will face lower revenue and tighter margins. The margin compression will initially impact earnings, particularly for smaller firms with limited pricing power. A repricing of earnings expectations will follow, dragging valuations with it.

The Fed’s historical track record of avoiding recession during tightening and easing cycles is poor. Most rate-cutting cycles have been in response to financial or economic stress, not smooth slowdowns. If the Fed cuts rates next year, it likely won’t be in response to a soft landing. That shift in narrative would catch most investors leaning the wrong way.

Positioning for a soft landing assumes the Fed can control inflation without breaking demand. The data say otherwise. The risk, as always, is that the market wakes up to this reality too late. Therefore, investors should consider preparing for such a possibility in advance.

📒 Year-End Portfolio Tactics

If the Fed’s soft landing narrative fails, investors will face a different environment than the one markets currently price. The assumptions behind strong equity valuations, tight credit spreads, and risk-on positioning will crack. If it does, that means you will need to act based on risk, not rhetoric. Here are some actions to consider.

1. Reduce Exposure to Overvalued Growth Assets: Tech and growth stocks led the rally on rate cut hopes and soft landing optimism. If earnings disappoint and rates stay higher, these valuations come under pressure.

- Trim overweight positions in mega-cap tech.

- Avoid speculative names with no earnings.

- Focus on companies with strong cash flow and pricing power.

2. Increase Cash and Short-Term Treasuries: If growth slows and volatility returns, capital preservation matters. Cash gives you optionality. Short-term Treasuries offer yield without duration risk.

- Rebalance toward 3-month to 1-year Treasury bills.

- Hold cash equivalents yielding over 4.5 percent.

- Avoid reaching for yield in low-quality credit.

3. Tilt Toward Defensive Sectors: Slower growth hits cyclicals and high beta sectors first. Defensive sectors hold up better in downturns.

- Favor healthcare, consumer staples, and utilities.

- Limit exposure to discretionary, financial, and industrial sectors.

- Screen for dividend sustainability and balance sheet strength.

4. Prepare for Credit Stress: If recession risk rises, corporate credit spreads will widen. Junk bonds will suffer. Bank lending tightens further.

- Exit high-yield bonds and floating-rate loans.

- Review credit exposure in bond funds.

- Consider higher-quality fixed income with lower default risk.

5. Be Patient and Opportunistic: If markets break, forced selling creates dislocations. You want dry powder ready.

- Hold 10–20 percent in cash or equivalents.

- Build watchlists of high-quality names at lower valuations.

- Add in stages as prices adjust, not all at once.

You don’t need to predict a recession. Instead, prepare for the potential risk if the Fed’s hopes for a soft landing fade. You can always increase risk more easily than recovering from losses. Remaining disciplined, protecting capital, and looking for opportunities is always the best course of action.

Trade accordingly.

Retail investors close out one of their best years ever. How they beat Wall Street at its own game

Story by Alex Harring

Retail investors have had a gangbuster year in 2025.

Mom-and-pop investors bought the dip at key points this year, providing strong returns as the market climbed to all-time highs. Once thought of as unsophisticated and easily duped, a new breed of retail investor is giving the professionals who have long dismissed them a run for their money, according to investors and market data analysts interviewed by CNBC.

But retail investors jumped head first into the turbulence. They bought a record of more than $3 billion in equities on net on April 3 — even as the S&P 500 fell around 5% in the session, according to market research firm VandaTrack. Elevated buying continued the following day despite the benchmark average dropping another 6%.

Trump put most of his steepest duties on pause April 9, exactly one week after “liberation day.” Small-scale stockholders were on the ground floor of the S&P 500’s 9.5% surge that session. The broad index has climbed more than 21% since April 2. It’s on track to finish 2025 higher by more than 17% after hitting several new intraday and closing records.

“We often talk about retail as being sort of late to the party,” said Viraj Patel, Vanda’s deputy head of research. “But this has been the polar opposite.”

At Siebert, Malek said the professionals were starting to get nervous as the S&P 500 fell below 5,000 during the tariff-induced sell-off. But their retail traders continued buying all the way down, drawing on their past successes in increasing exposure amid pullbacks as opposed to panicking.

Retail investors “have been more right about the market and how to react to, certainly, a lot of the emotionally driven trades of the year,” Malek said. “They’ve been much more accurate in their dealings than my colleagues in the institutional space.”

Beyond believing in buying the dip, these traders also benefited from a conviction that the “TACO trade” would pan out, according to Zhi Da, a finance professor at the University of Notre Dame who studies retail trader activity.

Known in full as “Trump Always Chickens Out,” this strategy encourages investors to buy into stocks when policy decisions from the White House cause market downturns, with the expectation that the actions will be reversed. On the other hand, institutional counterparts have been more cautious about trading around Trump’s policies, Da said.

Da acknowledged there was some luck involved and that 2025 was an “exception” to the rule. Typically, retail investors buy market dips too late and don’t benefit as much on average, he said.

A ‘more sophisticated’ investor

Retail’s positive 2025 comes years into the investing boom among everyday Americans that began during the pandemic. The next serious downturn in the market will test whether the elevated participation will last.

More than one out of every three 25-year-olds in 2024 moved significant sums from checking to investing accounts since they turned 22, according to JPMorgan data released earlier this year. That’s up from just 6% of 25-year-olds in 2015.

JPMorgan found 2025 retail flows surged to records, up more than 50% from last year and about 14% higher than the meme stock craze in early 2021. Individual investors’ share of total stock trades this year climbed to highs last seen during that short-squeeze mania four years ago, according to data from a working paper by professors at Chapman University, Boston College and the University of Illinois.

The narrative during 2021’s meme stock surge — which centered on stocks like GameStop and AMC — was that retail traders made simplistic investing decisions to “stick it to the man.” Two years later, the sentiment toward these meme-stock era market participants was captured in a film starring Paul Dano, Pete Davidson, Seth Rogen and Sebastian Stan called “Dumb Money.”

Vanda’s Patel and others said that view is changing. Small investors are taking advantage of the widening access to market research and data — and getting a better reputation on Wall Street as a result, they said. Retail has also established itself as being more adept at buying at lows, increasingly putting them in the arena with bigger counterparts, Patel said.

“The average retail investor’s just becoming more and more sophisticated,” Patel said. “This year has been kind of a good testament to that.”

To be sure, a new class of meme stocks including OpenDoor emerged this year. But Vanda found far more retail investor dollars in 2025 have been directed to names like Nvidia, Tesla and Palantir that outperformed the market over recent years.

Siebert’s Malek said he’s found everyday traders to be increasingly focused on longer-term investing, which can keep them from panic selling when the market goes down. Still, one question is top of mind for Malek and other investing leaders: What will retail traders do when the stock market, after multiple years of big gains, finally hits a lasting rough patch?

For now, retail investors are taking notice of their improved standing.

Real estate professional Josh Franklin remembers a decade ago when they were easily written off by big investors. The 28-year-old Tampa resident, who has invested in stocks like Robinhood and Palantir over the years and spends dozens of hours a week studying the market, now sees the small guy as central to the story.

“Back then, no one really cared about retail. They thought retail was dumb money,” Franklin said. “Now, retail kind of leads the charts.”

AI godfather says Meta’s new 29-year-old AI boss is ‘inexperienced’ and warns of staff exodus

Published Mon, Jan 5 202611:00 AM ESTUpdated 3 Hours Ago

Key Points

- Meta’s former chief AI scientist Yann Lecun criticized Meta’s AI strategy and warned of a potential staff exodus.

- The “godfather of AI” said Meta’s newest AI boss, 29-year-old billionaire Alexander Wang, was “young” and “inexperienced.”

- Wang has “no experience with research or how you practice research, how you do it. Or what would be attractive or repulsive to a researcher,” Lecun told the FT.

Meta’s former chief AI scientist, Yann Lecun, has called its 29-year-old AI boss “inexperienced,” and warned of a staff exodus from the company.

Alexander Wang, the billionaire co-founder of Scale AI, joined Meta as its chief AI officer in 2025 after the tech giant bought a 49% stake in his startup.

His hiring came amid an intensifying AI talent war, in which Meta reportedly offered $100 million signing bonuses to poach top talent from ChatGPT maker OpenAI, as it raced other hyperscalers to dominate the multibillion-dollar AI market with the most advanced models.

Lecun, who’s known as one of the “godfathers of AI” and quit Meta in November, called Wang “young” and “inexperienced” in an interview with the Financial Times.

“He learns fast, he knows what he doesn’t know,” Lecun said of Wang, who heads up Meta’s new AI research unit TBD Labs and is tasked with building new AI models. But Lecun added: “There’s no experience with research or how you practice research, how you do it. Or what would be attractive or repulsive to a researcher.”

Lecun, 65, added that Meta CEO Mark Zuckerberg “basically lost confidence in everyone who was involved” after the company was accused of gaming benchmarks to make its Llama 4 model look more impressive. Zuckerberg “basically sidelined the entire Gen AI organization,” Lecun said.

“A lot of people have left, a lot of people who haven’t yet left will leave,” Lecun added.

“We had a lot of new ideas and really cool stuff that they should implement. But they were just going for things that were essentially safe and proved,” he said. “When you do this, you fall behind.”

CNBC contacted Meta for a response, but had not received a response as this story went live.

AI superintelligence is a ‘dead end’ for LLMs

When asked about Meta’s AI hiring drive, Lecun said: “The future will say whether that was a good idea or not.”

But he added that “LLMs basically are a dead end when it comes to superintelligence.”

“I’m sure there’s a lot of people at Meta, including perhaps Alex, who would like me to not tell the world that,” Lecun said.

Lecun’s new startup, Advanced Machine Intelligence Labs, is focusing on “world models:” AI systems that learn from videos and physical data as well as language.

Nabla, a health tech AI startup that partnered with Lecun’s company in December, said in a press release that, unlike world models, LLMs “still face some structural constraints, including hallucinations, non-deterministic reasoning and limited handling of continuous multimodal data, which make autonomous decision-making challenging.”

https://roboticsbiz.com/20-emerging-jobs-created-by-artificial-intelligence-ai-in-2025

20 emerging jobs created by artificial intelligence (AI) in 2025

January 18, 2025

As artificial intelligence continues to evolve and integrate into various industries, it is not just reshaping how we work—it is creating a vast array of new job opportunities. While there has been concern about AI replacing traditional roles, the reality is quite the opposite. AI is fueling innovation by generating entirely new job categories that never existed before. These roles intersect with technology, creativity, and human expertise, offering exciting prospects for individuals to thrive in an AI-driven world.

As AI becomes more advanced, the job market will see the emergence of positions that require a deep understanding of AI tools, ethical considerations, and innovative applications in 2025. From AI trainers and ethics consultants to digital twin architects and emotion recognition specialists, these new roles highlight how AI transforms industries and the future of work transforms sectors and the future of work. These careers allow individuals to shape the development of AI and ensure its responsible use while offering new, fulfilling job opportunities that leverage both human intelligence and machine learning.

In this list, we highlight 20 new emerging jobs created by AI in 2025, showcasing the tremendous potential AI holds as both a driver of economic growth and a creator of dynamic careers. Whether you’re looking to explore a career in AI or simply curious about the impact of this technology, the following positions offer a glimpse into the exciting possibilities ahead.

– Advertisement –

1. AI Prompt Engineer

An AI Prompt Engineer specializes in designing precise and practical input, or prompts, for generative AI models to achieve desired outcomes. They experiment with language structures, parameters, and contextual cues to optimize AI outputs for applications like content creation, coding assistance, or customer service. These professionals also collaborate with teams to customize prompts for specific industries or business needs and maintain a repository of effective prompts for various use cases.

2. AI Model Trainer

AI Model Trainers focus on fine-tuning AI algorithms to suit specific applications by feeding them curated datasets and adjusting model parameters. Their duties include preparing datasets, training models to improve accuracy, and testing for reliability. They also adapt pre-trained models to meet unique business or industry requirements, ensuring that AI systems are efficient, relevant, and responsive to real-world scenarios.

3. AI Ethics Consultant

AI Ethics Consultants ensure that AI technologies are developed and deployed responsibly. They assess potential biases, transparency, and fairness in AI systems while advising organizations on ethical dilemmas. Their responsibilities include developing guidelines, ensuring compliance with global AI regulations, and leading workshops to educate teams on ethical AI practices. They play a critical role in aligning AI innovations with societal values.

– Advertisement –

4. AI Behavior Analyst

AI Behavior Analysts study and evaluate the decision-making processes of AI systems to ensure they behave as expected and align with user intent. Their work involves analyzing AI responses, identifying discrepancies or unintended consequences, and fine-tuning algorithms. They also provide feedback to developers for improving system behavior and work to make AI interactions more intuitive and human-like.

5. Synthetic Media Designer

Synthetic Media Designers create AI-generated multimedia content, including videos, animations, voiceovers, and realistic imagery. They use advanced AI tools to develop engaging visuals and sounds for marketing, entertainment, and education. Their work involves creative and technical skills, ensuring the generated content meets brand or audience expectations while maintaining authenticity.

6. AI Integration Specialist

AI Integration Specialists bridge the gap between AI technologies and existing systems by ensuring seamless implementation. They work on integrating AI solutions into software platforms, hardware systems, and organizational workflows. Their responsibilities include system compatibility checks, deployment support, and training end-users to maximize the potential of AI tools.

– Advertisement –

7. Digital Twin Architect

Digital Twin Architects design virtual models of real-world systems, such as factories, cities, or products, to simulate and optimize their performance. They use AI to monitor, predict, and improve real-time operations. Responsibilities include collecting data, building virtual environments, and maintaining synchronization between digital and physical entities to enhance efficiency and innovation.

8. AI Safety Analyst

AI Safety Analysts focus on identifying and mitigating risks associated with AI systems. They evaluate AI performance for potential biases, security vulnerabilities, and ethical concerns. Their role involves developing risk assessment protocols, ensuring AI compliance with safety standards, and collaborating with developers to improve system reliability.

9. Human-AI Collaboration Facilitator

Human-AI Collaboration Facilitators enable organizations to leverage AI effectively alongside human talent. They design strategies for task distribution between humans and machines, train employees on AI tools, and address concerns related to AI adoption. Their work ensures a harmonious and productive synergy between human creativity and AI efficiency.

10. Generative AI Educator

Generative AI Educators create and deliver training programs using generative AI tools for business, education, or personal projects. They design workshops, create learning materials, and guide individuals in harnessing AI capabilities for creative or functional purposes. Their role often involves staying updated on AI trends to incorporate the latest advancements into their teaching.

11. AI-Powered Content Curator

AI-Powered Content Curators leverage AI to analyze trends and personalize content for specific audiences. They use AI tools to gather, filter, and present content that aligns with user preferences or brand objectives. Their responsibilities include maintaining quality, relevance, and engagement while ensuring unbiased AI-generated recommendations.

12. AI-Generated Experience Designer

AI-generated experience Designers use AI to craft immersive and personalized experiences in gaming, VR, or customer engagement. They design interactive AI-driven narratives, simulations, or environments tailored to individual user preferences. Their work involves creative storytelling, technical AI knowledge, and a deep understanding of user experience.

13. AI Accountability Auditor

AI Accountability Auditors review and evaluate AI systems for compliance with ethical, legal, and operational standards. They conduct audits to ensure transparency, fairness, and security. Their duties include preparing detailed reports, suggesting corrective measures, and staying updated on AI regulations to guide organizations effectively.

14. AI Personalization Strategist

AI Personalization Strategists use AI-driven insights to customize products, services, or customer interactions. They analyze user data to design personalized recommendations, marketing campaigns, or product features. Their role requires balancing AI-driven decisions with human creativity to create unique, customer-centric experiences.

15. Data-Ecosystem Manager

Data-ecosystem managers oversee the data lifecycle used in AI systems, ensuring quality, security, and compliance. They manage data pipelines, monitor data health, and implement governance frameworks. Their role is vital for maintaining the integrity of AI models and adhering to privacy regulations.

16. Generative AI Voice Coach

Generative AI Voice Coaches train AI systems to produce realistic and emotionally resonant voices. They fine-tune AI models for specific tones, accents, or emotions, ensuring high-quality audio output. They collaborate with linguists, voice artists, and developers to create natural and effective voiceovers.

17. AI Storyteller

AI Storytellers combine human creativity with AI tools to craft compelling narratives for media, entertainment, and advertising. They guide AI-generated content to align with desired themes, styles, and emotional tones. Their responsibilities include editing, directing, and refining AI outputs to create engaging and cohesive stories.

18. AI-Enhanced Productivity Coach

AI-Enhanced Productivity Coaches train individuals and teams to optimize workflows using AI tools. They analyze tasks, recommend AI solutions, and provide ongoing support to maximize efficiency. Their role includes staying updated on emerging AI tools and customizing recommendations to fit specific needs.

19. Emotion Recognition Specialist

Emotion Recognition Specialists develop AI systems capable of detecting and analyzing human emotions. They train models using voice, facial expressions, and behavioral data to improve applications in customer service, mental health, and marketing. Their work includes refining algorithms to ensure sensitivity and accuracy in emotional analysis.

20. AI Bias Remediation Specialist

AI Bias Remediation Specialists identify and address biases in AI algorithms to ensure fairness and inclusivity. They audit datasets, develop mitigation strategies, and collaborate with developers to enhance model performance. Their role ensures AI systems make unbiased decisions, fostering trust and equity.

Conclusion

The rise of AI in 2025 is undeniably transforming the job market, not just by automating tasks but by creating entirely new career paths. These emerging roles present unique opportunities for individuals to engage with AI in ways that blend technology with human creativity, ethics, and problem-solving. As AI continues to grow, it will only open up more avenues for those ready to embrace the future of work.

Rather than fearing job loss, the advent of AI offers a chance for professionals to adapt, upskill, and thrive in a tech-powered world. The 20 jobs outlined in this list are just the beginning, highlighting the diverse roles essential in shaping a future where AI works alongside humans to achieve greater efficiency, innovation, and societal impact. By preparing for these opportunities, individuals can position themselves at the forefront of a technological revolution, making AI a tool for progress and a catalyst for career growth and fulfillment.